and the distribution of digital products.

DM Television

Which RPC node—Ethereum, Solana, or Polygon—is the best choice for your dApp?

Building a decentralized finance (DeFi) dApp implies having a secure link to blockchain networks. My article compares the three largest blockchains – Ethereum, Solana, and Polygon (PoS). I compare from the perspective of RPC node usage in DeFi apps. We're concerned with performance (speed, throughput) and price, described in simple terms. We'll also take into account popular RPC service providers (GetBlock, Infura, Alchemy, QuickNode) and how they differ for each network. Finally, I’ll provide practical guidance on choosing the right network and RPC node for specific DeFi use cases like trading, yield farming, or lending.

\

What Are RPC Nodes and Why Do dApps Need Them?

\ RPC nodes (Remote Procedure Call nodes) are the gateway to your dApp and the blockchain. In layman's terms, an RPC node is a server hosting a blockchain client that applications can request to read data or post transactions on a blockchain. Instead of having your app execute a full node blockchain by itself, it can call an RPC node's API to, for example, get an account balance, get the last block, or broadcast a new transaction. Your app sends the request to an RPC node, which traverses the blockchain network and executes the action, and returns the result to your app.

\ It's a valuable service – dApps are able to make calls on blockchain data and smart contracts and the developers do not have to operate their own nodes. Having a full node can be fiddly and resource-intensive (Ethereum's blockchain, for example, is several hundreds of gigabytes and growing). With an RPC provider, though, developers get simple access to the network: the provider does all the heavy lifting of syncing up the blockchain and staying online 24/7. Your dApp simply makes API calls to the provider's RPC endpoint (say, an HTTPS URL), and the provider returns the desired data or confirms the transaction.

\ Essentially, an RPC node is a remote entry point for the blockchain to your app. It executes commands on behalf of clients using the RPC protocol (say, JSON-RPC for Ethereum) and sends back the response. This setup is the basis for all web3 apps, so choosing a good RPC service and network is an important decision.

\

Ethereum vs. Solana vs. Polygon: Network Performance and Costs| | Throughput (TPS) (theoretical) | Real-world TPS averages | Block Time | Avg Transaction Fee | |----|----|----|----|----| | Ethereum | 15 TPS | 20 TPS | 12 seconds | A few dollars per tx (varies with gas price) | | Polygon | 7,000 TPS | 100+ TPS | 2 seconds | Around $0.01–$0.1 (a few cents) | | Solana | 65,000 TPS | 1,000+ TPS | 0.4 seconds | <$0.001 (fractions of a cent) |

Ethereum, Solana, and Polygon all support DeFi applications but vary greatly in design and capacity. Here is a summary of the strengths, trade-offs, performance, and typical costs of each network.

\

Ethereum (Layer 1 Mainnet)

\ Ethereum is the original smart contract platform (operational since 2015) and the foundation of the DeFi boom. Ethereum has excellent security and decentralization. Ethereum now operates using proof-of-stake with hundreds of thousands of validators supporting the network, which makes it ultra-trustworthy for high-value applications. In fact, Ethereum still dominates the majority of DeFi value locked in smart contracts (over 50% of total DeFi TVL), which appeals to its dominant user base of assets.

\ Performance. Ethereum favors decentralization over pure speed. It processes around 15 transactions per second on Layer 1, with a 12–14 second block time. That means if you send a transaction, you may wait ~12 seconds to get included in a block, and a few minutes for safer confirmation. By its very design, Ethereum's capacity is limited, which leads to network congestion during peak hours.

\ Cost. As block space is limited, Ethereum transaction fees (gas fees) can be substantial. Fees increase and decrease with demand, but performing a DeFi transaction on Ethereum can range from a few dollars to several tens of dollars in gas. Average costs fell during the first half of 2025, compared to the 2021 highs, but are still significantly higher than those on Polygon or Solana. It is a trade-off for Ethereum's security – users will pay more to use the most stress-tested DeFi protocols on Ethereum.

\ Use cases. Ethereum's greatest asset is handling high-value transactions and complex contracts in a highly secure environment. It's the preference of the majority of lending platforms, DEXs, and other core DeFi protocols where security and liquidity matter the most. The catch is those lower fees and slower speed, which don't make Ethereum as useful for low or high-frequency trades. Developers mitigate this by using cheaper transactions on Layer 2 scaling networks or sidechains (e.g., Polygon itself, or rollups) but still securing them on Ethereum.

