and the distribution of digital products.

Web3.0 Marketing Playbook #3 | How DeFi Integration Empower Protocol Growth

\ Keywords: Integration strategies, Point program trends, User Loyalty

\ Tl,dr:

Points programs unify DeFi integration across various dApps, enhancing asset utilization and effectively driving protocol growth while tackling the cold-start problem

Pendle, Curve, and Morpho emerge as the go-to platforms for initial liquidity scaling

Permissionless is the future

\

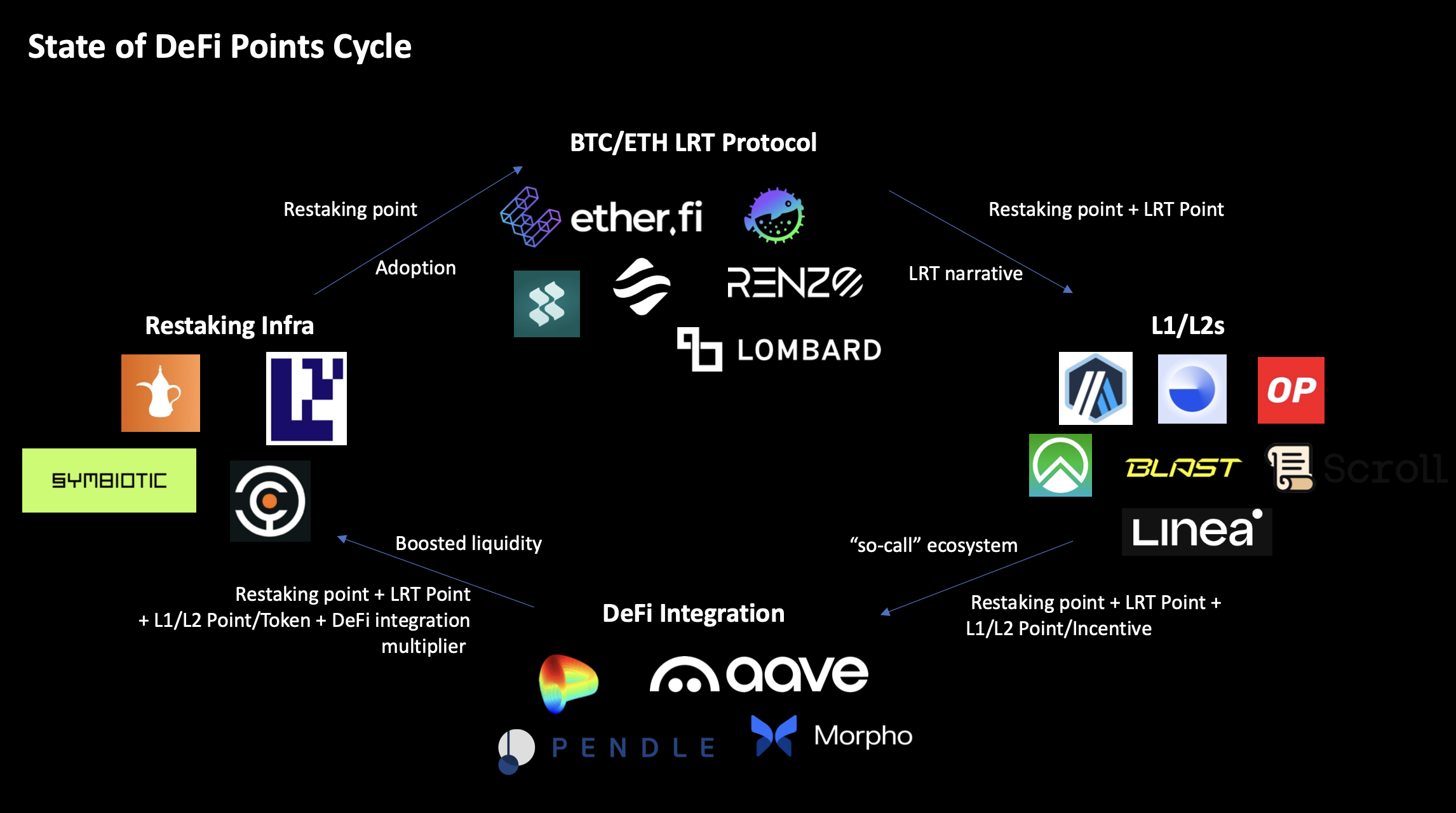

Speculation is rooted in the blood of crypto. The inherent nature of crypto speculation fuels the development of DeFi integrations in these points season, and vice versa, it brings tons of liquidity back to the new protocols by leverage. With the airdrops and points program becoming a standard in crypto 2024, DeFi integration plus points has been one of the most important solutions to bootstrap liquidity and deal with cold start problems.

