and the distribution of digital products.

State of Polkadot Q2 2024

- Polkadot ecosystem extrinsics increased by 46.7% QoQ, reaching 965,000 daily extrinsics in Q2 2024. The decrease in parachain addresses paired with the increase in extrinsics suggests users were more active in Q2 2024.

- Polkadot 2.0 addresses high entry barriers and resource inefficiencies with Agile Coretime, Elastic Scaling, and Asynchronous Backing. The current slot auction model, where parachains rent blockspace for up to two years, will be replaced with more flexible on-demand and bulk models for purchasing blockspace.

- The number of referenda reached an all-time high of 437. Polkadot has seen a sustained increase in governance activity since OpenGov's implementation.

- The Polkadot Treasury saw record usage in Q2 2024, with nearly 11 million DOT used for proposals. Referendum 457 seeks to diversify the Polkadot Treasury with USDT and USDC, allowing treasury proposals to be denominated in stablecoins.

Polkadot (DOT) is a distributed blockchain computing platform that acts as a base layer for other sovereign blockchains, called parachains, for validation and shared security. Polkadot was built using Substrate, a blockchain developmental framework. Furthermore, Polkadot’s base layer is known as the Relay Chain, which utilizes a Nominated Proof-of-Stake (NPoS) consensus mechanism, and its state machine is compiled to WebAssembly (Wasm).

Polkadot Relay Chain’s core function is to validate and provide security to its parachains. Parachains are added to the Relay Chain through Parachain Slot Auctions. Today, the auction process is a candle auction that lasts for one week in which potential parachains “bid” DOT tokens to secure a parachain slot. However, this model is being updated in 2024.

Lastly, parachains on Polkadot can communicate with one another through the Cross-Consensus Mechanism Format (XCM). The XCM is a messaging format that standardizes messages between Polkadot’s parachains, allowing for greater interoperability.

Website / X (Twitter) / Discord

Key Metrics Financial Analysis

Financial Analysis Market Capitalization

Market Capitalization

The crypto market saw a sharp increase in market capitalization over the past six months but faced a downturn in Q2 2024. DOT's Circulating Market Cap ended Q2 2024 at $8.6 billion, reflecting a 34% decrease. This decline shifted DOT's ranking among all crypto protocols from 13th at the end of Q1 2024 to 14th at the end of Q2 2024. For reference, BTC and ETH experienced price changes of -12% and -6%, respectively.

Revenue

The Polkadot Relay Chain’s revenue is derived from network transaction fees and tends to be relatively lower compared to its competitors due to the network's structural design. Polkadot experienced an abnormal spike in Q4 2023, with revenue reaching $2.8 million. This spike was primarily due to a substantial rise in extrinsics in late December, driven by Polkadot Inscriptions.

In Q2 2024, revenue metrics fell back to historical quarterly levels, except for the Q4 2023 anomaly. Revenue in USD was $151,000, reflecting a 37.5% QoQ decrease, while revenue in DOT was 21,400, reflecting a 25.7% QoQ decrease.

Treasury

The Polkadot Treasury is financed through block rewards, validator slashing, transaction fees, and staking inefficiencies. Treasury funds held in a system account are allocated for expenditures within a 24-day spend period, with any unspent funds subject to a 1% burn. Notably, all treasury expenditures are executed automatically on-chain. The passage of OpenGov has transformed the referendum lifecycle and decentralized the decision-making process, leading to increased treasury activity.

The Polkadot Treasury saw record usage in Q2 2024. Nearly 11 million DOT were used for proposals, 900 DOT were used for bounties, and 1 million DOT were burned. Additionally, Polkadot Referendum 457 seeks to diversify the Polkadot Treasury with USDT and USDC, allowing treasury proposals to be denominated in stablecoins. The Treasury Balance ended Q2 2024 at $166 million, of which stablecoins accounted for approximately $8 million.

SupplyPolkadot’s native token DOT serves three primary purposes: governance, staking, and parachain bonding. DOT has an inflationary monetary policy and no maximum supply. Its monetary policy adjusts according to network conditions, increasing staking rewards when the staked amount falls below the ideal rate to prevent security compromises, and decreasing rewards when the rate is exceeded to maintain liquidity.

As of Q2 2024, Polkadot’s supply metrics include a circulating supply of 1.5 billion (+2.4% QoQ), a staked supply of 863.4 million (+16.4% QoQ), resulting in an eligible supply staked of 59.0%. Polkadot yields include an annualized nominal yield of 14.3% (-3.9% QoQ) and an annualized real yield of 6.0% (-17.5%).

