and the distribution of digital products.

PayFi Ecosystem Analysis

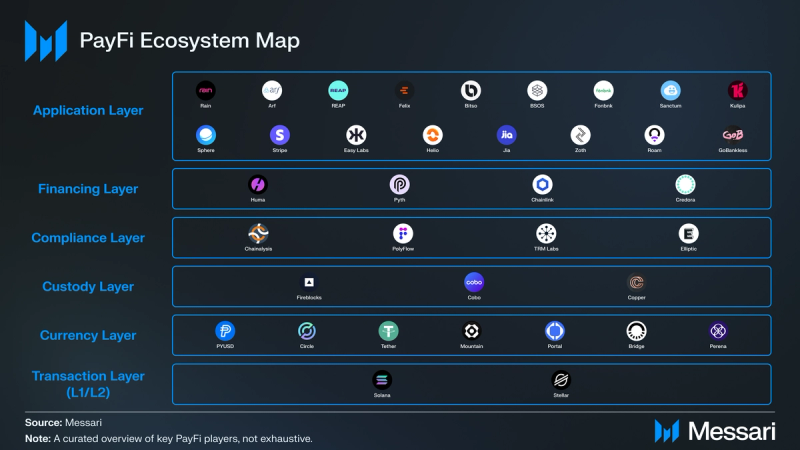

- PayFi (short for Payment Financing) leverages a six-layer infrastructure stack to create scalable solutions for global payment financing challenges.

- Stablecoin adoption is surging, with the total market cap growing 57% from $130 billion to $204 billion and monthly transfer volume increasing 148% from $1 trillion to $2.6 trillion in 2024, showcasing a strong foundation for onchain payment solutions.

- The financing layer within PayFi is rapidly maturing; monthly payments financed by Huma and Arf grew 116% from $63 million to $136 million in 2024, underscoring its increasing relevance for businesses globally.

- Emerging PayFi use cases, such as T+0 settlement and DePIN financing, transform how traditional industries can improve cash flow, reduce settlement delays, and open new opportunities for businesses of all sizes.

- Regulatory clarity and DeFi composability are critical for PayFi’s expansion in 2025, as the ecosystem aligns with global standards to unlock liquidity and foster institutional participation.

Payment financing operates on the principle of the time value of money, which means that a dollar today is worth more than a dollar in the future. Money received today can be invested in a business or market to generate additional value over time. Payment financing is already a cornerstone of the traditional financial system, ingrained in everyday life, and vital to global economic growth.

Examples of existing payment financing markets include credit cards, with a global transaction market of $16 trillion in 2023, and trade finance, which supports the $89 trillion market of global business-to-business payments. Remittances are another critical example, with 1 in 7 people globally relying on cross-border payment remittances, either by sending or receiving them. However, enabling remittances requires $4 trillion in pre-funded liquidity to support settlements, demonstrating the capital inefficiencies in current systems.

Despite its importance, traditional payment financing systems face significant challenges:

- Slow: cross-border payments can take several business days to settle.

- Expensive: sending remittances can incur high fees (averaging 7% globally).

- Inaccessible: many individuals who want access to these services, including 1.4 billion unbanked people globally, are denied due to geographical limitations, lack of identification, or insufficient income.

These inefficiencies highlight the need for more effective solutions.

PayFi, short for Payment Financing, makes essential financial use cases—such as credit, trade finance, and remittances—more accessible, secure, and efficient onchain. By leveraging blockchain technology and stablecoins, PayFi reduces settlement times and transaction costs. Solutions related to PayFi unlock greater access to payment financing for businesses and individuals across global markets.

In addition to improving existing systems, PayFi creates new markets that allow for entirely new financial use cases that were not possible before. This enables developers to design innovative financial solutions that streamline value exchange and reduce settlement latency.

Real-world assets (RWAs), such as stablecoins and tokenized invoices, serve as the medium of exchange within the PayFi ecosystem. These assets allow businesses to access liquidity, transact efficiently, and capitalize on opportunities in ways that traditional systems cannot match.

The PayFi ecosystem provides the technological infrastructure to build financial primitives that address longstanding inefficiencies in traditional payment financing systems. By enabling new and existing use cases, PayFi expands financial accessibility and drives economic growth on a global scale.

PayFi Use Case ExamplesPayFi applications address inefficiencies in traditional financial systems and unlock new opportunities. From enabling T+0 settlements to facilitating DePIN financing, the use cases below demonstrate PayFi's transformative potential across various industries.

Digital Asset-Backed Credit/Debit CardsDigital asset-backed credit cards are a prime example of how PayFi applications enable innovative financial solutions. One such application is Rain, which provides USDC-backed corporate cards tailored to Web3-native teams. In Rain’s model, corporate treasuries deposit their USDC into a vault, determining their credit limit. At the end of each billing cycle, the balance is settled automatically through onchain liquidation, ensuring transparency and efficiency. While Rain relies on USDC and vault-based operations, other solutions can be collateralized by any stablecoin supported in the currency layer or even blue chip crypto assets like Bitcoin or Ethereum.

Furthermore, not all payment solutions require a vault-based mechanism. Some systems like Kulipa integrate directly with self-custody wallets, enabling users to maintain control of their funds while accessing Web2 debit card capabilities. The adoption of low-latency blockchains has bolstered these flows, in many cases allowing funds to be locked at the point of card authorization while maintaining a self-custodial environment. The Solana protocol enables the use of Program Derived Addresses (PDAs) to support this use case, allowing a program to sign for the user in real-time. These flexible models cater to various business needs, reducing reliance on traditional banking infrastructure.

Digital asset-backed credit and debit cards represent a growing use case within PayFi that combines financial inclusivity with cutting-edge payment technology. These cards leverage blockchain for settlement liquidity and incorporate diverse collateral options.

Cross-Border Payment FinancingCross-border payment financing is a transformative solution addressing the inefficiencies of traditional banking rails, such as correspondent banks and SWIFT, which often delay transactions for several days. To meet the demand for same-day settlements, payment companies typically pre-deposit funds in destination countries, a process known as pre-funding. While effective in ensuring liquidity, pre-funding ties up working capital, limits business growth, and introduces financial risks, with an estimated $4 trillion locked in pre-funded accounts globally.