\

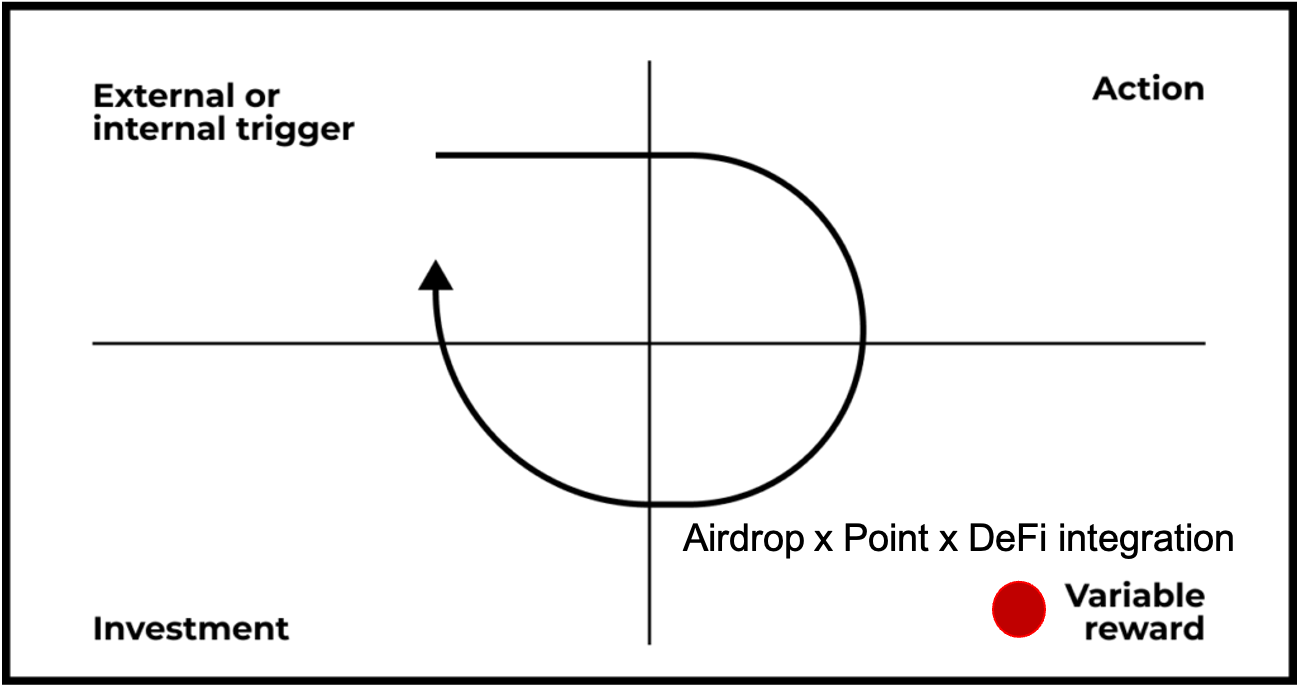

\ The industry’s relentless pursuit of user liquidity and attention through incremental innovation and token incentives has created an environment that is becoming more adversarial for all participants. Points, not a new form of user loyalty campaign, conquer DeFi in 2024 by restaking assets. Unlike fixed liquidity mining, points introduce an element of unpredictability and excitement. According to the Hook Model, proposed by Nir Eyal, the variability of the reward is crucial to the Hook Model. Novelty activates the dopamine system, which causes us to feel pleasure when we experience something new. The obsession with slot machines kind of assembles the craze of airdrop in DeFi. Players feel extremely motivated to participate since rewards are unpredictable and random.