\

Solana (Layer 1 High-Performance Chain)

Solana is a throughput-oriented Layer 1 blockchain launched in 2020 that was built for throughput-heavy applications. Solana has a completely different architecture than Ethereum – Solana uses a new hybrid of Proof of Stake and Proof of History, and it's not EVM-compatible (its smart contracts are coded in Rust or C, not Solidity). Solana is scalability and low-latency focused.

\ Performance. Solana theoretically has incredibly high performance – up to 65,000 TPS in ideal conditions. Also, it has very fast block times of around 0.4 seconds. In reality, Solana's real-world throughput is generally in the low hundreds or low thousands of TPS, which is still a light-year faster than Ethereum. For example, on a single 2024 benchmark run, Solana was processing ~1,000+ TPS average, compared to Ethereum's ~23 TPS. This speed enables Solana to execute high-frequency trading and other computationally demanding DeFi use cases. Transfers are confirmed almost instantly (sub-second), with users enjoying very interactive behavior.

\ Cost. Solana transaction costs are extremely low, effectively fractions of a cent per transfer (around $0.00025 average) chain.compare Network capacity keeps fees in check, with ample room for many transactions. For developers and users, that implies you're able to execute sophisticated DeFi strategies or hundreds of small transactions on Solana without the risk of gas prices being prohibitively expensive. (Solana's fee model is different from Ethereum's gas model and is designed to keep costs low.)

\ Trade-offs. The compromise of Solana is that it is less decentralized than Ethereum. Solana relies upon a smaller number of validators (on the order of ~1,100+ individual validators as of 2025) and requires hardware that is strong to enable nodes. There have been a few historical instances of network instability or downtime on Solana. While Solana is performance-optimized, it currently lacks Ethereum's battle-tested security or decentralization. Developers migrating to Solana also have a learning curve because you can't natively deploy Solidity contracts – you'd need to utilize Solana's native runtime and dev tooling.

\ Use cases. Solana is optimal when you need speed and high throughput. An algorithmic trading protocol in DeFi or an on-chain order book exchange, for example, might utilize Solana to handle hundreds of trades per second with negligible latency. Users get nearly instant trades and negligible fees. The Solana DeFi ecosystem (while smaller than Ethereum’s) includes projects like Serum (order book DEX), Raydium, Solend (lending), etc., which capitalize on these strengths. Just keep in mind the relative youth of the ecosystem – integration with wallets and other services may be more specialized (you’d typically use Phantom or Solflare wallet, not MetaMask).

\

Polygon (Proof-of-Stake Chain)

\ Polygon, also the Polygon PoS chain (formerly known as Matic network), is an Ethereum-compatible block chain but supports faster and less expensive transactions. Polygon is often described as a "sidechain" or Layer 2 solution for Ethereum, although in principle it does have its own validators (it's not a rollup). The key point is that Polygon is an EVM-compatible platform, so developers can run the same smart contracts and users can utilize Ethereum wallets (like MetaMask) to use Polygon dApps by simply switching networks.

\ Performance. Polygon PoS is much faster and more scalable than Ethereum L1. It is capable of handling several thousand transactions per second (theoretical limit typically cited around 7,000 TPS). Average block times are ~2 seconds. In the real world, Polygon's average daily throughput has been observed of tens or hundreds of TPS (well utilized but far from maxed out). This is still a massive improvement over Ethereum's ~15 TPS. The 2-second blocks are making UX quicker – transactions confirm in a couple of seconds.

\ Cost. Polygon transactions only cost a few cents (or less) in average gas fees. For example, a token swap on a Polygon DEX might cost <$0.10 in fees, versus $5-$20 on Ethereum mainnet. This low fee environment is ideal for cost-sensitive DeFi applications, including repeated trading, small value yield farming, gaming, or micro-transactions, in which Ethereum charges would be prohibitive. Polygon facilitates low fees through increased capacity and its native MATIC token for gas, which is cheaper and operates on different economics from ETH on mainnet.

\ Trade-offs. The trade-off of Polygon is partly in decentralization/security. The Polygon PoS chain is secured by a limited set of validators (around 100-105 validators in the active set). This is much smaller than Ethereum’s validator count, so one has to trust that Polygon’s validator set (often professional validators and exchanges) behaves honestly. Polygon periodically commits checkpoints to Ethereum (which provides some security backstop), but it’s not as trustless as an Ethereum Layer 2 rollup. However, Polygon has been operating well and has the benefit of being fully EVM-compatible, thus it has a large chunk of Ethereum's developer community.

