and the distribution of digital products.

DM Television

DeFi Yields Are a Lie—Here’s What You’re Really Earning

:::warning WARNING! This article and the entire course are not financial or any other type of advice. They are provided solely for educational and research purposes.

:::

From the AuthorFor over 7 years, I have not only been using DeFi tools but also studying them from a netstalker’s perspective. Now, it's time to talk about it in English. Below is my original mini-course, written specifically for Hackernoon.

Course Outline:- Part 0. Actual vs. Stated Yield in DeFi

- Part I. Liquidity Pools: From Theory to Practice

- Part II. Lending: EVM & NON-EVM Platforms. Key Strategies

- Part III. Staking vs. Farming: Similarities and Differences

- Part IV. Cross-Chain DeFi & Bridges

- Part V. Derivatives: From Basic to Advanced

- Part VI. DeFi Security from a User’s Perspective

- Part VII. Investments vs. DeFi

\ Note: Naturally, there will be more articles than parts, as a single article cannot cover everything in detail. Even a long-read format may not be enough.

Introduction Fundamental ResearchFor each topic, including this introductory one, I will be publishing 2-3 and, in some cases, 5-10 research papers that I consider the most important. List of Studies:

- Yield-Bearing Stablecoins: Comparing Risks, Rewards, and Market Trends;

- Curve vs CLAMM Liquidity Strategies: A Comparative Case Study;

- State of Crypto Report 2024: New Data on Swing States, Stablecoins, AI, Builder Energy, and More.

To maintain a moderate level of objectivity when evaluating the industry, I strive to use not only my own empirical data—although these were the main reason I decided to start the course with this chapter (I see too many misleading claims in various publications and videos)—but also external sources. This approach allows for a comprehensive meta-analysis.

\ Here are some examples of such reports:

DeFi Statistics [updated in 2023] by Nansen;

Crypto Theses for 2024 by Messari;

And similar sources, which I will reference with links.

\

Of course, I will also use data from standard on-chain aggregators, such as:

- CoinMarketCap.com;

- DeFiLlama.com;

- And others (links will be provided separately).

Most people who start exploring DeFi rely on data from three main sources:

- On-chain aggregators, such as DeFiLlama;

- dApp websites, such as Aave.com;

- Data from KOLs, influencers, bloggers, and other public figures.

\ However, all of these sources are unreliable for several reasons:

- Aggregators often average out indicators and only report data that projects “feed” them via GitHub repositories. This can lead to significant distortions—on platforms like Solv, 1 BTC might be valued at 2 or even 3 “BTC”.

- dApp websites (protocols themselves) manipulate data the most since they need to promote their pools, vaults, and other products. As a result, their reported yields are often highly exaggerated or calculated in ways that are detached from reality.

- Human “bias”: Any individual is subjective, and this is even more true for those selling something to their audience. Many influencers, including Mr. Beast, have been caught—not necessarily in outright fraud but in questionable practices that ultimately cost their audience a lot of money.

\ Additionally, there are practical aspects that highlight why actual yield (APR) is more important than APY, which is even more prone to manipulation:

- You need to accurately calculate both profits and potential losses, including risks of liquidation or when your impermanent losses (IL) become very permanent and substantial.

