and the distribution of digital products.

State of SynFutures Q2 2025

- On June 26, SynFutures launched a West Texas Intermediate (WTI) crude oil market on Base with perpetual trading, USDC settlement, and up to 10x leverage. Pyth Network supplies WTI price data. On June 27, a gold (XAU) market with similar trading parameters went live, using Chainlink for pricing.

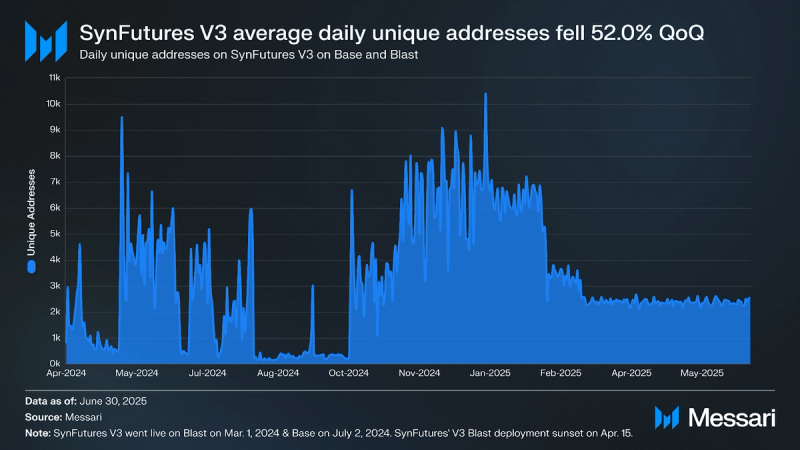

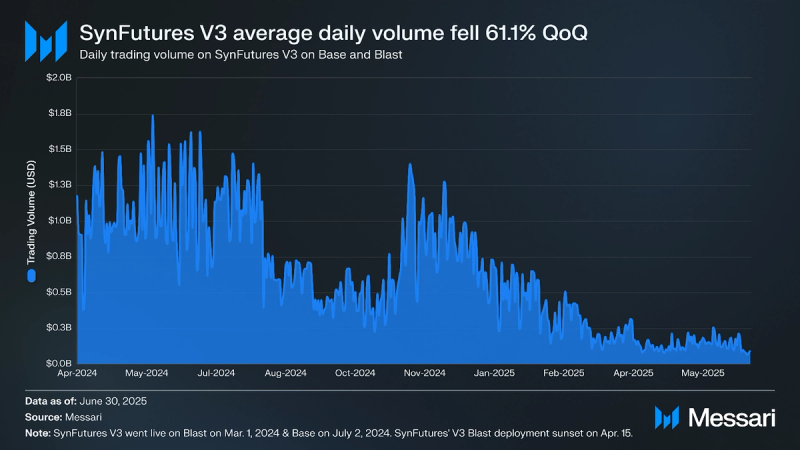

- SynFutures sunset its Blast deployment on April 15 to focus resources on Base. As a result of this transition period, the protocol processed $13.4 billion in perpetual futures volume in Q2 2025, down 61.1% ($20.4 billion) QoQ.

- In Q2, no daily total fell below 2,099 unique active addresses, reflecting a baseline of consistent activity. Still, daily unique addresses fell 52.0% QoQ from 4,680 to 2,250, and daily active addresses declined 52.9% QoQ from 4,780 to 2,250.

- On June 11, SynFutures launched its Builder Program to support third-party teams using its modular infrastructure. The first implementation of this strategy is Monday Trade, a spot DEX built on the Monad Testnet using SynFutures' core infrastructure.

SynFutures V3 (F) is a derivatives platform on Base powered by the Oyster AMM, a hybrid model combining single-token concentrated liquidity with an onchain orderbook. The system first fills limit orders at a given price range, called a Pearl, then uses AMM liquidity to fill any remaining volume in that range before repeating the process at adjacent Pearls as prices move.

The protocol’s other products include a spot aggregator, Synthia (an AI trading agent), and a perp launchpad. The spot aggregator sources liquidity from DEX pools on Base to optimize pricing for token swaps. Synthia is an AI trading agent that uses SynFutures’ infrastructure to execute spot trades and transfers from natural language commands on X. The perp launchpad provides grants, liquidity matching (up to $20,000), marketing, and technical support to early-stage perp projects.

In October 2023, SynFutures raised $22 million in a Series B round led by Pantera Capital to support the development of SynFutures V3. SynFutures V3 first launched on Blast in March 2024 after V1 and V2 of the protocol were deprecated in February. V3 then launched on Base in July 2024. The team deprecated the Blast deployment in April 2025 to focus resources on its preferred network, Base. For further details on SynFutures V3, refer to the SynFutures V3 Deep Dive section of our State of SynFutures Q3 2023 report.

