and the distribution of digital products.

State of Cardano Q4 2024

- Ouroboros Peras, an extension of Ouroboros Praos, was announced in Q4. The update improves the network's scalability by working with scaling solutions like Hydra and Mithril.

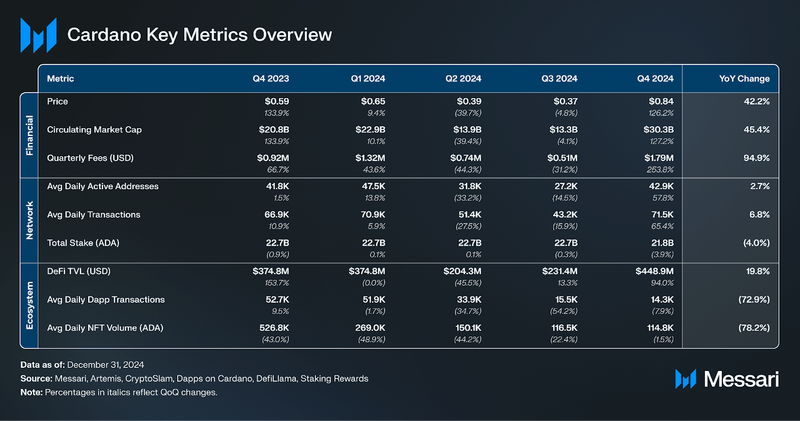

- The circulating market cap of ADA increased by 127% QoQ to $30.3 billion. ADA’s circulating market cap rank rose from 11th to 9th.

- Fees (USD) increased by 254% QoQ to $1.8 million, driven by a 65% increase in average daily transactions that reached 71,500.

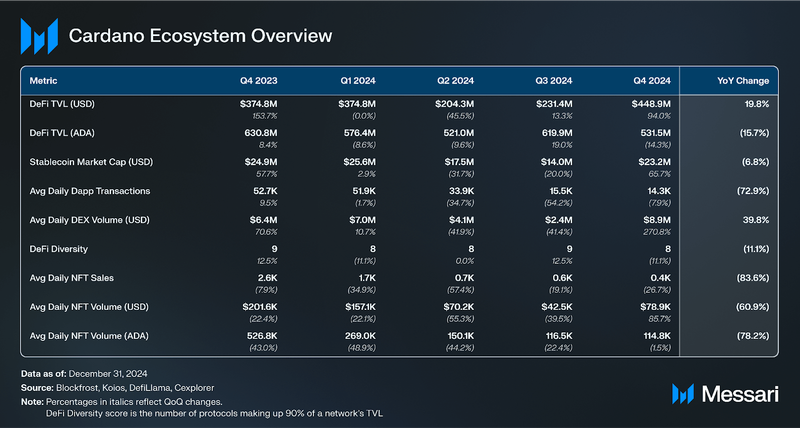

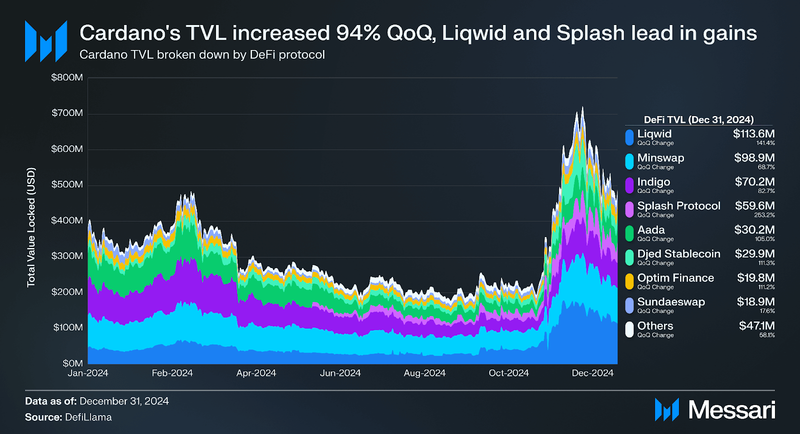

- DeFi TVL (USD) increased by 94% QoQ to $448.9 million. This was led by Liqwid and Minswap, whose TVL grew 141% and 69% QoQ, respectively.

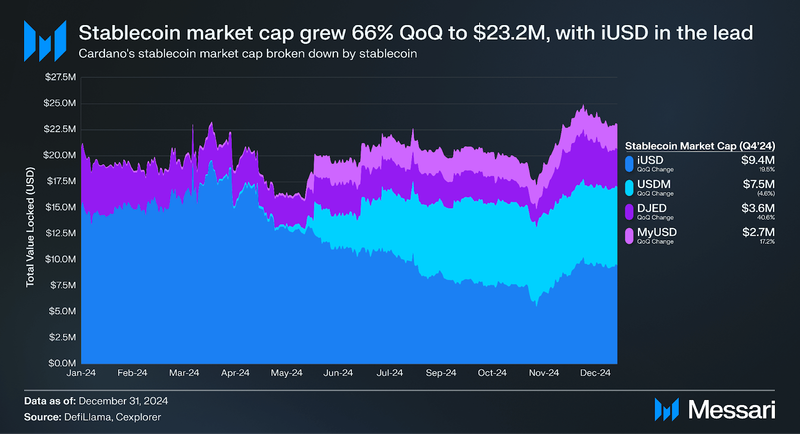

- The market cap of stablecoins increased by 66% QoQ to $23.2 million. iUSD maintained its lead as the top stablecoin, with $9.4 million.

