and the distribution of digital products.

14 Best Portfolio Trackers Compared

Today we will talk about portfolio trackers and compare the best crypto trackers based on their features, coin support, pricing, etc.

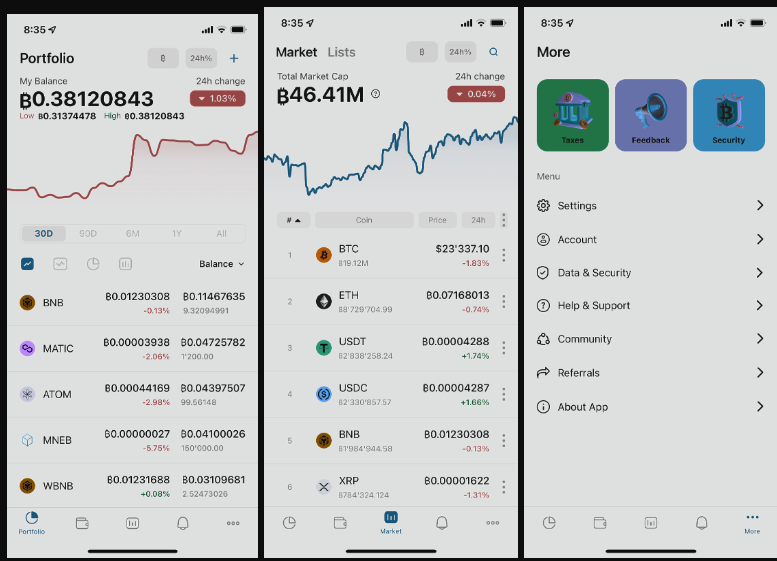

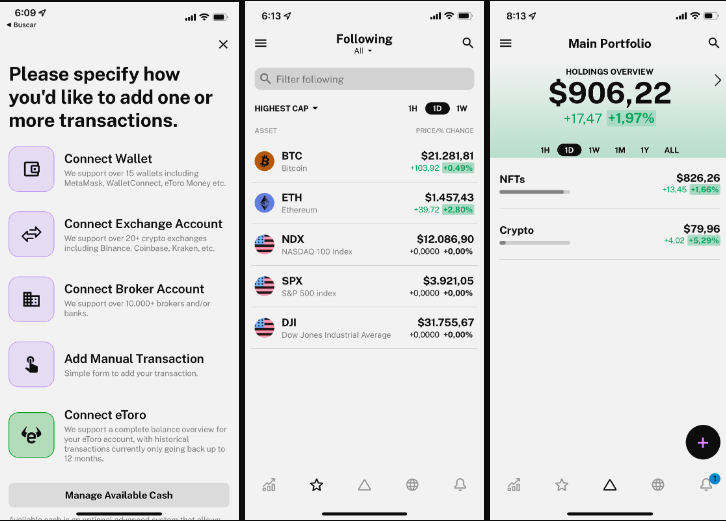

Accointing.comFeatures

- Set up alerts and analyze your portfolio to get real-time insight,

- Multi-currency display,

- Connection with + 5 blockchains and over 100 exchanges,

- Custom coins recognition,

- Transaction history for every wallet/exchange imported,

- PNL on assets being held + valuable insights about your portfolio,

- Easily add data through their CSV template file,

- Automated transactions sync through API connection,

- Shows all assets being held in a universal assets pool,

- Friendly data display and insights about your portfolio,

- Keep track 24/7: customizable alerts based on market movements,

- Your portfolio 24h Performance vs. Others,

- Net profits section.

Accuracy: 95%

Pricing – using the portfolio tracker is FREE, and users can sync as many wallets as they want

Cons

- No recognition for LP pools or farms allocations

- NFT support only for tax purposes

Pros

- Add data without limits

- Multi-currency display

- Alerts about your portfolio

- Watchlist section

- Friendly UI and UX (Intuitive)

- Transaction history for all wallets

- Multichain support

- Cefi + Defi integration

- Notable customer support + chatbot integration

- Realized P/L on different timeframes and can group per asset or wallet

Conclusion:

- Accointing.com offers one of the fastest data syncs (importing data) in the market for Cefi and Defi wallets. Their software can recognize all your assets and collect them in a universal assets pool. Also, their UI and UX are delightful compared to other platforms.

- Accointing.com has a very efficient CSV template to upload transactions compared to other platforms.

- Their portfolio tracking tool is FREE compared to other trackers that charge around 135$/year. Accointing.com has the best platform in terms of value for your money and product quality. Keep in mind that by using their product, you can keep track of your holdings and generate your tax report when needed.

- Top features to call out now – API connection with top exchanges is a must for most users. On top of that, their Defi ability is constantly increasing towards market needs.

- Accointing.com ranks as one of the top portfolio tracking tools at the moment, with a clear sign of leadership in the Cefi section and advanced Defi competence.

