and the distribution of digital products.

State of Sia Q1 2025

- Sia’s V2 hardfork is scheduled for June 6, 2025 (block 526,000), initiating a phased transition to improved transaction formats, performance, and scalability. Full migration completes by July 6 (block 530,000), allowing integrators time to upgrade.

- Sia’s storage utilization reached a five-quarter high in Q1 2025, climbing to 34.0% as total data stored increased by nearly 37% QoQ. This surge in demand contrasted with declining transaction activity and reflects improved real-world usage.

- Core modules, renterd, hostd, walletd, and explored received critical updates ahead of the June 6 V2 hardfork, including RHP4 support, Ed25519 keys, QUIC transport, and improved contract and sector management.

- Bandwidth pricing revealed diverging trends: upload costs declined for the third consecutive quarter, while download fees surged nearly 37%, highlighting growing bandwidth demands.

- Daily network revenue declined nearly 40.6% in Q1, with a 26.3% drop in the 7-day moving average. The downturn underscores the importance of V2’s rollout and ecosystem adoption efforts to revitalize activity and restore revenue growth amid challenging market conditions.

Sia is a decentralized cloud storage network that combines a Proof-of-Work (PoW) blockchain with a contract-based storage model. Storage contracts uphold storage agreements between hosts (storage providers) and renters (storage consumers). Renters define the amount of data to be stored, the timeframe for storage, and the price. Users and storage providers enter into storage contracts and deposit the native asset, Siacoin (SC), into an escrow account. Storage providers must cryptographically prove they are hosting the required data, and if they do not uphold the storage contract, their collateral is slashed. At contract expiry, the storage provider receives most of the escrowed funds, with a small portion (3.90%) going to holders of Siafund (SF) tokens. Siafunds are security tokens that accrue SC to the SF holder from finished contracts on Sia.

Sia facilitates a global data storage marketplace by connecting storage providers with underutilized hard drive capacity to storage consumers. Siacoin can be used to pay for gas on the Sia blockchain and as the medium of exchange for the storage market. Renters pay a storage fee, upload/download bandwidth prices, and gas to create storage contracts. Files stored on Sia are encrypted via ChaCha20 and stored redundantly via Reed–Soloman Erasure Coding. Encryption ensures that uploaded files remain private, and redundancy ensures security by sharding files. Files uploaded to Sia are split into 30 shards, or chunks, and sent to various hosts. Only 10 shards are required to rebuild the file, and their copies are re-duplicated to new hosts whenever one is offline. For a full primer on Sia, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

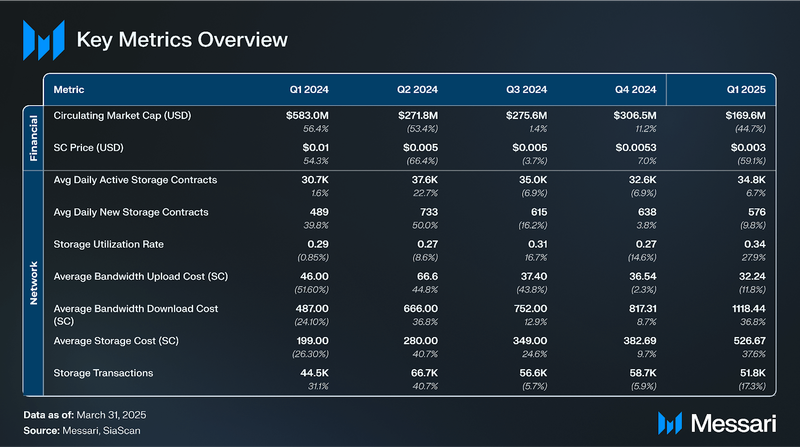

Key Metrics Financial Analysis

Financial Analysis

Sia’s financial metrics in Q1 2025 reflected broader market headwinds, with declines across market capitalization, token price, and network revenue. The contraction aligns with sector-wide softness rather than network-specific issues, as Sia’s core infrastructure remained fundamentally stable.