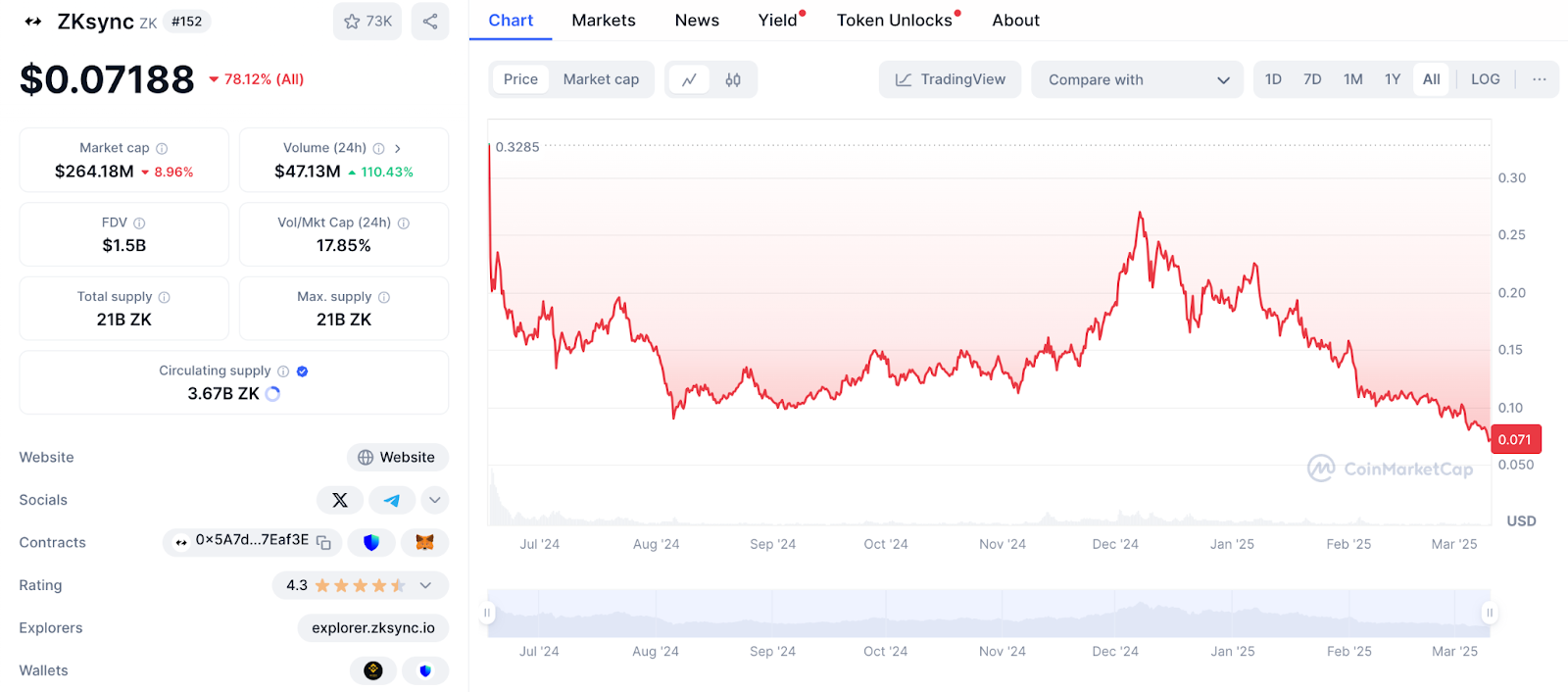

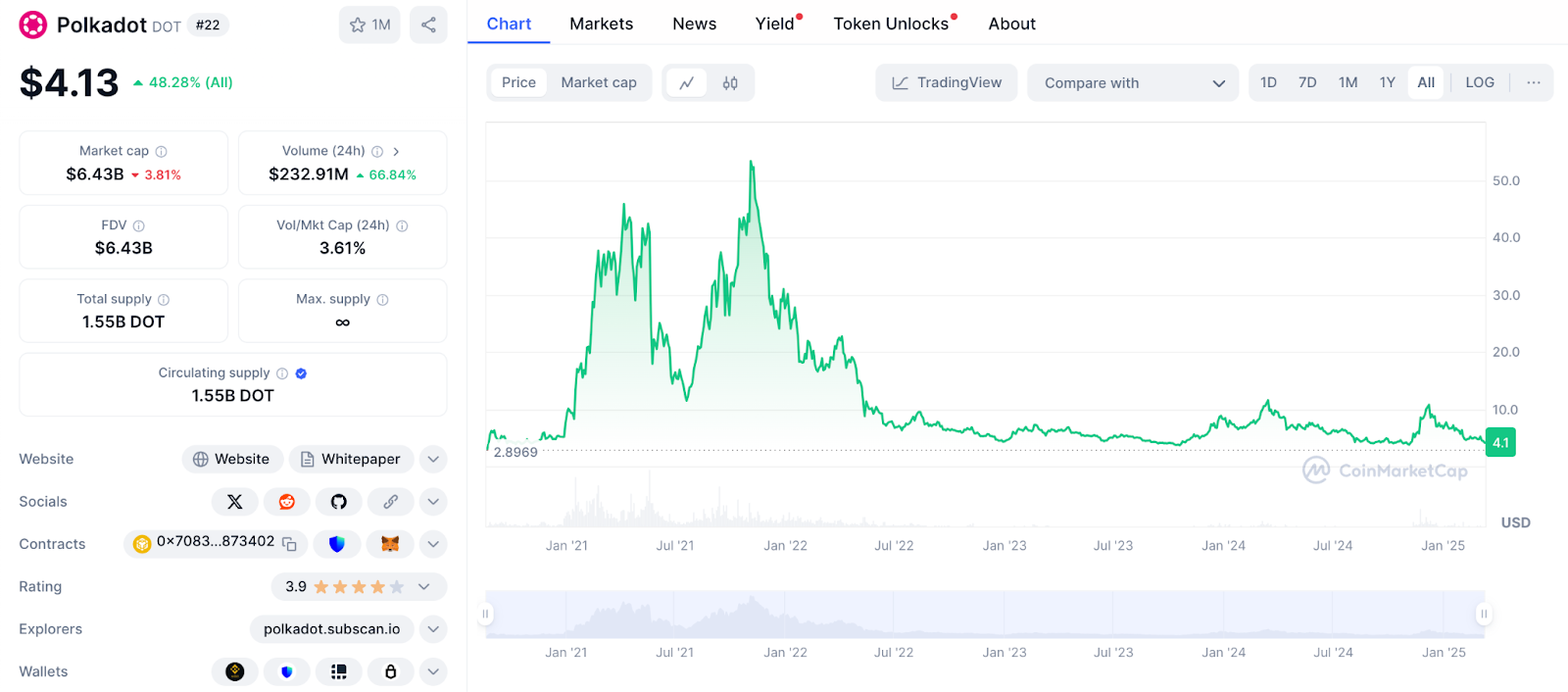

- Many people compare protocols based on APY and choose the one with the highest value. However, the actual yield is often much lower because rewards are paid in volatile tokens that continuously lose value—especially when the network loses its initial hype (e.g., look at Blast, zkSync, StarkNet before and after their airdrops).

- APR is crucial for complex strategies, such as delta-neutral strategies, which depend on multiple assets, protocols, and networks.

\ I could easily list at least a dozen more theoretical and practical reasons why actual APR/APY is critical—but I hope the above is convincing enough. Shall we move on?

APR & APY: Key Differences When Is APR More Important Than APY in DeFi? The Basics:- APR (Annual Percentage Rate) – A simple annual interest rate that does not account for compounding.

- APY (Annual Percentage Yield) – An effective interest rate that does include compounding (reinvesting earnings).

\ Both metrics are used in DeFi, but in different scenarios.

\ For example:

- APR is more useful when you manually reinvest rewards or if the rewards are received in a token you don’t want to hold. Often, such rewards are sold for stablecoins or converted into native assets like ETH, BTC, or SOL.

- APY is beneficial when there is auto-compounding, and you’re comfortable with it.

\ Technically, APR can be converted into APY, but it's always better to consider APR as the actual yield and APY as a potential bonus.

Why? Let’s Look at an Example.

APR = The Base, APY = The BonusIt’s March 2025, and the crypto market is crashing—some assets have dropped 5–10x in value. Now imagine you’re receiving rewards in ZK:

\ Or STRK:

Or DOT:

\ All These Tokens (ZK, STRK, DOT) Are Not Randomly Chosen. These tokens are actually used in various reward programs and services such as Hydration, Ignite, and others. In this context, you generally have three main approaches:

- Investment Approach. This is the strategy I personally advocate. If I receive something at an effective cost of $0—whether through airdrops, incentives, or other mechanisms—I hold it until a certain ATH (All-Time High). At a minimum, I keep 10%-30% of my rewards, sometimes even 70%-80%. Why? Because getting in on the same terms as VCs and funds is extremely difficult. Yes, this approach carries significant risks, but I’m not risking capital investment in tokens—instead, my risk lies in locked liquidity, unrealized gains, time spent, and gas fees burned. This strategy has allowed me to participate in hundreds of projects, something that would have been impossible if I had only bought tokens directly. I have one key rule for this approach: Liquidity is always finite. (We’ll return to this concept multiple times).

- Diversification Approach. Here, instead of accumulating the tokens you receive (ZK, STRK, DOT), you convert them into other assets—for example, ETH, BTC, or even SOL (although, let’s be honest, very few were accumulating SOL before its latest hype cycle). This approach seems safer, as it focuses on a more conservative strategy. However, the reality is: Bitcoin rarely grows 5–10x // Tokens like OM or RNDR also struggle to repeat their explosive gains once they are established. Still, I sometimes use this approach in specific strategies. A core principle I follow here: If everyone knows something, then no one truly knows anything. Meaning: you can never be 100% sure whether a token will rise, fall, or stagnate (stagnation is often overlooked). Because of this, the best initial form of decentralization is diversification—in portfolio strategy.

- Stabilization Approach. This one is straightforward: sell rewards immediately for stablecoins to lock in profits in USDT, USDC, USDe, DAI, or USDs (yes, these are all different assets, even if issued by the same entity). I personally favor DAI for being the most decentralized, but you can choose your preferred option. The downside of this approach is obvious: You won’t capture extreme profits, but you will secure a steady income. One of my key rules for this approach: Better smaller but safer gains. Chasing unsustainable profits has wiped out multiple generations of crypto investors. Just think back to 2014, 2018, or 2022.

\ All Three Approaches Have Their Pros and Cons. And in reality, most strategies are a mix of these three. I’ll explore their strengths and weaknesses throughout this course. Now, let’s return to the core question: What Is the Actual Yield in DeFi? Because ultimately, these approaches only matter if they generate real returns.

Quick Insights on Yield Personal ObservationsBased on my experience, here’s what I’ve observed:

- For a Conservative Approach:

- Normal Yield: 5–10% APR

- Good Yield: 10–15% APR

- Excellent Yield: 15–25% APR

- Above 25% is difficult to achieve in this approach, making it a rare case

- For a Moderately Aggressive Approach:

- Normal Yield: 10–15% APR

- Good Yield: 15–20% APR

- Excellent Yield: 25–30% APR

- Above 30% is something even top funds struggle to maintain

- For an Aggressive Approach: Any yield is possible, but sustaining it is the real challenge. High returns often come from risky protocols that are vulnerable to hacks, liquidity issues, and liquidation risks. Look at the statistics on meme tokens—where 90%, 95%, and even 97% of users either end up at a loss or barely break even.

\ Two Key Notes:

- Although we’re discussing APR, I don’t measure it over just one year. Instead, I prefer looking at its median value over at least 3–4 years, ideally 5+. Why? Because 40%-140% APR in a bull market (even short-term) can quickly turn into a disaster in a bear market, potentially leading to liquidations and debt traps. So think of this as Median APR, not just a momentary snapshot.

- I follow a balanced approach in DeFi, dividing my portfolio into four equal parts—I call this the 25/4 Rule:

- ¼ stays in a base asset (for me, that's ETH);

- ¼ remains in a hedging asset (BTC);

- ¼ is allocated to high-risk strategies (ICOs, derivatives, etc.);

- ¼ is kept in stablecoins (mostly DAI, but also some USDe, USDC, USDT, USDs, and others like GHO—mainly for strategy testing).

\ How Does This Compare to Market Data? Since stablecoin yields are what most newcomers focus on, let’s start there. But we’ll also cover other assets when relevant.

Yield Analysis: Meta-Analysis FindingsLet’s take a real-world example.

Report on 7 Stablecoins Over 71 Days- Yield Range: 10.80% to 16.45% (even with December 2024’s high yields).

- Final Average Yield: 13.01% APR (calculated from both mean and median values).

\ So, over roughly 2.5 months, most of which were in a bull cycle, the real return wasn’t ~~130%~~, but just 13%.

Now, let’s analyze what this means in practical terms…

Messari. Report. 2024“LST is a multi-billion-dollar industry that secures Ethereum, Solana, and other L1 networks. Liquid staking on Ethereum alone has a TVL of $15 billion (with 28 million ETH) and a staking yield of 3.7%. Staking services collectively generate $2.3 billion in revenue.”

