and the distribution of digital products.

DM Television

Understanding Aethir: A Comprehensive Overview

- Aethir has partnered with EigenLayer, ai16z, Injective, Near, LayerZero, Beam, Filecoin, Metastreet, Manta Network, Sophon, Magic Eden, Animoca, and Return Entertainment, among others.

- Aethir’s network includes ~400,000+ GPUs (containers) across 93 locations, providing over 11 million tensor cores and serving up to ~191.61 million users.

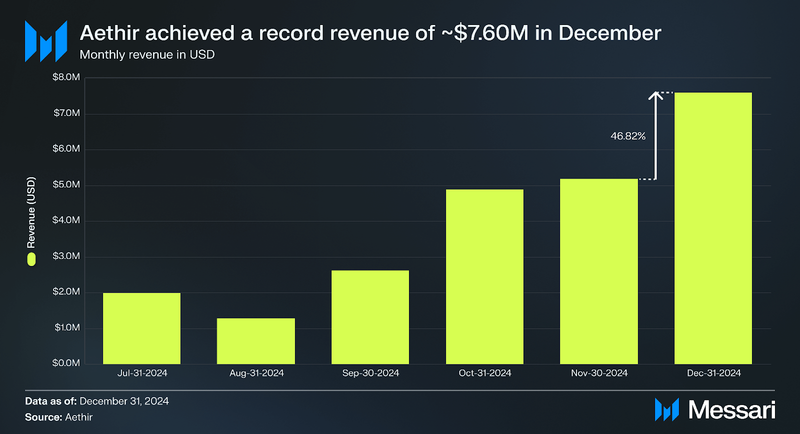

- In December, Aethir generated ~$7.60 million for an annual recurring revenue (ARR) of ~$90.68 million, with a total of ~266.19 million compute hours.

- Core technology integrates containers for virtual compute, checkers for quality validation, and indexers for resource allocation, allowing 15-minute compute sessions with real-time dynamic pricing.

- As of Dec. 31, 2024, the newly launched $100.00 Million Ecosystem Fund has supported 20 AI-focused projects (e.g., HeyAnon, ARC, TopHat, etc.) across four batches, providing grants, subsidies, and access to decentralized GPU resources.

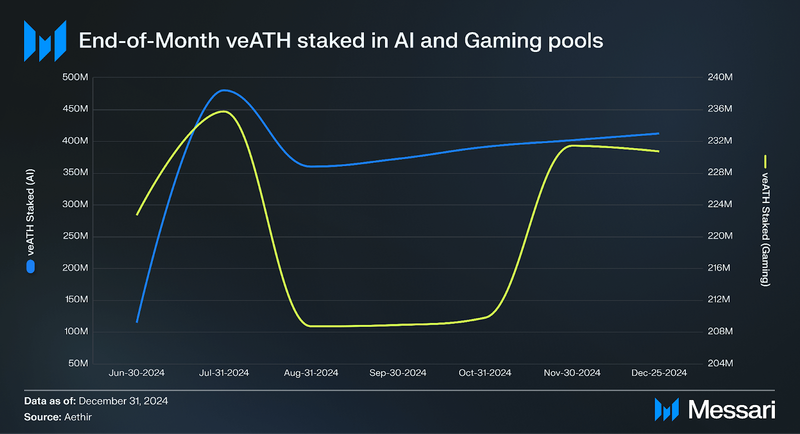

- A combined total of over $1.5 billion eATH is staked, specifically with ~412.12 million in the AI pools and ~230.71 million in the Gaming pools.

The AI market, valued at ~$184 billion in 2024, is projected to reach ~$826 billion by 2030, while the gaming industry is expected to hit ~$268 billion by 2025. Both sectors increasingly rely on GPU-intensive applications, driving demand for high-performance computing. However, the high cost of GPUs, often more than $30,000 per unit, has created an "AI wealth gap," where well-funded corporations dominate access to this infrastructure, leaving smaller businesses struggling to compete – stifling innovation and limiting participation in the AI and gaming markets.

