and the distribution of digital products.

DM Television

Top 5 crypto Margin trading exchanges | Trading on Margin

Estimated reading time: 18 minutes

In this article, we will be talking about Margin trading and how it works. We will also look at different exchanges allowing you to use margin trading and the leverage provided by them. By the end of it, you’ll learn margin trading and also how to use margin trading on different exchanges.

What is Margin trading?In simple terms, Margin trading allows you borrowed funds from a third party for trading using your original capital as collateral.

For example, a crypto exchange can lend you up to 200X of your original capital using your original capital as collateral. Now you can trade the borrowed funds, you will gain profits based on your the borrowed capital. However, if your balance becomes negative to an equal amount of your original capital, the exchange will liquidate your position and you will lose your original capital.

How does crypto margin trading work? An exampleLet’s assume you have $100 in your margin trading account as a budget to trade in crypto. Now, let’s consider that the exchange platform offers 5X leverage. Hence, keeping your deposited amount as collateral, the platform provides you with $500 to make a trade.

Now suppose you invested in bitcoin, and its value rises/ falls by 3%. In such a case, you incur a profit/ loss of (5×3 = 15%). Without using margin trading, your profit/ loss for an investment of $100 would have only been 3%.

However, let’s say the Bitcoin price goes down 20% (20% * 5 = 100%); this means you will lose all your original capital.

Margin trading increases your returns; however, you can also incur huge losses in margin trading. The crypto market is volatile, and nobody can truly determine the rise or fall of asset prices. Therefore, don’t invest what you can’t afford to lose.

Summary (TL;DR)- Margin trading helps you trade on a borrowed capital from a crypto exchange platform.

- Your original capital works as collateral, and the exchange lends you capital based on your chosen leverage.

- Binance is the world’s largest crypto trading platform in terms of volume and offers margin trading with a leverage of up to 125x.

- BYDFI is a crypto exchange with licenses from four different countries and offers leverage of up to 200x.

- Bybit is renowned for its margin trading services and charges a taker rebate and, in turn, pays you a maker rebate.

- Huobi Global is one of the best exchange platforms; however, they charge a significant fee from lower-level traders.

- PrimeXBT supports crypto, FX, commodities, and index for margin trading. They offer a leverage of up to 1000x on FX.

- You should always realize the risks involved in margin trading.

- If you are successful in determining the market outcome, you can gain significant returns. If not, then you’ll lose a considerable amount.

We have prepared a list of 5 margin trading exchanges that allow you to trade on margin in Bitcoin and other crypto-assets. Let’s have a look at them one by one.

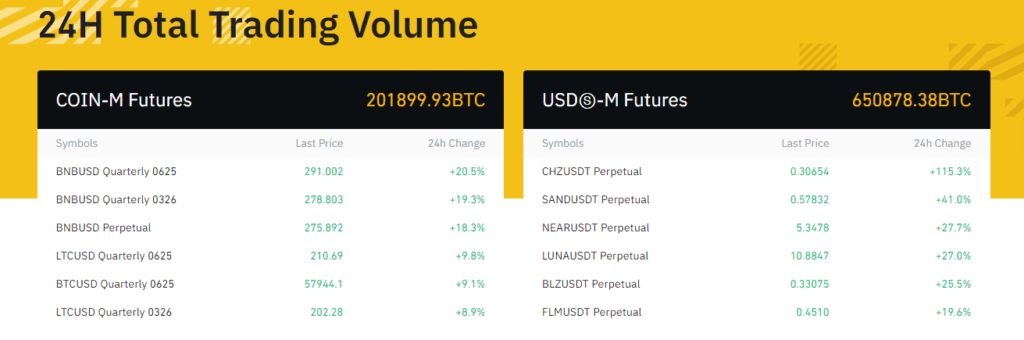

1. Binance Margin TradingBinance is the world’s biggest crypto exchange by volume and has one of the most diverse ranges of crypto assets. The exchange provides you with increased leverage and one of the highest liquidity in the market.

Binance Volume

Binance Volume

Margin Trading is essentially spot trading with leverage, however, the Binance Futures market provides higher leverage.