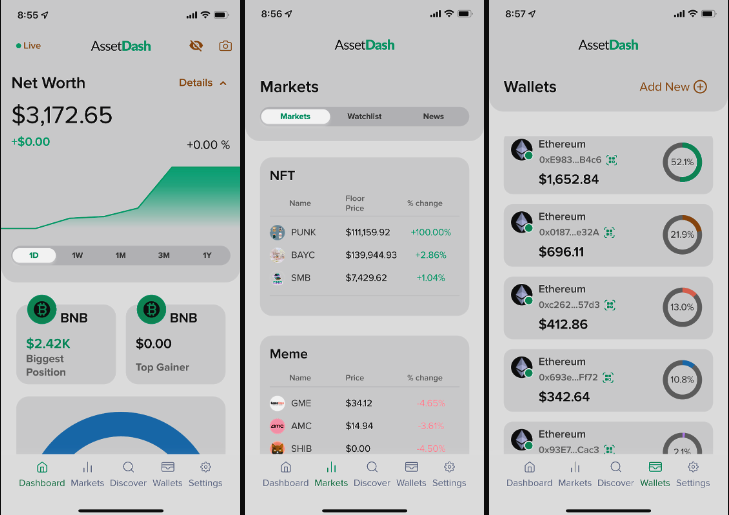

Asset Dash

Asset Dash

Features

- Track all your investments in a single location + analyze allocations across all asset classes.

- Breaking news and research based on your holdings

- High-level insights about your portfolio

- Track live floor prices for Solana and ETH NFTs

- Track profit/loss for your NFTs in real-time

- NFT and Defi market overview (top projects and volume)

Accuracy: 95% – minor problems recognizing Defi allocation (missing LP pools from Apeswap and farms from Auto)

Pricing: Free

Cons

- Slow sync

- Inaccurate Defi allocation in some cases,

- Wrong floor prices for some NFTs in Solana,

- Assets in wallets are not properly divided – they only show assets on a universal assets pool,

- For some top exchange’s sync option is unavailable (like Crypto.com products).

- Performance over different Timeframes doesn’t work properly.

Pros

- Privacy and security focused,

- Intuitive (great UI and UX),

- Capable of recognizing funds across multiple chains with one wallet,

- You can add more types of investments,

- Updated crypto news,

- Allows monitoring NFTs,

- Keep track of multiple investments (stocks, bank balances, and many more),

- Good API connection with Kucoin.

Conclusion: AssetDash is focused mainly on investors who invest in multiple assets and NFT and cryptocurrency traders. They do offer a good portfolio tracking tool – showing prices in real-time.

However, it lacks connectivity with certain major exchanges, and the Defi tracking section needs some improvement because it doesn’t show all LP positions or farms. The app is intuitive, the data display is correct, and it can be used anonymously.