PayFi applications provide a modern alternative by offering onchain liquidity solutions that enable real-time, cost-effective settlements. Leveraging stablecoins like USDC, these solutions allow licensed financial institutions to bypass the need for pre-funding by settling payments near-instantly and transparently on the blockchain. This model reduces operational costs and unlocks capital, enabling companies to invest in growth and scale their operations without additional working capital.

For example, Arf provides licensed financial institutions with short-term, revolving, and USDC-based credit lines for cross-border payments. This lets them settle with international partners in real-time while avoiding pre-funding challenges. Cross-border payment financing showcases how PayFi solutions leverage blockchain to streamline liquidity management, improve operational efficiency, and deliver faster, more flexible financial services.

Trade FinanceTrade finance is a cornerstone of global commerce, enabling businesses to access short-term funding to support operations and growth. Traditionally, these services rely on financial institutions that may deny access due to limited credit history or inadequate financial infrastructure, particularly in underdeveloped regions. PayFi addresses these barriers by allowing businesses to tokenize invoices or future income streams, using them as collateral to secure immediate funding. This approach democratizes access to capital while reducing dependency on traditional lending systems.

One example of blockchain-based trade finance innovation is Tether’s Trade Finance initiative. Recently, Tether financed a $45 million crude oil transaction in the Middle East, using USDT to expedite settlement and reduce costs. This demonstrates blockchain’s ability to modernize global trade flows by lowering costs, accelerating payment times, and improving transparency. Leveraging tokenized assets and blockchain infrastructure, PayFi creates a more accessible and efficient trade finance ecosystem, unlocking new opportunities for businesses of all sizes and positioning itself to transform the industry.

T+0 FinancingEven highly liquid RWAs like Treasury Bills can take two to three days to settle due to delays in liquidating underlying assets. PayFi applications address this inefficiency by leveraging liquidity pools to front redemptions, enabling settlement within the same day (T+0). The liquidity pools are reimbursed once the underlying asset is fully settled, offering a fast and transparent solution for these transactions.

This capability can transform global payment flows. For instance, companies with complex international supply chains, such as Amazon, often face delays when transferring funds across multiple jurisdictions (i.e., U.S. to U.K. to Hong Kong to China). PayFi solutions eliminate these bottlenecks, allowing suppliers to receive payments without multi-day lags. Similarly, fiat-to-stablecoin conversions on exchanges and payment platforms can benefit from T+0 settlements, significantly improving the payment experience for businesses and institutions.

DePIN FinancingDePIN projects operate on the principle that the cost of building large-scale infrastructure can be distributed among individuals in exchange for future value redistribution. These projects often require upfront costs for contributing resources like bandwidth or hardware to the network and high micro-transaction volumes to compensate participants. PayFi offerings can streamline the financial processes behind DePIN projects by enabling financing options and fast, low-cost micro-transaction settlement.

For example, a project like Roam, which focuses on decentralized Wi-Fi networks, can benefit. Users can use the Roam Loan program to purchase a Roam Wi-Fi router miner and repay their loan balance using mining rewards. This process is enabled in two ways: through a 30% stablecoin down payment with the remaining 70% loaned by Huma Finance or with a 4 SOL deposit requirement and a 100% loan financed by Roam or Huma. Users are then repaid their principal amount and interest via Roam airdrops and mining rewards. Once the loan is fully repaid, users gain full ownership of the router and can start earning full rewards from providing the DePIN service.

These loans are repaid seamlessly through mining rewards and Roam airdrops, making participation accessible and incentivizing contributors. By facilitating timely repayments and enabling full ownership of the hardware after the loan is repaid, PayFi plays a critical role in supporting the growth and sustainability of DePIN ecosystems.

Open PayFi Stack x PayFi Ecosystem

The PayFi ecosystem can be thought of as a six-layer technology stack, initially proposed by Huma Finance, each serving a distinct function to facilitate efficient and compliant payment financing solutions. The Open PayFi stack provides a blueprint for collaboration across well-defined layers while maintaining openness and flexibility.

This approach is inspired by the early days of the Internet when networks were isolated, closed, and unable to communicate. The introduction of the OSI model—a seven-layer framework—enabled composability and interoperability, paving the way for countless innovations that are now globally accessible. Similarly, the Open PayFi stack aims to establish a modular, open network architecture for payment financing, accelerating adoption and enabling new use cases without requiring every ecosystem player to operate under the same infrastructure.

Copilot Insights: What is the PayFi six-layer infrastructure stack?Transaction LayerThe foundation of the PayFi stack ensures high throughput, low transaction costs, and rapid settlement—essential attributes for effective payment processing. Blockchain platforms such as Solana and Stellar are optimized for these requirements, offering solutions such as Solana Pay and the Stellar Disbursement Platform to enhance payment efficiency.

SolanaSolana’s high-performance, highly scalable architecture makes it well-suited for PayFi. The network can process up to 65,000 transactions per second (TPS), typically costing between $0.0024 and $0.048 per transaction. This efficiency enables near-instant settlement times, which is essential for high-frequency use cases such as retail payments, e-commerce transactions, and real-time cash flow management. Solana achieves this performance through its unique parallel transaction processing, which allows multiple transactions to be verified simultaneously—eliminating network bottlenecks and ensuring consistent scalability as adoption grows.

Solana also supports a permissionless, borderless infrastructure, allowing developers to build and deploy payment applications without central approval. This fosters innovation across global markets and eliminates the need for intermediaries, reducing costs and increasing accessibility for businesses and individuals. Solana provides an ideal framework for global payment financing solutions by enabling cross-border payments.

Solana Pay is a generalized open-source framework for commerce payments that facilitates direct merchant-to-consumer transactions and is a central component of the Solana ecosystem’s contribution to PayFi. Solana Pay supports stablecoins like USDC and other Solana-native SPL tokens, enabling low-cost, real-time payments that eliminate the delays and high fees associated with traditional credit card systems. Solana Pay’s features include:

- Direct, Transparent Payments: Merchants receive payments near-instantly without involving third parties and can track all transactions.