LeverageBinance offers a leverage of up to 10X on crypto margin trading. The maximum available leverage for you will depend on your position’s notional value.

Binance has a ten-tiered leverage system for 10x in isolated margin trading. At the same time, you get maximum leverage of 5x in the master account and 3x in the regular account during cross-margin trading.

Isolated margin tradingBinance Isolated trading has a specific account associated with a trading pair. An account can only accept the denominated currency as margin. You cannot use these assets as collateral in any other cross-margin or isolated account.

To learn more about isolated margin trading, you can visit Binance or click here.

Cross margin tradingYou can use the assets in your cross-margin account as collateral. On requesting a loan, you receive the assets in your cross-margin account and then use them for cross-margin trading.

To read further about cross margin trading on Binance, you can either visit Binance or click here.

What is the maintenance margin at Binance?This is the minimum amount of collateral or your account balance for you to keep a trade open. If your credit goes below this level on incurring losses, then either you’ll have to add more funds or witness a liquidation.

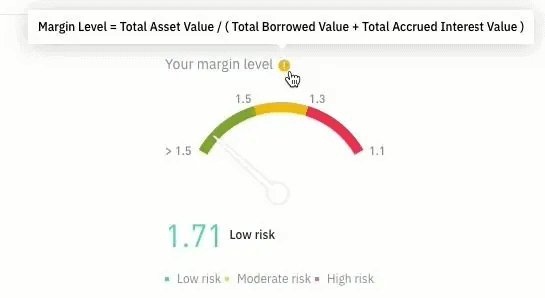

What is the Binance margin level?During margin trading, you will observe a meter on the screen. It represents the amount of risk you’ve taken by borrowing the funds. The meter changes according to the market, and if your prediction goes sideways, Binance can liquidate your funds.

Binance Risk Meter

What is Binance margin liquidation?

Binance Risk Meter

What is Binance margin liquidation?

This is the point on the margin level indicator, i.e., 1.1, below which Binance will automatically liquidate all your assets.

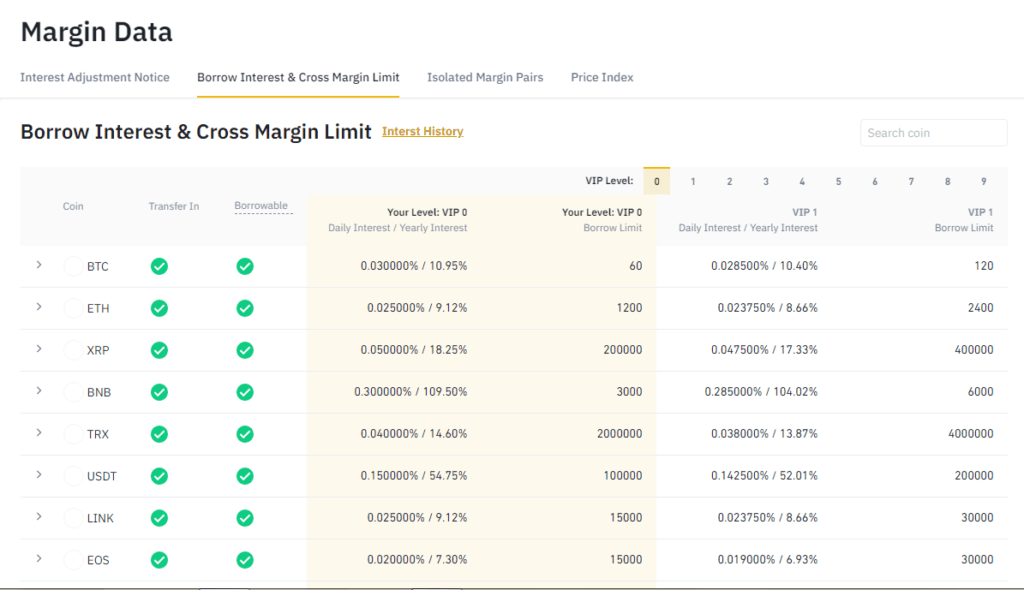

Binance FeesBinance has a tier system for charging taker and maker fees, which you can observe in the below table or by visiting their website.