Network Analysis Usage

Usage

The Polkadot Relay Chain has several primary functions, including securing and connecting parachains. Consequently, end users typically transact and use the network primarily through the parachains. The Relay Chain does support some end-user functionalities, including token transfers, staking, validator elections, governance voting, and participation in parachain slot auctions. With RFC-0032: Minimal Relay, it is proposed to migrate several of these subsystems into system parachains.

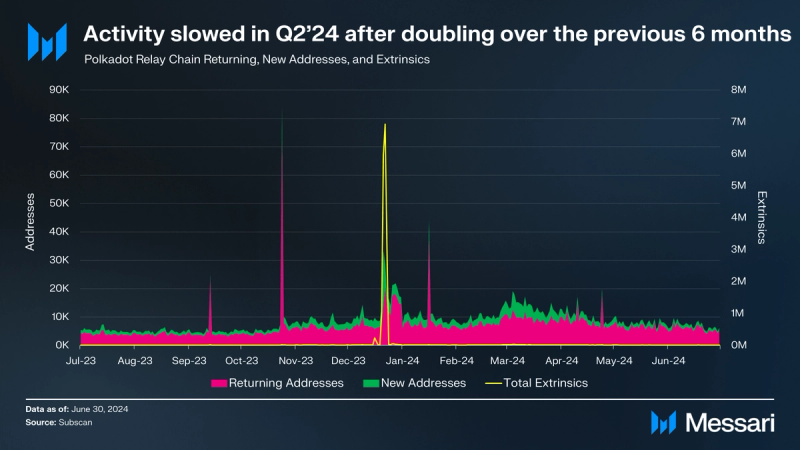

Following two consecutive quarters of growth, where Polkadot Relay Chain active addresses more than doubled, Polkadot activity slightly slowed in Q2 2024. The average daily new addresses were 1,500 (-50.8% QoQ), average daily returning addresses were 6,900 (-16.5% QoQ), and average daily active addresses were 8,400 (-25.9% QoQ).

In the Polkadot network, an extrinsic is an element that facilitates state transitions within the Relay Chain, akin to a transaction on other networks. From December 20th to 23rd, Polkadot Relay Chain extrinsics surged due to Polkadot Inscriptions, with the Relay Chain processing 4.3 million daily extrinsics. The network successfully managed this influx without any performance decline. The average daily extrinsics in Q2 2024 were 11,600, a 28.9% decrease from the previous quarter.

Security

Polkadot uses a Nominated Proof-of-Stake (NPoS) model designed to decentralize the validator set. Validators receive payments every 24 hours based on their completion of payable actions known as era points. This model incentivizes nominators to stake with lower-staked validators to earn higher rewards, resulting in a consistently decentralized validator set. The number of active validators has remained stable at 297; however Referendum 888 seeks to enable two approval voting protocol improvements, which are prerequisites to scaling the number of Polkadot validators to 500.

Nominators are participants in the network who stake with a validator. As of Q2 2024, there were 37,400 nominators. Nomination Pools are a feature of Polkadot’s staking system that allows users to pool their DOT tokens together onchain to nominate validators and receive rewards. At the end of Q2 2024, there were 233 Nomination Pools, reflecting a 4.5% increase QoQ.

Additionally, Polkadot has proposed to slash the unstaking period from 28 days to 2 days.

Governance

OpenGov, the new governance model for Polkadot, has transformed the referendum lifecycle and decentralized the decision-making process. The system allows multiple referenda to run concurrently, enabling faster decision-making. The Council and Technical Committee have been replaced by the Fellowship, a developer DAO that ensures decentralization through community voting, checks and balances, and flexible delegation based on conviction and token commitment.

Polkadot has seen a sustained increase in governance activity since OpenGov's implementation. As of Q2 2024, there was a monthly average of 346 delegated voters and 663 direct voters. The number of referenda reached an all-time high of 437.

Additionally, Polkadot DAO has allocated 3 million DOT to enhance DeFi, with 2 million DOT for Hydration to improve liquidity and trading efficiency, and 1 million DOT for StellaSwap to optimize AMM efficiency. Polkadot has chosen race car driver Conor Daly as its brand ambassador through community governance.

Ecosystem Analysis Development

Development

Polkadot boasts one of the largest developer bases in the crypto industry. According to Electric Capital, in July 2024 Polkadot had 2,400 monthly active developers, of which 760 were classified as full time, placing the network fourth behind Ethereum, Base, and Polygon. Artemis also tracks developer data, reporting an average of 165 weekly active core developers and 760 weekly active ecosystem developers in Q2 2024.