Performance AnalysisMarket Cap

Q1 2025 marked a quarter of decline for SC, reflecting broader market headwinds. The average daily market capitalization for the quarter was approximately $247.1 million, with an average token price of $0.00437. Despite periods of volatility, trading between $0.00303 and $0.00635, SC trended downward overall. By quarter-end, SC closed at a market cap of $169.6 million and a price of $0.00303, representing declines of approximately 44.6% and 42.9%, respectively, compared to Q4 2024.

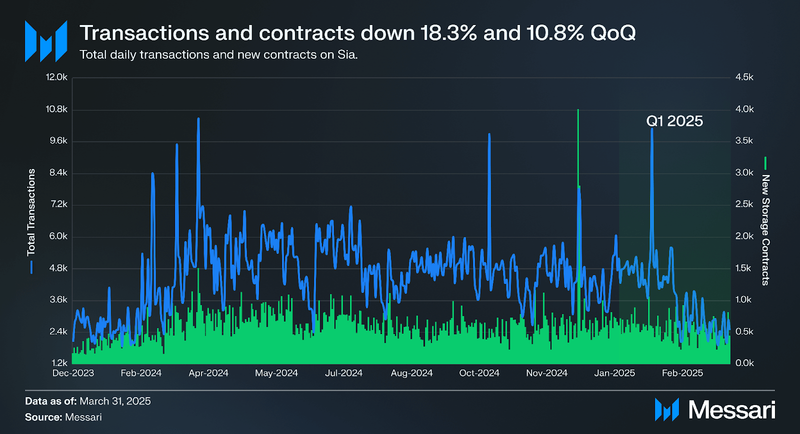

Transactions and New ContractsNew storage contracts are a key indicator of demand generation on the Sia network. They are initiated when renters allocate a prepaid budget known as an allowance. This allowance reflects the maximum amount of SC the renter is willing to spend for storing data across multiple hosts and is calculated by multiplying the storage price (in SC per terabyte), the total data volume, and the intended storage duration.

For instance, storing 2 TB of data for two months at a rate of 500 SC per TB would require an allowance of 2,000 SC (2x2x500). In addition to the allowance, renters pay contract formation and upload bandwidth fees at the time of contract initiation.

Hosts, in turn, are required to lock up collateral, which can be slashed if they fail to uphold the terms of the agreement, ensuring a financial incentive for uptime, data availability, and contract integrity. This structure underpins the economic foundation of Sia’s decentralized storage marketplace.

Network activity on the Sia blockchain experienced a moderate contraction in Q1 2025, reflecting broader market pressures across the crypto sector. Total daily transactions averaged 3,878 during the quarter, down 18.3% from 4,588 in Q4 2024. Similarly, new storage contract creation averaged 575.8 contracts per day, a 10.8% decrease from the prior quarter’s 638.2. While activity remains comfortably above the lows recorded in mid-2024, the pullback highlights a more cautious environment among users. However, the upcoming V2 hardfork, introducing major scalability, performance, and usability upgrades, positions the network for a resurgence in adoption and renewed momentum in the quarters ahead.

