and the distribution of digital products.

State of io.net Q1 2025

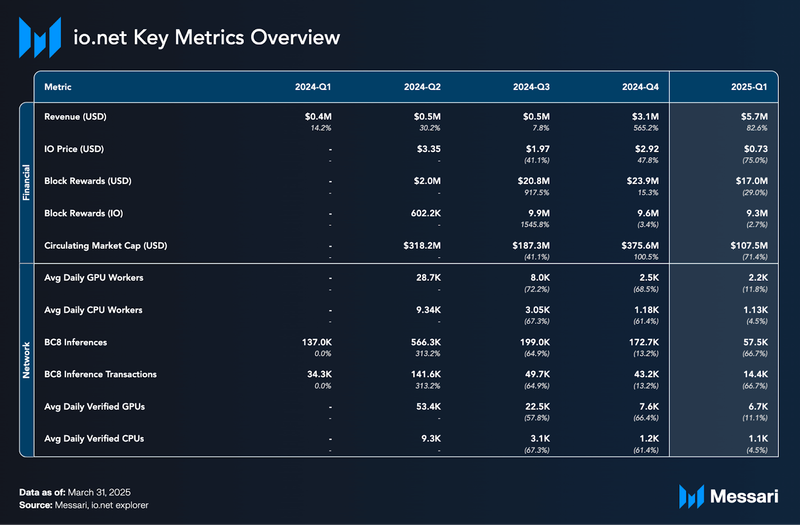

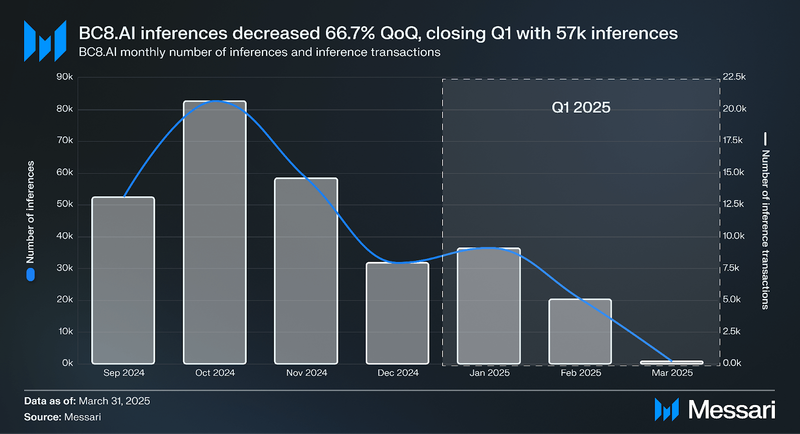

- io.net saw growth in quarterly revenue (+82.6%) – in contrast, io.net saw declines in IO market cap (−71.4%), token price (−74.9%), average daily verified GPUs (−11.1%), verified CPUs (−4.5%), and BC8.AI inferences and transactions (−66.7%).

- io.net integrated with various AI and compute-focused platforms, including LeonardoAI, KREA, Nexus Labs, and Mira Network.

- The project also collaborated with Injective to support DeFi + AI workloads and achieved SOC 2 compliance.

io.net (IO) is a decentralized network of graphics processing units (GPU) and central processing units (CPU) designed to provide scalable and efficient access to compute resources. The project’s decentralized physical infrastructure network (DePIN) provides increased flexibility and control of compute resources to suppliers and buyers. The main focus of io.net is to provide GPU resources for machine learning (ML) and artificial intelligence (AI) applications at scale. Built natively on top of Ray, an open-source unified framework for scaling AI and Python applications, io.net supports a wide array of machine learning frameworks—including TensorFlow, PyTorch, and others—facilitating everything from distributed training and hyperparameter tuning to model serving.

Its system intelligently matches and groups resources based on connectivity, geolocation, and hardware specifications to minimize latency. It enforces a one-hour minimum rental period for GPU clusters while allowing rentals of an unlimited duration. GPUs are sourced from underutilized avenues outside traditional cloud services, such as independent data centers, crypto miners, networks like Filecoin and Render, and consumer GPUs, which account for 90% of the total GPU supply but are often idle. To maintain robust security without compromising latency, io.net uses a kernel-level VPN with secure mesh protocols. Its IO agent detects and blocks unauthorized containers, encrypts data within the Docker file system, and prioritizes suppliers with SOC 2 compliance.

