and the distribution of digital products.

State of Hedera Q3 2024

- In Q3, Hedera experienced QoQ growth across many key metrics, including revenue in USD (+11%), revenue in HBAR (+85%), average daily transactions (+15%), and average daily active contracts (+24%).

- DeFi TVL in HBAR increased 9% QoQ to 1.03 billion. DeFi TVL in USD fell 18% QoQ; however, this decrease was less than the 20% dip seen in HBAR’s price QoQ. Overall, DeFi saw capital inflows in Q3.

- Karate Combat users prefer using Hedera over Ethereum. Karate Combat’s last event, KC49, saw 73% of all KARATE tokens played via the Hedera Network. The total number of KARATE played also increased as Karate Combat introduced the Hedera Network to new users.

- Hedera launched its Asset Tokenization Studio, an open-source, end-to-end toolkit for configuring, issuing, and managing tokenized bonds and equities on the Hedera network.

- Hedera continues to invest heavily in its smart contract infrastructure. Three network upgrades hit mainnet this quarter. Notable upgrades include the ability to perform atomic transfers of various asset types, the option to update NFT metadata while the NFT is held in a treasury, and improvements in token association and rejection.

Hedera (HBAR) is a high-performance, secure, and sustainable public, permissioned DLT network. Hedera is governed by a council of 31 of the world’s leading institutions, with community input on the network’s features and ecosystem standards via Hedera Improvement Proposals (HIPs). While anyone can submit a transaction and view the network history and data, only pre-approved entities run the nodes that validate transactions and participate in consensus. Members of the Council operate Hedera’s validator nodes while the network has public plans to transition to fully permissionless node operation over time. Although Hedera's network operation is currently permissioned in nature, the division of responsibility across 31 geographically and industry-diversified (collusion-proof) council members is unique among public networks.

The Hedera Network offers an optimized version of the Besu EVM for smart contracts (Hedera Smart Contract Service) alongside a native tokenization service (Hedera Token Service) and a high-throughput data writing and verification service (Hedera Consensus Service). These services are known as the Hedera Network Services, which developers can use in a permissionless fashion to build decentralized applications in a variety of programming languages. The Hashgraph Consensus Algorithm powers the network, delivering high throughput, fair ordering, and low-latency consensus for all transactions.

Website / X (Twitter) / Discord

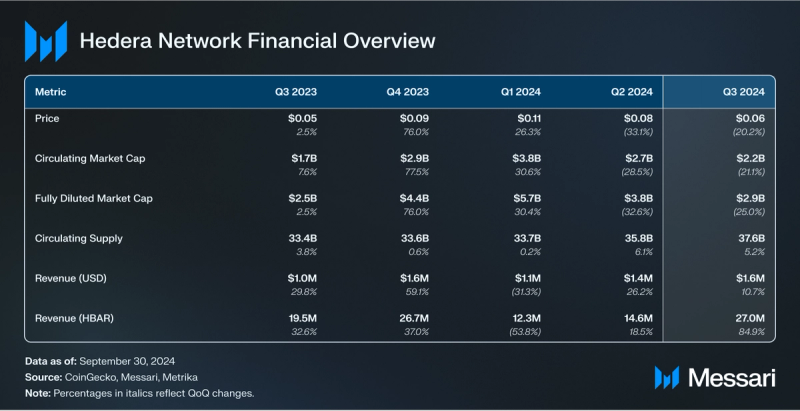

Key Metrics Financial Overview

Financial Overview Market Cap and Revenue

Market Cap and Revenue

The circulating market capitalization of HBAR continued to correct into Q3, down 21% QoQ to $2.2 billion after strong performances earlier this year and late last year. That said, HBAR’s market cap amongst all tokens fell 16 spots from 30 to 46, underperforming similarly priced cryptoassets. The circulating supply of HBAR increased slightly less than the previous quarter, increasing 5% this quarter to 37.6 billion HBAR. The price of HBAR also dipped this quarter, decreasing 20% QoQ from $0.08 to $0.06.