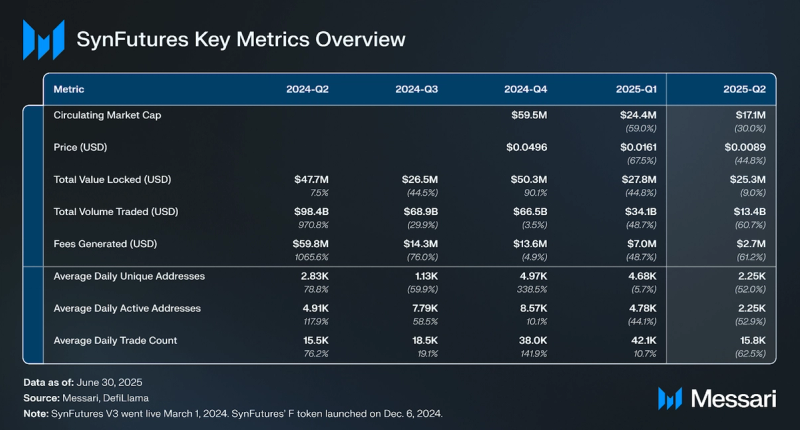

Key Metrics Performance AnalysisNetwork Overview

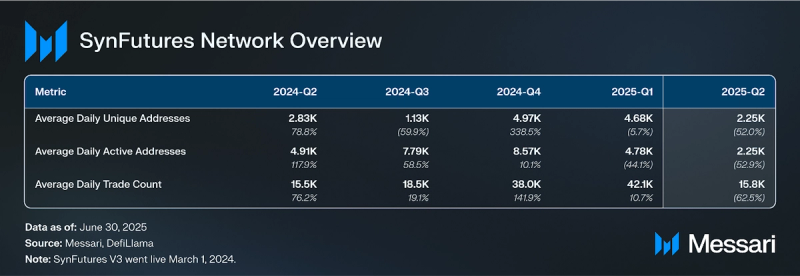

Performance AnalysisNetwork Overview  User Activity Metrics

User Activity Metrics

In Q2, SynFutures’ average daily unique addresses fell 52.0% QoQ from 4,680 to 2,250, and 20.5% YoY from 2,830 in Q2 2024. User activity remained consistent throughout the quarter, with daily unique addresses staying above 2,099 every day in Q2. This consistency marks a substantial improvement compared to a daily low of 145 unique addresses observed over the past year.

SynFutures’ average daily active addresses fell 52.9% QoQ from 4,780 to 2,250. Average daily active addresses represent the number of wallets interacting with the protocol daily. The protocol counts a single wallet multiple times daily if it participates in different interaction categories, such as executing trades, providing liquidity, or transferring assets. This differs from unique addresses, which count each wallet only once daily, regardless of how many interaction types it performs.

Asset Market Share

In Q2, ETH and BTC accounted for 86.9% market share of 1.6 million total trades by quote asset on SynFutures. ETH became the most traded asset in Q2 after BTC was the most traded asset for the last four quarters, with 758,100 trades (45.8% share), followed by BTC with 682,200 trades (41.2% share). SUI (Sui L1 blockchain token) was third with 37,300 trades (2.3% share), and GOAT (Solana-based memecoin) was fourth with 21,400 trades (1.3% share). Assets traded outside the top four accounted for 157,700 trades (9.5% share), led by ME (Magic Eden token), MEW (Solana-based memecoin), MOVE (Movement Labs L2 blockchain token), and PENGU (Pudgy Penguins token).