Asset Dash

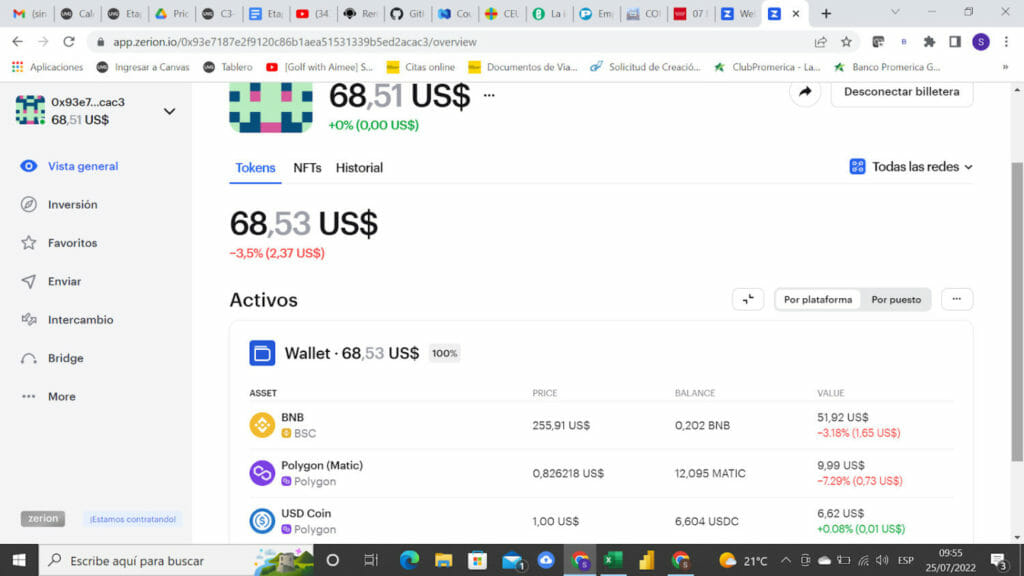

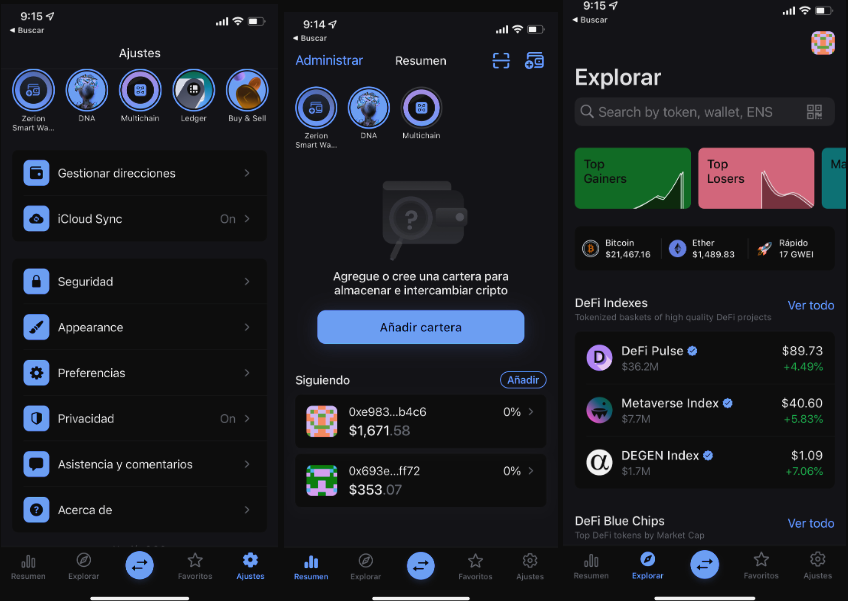

Zerion

Asset Dash

Zerion

Features

- Social crypto: Follow any wallet address, ENS handle, or NFT collection to stay on top of the latest trends and tokens,

- Connect to any dapp on any device,

- 500+ integrated protocols,

- Multichain integration,

- Notifications on wallet movements,

- Track unlimited wallets.

Accuracy: 99% on Defi – Zerion can recognize all your asset allocation on Defi without a doubt and display a portfolio overview in real-time.

Pricing: Free

Cons

Zerion

Zerion

- Lacks connection with major exchanges or Cefi (centralized finance) services,

- Sometimes getting a graph display on a computer is difficult,

- Problems recognizing custom tokens LP pools on BSC,

- Checking transactions history is only available on ETH,

- NFT support is only for ETH at the moment.

Pros

- Defi support available for multiple chains,

- NFT support and tracker,

- Intuitive UI and UX – amazing display and easy-to-change settings,

- Devs can build on top of their API and Defi SDK engine,

- The Defi interface supports 60+ protocols, making it highly productive,

- Mobile and desktop support.

Conclusion: A web 3 portfolio tracker – from Defi to NFTs and everything in between. Zerion is best for those who partake in Defi or any ETH degen that wants to keep track of their portfolio.

Due to this, if you use a centralized exchange like Binance,Crypto.com, or Kraken, this tracker will not provide much use for you…

Zerion

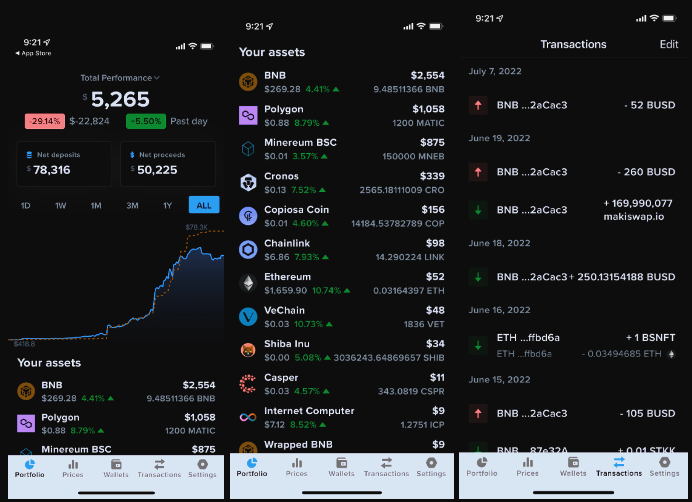

Cointracker

Zerion

Cointracker

Features

- Defi center (overview of your Defi positions on ETH),

- NFT center (only for ETH),

- Support multiple blockchains and major exchanges sync,

- PNL on assets being held,

- Shows net deposits & net proceeds.

Accuracy: around 80% – missing stablecoins allocation on BSC and wrong calculations for custom tokens price.