\ In general, an ETH yield of 3–5% can be considered normal. However, for now, we are focusing on stablecoin yields, so let’s look for more examples. We’ll return to native tokens shortly.

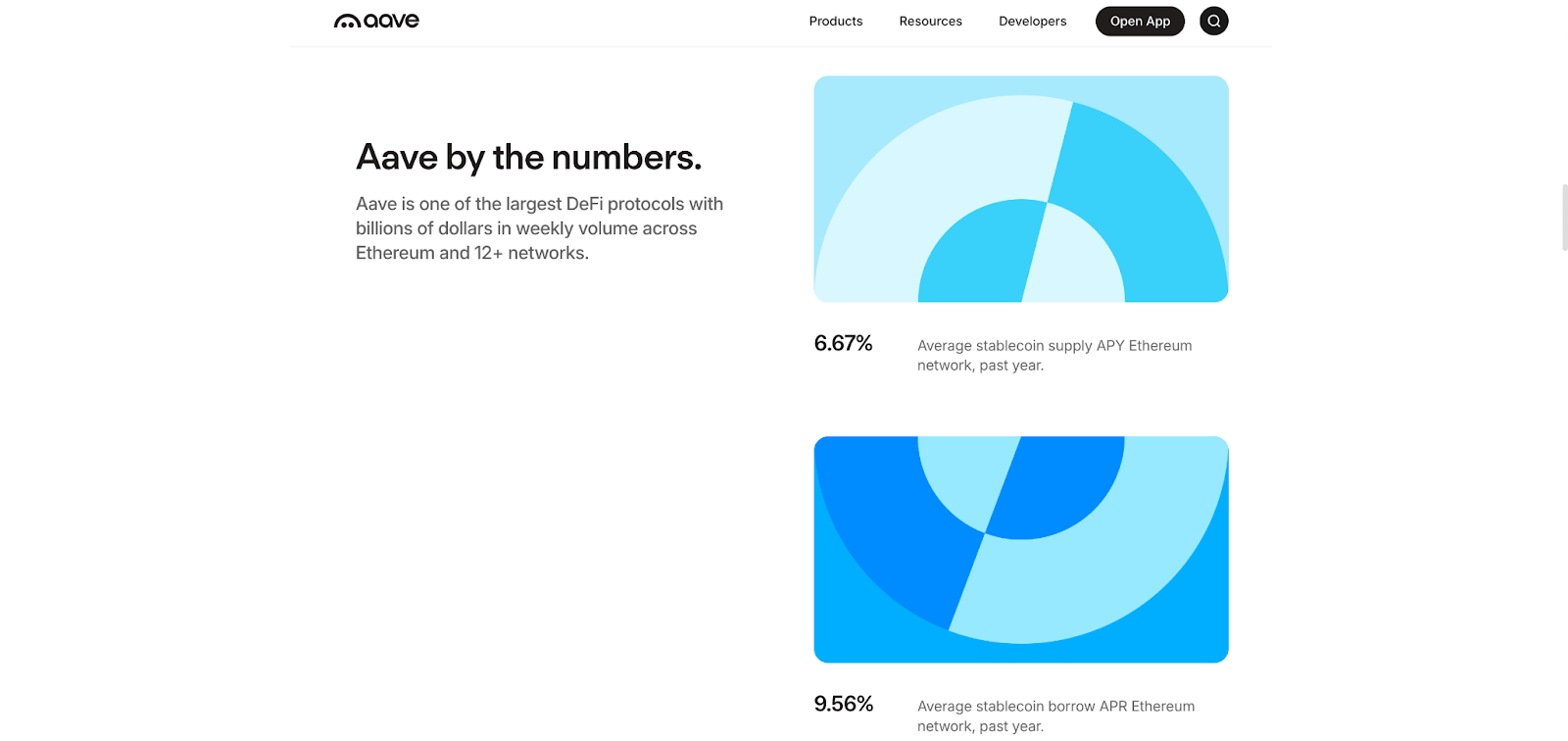

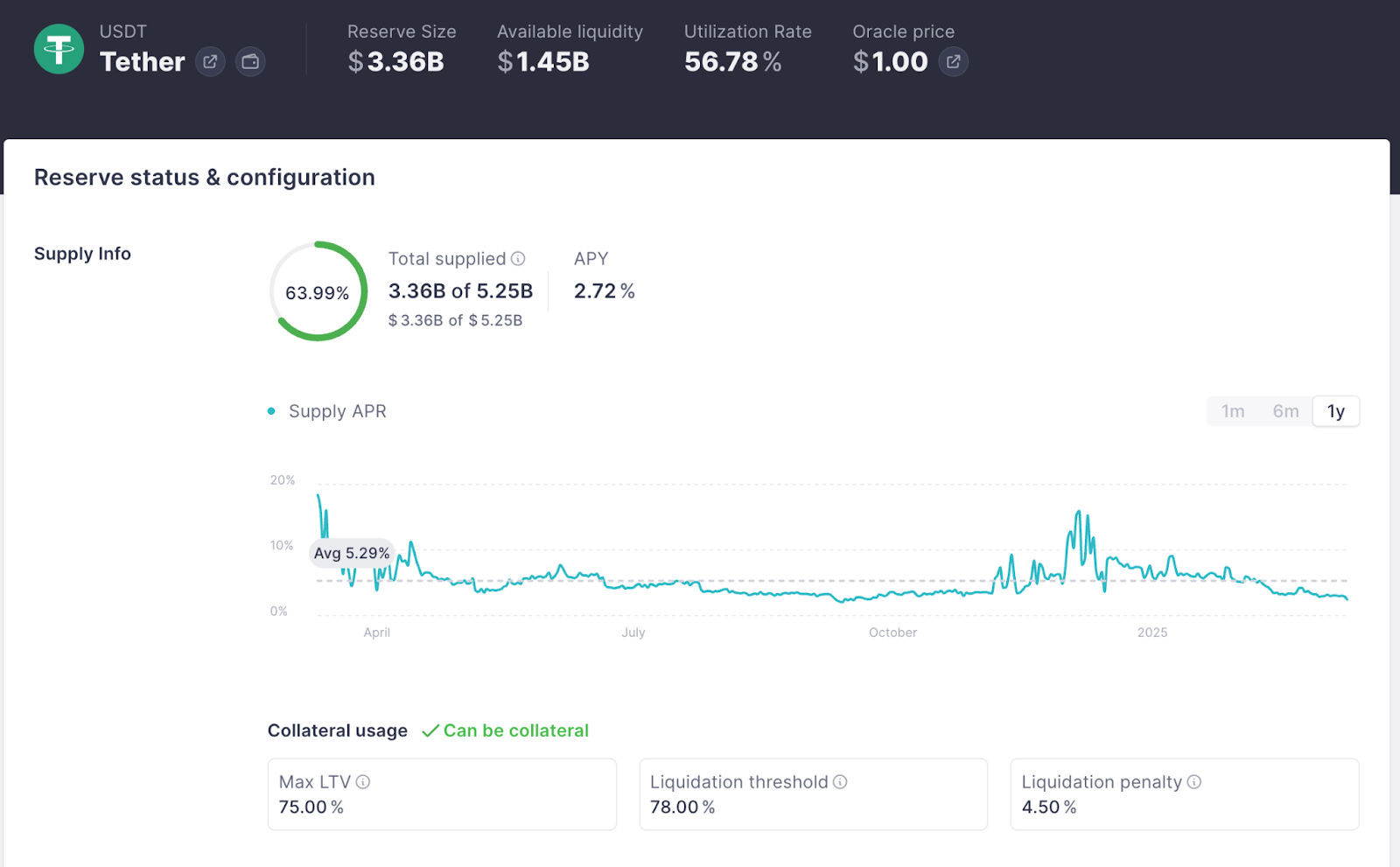

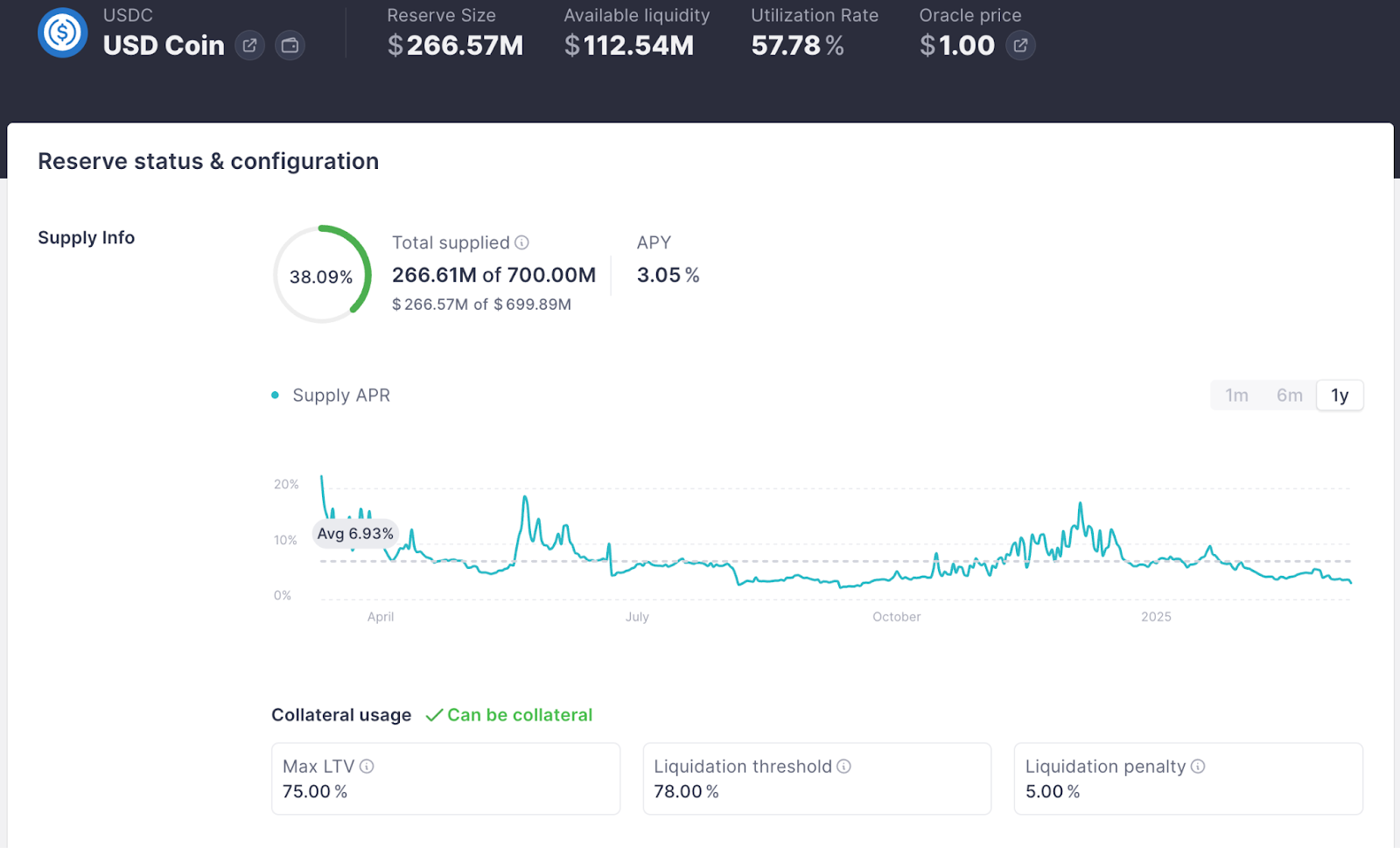

AAVE. WebGo to: aave.com:

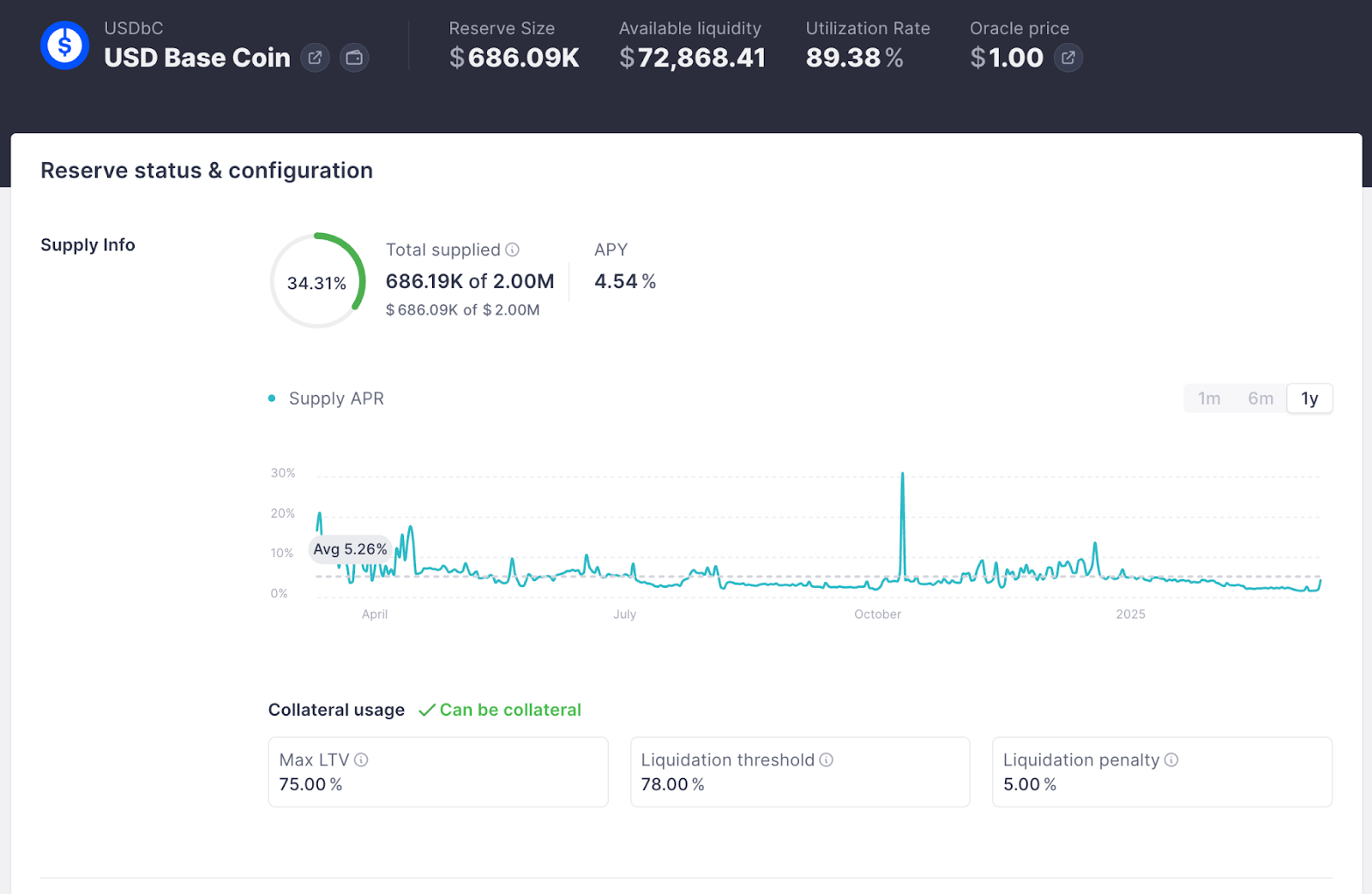

But of course, we can take it a step further and analyze markets across different networks. For example, Base (USDC):

USDt (Ethereum):

USDc (Arbitrum):

\And thus, you’ll see that the 5%-7% range is the norm for deposits. You can also track interest rate data here: config.fyi.