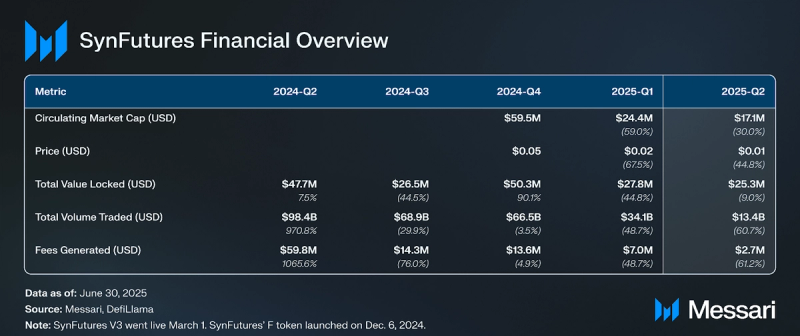

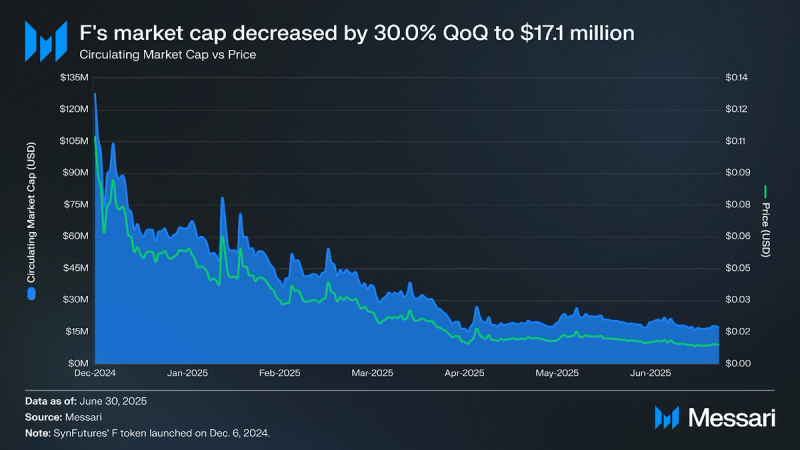

Financial Overview Market Cap

Market Cap

SynFutures' market capitalization decreased 30.0% QoQ from $24.4 million on March 31 to $17.1 million on June 30. The F token price declined 44.8% ($0.007) QoQ from $0.016 to $0.009 during the same time frame. Launched on Dec. 6, 2024, the F token remains relatively early in its lifecycle, and new tokens often experience price volatility as markets determine appropriate valuations. As SynFutures expands on Base, introduces real-world asset markets, and increases F token utility through the Builder Program, these initiatives may support more durable usage and valuation over time.

Volume

SynFutures' average daily trading volume declined 61.1% QoQ from $379.1 million to $147.4 million. On April 11, SynFutures announced the deprecation of its protocol on Blast, an Ethereum L2 blockchain, effective April 15 at 08:00 UTC. Q2 trading volume peaked the same day at $314.0 million, likely reflecting user activity related to moving funds from Blast before its April 15 shutdown. From April 15 to June 30, SynFutures’ average daily volume was $133.3 million.

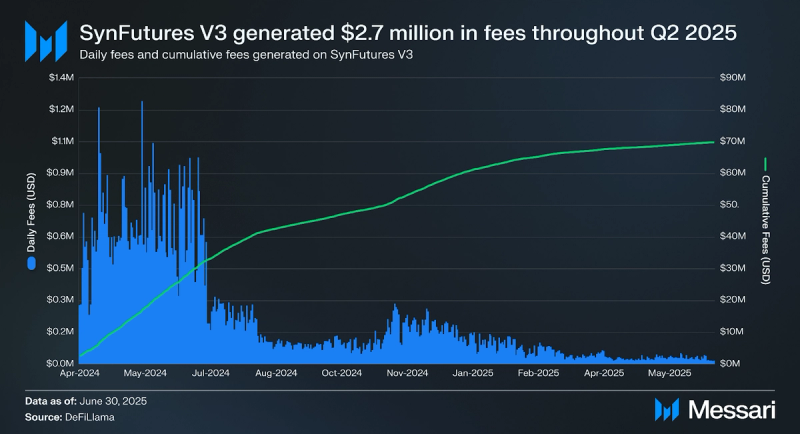

Fees

As of June 30, SynFutures V3 has generated $69.8 million in cumulative fees since its launch in March 2024. In Q2, SynFutures’ V3 generated $2.7 million in fees, down 61.2% from $7.0 million in Q1.