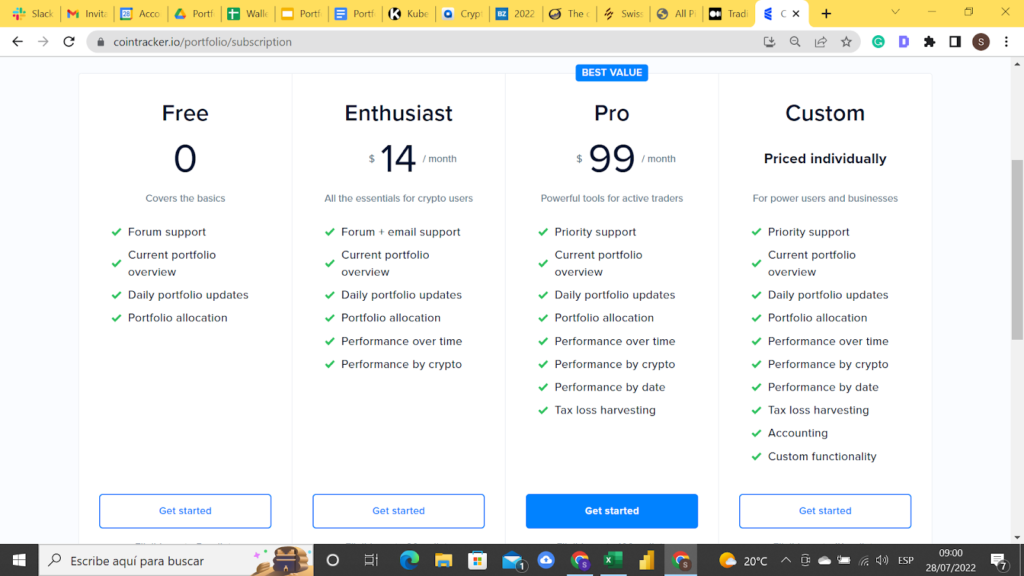

Pricing: you can use the portfolio tracker for Free, but you need to pay to get access to certain features.

Cointracker

Cointracker

Cons

- It can get expensive if you are an active trader,

- Performance over time and by crypto is restricted to paid plans,

- Errors while recognizing stablecoins allocation on Defi (BSC),

- Most of the features are blocked for paid subscriptions.

Pros

- User-friendly (great UI and UX),

- Can handle Cefi + Defi integration,

- Connection with major exchanges,

- Daily portfolio updates, emails/alerts,

- All-time realized return section,

- Access to view Market Value + Net Proceeds,

- Mobile and Desktop support.

Conclusion: Cointracker has a modest portfolio tracking tool, capable of connecting with many large exchanges, and can handle support for multiple blockchains.

But compared to other platforms, their Defi tracking system needs some improvements for some chains, and you have to pay extra for most of the features to access a proper portfolio tracking tool makes it very expensive.

Cointracker

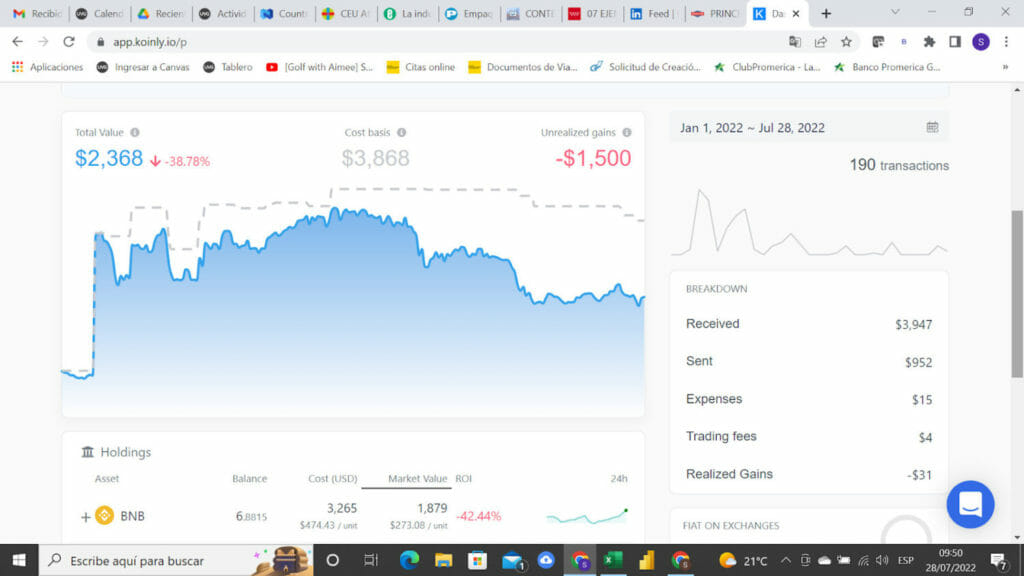

Koinly

Cointracker

Koinly

Features

- ROI and invested fiat,

- Income overview,

- Profit/loss & capital gains,

- Cost basis and unrealized gains displayed.

Accuracy: 95% – most of the allocations were correct (API sync from exchanges worked perfectly; there was a minor problem for an LP pool transaction on BSC.

VISIT KOINLYPricing: portfolio tracking tool is free for Koinly

Cons

- Data display can be complex for some people,

- Not a lot of guidance on how to import,

- You can not see your Defi positions,

Pros

- Sync as many wallets as you want without trespassing 10k transactions.

- Extensive wallets and exchanges support.

- Cost basis and unrealized gains section.

- Provides # of transactions for a timeframe.

- Shows ROI on assets and cost of purchase.