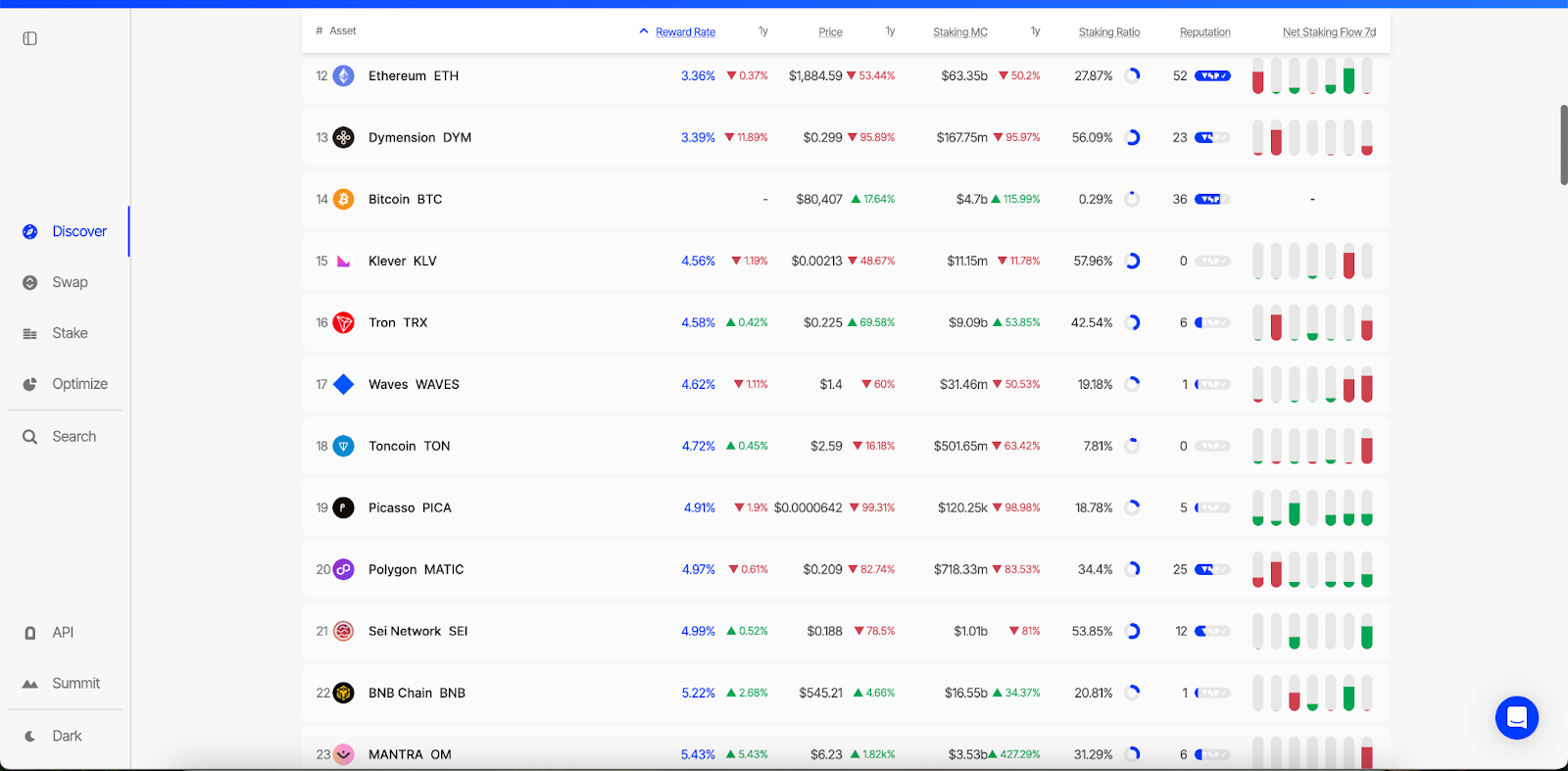

StakingRewards: Rewards in Native TokensCheck the website: stakingrewards.com/assets/proof-of-stake:

Again, 3-5%, but in native tokens, which means these numbers may not be ideal for our current focus. However, Tron and POL showed minimal fluctuations, making them worth noting. In any case, let’s keep them in mind—they will be useful later.