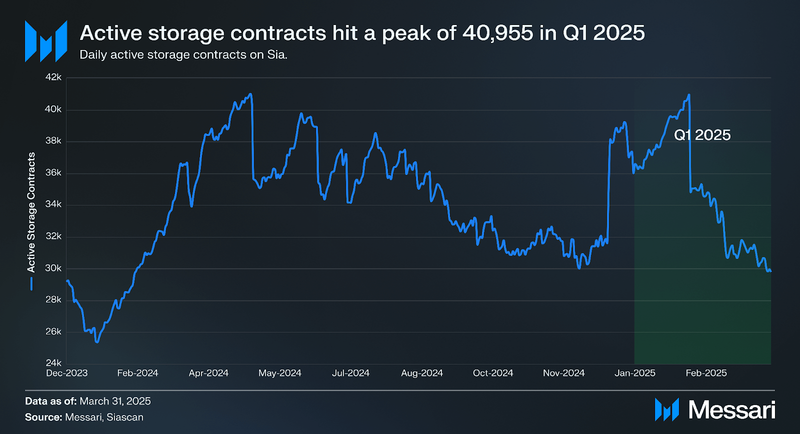

Active Storage

Q1 2025 saw an improvement in the average number of active storage contracts on the Sia network. Active contracts averaged 34,806 during the quarter, up 7.2% from 32,611 in Q4 2024, even as broader network activity indicators such as transactions, new contracts, and revenue declined. This divergence likely reflects a combination of longer contract lifetimes, improved network stability following core infrastructure upgrades, and lower USD-denominated storage costs that incentivized existing users to maintain their contracts despite broader market headwinds. The quarter also featured a peak of 40,955 contracts on February 6, 2025, coinciding with the Sia Foundation’s announcement that the upcoming V2 hardfork would roll out in two phases. This clarification of the upgrade timeline likely bolstered user confidence and contributed to a short-term surge in contract activity. While the latter part of the quarter showed signs of cooling, the overall increase in average activity underscores renewed user engagement ahead of the network’s transition to V2.

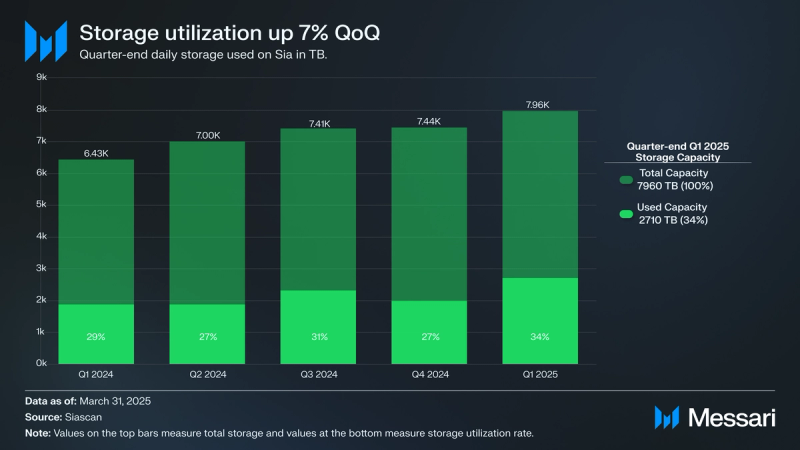

Utilization

After previous quarters of fluctuating demand, Q1 2025 marked a significant rebound in storage utilization on the Sia network, suggesting renewed interest in its decentralized cloud infrastructure. Total data stored surged to 2,710 TB, up from 1,980 TB in Q4 2024, representing a 36.8% QoQ increase. This uptick occurred alongside an expansion in available storage capacity, which grew to 7,960 TB, indicating that supply and demand saw meaningful growth.

Most notably, the utilization rate climbed to 34.0%, the highest level recorded in the last five quarters and a clear reversal of the declining efficiency trend seen through much of 2024. In Q4, only 26.6% of available capacity was in use. The rebound in Q1 suggests that the network was more effective at converting offered capacity into actual rented space; likely factors that played a role in the resurgence could be attributed mainly to infrastructure upgrades and ecosystem incentives. Upgrades such as renterd v2.1’s parallel migrator threads and hostd’s QUIC protocol integration dramatically improved upload throughput and host connectivity, making the network faster and more stable for renters. Adoption-driving grants like Dartsia Mobile App V2, which added secure mobile file previews, and S5 Network’s trustless filesystem layer possibly contributed to increased real-world usage, especially as these tools targeted user experience and performance in production environments.