- Integration with E-Commerce: Solana Pay integrates with platforms like Shopify via Helio, allowing businesses to accept stablecoins for online purchases with minimal setup.

- Wallet Interoperability: It supports a variety of Solana-based wallets (i.e., Phantom, Solflare, etc.), ensuring users can transact using their preferred tools.

Beyond facilitating payments, major financial institutions like Visa, PayPal, Stripe, and Circle have built Solana integrations to strengthen liquidity within the PayFi ecosystem, ensuring stablecoin accessibility for merchants and consumers. Solana’s integration with PayPal was done to improve the speed, scalability, accessibility, and cost of PYUSD transactions. This integration enhances the efficiency of PYUSD transactions and aims to broaden its adoption across various platforms, contributing to the growth of Solana's ecosystem. All of these integrations leveraging Solana’s low transaction costs and scalability, provide the foundation for new financial models, including onchain credit systems and programmable payments.

Other payment-related innovations in the Solana ecosystem include blockchain links (blinks). Blinks are a feature introduced by Solana that transforms onchain actions into shareable links, allowing users to perform blockchain transactions directly from various platforms without leaving their current app or web page. This innovation is part of Solana Actions, APIs that facilitate transactions on the Solana blockchain. Blinks have been integrated into various platforms, including social media and e-commerce sites, enabling activities such as buying NFTs, swapping tokens, and staking SOL directly from social media timelines.

Solana’s infrastructure improves existing systems and enables new use cases that were previously impossible. By supporting innovations like programmable credit, microtransactions, and value exchange, Solana empowers developers to create financial primitives that expand access to capital, reduce settlement latency, and drive the adoption of digital payments across industries.

In summary, Solana’s high throughput, scalability, and low-cost transactions position it as a backbone for payment solutions in the PayFi ecosystem. Its decentralized and developer-friendly infrastructure fosters innovation, making Solana a natural choice for building scalable, global payment applications and driving the future of onchain finance.

StellarFounded in 2014, Stellar is a proven blockchain optimized for global payments, making it well-suited for the transaction layer in the PayFi ecosystem. Stellar's fast transaction speed—processing payments within 5 seconds—paired with the low transaction fees, averaging $0.00005, positions it as a cost-effective and scalable solution for cross-border payments. Stellar enables direct, peer-to-peer transactions while simplifying currency conversions, which is particularly impactful in remittances and emerging markets where traditional systems are costly and inefficient.

A key strength of Stellar is its asset tokenization capabilities, which allow users to digitize assets, from national currencies to commodities like precious metals. This enables fast, inexpensive asset transfers between parties, even across borders or currencies. Anchors, a Stellar-specific term for the on/off-ramps connecting the Stellar network to traditional financial systems like financial institutions or fintech companies, enhance accessibility by bridging the gap between blockchain and traditional finance.

Complementing Stellar is the Stellar Disbursement Platform (SDP), an open-source solution for bulk payments. The SDP supports up to 10,000 transactions in a single operation, settling funds near-instantly and operating 24/7. It also simplifies recipient onboarding through wallet creation via SMS invitations. With integrations like MoneyGram, the SDP bridges digital assets with fiat, enabling real-time payroll, humanitarian aid, and vendor payment disbursements.

The introduction of Soroban in March 2024, the Stellar smart contract platform, is an additional advancement for the network, enabling it to host smart contracts on the PayFi stack. Soroban adds programmability to Stellar, allowing developers to build scalable dapps that automate complex financial processes. With Soroban, Stellar now supports DeFi protocols, decentralized exchanges (DEXs), and other financial products, which previously limited the network's capabilities. These tools allow developers to create dapps on the application layer of the PayFi stack.

By combining its proven role as a payment-focused blockchain, smart contracts, and the SDP’s bulk payment capabilities, Stellar is uniquely positioned to be a key foundational contributor to the transaction layer of the PayFi ecosystem. The Stellar infrastructure enables more secure, efficient, and cost-effective solutions for global payment financing while paving the way for innovative financial primitives to address gaps in traditional systems.

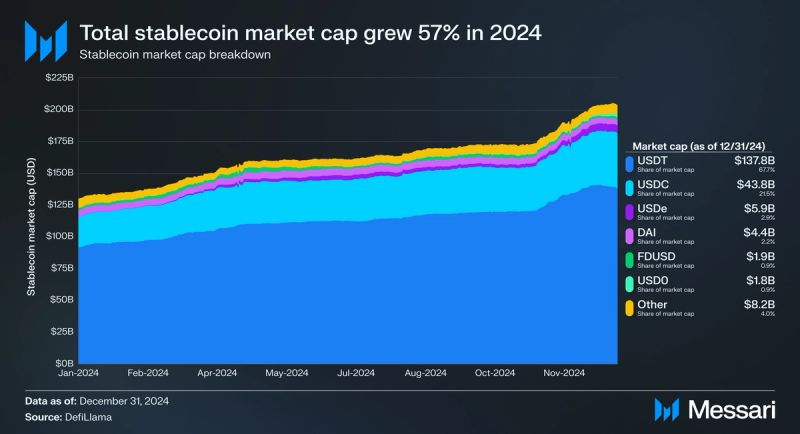

Currency LayerThe currency layer for PayFi dapps is predominantly built on USDC, with PYUSD and USDP also utilized in some cases. New PayFi dapps can integrate other major stablecoins, such as USDT and USDM, with additional non-USD options like EURC, XSGD, GYEN, and HKDR expected in the future. The availability of multiple stablecoins tied to different national currencies enhances accessibility for on/off ramps, enabling more versatile payment options beyond USD-backed conversions. This supports international transactions and crypto-to-fiat settlements, improving the attainability of blockchain transactions globally.

In 2024, the total stablecoin market cap increased by 57%, from $130 billion to $204 billion. This growth is largely driven by the dominance of the two major stablecoins, with USDT capturing a 68% share of market cap and USDC holding 22%. As the stablecoin market expands, the range of use cases built on stablecoins will likely grow alongside it, including PayFi applications. The increased adoption of stablecoins as a store of value and medium of exchange creates a supportive foundation for applications leveraging these assets.

