and the distribution of digital products.

State of Filecoin Q1 2025

- By the end of Q1 2025, over 5,000 unique contracts had been deployed on the Filecoin Virtual Machine (FVM), supporting over 3.2 million transactions.

- Filecoin is approaching the launch of Proof of Data Possession (PDP) and preparing for the Filecoin Fast Finality (F3) upgrade to accelerate transaction settlement.

- The ecosystem expanded partnerships across AI and blockchain networks, with projects like Aethir, KiteAI, and Cardano (Blockfrost) adopting Filecoin for decentralized, verifiable data storage.

- In March 2025, the Filecoin Community launched FIL ProPGF, an onchain funding program for public goods. Applications are open and the first grants are expected by May.

- USDFC, a FIL-collateralized stablecoin developed by Secured Finance, introduces a native USD-pegged asset to the Filecoin ecosystem. It enables stable payments and DeFi participation by allowing users to borrow against FIL without liquidating their holdings.

Filecoin (FIL) is building a marketplace for data services, with the first service being archival storage on top of the InterPlanetary File System (IPFS). Filecoin uses a market-driven model where users negotiate storage deals with providers at variable pricing. A storage deal acts like a service agreement, where users pay providers to store data for a specified duration.

Filecoin uses an incentive model based on cryptographic proofs, Proof of Replication (PoRep) and Proof of Spacetime (PoSt), to verify that storage providers reliably store client data over time. Providers are rewarded with FIL, the network’s native token, for participating in storage deals. Storage providers are slashed if they fail to provide reliable uptime or act maliciously against the network.

To retrieve data, Filecoin users pay a retrieval provider to fetch data. Unlike storage deals, which involve transactions onchain, retrieval deals use payment channels to settle payments offchain, to enable faster retrieval. Besides storage and retrieval, Filecoin aims to offer an open market where compute power can be contracted to run over data, providing more efficient alternatives to traditional centralized systems. Key protocol upgrades to enable compute-over-data services include smart contracts (the Filecoin Virtual Machine - FVM) and scaling (Interplanetary Consensus - IPC).

Key Metrics Performance AnalysisNetwork Overview

Performance AnalysisNetwork OverviewFilecoin is primarily used to decentrally store data through two parties:

- The demand side, i.e., storage users needing data storage.

- The supply side, i.e., storage providers with excess storage capacity.

The amount of data stored in active storage deals between users and storage providers gauges the demand for Filecoin storage.

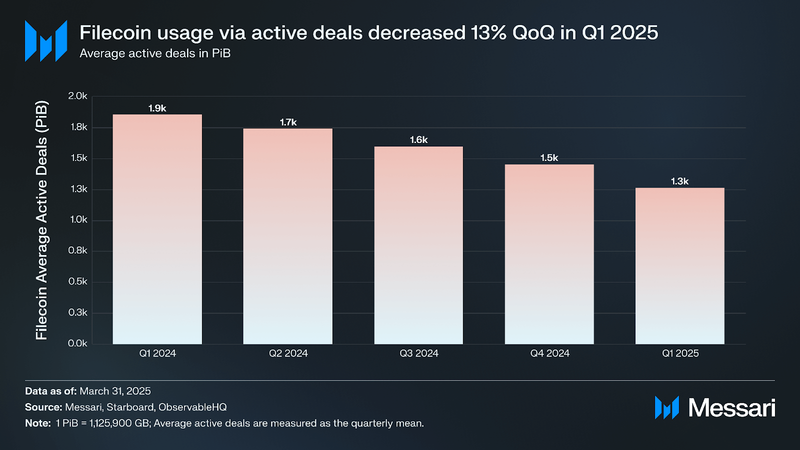

Storage Deals

In Q1 2025, approximately 1,300 petabytes (PiB) of data were stored on Filecoin through active storage deals, a 13% decline from 1,500 PiB in Q4 2024. The number of active storage deals also fell 13% QoQ, from 43 million to 38 million. This reduction aligns with a broader strategic pivot from maximizing raw storage volume to emphasizing high-value, enterprise-oriented storage solutions.