Conclusion: Koinly offers a very good portfolio tracking tool for free; they can handle support for many blockchains, their API integrations for major exchanges work perfectly, and they provide a breakdown of useful data to judge your portfolio performance such as: received, sent, expenses, trading fees and realized gains. However, since they do not offer a mobile app, many will pass on using it for tracking purposes.

Koinly

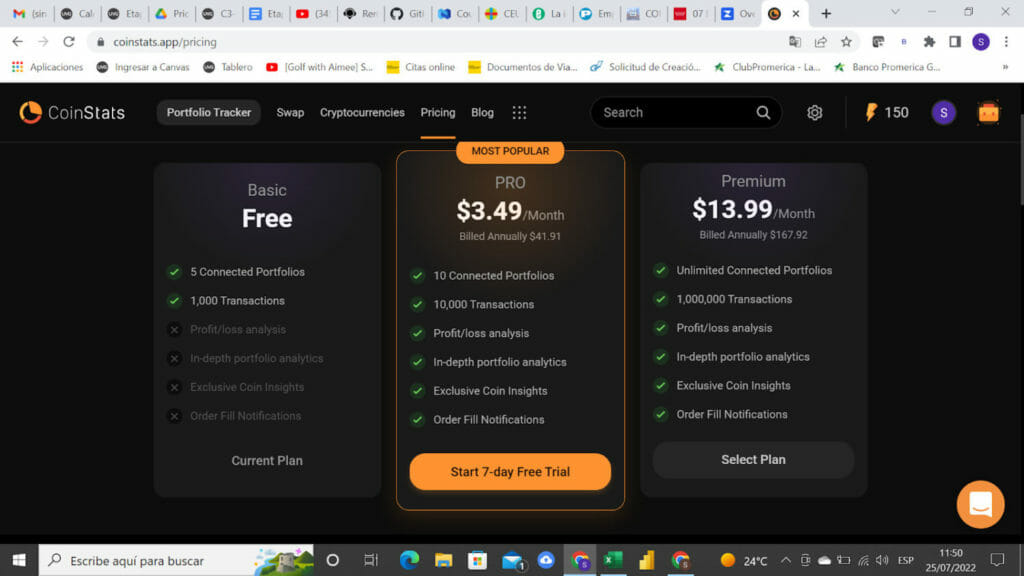

Coinstats

Koinly

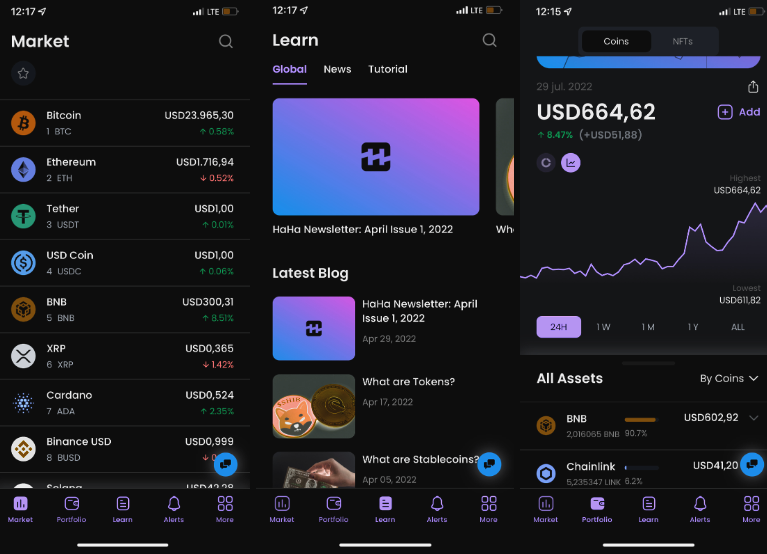

Coinstats

Features

- Portfolio tracker for Defi positions and Cefi

- One dashboard for everything

- Seamless portfolio management

- Quick and secure

Accuracy: around 99% – great sync with centralized finance products (CDC app, Binance, Kucoin); meanwhile, Defi offers excellent tracking for Cronos, Binance, and Ethereum.

Pricing: 7-day free trial* or FREE by having up to 1k transactions.

Coinstats

Coinstats

Cons

- Minor errors while synching Binance exchange (API sync took too long)

- You need to acquire a paid plan to get access to PNL analysis

- Customized price alerts are restricted to paid plans

- Learn crypto section seems to be outdated

- Lack of quality in most news portrayed in app

- premium package is required for unlimited exchange connections

Pros

- Defi and NFTs support is available for multiple chains

- Intuitive UI and UX

- Customizable notifications

- Ease of changing currency display

- Offer a Defi swap

- Last trade PNL

- Crypto news distributed from over 40 sources

- Supports more than 8,000 crypto assets and 300 exchanges

- Can Pay subscription with crypto

Conclusion: CoinStats is among the portfolio trackers capable of handling support for multiple wallets and consolidating crypto assets + NFTs across several blockchains.