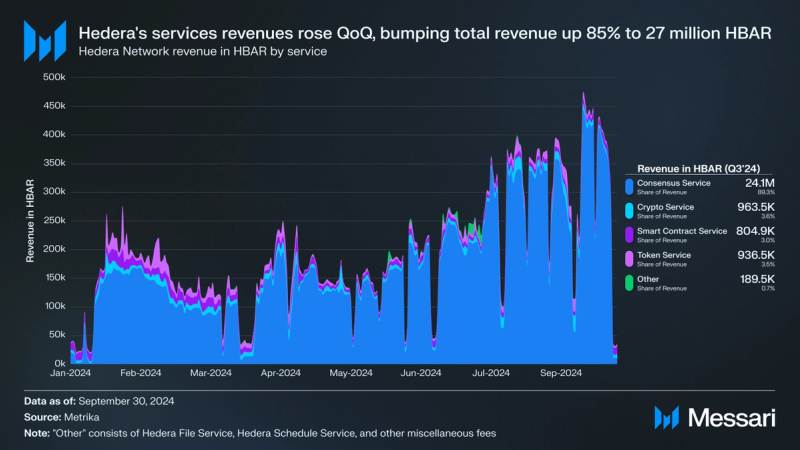

Hedera Network’s revenue, generated from network transaction fees, hit an all-time high of 27.0 million HBAR this quarter. Revenue jumped 85% QoQ and surpassed the previous high in Q4’23 of 26.7 million HBAR. Additionally, dollar-denominated revenue pushed up 10% QoQ to $1.6 million. Q3’24 became the second-highest quarterly revenue mark in USD, ending just $60,000 away from its USD all-time high in Q4’23.

All of Hedera’s network services experienced revenue growth in Q3. Hedera’s Consensus Service revenue increased 94% QoQ, accounting for 89% of the network’s total revenue in Q3. The Hedera Token Service grew 54% QoQ to 937,000 HBAR, while Hedera’s Crypto Service revenue increased by 30% QoQ to 964,000 HBAR. The Smart Contract Service experienced the smallest change in revenue QoQ, up 6.5% to 805,000. All other sources of HBAR revenue increased 147% QoQ to 190,000 HBAR.

Supply DynamicsThe Hedera Network’s native token, HBAR, serves multiple essential functions to the network. It facilitates payment of network usage fees and rewards Proof-of-Stake validators for operating and securing the network. Users can delegate their HBAR to participate in network validation and earn staking rewards. In the future, the network aims to enable staking for permissionless public validators.

At the end of Q3, 37.6 billion HBAR was in circulation, representing 75% of the fixed total 50 billion supply. HBAR is distributed each quarter as reported through the Hedera Treasury Management Report. The report forecasts that the circulating supply will increase by just under 287 million HBAR next quarter (Q4’24). The large majority of this supply growth will be used to foster the ecosystem and support open-source development.

Network Overview Usage

Usage

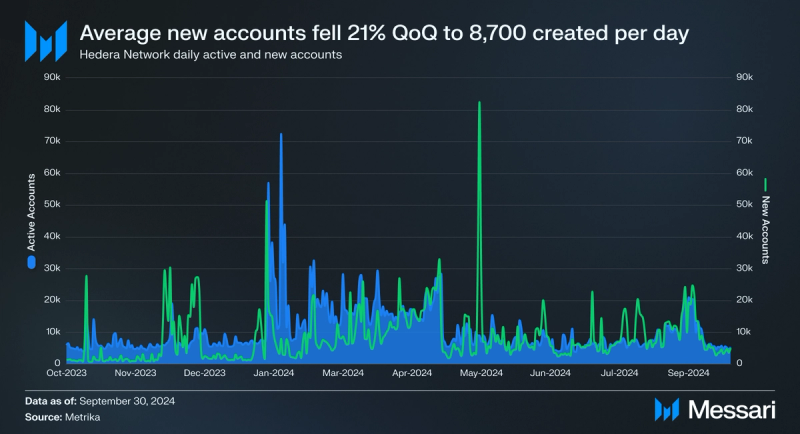

The daily average number of new accounts declined in Q3, down 22% from 11,100 to 8,700. Additionally, active accounts on the Hedera Network saw a 23% decline in Q3, going from 10,600 to 8,100.