Over the last six months, Polkadot has had a number of developer-related announcements, including:

- Further expansion of the Polkadot Blockchain Academy, including a new Founders Track, plans for further growth in the Asia-Pacific region, and a remote option.

- The Polkadot Alpha Program was launched to support developers across the development life cycle, including with Agile Coretime.

- Dune Analytics integrated Polkadot and Kusama data.

- The Web3 Foundation has granted Decentered Studio a grant to craft events, boosting community collaboration.

- Polkadot launched a new SDK, Polkadot Play, targeted at gaming.

- Polkadot was active at Consensus 2024 in Austin, TX.

- EasyA launched a Polkadot education initiative to onboard new developers.

- Polkadot's JAM Prize Fund opened offering $60 million in prizes for developers implementing JAM, the next major Polkadot upgrade.

- Polkadot has launched a Ledger app allowing users to interact with Polkadot securely via Ledger Live.

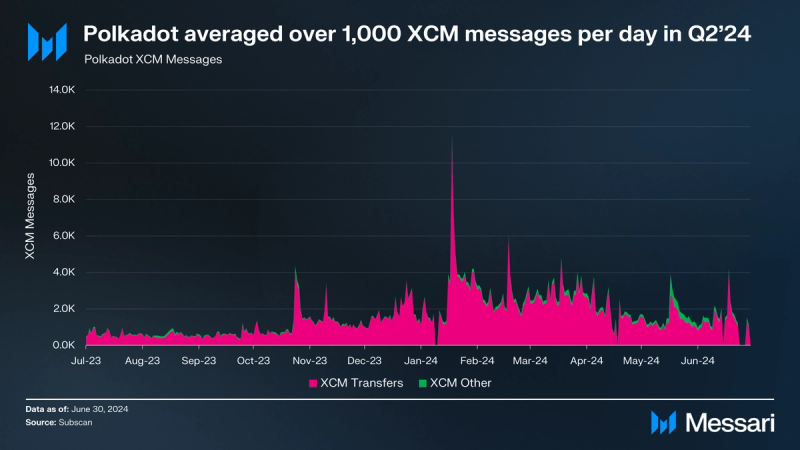

The Cross-Consensus Message Format (XCM) is a standardized messaging format and language that enables seamless communication between parachains and other consensus-driven systems. XCM plays a crucial role in facilitating interoperability and complex cross-consensus interactions. It allows blockchains to exchange messages, perform operations, and transfer assets, among other use cases.

In Q2 2024, Polkadot's XCM activity slowed. Daily XCM transfers averaged 1,406, a decrease of 48% QoQ, while non-asset transfer use cases, termed "XCM Other," increased to 202 daily, an 18% rise QoQ. The total daily XCM messages averaged 1,609, down 44% QoQ.

Parachain Messages

There are multiple ways in which messages are passed on the Polkadot Network: from parachains to the relay chain is upstream message passing, from the relay chain to parachains is downstream message passing, and from parachains to parachains is horizontal message passing. The above chart describes horizontal message passing.

In Q2 2024, Manta was the leading parachain by horizontal messages, averaging 21,300 daily messages (-51.6% QoQ). Moonbeam followed with 20,700 daily messages (-50.8%). Hydradx saw 17,500 daily messages (-28.9%), Bifrost recorded 17,100 daily messages (-4.0%), and Assethub experienced a slight increase with 8,700 daily messages (+5.2%). The sum of the other parachains had 14,600 daily messages (-33.5%).

Additional parachain-related updates for Q2 2024 include:

- Polkadot published a deep dive on parachains in the AI vertical including OriginTrail’s verifiable knowledge graph, Phala Network’s secure AI-Agent Contract, and Bittensor’s AI platform.

- Polkadot highlighted the ongoing development of bridges, including the BEEFY protocol, the Polkadot to Kusama bridge, and Snowbridge for trustless Ethereum bridging.

- Polkadot highlighted the ongoing development of Real World Asset (RWA) parachains and protocols, including Centrifuge, Energy Web for green assets, and AgroToken for agricultural commodities.

- Picasso Network integrated Inter-Blockchain Communication (IBC) with Ethereum, enabling native asset and data transfers between Ethereum, Cosmos Hub, Polkadot, and Kusama.

- Pudgy Penguins, an Ethereum NFT brand, will debut a mobile game in 2025 on the Polkadot-based Mythos Chain.

The majority of activity on the Polkadot Network happens on parachains. In Q2 2024, Polkadot parachain active addresses saw a decline, with average daily active addresses of 28,200, reflecting a 13.8% decrease from the previous quarter.