Currently, it is one of the most accurate portfolio trackers in the market and provides very deep analytics about all your movements/transaction history.

Coinstats

CryptoPro

Coinstats

CryptoPro

Features

- Exchange API import

- Crypto news

- Customizable alerts (spike in price, volume, or trading activity)

- QR code requests

- Compare prices/volumes across exchanges

Accuracy: 70% – wrong stablecoins allocation for Metamask wallet and problems recognizing custom coins

Pricing: You can use the app for free, but with several restrictions. A $47.99/year auto-renewing subscription with a 7-day free trial is available for advanced users. This includes candlestick graphs with indicators, automatic portfolio import from exchanges and wallets, and more. Advanced features can also be unlocked for free by inviting friends to download the app.

Cons

- no web app or desktop support

- Restricted supported exchanges

- UX, while adding alerts, is tedious

- It can get expensive if you are dealing with numerous transactions

- Problems recognizing custom coins allocation

- Restricted blockchain capability

Pros

- You can view your gains & and losses, asset distribution, and equity history chart.

- Sync across multiple devices

- Currency conversion calculator

- Referral program – if you refer a couple of friends, you can get the product for FREE ( for a year only*).

- Customizable coins icon display

Conclusion: The app does a decent job at tracking your assets and overall portfolio value. Still, the information provided by some cryptos is way too outdated (this even happens for the top 100 coins – “poor news sources can lead to poor decisions while investing”).

On top of that, the app does not sync properly with ETH addresses and lacks support for many major exchanges like Binance or Crypto.com.

CryptoPro

Kubera

CryptoPro

Kubera

Features

- Your own Personal Balance Sheet.

- Track Stock & Crypto Portfolios.

- Supports Global Banks, Brokerages, currencies & more

- Full financial overview

Accuracy: 70% – Kubera can track cefi transactions properly, but the Defi engine on metamask had some errors recognizing custom coins.

Pricing: Kubera charges $150/year ($15/month) for their portfolio tracking service. You can also test it with a 14-day trial for just $1.

Cons

- Supports only a few of the top large exchanges

- Slow data sync

- Limited Defi capability* (minor errors recognizing custom coins allocation)

- No crypto market data (no top 100 section)

- The application is web-only, with no mobile or desktop application available.

Pros

- Create multiple portfolios for different assets

- The site is very intuitive, and so is the process of uploading data

- Kubera supports Defi assets on multiple chains like Ethereum, BSC, Polygon, Arbitrum, Optimism, Avalanche, Solana & Cosmos

Conclusion: (one-stop-shop financial tracker)

Kubera

Delta

Kubera

Delta

Features

- Market charts in your local currency and get alerts to make sure you don’t miss out on your next crypto investment.

- Huge library of crypto coins

- Market overview and watchlist

- Detailed trading analysis

- Tracks NFTs

- Delta direct – links cryptocurrency token teams to existing and potential future coin investors and traders free of charge

Accuracy: 92% – very accurate results for Cefi transactions, but for some cases on Cardano Blockchain it wasn’t able to recognize some LP pools

Pricing: $58.99 a year for the Pro plan.

Cons

- By upgrading, it can get expensive

- Restricted data upload for the FREE version

- Binance Smart Chain and Polygon are restricted to PRO users

Pros

- Supports over 300 exchanges

- Customization of notifications

- Portfolio analytics based on your trades (gamechanger)

- Multiple crypto portfolios

- Sync across multiple devices

- Track and Follow NFTs collections

Conclusion: Delta supports many cryptocurrency exchanges and tries to keep investors and potential investors in touch with companies.

It aims to serve as a multi-assets tracker; still, for crypto, they need some improvement on their data sync with major exchanges, blockchains supported, and Defi capabilities; because, at the moment, they mainly support Ethereum and BTC.

Delta

Haha

Delta

Haha

Features

- Learn about crypto

- Transactions fees summary

- Track NFTs

- Support for major exchanges and many blockchains

Accuracy: 70% – CRONOS sync doesn’t work, and on BSC, the software wasn’t able to track BUSD allocation)

Pricing: NA, but you can add multiple wallets for FREE.

Cons

- Bad syncing with Cronos

- Weak NFT support

- Restricted Defi capability

- Learn section seems to be outdated

Pros

- incredible UI and UX (ease of use)

- Intuitive app

- Custom Notifications

- Earn karma rewards – redeemable

- Push price alerts

Conclusion: Haha serves as an ideal portfolio tracking for those holding coins on exchanges or Decentralized wallets; the software is capable of recognizing most of the funds being held; including custom coins, but on some blockchains, they import the data with errors (with missing funds).