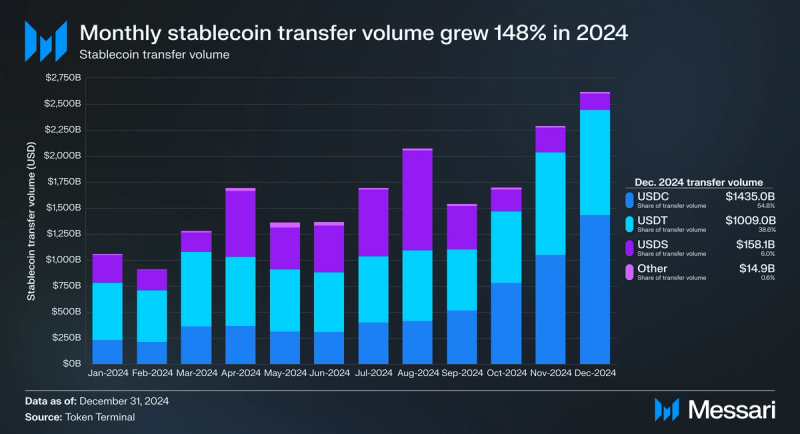

The monthly stablecoin transfer volume increased by 148% in 2024, from $1 trillion to $2.6 trillion. In December 2024, the share of transfer volume was the inverse of the stablecoin market cap distribution, with USDC accounting for 55% of transfer volume compared to 39% for USDT. While the increase in stablecoin transfer volume can be attributed to various factors, USDC’s larger share of transfer volume relative to its market cap suggests it is more frequently utilized in dapps requiring significant transfer activity. Conversely, USDT’s lower share of transfer volume relative to its market cap likely indicates its predominant use as a store of value. These trends highlight USDC’s potential as a foundational stablecoin for applications requiring a high volume of microtransactions. This aligns with the needs of PayFi applications, which depend heavily on such transaction patterns, underscoring USDC’s suitability for the Currency Layer of the PayFi infrastructure stack.

In addition to stablecoins enabling a medium of exchange for PayFi dapps, infrastructure providers like Portal and Perena ensure the management of stablecoin assets. Portal focuses on infrastructure that helps users transact by leveraging blockchain-based assets to bridge traditional and decentralized financial systems.

PortalPortal provides wallet infrastructure and a Web3 interface to help partners enable Web3 capabilities on their apps. Its SDK allows partners to connect to protocols and decentralized applications via mobile or desktop browsers. Using multi-party computation (MPC) cryptography, Portal offers an embedded wallet without seed phrases, enhancing security and user accessibility.

Portal also supports stablecoin infrastructure, enabling the creation of USD Stablecoin Accounts. These accounts allow users to receive, store, and spend wealth in digital dollars, particularly in emerging markets. Portal’s infrastructure supports features like Visa-backed physical and virtual credit cards for spending stablecoins locally and off-ramp solutions that facilitate cashing digital dollars into local currencies. Portal supports use cases like DeFi swaps, NFT games, and cross-border payments. Portal has partnered with exchanges, fintechs, and developers to facilitate Web3 onboarding and integration while expanding stablecoin accessibility for global users.

PerenaPerena is a stablecoin infrastructure provider on the Solana blockchain focused on creating a unified and liquid ecosystem for stablecoins. It addresses challenges like liquidity fragmentation and inefficient capital usage in the stablecoin market. At the core of Perena’s offerings is Numéraire, a multi-swap stableswap integrated with major stablecoins, including USDT, USDC, and PYUSD. Numéraire (Beta) is an automated market maker (AMM) that enables the creation and swapping of stablecoins and aims to maximize capital efficiency while protecting users from MEV attacks.

Perena’s innovative use of a tranched collateralized debt position (CDP) system enables the minting of synthetic stablecoins backed by tokenized real-world asset yields. This approach aims to transform stableswaps into liquid synthetic dollars, bridging the gap between DeFi principles and traditional finance systems. Perena seeks to build a scalable, liquid, stablecoin ecosystem within the Solana network.

Custody LayerThis layer addresses the secure storage and management of digital assets, which is crucial for payment financing. Institutional-grade custody solutions are provided by companies such as Fireblocks, Cobo, and Copper. These platforms offer features like multi-party control of assets, security protocols for asset liquidation in case of default, and granular account management controls. Such sophisticated custody solutions are essential for institutional users and are increasingly becoming accessible to retail and small business users through advancements in self-custody wallet technologies.

Compliance LayerOne critical challenge for utilizing stablecoins in real-world payments is ensuring regulatory compliance, particularly regarding Anti-Money Laundering (AML) practices. The permissionless nature of assets moving across wallets and chains complicates tracking illicit activity, creating blind spots that regulatory agencies find challenging to navigate. Moreover, the centralized structures of many cryptocurrency payment systems introduce custodial risks, inefficiencies from fiat settlement integrations, and limited service capabilities.

To address these challenges, companies like Chainalysis, Elliptic, and TRM Labs offer advanced AML solutions that improve monitoring and tracking capabilities. Similarly, PolyFlow provides an innovative compliance-focused infrastructure layer tailored for PayFi. PolyFlow offers a modern framework to tackle the inefficiencies and risks in traditional cryptocurrency payment systems by decentralizing transaction handling, incorporating privacy-preserving technology, and ensuring custody-free operations.

PolyFlowPolyFlow is an infrastructure layer designed to enable the direct purchase of goods and services using cryptocurrency. It focuses on fund settlement between wallets—whether crypto or fiat—without relying on banking accounts. It decentralizes real-world transaction handling to reduce centralized custody risks and regulatory blind spots, offering a custody-free model that adheres to compliance standards.

Key to PolyFlow’s value proposition is its Payment Identity (PID) layer, a decentralized ID linked to encrypted user privacy-protected KYC/KYB information. This enhances regulatory compliance without compromising user privacy. The PID is instrumental in establishing a credit framework for small and medium-sized businesses. This strategy targets the often underserved sector that investors can support, promoting financial inclusion and growth. PolyFlow also addresses inefficiencies in the traditional crypto payment model by reducing reliance on opaque centralized systems and minimizing dependence on traditional fiat settlement.

