and the distribution of digital products.

8 Best Crypto Debit and Credit Cards

If you are a novice user and are planning to buy a new bitcoin card, then you are in the right place. This article, “8 Best Crypto Debit and Credit Cards,” will review the different types of Bitcoin debit and credit cards, and compare their security, features, advantages, etc.

Summary List of some best crypto Debit and Credit cards: 1. Binance Card What is Binance Card?Do you also want to put your cryptocurrency to use in the real world? Then the Binance card can be the one go-to tool for you that will surely help you to achieve this goal.

Binance Card is a Visa card that you can use to spend all your cryptos at more than 60 million merchants all around the globe. Furthermore, this Card converts your cryptos to fiat within seconds, and that too free of cost.

However, using your cryptos to buy daily necessities, groceries, and favorite eateries might be extremely time-consuming and tedious. But here’s the thing, Binance debit card can do this for you within minutes.

Binance released this debit card in some selected European countries in the year 2020. It aims that the cryptos should be used in real-time, and that too without any friction.

While many other rival companies have also come up with debit cards of their own, there’s one thing for sure the Binance Card’s usage has made the cryptos more helpful and the blockchain more tangible in everyday life.

GET THE BINANCE CARD NOW! Binance Debit Card

Features

Binance Debit Card

Features

- Binance Card is a Visa debit card that can be used at over 60 million merchants all over the world.

- Binance offers all users cashback rewards of up to 8% in BNB. These are all eligible purchases that users make with their Binance Visa Card.

- All the cashback from eligible purchases is automatically deposited in the user’s Funding Wallet.

- This Card has free ATM withdrawals, and no annual or foreign exchange fee is charged. Although, third-party fees may be applicable.

- There is no need to pre-convert your cryptos as users can hold crypto in their Binance Funding wallet and exchange only when they are making payments.

- Users can now be carefree as all their Binance card transactions and funds are protected by Binance’s world-class security.

Also, read Binance Card Review: Is This the Best Crypto Card?

Binance Card Features

2. Coinbase Card

What is a Coinbase Card?

Binance Card Features

2. Coinbase Card

What is a Coinbase Card?

Coinbase exchange announced their Visa card on 11 April in the year 2019. It empowers all the users to spend their cryptos anywhere without needing to keep a fiat currency balance in their Coinbase account. Instead, it converts the crypto to fiat on demand in a flash.

This visa debit card is an additional feature conjoined with Coinbase exchange rather than being a standalone project. As a result, users don’t have to worry about staking proprietary tokens or fear losing potential money as it’s a reputable company.

Coinbase’s Card is claimed to be the easiest and quickest tool by their team, and it helps users to spend their crypto worldwide.

GET THE COINBASE CARD NOW!Moreover, their goal is to make it a real-world application in order to create seamless ways to spend all their cryptos in real-time. Furthermore, it was never this effortless and swift to use cryptocurrencies instantaneously.