Aethir addresses these challenges with its decentralized cloud computing network, aggregating idle and underutilized GPUs into a global pool of shared power. Offering flexible service models, Aethir allows scalable, on-demand access to enterprise-grade GPU resources through (i) Infrastructure as a Service (IaaS), which is a pay-as-you-use model with virtualized GPU instances with services and tools for developing, testing, and deploying GPU-accelerated applications, via Aethir Atmosphere; and (ii) bare metal solutions, made for users who want complete control of their training models on dedicated infrastructure, via Aethir Earth. This decentralized approach reduces costs and increases accessibility, democratizing access to advanced computing power.

BackgroundAethir, founded in 2021, is a decentralized enterprise-grade cloud computing network that provides scalable and globally distributed GPU resources for AI, gaming, and Web3 infrastructure. It supports businesses by providing AI chips (e.g., NVIDIA H100s and NVIDIA H200s) through a decentralized architecture, making performance computing flexible and cost-efficient.

The Aethir team includes Mark Rydon (Co-Founder and CSO), with experience at NOTA Platform, Flux Capital, and Bechtel Corporation; Daniel Wang (Co-Founder and CEO), formerly CIO of YGG E2, Head of International Publishing at Riot Games, and Head of Operations at Riot Games China; Kyle Okamoto (CTO), formerly CEO of Ericsson's IoT and Edge Gravity businesses, Chief Network Officer at Verizon Media; and Paul Thind (CRO), former GM at Disney’s VMK, COO at Outspark/Gamigo, Co-Founder and CEO of Triggerspot Inc, with consulting and advisory roles at Zynga, 20th Century Fox, Sanrio, and Trick Studios.

Since its inception, the team has raised over $9.80 million from investors (e.g., Framework Ventures, Merit Circle, Hashkey, Animoca Brands, Sanctor Capital, and Infinity Ventures Crypto, among others, along with ~$130 million from a large node sale. Aethir officially launched on Ethereum Mainnet on Jun. 12, 2024.

Technology

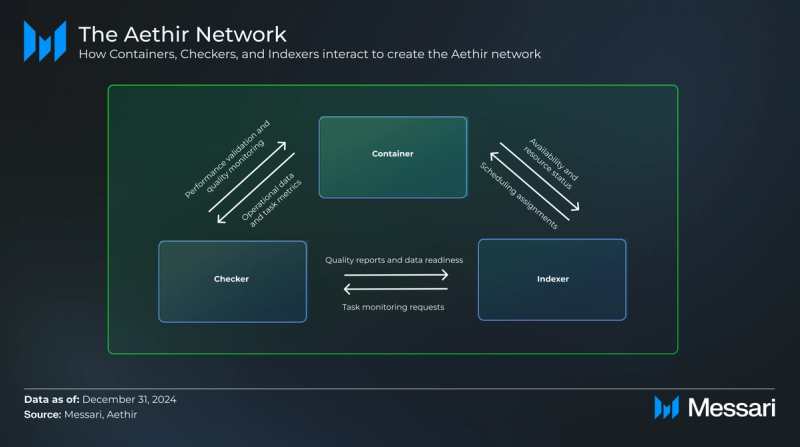

The Aethir network is comprised of three core components:

- Containers: Virtual or physical endpoints where applications are executed and rendered. Containers are rewarded for maintaining readiness and providing compute services.

- Checkers: Verifiers that ensure the integrity and performance of containers by conducting checks at various stages, such as registration, standby, and rendering. Checkers maintain Quality of Service (QoS) through continuous performance validation and are incentivized via base and bonus rewards.

- Indexers: Matchmakers that connect users to suitable containers based on various factors (e.g., latency, service quality, and cost).

These components work together to facilitate compute sessions, which are the operational units of the Aethir network. Each session is 15 minutes, during which containers fulfill user requests. Service fees are dynamically adjusted based on real-time demand, functioning like a bidding system where prices reflect resource availability and usage intensity.

Below is a more detailed overview of the three components.