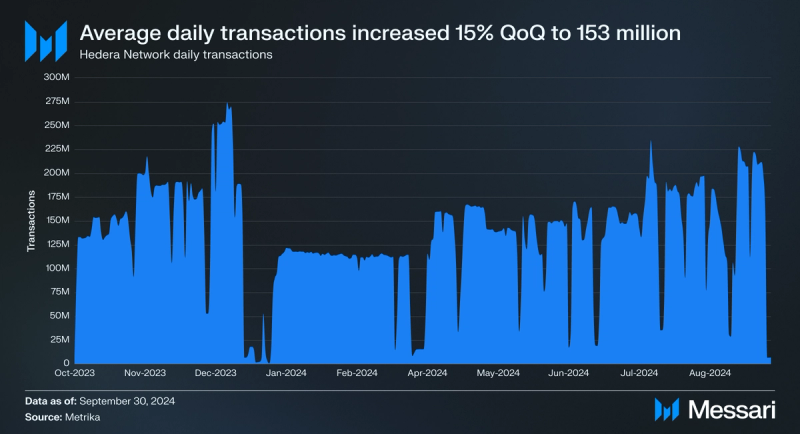

Following Q2’s rebound in average daily transactions, Q3 continued the trend, increasing by 15% QoQ from 133 million to 153 million. The Hedera Consensus Service remains the predominant source of this activity, responsible for 99% of all transactions on the network.

In Q3, the Hedera network reported 22.3 billion HBAR staked, representing 59% of the circulating and 45% of the total supply. This high staking percentage relative to the circulating supply can be attributed to entities such as Hashgraph. They stake their HBAR allocations and the Hedera Treasury to assist validators in meeting the minimum staking threshold to participate in network consensus. It’s worth mentioning that these entities have chosen not to collect staking rewards. Notably, 70% of staked HBAR do not receive rewards.

Development

Daily average contracts increased by 24% in Q3, growing from 129 to 160 active contracts. This growth was principally due to sporadic spikes seen throughout the month of September. Throughout the quarter, Hedera introduced various developer-focused tools and products via three network upgrades:

- V0.51 Upgrade (July 17) - This release introduced key enhancements through HIP-206 and HIP-906:

- HIP-206 defined a new function in the Hedera Token Service (HTS) system contract, enabling atomic transfers of HBAR, fungible, and non-fungible tokens. This feature exposes existing HAPI calls through smart contracts while honoring granted allowances. Key benefits include native royalty support on the EVM, direct interaction with HBAR and HTS tokens, the elimination of token wrapping, reduced complexity, and cost savings by streamlining asset interactions.

- HIP-906 added a new Hedera Account Service system contract, allowing developers to query and grant HBAR approvals directly within smart contracts through hbarAllowance and hbarApprove. This eliminates the need for context switching, introduces an account proxy for HBAR allowances, simplifies workflows, enhances security, and unlocks new use cases, particularly for DeFi applications and token marketplaces.

- V0.52 Upgrade (July 31) - The release introduced initial support for HIP-904:

- HIP-904 introduced the TokenReject function, enabling users to reject undesired tokens by transferring their full balance from their account to the treasury. It supports rejecting fungible and non-fungible tokens, handling up to 10 rejections in a single transaction while bypassing custom fees and royalties. This functionality allows users to manage their token holdings effectively by removing unwanted assets. Doing so protects them from scams or unsolicited airdrops and ensures they are not burdened with excessive or malicious fees. The account remains associated with the rejected tokens, offering flexibility for future transactions. This feature enhances user control over token portfolios and improves the overall token management experience.

- V0.53 Upgrade (September 11) - The release introduces several key enhancements through HIP-719, HIP-850, HIP-993, and continued development of HIP-904:

- HIP-719 allows token association and dissociation via a proxy facade contract, offering a syntax familiar to developers accustomed to ERC-20 and ERC-721 standards. This feature enables both externally owned accounts (EOAs) and contracts to call token functions, streamlining the development experience.

- HIP-850 enabled the Supply Key to update NFT metadata while the NFT is held in the treasury. This feature allows NFT owners to modify metadata while the asset is under treasury custody, ensuring unauthorized parties cannot alter it after distribution.

- HIP-993 enhanced record stream readability and extensibility by introducing itemized auto-creation fees, unified child consensus times, and clean hollow account completion records. Future improvements in release 0.54 will include rapid failure handling for throttled child transactions. These refinements streamlined transaction tracking and improved the clarity of the record stream for developers.