Binance Margin Trading Fee

Binance Margin Trading Fee

However, Binance isolated margin users have a discount of 25% on interest on using BNB as a payment method. In contrast, cross-margin trading users get a discount of 5% on using BNB.

Calculation of FeesYou can calculate the commission by

Commission fee = fee rate x notional fee

Coin-margined futures contracts:

(Contract size x number of contracts)/ opening price

USDT-margined futures contract:

Notional value = trade price x number of contracts

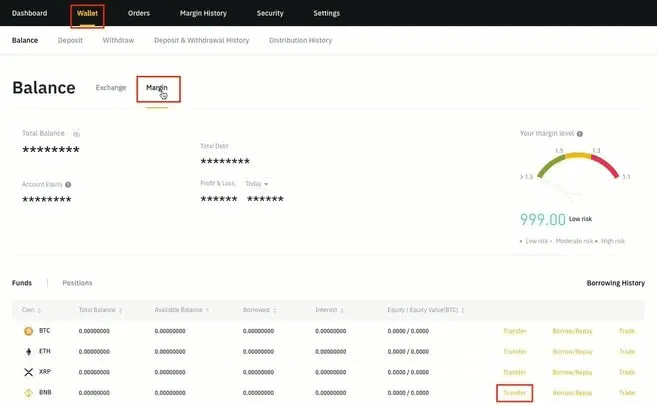

Getting started with Binance Margin Trading ExchangeYou can follow these steps to create your Binance margin trading account and get started:

- Create an account and complete your KYC at Binance.

- Login and click on your profile tab and then visit your account dashboard.

- Now click on Margin.

- Read all the policies carefully and if you agree, click on ‘open margin account.’

- Now transfer funds by clicking on the wallet tab and then on margin.

Binance Margin Trading

Binance Margin Trading: Pros and Cons

2. BYDFI margin trading

Binance Margin Trading

Binance Margin Trading: Pros and Cons

2. BYDFI margin trading

BYDFI is an exchange offering crypto spot, margin, copy trading, and contract trading options. They offer the highest leverage for margin trading. BYDFI currently functions in 150+ countries and has collaborated with CoinMarketCap, Binance, and many other companies.

BYDFI: Crypto Margin Trading Exchange

Leverage on BYDFI

BYDFI: Crypto Margin Trading Exchange

Leverage on BYDFI

BYDFI offers a leverage of up to 200x on BTC, i.e., you can trade for up to 200 BTC by having a capital of 1 BTC. BYDFI offer margin trading on both Spot and Derivative market (Futures).

How does your margin account work at BYDFI?At BYDFI, after you deposit funds, you can simply hover on the contract and click on crypto and invest on margin. On the right side of the screen, you can see the leverage slider and space to enter the amount to go long or short.

Leverage BYDFI

Leverage BYDFI

After you place your order, funds automatically transfer to your margin account. Now your position is open until you manually close it from the bottom of the screen.

What is floating P&L?When you open trade, then you see a varying amount in USDT next to the Margin balance. This amount is your profit if it’s +ve or loss if it’s negative. But it’s not your actual profit/ loss as you’ve not yet closed the trade.

You can keep track of your position and its returns with the help of floating P&L.

How to go long or short on BYDFI?On visiting the crypto tab, you could see a green and a red button on the right side.

Now, by clicking on the green button or buy, you go long. Going long means you expect to make a positive return from a rise in the asset’s value.

By clicking on the red button or sell, you go short. Going short means, you’re predicting a fall in the asset’s value and seeking to gain returns from the fall in value.