Haha

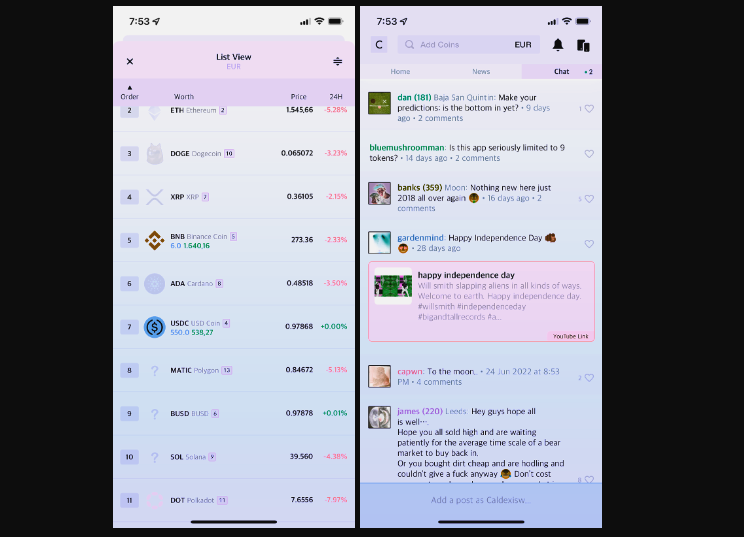

BitWorth

Haha

BitWorth

Features

- Chat section (to talk with other users)

- Sync multiple devices

- User-friendly display

- Change portfolio view (graph or donut chart)

- Updated news

Accuracy: NA

Pricing: FREE

Cons

- you must add data manually

- No sync option for major exchanges or wallets

- Restricted assets support

Pros

- Updated News section (can filter by: trending, newest, and quality)

- Good UI and UX

- Add unlimited assets

- Leaderboard

Conclusion: a portfolio tracker for beginners who just have a few coins on the space.

BitWorth

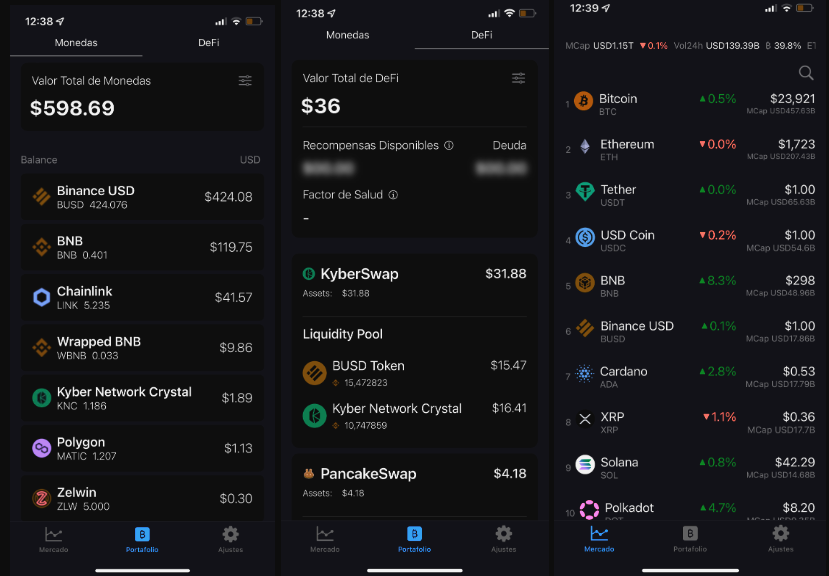

Road2crypto

BitWorth

Road2crypto

Features

- Shows Defi allocations (LP pools, farms)

- Capable of recognizing assets on one wallet for multiple blockchains

- Combined portfolio balance

Accuracy

- 95% of the platform is capable of recognizing properly all assets being held

Pricing

Cons

- The free version is only restricted to one wallet

- Missing major exchanges API sync

- You need to acquire a paid plan to get access to a considerable level of support

Pros

- Coin history for every wallet

- Combined portfolio balance

- Many blockchains sync available

- Multi-currency support

- Track Defi rewards/debt

Conclusion: modest portfolio tracking ability, but its free trial has a lot of restrictions compared to other software.

Road2crypto

Nansen Portfolio

Road2crypto

Nansen Portfolio

Features

- Shows Defi allocations (LP pools, farms) across multiple blockchains

- Capable of recognizing assets on one wallet for multiple blockchains

- Combined portfolio balance

- Up to 470+ protocols supported

- Access to smart alerts and research reports (on-chain analysis)

- On-chain analytics tool + web3 portfolio tracker

Accuracy

- 100% – the platform is capable of recognizing properly all assets being held on Defi wallets (web 3 portfolio tracker)