\

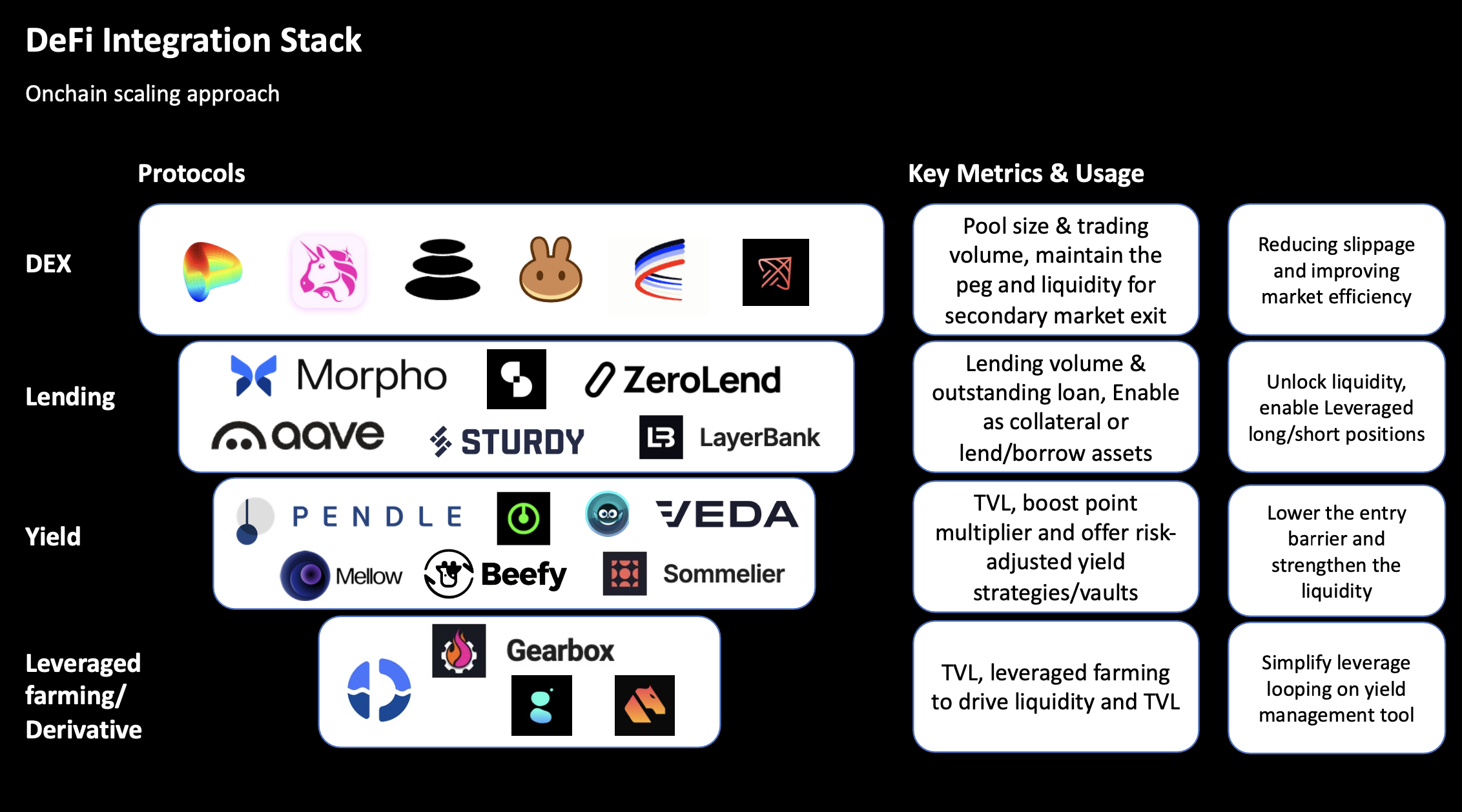

\ We explore the ways in which decentralized finance (DeFi) protocols began to tokenize ever-more complex forms of value in a composable manner, enabling an entire sector of decentralized financial services on chain, including lending, borrowing, trading, yield generation, and more. In many respects, DeFi protocols represent some of the first on-chain consumer apps to achieve product-market fit, fundamentally altering the way users interact with blockchains and continuing to serve as a driving force for on-chain activity today.

\

If you’ve been an active on-chain participant in 2024, you shouldn't be unfamiliar with the graph below. As blockchains continue to grow and become more scalable, on-chain consumer apps and the wide range of possibilities they entail are now poised to have a greater influence on the broader crypto experience than ever before. The combination of speculation and utility can be quite powerful. Speculation can serve as an effective tool for early user acquisition. The internet itself thrives on attention, and in a world where competition for attention is growing exponentially, every dApp needs a certain level of attention to remain relevant.