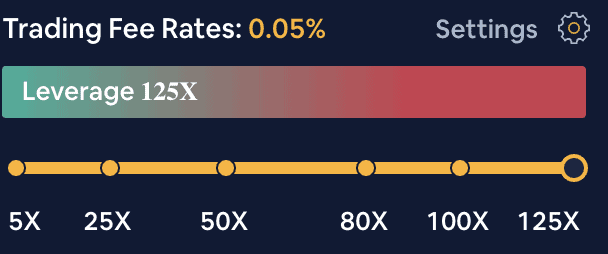

Margin trading rules at BYDFI- There is a minimum trading barrier of 5 USDT and a maximum limit of 20,000 USDT for all types of leverages.

- The leverage limit is from 5x to 125x.

- You can trade 24×7; however, all positions au-to close at 05:55:00 SGT.

- There is a trading fee of (Margin * Leverage * 0.05%) applicable on all margin trading orders.

BYDFI has trading fees of 0.05%, and they charge an opening and closing fee according to the formula:

(Opening/ Closing fee = Margin * Leverage * 0.05%)

The exchange also charges a derivative handling fee, which can we can calculate as:

(Opening/ Liquidation fee = Margin * Leverage * 0.025%)

BYDFI deducts all its fees while opening trade and doesn’t charge you anything when closing a transaction.

Getting started with BYDFI Margin Trading ExchangeYou can follow these steps to start margin trading at BYDFI:

- Click on signup and create a trading account on BYDFI.

- Complete your KYC and deposit funds.

- Now activate your margin trading account and begin trading.

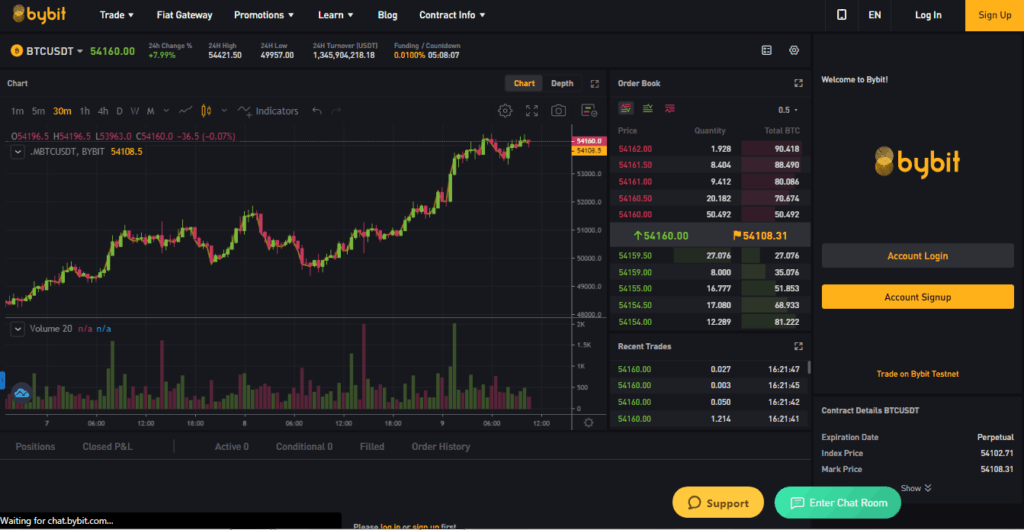

Bybit is an extremely intuitive platform and offers an excellent user interface. It has been offering margin services for a very long time. Hence they are reliable and are also one of the most secure exchanges out there.

Bybit: Crypto Margin Trading Exchange

Leverage on Bybit

Bybit: Crypto Margin Trading Exchange

Leverage on Bybit

You can adjust the leverage Bybit offers on the top right side of the screen. You get leverage from 1x to 100x on Bybit.

Bybit: Crypto Margin Trading Exchange User Interface

Maintenance and Initial margin

Bybit: Crypto Margin Trading Exchange User Interface

Maintenance and Initial margin

Maintenance margin determines the specific price triggering liquidation while referring to the minimum amount required to hold a leveraged position.

Bybit determines the margin required to open a position by leverage and position size. It is known as the initial margin.

Bybit Isolated marginIf the isolated margin position gets liquidated, Bybit does not draw margin to that position anymore. You can switch to isolated margin mode as, by default, you use the cross-margin method.