Moonbeam maintained its lead as the top parachain with 12,100 daily active addresses, despite declining 11.5% QoQ. Moonbeam announced the Moonrise initiative, which includes developments such as reducing block times to six seconds, incorporating Ethereum's Dencun compatibility, and establishing a $13 million Ecosystem Fund.

Nodle followed with 7,000 daily active addresses (-3.6% QoQ). Nodle launched on zkSync, where the first initiative will be the deployment of its new Click camera app.

The Relay Chain had 5,800 daily active addresses (-18.3% QoQ). Manta had 800 daily active addresses (-33.0% QoQ). Manta held its TGE in January 2024 and was subsequently listed on Binance. Astar had 600 daily active addresses (-34.2% QoQ). Astar announced in Q1 2024 that it would be building a zkEVM with the Polygon CDK and in Q2 2024, it connected to the Polygon Agg Layer. The sum of the other parachains collectively had 2,000 daily active addresses, down 26.6% QoQ.

Parachain Extrinsics

While active addresses decreased, extrinsics saw a 46.7% increase QoQ, reaching 965,000 daily extrinsics in Q2 2024. The decrease in parachain addresses paired with the increase in extrinsics suggests users were more active in Q2 2024.

Phala Network, the leading parachain, reported 155,100 daily extrinsics (+19.6% QoQ). Frequency recorded 105,900 daily extrinsics (+597.1%). NeuroWeb saw 101,500 daily extrinsics (+48.0%). Moonbeam averaged 82,800 daily extrinsics (-14.6%) and was the only leading parachain that saw a decrease in extrinsics activity. Energywebx had 54,800 daily extrinsics (+98.0%), while other parachains collectively averaged 464,800 daily extrinsics (+45.4%).

Technical RoadmapPolkadot has completed and shared the official release of Polkadot 1.0, marking the fulfillment of the Polkadot whitepaper. Polkadot 2.0, as determined by the community, will be shaped by community discussions and consensus. Polkadot 1.0's rigid leasing model for parachains, requiring competitive auctions and substantial DOT collateral, presents barriers to smaller projects and often leads to suboptimal resource utilization. Polkadot 2.0 introduces a dynamic economic model for managing computational resources through various technical upgrades.

Polkadot 2.0 introduces Agile Coretime, Elastic Scaling, and Asynchronous Backing, which are key components of this new economic model:

- Agile Coretime: Addresses inefficiencies by enabling dynamic allocation of computational resources, aligning resource availability with actual network demand, ensuring more efficient use and broader accessibility.

- Elastic Scaling: Enables parachains to utilize multiple cores within the same Relay Chain block, increasing network throughput and handling higher transaction loads efficiently.

- Asynchronous Backing: Optimizes block generation and validation by enhancing the efficiency and throughput of parablocks, reducing block time from twelve to six seconds, and delivering up to 10x higher throughput for Polkadot’s parachain consensus protocol.

Additionally, Gavin Wood announced JAM, a new Polkadot chain version. JAM aims to enhance scalability, decentralization, and ease of use, enabling synchronous composability and reducing fragmentation. Referendum 682 and a 10 million DOT prize will support its development.

Closing SummaryDespite a slowdown in the crypto markets, the Polkadot ecosystem saw an increase in activity in Q2 2024. Extrinsics rose by 46.7% QoQ, reaching 965,000 average daily extrinsics in Q2 2024. The decrease in parachain addresses paired with the increase in extrinsics suggests users were more active in Q2 2024. OpenGov's impact on the network was evident, with the number of referenda reaching an all-time high of 437 and the Polkadot Treasury seeing record usage in Q2 2024, with nearly 11 million DOT used for proposals.

Polkadot core developers shared further details on key technical components of Polkadot 2.0, which addresses high entry barriers and resource inefficiencies with Agile Coretime, Elastic Scaling, and Asynchronous Backing. The current slot auction model, where parachains rent blockspace for up to two years, will be replaced with more flexible on-demand and bulk models for purchasing blockspace. Additionally, Gavin Wood announced JAM, a new Polkadot chain version. JAM aims to enhance scalability, decentralization, and ease of use, enabling synchronous composability and reducing fragmentation. The JAM Prize Fund also opened, offering $60 million in prizes for developers implementing JAM.

Looking ahead, the Polkadot community is poised to further shape Polkadot 2.0 with the ongoing development of technologies like Agile Coretime, On-Demand Parachains, and Elastic Scaling will ensure further growth and innovation.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.