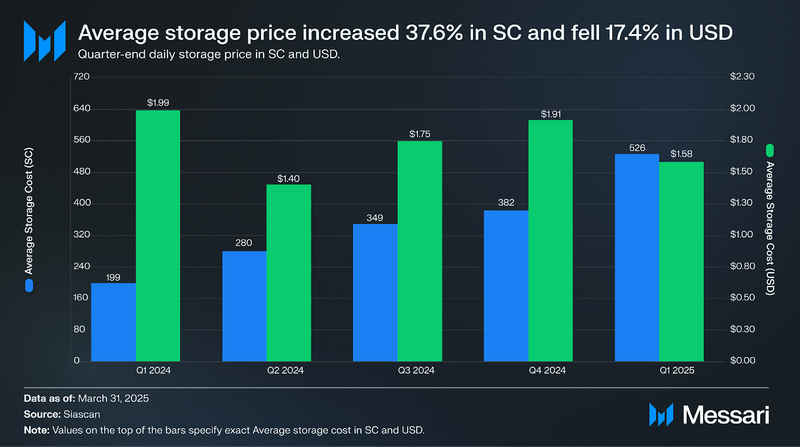

Storage Prices

In Q1 2025, the average storage cost surged to 526.67 SC per TB/month, a 37.6% increase from the previous quarter. However, when denominated in USD, the average cost decreased to $1.58, down from $1.91 in Q4 2024. This divergence indicates that while hosts raised SC-denominated prices to offset the declining value of Siacoin, the adjustments weren’t sufficient to maintain USD revenue parity.

Simultaneously, Q1 2025 marked the highest network utilization rate in over a year, with storage demand rising nearly 37% from the previous quarter. These usage-driven dynamics played a secondary but essential role in driving SC pricing upward.

While hosts adjusted to token devaluation, renters benefited from lower real-world costs, creating an environment where network affordability improved even as SC-denominated costs rose sharply.

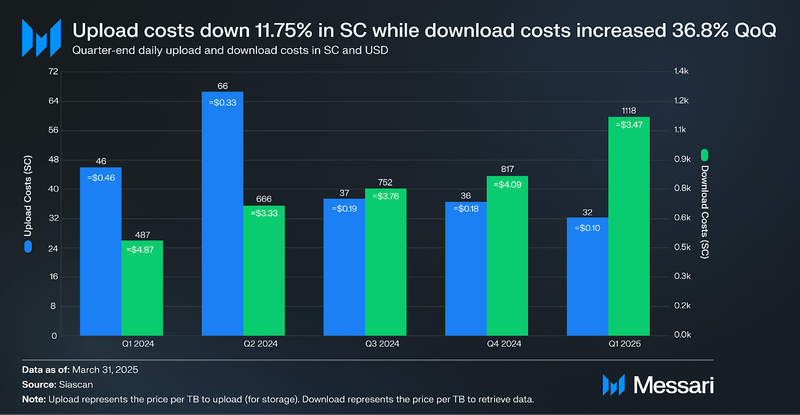

Bandwidth Costs

Q1 2025 revealed a clear split in Sia’s bandwidth pricing trends. Upload costs declined 11.8% QoQ to 32.24 SC per TB, continuing a multi-quarter downtrend, while download costs surged 36.8% to 1,118 SC per TB, marking the steepest increase in five quarters.

The decline in upload pricing reflects the benefits of recent performance optimizations within Sia’s storage infrastructure. Updates to the renterd module in Q1, including more efficient MIME type inference and expanded parallel migrator threads, enhanced data ingestion throughput, and reduced operational overhead for hosts. These improvements likely allowed hosts to pass cost savings onto users while maintaining or improving their margins. As a result, upload bandwidth became more competitively priced.

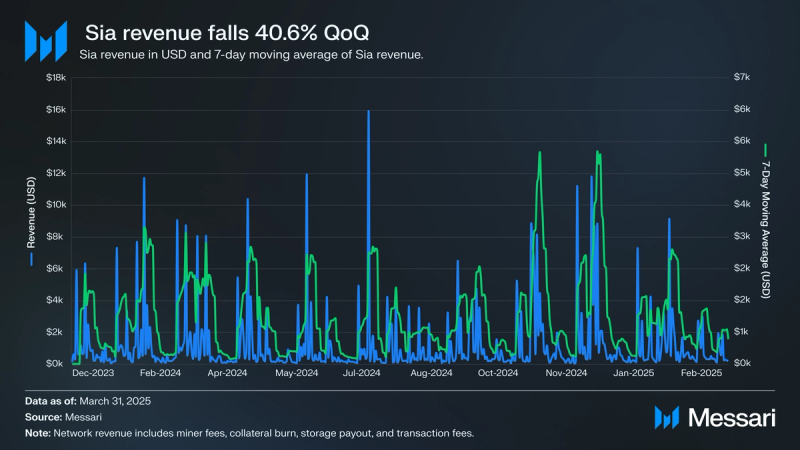

RevenueSia’s network revenue consists of payouts to hosts, miner fees, Siafund (SF) fees, and burned collateral. Hosts earn most of the storage-related payments, while miners capture transaction fees to secure the network. Siafund holders receive a fixed fee (3.9%) from completed storage contracts. While not directly paid to any party, burned collateral reduces Siacoin supply and is included as revenue due to its scarcity-enhancing effect on SC’s value.