\ Use cases. Polygon is typically used to scale Ethereum-based dApps. If you already have an existing DeFi application (DEX, lending, yield aggregator, etc.) running on Ethereum, going live on Polygon allows you to offer users much lower fees and even speed without necessarily having to employ significantly different code and wallets. Several popular Ethereum DeFi protocols (Aave, Curve, Uniswap, SushiSwap, etc.) have implementations on Polygon precisely for this reason. For the purpose of yield farming, Polygon was the go-to in the "core DeFi summer" since farmers could compound yields often without sacrificing a small fortune in gas. Polygon is often a good choice when you want a compromise between convenience and less performance cost: you still rely on Ethereum tech (and you can easily bridge your assets from Ethereum), but you experience performance close to that of a high-throughput chain.

\

RPC Node Providers for Ethereum, Solana, and PolygonYou can, as a programmer, run your own nodes on each blockchain, but this might not be practical (especially for Solana, which requires top-of-the-line hardware, or Ethereum, which requires a lot of updates and maintenance). The easier thing to do is utilize a hosted RPC provider – an offering that will give you API endpoints for the networks you need. The large RPC infrastructure vendors abstract out the node management and provide stable, scalable access, usually with free plans to begin.

\ I compare here four of the most popular RPC providers and their support for Ethereum, Solana, and Polygon.