ContainersAs a core part of the network, each Container must (i) meet specific processing and graphical benchmarks to support high-speed and low-latency interactions, (ii) remain in a constant "ready" state, with pre-installed applications and services to allow immediate activation upon request, and (iii) pass performance checks to validate their operation against network standards.

Billing and usage for containers are directly tied to their activity:

- Active Use: Containers performing tasks earn service rewards, compensating for compute contributions during active use (e.g., Proof of Delivery and service fees).

- Standby Mode: Containers in standby mode, ready for deployment but not actively being used, earn readiness rewards for maintaining high availability (e.g., Proof of Capacity).

Containers must stake ATH tokens before contributing resources. Failure to meet performance standards (i.e., providing subpar service or engaging in disruptive behavior) results in penalties (e.g., slashing of staked tokens). Additionally, underperforming containers may face fee adjustments to reflect their reduced reliability.

CheckersCheckers uphold the integrity and performance of containers within the Aethir network by conducting essential quality checks, including (i) liveness detection, involving continuous heartbeat monitoring to confirm operational status, (ii) rendering quality checks, which assess performance during active rendering to ensure compliance with network standards (i.e., Proof of Delivery), and (iii) capacity testing, consisting of daily hardware evaluations to validate service readiness (i.e., Proof of Capacity). Successful validations improve scheduling priority, while failures result in task reassignment or penalties for the operator.

Checkers earn rewards in two categories:

- Base Rewards: Distributed daily based on task completion.

- Bonus Rewards: Allocated quarterly to incentivize exceptional performance.

These rewards, often called checker node emissions, are distributed in ATH tokens as compensation. Notably, checkers are not required to stake ATH, unlike Edge and IDC nodes. However, depending on the severity of the infractions, checkers who fail to meet quality benchmarks face penalties, including temporary bans or permanent disqualification.

Furthermore, with MetaStreet’s Yield Pass, launched on the NodeFi platform, checkers can now (i) unlock liquidity by tokenizing and trading future node emissions for immediate value, (ii) borrow against nodes to secure financing without selling their holdings, and (iii) maximize earnings through staking and liquidity provision.

Participation as a Checker requires a Checker Node License, an ERC-721 NFT that allows operators to deploy nodes independently or delegate tasks using virtual or physical setups. Checker Node Licenses were first offered via a Strategic Partner Whitelist Sale on Mar. 18, 2024, followed by a public sale on Mar. 20, 2024. With public sales now closed, licenses are expected to trade on secondary markets.

To operate a Checker node, operators must install the Checker Node Client, a software application designed for running and managing nodes. Additional information about previous Checker node sales is available here.

IndexersIndexers act as a bridge between onchain settlement and offchain data processing to support enterprise workloads. They connect consumers to the most suitable containers, ensuring seamless "second on" service with minimal latency and optimized experiences. Scheduling is based on (i) Container status (i.e., Standby state), (ii) whether the Container has pre-loaded applications, (iii) hardware and network compatibility, (iv) low latency relative to user location, and (v) competitive service fees not exceeding the requests’ budget.

Prioritization considers the lowest fees, best user experience, or highest evaluation score. Additionally, indexers are selected randomly to promote decentralization, reduce fraud risks, and avoid delays caused by protocol complexity.

Compute ProvidersAlthough not explicitly defined as a core component, Compute Providers are indispensable to the ecosystem – supplying the physical GPU hardware – which is then utilized to create containers that execute computational tasks within the network. Users can also contribute to the Aethir network by purchasing an Aethir Edge, an edge computing hardware device equipped with a GPU that connects directly to the network.

To participate, Compute Providers must stake ATH, with the staking amount based on various factors (i.e., global average staking coefficient, GPU specifications (K-value), and last month's Emission Token Number). Staking is mandatory throughout the operation, with configuration changes requiring restaking and a 180-day unlocking period for unstaking.

Compute Providers receive evenly weighted rewards through the following mechanisms:

- Proof of Capacity (PoC): Daily rewards based on GPU availability, uptime, and the container's K-value.

