and the distribution of digital products.

DM Television

Understanding Babylon: A Comprehensive Overview

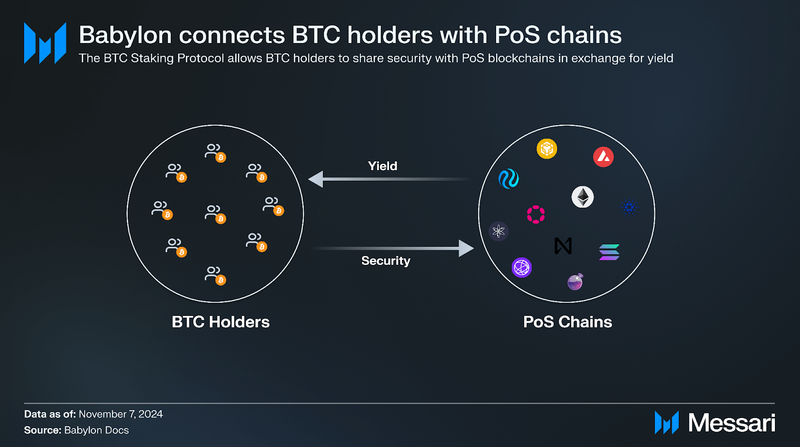

- Babylon unlocks idle BTC by allowing BTC holders to stake and secure Proof-of-Stake (PoS) blockchains to earn yield in a self-custodial and trustless manner.

- Babylon Chain enables PoS blockchains to onboard Bitcoin security by providing a marketplace to match BTC stakers with PoS chains and communicating staking and validation information between networks.

- Slashability is provided through an additional consensus layer using cryptographic signatures that overcome Bitcoin’s limited programmability.

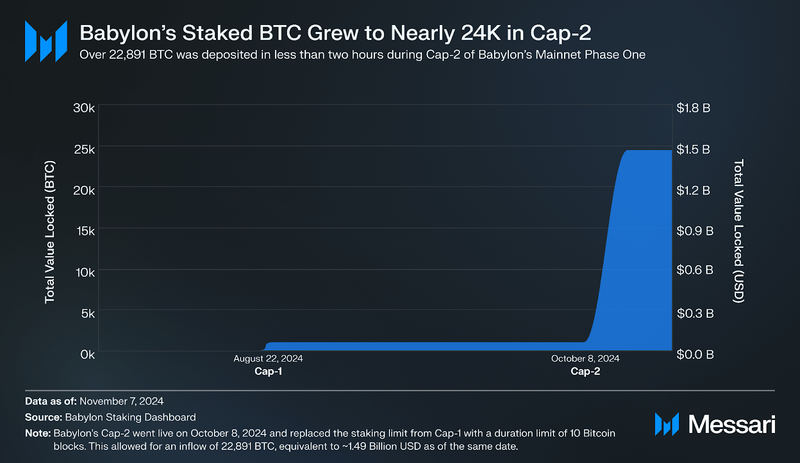

- Mainnet launched on August 22, 2024, and the initial staking cap (Cap-1) of 1,000 BTC was filled in ~74 minutes by over 12,740 unique addresses.

- The second staking cap (Cap-2) went live on October 8, 2024, with 22,891 BTC staked in under two hours, bringing the Total Value Locked (TVL) to nearly 1.50 Billion USD.

Over the years, Bitcoin has become increasingly ossified and resistant to protocol changes. While this has strengthened Bitcoin's security and made it a reliable store of value, it has limited the ability to generate native yield for BTC holders.

Bridging is the traditional approach to extend Bitcoin’s value and allow for staking. While this method provides BTC holders with new opportunities for yield generation, it also introduces smart contract risks and may rely on third-party custodians. Currently, many bitcoin sidechains rely on multi-sig bridges and introduce trust assumptions for BTC holders.

Babylon offers an alternative solution to overcome Bitcoin's limitations. It enables BTC holders to stake BTC by locking the asset on the Bitcoin network and share economic security with PoS blockchains. Unlike BTC staking solutions such as Wrapped Bitcoin (WBTC), Babylon does not require bridging or third-party custody and allows BTC holders to stake securely and remotely. Through this, Babylon unlocks new BTC use cases like dual staking, use in liquid staking projects, and a streamlined staking experience for wallets and custodians.