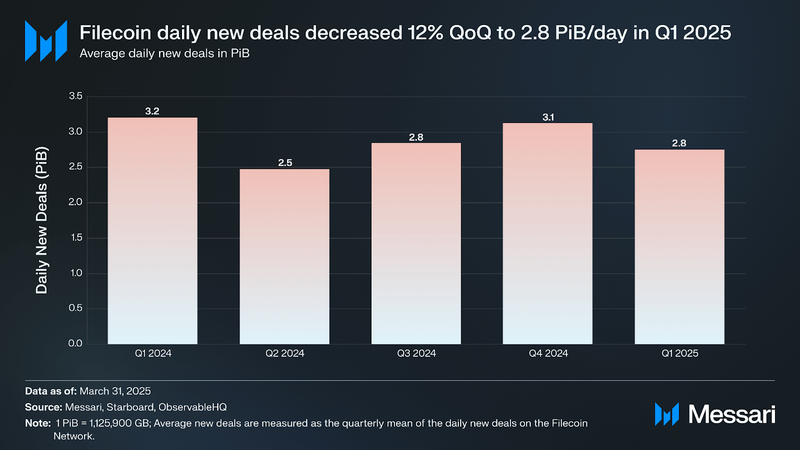

In Q1 2025, daily new storage deals on Filecoin fell 12% QoQ, from 3.1 PiB to 2.8 PiB. Total active deals declined by 13%, from 43 million to 38 million.

The drop reflects a strategic shift toward more selective, long-term storage use cases during the quarter. Filecoin partnerships with organizations like the Smithsonian, Internet Archive, and MIT focused on preserving valuable cultural and academic data. These deals are typically larger and longer in duration, leading to fewer overall deals but higher-value storage.

In parallel, projects like Aethir, KiteAI, and Storacha continued adopting Filecoin for reliable, verifiable storage, focusing on quality and long-term integrity over raw deal volume.

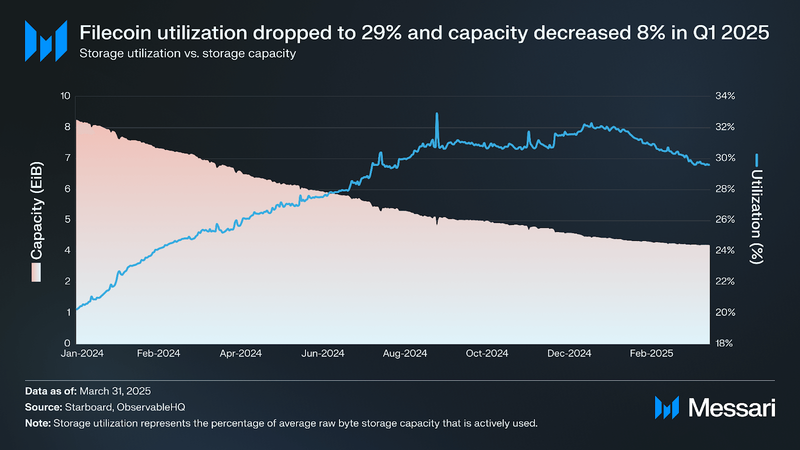

Utilization vs. Capacity

In Q1 2025, Filecoin’s storage utilization rate declined to 30%, down from 32% in Q4 2024. This was driven mainly by an 8% drop in raw byte capacity, from 4.2 exbibytes (EiB) to 3.8 EiB, as many storage providers exited the network.

These shifts reflect Filecoin’s continued move away from incentivizing idle capacity and toward supporting high-value, long-term storage. Since peaking at 17 EiB in Q3’22, total storage capacity has steadily decreased as block rewards declined and incentives were restructured to favor verified data, durable deal execution, and retrieval performance. The Network v25 upgrade in March 2025 raised participation standards by streamlining deal efficiency and preparing for Fast Finality, which will reduce settlement times and require more responsive infrastructure.

ClientsAs per Messari’s guide on decentralized storage networks, Filecoin is geared toward providing cold storage solutions (e.g., archival and recovery) for enterprises and developers. Low storage prices make it an attractive option for businesses looking to store large volumes of data affordably. However, with the launch of Proof of Data Possession (PDP), Filecoin has started to expand beyond cold storage. PDP enables lightweight, ongoing verification of stored data, making the network more viable for use cases that require more frequent access and reliability. This also lays the groundwork for supporting more dynamic, S3-like storage scenarios natively within the network.