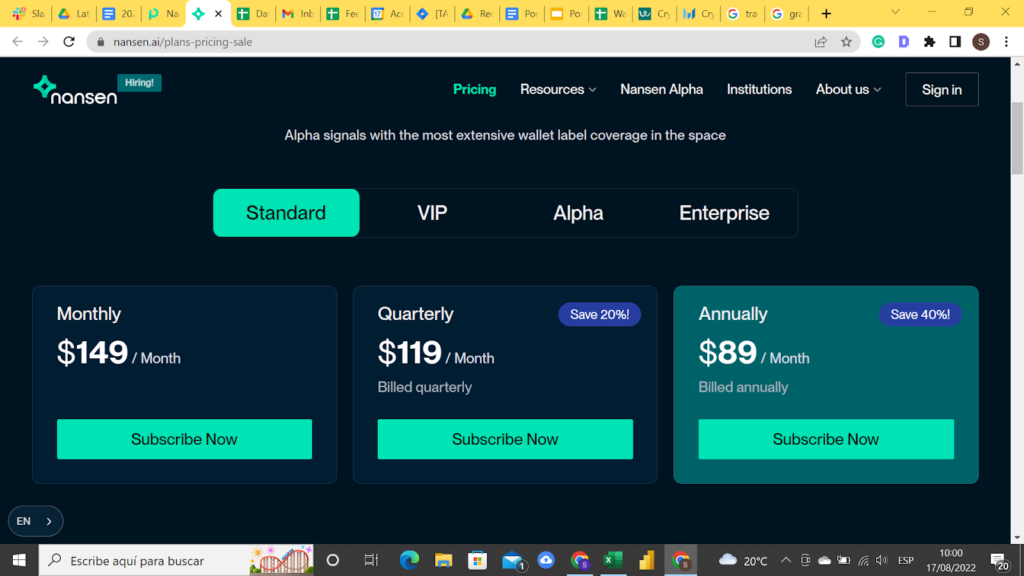

Pricing

Nansen Portfolio

Nansen Portfolio

Cons

- Missing major exchanges API sync (no Cefi connection integration)

- You need to acquire a paid plan to get access to on-chain analysis

- Portfolio performance over different timeframes is not available

- Wallet profiler only available for ETH

- No NFT tracking

Pros

- Transaction history for every wallet and blockchain

- Combined portfolio balance

- Many blockchains sync available (multichain capability)

- Track Defi rewards/debt in real-time

- Can pay the subscription in crypto

Conclusion: web 3 portfolio tracker + on-chain market analytics (providing smart alerts based on market movements and hints)

NavexaFeatures

- Navexa offers consumers real-time statistics and tracking of their portfolios, enabling them to keep track of their investments and manage their portfolios intelligently.

- By giving customers access to comprehensive tax information that can be used to create tax returns and keep track of capital gains, Navexa makes tax reporting simpler.

- Navexa provides a variety of news and market information sources, enabling users to stay current on the most recent news and market trends.

Accuracy

Users can access reliable and recent information on market data, news, and the performance of their portfolios through Navexa. The platform makes use of trustworthy data sources to guarantee that users have access to the most recent data, and it uses algorithms and analytics tools to give customers precise insights into the performance of their portfolios.

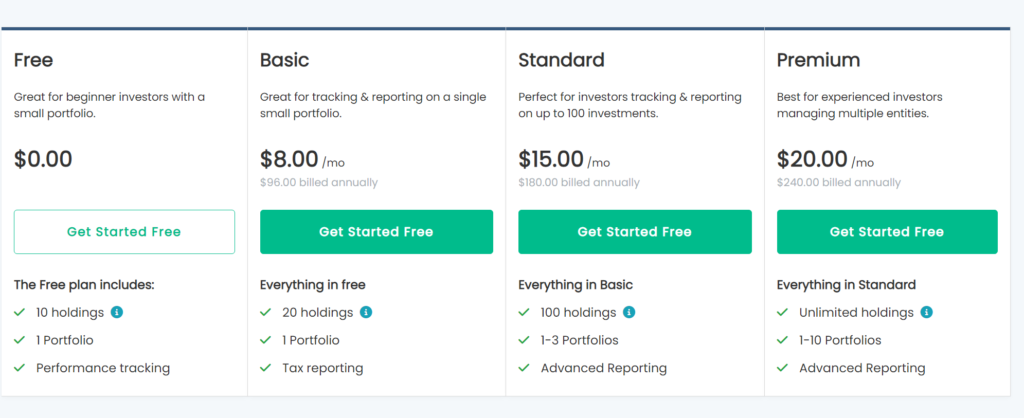

Pricing

Pros

- Tracks stock and cryptocurrency performance on a single website

- To track performance, upload investment documents for free.

- Compare your performance to benchmarks. (with paid subscription)

Cons

Fairly pricey app, especially considering the abundance of accessible free options

The best articles and features are behind pay walls.

Major American brokerages are not supported.

Accointing.com offers one of the fastest data syncs (importing data) in the market for Cefi products; also, their UI and UX are very pleasant compared to other platforms. It has a very efficient CSV template to upload transactions compared to other platforms. Pricing range summary (FREE vs paid) – typically, portfolio trackers charge around 135$/year. Top features to call out at the moment – API connection with top exchanges is a must for most users; on top of that, the Defi capability will have to increase in the near future based on the market needs. Accointing.com is one of the top portfolio tracking tools at the moment, with a clear sign of strength in the Cefi integration.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.