Asset Tokenization Studio is Hedera's open-source, end-to-end toolkit designed to simplify the configuration, issuance, and management of tokenized bonds and equities on the Hedera network. The studio converts real-world assets like stocks, bonds, and real estate into digital tokens on a blockchain or distributed ledger technology (DLT). In doing so, Asset Tokenization Studio enhances accessibility, liquidity, and transparency in financial markets. It allows issuers to create, manage, and operate digital securities in compliance with global regulations. As of writing, the studio adheres to U.S. SEC Regulations D (506-b and 506-c) and Regulation S, with plans to extend support to other jurisdictions.

Asset Tokenization Studio improves upon the basic ERC-1400 standard by enabling users to keep the entire asset's life cycle onchain. Components of the lifecycle include ownership, compliance components like KYC and whitelisting, document handling, and notifications. This reduces risks and operational complexities associated with maintaining data and actions offchain. The platform features a user-friendly web interface, built-in wallet integrations with popular wallets like MetaMask, HashPack, and Blade Wallet, and an open-source software development kit (SDK). The SDK allows developers to build custom tokenization solutions and deploy decentralized apps on the Hedera network.

The architecture of Asset Tokenization Studio is modular and multi-layered, consisting of core, define, and customize implementations. The core layer is based on the ERC-1400 standard. To ensure efficient and compliant token management, the core layer includes modules for access control, control lists, supply caps, pause functionality, locks, and snapshots. The define layer builds upon the core by defining various digital securities and processing corporate actions. In contrast, the customize layer allows issuers to tailor digital securities to comply with specific legal and regulatory requirements.

Asset Tokenization Studio leverages Hedera's unique network features to address compliance, security, and regulatory requirements, providing native KYC/AML account flags and high customizability. The studio was launched by key Hedera ecosystem partners, including RedSwan, ioBuilders, The HBAR Foundation, and Hashgraph, to offer solutions for KYC/AML compliance, custody, wallet integration, infrastructure management, smart contract monitoring, and regulatory compliance. Enhanced factory contracts automate and standardize the tokenization process, ensuring that all asset details are securely managed entirely onchain.

By keeping the entire asset lifecycle on Hedera, Asset Tokenization Studio reduces risks and operational complexities, thereby opening up new investment opportunities and enhancing market liquidity. This comprehensive framework paves the way for a better financial system, enabling end users and institutions to capture previously unrealized value within traditional markets.

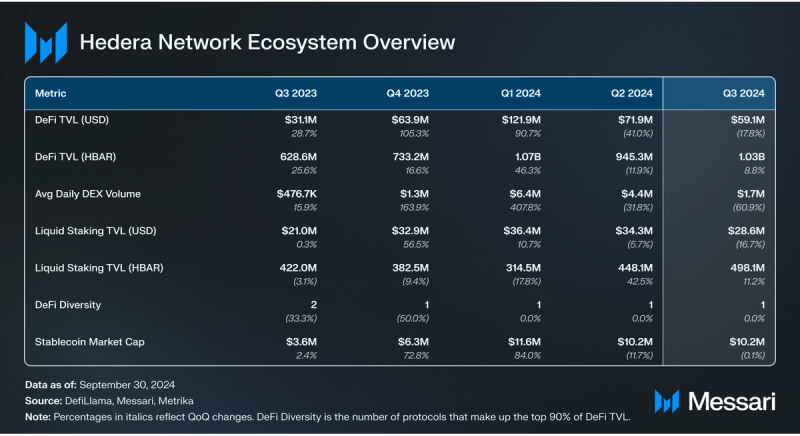

Ecosystem Overview DeFi

DeFi

This quarter, DeFi total value locked (TVL) on Hedera hit a yearly low in USD. TVL in USD moved down 18% QoQ from $71.9 million to $59.1 million. However, DeFi TVL in HBAR rose QoQ from 0.95 billion to 1.03 billion HBAR, marking a 9% increase QoQ. Furthermore, the delta between the decreases in USD TVL and increases in HBAR TVL suggests that the majority of the USD TVL decline was due to the depreciation in the price of HBAR, not capital outflows. At the end of the quarter, Hedera ranked #48 by TVL among blockchain networks, up three spots QoQ.

SaucerSwap introduced onchain governance for the protocol powered by Hedera’s Consensus Service this quarter. Not long after the announcement, a governance report was issued that reflected a substantial shift toward a more decentralized operational framework. The DAO now oversees both incentive programs and treasury management. In addition to managing V1 and V2 incentives, the DAO’s scope now includes key financial activities, such as the creation of yield farms, setting protocol fees, managing liquidity pools, and approving Liquidity-Aligned Reward Initiative (LARI) campaign allocations. This expanded role allows the DAO to adjust token emissions and make significant tokenomics changes, enhancing the protocol’s adaptivity to market dynamics.