DeStor, a service provider on Filecoin that connects clients to storage providers, partnered with Qamcom Decentralised Data Security (DDS) to support a range of storage use cases. This includes data clients like YayPal, a Web3 gaming studio with over 500,000 users, and Fieldstream, an AI marketing analytics platform. Recent examples of client adoption span both archival (cold) and hot storage use cases:

- GhostDrive: Prioritizes privacy and security through encryption, decentralization, and advanced storage optimization techniques.

- Seal: Provides storage onramps for large clients such as UC Berkeley, Starling Labs, the Atlas Experiment, and the Casper Network.

- CIDGravity: Focuses on enterprise integrations with open-source platforms like Nextcloud.

- Heurist and 375ai (via Akave): Leverage Filecoin for AI and DePIN data storage.

- Humanode and Gaianet (via Storacha): Use Filecoin for identity systems and AI data infrastructure.

- FanTV (via Lighthouse): Utilizes decentralized video storage and delivery.

- Intuizi: A Web2 SaaS company applying Filecoin to improve marketing data pipelines.

- The Defiant: A Web3 media outlet archiving investigative journalism and reports.

Beyond these examples, additional storage solutions, including Lighthouse, RIBS, Retriev, and Flamenco are driving adoption across both traditional and emerging storage workloads.

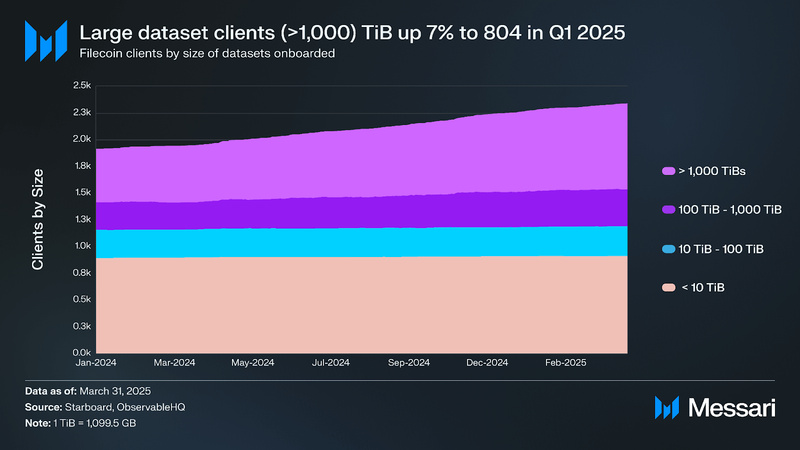

By the end of Q1 2025, Filecoin hosted 2,340 onboarded datasets, representing a 3% QoQ increase from 2,263 datasets in Q4 2024. Of these, 804 clients onboarded large-scale datasets exceeding 1,000 TiB, indicating ongoing interest in decentralized storage for high-volume, long-term use cases.

This continued growth was supported by the effects of FIP-0092, introduced during the Waffle upgrade in Q3 2024, which implemented Non-Interactive Proof of Replication (NI-PoRep) to reduce proving complexity and lower onboarding costs. Additionally, momentum was reinforced in Q1 2025 by the ecosystem’s strategic shift toward high-value, durable storage use cases, with major archival initiatives (Smithsonian Institution, Internet Archive, MIT Open Learning) and AI-focused projects (Aethir, KiteAI, Akave) onboarding significant datasets.

The network’s preparation for the Proof of Data Possession (PDP) launch also incentivized the onboarding of verifiable, long-term storage clients, as Filecoin increasingly positioned itself as infrastructure for cultural preservation, AI data lakes, and multichain blockchain data archiving.

FVM TractionAs part of its broader shift from a storage-only network to a programmable data infrastructure layer for AI and Web3 applications, Filecoin launched the Filecoin Virtual Machine (FVM) in March 2023. The FVM enables Ethereum-style smart contracts directly on top of Filecoin’s storage layer, allowing developers to build applications that automate data onboarding, pricing, retrieval, and compute coordination. Since its launch, adoption has steadily grown; by March 31, 2025, over 5,000 unique contracts had been deployed on the FVM, facilitating more than 3.2 million transactions.