With its payment liquidity pool (PLP) for settlement execution, PolyFlow simplifies the gateway to crypto mass adoption for multiple use cases, such as supply chain finance on the Stellar network. By leveraging tokenization, PolyFlow unlocks onchain liquidity for tokenized ‘accounts receivable’ assets and effectively transfers enterprise buyers' credit to upstream suppliers, thereby enhancing capital accessibility. By integrating DeFi compatibility, PolyFlow generates yield through liquidity provision for payment transactions, a critical requirement for the widespread adoption of PayFi. The PLP combines innovative compliance adherence, privacy protection, and service versatility, positioning itself as a foundational compliance protocol in the PayFi ecosystem.

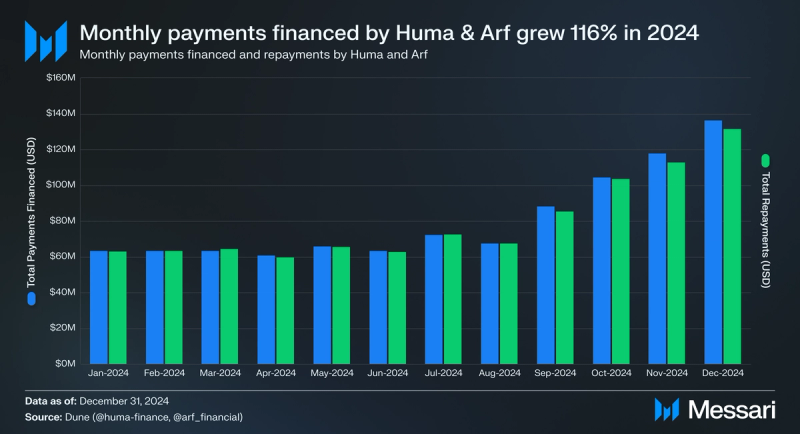

Financing LayerThe financing layer encompasses protocols that enable lending pools for PayFi applications by connecting capital supply with demand. It focuses on managing risk, asset pricing, structuring, tokenization, and distribution, making it a critical part of PayFi infrastructure. Huma Finance serves as a leading decentralized lending infrastructure protocol, coordinating the operation of these pools within the PayFi ecosystem. Huma enables lenders to supply capital for fixed durations (e.g., three or six months). Liquidity providers can then earn returns ranging from 10% to 20%, as seen on the Arf pool on Solana. These yields are funded by borrowing fees collected from users of PayFi applications. The loans are collateralized with assets such as future income statements, validated by credit assessment services like Credora. Oracles like Chainlink and Pyth integrate onchain and offchain data, supporting accurate credit assessments and further reinforcing this growth cycle.

HumaCopilot Insights: What is Huma Finance?At its core, Huma enables liquidity providers (LPs) to deposit, earn, and withdraw funds while offering borrowers access to credit facilities. The protocol differentiates itself from traditional DeFi lending platforms in several key ways:

- Tailored for Payment Financing: Huma specializes in payment financing, offering credit lines and receivable-backed credit options to address the specific liquidity needs within this space.

- Modular Structured Finance: Huma’s structured finance modules provide flexibility in adapting to different financial contexts, allowing customization of repayment schedules, fee structures, and tranches. This adaptability makes Huma suitable for a variety of use cases across industries.

- Advanced Risk Management: Huma’s risk management framework incorporates dynamic evaluation agents for assessing credit. These agents review and approve credit requests, determine credit terms (e.g., limits, duration, interest rates), declare defaults when necessary, and restructure credit terms. The system aims to mitigate risk effectively and maintain borrower accountability throughout the lending process.

- Instant Liquidity: Huma provides immediate access to funds through efficient liquidity solutions, enabling borrowers to deploy capital quickly.

- Compliance and Open Architecture: Huma works with licensed partners to perform KYC/KYB processes and investor checks to ensure regulatory compliance. Its open, modular architecture also supports cross-layer interoperability, fostering the creation of innovative financing solutions.

For lenders, funding PayFi applications can offer higher yield returns on a user’s USDC than other alternatives, such as Ondo, albeit with higher risk due to the possibility of delinquent loan repayments. Ondo offers an alternative to typical DeFi yield opportunities by introducing tokens collateralized by U.S. Treasury RWAs. For instance, OUSG is a tokenized security backed by Blackrock's U.S. Treasuries ETF (SHV), which tracks the performance of short-term U.S. Treasury bonds maturing within one year. Historically, these yields are reliable but low and can fluctuate with market conditions, often reflecting broader economic trends such as inflation and Federal Reserve interest rate adjustments. This can compress returns during periods of monetary easing.

Yields enabled by PayFi dapps are derived from payment financing primitives essential to many businesses, such as international payments. The critical role these primitives play in everyday business operations ensures stable demand, which supports consistent returns and reduces susceptibility to broader economic fluctuations.

These financing layers can provide real-time evaluations of lenders. This transparency can bolster lender confidence and attract institutional participation. This can create a positive flywheel: as more borrowers repay loans successfully, the system's credibility is enhanced, increasing liquidity from larger suppliers.

Huma also supports the application layer of the PayFi stack, comprising applications that deliver a range of payment financing services. An example is Arf, which specializes in cross-border payments. Monthly payments financed by Huma & Arf increased 116% in 2024, rising from $63 million in January to $136 million in December. Monthly repayments also increased 108% in 2024, rising from $63 million in January to $131 million in December. Huma’s total onchain transaction volume has surpassed $2.9 billion on an all-time basis.

Rain, a digital-asset-backed credit card platform, exemplifies how PayFi sector applications leverage the PayFi stack's foundational infrastructure, such as liquidity pools and financing protocols provided by platforms like Huma. In addition to Rain, Huma operates diverse lending pools tailored to various financing needs, supporting dapps such as BSOS for trade finance, Jia for small business financing, and Roam, a decentralized global Wi-Fi roaming network.

Roam leverages Huma to operate a DePIN hardware financing program on Stellar, allowing users to leverage cash flow generated by Roam products (i.e., Roam Rainier MAX 60 routers). Users can use Roam tokens or NFTs as collateral to obtain loans from Huma, which can then be used to purchase Wi-Fi hardware. Operators can manage the equipment, earn through RoamPoints rewards, and repay their loans.