BackgroundBabylon was founded in 2022 by David Tse and Dr. Fisher Yu. The inspiration for Babylon came from a research paper on Bitcoin security co-authored with EigenLayer’s founder Sreeram Kannan.

Babylon is a BTC staking protocol connecting BTC holders seeking yield with PoS blockchains desiring staked BTC for economic security. Despite Bitcoin’s lack of smart contracts, Babylon enables slashability through Bitcoin Script and a cryptographic mechanism.

On February 28, 2024, the BTC staking testnet-3 went live on Bitcoin Signet. This testnet was sunset in May 2024, and BTC staking testnet-4 launched on May 28, 2024.

The mainnet launched on Aug. 22, 2024, and will be rolled out in three phases. Phase One features Bitcoin locking and point rewards for stakers and finality providers. During this time, staking caps are implemented and relaxed as the phase progresses. Two staking caps have been completed, with the second cap implemented on October 8, 2024, and active for 10 Bitcoin blocks. Phase One does not implement slashing or require stakers to consent to slashing.

The core developer, Babylonchain Inc., raised $70 million in a Series B round in May 2024, led by Paradigm. Babylonchain Inc. had previously raised $18 million in a series A round led by Polychain Capital and Hack VC in December 2023. In May 2023, $8.80 million was raised in a seed round. A full list of investments in Babylonchain Inc. can be found here.

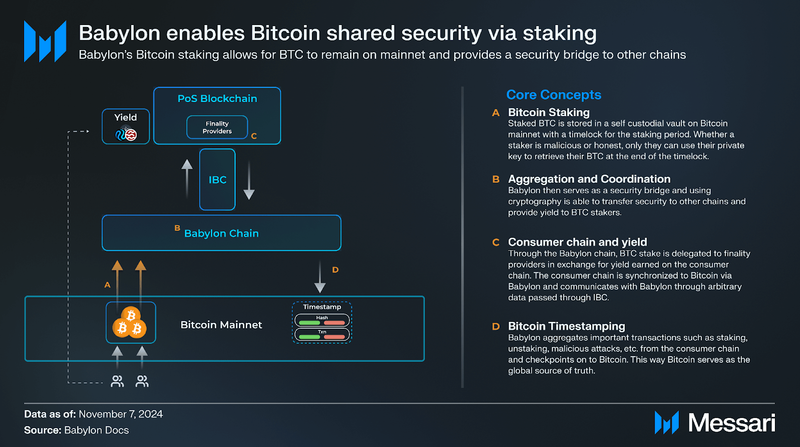

TechnologyBabylon is a trustless and self-custodial BTC staking protocol that enables BTC holders to earn yield from PoS chains for sharing Bitcoin’s crypto-economic security. BTC holders can lock BTC on the Bitcoin network and stake to any IBC-enabled PoS blockchain, eliminating the need to bridge. It leverages its own PoS blockchain, Babylon Chain, to facilitate cross-chain synchronization between PoS blockchains and Bitcoin. Bitcoin provides a timestamping service with transactions from PoS blockchains checkpointed onto Bitcoin to provide long-range security.

The BTC staking protocol serves as a marketplace connecting PoS blockchains with BTC holders. The marketplace allows:

- PoS blockchains to receive Bitcoin security, and

- BTC holders to earn yield for providing security.

BTC Staking Protocol

BTC Staking ProtocolThe BTC staking protocol utilizes “remote staking” for security sharing, where BTC holders lock BTC on Bitcoin and can be slashed for malicious activity on the PoS blockchain. It is similar to how EigenLayer extends Ethereum security to other protocols, but Babylon has enabled this functionality for Bitcoin by building within its constraints.

Babylon nodes rely on CometBFT, which provides Byzantine Fault Tolerance (BFT) to ensure the network can reach consensus even if some nodes behave maliciously. An extra consensus layer is implemented where finality providers (validators) receive BTC stake delegations and vote for blocks on top of CometBFT to finalize them on the Babylon Chain. Voting is performed using Extractible-One-Time-Signatures (EOTS), a cryptographic mechanism that allows for slashability. A block is considered finalized only after it has been finalized by the base consensus protocol and has received signatures from over 66.66% of staked BTC.