In addition, the DAO now governs treasury operations, such as distributing protocol fees for SAUCE buybacks, handling HBAR staking rewards, and managing liquidity across SaucerSwap and other protocols. By directly controlling unallocated incentives and managing reward allocations, the DAO ensures efficient fund distribution while preventing liquidity fragmentation. This governance model attempts to align the interests of diverse stakeholders by offering a more sustainable and community-driven framework for long-term protocol development.

This quarter, SaucerSwap Labs introduced a 0.4% interface fee to enhance the protocol’s long-term sustainability. This fee applies exclusively to trades executed through the main interface and excludes stablecoin-to-stablecoin trades. Separate from existing swap fees, the interface fee is designed to fund operations and development by reducing reliance on SAUCE token emissions. The revenue generated will support infrastructure, marketing, and platform maintenance, ensuring the protocol’s continued growth. This aligns with industry practices, following the model established by Uniswap, and aims to balance user experience with sustainable development.

The rest of Hedera’s DeFi TVL is split across HbarSuite, HeliSwap, DaVinciGraph, and Pangolin. HbarSuite continues to solidify its position as the #2 DeFi protocol in the Hedera Network ecosystem. In Q3, HbarSuite ended the quarter with $2.8 million in TVL, an 8% dip in TVL QoQ. HeliSwap and Pangolin both saw downtrends in TVL, down 20% QoQ to $1.5 million and down 22% to $54,200, respectively. Meanwhile, DaVinciGraph experienced a 14% decrease in TVL, ending Q3 with $1.2 million in TVL.

DeFi Diversity measures the number of protocols constituting the top 90% of DeFi TVL. A higher DeFi Diversity score implies a larger distribution of TVL across protocols, not including liquid staking. A higher score also suggests a lower risk of widespread ecosystem contagion resulting from adverse events like exploits or protocol migrations. The Hedera network ended Q3 with a DeFi Diversity score of 1 (flat QoQ). Hedera’s score is so low because SaucerSwap alone accounts for more than 90% of Hedera’s DeFi TVL. Liquid staking is not included in DeFi TVL.

DEX volumes on Hedera continued to pull back after a bullish Q1. The average daily DEX volume decreased 61% QoQ from $4.4 million to $1.7 million. Compared to last year (Q3’23), the average daily DEX volume was 356% higher in Q3’24.

Essentially all DEX volumes (96%) on Hedera occur on SaucerSwap. In Q4’23, SaucerSwap introduced a concentrated liquidity (CL) AMM to its product suite (SaucerSwap V2). Due to this, SaucerSwap can offer more efficient pricing for token swaps, leading to higher volume. For example, prior to the launch of V2, SaucerSwap averaged $439,000 daily volume in Q3'23 (27% of SaucerSwap’s average daily DEX volume for Q3’24).