Coinbase Card

Features

Coinbase Card

Features

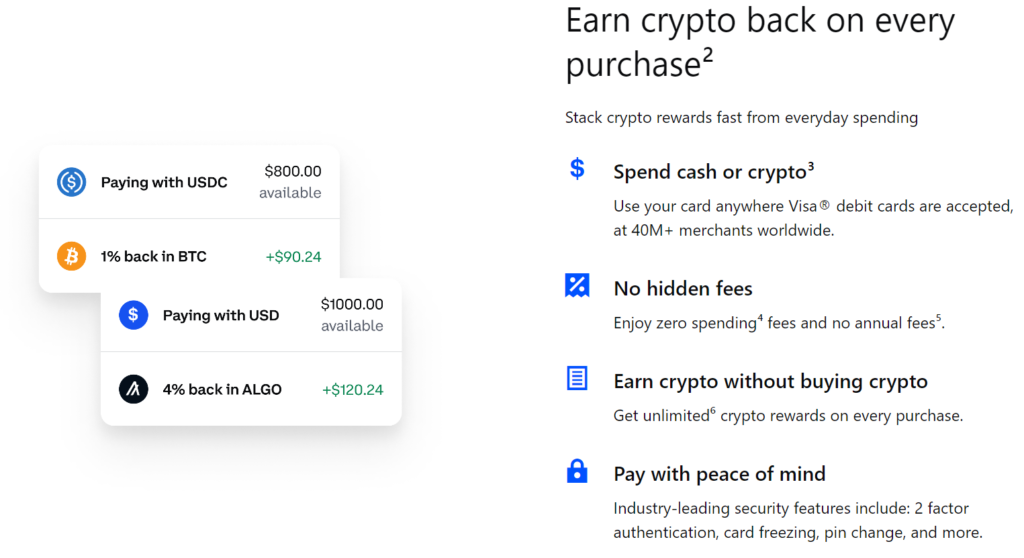

- Coinbase card is very convenient as now users can instantly pay wherever a Visa card is accepted. This Card is accepted across 40M+ merchants worldwide.

- Your cryptos are converted to fiat in no time. Before any purchase or ATM withdrawal that you make, Coinbase draws and then converts funds directly from your Coinbase account. Hence, there’s no need for you to wait, and it’s that instant.

- There are zero spending fees and also no annual fees.

- This visa card lets users pay in peace as it includes industry-leading security features like card freezing, Two-factor authentication, pin change, and many more.

- You can get many rewards from this Card, like you can earn popular and up-and-coming assets like The Graph or Bitcoin.

- However, your crypto rewards can increase their value over time.

- There is a mobile application available on Android and iOS for the Coinbase Card.

Also, read Coinbase Card Review : Best Crypto Debit Card

Coinbase Card Features

3. Gemini Crypto Credit Card

What is a Gemini Crypto credit card?

Coinbase Card Features

3. Gemini Crypto Credit Card

What is a Gemini Crypto credit card?

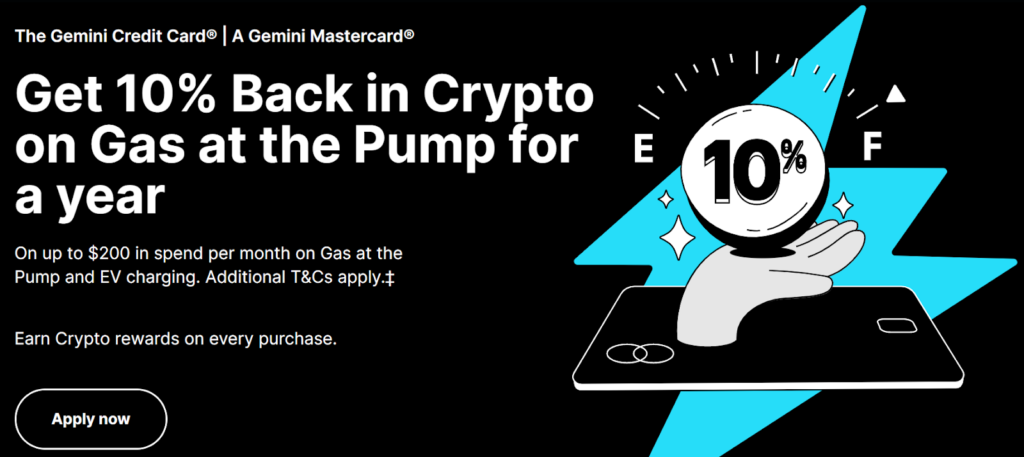

Gemini credit cards help users earn rewards in either Bitcoin, Ethereum, or 60+ other cryptos that are currently available on Gemini. It is one of those credit cards that deposits all your crypto rewards within no time.

That means whatever cryptos users earn lands in their Gemini account the exact moment they swipe, not a month later. Moreover, there is no need to time the market or pay any kind of trading fees.

All users can simply earn ether, bitcoin, or any of their favorite cryptos simply by living their life, every purchase, and every day.

GET THE GEMINI CARD NOW!Furthermore, Gemini has now teamed up with WebBank and Mastercard, the exclusive card network, to offer users several innovative features for its credit card.

Gemini Credit Card

Features

Gemini Credit Card

Features

- Gemini crypto credit card provides their cardholders a chance to earn up to 3% back on each qualifying purchase in bitcoin or any other crypto available on Gemini.