BTC holders can become finality providers and self-delegate, or delegate to other finality providers. Finality providers earn a share of the staking commission for providing security to PoS blockchains.

Staking-related Transactions

Staking-related TransactionsBabylon leverages Bitcoin's native UTXO model and Bitcoin Script to enable “staking contracts.” Unlike account-based models, which track balances through accounts, the UTXO model records individual outputs from each transaction that must be entirely spent in future transactions.

Staking, unbonding, and slashing are implemented using UTXO transactions, with Bitcoin Script opcodes enforcing timelocks and spending conditions. Although Bitcoin Script is limited compared to smart contracts, it provides enough flexibility to enable secure staking through timelocks and signature conditions.

BTC holders initiate staking by sending a “staking transaction” to Bitcoin and locking BTC in a self-custodial vault. This creates a UTXO with opcodes enforcing spending conditions. The staker can then delegate to a finality provider who uses the associated private key to sign Babylon blocks and validate for the consumer chain.

Slashing SecurityEOTS is the cryptographic mechanism used to enforce slashing rules directly on the Bitcoin network. It is built on the Schnorr signature scheme implemented by Bitcoin in the Taproot upgrade. Through EOTS, Babylon ensures that if a finality provider behaves maliciously by engaging in double voting or selective slashing, the private key is exposed. Anyone can then submit a slashing transaction to burn 33.33% of the staked BTC.

By locking BTC on the Bitcoin blockchain and implementing EOTS to leak private keys for equivocations, Babylon guarantees that even if a consumer blockchain is compromised, staked and delegated BTC remains safe as long as the finality provider behaves honestly. This provides a unique safety property compared to most bridge protocols, where compromising the consumer blockchain often affects the underlying assets.

Covenant CommitteeBabylon relies on a covenant committee to enforce the staking rules and protect against attacks by BTC stakers and finality providers. Each member of the committee runs the covenant emulator program to monitor, verify, and co-sign BTC staking requests using a multi-signature scheme.

The covenant committee enforces the following rules: (i) when a staker is slashed, the percentage of slashed BTC must meet the protocol’s slashing percentage of 33.33%, (ii) slashed BTC must be sent to the protocol-specified slashing address, and (iii) unbonding times must adhere to the protocol’s minimum unbonding period before funds can be unlocked.

The committee is necessary to enforce staking rules due to Bitcoin’s lack of programmability. Its authority is limited to approving or denying staking requests through co-signing BTC transactions, and it cannot collude against honest stakers. Safeguards to prevent a dishonest committee from developing include having stakers’ counterparties (i.e., foundations) on the board and executing governance proposals to re-elect members.

Forkless RollupsBabylon’s BTC staking protocol allows for “forkless rollups” that improve security while achieving significantly faster finality. Traditional rollups can take minutes (for ZK-rollups) or weeks (for optimistic rollups) to finalize transactions, whereas rollups using Babylon can achieve sub-second finality.

This is accomplished by incentivizing sequencers to behave honestly by locking up BTC as collateral, earning yield for honest behavior, and facing slashing penalties for misconduct such as forking attacks. A finality gadget is implemented with finality providers validating and signing blocks before they are sent to the Layer-1 rollup contract. The contract only accepts blocks if they have received valid signatures from finality providers.

Additionally, rollup security can be decentralized by introducing multiple finality providers to validate and sign blocks before submission to the Layer-1 chain. BTC stakers can delegate to sequencers or finality providers to participate in consensus and earn yield.

This approach addresses the security-finality tradeoff that has hindered rollup adoption by applications requiring both strong security guarantees and fast finality, such as high-frequency trading, gaming, and sports betting.