Website / X (Twitter) / Discord

Key Metrics Financial Analysis

Financial Analysis

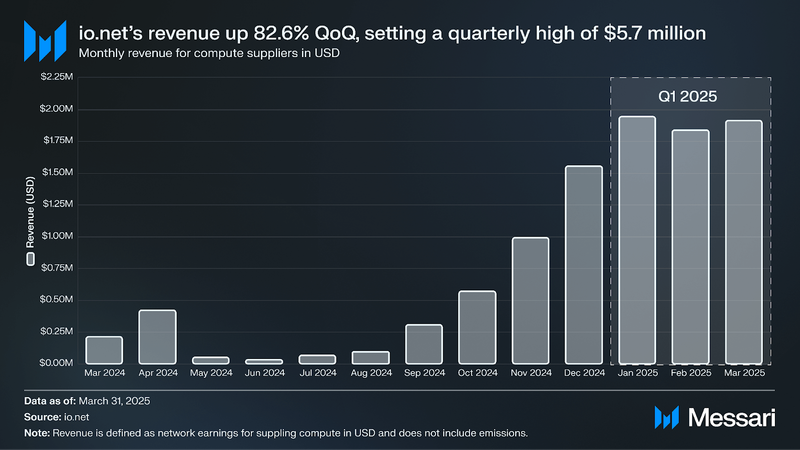

In the context of io.net, revenue is the amount of money compute buyers pay to GPU and CPU providers. Compute buyers can rent compute for as long as they desire, but they must rent for at least one hour. Currently, io.net allows buyers to pay with IO, USDC, or a credit card via a third party. In the future, there will be a 2% facilitation fee when paying in USDC; however, this fee is currently being waived, and the total cost to reserve compute goes to the suppliers. In Q1, io.net’s revenue increased by 82.6%, rising from $3.1 million to $5.7 million. This growth was driven by three months of all-time highs in monthly revenue, which also led to an all-time high in quarterly revenue.

The IO token was launched on June 11, 2024, via Binance’s Launchpool. Its initial circulating supply was 95 million, and the total token supply was 500 million. The token has a 20-year emissions schedule that reduces monthly, resulting in a maximum supply of 800 million.

After a strong Q4 2024, where the market cap of IO rose 100.5% QoQ to $376 million, Q1 2025 saw a reversal. IO’s market cap fell 71.4% QoQ to $108 million, driven by a 74.9% drop in token price despite a 14.5% increase in circulating supply. As a result, IO dropped from the 188th to the 298th largest crypto asset by circulating market cap during the quarter.

Network Analysis

io.net requires devices with at least 12 GB of RAM, 500 GB of free disk space, and a high-speed internet connection (over 500 MB/s download, 250 Mbps upload, and under 30 ms ping). To ensure suppliers' CPU/GPU resources are genuine and perform as expected, io.net implements an hourly Proof-of-Work (PoW) verification process. This process, which runs for about 15 minutes, uses a cryptographic puzzle to verify the authenticity and performance of devices, deter fraud, and ensure fair resource allocation. The PoW system comprises three components: a Binary Checker API that seeks a valid solution, a Challenges API that generates the puzzles, and a Results Submission API for verifying the solutions. Devices are visibly marked as verified, pending, or failed on the user interface, and any errors are logged for troubleshooting.