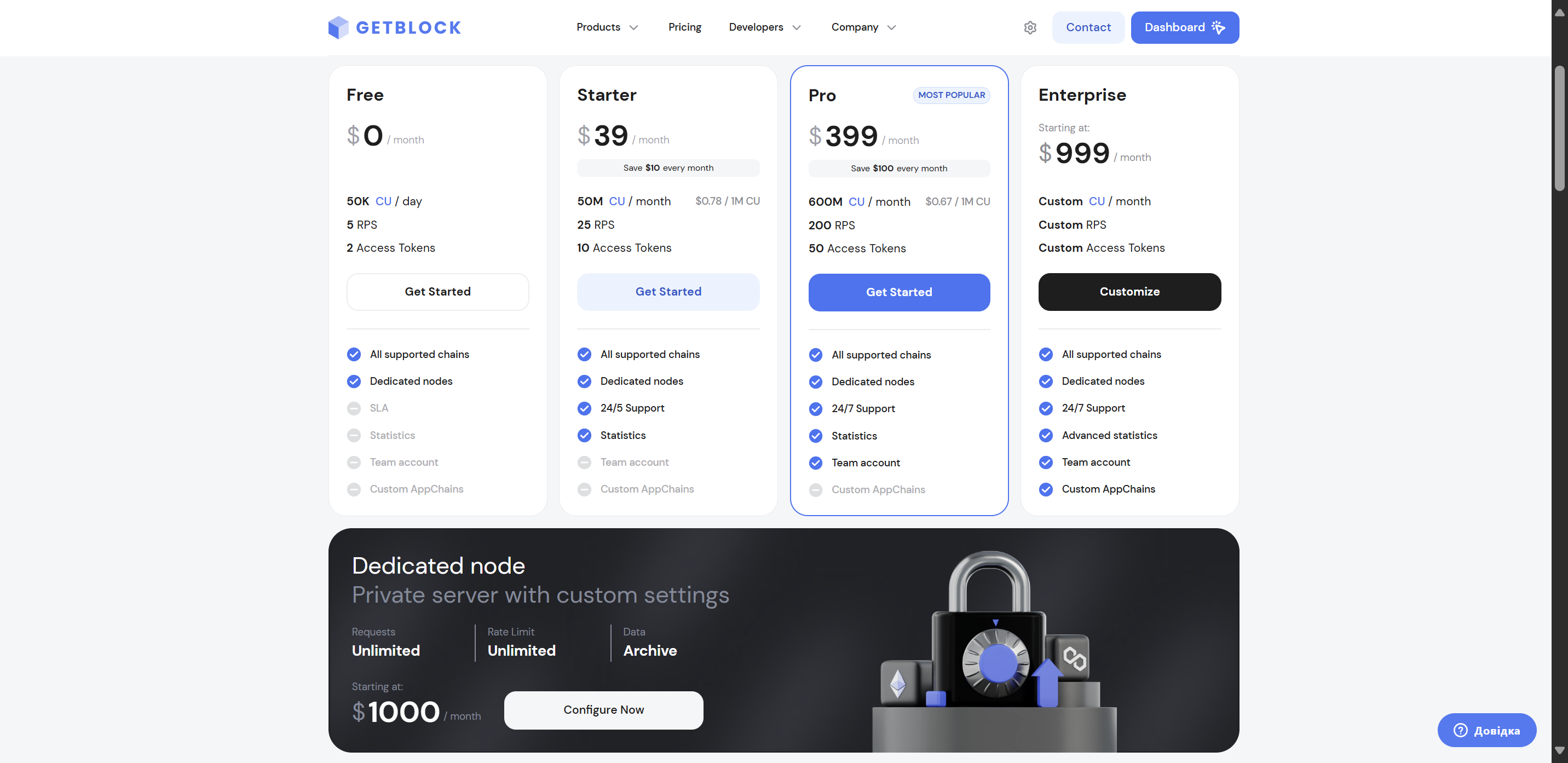

GetBlock

\ GetBlock is RPC node service provider that offers access to a wide variety of blockchains with an adaptable pricing plan offering a good free tier. GetBlock's value lies in having support for 50+ blockchains and a "one account, many chains" offer on par with QuickNode.

\ Network support. GetBlock provides super-support for a network list – over 50 protocols in 2025. All our focus networks (Ethereum, Polygon, Solana) and many others like BNB Chain, Tron, Avalanche, Fantom, Arbitrum, Optimism, Bitcoin, Ton, Aptos, etc. If you are working with some of the less widely known chains in addition to the major ones, GetBlock very likely has an endpoint for it. They support JSON-RPC, REST, and WebSocket APIs for these networks, so there's full flexibility in how you connect.

\ Features. In addition to shared RPC nodes, GetBlock offers the ability to rent dedicated nodes and custom solutions. For example, you can rent a dedicated node instance if you need one (convenient for enterprise or if you have very high throughput or custom requirements). They also talk about value-added services like providing raw blockchain data for analytics to enable and even custom blockchain explorers or dashboards for clients. Essentially, GetBlock is more than a node provider but a partner who can execute custom infrastructure work if required. For most developers, however, the main usage is the simple-to-use multi-chain RPC service.

\ Why to use GetBlock. If you need maximum chain flexibility or anticipate hopping across many blockchains, use GetBlock. Compared to Ethereum, Polygon, and Solana, it provides the same access as the others. It might not have comparable brand recognition within the Ethereum ecosystem as Infura/Alchemy but is a competent alternative. The free plan is "most powerful" for multi-chain access, so you can play with many networks for free. Developers also prefer GetBlock for its easy scaling – you can begin for free, then you can scale to precisely the amount of requests you require (they even have small increments such as 5M, 10M requests plans, etc., which other RPC nodes providers don't have). If your DeFi project is in need of bridging data from, say, Ethereum and Solana and another chain like BNB or Avalanche, GetBlock has all of them in a single service. And, if you ever need to have a special node (say, a private Polygon node for your project), GetBlock can provide that as a managed service.

Infura

\ Infura is arguably one of the longest-standing and most widely used blockchain API providers, notably famous among the Ethereum community. Infura, a ConsenSys subsidiary, became popular for providing MetaMask's default connections to Ethereum and some of the earliest dApps. It is a good choice for Ethereum and EVM-compatible networks.

\ Network Support. Infura supports Ethereum and Ethereum-related chains only. It supports Ethereum mainnet and testnets and also EVM top-level chains/Layer2s like Polygon, Optimism, Arbitrum, Avalanche, Celo, NEAR, etc. Infura does not support Solana because Solana is not EVM-compatible. If your dApp is Ethereum or Polygon-based, Infura's the one for you; but for Solana or non-EVM chains, you'd require another provider.

\ Performance. Infura has a solid foundation (backed by cloud infrastructure) and is reliability-centered on Ethereum. It isn't always the absolute lowest latency, but it's incredibly stable. One test saw Infura's response times for Ethereum calls at around 133ms from a US endpoint, which was slightly higher than QuickNode's but about in the same ballpark. Infura's architecture is designed with consistency in mind and they even offer an add-on called Infura Turbo (ITX) for transaction relays. For most dApp applications, Infura's performance is more than and sufficiently good.

\ Why use Infura. If you're developing primarily on Ethereum (or Polygon) and want a "set it and forget it" solution that is battle-hardened, Infura is a suitable choice. It is shipped with a lot of developer libraries and tools pre-installed. The compromise is that Infura is a centralized service – which has led to controversy regarding decentralization (Infura can in theory be an app's single point of failure if relied upon excessively). ConsenSys is working on a decentralized network (DIN) in response to this infura.io. But on an entirely developer convenience-driven basis, Infura's established reputation and copious amount of free tier accessibility make it very tempting for EVM dApps.