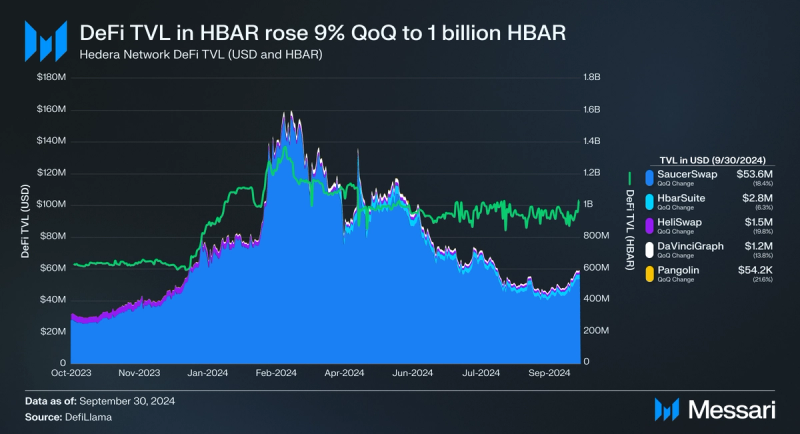

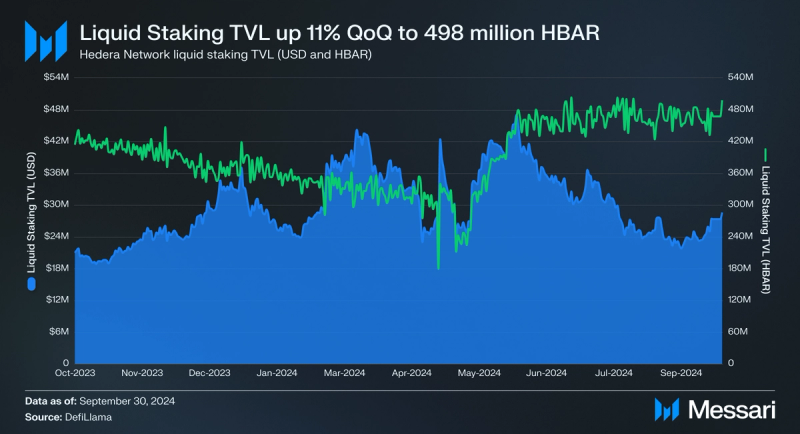

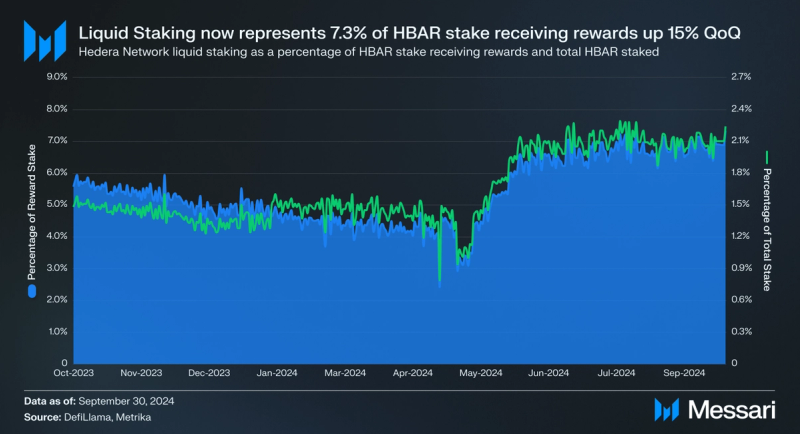

Although liquid staking TVL is not included in the DeFi TVL figure, it remains a relevant metric with growing significance. Stader is the only provider of liquid staking on the Hedera network, with $28.6 million in TVL. Liquid staking USD TVL was down 17% QoQ, moving from $34.3 million to $28.6 million. This drawdown in USD TVL was due to the 20% pullback HBAR price experienced in Q3 and not capital outflows. On the contrary, liquid staking TVL in HBAR experienced capital inflows QoQ rising 11% from Q2 to 498.1 million HBAR staked by the end of Q3.

The HBAR Foundation’s DeFi growth initiative made liquid staking a priority of the program, and it appears to have spurred the growth of liquid staking on Hedera. Liquid staking as a percentage of HBAR stake receiving rewards increased 15% QoQ, ending the quarter representing 7.3% of the total HBAR stake receiving rewards on Hedera.

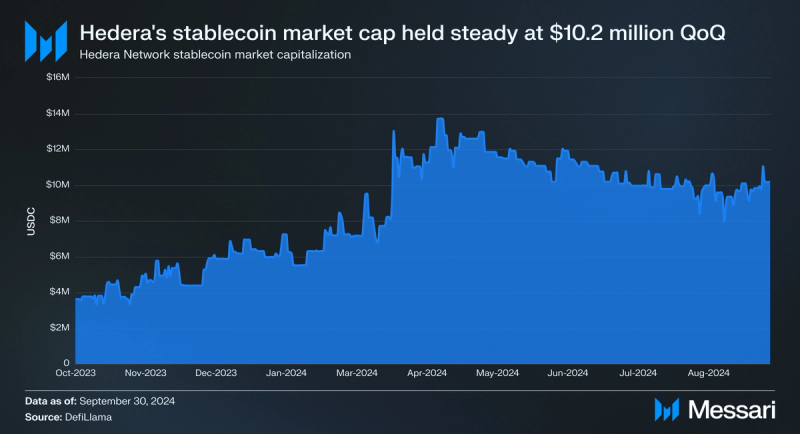

The only natively deployed stablecoin on the Hedera Network is USDC. USDC on Hedera was very stable QoQ, maintaining a market cap of $10.2 million. As of writing, 261,000 USDC, 222,000 USDT, and 98,000 DAI have been bridged to Hedera, representing roughly 5% of the natively issued USDC market cap. A significant portion of natively issued USDC and bridged stablecoins are used in Hedera’s DeFi ecosystem.