Bybit Cross marginUnder cross-margin, when the assets’ value is lower than the stop limit, the position will be liquidated. You cannot select your leverage under cross-margin, and it is decided based on your current risk limit.

You can read more about isolated and cross-margin trading at Bybit by clicking here.

Bybit LiquidationThe exchange provides all it could to prevent liquidation caused by market manipulation or low liquidity. The exchange also uses partial liquidation to lower the required maintenance margin.

Bybit Insurance FundBybit has an insurance fund in case a liquidation occurs. You can check their daily insurance fund’s balance here.

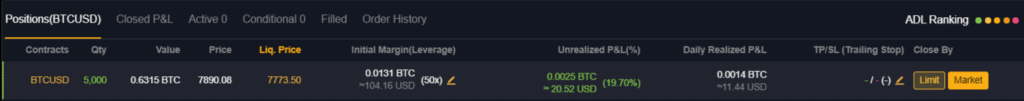

ADL mechanismSuppose the position cannot be liquidated at a better price, and the insurance fund cannot cover the loss. In that case, the ADL mechanism comes into the limelight.

Bybit ADL

Bybit ADL

Here, a trader with the highest ADL ranking is selected and delivered all your assets. Then the platform moves to the next trader in line and so on until it sells all your assets with effective leverage use.

Bybit FeesBybit charges a fee slightly differently, i.e., you get to pay a taker rebate and a negative fee of maker rebate.

A negative fee implies that Bybit pays you a certain amount as a maker rebate to increase the order book’s depth.

Getting started with Bybit Margin Trading ExchangeYou can follow these step to get started with margin trading on Bybit:

- Sign up and create an account on Bybit.

- Then deposit funds by hovering over the ‘trade’ tab and then clicking on ‘deposit.’

- Now click on the ‘market’ tab and set the leverage and quantity you wish to trade.

- Execute your market order and begin margin trading on bybit.

Huobi is a Singapore-based crypto exchange platform working in Seychelles. They have a beginner-friendly mobile app and website and offer trading in 180+ coins.

Huobi: Crypto Margin Trading Exchanges

Leverage on Huobi

Huobi: Crypto Margin Trading Exchanges

Leverage on Huobi

At Huobi, you can choose leverage anywhere between 1x and 125x. However, you cannot change leverage until you don’t hold any position or have any pending orders.

Huobi Isolated marginAn isolated margin account has fixed collateral and a higher risk of liquidation. However, in liquidation, the assets that are only associated with this account are liquidated. Hence the loss is limited to a particular section, which is why beginners.

You can have a look at the tier-based loan limit of isolated margin trading by clicking here.

Huobi Cross marginYou can use all of your tradable balance as margin and thus reduce the risk of liquidation. Your loan amount depends on your BTC equivalent trading volume and the amount of HT holdings in your wallet.

You can have a look at the tier-based loan limit of cross-margin trading by clicking here.

Quick marginHuobi provides a unique feature of automatic loan and repayment. By activating a quick margin, you can directly trade at a higher value than your capacity. The platform will automatically provide you the loan of the exceeding amount and charge the interest, respectively.

To learn more about quick margin, click here.