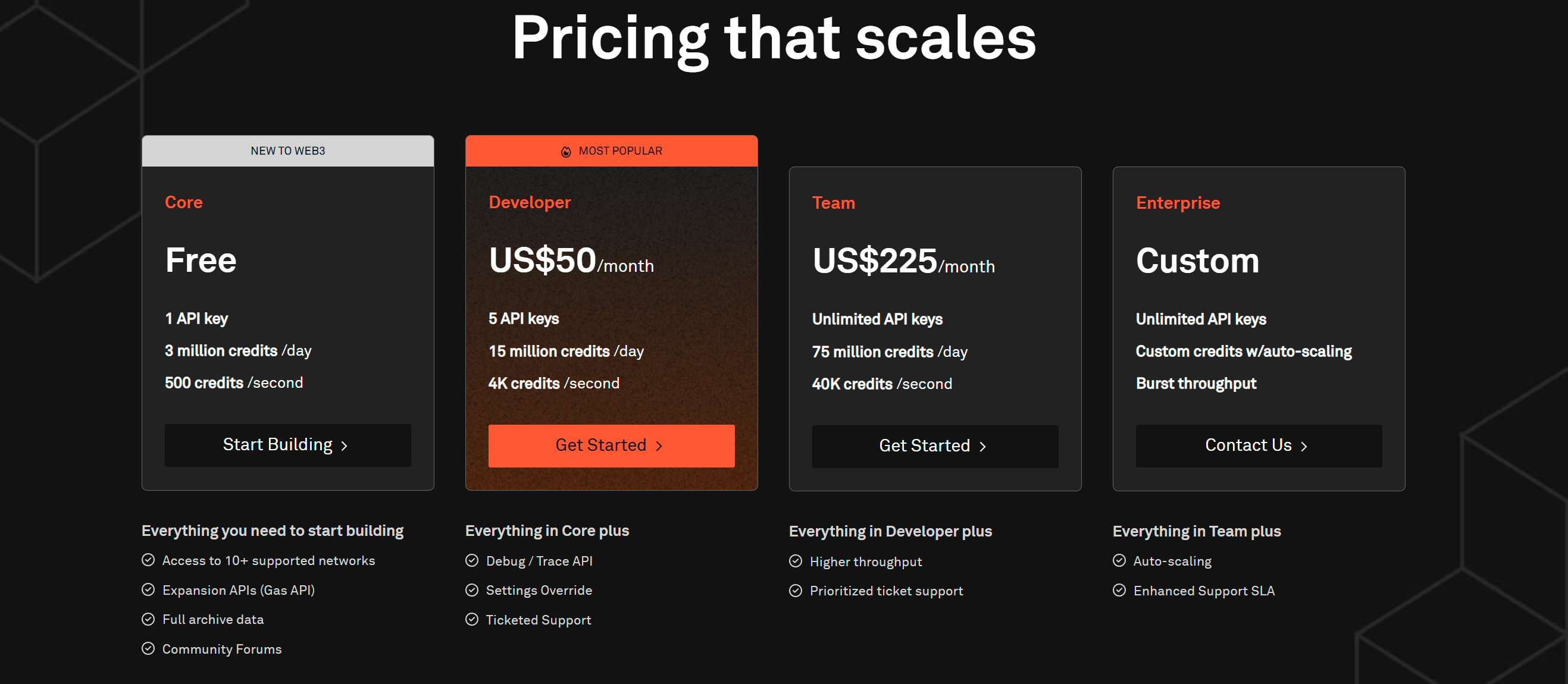

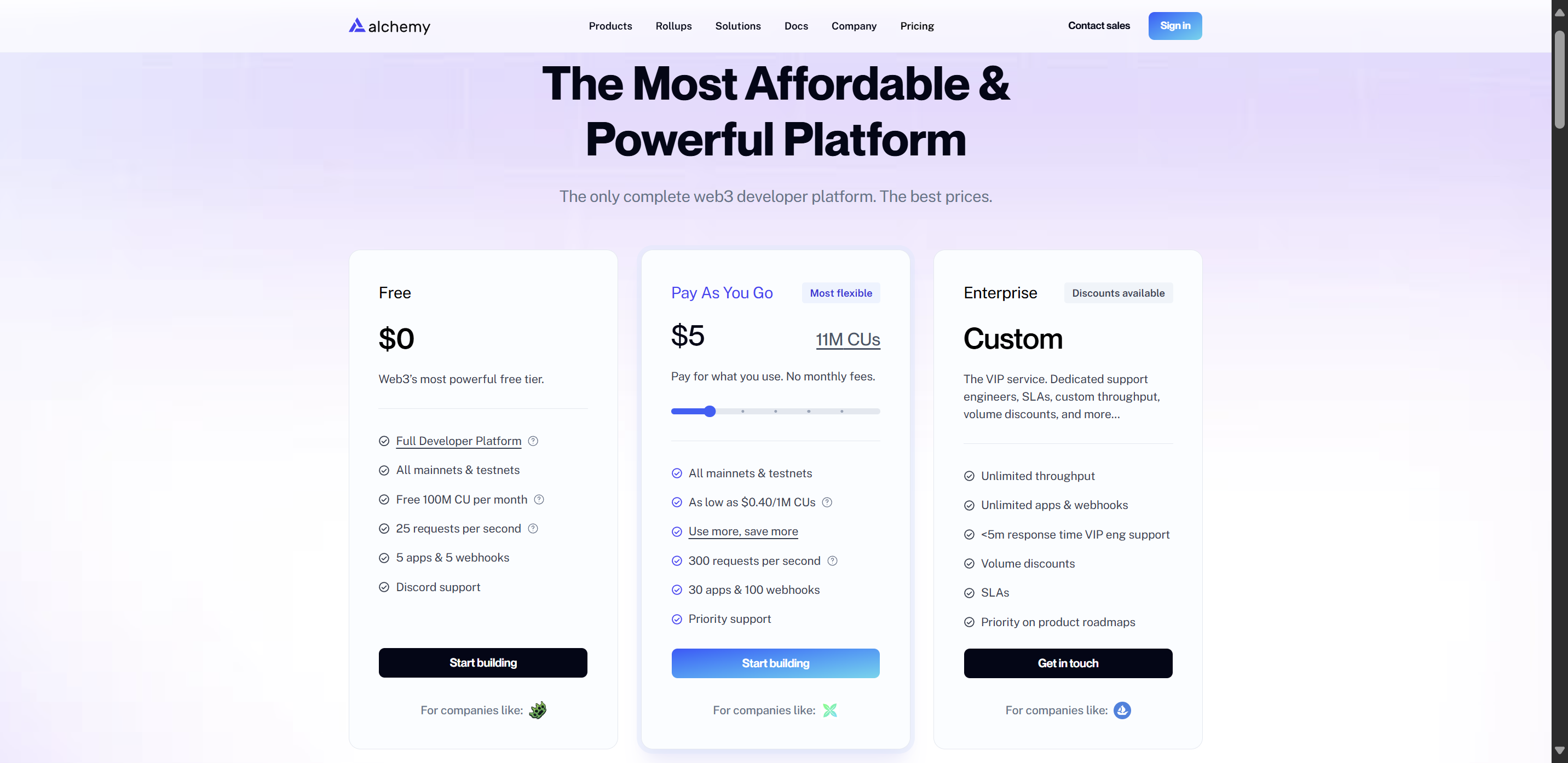

Alchemy

\ Alchemy is yet another premium blockchain developer platform that has become popular because it offers upgraded APIs and tools. Alchemy started life with its roots in Ethereum support but has since developed into a multi-chain platform. It likes to market itself as providing something more than plain RPC endpoints – with Alchemy, you get dashboards, debugging capabilities, and upgraded data APIs (for NFTs, tokens, etc.).

\ Network support. Alchemy supports multiple networks, including all major ones we’re discussing: Ethereum, Polygon, and Solana (as of recent updates). In fact, Alchemy supports 8+ chains: Ethereum (+L2s like Optimism, Arbitrum), Polygon PoS, Polygon zkEVM, Base (Coinbase’s L2), Starknet, Astar, and Solana. It does mean you can have one Alchemy account use both your Ethereum dApp and your Solana program, nice. (Note: Alchemy has no BSC support, e.g., because it focuses more on the quality of networks instead of quantity).

\ Features. Alchemy is unique in the sense that it provides value-added services. They provide more feature-rich APIs like an NFT API, Token API, transaction history API, Webhooks for listening to mempool, debug/trace APIs, etc., that simplify certain tasks for developers. These are not typically included in Infura's baseline service. Alchemy also emphasizes data accuracy and analytics – their platform ensures consistent query results and offers developer dashboards for monitoring usage and even identifying problems with your dApp. Many big projects (OpenSea, Aave, etc.) have used Alchemy for reasons above.

\ Reliability. Alchemy's design is reliability-focused. In isolated tests, Alchemy's latency for basic Ethereum calls is on par with Infura. A test in 2022 showed Alchemy averaging ~40ms vs Infura ~38ms for eth_blockNumber requests (basically a tie). QuickNode's own testing had Alchemy a hair quicker than some in some places, and a hair behind QuickNode in others, but all sub-hundreds of milliseconds. Alchemy is also proud of measurements like synchronizing 30% of Ethereum nodes for redundancy to ensure data correctness.