The largest native USDC DEX deposits include:

- USDC/HBAR - 1.3 million - SaucerSwap (V1)

- USDC/HBAR - 215,000 - SaucerSwap (V2)

- USDC/USDC[hts] - 264,000 - SaucerSwap (V2)

- USDC/HSUITE - 154,000 - HbarSuite

- USDC/SAUCE - 103,000 - SaucerSwap (V1)

The largest bridged stablecoin DEX deposits include:

- USDC[hts]/USDT[hts] - 107,000/196,000 - SaucerSwap (V2)

- USDC[hts]/DAI[hts] - 33,000/98,000 - SaucerSwap (V2)

Karate Combat is a full-combat karate league that offers fans a unique entertainment experience and has contributed to a large amount of activity on the Hedera network. Fans vote on who they believe will win a match via Karate Combat’s mobile application, the web application, or on Snapshot. This voting process is called “playing” by the protocol and uses KARATE tokens. When fans correctly predict the winner of a match, they are rewarded with KARATE tokens, and if they are wrong in their prediction, they lose nothing.

The KARATE token is available on Hedera and Ethereum, but there are some differences depending on where users have their tokens and how they want to play. Fans who cast their votes on the Karate Combat mobile application will be using the Hedera network to do so. In contrast, both Hedera and Ethereum wallets are available to users of the web application. Fans with KARATE tokens on Ethereum can also vote through Snapshot if they want to. Additionally, fans voting on Ethereum will need to claim their KARATE token rewards after correctly predicting the outcome of a match, whereas fans using the mobile application powered by Hedera will have their KARATE tokens airdropped to them.

The KARATE token is also used as the league's governance token. After suggestions for the league's ruleset are fleshed out in the governance forum, KARATE holders can vote on the proposals. The most recent rule change was KICK-10, which sought to allow elbow strikes.

Karate Combat events are free to watch and can easily be found on their YouTube channel, amongst other platforms. They have amassed over 700,000 subscribers and frequently get 100,000 views on their event streams.

Network Services Overview

The Hedera Network Services are the core offerings of the Hedera network. These services include the Consensus Service, Smart Contract Service, and Token Service. All these services are supported by the Hashgraph algorithm and offer official SDKs for accessing the API in programming languages such as JavaScript, Java, Go, and Swift, as well as community SDKs supporting .NET, Python, and Venin SDK for JavaScript. Each service has its intended use and primary users, and usage frequency varies depending on the service.

Consensus Service

The Hedera Consensus Service enables the verifiable time-stamping and ordering of events for Web2 and Web3 applications. Users submit messages to the Hedera Network, where the messages are time-stamped and ordered by the Hashgraph algorithm. These messages form an auditable history of verifiable and trustless events. The Consensus Service is utilized by various applications such as tracking supply chain provenance, logging asset transfers between blockchain networks, counting votes in a decentralized autonomous organization (DAO), monitoring Internet of Things (IoT) devices, and more.

In Q3, the Hedera Consensus Service extended the same trends seen in the prior quarter — increasing transactions and decreasing active accounts. Consensus Service daily average transactions increased 15% QoQ to reach a yearly high of 152.7 million, while daily average active accounts dipped 37% to a yearly low of 1,100.

One avenue of growth for the Hedera Consensus Service in 2024 has been inscriptions, specifically Hashinals (HCS-5). Hashinals enable metadata to be stored entirely onchain through the Hedera Consensus Service. Unlike traditional NFTs, Hashinals typically store metadata offchain. As of writing, over 140,000 Hashinals have been minted on the Hedera Consensus Service.

Crypto Service

The Hedera Crypto Service plays a vital role in tracking the flow of HBAR throughout the ecosystem, making the asset more liquid and mobile. Through this service, users can perform essential operations on the Hedera Network, including creating and managing accounts, transferring HBAR, fungible, and non-fungible tokens, rotating account keys, and approving account allowances.