- Proof of Delivery (PoD): Rewards for completing compute tasks, calculated based on task complexity and rendering time.

- Edge Device Rewards: Calculated based on an emissions schedule and are subject to a 5% network fee.

On the buyer side, service fees are paid in fiat-denominated prices, settled in ATH, with a 20% platform fee deducted. The Aethir platform sets baseline uniform prices for containers based on their region and specifications, with separate pricing structures for Reserve (pre-booked) and On-Demand (dynamic pricing) modes.

Additionally, penalties, including slashing, ensure accountability by forfeiting rewards for downtime or performance failures, with severe cases leading to staking collateral loss and network removal. Full details regarding the above are available here.

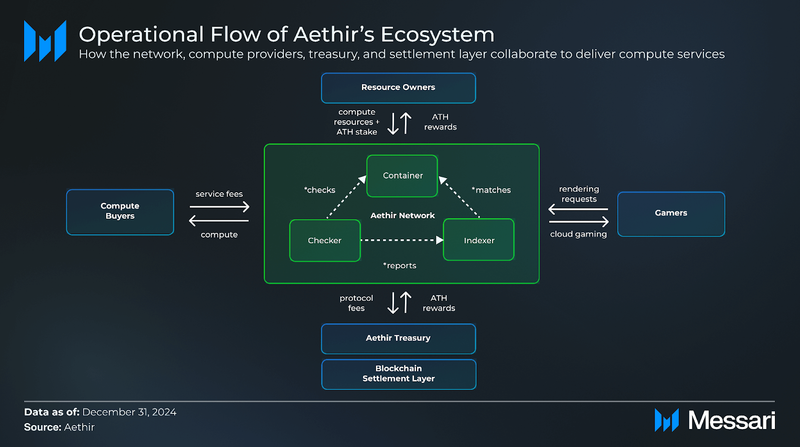

Putting It All Together

While the Aethir network and Compute Providers serve as the backbone of the infrastructure, they operate within a broader ecosystem comprising three other key components, including (i) Compute Buyers and Gamers, who utilize the network’s compute power; (ii) the Treasury, responsible for managing network fees and allocating ATH tokens for protocol development and growth; and (iii) the Settlement Layer, which records transactions and distributes ATH rewards. Here is an example of how they operate together:

- A company submits a request for compute resources to Aethir, specifying GPU requirements, latency expectations, budget, and duration for their cloud gaming service.

- The Indexer matches the request to a suitable Container based on performance, proximity, and service fee criteria.

- The assigned Container executes real-time rendering tasks, streaming game graphics to the players' devices with minimal latency.

- Checkers monitor the Container's performance, verifying specifications, rendering quality, and compliance with Aethir’s standards.

- Players enjoy seamless gameplay powered by the Container's computational resources.

- Compute Providers (Resource Owners) supply the GPUs that contribute to the Aethir network and receive ATH rewards for powering the service.

- The company pays service fees, which the Aethir Treasury processes to distribute ATH rewards to Resource Owners and cover protocol fees.

- The Blockchain Settlement Layer records all transactions, ensuring transparency and accountability while logging Proof of Capacity and Proof of Delivery data.

Through its technology and system, Aethir offers two distinct products under Aethir Cloud, designed to meet the demands of AI applications and gaming:

- Aethir Earth: Bare metal local GPU resources for compute-intensive tasks like AI model training and machine learning, offering high performance without virtualization overhead, scalability, reliability, and optimized performance.

- Aethir Atmosphere: Decentralized rendering containers for real-time, high-quality cloud gaming experiences, allowing seamless gameplay with low latency, scalability, and accessibility across various devices.

As outlined in the project’s documentation, ATH runs as an ERC-20 token on Ethereum and an ArbERC-20 token on Arbitrum. It serves several key functions across the Aethir network, including:

- Pay for services (e.g., GPU computing for AI applications, cloud gaming, and virtualized compute tasks) on the Aethir network.

- Stake to support network operations and earn staking rewards.