\ Why use Alchemy. If you want a one-stop shop developer platform with great multi-chain support and lots of other tooling, Alchemy is a great option. For a DeFi dApp that will scale to many networks (e.g., Ethereum mainnet and a Polygon implementation, or even Solana), Alchemy enables you to manage all those in one UI. The free plan will comfortably cover most hackathons and MVPs. And, if your dApp needs things like historical token balances, NFT metadata, or transaction simulation, Alchemy's higher-level APIs can be a timesaver – you might not have to run your own indexing server. The tradeoff could be a bit more complexity than an ordinary RPC service and, perhaps, a price as you grow high utilization (always review pricing if you're expecting billions of calls). But overall, Alchemy is developer-friendly and appropriate for serious DeFi projects that value analytics and cross-chain flexibility.

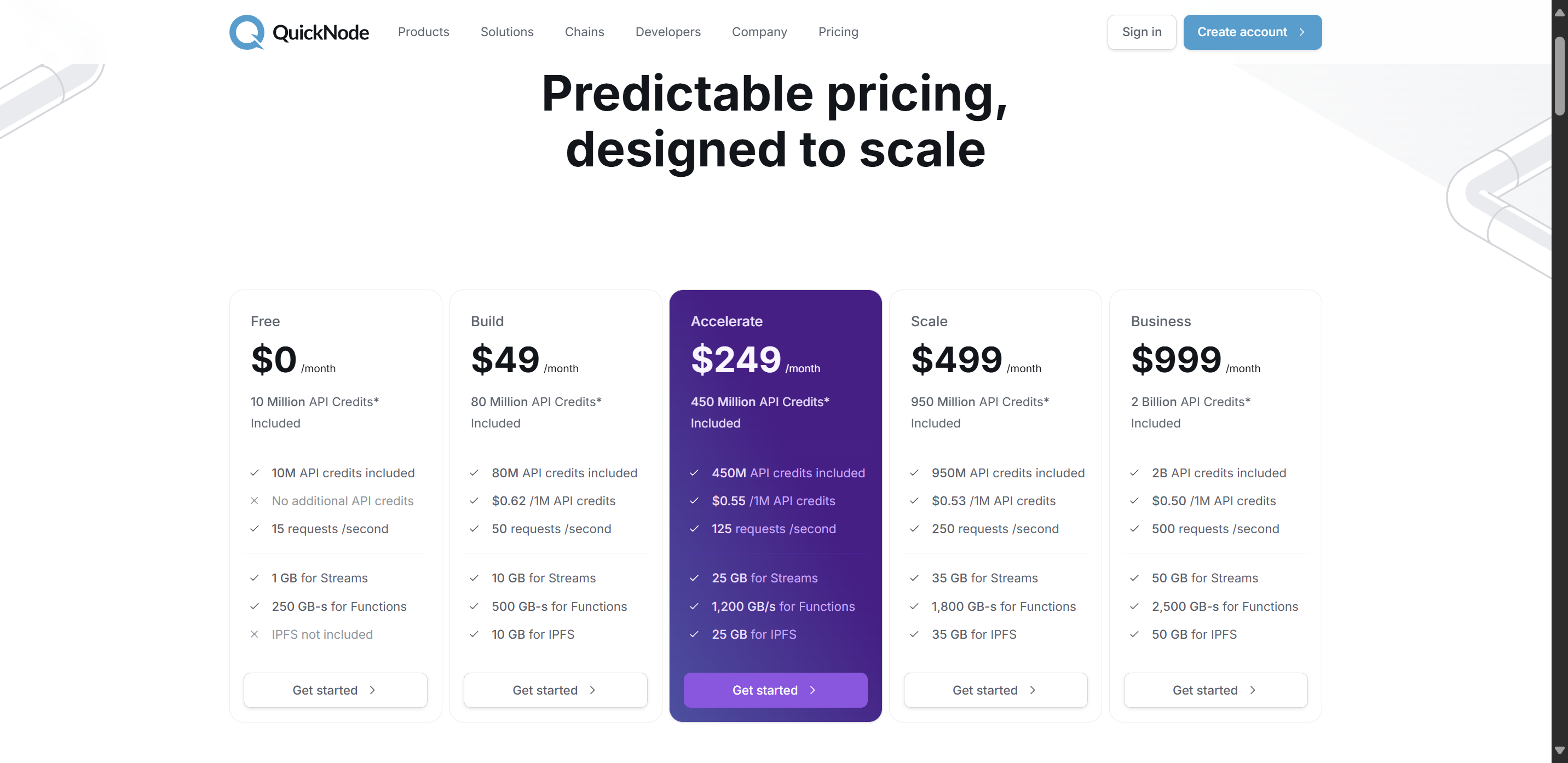

QuickNode

\ QuickNode is a fast-growing blockchain infrastructure firm that prioritizes speed, global availability, and support for multiple chains. QuickNode is generally praised for its performance and used by solo developers and large enterprises that need strong, low-latency connectivity to a variety of blockchains.