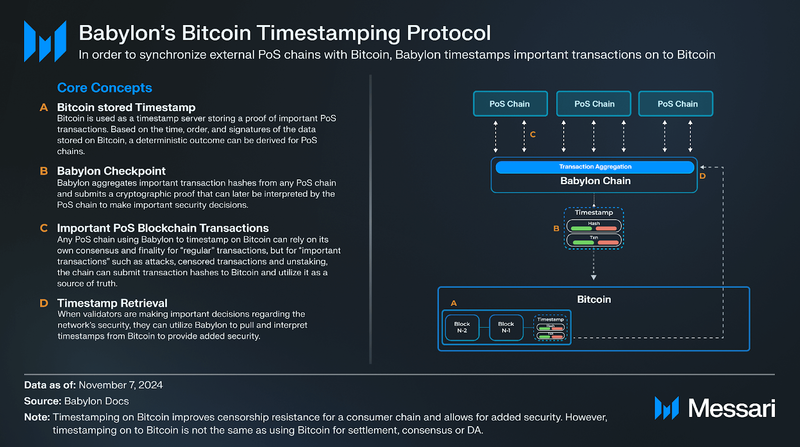

Bitcoin Timestamping Protocol

Babylon’s Bitcoin Timestamping Protocol allows transaction hashes from PoS chains to be posted on the Bitcoin blockchain, enabling the reference of Bitcoin's state for security. The protocol consists of (i) Bitcoin as a timestamping server, (ii) Babylon Chain as a checkpoint aggregation and data availability layer, (iii) and PoS blockchains as consumers of Bitcoin security.

Babylon ChainBabylon implements a PoS blockchain based on Cosmos SDK to synchronize Bitcoin with other PoS blockchains. It provides a checkpoint aggregation and data availability service, allowing transactions from PoS blockchains to be transmitted to Bitcoin to receive timestamps and security. The Inter-Blockchain Communication (IBC) protocol relays the data between Babylon Chain and other Cosmos Zones before Babylon Chain submits checkpoints to Bitcoin.

Unbonding SecurityBitcoin security can be leveraged to protect PoS blockchains against long-range attacks, where malicious actors create alternative blockchain histories after unbonding. To achieve this protection, a fork choice rule is implemented that provides preference for the fork with a Bitcoin timestamp prior to the attack. This ensures that validators do not choose the attacking fork.

While cosmos zones typically require unbonding periods of 21 days to achieve social consensus and mitigate long-range attacks during the process, Babylon’s Bitcoin timestamping protocol allows for secure, same-day unbonding. Babylon reduces this timeframe through an epoching module that disables Cosmos SDK’s functionalities requiring validator set updates with every block and the 21-day unbonding rule. This allows for significantly shorter unbonding times and reduced checkpointing costs.

The frequency of checkpoints is reduced by dividing the Babylon Chain into epochs of 900 blocks (~30 minutes). At the end of each epoch, staking-related messages and validator set updates are processed. Unbonding is finalized once the epoch’s checkpoint is confirmed on the Bitcoin blockchain, which occurs every 100 Bitcoin blocks (~17 hours).

Babylon also provides censorship resistance to PoS blockchains by leveraging the Bitcoin timestamps of the PoS blockchain. If a PoS blockchain faces censorship by a malicious set of validators, Babylon enables the blockchain to operate as a rollup of Bitcoin, benefiting from Bitcoin's 50% censorship resilience.

Checkpointing to BitcoinCheckpointing is the process of timestamping transactions from consumer chains onto the Bitcoin blockchain via Babylon. To enable this communication, a CosmWasm smart contract is deployed in each consumer zone.

Consumer chains periodically send block headers with finality provider signatures to Babylon through the IBC protocol (IBC relayer). Due to Bitcoin’s limited data capacity, signatures are aggregated into a BLS multi-signature for compactness before being checkpointed to Bitcoin. Block headers received from consumer chains are indexed and checkpointed on Babylon before they are finalized on Bitcoin.

After Bitcoin confirmation, transactions receive Bitcoin timestamps with validity proofs from Babylon via IBC. Validators of the consumer chain can then download Babylon blocks to verify that checkpoints are contained and properly checkpointed by Bitcoin. This process creates a timestamped sequence of events from the consumer chain on Bitcoin’s ledger, secured by its Proof-of-Work consensus.

Babylon Node ModulesBabylon nodes are comprised of modules that enable the checkpointing process.

