and the distribution of digital products.

DM Television

Webull Review: Powerful Trading Platform

Trading platforms offer a variety of tools and resources, including real-time market data, research reports, financial news, and analysis tools, to assist investors in making informed selections.

Today, this Webull review will introduce you to a commission- free online brokerage platform named Webull. This review will provide complete insight into the trading platform.

Summary What is Webull?Users can invest in a range of financial instruments, including stocks, options, exchange-traded funds (ETFs), and cryptocurrencies, using the commission-free online trading platform Webull. The portal provides a number of features, including in-depth analytical tools, technical indicators, financial news, and real-time market data.

Further, Webull also provides a variety of teaching tools, such as tutorials, live webinars, and a community of traders who share knowledge and tactics.

Try Webull Webull Features

Webull Features

Webull offers a wide variety of features and tools to help its users to make informed decisions and wisely manage their portfolios. These features include:

- Commission-free trading: Trading without commissions is possible on Webull for stocks, options, ETFs, and cryptocurrencies.

- Real-time market data: The site offers real-time market data for a variety of financial instruments, including quotes, charts, and headlines.

- Technical indicators: Webull provides a range of technical indicators, including relative strength index (RSI) and moving averages, to assist traders in trend analysis and decision-making.

- Desktop trading platform: Webull also provides a desktop trading platform with cutting-edge features and customizability choices.

- Cryptocurrency Trading: Bitcoin, Ethereum, and Litecoin are some of the cryptocurrencies that customers can trade on Webull. The platform offers over 40+ cryptocurrencies with as little as $1.

- Margin Trading: Webull margin trading enables investors to borrow money to augment their purchasing power and potentially boost returns. Yet, there are additional costs and risks associated with margin trading.

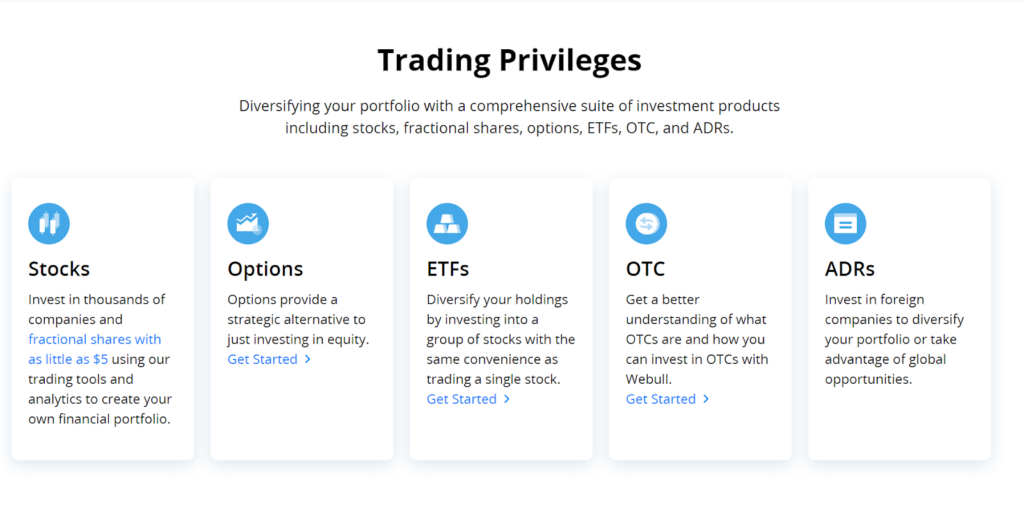

- Stocks: Webull stocks provides commission-free trading for stocks listed on major US exchanges such as the NYSE and NASDAQ.

- ETFs: Webull users can trade exchange-traded funds (ETFs) with no commission fees. ETFs are mutual funds that track the performance of a specific market index, industry, or asset type.

- Options: Webull options trading offers trading on equities and ETFs. Users can trade options without paying any commissions or contract costs.

- Cryptocurrency: Webull crypto allows trading for prominent digital currencies like Bitcoin, Ethereum, and Dogecoin.

- OTC: Webull OTC enables users to trade equities with no commissions, which might be advantageous for investors looking to trade lower-priced stocks or those listed on international exchanges.

- Fractional Shares: Investors can purchase and sell fractional shares of stock, which implies they can possess a piece of a share rather than the entire share, through fractional share trading. This can be advantageous for investors who wish to invest in high-priced businesses but cannot afford to purchase an entire share.

- Paper Trading: The Webull paper trading function simulates real-time market conditions, including real-time quotes and price changes. Users can practice trading stocks, options, and cryptocurrencies, as well as experimenting with various order types and trading methods.

- Cash Management: Webull Cash is a cash management service provided by Webull. Webull Cash is an FDIC-insured cash management program that allows customers to earn interest on uninvested funds, utilize debit cards, and pay bills. Besides, users can earn competitive interest on their uninvested cash balances.

- Recurring Investment: The recurring investment allows users to invest a set amount of money in stocks, ETFs, or cryptocurrencies on a regular basis. This feature can be beneficial to investors who want to construct a long-term investing portfolio without having to conduct trades manually on a regular basis.