\ Current Trends in DeFi Integration

From Uniswap to Curve

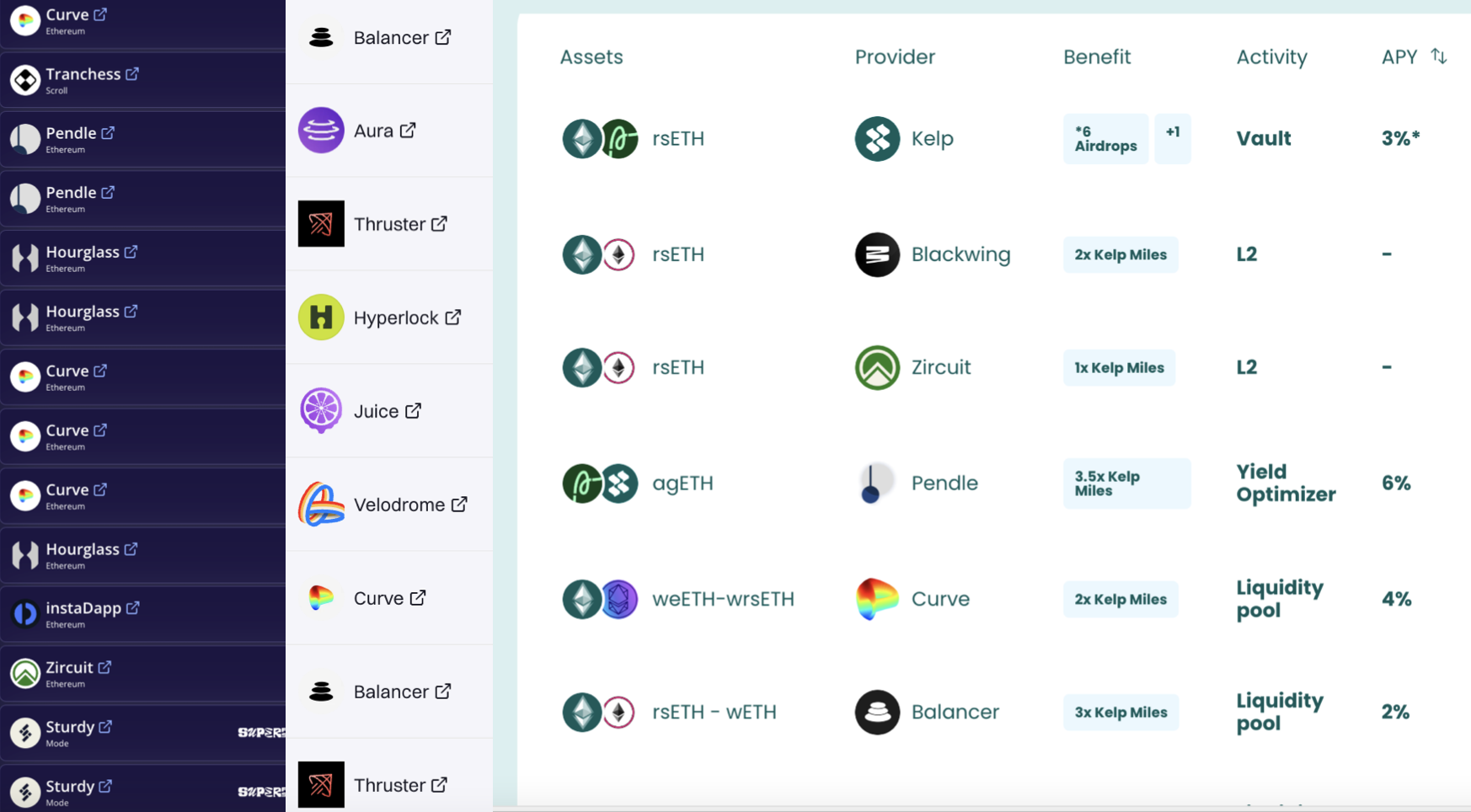

During the recent restaking war, Curve has emerged as a leading platform for DEX liquidity, surpassing Uniswap. Curve's advanced trading mechanics and ecosystem support, including CRV bribes, access to DeFi power users, and co-mkt, have made it a preferred choice for projects seeking liquidity. Unlike Uniswap, Curve's ecosystem offers comprehensive support for early-stage projects, driving its dominance in this niche.

\

Pendle's Dominance in Yield Trading

\ Pendle has established itself as a go-to platform for yield trading and a key component of on-chain liquidity. By aligning with the crypto Twitter narrative around liquid staking tokens (LSTs), Bitcoin staking, and real-world assets (RWAs), Pendle has positioned itself at the forefront of yield provision. Its ability to cater to emerging trends has solidified its role in the DeFi landscape, achieving a peak TVL $6.7Billion during the point season.

\

Vault Popularity

\ As restaking projects proliferate, leveraging platforms like Eigenlayer alone is no longer sufficient. Projects are increasingly integrating with additional restaking infrastructures such as Karak, Symbotic, and Renzo for Solana (SOL) and Etherfi for Bitcoin (BTC). These vaults, including Usual’s USDe and Elixir’s deUSD, not only enhance yield across various protocols but also simplify the staking process. By reducing manual effort and lowering entry barriers, these vaults have attracted significant liquidity, with Etherfi leading the charge due to its robust influence and total value locked (TVL).

\ \ Looking Ahead Looking to the future, the trajectory of on-chain consumer app development today suggests that the race to achieve mass adoption of crypto will only accelerate and become more competitive. For most teams, the ultimate goal will be to build lasting social capital and user loyalty. As for the product, products that are permissionless, leverage-based, and simplify yield processes through innovative vaults will be best positioned to capture market share.

\

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.