and the distribution of digital products.

Synthetix Q2 2024 Brief

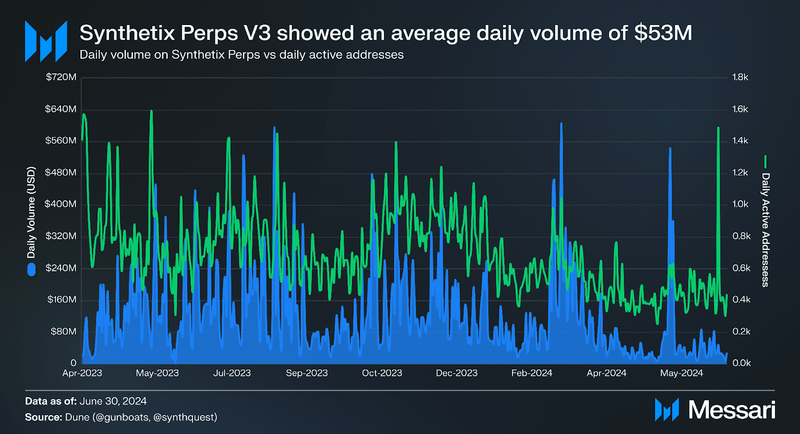

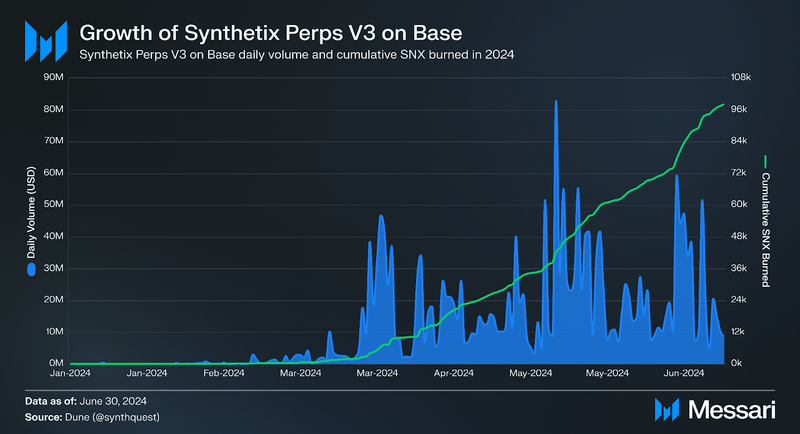

- Average daily trading volumes on Synthetix V3 reached $53 million on Base, maintaining momentum after the addition of perps for assets like SNX and SOL, which boosted growth in Q2 2024.

- Despite Synthetix's overall trading volume falling 57% QoQ, V3's deployment on Base showed resilience, even amidst a broader market downturn.

- Synthetix expanded its ecosystem through strategic initiatives on Arbitrum, including a 12-week LTIP program that distributed 2 million ARB tokens and the introduction of new collateral options like USDC, ETH, and ARB.

- In Q2 2024, significant governance actions occurred, including the implementation of SIP-384, which transitioned governance from OP Mainnet to Synthetix Chain, and SIP-378, which introduced trading improvements aimed at increasing user engagement on Perps V3.

Synthetix (SNX) is a decentralized synthetic asset issuance and liquidity protocol that allows users to trade synthetic assets (Synths). Synths track the price of external assets through oracles like Chainlink, Pyth, and Uniswap V3 TWAP. Users can trade in both spot and perpetual futures markets for synthetic assets. SNX is the native protocol token, used for governance and as collateral backing the network's liquidity.

With the launch of Synthetix V3 on Base in Q2 2024, the protocol transitioned to a new architecture that supports multiple collateral types for minting the Synthetix stablecoin, sUSD. These collateral types now include SNX, ETH, USDC, and yield-generating assets like stataUSDC. Synthetix Perps is the protocol’s leading product. The DAO uses a novel V3 Governance Module (V3GM), which has councils of appointees voted on by SNX holders.