- Users can get up to 2% back on groceries, 3% on dining, and 1% on miscellaneous purchases.

- Cardholders can receive the full value of their rewards as the Card has no annual fee.

- They provide all their users with 24*7 live agent support so that they can have access to customer support anytime.

- The sleek metal card is available in silver, rose gold, or black. It is contactless and was built with total security in mind. Moreover, there’s no information that appears on the Card except for the cardholder’s name.

- They provide Mastercard Zero Liability Protection on unauthorized transactions.

- Users can also lock their Cards directly from the Gemini app.

- Furthermore, there are exclusive offers with select merchants such as Lyft, HelloFresh, DoorDash, and ShopRunner.

Also, read Gemini Review : Best Crypto Exchange in the USA?

Gemini Card Features

4. Wirex Card

What is a Wirex Card?

Gemini Card Features

4. Wirex Card

What is a Wirex Card?

Wirex provides users with an ultimate travel card. This multi-currency travel card will make difficult things very easy. It automatically converts to local currency at the exact point of sale using Over-the-Counter(OTC) rates and the best possible life.

Hence, this means that users can seamlessly spend any of the 50 cryptos and traditional currencies in real life, whether users are tapping in on public transport or picking up the cheque. This is a total game-changer.

LINK TO WIREX CARD Wirex Card

Features

Wirex Card

Features

- Wirex multi-currency Card lets users pay internationally without any kind of hidden charges. Additionally, users earn WXT rewards with every in-store and online purchase.

- The Card automatically converts to the local currency if users are paying internationally, saving users up to 3% on overseas transactions.

- Wirex card gives you a global reach, i.e., you can spend over 150+ currencies at live rates at more than 80 M locations worldwide.

- They provide you with instant in-app alerts that help you keep track of all your payments.

- Crypto back rewards pay back up to 2% rewards in WXT on all spending, online and in-store.

- Moreover, you can do up to SG$400 monthly ATM withdrawals, and there is no maintenance charge.

Wirex Card Features

5. Nexo Card

What is a Nexo Card?

Wirex Card Features

5. Nexo Card

What is a Nexo Card?

Nexo card is a crypto-powered debit card that mainly works on Mastercard. This Card is the only Card that allows users to spend without selling their cryptocurrency holdings.

The Nexo card is linked directly to the Nexo account in order to access funds without banks. Users can get incentives worth 5% cashback if they make use of this Card for payments.

Moreover, users can enable the “Purchase with 0% APR” option present in the Card settings menu inside the Card tab. Once the setting is enabled, they’ll transfer just enough collateral to keep users’ LTV below 20%.

GET THE NEXO CARD NOW!Therefore, users benefit from their 0% Dynamic interest, provided that users have enough assets in their accounts.

Nexo Debit Card

Features

Nexo Debit Card

Features

- Users can freeze or unfreeze their Card with just a single tap if their Card gets stolen or lost anywhere.

- There is no need for your physical Card to arrive as you can simply activate your virtual Nexo Card with just a single tap and start spending with your mobile instantly.

- Users can receive and manage all notifications of their Nexo card transactions.

- There are no minimum monthly fees or any repayments on the Nexo card.

- Users can easily view their PIN and also change it at the nearest ATM anytime, anywhere.

- Users can enjoy 2% cashback on all their purchases and up to 0.5% in crypto rewards when earning in Bitcoin.

- Furthermore, users can track all of the transactions that they have made as they’ll get an instant notification.

Also, read Nexo Card Review: Is It the Best Crypto Card?

Nexo Card Features

6. Bitpay Card

What is a Bitpay Card?

Nexo Card Features

6. Bitpay Card

What is a Bitpay Card?

Bitpay is a known crypto payment gateway platform that came into the picture in the year 2011. According to the Bitpay platform, the Bitpay card is a Master prepaid card.

Its primary purpose is to aid us in bridging the gap between virtual and real currencies. Users can use this Bitpay.com card to make both online and offline transactions and also for ATM withdrawals. Bitpay cards can only be used within the United States.

Further, when users provide all the necessary personal details and other documentation for verification, they will give users a wallet. And then later, users can simply order a Bitpay Master card via the Bitpay Application and start making crypto payments using that Card.