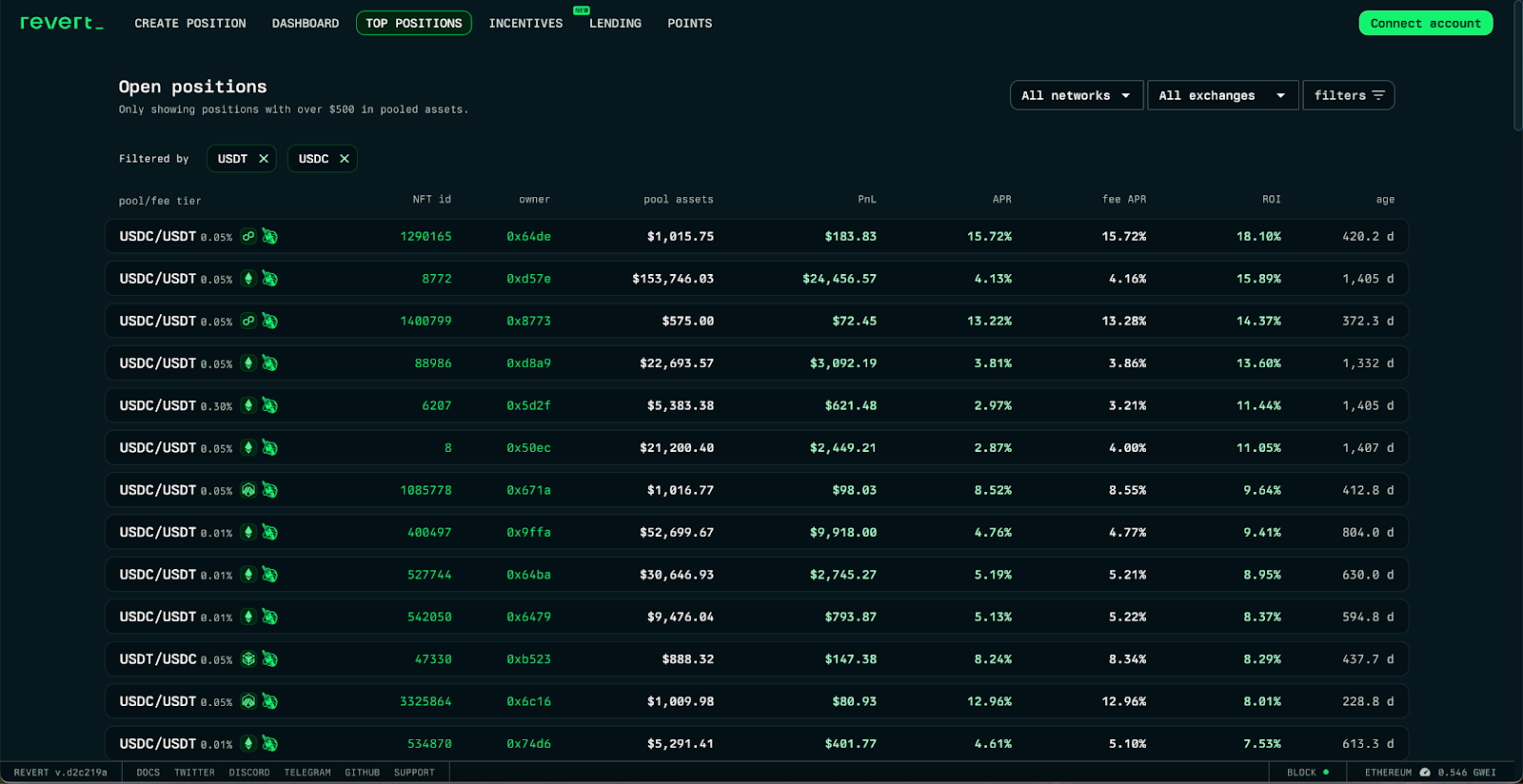

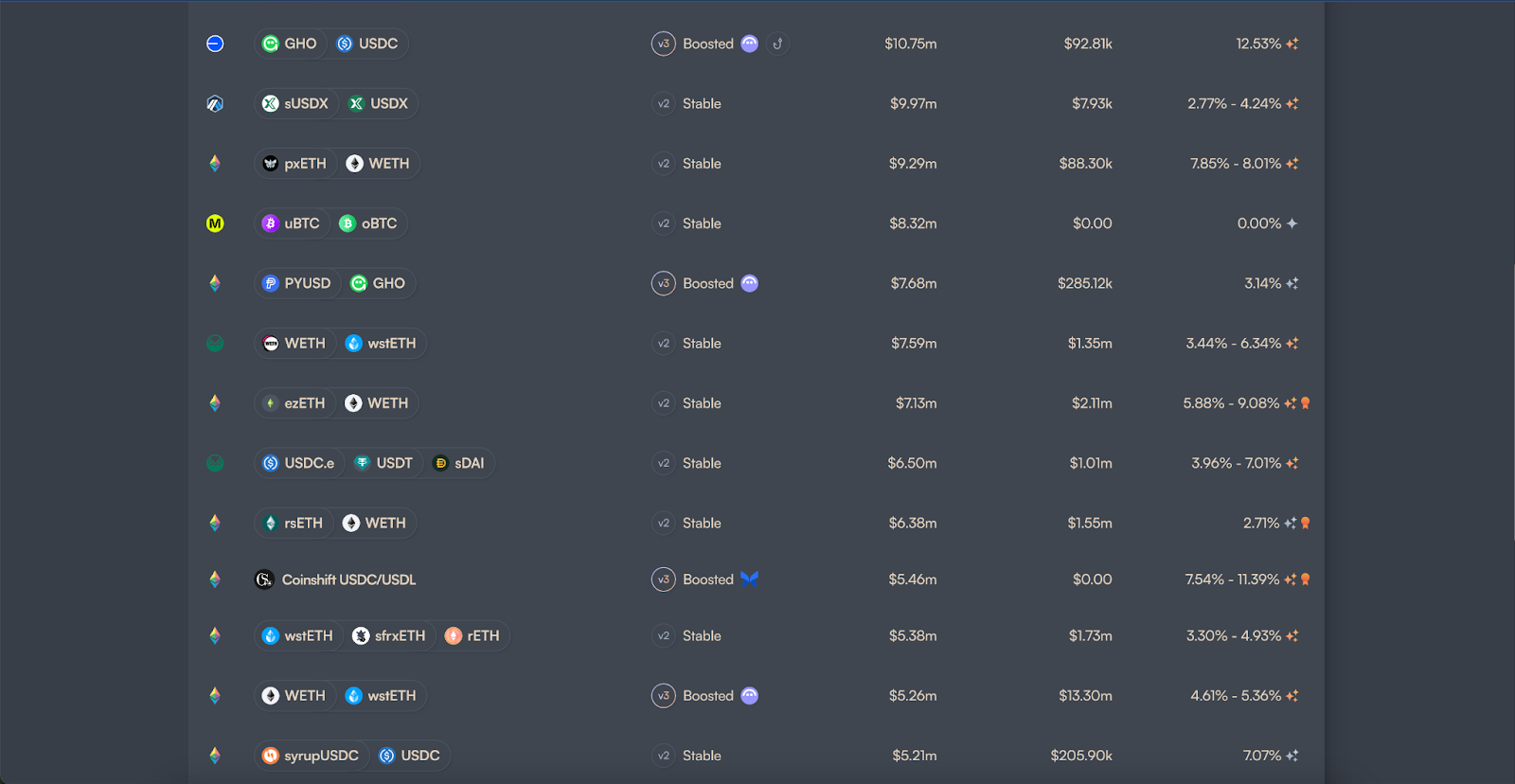

Revert. PoolsOne of the most popular DeFi websites focused on EVM pools: revert.finance/#/top-positions:

\

\ As we can see, if a pool has low TVL and/or is relatively new, it may still show a high yield. However, in general, the median yield remains around 10%. We can look at individual services to confirm this…

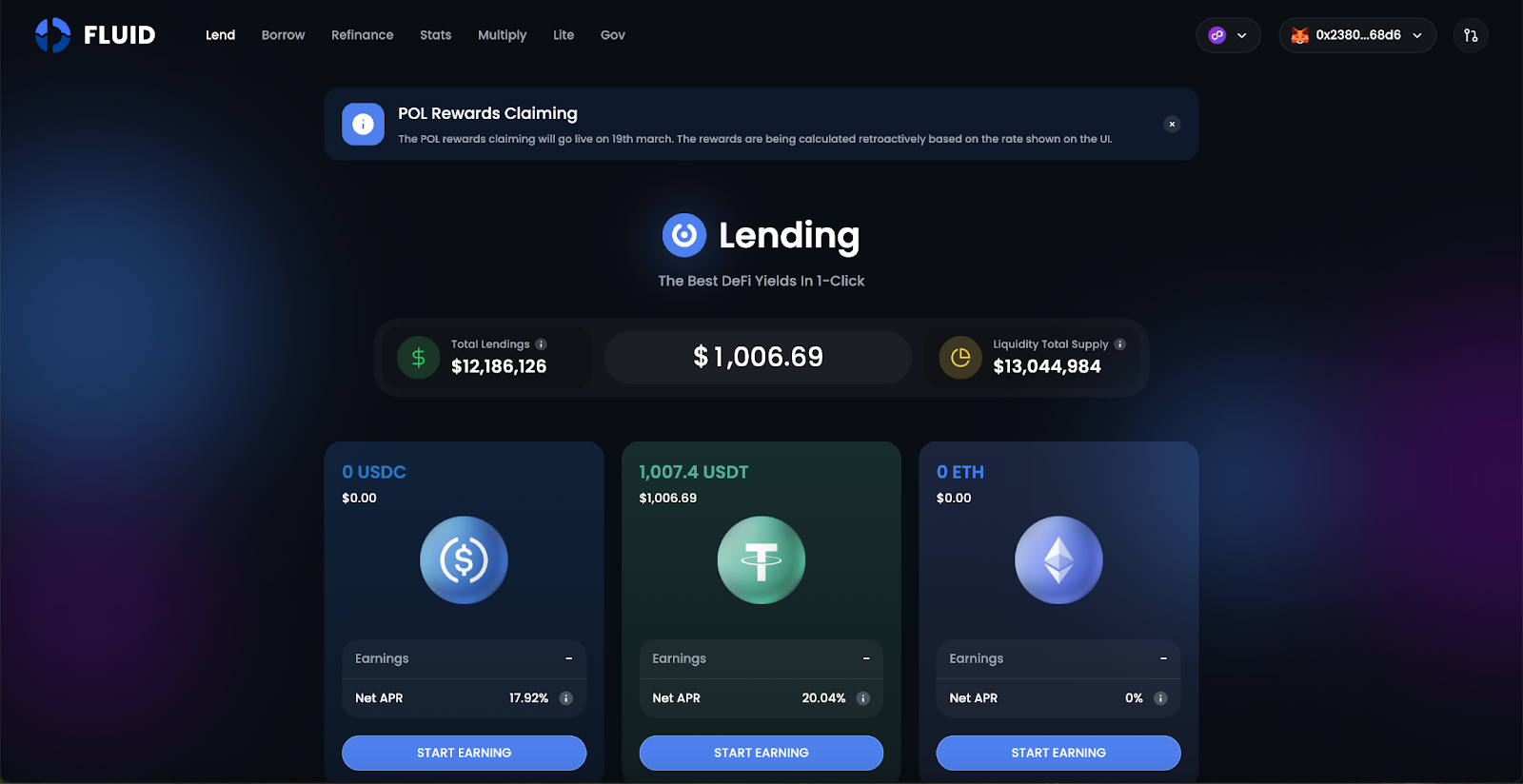

FluidAt the moment, pools have emerged on Polygon (fluid.instadapp.io/lending/137) with APR of 20% and even higher.

But in other networks, everything remains stable:

From this, we can draw a simple conclusion:

- High-yield pools are usually (a) newly created, especially (b) in emerging networks that offer additional rewards (like ZK and many others currently).

- Profitable deposits are often subsidized, with rare exceptions—such as those involved in complex financial schemes (which we’ll discuss later).

\ Still, 7%-10% is already a solid yield.