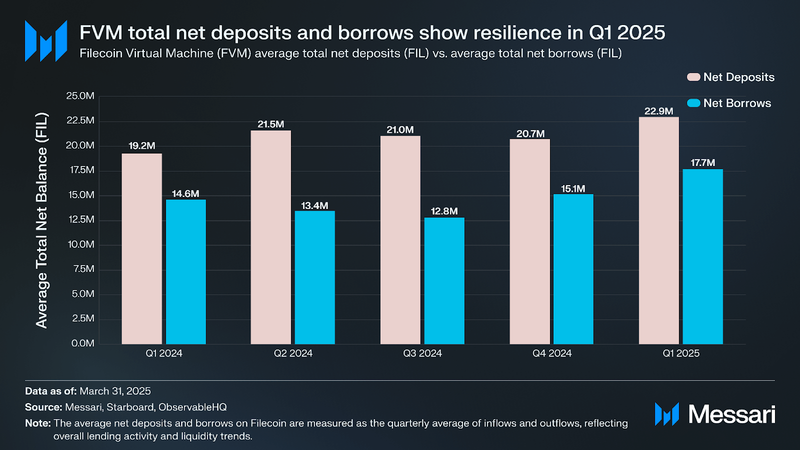

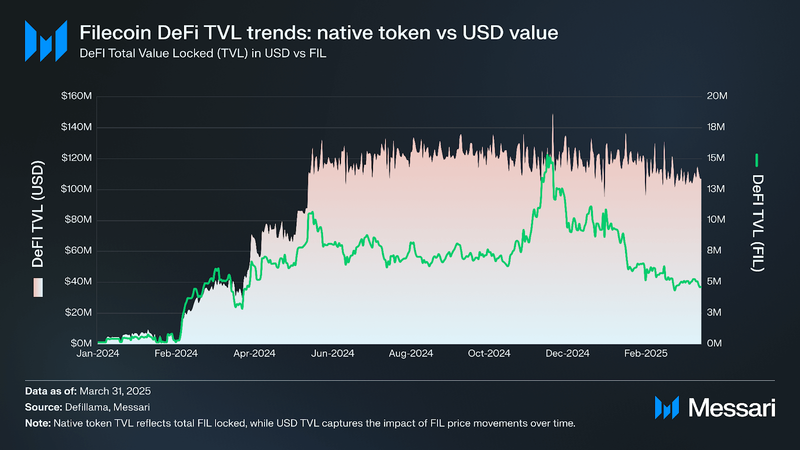

In contrast, native token activity measured in FIL showed continued growth. Inflows rose to 23 million FIL (+11% QoQ), while outflows increased to 18 million FIL (+17% QoQ). This growth in FIL-denominated activity occurred despite a 44% drop in FIL's price during the quarter, suggesting expanding usage of Filecoin-native services. The divergence between token volume growth and declining USD value indicates increased engagement with Layer-2 solutions and decentralized storage use cases, including AI-related datasets.

Financial OverviewFilecoin's revenue model shares similarities with Ethereum due to its EIP-1559-inspired gas system, where some network fees are burned to regulate congestion. However, unlike Ethereum, Filecoin’s economy is storage-driven, with storage users paying fees and storage providers earning revenue while managing collateral and penalties.

Network Fees

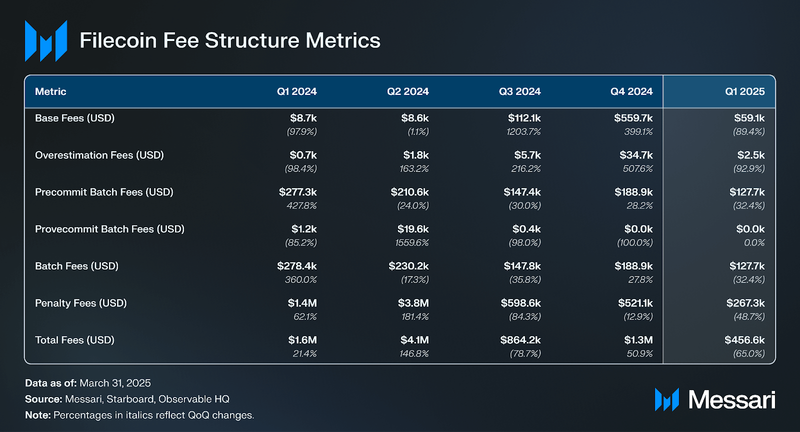

As per Messari's revenue analysis, Filecoin's fees comprise of:

- Base Fees: Determined by blockspace congestion and required by any storage proof.