To prioritize risk management, Huma focuses on launching low-risk pools to ensure stability and security rather than indiscriminately increasing the number of available options.

Currently, seven active pools on EVM-compatible blockchains support the applications listed above. Arf partnered with Huma and their pool is active on Solana and Stellar. Stellar also supports a finance pool for Roam, demonstrating the network’s growing PayFi adoption within the ecosystem.

Application LayerThe PayFi ecosystem is vast and underpinned by major players driving innovation and adoption across its foundational layers, such as Stellar, Solana, and Huma. While key layers of the Open PayFi Stack—such as transaction and financing—provide the infrastructure for secure and efficient operations, the most critical layer for user engagement is the application layer. This layer enables end users to interact with PayFi solutions across diverse use cases, including cross-border payments, remittances, DePIN funding, trade finance, and more.

This section highlights some of the key participants in the PayFi application layer today, where the impact of these innovations is most visible to users. While not exhaustive, this overview demonstrates the breadth of the PayFi ecosystem as it continues to grow and evolve.

ArfArf is a global liquidity platform providing short-term financing solutions for cross-border payments, focusing on licensed financial institutions. Arf offers onchain liquidity that enables 24/7 instant, low-cost USDC-based settlements, removing the need for pre-funded accounts. Traditional cross-border payments require financial institutions to maintain significant pre-funded capital in accounts across multiple countries, a capital-intensive and inefficient model that hinders scalability and innovation. Arf addresses this by introducing the world’s first short-term, revolving, USDC-based liquidity solution for cross-border payments, eliminating pre-funding and counterparty risks.

The protocol has become one of the fastest-growing stablecoin use cases, with over $2.9 billion in onchain volume and no credit defaults to date. By enabling same-day settlements with complete traceability through onchain transparency, Arf ensures faster, cheaper, and more reliable payment flows. Arf’s liquidity pools currently offer an APY of 10 to 20% while maintaining a healthy gross margin. Backed by notable investors like Circle Ventures and the Stellar Development Foundation, Arf aims to democratize liquidity access, promoting financial inclusion on a global scale.

Arf has demonstrated strong capital efficiency, achieving rapid turnover with 50 cycles per year and processing $1.5 billion in loan volume. In December 2024, it operated with an average liquidity of $30 million and plans to scale this to $200-$250 million in 2025.

Bitso x FelixFelix, a WhatsApp-based payments platform, and Bitso, a cryptocurrency exchange with over 5 million users, have partnered to transform remittance payments across Latin America. Traditional remittance processes are slow and costly, often requiring users to visit physical locations, pay high transaction fees averaging $10 for a $300 transfer, and handle cash, which can pose safety risks. Felix delivers a secure, affordable remittance solution by integrating Stellar payment rails, USDC, and Bitso’s on/off-ramps.

Using Felix, users in the U.S. send remittances directly through WhatsApp by interacting with an AI bot that collects transaction details and provides a secure payment link. Payments are made with debit cards, and once completed, funds are collected as U.S. dollars, converted to USDC in Felix’s Bitso account, and then transferred to local currencies such as Mexican pesos. These funds travel through local banking rails, such as SPEI in Mexico or other country-specific systems, and are deposited into recipients’ bank accounts.

This solution significantly reduces the time and costs of cross-border payments, enabling funds to arrive within seconds. With a user-friendly platform and extensive local banking integrations, Felix and Bitso ensure broad access to remittances across Latin America, improving financial inclusion and creating a faster, less cumbersome cross-border payment experience for both senders and recipients.

Airtm x BridgePaying workers in regions with volatile currencies and high inflation presents significant challenges for employers and employees. Employers need a reliable and efficient way to meet global payroll requirements, while workers require timely payments that retain their value and can withstand local currency instability. Traditional cross-border payment systems are slow, costly, and often fail to penetrate emerging markets. They also involve complex compliance processes, expensive currency conversion, and technical barriers to integrating modern payment networks.

To address these challenges, Airtm and Bridge, powered by the Stellar network, developed a platform for cross-border payments. Airtm is a financial technology company that provides users with a globally connected digital dollar account, enabling them to receive payments, access money in e-wallets, and convert funds to local currency. Users can add funds through over 400 methods, withdraw money near-instantly, and send or request payments from other Airtm users. With the integration of Bridge’s stablecoin orchestration service, the platform ensures efficient currency conversions between fiat and stablecoins like USDC or USDP, providing secure and inflation-resistant payment options.

The platform leverages Stellar's low-cost and instant payment infrastructure, which is supported by Airtm’s robust capabilities. Users can withdraw funds peer-to-peer to digital wallets, cryptocurrencies, and more. They can also transfer funds directly to their local bank accounts in 15 countries, including Argentina, Brazil, and Mexico. By combining Airtm’s global financial tools, Bridge’s stablecoin services, and the Stellar network, this solution empowers individuals and businesses in emerging markets with fast, affordable, and reliable access to earnings.

BSOSEstablished in 2018, BSOS powers supply chain growth for fintech solutions, providing liquidity to startups through blockchain and DeFi. BSOS’s Green Finance Pool allows accredited investors to fund projects like ChargeSmith, an EV charging station network in Taiwan, using short-term credit loans backed by projected revenue. With a goal of 1,500 charging stations by 2025, ChargeSmith relies on BSOS and Huma to secure credit for expansion. The Green Finance Pool offers monthly interest, with collateral backed by charging stations and managed revenue. BSOS also integrates enterprise resource planning with onchain liquidity, enabling shorter-term trade finance.

Easy LabsEasy Labs is a Web3 financial contract automation platform that enables teams to build and manage complex payment flows. The platform allows both Web2 and Web3 teams to reduce transaction costs, scale operations, earn passive yield on assets, settle payments faster, and facilitate cross-border transactions while gaining a clearer understanding of organization-wide fund flows. Easy Labs aims to bring Web3 efficiencies to traditional Web2 businesses.