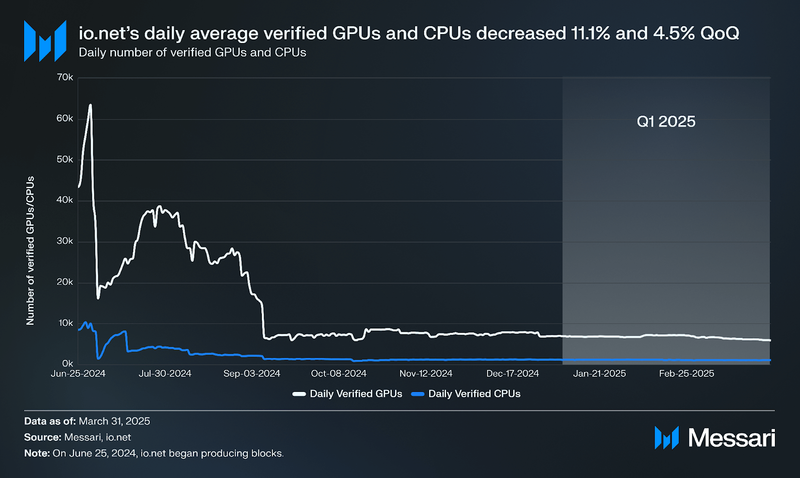

The average daily number of verified compute continued to decline in Q1 2025. Verified GPUs fell 11.1% QoQ, averaging 6,720 per day, while verified CPUs dropped 4.5% QoQ to an average of 1,130 daily. This extends a broader downtrend from peak activity in mid-2024, reflecting ongoing supply-side contraction and reduced token incentives amid a 74.9% QoQ decline in IO’s price.

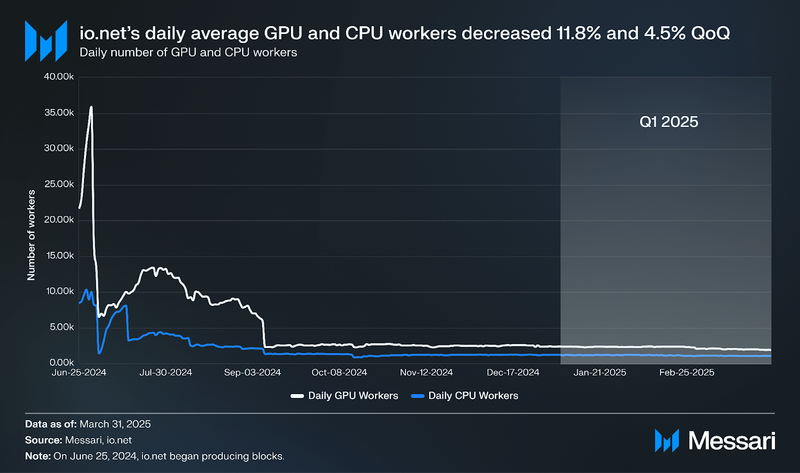

After strong early traction, the average daily number of GPU and CPU workers declined in Q1 to 2,220 and 1,130, representing QoQ drops of 11.8% and 4.5%, respectively – reflecting continued supply-side contraction.

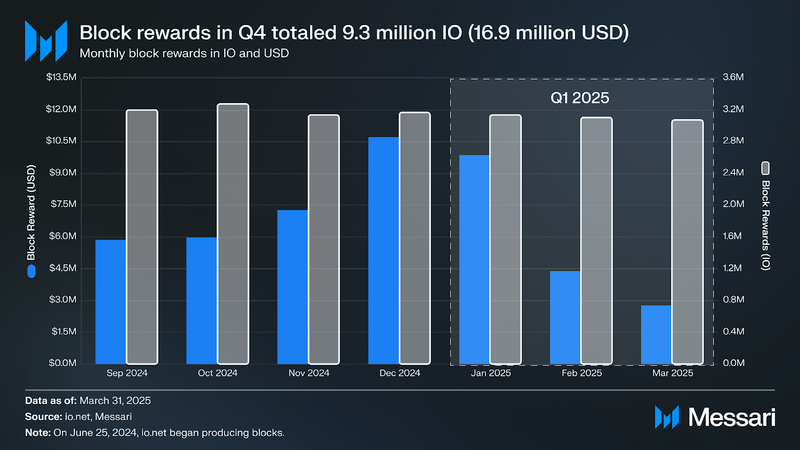

io.net began producing blocks and emitting the IO token as rewards for GPU and CPU suppliers on June 25, 2024. Since then, io.net has emitted 40 million IO, 9.3 million of which were emitted in Q1, equivalent to $16.9 million.