- Batch Fees: Used for bundling storage proofs to optimize costs.

- Overestimation Fees: Required to optimize gas usage.

- Penalty Fees: Collected for storage provider failures.

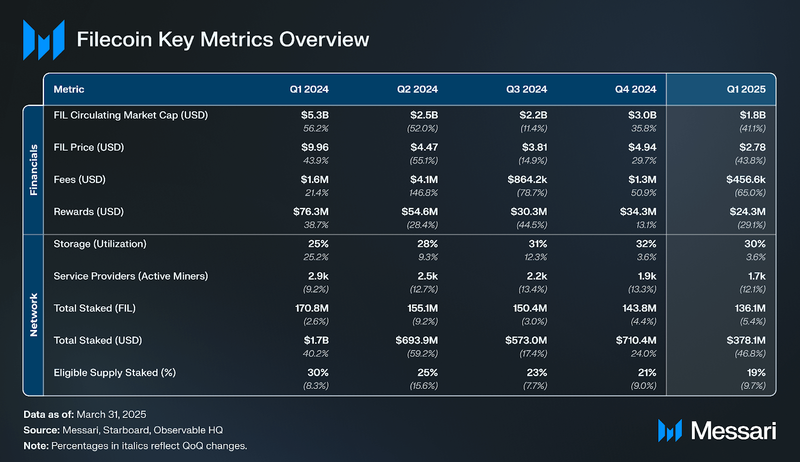

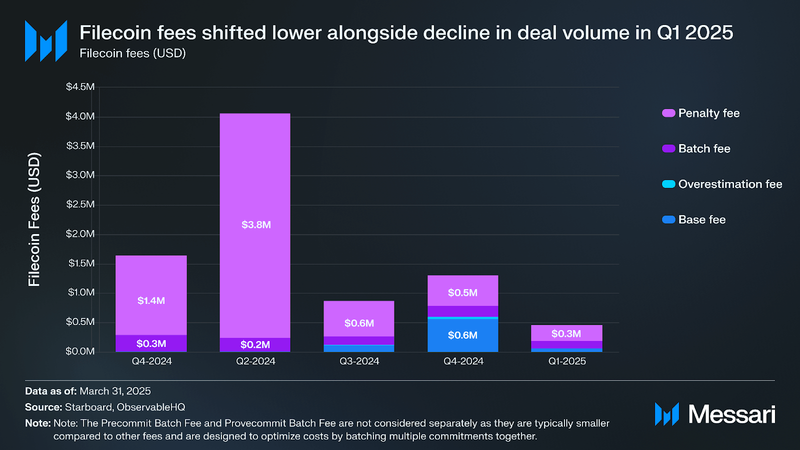

In Q1 2025, Filecoin’s total network fees fell to $457,000, down 65% QoQ from $1.3 million in Q4 2024, reflecting reduced activity as daily storage deals declined 12% QoQ.

- Base fees dropped 89% QoQ to $59,000, reversing from the temporary spike in Q4 2024 and indicating lower network congestion.

- Overestimation fees fell 93% QoQ to $2,500, suggesting improved gas estimation and reduced transaction volatility.

- Batch fees, which cover Precommit and Provecommit operations, declined 32% QoQ to $130,000, consistent with slower storage onboarding and fewer new storage deals.

- Penalty fees decreased 49% QoQ to $270,000, continuing a multi-quarter downtrend as the network consolidates around more reliable, enterprise-oriented providers.