- Compute Providers and containers earn rewards through Proof of Capacity (PoC) and Proof of Delivery (PoD) mechanisms, which are distributed on Ethereum.

- Checkers are incentivized with base and bonus rewards tied to task performance, while Aethir Edge devices earn emissions-based rewards. All Checker and Edge rewards are distributed on Arbitrum.

- Token holders can stake ATH in AI or gaming pools to earn regular rewards, all distributed on Ethereum, with the gaming pool providing additional veCARV tokens via a partnership with CARV Protocol.

- Participate in governance decisions once the DAO is rolled out, including platform updates, platform parameters, staking requirements, and other network updates.

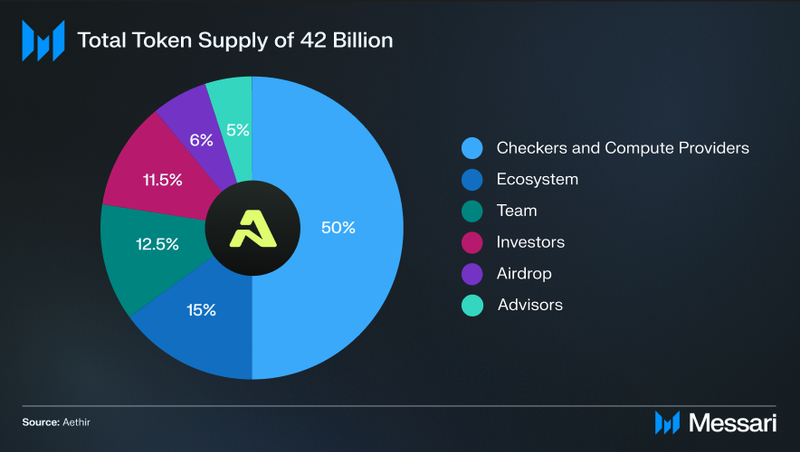

The pie chart above depicts the following ATH token allocations (valued at ~$2.94 billion as of Dec. 31, 2024, with ATH priced at ~$0.07):

- Checkers and Compute Providers: 50.00% (21.00 billion ATH, ~$1.47 billion)

- Team: 12.50% (5.25 billion ATH, ~$367.50 million)

- Ecosystem: 15.00% (6.30 billion ATH, ~$441.00 million)

- Investors: 11.50% (4.83 billion ATH, ~$338.10 million)

- Airdrop: 6.00% (2.52 billion ATH, ~$176.40 million)

- The airdrop will be distributed across three seasons to reward long-term ecosystem participants, with 1.50% allocated for both seasons one and two, and 3.00% for season three.

- Advisors: 5.00% (2.10 billion ATH, ~$147.00 million)

Notably, Aethir's compute reward emissions use a decay function to balance early-stage bootstrapping with long-term sustainability, assuring later participants remain incentivized. Details regarding the exact emissions will be released at a later date.

Token VestingVesting schedules for the parties mentioned above:

- Checkers and Compute Providers: Checkers have a four-year linear vesting schedule tied to performance guidelines, while Edge and Enterprise Compute Providers follow specific reward schedules for vesting.

- Team: 18-month cliff, followed by 36 months of linear vesting.

- Ecosystem: 50.00% released upon the token generation event, with the remaining vesting linearly over 24 months. The DAO Treasury follows a 48-month linear vesting schedule.

- Investors: 12-month cliff, followed by 24 months of linear vesting.

- Airdrop: 25.00% released upon the token generation event; 25.00% released eight months later; and the remaining 50.00% released another eight months thereafter.

Aethir's governance framework, as outlined in their latest roadmap, was initially scheduled for implementation in Q4 2024 through a four-stage process:

- Development Phase: Establish core elements (e.g., smart contracts, voting mechanisms, and staking features).

- Community Education and Onboarding: Conduct workshops and sessions to prepare stakeholders for participation.

- Beta Testing: Roll out a trial version of the governance system for selected users to test functionality and provide feedback.

- Full Launch: After adjustments, deploy the finalized governance system.