BC8.AI is an AI image generation platform that allows users to create images via prompts, similar to Midjourney. BC8.AI is powered by io.net, running its AI image generation model via io.net’s decentralized compute network. In Q1 2025, BC8.AI processed 57,500 inferences and 14,275 inference transactions, marking a 66.7% QoQ decline in both categories as usage contracted from Q4 2024.

Qualitative AnalysisGeneral Development and GrowthWhile the metrics above show mixed performance, Q1 saw several qualitative developments, with January being the most active.

January:

- io.net partnered with Zerebro to power Ethereum validator operations using decentralized GPU compute.

- KREA integrated io.net’s 300,000+ GPU network to meet growing demand from clients like Nike and Apple for AI-powered image and video generation.

- Alpha Network partnered with io.net to build a privacy-focused decentralized AI environment using zero-knowledge verification protocols and GPU compute clusters.

- LeonardoAI partnered with io.net to scale its AI-generated visuals platform, leveraging GPU compute at 90% lower costs than traditional cloud providers.

- Io.net and Injective collaborated to power DeFi + AI (DeFAI) applications by merging decentralized GPU compute with Injective’s iAgent SDK.

- Io.net achieved SOC 2 compliance, reinforcing enterprise-grade security and data integrity standards.

- Nexus Labs collaborated with io.net to scale zero-knowledge proof computation on the Nexus zkVM using decentralized GPU compute.

- Mira Network partnered with io.net to scale trustless AI verification, processing over 200,000 inferences daily and launching a Delegator Node Program.

February:

- Nillion partnered with io.net to power blind computation for privacy-first AI inference using decentralized GPUs.

- Orbit teamed with io.net to ensure verifiable, onchain AI agent decisions in DeFi through decentralized GPU compute.

- CreatorBid partnered with io.net to create scalable AI-generated content, including video and live streaming.

- Oasis Protocol and io.net combined trusted execution environments with GPU compute for private, decentralized AI.

- Gaianet partnered with io.net to enhance censorship-resistant AI agent inference using distributed GPUs.

- Rivalz AI launched the ROME Swarm protocol with io.net GPU compute, enabling scalable AI-native agent economies.

- GAIB partnered with io.net to launch tokenized AI infrastructure and supply high-performance H200 GPUs.

- Io.net joined the DePIN Pledge alongside Fluence and others to decentralize core internet infrastructure.

- ChainGPT integrated io.net’s decentralized GPUs to boost blockchain analytics, smart contract inference, and AI development.

March:

- FrodoBots teamed up with io.net to power AI research in urban navigation using decentralized compute for large-scale simulation.

- Oortech integrated io.net to build decentralized AI infrastructure with cost-effective and scalable compute.

- Allora Network partnered with io.net to scale AI inference in finance using io.net’s global GPU cloud.

- Filecoin and io.net advanced decentralized infrastructure integration, connecting idle SP GPUs with AI compute demand.

- MAIGA integrated IO Intelligence’s models via io.net to enhance real-time trading decision-making.

- Nesa partnered with io.net to scale decentralized AI workloads across 1,000+ blockchain-hosted AI models.

The broader crypto market contracted in Q1, with BTC and ETH market capitalizations declining 11.4% and 45.2% QoQ, respectively. Io.net’s IO token followed suit, with its market cap falling 71.4% due to a 74.9% drop in token price. In contrast, network revenue continued to grow, reaching $5.7 million for the quarter, an 82.6% QoQ increase, marking a second straight quarterly high. Verified supply continued its gradual contraction, with average daily verified GPUs down 11.1% to 6,720 and verified CPUs down 4.5% to 1,130.

While quantitative metrics were mixed, io.net maintained a consistent pace of ecosystem development. Q1 featured more than a dozen integrations, including Nesa (decentralized AI models), Allora (financial inference), and Filecoin (compute–storage interoperability). These partnerships reflect the network’s broadening role in decentralized AI infrastructure, even as it continues to refine its economic models.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.