Sia’s network revenue continued its downward trajectory in Q1 2025, reflecting sustained macro headwinds and a notable contraction in onchain activity. Average daily revenue across the quarter settled at approximately $997, a 40.6% decrease from the previous quarter's $1,679. This can also be seen on the 7-day moving average, which declined 26.3% QoQ, going from $1,548 in Q4 2024 to $1,141 in Q1 2025.

This drawdown mirrors the concurrent declines observed in new storage contract formation, active contract counts, and SC market performance. These indicators suggest a cyclical low in ecosystem activity, magnified by broader market uncertainty.

The upcoming V2 hardfork, which introduces a more scalable UTXO model, faster sync times, and enhanced smart contract support, will aim to catalyze the Sia network and improve economic performance in the quarters ahead.

Qualitative AnalysisSoftware updatesThe first quarter of 2025 saw multiple releases across Sia’s core software components, focused on preparing the network for the upcoming V2 hard fork scheduled for June 6, 2025.

- V2 Hardfork Transition: The Sia network hardfork was rescheduled to ensure a smooth upgrade path. The transition will occur in two phases: an “Allow Height” at block 526,000 (around June 6, 2025), where both V1 and V2 transactions coexist, followed by a “Require Height” at block 530,000 (around July 6, 2025), when only V2 transactions are accepted. This extension gives integrators ample time to update their software, after which all users must use the new transaction format.

- renterd introduced autopilot improvements, enhanced API security with cookie-based authentication, and fixed upload and contract refresh issues. Performance optimizations included background sector pruning and improved error handling. Files downloaded via the UI are also no longer buffered in memory and instead streamed to disk. Configuration files were standardized to OS-native locations to simplify node management.

- hostd released several beta versions, adding RHP4 protocol support,, optimizing sector lookups by 50%, and enabling QUIC support for browser-based storage interactions.

- walletd updates included new endpoints for spent output verification to facilitate atomic swaps. Configuration files were standardized to OS-native locations to simplify node management. Improvement on overall query performance, tweaked the API to improve the developer experience, and made it easier to configure a custom testnet for testing.

- explored has seen multiple smaller bug fixes, got a new endpoint for manually scanning hosts, and transitioned to MaxMind GeoIP2 for improved host geolocation accuracy and adopted median-based pricing models to estimate host costs better.

Sia’s Q1 2025 core software updates laid essential groundwork for the upcoming V2 hard fork (Utreexo), the network’s most significant upgrade since launch.

Ecosystem Grant UpdateThe Sia Foundation continues to support ecosystem growth through its grants program, approving seven new grant recipients. Grants are decided biweekly by a committee of three foundation employees and three community members.

SAI (Sia AI): A Python framework integrating AI-powered interactions with Sia’s walletd. It enables users to manage Siacoin transactions and wallet operations via natural language commands.

Sia Satellite refurbishing: The Refurbishing of Sia Satellite project seeks to modernize and stabilize the only known public satellite interface for the Sia network. The initiative addresses long-standing usability issues, prepares the service for the upcoming V2 hard fork by adding support for new host and contract standards, and removes the reliance on a custom fork of renterd, a key barrier to adoption. The project will also redesign the user interface in response to community feedback. By streamlining operations and reducing technical friction, the refurbished Sia Satellite aims to expand network access for non-crypto users and advance the Foundation’s mission of user-owned data, while enabling greater decentralization through easier service replication.