FonbnkFonbnk is a global marketplace that allows users to convert mobile airtime into digital money, bridging Web3 technology with hyper-local payment methods for fast, secure, and dollar-based settlements. Supported in countries like Nigeria, Kenya, and South Africa and operating on PayFi blockchain pillars such as Stellar, Solana, and Celo, Fonbnk aims to revolutionize cross-border payments and promote financial inclusion. The platform enables users to swap airtime with trusted market makers, converting it into stablecoins that can be deposited into digital wallets, swapped for local currency, or used to access DeFi services.

Fonbnk’s on-ramp process lets users transfer funds to an agent and receive stablecoins in their wallets. At the same time, its off-ramp feature allows crypto to be converted back into fiat currency and deposited into bank accounts or other specified methods. With its fast and secure mobile top-up services and integration of stablecoins, Fonbnk empowers individuals in emerging markets with easy access to digital and traditional financial systems, driving financial inclusion and innovation.

GoBanklessGoBankless is a digital banking platform leveraging blockchain technology to enable peer-to-peer payments and stablecoin transactions across Africa. The platform facilitates instant cross-border payments, USDC-to-cash conversions, and cash delivery services, with features like real-time funding, prepaid digital cards, and customs clearance integration. By minimizing fees and providing tailored solutions, GoBankless empowers businesses and individuals to access efficient and affordable financial services.

For Africa’s financial ecosystem, GoBankless is critical in promoting financial inclusion by offering accessible tools for the underbanked and unbanked populations. Its real-time, low-cost payment solutions support SMEs, enhance cash flow management, and boost operational efficiency. Additionally, the app fosters economic growth by empowering informal economies and enabling interoperability across different financial platforms. GoBankless drives innovation and accessibility in Africa’s financial landscape while promoting broader economic activity.

HelioHelio is a self-serve platform that enables merchants, creators, and developers to accept onchain payments in USDC and hundreds of digital currencies, with features like instant payouts, low fees, and advanced Web3 capabilities. Helio Pay supports integration into e-commerce systems, providing onchain checkout and custom trading infrastructure for marketplaces, DEXs, and high-volume apps. Supported across Solana, Bitcoin, Ethereum, and Polygon, Helio offers real-time payouts with a 1% transaction fee, eliminating chargeback risks. The platform runs Shopify's official Solana Pay plugin and supports merchants through no-code integrations, benefiting over 6,000 sellers with $1.5 billion in annual sales. Helio’s funding includes a $3 million seed round in April 2023, and its NFT subscription, HelioX, reduces transaction fees for merchants.

JiaJia is a blockchain-based microfinance platform that provides small-business loans to enterprises in emerging markets, focusing on Kenya and the Philippines. Jia offers revenue-backed loans to help businesses grow or maintain operations, serving medical clinics, consumer goods, food and beverage, and transportation sectors. An example customer might include a medical clinic needing short-term capital to procure supplies, which would be challenging without affordable financing. Borrowers who repay loans are rewarded with Jia tokens, incentivizing timely repayment while fostering community ownership in the lending ecosystem.

RainRain offers a digital asset-backed credit card solution that allows businesses (mainly Web3 companies and DAOs) to spend stablecoins like USDC wherever Visa is accepted, leveraging Polygon. The cards enable fast, low-cost transactions for expenses like corporate travel, with integration into mobile wallets such as Apple Pay and Google Pay. Rain reshapes spend management for Web3 teams by providing USDC-backed corporate cards, where corporate treasuries pledge assets to set credit limits, with onchain liquidation at the end of each billing period. Rain partners with Huma Finance as a liquidity provider, offering an accessible solution for crypto-native organizations needing fiat transactions without relying on traditional credit card assets.

ReapReap is a Hong Kong-based financial management platform offering businesses a suite of tools to simplify payments, expense management, and cash flow operations. By bridging traditional banking and digital assets, Reap empowers businesses with solutions tailored to both Web2 and Web3.

Their key offering is the Reap Card, a secured Visa corporate credit card collateralized with fiat or stablecoins like USDC, providing businesses with credit access without traditional banking dependencies. The card supports flexible repayments in fiat or digital currencies, accommodating diverse operational needs. Through Reap Pay, businesses can make global payments, such as rent or payroll, without requiring a bank account, leveraging stablecoins to reduce reliance on conventional banking systems. The platform’s Reap Treasury consolidates fund management with distinct balances for Reap Card, Reap Pay, and general funds, enabling seamless transfers to optimize liquidity and payment capabilities. Reap supports transferring USDC & USDT on Solana, Ethereum, Polygon, and USDT on Tron.

Reap combines innovative payment infrastructure with robust security and privacy features, establishing itself as a comprehensive financial management solution for businesses navigating traditional and blockchain-enabled financial environments.

SanctumSanctum is a platform enabling the launch and trading of liquid staking tokens (LSTs) on the Solana blockchain. Its features include zero-slippage trading and yield generation through deposited LSTs. The platform is integrated with Jupiter and Solflare. It allows teams, creators, and DAOs to create LSTs and earn staking rewards from token holders, providing innovative tools for monetization and community engagement.

In the PayFi ecosystem, Sanctum’s Creator Coins offer a sustainable, permissionless way for creators to monetize their communities by issuing coins backed 1:1 with SOL. This ensures stability and reliability while allowing creators to earn predictable rewards from staking income. Supporters holding these coins gain access to exclusive content, perks, and experiences, fostering deeper creator-fan connections. Creator Coins also highlight the real-world utility of cryptocurrencies by moving beyond speculative trading to create tangible value.

Examples include HealthSOL, a health charity initiative that allows users to hold HealthSOL and donate staking rewards to public health initiatives in emerging markets, and Flojo, a wellness beverage brand using Creator Coins to build a loyal community while bypassing traditional advertising. By leveraging its unified liquidity layer, Sanctum guarantees 1:1 coin backing to SOL.

SphereSphere is a blockchain-based payment platform built on the Solana blockchain, designed to facilitate cryptocurrency and fiat business transactions. It offers fiat on-ramps, recurring subscriptions, and API integration, enabling acceptance of payments across crypto and fiat. Sphere focuses on simplifying cross-border transactions and reducing high fees and processing times seen in TradFi. Initially supporting DePIN networks like Helium, Sphere allows users to transact in fiat without holding native tokens. It also aims to expand its services to other DePINs, including Hivemapper and Render, while becoming a comprehensive API for currency swaps and cross-chain payments. Sphere supports major credit cards (Visa, Mastercard, American Express, Discover), bank transfers, and wires in over 120 countries, focusing on developing economies.