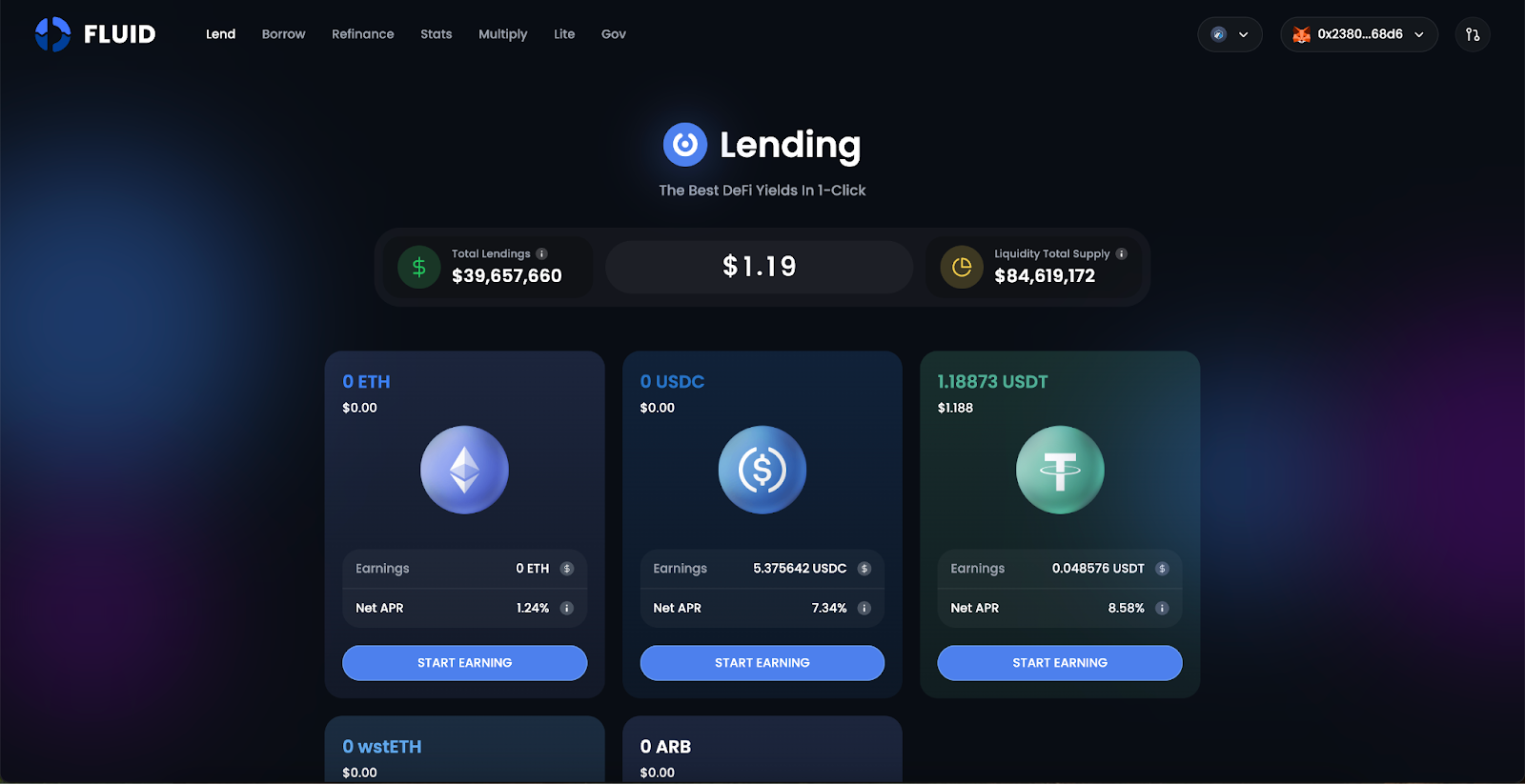

BeefyYou can check APR data aggregated from various sources here: app.beefy.com:

As we can see, even exotic strategies with low TVL fluctuate around 10-18%, while more traditional approaches tend to offer lower returns:

And finally, let me provide one more example…

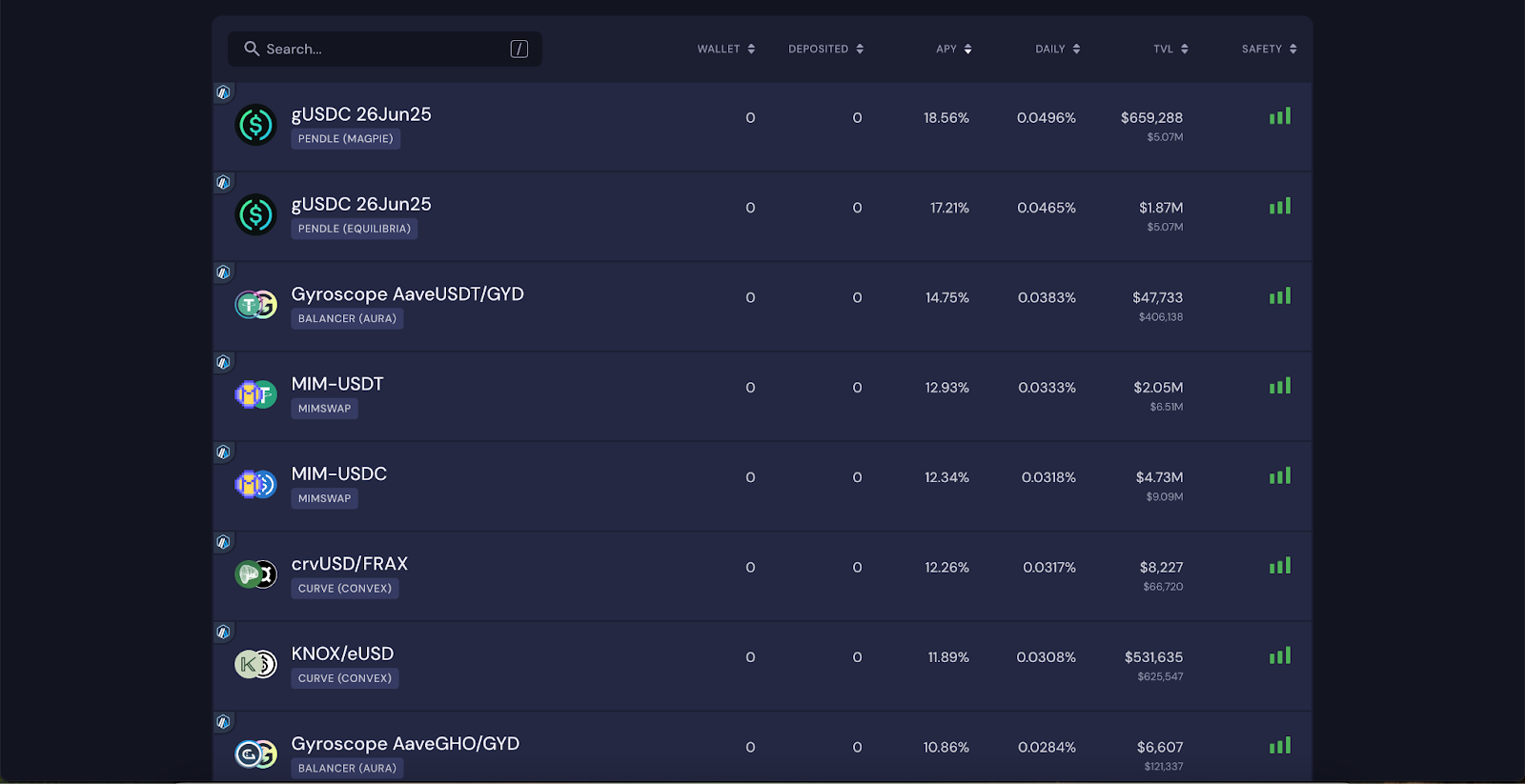

BalancerLink: balancer.fi/pools?skip=0&orderBy=totalLiquidity&orderDirection=desc&poolTypes=STABLE:

And once again, the numbers range from 2-4% to 11-12%. With this in mind, I have several insights and arguments I’d like to share with you.

Why Does Yield Vary?This question has many answers, but I’ll try to keep it as concise as possible:

- The biggest factor influencing yield rates is the novelty of the network, protocol, or application. When all three are new, APR tends to be the highest, but this comes at the cost of security and stability—as seen in WooFi hacks and similar incidents.

- That’s why this course won’t just focus on yield but also on security.

- The simple rule here is: Earning money is important, but keeping and growing it is even more critical. Yield only covers the first step.

- Another reason for high (or artificially inflated) yield rates is the use of wrapped tokens.

- Bridges, especially first-generation ones, use this mechanism for cross-chain operations.

- Protocols like Curve do it to create derivative stablecoins.

- Restaking projects leverage it for liquid staking derivatives (LSD).

- The rule here is also straightforward: The more complex the wrapping, the riskier it is.

- Example:

- ETH has a security score of 9 or even 10 out of 10.

- stETH (Lido’s liquid staking token) might be 7 or 8 out of 10 (and could drop further due to ongoing legal cases).