A checkpointing module receives BLS signatures to create the checkpoint and maintains the confirmation status. Once sufficient voting power is accumulated by Babylon validators, the checkpoint is submitted to Bitcoin by the vigilante submitter program. To assist in providing Bitcoin security, the zone concierge module provides BTC timestamps to headers received from IBC light clients and ensures these headers are indexed and linked to Babylon’s epoching system. Once the epoch containing these headers is checkpointed to Bitcoin, the Zone Concierge module generates proofs to confirm the headers are finalized on Bitcoin.

The vigilante reporter reports checkpoints and BTC block headers back to Babylon. The BTC light client identifies the canonical chain from Bitcoin headers to determine if checkpoints are included in the Bitcoin ledger and are deep enough to be finalized. The BTC checkpoint module then processes the checkpoints to confirm the inclusion.

The checkpointing monitor ensures consistency and liveness between Babylon’s node and Bitcoin’s canonical chain. It raises alerts for inconsistencies, missing checkpoints, or delays and monitors for potential liveness attacks, enabling timely responses to critical issues.

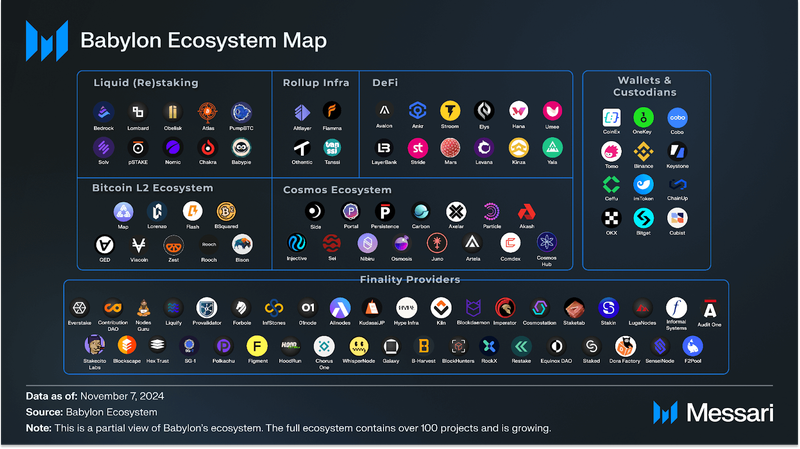

State of the Babylon EcosystemBabylon has a vast ecosystem of over 100 projects, ranging from Layer-1s and DeFi protocols to AI and gaming projects. By enabling BTC holders to share security with PoS blockchains, Babylon creates new opportunities for staked BTC to be restaked across multiple PoS blockchains and DeFi ecosystems. Projects building on Babylon can now access over $1.20 trillion in BTC economic security and reduce their reliance on native token inflation. This is especially beneficial to projects with low token valuations that can now bootstrap Bitcoin security via Babylon.

Babylon provides various new opportunities for expanded functionality, such as dual-stake security and rewards, liquid staking tokens (LSTs), restaking across ecosystems, and flexible verifier infrastructure for rollups.

Key projects that highlight the variety of benefits Babylon provides include:

Bitcoin L2 Ecosystem

- Lorenzo Protocol is the first “Bitcoin Liquidity Finance Layer” and is enabled through its integration with Babylon. This allows for the creation of stBTC, LSTs representing BTC staked through Babylon's protocol.

- B² Network was built on Babylon to leverage its BTC staking and timestamping protocols, enhancing the security of B² Rollups and protecting its PoS consensus from long-range attacks. In addition to using staked BTC via Babylon to secure B² Rollups and the B² Hub, B² Rollups also benefit from new use cases such as liquid staking and restaking.

- Zest Protocol is a DeFi protocol built on Stacks. It has integrated with Babylon to create a BTC staking pool, allowing BTC stakers to earn yield with Bitcoin economic security. Users can stake on Zest and receive BTCz, which can then be used in DeFi within the Stacks ecosystem.

Liquid (Re)staking

- Nomic provides a non-custodial Bitcoin bridge to Cosmos and has integrated with Babylon to introduce dual-stake security and stBTC as an LST. BTC holders can stake on Nomic via Babylon and earn rewards in NOM and nBTC. Users can lock nBTC in Nomic’s staking pool to receive stBTC for use in DeFi protocols to earn additional rewards.