- Webull Smart Advisor: Webull provides a robo-advisor service known as “Webull Smart Advisor.” This program offers automated portfolio management and investment recommendations based on the user’s own financial goals, risk tolerance, and investment time horizon. To manage user portfolios, Webull Smart Advisor employs a blend of algorithmic investment algorithms and human management. The Webull platform allows users to track their portfolio performance and progress toward their financial goals. They can also change their investing preferences or take money out of their portfolio at any moment.

Webull Pricing

Webull Pricing

Webull offers commission-free trading for stocks, options, ETFs, and cryptocurrencies. However, the platform does charge fees for certain services, such as margin trading and wire transfers.

Here are some of the fees associated with using Webull:

- Margin trading: Webull charges interest on margin trading, which allows traders to borrow funds to increase their buying power. The interest rates vary depending on the amount borrowed and the length of time the funds are borrowed.

- Wire transfer: Webull charges a fee of $25 for domestic wire transfers and $45 for international wire transfers.

- ACH transfer: ACH transfers are free of charge for deposits and withdrawals.

- Account maintenance fee: Webull does not charge an account maintenance fee.

- Regulatory fees: All securities transactions are subject to regulatory fees that are charged by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Webull offers customer support through various channels, including email, phone, and chat. Here are some details on the different customer support options available on Webull:

- Email: Users can contact Webull’s customer support team via email at [email protected]. The team typically responds to email inquiries within 24 hours.

- Phone: Users can call Webull’s customer support team at 1-888-828-0618. The phone lines are open from Monday to Friday, 9:00 AM to 5:30 PM Eastern Time.

- Chat: Users can also chat with Webull’s customer support team through the in-app chat feature. The chat is available 24/7, and users can access it by clicking on the “Help” icon in the app.

In addition to these channels, Webull also provides a range of self-help resources, including FAQs, tutorials, and a community forum where users can share tips and insights.

Overall, Webull aims to provide prompt and responsive customer support to help users with their questions and concerns. However, it’s important to note that response times may vary depending on the volume of inquiries and the complexity of the issue.

Is Webull Safe?

Yes, Webull is absolutely safe to use and it takes security very seriously and employs a range of measures to protect users’ personal and financial information. Here are some key security features and practices implemented by Webull:

- Secure login: Webull requires users to log in using a unique username and password combination, and supports multi-factor authentication for added security.

- Encryption: Webull uses encryption technology to secure data transmission between users’ devices and the Webull servers, protecting user data from interception by unauthorized third parties.

- Identity verification: To ensure that users are who they say they are, Webull requires users to go through a video verification process during account registration.

- Protection against fraud: Webull employs fraud detection measures to identify and prevent fraudulent activity on the platform, including identity theft, money laundering, and phishing attacks.

- Privacy policy: Webull has a comprehensive privacy policy that outlines how user data is collected, stored, and used, as well as users’ rights to control their data.

- Account protection: Webull offers account protection through the Securities Investor Protection Corporation (SIPC), which protects users’ investments in the event of a broker-dealer failure, up to $500,000.

Given that Webull targets customers who prefer using mobile devices, it becomes reasonable that the company has a well rated Webull app.

Users of the software have access to sophisticated features including voice control, a paper trading account, charts, and indicators. Besides, you can use the below links to use the Webull platform:

- For Mac: Intel chip-based Mac and M1 chip-based Mac

- For Windows

- For iOS

- For Android

The user-friendly interface, zero-commission trading, and extensive selection of investment products are some of Webull’s advantages. Additionally, it provides a paper trading simulator that enables investors to test out trading methods without putting actual money at risk.

Webull’s customer support, on the other hand, has come under fire for being slow and unresponsive, and the platform’s sophisticated features may make it unsuitable for beginners. Moreover, it does not support bonds or mutual funds, nor does it provide trading in fractional shares.

All things considered, Webull is a wonderful choice for experienced traders who want access to sophisticated trading tools and are confident in utilizing a complicated platform. Beginners, however, might wish to think about other choices that provide greater help and advice.

Try Webull FAQs What is unsettled cash in Webull?Unsettled cash in Webull refers to money deposited into a user’s brokerage account but not yet settled or cleared. When a user purchases or sells stocks in their account, the trade takes time to settle, so the money is not instantly available for use.

- When a buy order is placed, the funds used to make the purchase are considered unsettled until the trade is performed, and the securities are delivered to the account.

- In the instance of a sell order, the selling proceeds are considered unsettled until the deal is completed, and the money is deposited into the account.

The time it takes for a deposit to show in your Webull account can be affected by a number of factors, including the funding type and the time of day the transaction was initiated. The following are the estimated time frames for various sorts of deposits on Webull:

- ACH Transfer: Depending on the size and your bank’s processing time, deposits made via Automated Clearing House (ACH) transfer can take 1-5 business days to appear in your account.

- Wire Transfer: Wire transfer deposits normally show in your account within 1-2 business days.

- Webull’s Instant Deposit function allows users to send funds instantly using a debit card or another linked account. Instant deposits have a cost and are frequently accessible.

For on-demand analysis of any cryptocurrency, join our Telegram channel.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.