Nydia Passkey Holder: a lightweight, browser-based authenticator designed to streamline passwordless authentication using secure cryptographic keys. Nydia allows users to manage and use passkeys directly within the browser without relying on external hardware or platform-specific solutions. In its latest update, Nydia added support for the Ed25519 digital signature algorithm, offering faster verification, smaller key sizes, and enhanced cryptographic security. With full Firefox support and partial Chrome availability, this update positions Nydia for broader cross-browser compatibility. Additional improvements include modularizing the CSS architecture for easier maintenance and setting the stage for upcoming Safari support, ensuring a smoother development experience and a more robust user interface.

SiaFund Earnings Tracker: SiaFund Earnings is a web-based analytics platform that tracks SiaFund claim amounts transparently, providing users with insights into network utilization and economic activity on Sia. Designed for prospective and current SiaFund holders, the site helps evaluate potential returns and offers a snapshot of historical earnings, supporting informed investment decisions.

Renterd Backup Automation Utility: The Renterd Database Backup Automation Utility project aims to develop a simple, user-friendly tool for automating backups of renterd database instances, along with a step-by-step video tutorial to guide users through installation, configuration, and recovery. Addressing a long-standing community request, this utility offers flexible scheduling, support for both SQLite and MySQL, backup verification, and delivery options via email, all designed to safeguard user data and ensure operational continuity.

Luogo: Luogo is a privacy-first group location sharing app. Designed as a user-friendly alternative to services like Life360 and OwnTracks. Built on top of S5 decentralized storage, Luogo enables real-time location sharing within private groups while ensuring that user data remains encrypted, locally stored, and inaccessible to third parties.

SecureSphere: SecureSphere is an innovative password management and breach monitoring solution designed to prioritize user privacy and data ownership. By storing encrypted data on the Sia network, SecureSphere eliminates the need for centralized servers, significantly reducing vulnerability to breaches.

Development milestones:Throughout Q1 2025, previously funded projects achieved significant development milestones, further expanding the capabilities and usability of the Sia ecosystem.

Dartsia Mobile App V2: Successfully released on the Google Play Store, marking a major milestone for mobile host management. The app now includes file previews, host scoring, and notification functionality. Work continues on backup features and finalizing the app’s website.

SiaGraph: Progressed with removing dependencies on SiaCentral, focusing on financial statistics and host monitoring. Development of new financial reporting pages is ongoing.

Tiri Vault: Upgraded to support multi-user environments and implemented a custom UI. Next steps include enhancing subscription stability, synchronization algorithms, and wallet integration.

S5 Network: Completed core components for trustless file system access and encryption. The team made significant progress on the TypeScript library and web design components, with the first major release of Vup Web underway.

Sia Virtual Block Device(sia_vbd): Released version 0.4.0, adding features like branching, tagging, and volume resizing. These enhancements give users finer control over stored data and pave the way for more sophisticated virtual storage workflows.

Lume Web: Continued progress on portal infrastructure, abuse reporting, and billing support. The abuse reporting plugin was completed with automated classification and case tracking, while frontend testing and integration with the dashboard and IPFS plugin are planned for upcoming weeks.

These milestones highlight the ongoing innovation and development within the Sia ecosystem, driving advancements in decentralized storage solutions and enhancing user experience across various platforms.

Closing SummaryQ1 2025 marked a pivotal moment for the Sia ecosystem, defined by both headwinds in network activity and encouraging signs of infrastructure maturity. Despite a downturn in active contracts, transactions, and revenue, largely reflective of broader market conditions, Sia’s core value proposition as a decentralized storage platform remained resilient. Notably, network utilization rebounded to a five-quarter high, driven by a combination of protocol optimizations and a maturing suite of user-centric tools.

Major advancements across core modules, including renterd, hostd, walletd, and explored have set the stage for the V2 hardfork, a landmark upgrade scheduled for June 6, 2025. The phased transition introduces a more scalable, performant, and user-friendly foundation for the future of decentralized storage on Sia.

Ecosystem development continued steadily, with grant-funded projects delivering tangible progress across mobile accessibility, analytics, synchronization, and web portal infrastructure. These milestones underscore the Sia Foundation’s effective support of builders and its commitment to a more decentralized, privacy-preserving internet.

As the network approaches the V2 era, Sia stands positioned to capitalize on its architectural improvements and developer momentum, with the next phase of growth tied to broader adoption, ecosystem integration, and sustained market confidence.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.