After increasing for three consecutive quarters, Hedera’s Crypto Service transactions decreased. Daily average transactions slid 26% QoQ from 249,000 to 184,000. Moving lockstep were active accounts using Hedera’s Crypto Service, which dropped by 25% QoQ from 3,800 to 2,800.

Smart Contract Service

The Hedera Smart Contract Service enables developers to create and deploy smart contracts on Hedera. The service works with the Hedera Token Service to enable users to create and deploy fungible and non-fungible tokens. The service is also EVM-compatible via the HyperLedger Besu EVM client, providing support for Solidity-based smart contracts and core Ethereum tooling.

Over the past year, Hedera has been focused on improving both the developer and user experience for the Hedera Smart Contract Service. As a result, daily average transactions and active accounts increased significantly. However, Q3 saw the continuation of the Q2 drawdown of the aforementioned gains. In Q3, daily average transactions slid 38% QoQ from 63,000 to 39,400, and daily average active accounts dropped 13% QoQ from 5,000 to 4,300. Despite the downward trend, both daily average active accounts and transactions in Q3 were significantly higher than what was seen in any quarter in 2023.

Improvements around the Smart Contract service continue to be worked on, as seen through a variety of HIPs. For example, HIP-632 simplifies signature verification in smart contracts, enhances Hedera-Ethereum authorization compatibility, and improves the developer experience by streamlining transaction authentication.

Token Service

The Hedera Token Service allows users to mint and manage custom fungible and non-fungible tokens on Hedera. Tokens issued on Hedera are also configurable with customizable parameters such as account KYC verification, freeze, token supply management, transfer, etc. Token transfers on Hedera always cost a transaction fee of $0.0001 USD, paid in HBAR.

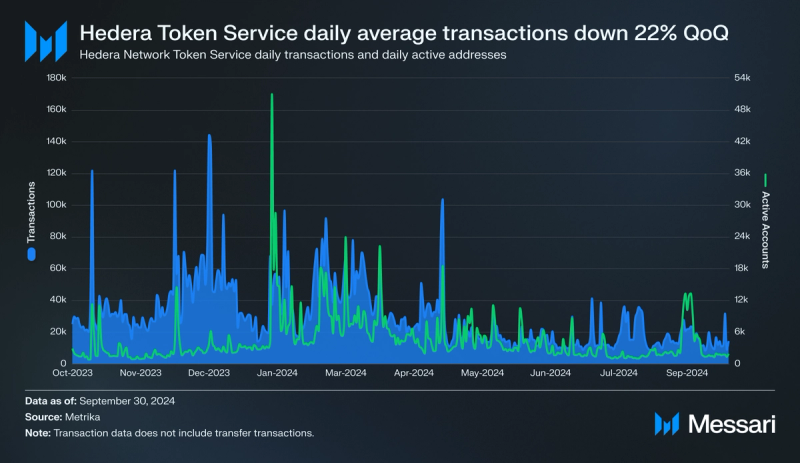

The average daily transactions for Hedera’s Token Service were down 22% QoQ from 21,400 to 16,700. The average daily active addresses followed this downturn and dipped 38% QoQ from 4,500 to 2,800.

At the beginning of Q3, the V0.51 upgrade implemented HIP-206. The proposal defines a new function in the Hedera Token Service (HTS) system contract, enabling atomic transfers of HBAR, fungible, and non-fungible tokens. Additionally, at the end of September, the V0.53 upgrade implemented HIP-850, which enables the Supply Key to update NFT metadata while the NFT is held in the treasury. This feature grants NFT owners the flexibility to modify metadata while the asset is under treasury custody, ensuring unauthorized parties cannot alter it after distribution.

Closing SummaryHedera introduced several key developments in Q3, namely the launch of the Asset Tokenization Studio, an open-source toolkit for issuing and managing tokenized bonds and equities. The network reported a significant increase in key metrics, with revenue in HBAR rising by 85% and daily active contracts up by 24%. DeFi TVL in HBAR also grew 9%, though USD-denominated TVL declined by 18% due to the drop in HBAR’s price. Network upgrades improved functionality by enabling atomic transfers, NFT metadata updates within treasuries, and token association enhancements. Karate Combat further increased network engagement, with most KARATE being played on Hedera. Despite market cap and price corrections, the Hedera ecosystem expanded with increased staking activity and smart contract upgrades, positioning the network for more adoption in DeFi and gaming.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.