- Solv has built on Babylon to integrate BTC staking yields into SolvBTC, its wrapped BTC token. Users can stake SolvBTC on the platform to receive SolvBTC.BBN, earning yield while maintaining liquidity for use across DeFi protocols and networks.

DeFi

- Ankr receives Bitcoin economic security and increased liquidity through Babylon’s BTC staking solution. This collaboration enables Ankr to create LSTs for staked BTC, allowing BTC holders to securely stake and restake across PoS blockchains to earn yields.

- Kinza Finance has launched kBTC as a BTC liquid restaking token (LRT), which is enabled by its Babylon integration. Users can deposit BTC on the Kinza platform via Babylon and receive the LRT in a 1:1 exchange. kBTC holders earn dual rewards while maintaining liquidity for use in DeFi activities.

Cosmos Ecosystem

- Particle Network has built on Babylon to enhance the security of its Delegated Proof-of-Stake (DPoS) consensus by implementing dual-staking. In this model, two independent validator sets—one secured by PARTI and the other by BTC through Babylon’s BTC staking protocol—must both agree on the validity of a block for it to be finalized. ThSis approach bootstraps economic security from BTC staking and improves network security to make it more resilient for cross-chain operations.

- Sei benefits from Bitcoin’s economic security and faster unbonding times. Sei also receives reduced reliance on its native token for economic security and protection against threats like censorship by validators.

- Juno has integrated with Babylon to benefit from Bitcoin economic security and faster unbonding times. Users receive flexible security, with the option to wait for Bitcoin confirmation from Babylon when an additional layer of security is needed.

- Akash Network provides decentralized cloud infrastructure and has built on Babylon to enhance its security through Bitcoin timestamping. Akash benefits from reduced economic security costs, faster unbonding, and greater protection against threats like double-spend attacks.

Rollup Infrastructure

- AltLayer is building on Babylon and has proposed building decentralized verification layers for rollups secured by Bitcoin. This integration aims to enhance security and improve the latency and interoperability of rollup-centric infrastructure. Verifiers can be built on the Babylon chain or as a standalone network, offering flexibility to meet various rollup requirements.

- Fiamma’s integration with Babylon enhances its BitVM2 implementation. It enables soft finality for ZKP verification using BTC’s economic security provided by Babylon, while BitVM2 offers hard finality through Bitcoin's network security. As a result, Babylon’s finality providers can receive additional rewards, and the transferability of assets on Bitcoin is improved.

Wallets & Custodians

- Bitget Wallet has created a simplified user experience that allows for BTC staking with a “single click” and has created an app section exclusively for Babylon.

- Cobo has developed a Babylon staking API in its Multi-Party Computation (MPC) wallet to streamline the user staking experience.

Phase One of the Babylon BTC Staking mainnet launched on August 22, 2024. BTC holders can lock BTC for future staking, delegate voting power to finality providers, and accrue points. The points program went live on October 4, 2024, and measures staking activity to allocate points among stakers and finality providers.

Stakes are active for a maximum of 64,000 Bitcoin blocks (~15 months), after which they automatically expire and can be withdrawn. Stakers can unbond at any time during this period, subject to an unbonding period of 1,008 blocks (~seven days). No points are earned during this period. The process is secured by a covenant committee operating within a 6-of-9 multi-signature scheme that co-signs unbonding requests.

Phase One does not implement slashing. Staking functionality will be activated in Phase Two when Babylon Chain is implemented.

Cap-1Babylon’s Cap-1 went live on August 22, 2024, and implemented a 1,000 BTC limit on staking deposits. Stakers could deposit up to 0.05 BTC per individual transaction until the cap was filled. The total amount was exhausted in six Bitcoin blocks (~74 mins) by ~12,740 unique addresses. During this time, 3,125 points per Bitcoin block were allocated between stakers and finality providers. Any additional stakers were not accepted and did not receive points.