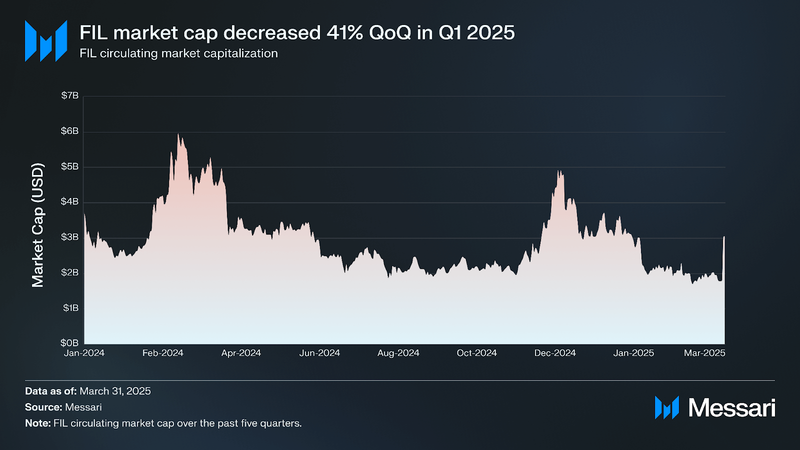

In Q1 2025, FIL’s circulating market cap (USD) declined 41% QoQ to $1.8 billion, down from $3.0 billion in Q4 2024. The decline was driven by a 44% QoQ drop in FIL’s token price, which fell from $4.94 to $2.78 while circulating supply grew 4.7% QoQ to 646.2 million FIL, consistent with previous issuance rates.

DeFi Ecosystem

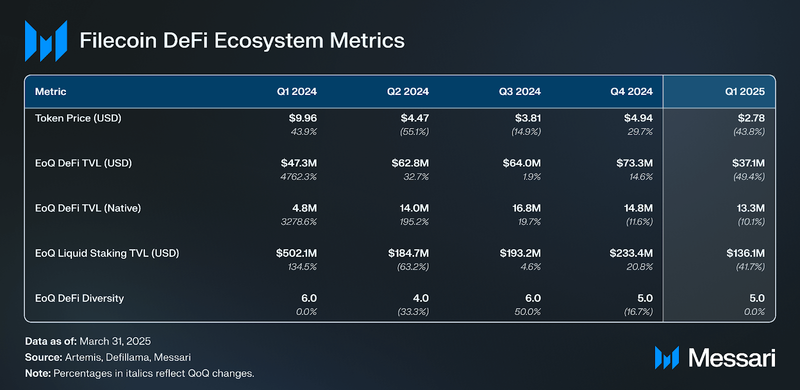

Liquid staking TVL fell to $136 million, down 42% from $233 million in the previous quarter, driven by the drop in FIL’s price and a slowdown in staking inflows. The eligible staked ratio also declined from 21% to 19% QoQ, reflecting a more cautious approach among token holders amid market volatility.

TVL Trends

Filecoin’s DeFi TVL grew steadily through late 2024 but slowed in Q1 2025. TVL declined 49% QoQ, from $73 million in Q4 2024 to $37 million in Q1 2025. In contrast, TVL (FIL) dropped only 10%, from 15 million to 13 million. The discrepancy was primarily due to a 44% decline in FIL’s price during the quarter.

Qualitative AnalysisKey DevelopmentsNetwork v25 Upgrade ("Teep"): The Network v25 upgrade ("Teep"), deployed on March 26, 2025, introduced protocol improvements to optimize storage operations and prepare for Fast Finality (F3). Key changes included:

- Streamlined termination fee calculations for storage providers.

- Added transient storage support in the Filecoin EVM (FEVM) to enhance Ethereum compatibility.

- Implemented consensus updates required for F3 activation.

The upgrade improves network efficiency, expands smart contract functionality, and sets the foundation for reduced transaction finality times.

Filecoin Fast Finality (F3): The Fast Finality (F3) upgrade aims to reduce transaction finality times on the Filecoin network from approximately 7.5 hours (900 epochs) to just minutes (4 epochs), representing a 100x improvement. Announced in Q3 2024, F3 underwent passive testing during late Q4 2024, with refinements extending into Q1 2025. While the Bootstrap phase performed successfully, challenges during the Steady State phase, including inconsistent progress and bandwidth concerns, led to a revised deployment timeline. Mainnet activation is now targeted for Q2 2025 alongside the Network v25 ("Teep") upgrade, which will introduce additional consensus optimizations.

F3 enhances transaction throughput, smart contract execution, and cross-chain functionality. It implements the MCOPY opcode (EIP-5656 support) to optimize Solidity contract performance and introduces historical randomness retrieval to improve decentralized application security.