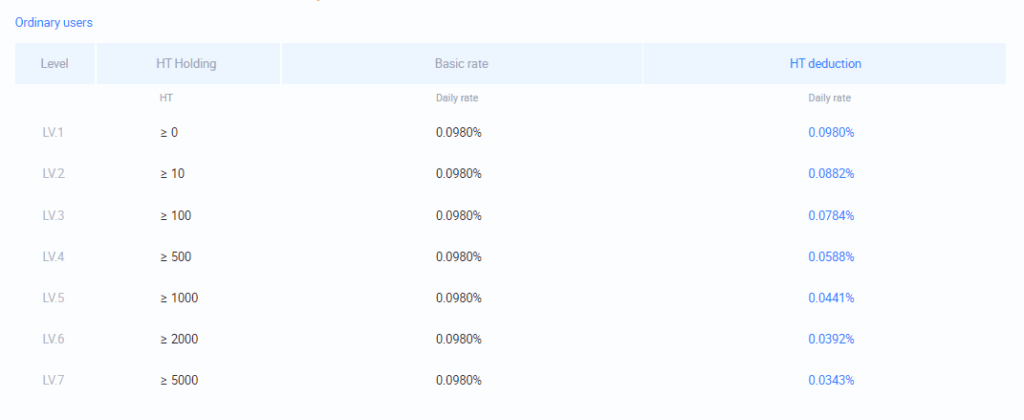

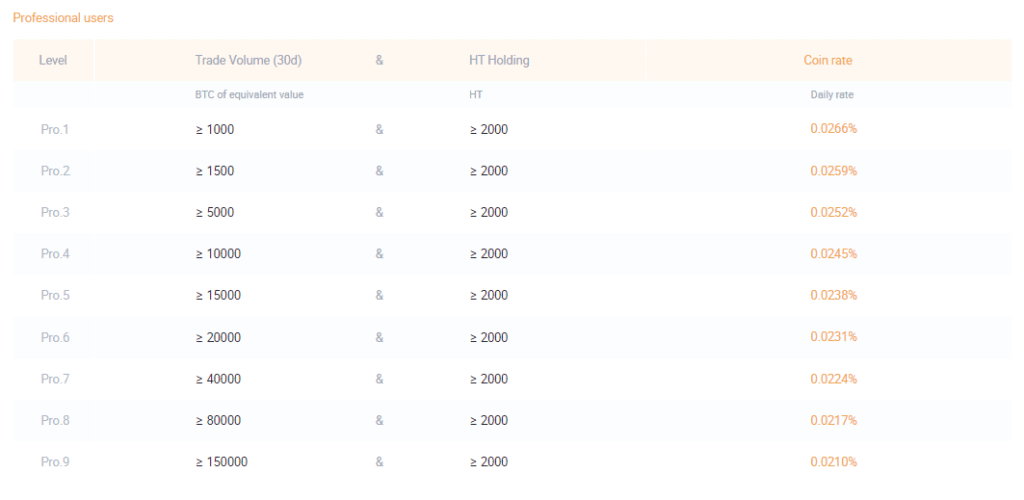

Huobi FeesHuobi has a tier system for charging fees. You can have a look at the fees in the below tables. Isolated margin and cross-margin have different interest tiers, and you can look at them by clicking here.

Ordinary users

Huobi Fee for normal users

Huobi Fee for normal users

Professional users

Huobi Fee for professional users

Huobi Fee for professional users

You can also enable the option to pay the fee via Point Card, and each Point Card is worth 1 USDT. To learn more about point cards, click here.

Getting started with Huobi Margin Trading ExchangeFollow these steps to begin margin trading on Huobi:

- Sign-up and create your account.

- Then deposit funds to your Huobi account.

- To enable margin trading, go to the ‘margin trading’ tab.

- Go to the ‘transfer in’ tab, and deposit the funds from your regular wallet to your margin trading wallet.

- Now you’re all set to begin margin trading.