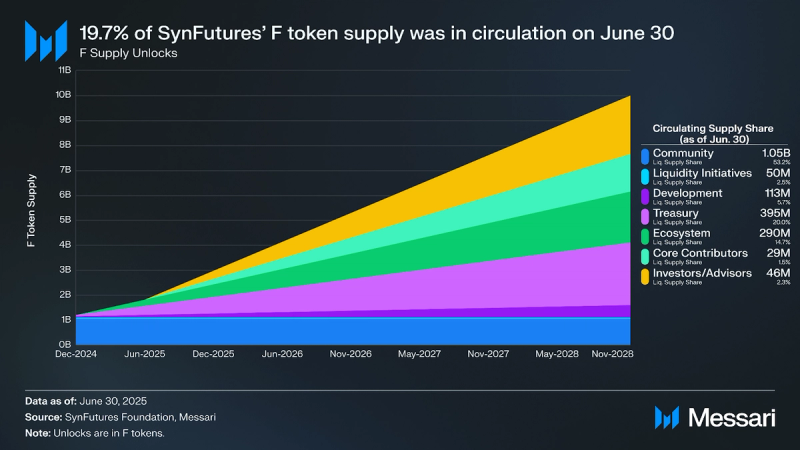

Token Supply

As of June 30, 1.97 billion F tokens (19.7% of the total supply) were circulating, up from 1.59 billion (15.9% of the total supply) on March 31, according to SynFutures’ vesting schedule. SynFutures unlocked 383.4 million F tokens (3.83% of the total supply) during Q2. June 6 marked the end of the six-month cliff for the Core Contributors’ allocation (15% or 1.5 billion tokens) and the Investors and Advisors allocation (23.5% or 2.35 billion tokens). This event triggered a linear unlock schedule for both groups, with tokens continuing to unlock linearly over the next 3.5 years until Dec. 6, 2028. Moving forward, all remaining F token allocations will continue unlocking linearly until fully vested on Dec. 6, 2028.

Qualitative Analysis F Token Binance Alpha Trading CompetitionOn June 15, SynFutures announced the F token launch on Binance Alpha with a trading competition on Binance. From June 15 to June 29, users competed for a reward pool of approximately $550,000 worth of F tokens exclusively via Binance Wallet (Keyless) or Binance Alpha. The top 6,940 ranked traders by purchase volume of F tokens during the promotion period received an equal share of 49.3 million F tokens (7,100 F per address). The competition excluded token sales and bridging transactions. To qualify, users had to be from approved regions (non-U.S. or non-sanctioned regions), verify their accounts (KYC), and hold an active Binance Wallet. Eligible participants received distributed rewards on July 13, contingent on active Binance Wallet accounts and completed account verification (KYC).

Synthia and Spot AggregatorOn Feb. 20, SynFutures launched Synthia, an AI agent enabling users to trade, swap, and transfer crypto assets on Base using natural language commands via X. Users interact with Synthia by posting commands such as “Swap 10 USDC for ETH” or “Transfer 50 USDC to [wallet address]” and tagging Synthia’s handle, @Synthia_SF. The agent executes these commands onchain using SynFutures’ spot aggregator, launched on March 5. The aggregator combines liquidity from the following DEXs on Base to improve pricing efficiency: Uniswap, PancakeSwap, Aerodrome, SushiSwap, and AlienBase. When users submit a trade, the spot aggregator scans liquidity pools across the integrated DEXs to determine the best token price at execution.

In the case that no direct liquidity pool exists between two tokens, the spot aggregator employs a multi-hop technique to route trades through intermediate tokens. For example, from token A to token B to token C, to complete the transaction. To minimize slippage, the aggregator also divides large orders across multiple liquidity pools simultaneously, known as split pool routing.

The aggregator selects pools containing anchor tokens, currently USDC, USDbC, WETH, cbBTC, and Virtual, each requiring a minimum of $10,000 in liquidity. The aggregator displays combined liquidity from these pools in an order book interface, enabling users to view available swap routes before execution.

To use Synthia, users first log in to Synthia’s portal with their X accounts, delegate transaction authority to Synthia via their Privy wallets (an authentication service for Web3 applications), and fund these wallets to execute transactions. In addition to facilitating asset swaps and transfers, Synthia provides market analysis and updates on X.

SynFutures outlined future phases for Synthia’s development. Phase 2 will introduce a no-code AI agent builder, allowing users to create customized DeFi trading agents. This phase includes tools for customizing trading logic and developer access via APIs and SDKs. Phase 3 aims to introduce AI entities capable of autonomously creating and managing other specialized AI agents for DeFi.

Sunsetting SynFutures’ Blast DeploymentOn April 11, SynFutures announced the deprecation of its protocol on Blast, an Ethereum L2 blockchain, effective April 15 at 08:00 UTC. SynFutures instructed users to close all active positions and withdraw liquidity from Blast pairs before the April 15 cutoff to prevent loss of funds. After this deadline, SynFutures discontinued service on Blast, rendering the protocol inaccessible. According to SynFutures, the decision was strategic to shift their resources toward ecosystems demonstrating higher user engagement, deeper liquidity, and stronger product-market fit, specifically highlighting Base as its preferred network.

Launch of Oil (WTI) and Gold (XAU) MarketsSynFutures introduced two new commodity-based trading markets on Base in late June. On June 26, SynFutures launched a West Texas Intermediate (WTI) crude oil market, enabling perpetual futures trading settled in USDC, with up to 10x leverage. SynFutures initially offered zero trading fees on the market until July 26. Pyth Network provides WTI price data for SynFutures.