For storage providers, F3 is designed to streamline onboarding and deal execution by significantly reducing finalization times, enabling faster transaction settlements and more reliable Service Level Agreements (SLAs) without requiring additional hardware upgrades. The upgrade also improves node efficiency, making light clients more accessible and resource-efficient for new network participants.

Proof of Data Possession (PDP): Proof of Data Possession (PDP) approached mainnet launch at the end of Q1 2025, following final contract optimizations, external audits, and integration testing with early adopters such as Storacha and Akave.

PDP is a verification system designed to periodically check that storage providers continue to hold client data without fully retrieving or decoding the files. It complements Proof of Replication (PoRep), which verifies that data was initially stored correctly, by adding an ongoing, lightweight method to ensure long-term storage integrity throughout a deal’s duration.

Layer-2 Scaling & Cross-Chain Storage: Introduced at FIL Bangkok in November 2024, Filecoin’s new Layer-2 solutions, Basin, Akave, and Storacha, continued development during Q1 2025 to enhance decentralized storage scalability, AI adoption, and multichain interoperability.

- Basin expanded early usage with applications like WeatherXM and Recall Network, integrating hot and cold storage with S3 compatibility.

- Akave advanced its Yucca testnet, building AI-optimized Data Lakes backed by ZK-proofs to ensure data integrity and reduce egress costs.

- Storacha continued operating in closed alpha, focusing on verifiable data ownership and sharded file management for large AI datasets.

These developments are expected to benefit further from the Proof of Data Possession (PDP) launch, enabling more efficient hot storage solutions across Filecoin.

Partnership and Ecosystem Expansions- Filecoin x Cardano and Solana: Cardano’s Blockfrost and Solana’s Old Faithful initiatives expanded decentralized storage adoption by archiving blockchain data on Filecoin. Blockfrost, a key API service supporting Cardano developers, integrated Filecoin to back up IPFS node clusters and provide more resilient, decentralized data storage for Cardano applications. Similarly, the Old Faithful uses Filecoin to preserve Solana’s full historical ledger, reducing reliance on centralized storage.

Decentralized AI Data Storage: Several projects expanded their use of Filecoin in Q1 2025 to store AI-related datasets in a decentralized, verifiable manner.

- Aethir: A decentralized cloud platform optimizing GPU resources for AI workloads.

- KiteAI: Develops infrastructure for AI agents based on verifiable, decentralized data sourcing.

- Nuklai: Focuses on building decentralized knowledge graphs and data marketplaces.

- SingularityNET: Integrates Filecoin for metadata storage and secure management of decentralized AI services.

Decentralized AI Agent Infrastructure: Several projects leveraged Filecoin to support decentralized AI agent operations through verifiable coordination, reputation, and execution proofs.

- Recall: Builds decentralized reputation systems for AI agents using immutable data proofs.

- Theoriq: Facilitates coordination among AI agents by providing open, verifiable access to decentralized datasets.

- Ungate AI: Develops decentralized identity systems and execution proof mechanisms for AI agent interactions.

Developer Initiatives and Community Growth:

- FIL ProPGF Launch: In March 2025, Filecoin Foundation launched the FIL ProPGF, a proactive, onchain funding mechanism to support public goods development across the Filecoin ecosystem. Applications opened immediately, with early funding decisions expected by May 2025. The program prioritizes projects in tooling, research, governance, user experience (UX) improvements, and customer success initiatives, aiming to create sustainable, community-driven innovation.

- FILFrame Toolkit: Filecoin Foundation released the FILFrame Toolkit in early 2025 to simplify frontend development for Filecoin-based applications. It provides ready-to-use React components and TypeScript utilities that help developers more easily integrate storage functionality, smart contract interactions, and network tools into decentralized applications (dApps) built on Filecoin.

- Portrait Public Beta: Portrait, a decentralized website builder, launched its public beta in early 2025 on Base Sepolia, an Ethereum Layer-2 testnet. It enables users to create and publish peer-to-peer websites by storing content on IPFS and backing it with Filecoin for permanent decentralized hosting. The platform aims to make decentralized web publishing more accessible by removing the need for centralized servers.

- Drips x FIL-RetroPGF-2: FIL-RetroPGF-2 grant recipients were encouraged to adopt the Drips toolkit to allocate funding toward critical upstream dependencies, promoting a sustainable funding ecosystem.