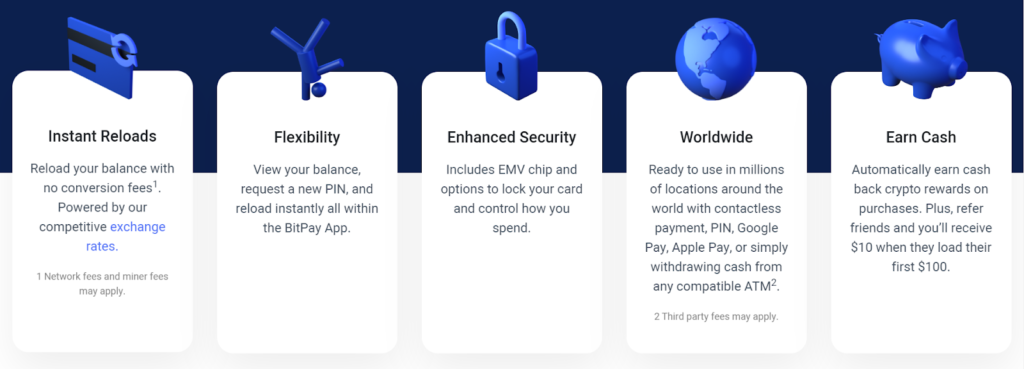

Bitpay Card

Features

Bitpay Card

Features

- Bitpay card does not charge any conversion fees while reloading the card balance from bitcoin to fiat currency. Also, the Bitpay exchange rates are competitive.

- Bitpay cards are mainly for people who want to spend and live on crypto.

- Users can pay and spend all their bills worldwide using this Bitpay crypto debit card. They can either do it online by making use of a pin or by simply making an ATM withdrawal.

- The Card has an EMV chip and other options to lock your Card and get control over how you spend.

- In addition to this, for Bitpay cards, users can also make use of the Bitpay Wallet app in order to manage and spend their bitcoins.

- Moreover, users can also turn Bitcoin into dollars and pay it with a Bitpay card.

Also, read Bitpay Card Review – Is this Crypto Card worth buying?

Bitpay Card Features

7. Uphold Card

What is an Uphold Card?

Bitpay Card Features

7. Uphold Card

What is an Uphold Card?

Uphold Card is like an all-in-one flexible debit card that allows users to pay for their groceries using crypto, stocks, and metal. The Uphold card permits all residents of the United States to make payments and also trade through Mastercard.

Besides this, the Uphold debit card is accepted by over 50 million merchants and almost at all ATMs worldwide. According to reports, U.K. users will also be able to make use of the Uphold card very soon.

GET THE UPHOLD CARD Features- The physical Uphold debit card and accompanying mobile application are well-suited for beginners and are easy to learn.

- Uphold also endures independent audits quarterly in order to confirm that user funds are secure.

- In addition to this, Uphold’s precious metal holdings are daily audited.

- The Uphold Card mobile application enables users to access or even hide card details, place temporary card freezes, change their PINs, receive push notifications for purchases, and break down spending by category.

- At the end of each quarter, Upholde reimburses cardholders for any foreign exchange (F.X.) fees charged when using the Uphold debit card for international purchases.

- However, users can make use of fiat, crypto, and precious metals for purchases with this Card.

- Furthermore, users may receive cashback rewards for in-store and online purchases made with crypto assets or fiat (up to $5,000 monthly).

Also, read Uphold Card Review – Is it Legit or Scam?