Specifically, governance will be structured between (i) the Council, managing the day-to-day operations of the ecosystem, and (ii) the Foundation Board, overseeing the major initiatives (e.g., treasury-related and significant governance decisions). Two years post governance launch, ATH tokenholders with over 5.00% of the circulating token supply will be able to propose changes directly, bypassing the need for Council sponsorship. The Council will comprise the following representatives:

- Compute Providers: Two representatives (i.e., Edge and Enterprise) are elected based on their ecosystem contributions.

- Checkers: Elected based on their ecosystem contributions.

- ATH Tokenholders: All ATH token holders will be eligible to vote, with staked ATH (veATH) granting enhanced governance privileges and a 1.5x voting power multiplier.

- The Indexer Representative: Appointed by a governance vote of staked ATH tokenholders, the Indexer will serve a three-year term unless removed due to a governance vote, insolvency, non-compliance, or operational failure, with a by-election held to appoint a replacement. The Indexer, excluded from serving as a Compute Provider or Checker, manages compute allocation by overseeing off-take and service level agreements – while reporting resource demands to the Council and Foundation Board.

- The Foundation Representative

Another layer of security beyond the Council will be the Sentinel, a community-elected multisig group with periodic renewal through community governance votes. Their primary responsibilities will include (i) vetoing changes to bylaws or proposals deemed harmful, and (ii) publishing justifications for any vetoes to ensure transparency. Any veto will be subject to Council approval. However, 24 months after the governance mechanism launches, an override mechanism will be activated in which community votes of over 75.00% will be able to override a Council veto. Bringing it all together, here are the stages that each proposal goes through:

- Temperature Check: Initial stage to gauge community interest in a proposal.

- Debate: Formal discussion to refine and address concerns.

- Implementation Preparation: Time allotted for preparing necessary on-chain changes based on the proposal's context.

- Decision: Final onchain vote to determine whether the proposal will be implemented.

Further details regarding quorum percentages, types of proposals, classes of proposals, and amendments can be read here.

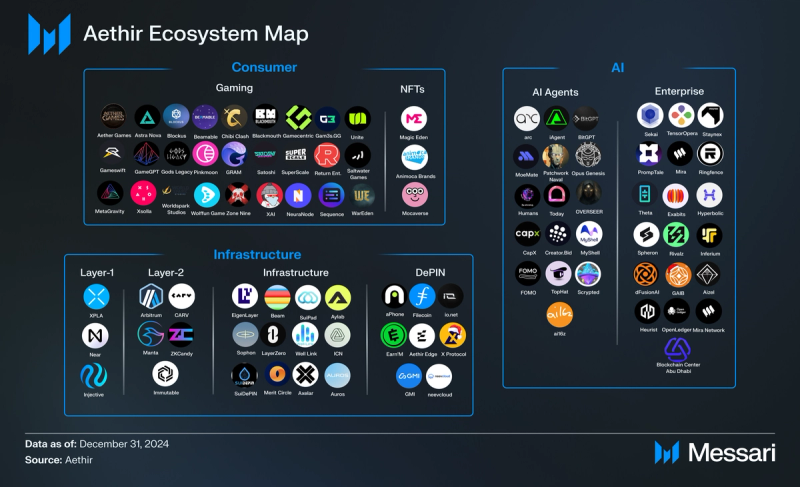

State of the Aethir Ecosystem Key ProjectsInfrastructure:

Key ProjectsInfrastructure: - EigenLayer: EigenLayer, a blockchain infrastructure enabling restacking, partnered with Aethir to allow ATH holders to stake and delegate on EigenLayer - simplifying GPU provider onboarding and boosting staking rewards.

- Near: NEAR Protocol, a scalable, developer-friendly blockchain partnered with Aethir as part of the Delphi Labs AI Accelerator program, where Aethir provided GPU resources to support participating projects.

- Injective: Injective, a Layer-1 blockchain optimized for decentralized finance (DeFi) applications, partnered with Aethir to create the first tokenized marketplace for GPU compute resources.

- LayerZero: An omnichain interoperability protocol that partnered with Aethir by integrating with their network, offering multichain capabilities.