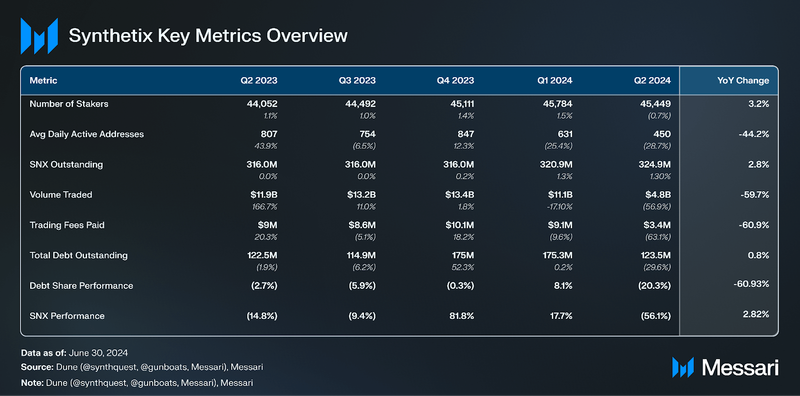

Key Metrics Performance AnalysisDaily Volume and DAAs

Performance AnalysisDaily Volume and DAAs

Synthetix's V3 rollout has gained momentum, particularly on Base, where average daily trading volumes reached $53 million in Q2 2024. The recent addition of perp markets for assets like SNX and SOL has contributed to this growth. Base Andromeda, operational since early December under SIP-348, is now prepared for gradual expansion. The LP limit on Base was increased to $10 million through SCCP-311, and with utilization approaching 50%, open interest caps may be raised accordingly. This growth reflects strong interest in LP opportunities.

However, despite these developments, Synthetix experienced a significant decline in overall trading volume, decreasing from $11.1 billion to $4.8 billion in the past quarter—a 57% decline QoQ and a 60% drop YoY, likely influenced by broader market trends.

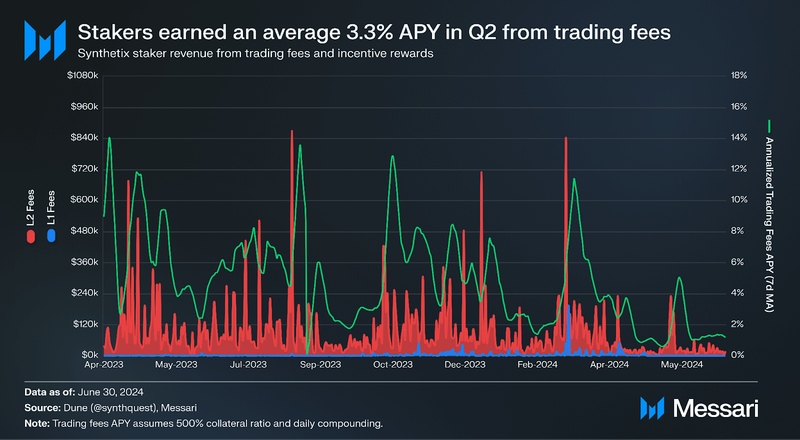

Fees to Stakers

In Q2 2024, Synthetix had 45,500 SNX stakers, a decrease of 0.7% from 45,800 in the previous quarter. Trading fees generated an average annualized percentage yield (APY) of 3.3%, reflecting a 1% decrease from the previous quarter. However, earnings from trading fees increased from $9 million to approximately $13 million, primarily due to revenue generated from Synthetix Perps V3 markets, which offer cost-effective trading with lower gas fees. Rather than being paid as dividends, these trading fees are used to burn sUSD, reducing debt for stakers. Additionally, Synthetix Perps V3 on Base allocates 40% of fees towards buying back and burning bridged SNX.

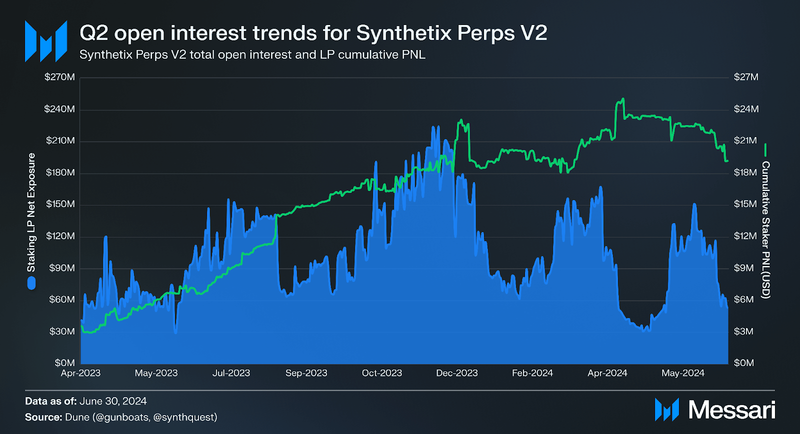

OI and Staker Perp Exposure

After a successful first year of Synthetix Perps V2, SNX stakers continued to earn positive PNL in Q2 2024. A key feature of V2 allows market makers to earn the spread generated when takers trade against LP collateral (staked SNX), minimizing LP exposure, though not without risk. Instead of earning the spread, LPs benefit from fees generated by increased trading volumes, reducing their exposure to traders' directional moves.