- Restaking derivatives can never go above 7 out of 10 by design. (If this isn’t fully clear yet, don’t worry—we’ll cover these topics later. For now, the goal is simply to introduce different aspects of DeFi.)

- One of the main drivers of yield fluctuations is market cycles.

- When demand for tokens increases, borrowing activity rises, making loans more expensive, which in turn increases deposit rates.

- This is why late 2024 saw exceptionally high yields (as seen in the “71-Day Report” mentioned earlier).

- The rule here: Most DeFi protocols use dynamic rate calculations.

\ Of course, there are other factors, which I’ll cover in different sections of this course.

Why Do So Many People Believe in High DeFi Yields?There are many reasons, but I’ll highlight a few key ones:

- Many people are still new to crypto.

- There are about 500–650 million crypto wallets worldwide, but the number of actual users is much lower.

- For example, I personally have hundreds of wallets across BTC, ETH, and other ecosystems—so the total number of unique individuals is significantly smaller.

- Looking at airdrop participation, we often see hundreds of thousands of real users (not Sybil accounts).

- Estimates suggest that the DeFi user base is only in the millions or tens of millions—a tiny fraction compared to the 5+ billion internet users worldwide.

- Conclusion: People believe what they are shown and sold. Yes, it sounds simple, but it’s a fact.

- Projects, protocols, and entire ecosystems want to make their products appear valuable.

- They openly advertise high yield rates, but when you dig deeper, actual returns are always lower due to:

- (a) Reward token devaluation.

- (b) Inflation eroding real returns.

- (c) More users diluting rewards (paying $1M to 100 people vs. 10,000 people is very different).

- (d) Market volatility.

- Lesson: Only trust your own research and experience.

- The rule here: Your keys = your money = your responsibility. DYOR.

- Influencers often showcase impressive results in their public portfolios…

- But they don’t mention that their strategies involve:

- Complex, high-risk, and sometimes controversial tactics like looping (essentially leveraged borrowing).

- Yield farming, where rewards might be paid in exotic tokens with poor liquidity.

- Vaults, where custodians may not be trustworthy.

- Derivatives, which require their own deep discussion (especially considering that beginners often jump into perpetual contracts, futures, and options without understanding the risks).

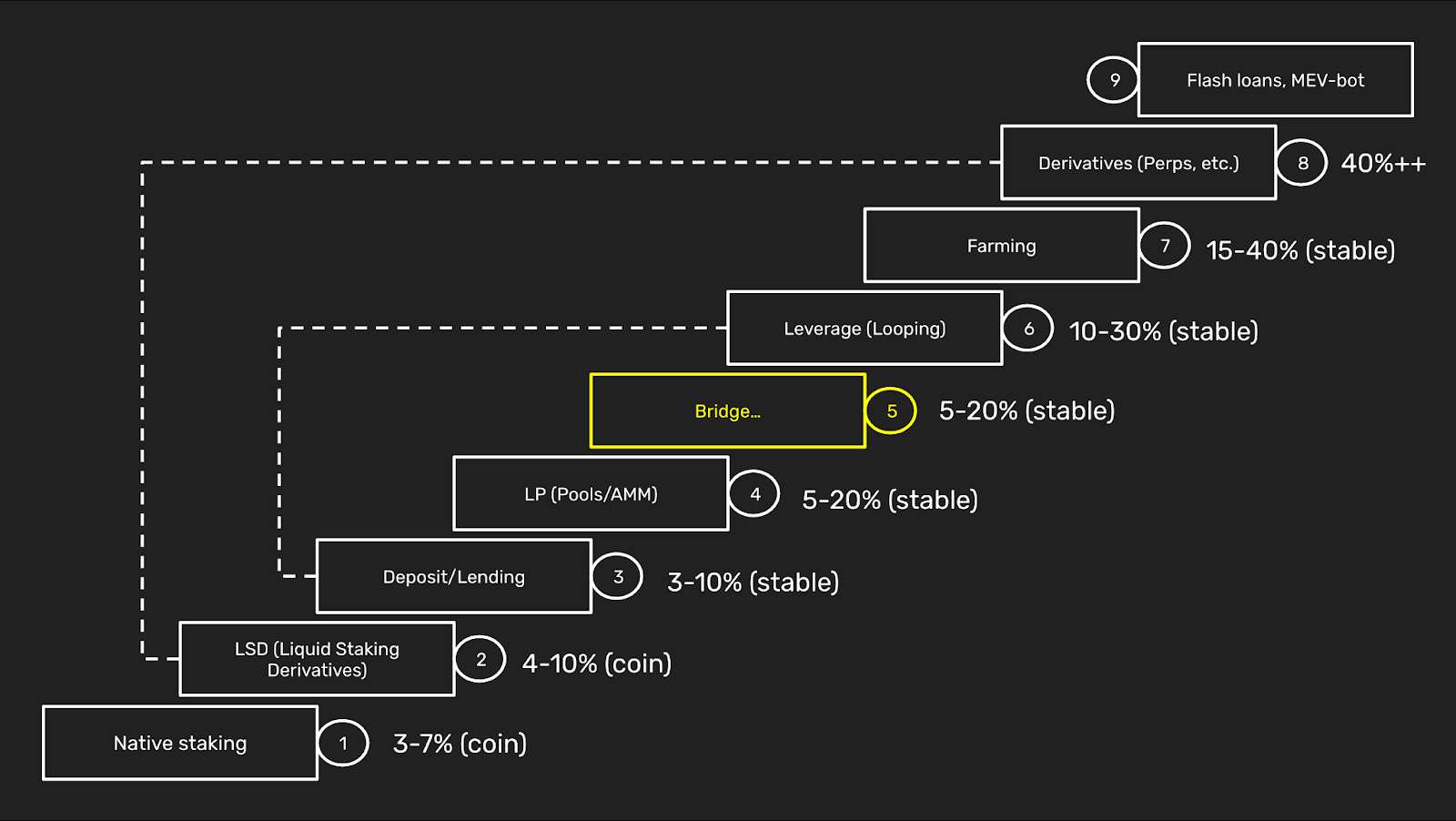

\ Final Thought: The Risk Ladder. Given the last point, I created a Risk Ladder back in the early DeFi era (2017–2019). And that’s exactly where I’ll wrap up this section.

The Risk Ladder – Your Guide to DeFiThis Risk Ladder will be explored throughout the entire course, but for now, I want you to remember these four fundamental rules when working with it:

- Risk is partly subjective, but also objectively measurable.

- Some people find yield farming easier, while others prefer re-staking.

- Some grasp delta-neutral strategies quickly, while others excel in liquidity pools.

- However, each risk level has an objective baseline, and that’s what we’ll discuss in detail.

- Skipping steps is not an option—no matter how tempting it is.

- If you haven’t mastered the basic deposit-lending mechanics in AAVE (or any other solid alternative), you shouldn’t be using looping, let alone more complex strategies.

- Unfortunately, most beginners jump straight into high-risk strategies simply because the yield looks higher.

- In 999 out of 1000 cases, the risks far outweigh the rewards due to lack of experience.

- Right now, I see dozens of people going through liquidation crises because they skipped the basics.

- Each step includes multiple tools, but everything is interconnected.

- Example: HODLing stETH is one thing, but using stETH in farming strategies is something entirely different.

- What was once a safe approach can suddenly turn toxic—especially for beginners.

- The percentage yields mentioned are approximate and based on EVM networks.

- DeFi exists beyond EVM, in ecosystems like Bitcoin, Solana, and Cosmos.

- Personally, I spend 75-80% of my time in the ETH, SOL, and BTC ecosystems, with some experience in Cosmos.

- In other ecosystems, I mainly experiment, though I’ve been doing so for quite some time.

- The Risk Ladder is more of a framework than a literal representation—just like seeing a mountain on a map is very different from actually climbing it.

I think this is a good place to wrap up the first part of our journey. Its importance cannot be overstated, even though at first glance, it might seem like music notation to someone picking up a guitar or piano for the first time—like it’s unnecessary, and all you need to do is strum or press keys. But in the end, those who invest in learning the fundamentals always outperform casual hobbyists.

\ The same applies to DeFi:

- In the short term, those who dive straight into tools might seem ahead.

- In the medium and long term, those who understand investment principles, risk management, and DeFi security will always come out on top.

\ So—we’ll continue soon. For now, that’s all. See you!

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.