- Axelar: A cross-chain communication network enabling secure message and token transfers. Aethir integrated Axelar’s Interchain Token Service (ITS) and Squid platform to streamline ATH token bridging between Ethereum and Arbitrum.

- Auros: A market-making and algorithmic trading firm that will add liquidity to the ATH token.

- Filecoin: A decentralized storage provider that partnered with Aethir to integrate GPU leasing for its storage providers, enabling on-demand data sealing and creating a full-stack solution for decentralized computation and storage.

- Manta Network - A modular Ethereum Layer-2 partnered with Aethir to integrate decentralized GPU resources.

- TensorOpera: An AI platform that integrated Aethir’s distributed GPUs into its Nexus AI platform, offering competitive rates for model deployment, fine-tuning, and training.

- Ai16z: An AI Agent framework partnered with Aethir to help provide a streamlined pathway for elizaOS developers to apply for GPU grants.

- Ecosystem Fund Projects:

- Batch 1: Includes TopHat, a no-code AI agent launchpad, and Capx AI, a platform for users to build, own, and trade AI agents, among others.

- Batch 2: Includes ARC (AI Arena), an AI agent launchpad platform, and BitGPT, a front-end interface designed for onchain transactions and education, among others.

- Batch 3: Includes iAgent, an AI training platform for gamers to train their AI agents from gameplay footage, and MyShell, an AI consumer layer, allowing developers to build, share, and own AI Apps easily, among others.

- Batch 4: Includes HeyAnon, a DeFAI tool, and dFusion AI, a decentralized platform to gather high-quality data, among others.

- Mira: An AI verification platform providing trustless AI output verification partnered with Aethir to combine their trustless verification technology with Aethir’s decentralized GPU network to cut down AI error rates from ~30% to ~5%.

- OpenLedger: A data blockchain for AI that partnered with Aethir to use their decentralized GPU network.

- Magic Eden: An NFT trading platform leveraging Aethir’s GPU power for gaming partners, while serving as the preferred NFT platform for Aethir’s gaming clients.

- Return Entertainment: A cloud-first gaming platform focused on immersive experiences, Aethir’s GPU network was leveraged to power its cloud gaming platform, which resides in Samsung’s cloud TV gaming hub.

- Immutable: A Web3 L2 for NFTs and BlockChain Gaming, secured by Ethereum, using Aethir to provide GPU cloud infrastructure for game developers and publishers building and deploying games through the Immutable ecosystem.

- Sequence: A Web3 game development platform using Aethir to provide scalable GPU cloud infrastructure for seamless Web3 gaming experiences, supporting features like NFTs and in-game marketplaces.

- Sophon: A zkSync hyperchain for AI, gaming, and entertainment that integrated Aethir’s decentralized GPU cloud. Notably, both networks strengthen decentralization through a mutual node swap.

- Xsolla: A global video game commerce company that collaborated with Aethir to power its Pay-As-You-Go (PAYG) cloud gaming platform with decentralized GPU infrastructure.

- SuperScale: A gaming growth engine and analytics platform that collaborated with Aethir to power its case studies around User Acquisition and down funnel metrics in Mobile Gaming.

- MetaGravity: A gaming infrastructure company leveraging Aethir's decentralized GPU cloud to support its HyperScale engine.

In October, Aethir launched a $100 Million Ecosystem Fund, structured in multiple phases to support innovation in AI and gaming. Phase 1 introduced the Aethir Catalyst program, a $10 million grant with XAI, and a $10 million grant with XPLA. The fund offers (i) financial grants ranging from $5,000 to $200,000 (in ATH tokens) to help AI and gaming projects launch and sustain operations; (ii) discounts of up to 35.00% on Aethir's GPU compute services for contracts lasting six months or more; and, (iii) access to Aethir's hardware ecosystem (e.g., Aethir Edge).

Eligibility for grants and subsidies requires using Aethir’s platform or partnering via token allocations. The Aethir Grant Committee evaluates applications based on compute needs, user traction, revenue metrics, and project innovation. Applicants can participate here.