Pyth is an oracle network delivering near real-time pricing data for cryptocurrencies, commodities, and equities to blockchain applications. It sources pricing directly from over 90 institutional data providers, including global exchanges, trading firms, and market makers. Data providers publish price data to Pythnet, a dedicated proof-of-authority blockchain. Each validator publishes asset prices, including spot price and confidence intervals, every 400 milliseconds. Pythnet aggregates this data using a weighted median algorithm to produce a single trusted price for each asset. These prices are then relayed across blockchains using Wormhole’s cross-chain messaging protocol. SynFutures and similar protocols request Pyth price updates as needed, incurring data and gas fees per request.

On June 27, SynFutures launched a gold (XAU) market, supporting perpetual trading, USDC settlement, and up to 10x leverage. Chainlink provides the gold price feeds.

Chainlink is a decentralized oracle network that delivers offchain price data to blockchain applications, reducing reliance on single data sources to minimize the impact of outlier prices. Chainlink’s Decentralized Oracle Network (DON) aggregates pricing data from multiple offchain sources, such as centralized exchanges (CEXs), and transmits verified information onto the blockchain. Protocols like SynFutures rely on Chainlink’s price feeds to securely determine asset prices for trading and financial operations, reducing the risk of incorrect or manipulated data affecting market integrity.

Partnerships x Builder ProgramBuilder Program

On June 11, SynFutures introduced its Builder Program to provide technical support, strategic guidance, and financial grants to developers launching DeFi trading platforms using SynFutures’ infrastructure. The Builder Program offers participants modular trading infrastructure, liquidity management, execution engines, and frontend application templates. Participants, such as Monday Trade, return a share of their revenue to SynFutures, which uses the funds to repurchase F tokens. SynFutures identified several priority development areas, including perpetual markets for real-world assets, delta-neutral yield stablecoins, decentralized prediction markets settled via perpetual futures, tokenized equities exchanges, and mobile applications for one-click perpetual futures trading.

Monday Trade

As a first instance of the builder program, on May 19, SynFutures partnered with Monday Trade, a Monad-native trading platform currently on testnet, by integrating SynFutures' infrastructure. Monday Trade combines AMM and orderbook-based trading in a unified interface, achieving near-centralized exchange speeds due to Monad’s 10,000 transactions per second (TPS) and sub-second block times. Monday Trade inherits SynFutures’ infrastructure, including its perpetual futures capabilities, enabling professional-grade onchain trading without centralized custody.

GoPlus Security

On June 17, SynFutures partnered with GoPlus Security, a Web3 security provider specializing in liquidity protection and user safety. GoPlus Security locked SynFutures’ official F/USDC liquidity pool on PancakeSwap using its SafeToken Locker. Locking liquidity refers to securing deposited tokens in a smart contract, preventing liquidity providers from withdrawing funds before a predetermined date. This mitigates the risk of liquidity withdrawals that could destabilize token prices, such as in rug-pull scenarios. GoPlus also offers browser plugins and integrations with platforms like Etherscan, alerting users to risky transactions or phishing threats, adding another security layer for users trading or providing liquidity in the F/USDC pool.

Closing SummarySynFutures expanded its product suite in Q2 2025 by launching perpetual markets for oil and gold on Base with up to 10x leverage, supported by oracles from Pyth and Chainlink. It also advanced its AI trading initiative with Synthia, an agent that enables natural language-based swaps and transfers via X.

Additionally, SynFutures partnered with security providers GoPlus and ChainPatrol, the Monad-native trading platform Monday Trade, and AGNT Hub’s AI agent marketplace. On June 11, SynFutures also launched its Builder Program to support external teams building DeFi infrastructure using SynFutures’ core systems. The protocol capped off the quarter with a Binance airdrop campaign and two significant token unlocks in June, bringing the circulating supply to 1.97 billion Ftokens (19.7% of the total supply).

Still, SynFutures activity declined in Q2 2025 as average daily trading volume fell 61.1%QoQ to $147.4 million, and protocol fees decreased 61.2% to $2.7 million. Average daily unique addresses dropped 52.0% QoQ to 2,250, while the protocol’s market capitalization fell 30.0% QoQ to $17.1 million as the Ftoken price declined 44.8% from $0.016 to $0.009. Looking ahead, new deployments on Base and ongoing progress with the Synthia agent and Builder Program provide fresh catalysts for protocol activity in the second half of 2025.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.