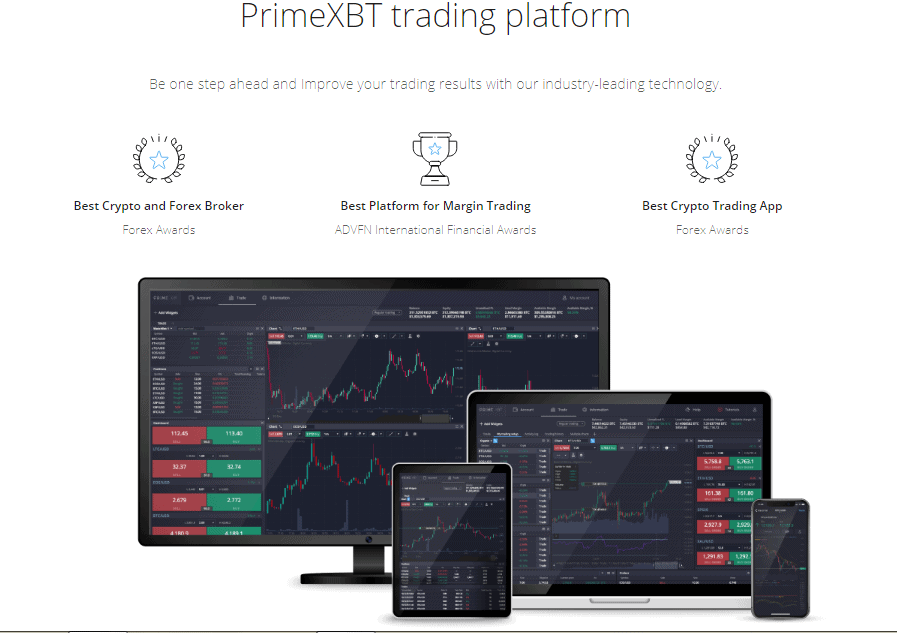

PrimeXBT offers a fully customizable platform where you can move the charts, market window, etc., based on your requirements. They provide a simple user interface with video tutorials for beginners and have inbuilt tools for technical analysis.