Open interest (OI) serves as a measure of both risk and demand for Synthetix Perps. After peaking at over $200 million in December 2023, OI declined at the start of 2024 but recovered with increased trading activity. Q2 2024 ended with $132 million in OI, a 14% decrease from $154 million QoQ. While OI on Synthetix differs from that on order-book DEXs, it likely provides a more accurate gauge of perpetual contract demand.

Expansion of Synthetix V3

Synthetix Andromeda introduced Perps V3 to Base in 2023, increasing OI caps by $10 million, which enabled the addition of SNX, SOL, and other perpetual markets on V3. As activity on Base grows, Synthetix V3 is well-positioned to expand. To further drive adoption, the DAO approved USDC and SNX incentives on Base. Unlike Perps V2, V3 features different tokenomics, with USDC used as collateral instead of SNX. Additionally, 50% of trading fees generated on V3 are sent to a burner address, where they are used to buy and burn SNX, providing a deflationary effect on the token’s supply.

Key DevelopmentsCollateral and Liquidity Enhancements:

- SIP-371: Added sUSDe as yield-bearing collateral to Synthetix V3 on Arbitrum, with a 200% collateral ratio and $50M LP cap, improving capital efficiency for liquidity providers.

- SIP-389: Introduced yield tokens (aUSDC, wstETH) from Aave and Lido as collateral on Arbitrum V3, enhancing liquidity options for LPs.

- SIP-377: Added stataUSDC as collateral on Base, providing LPs with yield-generating options, boosting liquidity and scalability on Base.

Expansion of Tradable Markets:

- SIP-2058: Listed Axelar Token (AXL) on Perps for the Base chain, expanding the platform’s range of tradable assets.

- SIP-373: Preemptively approved the listing of ENA token on Perps V3 on Base, supporting Ethena Labs' governance token.

- SIP-374: Granted preemptive approval for listing the DEGEN token on Perps V3 on Base, simplifying governance for this high-interest token.

- SIP-375: Listed BOME-PERP and ETHFI-PERP on Perps V3 on Base, tapping into high-demand tokens for increased user attraction.

- SIP-376 & SIP-379: Migrated 11 and 6 popular markets (DOGE-PERP, AVAX-PERP, LINK-PERP, GMX-PERP) from Perps V2 on Optimism to Perps V3 on Base, supporting the transition to the upgraded platform.

- SIP-380: Listed TON-PERP, ARKM-PERP, GALA-PERP, and TAO-PERP on Perps V3 on Base, expanding high-demand asset offerings.

Governance and Platform Improvements:

- SIP-384: Launched the Synthetix Chain using the OP Stack, transitioning governance from OP Mainnet to the Synthetix Chain, centralizing Synthetix V3 governance.

- SIP-381: Enabled pool owners to control reward distribution, offering flexibility while maintaining security.

- SIP-378: Introduced improvements to Perps V3, including zero-fee trading and enhanced trading mechanics, improving user experience.

- SIP-393: Created the Degenthetix pool and perps market on Synthetix V3, offering experimental trading of long-tail assets outside the Spartan Pool, driving innovation and risk management.

In Q2 2024, Synthetix made notable progress with the rollout of V3, particularly on Base, where the average daily trading volume reached $53 million. This was driven by the introduction of new perpetual futures markets (perps) for assets like SNX and SOL. This expansion reflects the growing interest in Synthetix’s offerings, especially as Base Andromeda prepares for further growth. Despite these positive developments, the protocol faced challenges with an overall decline in total trading volume, dropping from $11.1 billion to $4.8 billion.

The quarter also saw a slight reduction in the number of SNX stakers, with trading fees generating an annualized yield of 3.3%. However, the revenue from trading fees increased, largely due to the performance of Synthetix Perps V3 markets. Additionally, the deployment of V3 to Arbitrum, along with new collateral options and incentives, indicates ongoing efforts to strengthen the protocol’s usage and user base across networks. As Synthetix continues to evolve, these developments highlight both the potential and the challenges facing the protocol in a competitive market environment.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.