Building on its core offerings, Sphere has introduced Spherenet, a permissioned blockchain solution built on the Solana Virtual Machine (SVM) and designed for regulated financial entities. Spherenet is a credibly neutral, privacy-preserving, and natively compliant shared account ledger. Spherenet facilitates licensed counterparty discovery, verification, and universal settlement at near-instant speeds. Developed by a global consortium of regulated institutions and fintechs, Spherenet provides secure, compliant infrastructure for cross-border trade finance and emerging market transactions. With advanced features like confidential transfers and delegated authority, Spherenet ensures jurisdictional compliance while maintaining privacy. Currently operational in 14 emerging and developed jurisdictions, Spherenet underscores Sphere’s mission to bridge traditional finance and blockchain, enabling integration for regulated institutions in PayFi.

ZothZoth is a blockchain-based platform that bridges TradFi and DeFi by tokenizing RWAs to provide liquidity solutions and high-yield investment opportunities. Founded in 2023, Zoth offers institutional and accredited investors access to secure, fixed-income products, such as trade finance receivables, U.S. Treasury Bills, and corporate bonds. Zoth’s offerings include ZeUSD, a stablecoin backed by high-quality RWAs, and the $100 million Tokenized Liquid Note (ZTLN), backed by U.S. Treasuries and corporate bonds. With $106 million in assets originated, a 91% repeat investment rate, and a 0% default rate, Zoth aims to create secure and efficient financial products integrated into the blockchain ecosystem.

Future of PayFiPayFi is set to expand with increasing offerings and growing user adoption. This section highlights specific use cases and applications expected to experience significant advancements in 2025 and key ecosystem developments that will drive and support this growth.

T+0 settlementPayFi's future could involve transforming cross-border transactions through T+0 settlement. Currently, cross-border payments take two to three days to settle, creating inefficiencies and cash flow challenges. Protocols that leverage the PayFi six-layer infrastructure stack can enable same-day settlement, directly addressing these issues. This can streamline global payment flows in a way that is impossible for today’s financial systems.

This capability is especially impactful for global companies navigating complex supply chains across multiple jurisdictions. For example, businesses like Amazon often deal with multi-step payment flows that can result in operational delays due to settlement bottlenecks. T+0 financing eliminates these obstacles, ensuring seamless, real-time transactions and unlocking operational efficiency at scale.

As the T+0 settlement solution develops, it could set a new benchmark for financial innovation and become a key differentiator for the PayFi ecosystem. By providing a settlement speed that traditional finance cannot match, T+0 financing positions PayFi as a leader in driving innovation for global payment systems. Its success could catalyze broader adoption, showcasing the transformative potential of blockchain-based financial solutions.

Market EducationMany protocols within the PayFi ecosystem leverage technologies from TradFi, DeFi, and RWAs, creating advantageous interoperability for building innovative solutions. However, this overlap can blur distinctions, making it challenging for users to differentiate PayFi-specific offerings from those rooted solely in other sectors. A prime example is the comparison between Aave’s DeFi lending protocol and Jia, a PayFi-focused small business financing platform that collateralizes tokenized ‘accounts receivable’ assets to fund loans. PayFi requires a coordinated effort to educate the market on its unique use cases to establish a clear identity. Tools such as the PayFi infrastructure stack and industry conferences will be critical in advancing awareness and driving growth for the sector.

In 2025, multiple protocols/chains involved in the PayFi ecosystem will focus on raising awareness and communicating the sector's value proposition through active participation in major industry conferences. This includes Huma, the Solana Foundation, and the Stellar Development Foundation, who have planned PayFi events to be executed in the near future:

- February 2025: Consensus, Hong Kong

- May 2025: Token 2049, Dubai

- September 2025: Token 2049, Singapore

- November 2025: Meridian

- December 2025: Breakpoint, Abu Dhabi

These events will provide opportunities to showcase PayFi’s ongoing developments and engage with key stakeholders.

Regulatory DevelopmentsA key focus for 2025 will be monitoring and adapting to regulatory developments in various jurisdictions. The most significant regulatory changes for PayFi will center on stablecoin regulations and the application of crypto travel rules across jurisdictions. These frameworks are crucial for enabling financial institutions to utilize stablecoins for payments, compliantly. Clear regulatory guidance will accelerate the adoption of stablecoins, particularly in regions like the UAE, where progressive policies have already encouraged institutional participation in the PayFi and RWA domains. This clarity is expected to drive ecosystem growth by providing the compliance certainty necessary for conservative institutions to scale their involvement in PayFi.

Also, recent regulatory frameworks, such as the EU’s MiCA regulation, foster a more compliant environment for RWAs. Countries like Switzerland, Luxembourg, Liechtenstein, and Singapore have already launched notable compliant tokenization initiatives. In October 2024, the World Economic Forum (WEF) announced that Australia, the United Kingdom, Brazil, and South Korea have committed to unveiling new regulatory frameworks. In addition to this, a potential pro-innovation approach from the Trump administration might bring about stablecoin legislation, providing clarity and bolstering institutional trust. Such policies, if implemented, could greatly improve the U.S. regulatory framework, creating a more favorable environment for blockchain-based payment systems.

Projects within the PayFi sector will prioritize staying agile and compliant in response to these evolving frameworks. This includes developing standardized legal agreements for tokenized assets to streamline transactions and enhance investor confidence.

Closing SummaryPayFi represents a transformative approach to payment financing, addressing inefficiencies in traditional systems while enabling entirely new use cases. As stablecoin adoption grows, blockchain infrastructure matures, and regulatory clarity improves, PayFi is positioned to drive significant innovation across global markets. With foundational support from key players like Huma, Solana, and Stellar and promising metrics indicating rapid adoption, PayFi is poised to expand its influence in 2025, offering scalable, efficient, and accessible financial solutions for businesses and individuals worldwide.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.