Since its inception, 20 AI agent-focused projects have been accepted across four batches, as highlighted in the key projects section.

Tactical Compute InitiativePast funding included Tactical Compute (TACOM), a $40 million AI compute initiative with Beam Foundation and MetaStreet, using Aethir's GPU network to address compute scarcity and support AI-crypto projects through hardware financing, yield arbitrage, and network bootstrapping.

OtherIn addition, Aethir has partnered with the Blockchain Center Abu Dhabi, a global innovation hub, to expand its reach and support in the MENA region.

Network MetricsOn the supply side, the network comprises ~400,000 GPU (containers) distributed across 93 locations, delivering a total compute power of over 11 million tensor cores as of Dec. 31, 2024. The current infrastructure supports a monthly compute capacity that serves up to ~193.70 million individuals.

On the demand side, monthly revenue hit ~$7.60 million in December, for an annual recurring revenue (ARR) of ~$90.68 million, marking a ~46.82% increase from November’s ~$5.18 million, with total compute hours delivered reaching ~266.19 million. These metrics relative to other DePIN projects can be found in the Messari 2024 State of DePIN report.

As for onchain metrics, by the end of December, staked veATH reached ~412.12 million in the AI pools and ~230.71 million in the Gaming pools, reflecting an MoM increase of ~2.64% and a decrease of ~0.31%, respectively, bringing the total staked amount across all pools to over $1.5 billion. Further metrics (e.g., Average APR, total transactions, etc.) can be explored on this dashboard.

RoadmapOn Aug. 22, 2024, Aethir released a comprehensive six-month roadmap, complementing their existing documentation. Below are its combined contents:

Q3/Q4 2024:

- Aethir Cloud Portal: Portal to streamline onboarding for enterprise customers, provide seamless access to Aethir’s GPU infrastructure, and simplify ATH token payments for services.

- Sophon Migration: Expansion to the Sophon blockchain to improve ATH token liquidity and expand staking opportunities.

- Aethir Governance Launch: Introduction of a decentralized governance model.

- Eco-Fund and Aethir Incubator Launch: (i) Launch of a fund to support developers and builders within the Aethir ecosystem and (ii) an incubator program to support early-stage projects in AI, gaming, and computing infrastructure.

2025:

- AI Model-as-a-Service (PaaS): Introduction of a platform-as-a-service model for developers, offering pre-configured AI/ML stacks.

- Showcase Portal for Games: Portal that highlights gaming projects built on Aethir’s infrastructure.

- Expanded Aethir Edge Features: Introduces AI inference capabilities and cloud phone use cases, enhanced with AI-supported agents.

- Aethir Air: Adding native SDKs for Windows and iOS to enhance developer tools.

- Aethir Earth: Launching an open API for managing bare metal machines.

Aethir delivers distributed cloud infrastructure for AI and gaming by aggregating idle and underutilized GPUs into a global pool of shared computational power. It offers enterprise-grade performance at lower costs through two primary products: (i) Aethir Earth, delivering local bare metal GPU resources for compute-intensive workloads, and (ii) Aethir Atmosphere, allowing real-time cloud gaming through decentralized rendering containers. The platform integrates containers, checkers, and indexers to ensure the quality and efficiency of resource allocation for compute providers.

Supported by strategic partnerships, Aethir empowers developers and enterprises through initiatives like its $100 Million Ecosystem Fund. More specifically, across four batches, Aethir has helped 20 AI agent-focused projects and offered a streamlined pathway for ai16z Eliza agent framework developers to access GPU grants.

As of Dec. 31, 2024, Aethir’s network encompasses ~400,000 GPUs (containers) across 93 global locations, generating ~$7.60 million in revenue for December. This represents a ~46.82% increase from November's ~$5.18 million.

Looking ahead, Aethir plans to expand governance mechanisms, launch an ecosystem incubator, and enhance its infrastructure with new capabilities, including improved support for developers and enterprises relying on GPU-powered solutions.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.