\ Network support. QuickNode is truly multi-chain – it has Ethereum, Polygon, Solana, and dozens more. In total, QuickNode supports 60+ networks (not just mainnets, but many testnets) on multiple blockchains. For example, you can get endpoints for BNB Smart Chain, Avalanche, Fantom, Arbitrum, Optimism, Algorand, Celo, etc., in a single QuickNode account. Notably, QuickNode has been extensively used by Solana developers, as they offer Solana websocket endpoints solely dedicated to Solana and even a high-performance, specialized Solana API (they have named it "Yellowstone" gRPC service) for live streaming data.

\ Performance. QuickNode, by their name, market themselves as "quick." They are globally distributed in their setup so that you can choose endpoint regions (to reduce latency) on their higher-tier plans. In a comparison test run by QuickNode's team, QuickNode had the fastest response time for Ethereum API calls in the U.S., having an average response faster than Alchemy (115ms) and Infura (133ms) in that test. In European and Asian tests, QuickNode performed exceptionally too. In practical terms, this means QuickNode can handle high loads of requests with near zero latency – useful to dApps that require snappy update responsiveness (e.g., a trading dashboard fetching on-chain prices). QuickNode also has an API analytics dashboard so that you can monitor performance and set up alerts.

\ Why use QuickNode. QuickNode is a great choice if you require high-performance or require a single provider to support a multiplicity of chains, such as Solana. For example, if you're creating a DeFi analytics app that pulls in data from both Ethereum and Solana simultaneously, QuickNode can do it. If your dApp relies on real-time updates (such as a trading bot or a dashboard), QuickNode's high RPS limits and low latency will be a star. They also provide WebSocket connections (for real-time blockchain event reception) on networks like Solana and Ethereum. The dev experience is good: QuickNode has reasonable docs and even a marketplace of add-ons/accelerators (e.g., MEV, analytics tools, etc.). Keep in mind that QuickNode is a newer company (started in 2017) than Infura, but it has worked very well. Generally, QuickNode is often "the fastest out-of-the-box RPC," and hence well-suited to high-frequency DeFi use cases or multi-chain deployment.

\

ConclusionWhich RPC node is "most appropriate" will actually depend on your dApp's requirements:

If you are looking at an Ethereum DeFi dApp and require proven reliability, you can start with Infura (easy to integrate, used by lots) or Alchemy (if you will be using their additional functionality). Both will also cover Polygon if you expand there, so you can't go wrong. You can even use both of them together (for redundancy, or load splitting).

If your dApp is Solana-native or multi-chain with Solana, QuickNode is probably the way to go with its Solana experience and speed. Alchemy is fast on Solana support, so that's another option if you prefer their ecosystem. GetBlock can also handle Solana if you want to experiment with it using a single account with EVM chains.

If budget is a primary concern (i.e., you are a small hackathon team or small project), utilize the free tiers. QuickNode and Infura's free tiers are generous. GetBlock's free daily requests on most chains is handy for building. You can start free on one or more providers and only scale up as you hit limits. Make sure to monitor your use so you don't exceed free buckets by mistake (some providers will start to rate-limit or charge pay-as-you-go beyond the free bucket).

For specific use cases:

Real-time or high-frequency DeFi -> Solana + GetBlock/QiuckNode (for performance)

Frequent transactions/yield farming -> Polygon + Infura/GetBlock (for cost efficiency with well-known tools)

High-value lending or sophisticated composability -> Ethereum + GetBlock/Alchemy (for security and ecosystem)

\

Final tip. Some projects use a multi-network strategy (e.g., deploy on Ethereum and a Layer 2/sidechain). In those cases, it is easier to use the same RPC provider for all of them. All of the providers we discussed support multiple networks, so you could, say, use GetBlock for Ethereum and for your Polygon node (and even add Solana in there), or use QuickNode for Ethereum and Solana together, etc. This keeps your infrastructure more homogeneous and typically gets you volume discounts. It’s also wise to have fail-safes – some dApp devs configure a fallback RPC provider (e.g., try Alchemy, but if it’s down, failover to Infura) to maximize reliability.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.