PrimeXBT: Crypto Margin Trading Exchanges

Leverage on PrimeXBT

PrimeXBT: Crypto Margin Trading Exchanges

Leverage on PrimeXBT

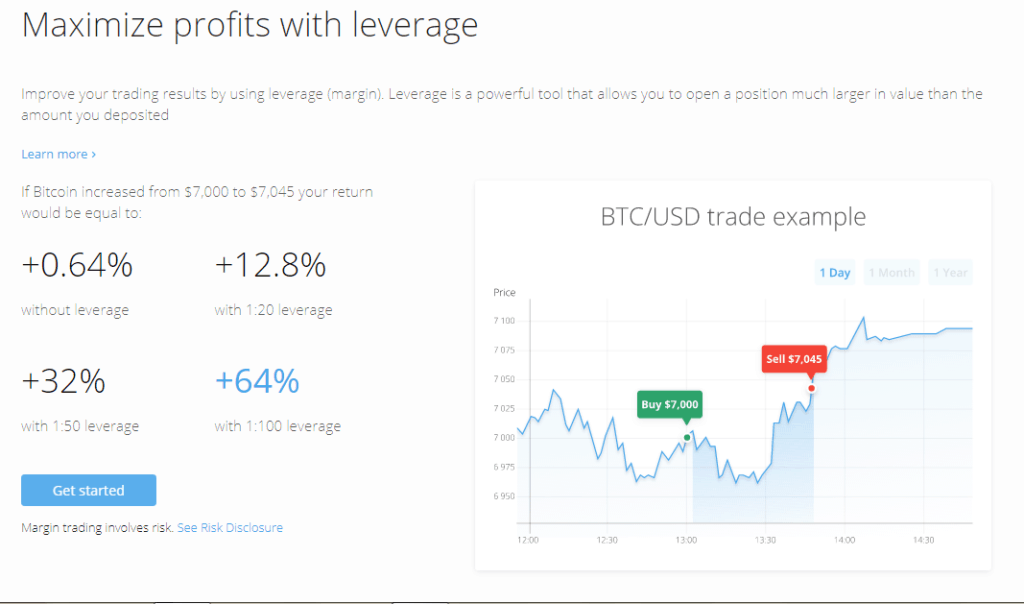

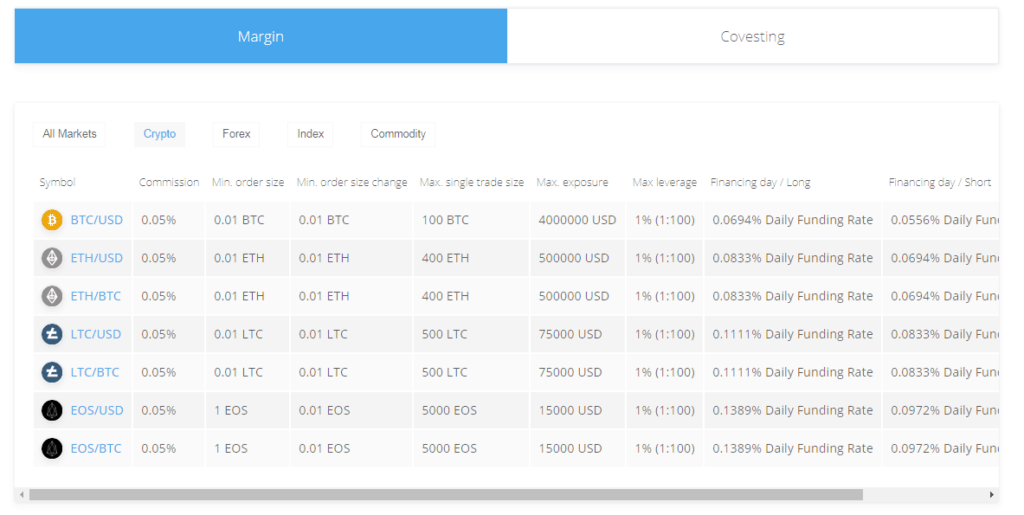

There are over 50 options with varying leverage available to trade. PrimeXBT offers maximum leverage of 100x on crypto, index, and commodity.

PrimeXBT leverage

PrimeXBT Cross margin

PrimeXBT leverage

PrimeXBT Cross margin

PrimeXBT offers only cross-margin trading services. Cross margin lets you use all of your funds and may lead to loss of all your assets at the time of liquidation. Due to its complex features, experienced traders prefer cross-margin trading.

PrimeXBT FeesYou can look at the crypto margin trading interest in the below table and the fee on others visiting their website.

PrimeXBT Margin Trading Exchange

Getting started with PrimeXBT margin trading exchange

PrimeXBT Margin Trading Exchange

Getting started with PrimeXBT margin trading exchange

PrimeXBT is a beginner-friendly platform; hence you can quickly begin margin trading. However, you can also follow these steps:

- Create an account on PrimeXBT.

- Now deposit bitcoins in your account wallet.

- Click on margin trading and then activate your margin trading account.

- Transfer funds in your margin account and begin trading.

PrimeXBT: Crypto Margin Trading Exchanges

PrimeXBT: Pros and Cons

Margin Trading: Know before you trade

PrimeXBT: Crypto Margin Trading Exchanges

PrimeXBT: Pros and Cons

Margin Trading: Know before you trade

You should keep in mind the risks of margin trading before you decide to jump into the market. The points below might help you a bit in understanding the risks of margin trading:

- Since crypto markets are highly volatile, you can never entirely predict which way the market is heading and whether you’ll gain or lose.

- Even a small drop in price can make you incur severe losses.

- There are other risks like your internet connection or the platform’s market connectivity. If you have a weak internet connection, the asset’s price might already have changed by the time the exchange receives your order.

- We advise beginner traders to stay away from margin trading. They do not have much experience and can most probably end up losing all of their capital.

- You should be extra careful of your margin account security.

Margin trading can help you gain significant returns with minimal capital. However, you can also incur losses if the market goes sideways. Many exchanges offer margin trading services, however, Binance, Bybit or BYDFI can be your best option in the industry. They provide perfect leverage, with efficient security and competitive fees.

Frequently Asked Questions Can you trade crypto on margin?You can trade crypto on margin. There are many exchanges offering crypto margin trading, such as Binance, BYDFI, Huobi, etc.

Is margin trading a good idea?Margin trading can help you get high returns by investing minimum capital. However, you must keep in mind that you can suffer significant losses if the price decreases.

When does 5x means on Binance?5x signifies your leverage on the asset you’re willing to invest. For example, choose a leverage of 5x. The exchange will provide you 5 USDT for every USDT of your original capital.

What is the difference between margin trading and spot trading?Spot trading involves the traditional buying and selling of crypto assets. At the same time, margin trading consists of investing in an asset with capital provided by the exchange based on your chosen leverage.

What is a Margin call?When the investor’s borrowed funds are suffering a loss, the exchange will ask the investor to either deposit more funds or sell the investor’s collateral to cover the loss.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.