Recognition and Events:

- Filecoin AI Blueprints Hackathon: A four-week hackathon organized with Encode Club, focused on building decentralized AI infrastructure, emphasizing data provenance, storage, and integrity.

- FIL Dev Summit 6: Scheduled for May 12–13, 2025, in Toronto, with virtual kickoff sessions running from April 23–30 to support builders focused on storage, retrieval, and governance tooling.

- Storage Cultural Preservation: In Q1 2025, over 500,000 culturally significant digital artifacts were archived onto Filecoin as part of large-scale preservation initiatives. Institutions such as the Smithsonian Institution, Flickr Foundation, Internet Archive, MIT Open Learning, and Starling Lab partnered with Filecoin Foundation to safeguard historical records, photographs, educational content, and government web archives.

These efforts focused on ensuring long-term data resilience, reducing dependence on centralized servers, and preserving critical cultural heritage across public, academic, and historical institutions. Examples include the Smithsonian’s early audio recordings archive, Flickr Commons’ photography collections, the Internet Archive’s End of Term Web Archive, and MIT’s OpenCourseWare repository.

- Media and Research Expansion: Several journalism, research, and academic organizations expanded their use of Filecoin during Q1 2025 to protect contemporary information assets. The Defiant, a Web3 media outlet, began archiving its investigative journalism on Filecoin to address risks like link rot and content censorship. Rolling Stone extended its decentralized media initiatives by securing parts of its digital archives. MIT Open Learning and UC Berkeley enhanced their decentralized storage strategies to protect educational course materials, open research data, and institutional records.

- Security Program Expansion: Filecoin Foundation expanded its decentralized incident response network, increased the scope of chaos testing and fuzzing, continued growing its bug bounty program (awarding over $650,000 to date), and launched a vetted Auditor Network to streamline security audits.

- FilPoll V2 Launch: In February 2025, the Filecoin Foundation launched FilPoll V2, a governance tool combining Filecoin Improvement Proposals (FIP) tracking, sentiment polling, and community proposal reviews. The upgrade aims to improve transparency, surface broader community input, and support more inclusive decision-making within the Filecoin governance process.

- Governance Milestone: The community surpassed 100 FIPs reviewed to date, reflecting growing protocol engagement.

- FIDL Reporting Initiatives: The Filecoin Incentive Design Lab (FIDL) launched new reporting dashboards for clients, storage providers, and allocators, enhancing metrics visibility and retrievability tracking across the network.

- Stablecoin Development (USDFC): In Q1 2025, Filecoin's financial tooling expanded with growing interest in USDFC, a FIL-collateralized stablecoin developed by Secured Finance. USDFC allows users to transact in a USD-pegged asset without liquidating FIL, supporting new use cases across DeFi, long-term deal execution, and storage payments. During the quarter, USDFC offered up to 9.45% APR on 6-month terms, attracting interest from users seeking stability amid FIL price volatility. Early use cases spanned media archiving, AI workloads, and Web2 data platforms. As Filecoin’s ecosystem evolves, USDFC may play a larger role in enabling predictable pricing and expanding the adoption of decentralized storage services.

In Q1 2025, Filecoin continued its strategic transition from emphasizing raw storage volume to prioritizing high-value, enterprise-grade users and storage providers. Although active storage deals and network utilization declined, these shifts reflected a deliberate pivot toward long-term archiving, AI-optimized datasets, and Web2/Web3 enterprise integrations.

Key developments during the quarter included the near-finalization of Proof of Data Possession (PDP) for continuous data verification, ongoing Layer-2 scaling initiatives (Basin, Akave, Storacha), and preparation for the Fast Finality (F3) upgrade to improve transaction settlement speeds. Despite a 41% drop in FIL’s market cap and a 49% decline in DeFi TVL (USD), native FIL-denominated activity remained resilient, supported by new client onboarding and retrieval market growth.

The ecosystem expanded through partnerships with major networks (Cardano, Solana) and AI infrastructure projects (Aethir, KiteAI, Nuklai). New community initiatives like FIL ProPGF and governance upgrades like FilPoll V2 strengthened decentralized participation. Large-scale cultural preservation efforts, media partnerships, and recognition in initiatives like Impact Base further demonstrated Filecoin’s real-world impact.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.