Uphold Card Features

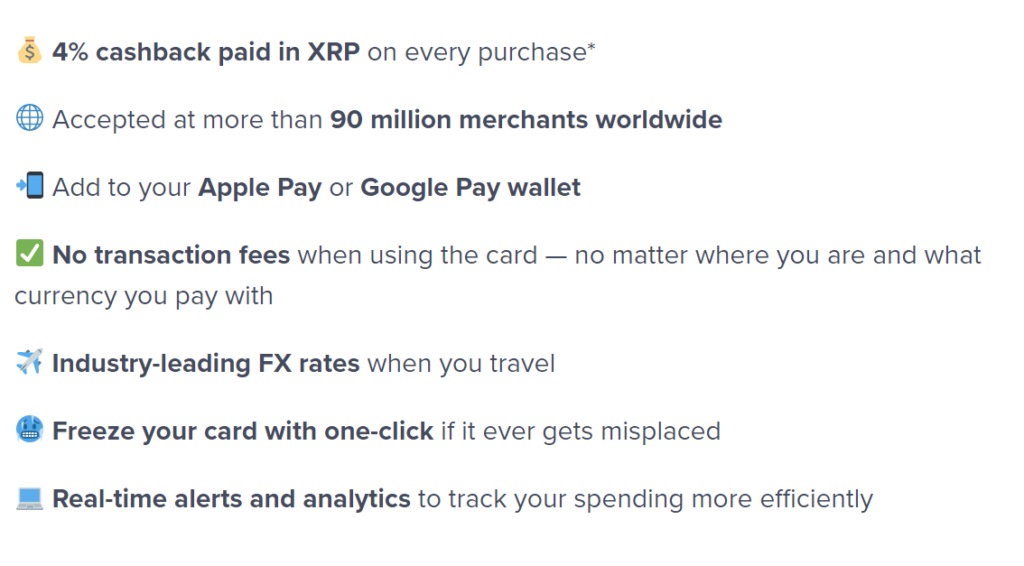

8. Crypto.com card

What is a Crypto.com card?

Uphold Card Features

8. Crypto.com card

What is a Crypto.com card?

The Crypto.com card is a prepaid metal card launched by Crypto.com. Crypto.com is a Hong Kong-based start-up that came into the picture in year 2017.

Crypto.com Visa cards are available without any cost, and users don’t need to pay any price for setting up processes or shipping. But to avail of the benefits of the Visa card (Crypto.com) freely, users have to stake a certain amount of CRO token on Crypto.com Application for six months.

GET THE CRYPTO.COM CARDMoreover, many types of wallets are available inside the application; choose the one according to your currency transaction.

Crypto.com Card

Features

Crypto.com Card

Features

- Crypto.com card has many features, and they differ according to the type of card users have.

- There is five different cards: Obsidian card, Frosted rose gold & icy white, Royal indigo & Jade green, Ruby steel, and Midnight blue.

- All these cards have different CRO rewards, like 5%, 3%, 2%, 1%, and none, respectively. CRO rewards are instantly reflected with each eligible transaction.

- Each Card offers some card benefits on accounts like Spotify, Expedia, Airbnb, Netflix, Airport Lounges, and Amazon Prime.

- The visa card allows ATM monthly withdrawals of 5000 – 10000 USD.

- Some benefits are available to users only if they stake continuously.

Also, read MCO Card Review | Crypto Metal Visa Card Review

Crypto.com Card Features

Conclusion

Crypto.com Card Features

Conclusion

Every card has its own features, cashback, and security like Gemini and Binance give the maximum cashback of 10% and 8% respectively. Although there is no monthly or annual fee charged by any of the platforms, some do charge ATM withdrawal fees and brokerage fees. According to me, Binance provides a great and secure card with a good amount of cashback.

- USDC’s woes are the result of the US crackdown: Circle CEO

- CoinCodeCap’s The Weekly: Issue 2

- 3D-Printed Houses: Top 10 Examples

- The SEC Denied VanEck’s Proposal for a Spot Bitcoin ETF

The Bitpay.com card is a secure and safe option. Users can protect their Bitpay cards with their signature and also their PIN. The Google Authenticator also provides 2FA (Two-factor authentication). Moreover, the Bitpay card is also not linked to personal bank information or other financial accounts.

Is the Nexo Mastercard anonymous?No, the Nexo Mastercard is not at all anonymous. In order to access all the services of the Nexo.io card, you must compulsorily go through the identity verification process of the Nexo platform.

Where can I use the Coinbase card?Coinbase is a crypto Visa card. Hence, users can make use of it anywhere where Visa cards are accepted. Moreover, they can use it for purchasing online, offline, and internally.

Can you trade fiat currencies on Binance?No, users can not trade or deposit fiat currencies using a Binance card. To start trading, users must already have some cryptocurrency to deposit into a Binance card.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.