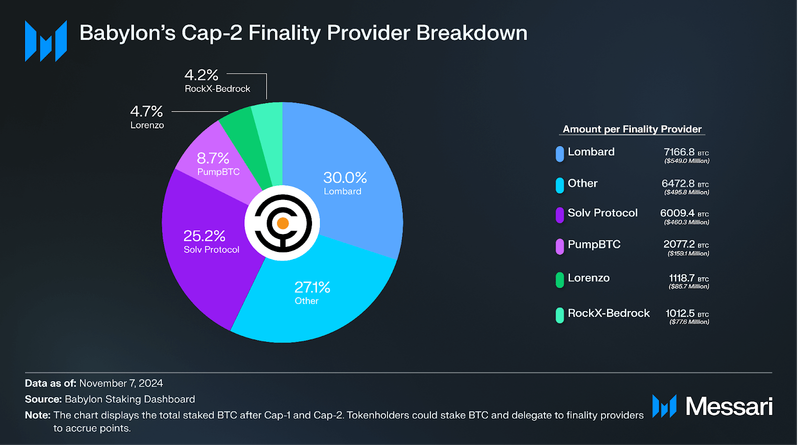

An estimated 80% of the staked amount in Cap-1 came from LST projects, and 369 BTC was received after the cap was filled. Additionally, ~20,620 delegations were received by over 100 finality providers.

The top three finality providers by BTC deposits were RockX (297.90 BTC), Solv Protocol (150.50 BTC), and Lorenzo Protocol (129.38 BTC). Four out of the top five finality providers by delegated amount were liquid staking and restaking projects, comprising 68.20% of the total staked BTC.

Cap-2The second staking cap went live on October 8, 2024. The individual transaction cap was raised to 500 BTC to achieve 50% lower unbonding transaction fees, and the points per Bitcoin block increased to 10,000 points. Unlike Cap-1, a duration cap of 10 Bitcoin blocks was implemented instead of a staking limit.

During Cap-2, a total of 22,891 BTC was staked in under two hours by ~12,570 unique addresses. This brings Babylon’s TVL to 23,891 BTC. Replacing the staking cap with a duration limit revealed a high demand for native BTC staking, driven by a desire for the benefits Babylon provides to Bitcoin and PoS ecosystems. Babylon not only brings BTC liquidity and security to PoS systems, but it also enables the Bitcoin ecosystem to thrive by providing its user base with new opportunities for yield generation and participation in DeFi activities.

Similar to Cap-1, the Cap-2 launch experienced demand dominated by liquid staking and restaking projects. These projects make up the top five finality providers with a combined ~17,400 BTC deposits and stand to benefit from enhanced security, liquidity, cross-chain functionality, and growth opportunities once Babylon is fully operational.

RoadmapThe Babylon mainnet launched on August 22, 2024, and introduces features through three phases. As of October 11, 2024, Babylon is in Phase One, with subsequent phases to follow.

- Phase Two: BTC Staking will be activated with the launch of Babylon Chain. Finality providers who received sufficient delegations in Phase One will begin participating in consensus. The Bitcoin timestamping protocol will be implemented for cross-chain time synchronization.

- Phase Three: Staking to secure PoS blockchains and earn yield is activated. Babylon Chain now enables BTC holders to stake and restake to secure multiple PoS systems and earn additional rewards.

Babylon is a self-custodial BTC staking protocol that unlocks opportunities for both PoS blockchains and BTC holders. By overcoming Bitcoin’s limited programmability, BTC holders can stake BTC and earn yield by sharing economic security with PoS blockchains. Babylon’s BTC staking solution further provides benefits, such as faster unbonding times, censorship resistance, and the ability to bootstrap projects with low token valuations. Babylon has also made breakthroughs in addressing common rollup architecture challenges and enabled new functionalities across various projects and ecosystems.

Babylon has received strong demand, as demonstrated by attracting over 100 projects into its ecosystem. These projects stand to benefit from increased liquidity and expanded functionalities, such as using BTC for dual-stake security, LST projects, and restaking across ecosystems. This demand is reinforced by the Cap-1 and Cap-2 achievements that brought Babylon’s TVL to 23,891 BTC. As its mainnet rollout continues, Babylon is poised to reshape the blockchain landscape by bringing Bitcoin security and liquidity into the PoS ecosystem.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.