Cardano (ADA) is a Proof-of-Stake (PoS) Layer-1 network launched in 2017. Cardano aims to provide security, scalability, and functionality to decentralized applications and systems building atop the network. In addition to its community of developers, node operators, and projects, Cardano is supported by entities like Input Output Hong Kong (IOHK), Cardano Foundation, Intersect, EMURGO, and others. These entities support the network’s development, adoption, and finances as Cardano moves toward the age of Voltaire (Governance), the final phase of its roadmap.

Cardano has taken a unique approach to development compared to other smart contract networks. The Ouroboros consensus mechanism allows for stake delegation, while the extended unspent transaction output (eUTXO) accounting model enables native token transfers, scalability, and decentralization.

With a dedicated community of users and developers, Cardano has demonstrated staying power. After the launch of smart contract support via the Alonzo hard fork in 2021, Cardano began to compete in more traditional crypto markets, such as DeFi and NFTs. For a full primer on Cardano, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

Key Metrics Financial Analysis

Financial Analysis

ADA is the native asset of Cardano that is used as the primary medium of exchange when transacting on the network. It has four primary network-level use cases:

- To settle network transaction fees.

- To register a stake pool to participate in network consensus as a stake pool operator (SPO).

- To stake as a stake pool operator or delegator to help secure the network and earn token rewards.

- To reward voters and fund projects in Project Catalyst.

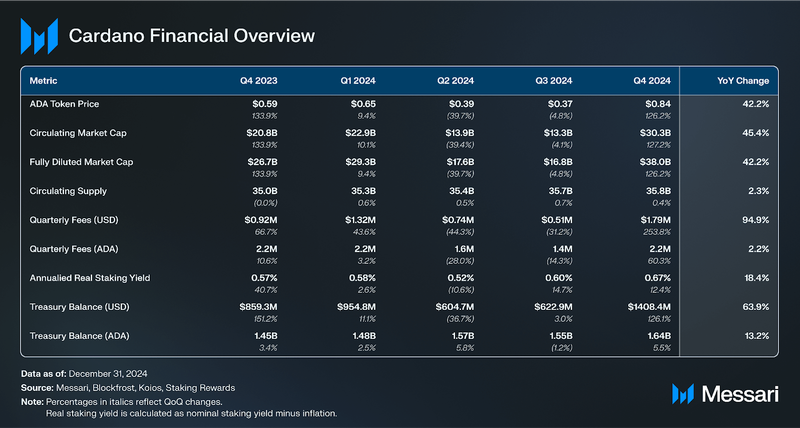

ADA’s maximum token supply is 45 billion, and its circulating token supply experiences inflation until it reaches that maximum. After each five-day epoch, 0.3% of ADA reserves (i.e., the ADA not in circulation) are distributed as SPO rewards—inflation trends towards zero as the reserves deplete and the circulating supply approaches 45 billion.

Annualized real staking yield accounts for any value dilution due to inflation—in Q4, it was 0.7%, though this can vary by stake pool. Annualized real staking yield increased 18% year over year.

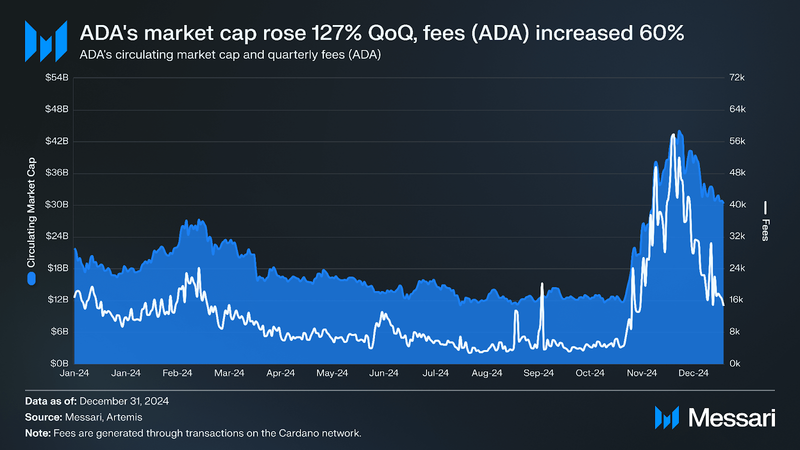

ADA’s price increased 126% to $0.84 in Q4. ADA’s market cap rose 127% QoQ to $30.3 billion, with a slight discrepancy due to a 2.2% decrease in circulating supply. Due to the price increase, ADA’s circulating market cap rank rose from 11th to 9th in Q4. The price and market cap increase coincided with the U.S. election in November and a rise in coins based in the U.S.

Each transaction on Cardano is accompanied by a network transaction fee for processing transactions and paying storage costs. Fees are calculated by a minimum fee plus a variable fee based on transaction size. Fees (USD) increased 254% QoQ to $1.8 million, while fees (ADA) decreased by a lesser 60% QoQ to 2.2 million. Fees (USD) increased by 95% YoY, correlated with rising token prices and transaction activity.

Copilot Insights: How did ADA perform compared to other L1s in Q4 2024

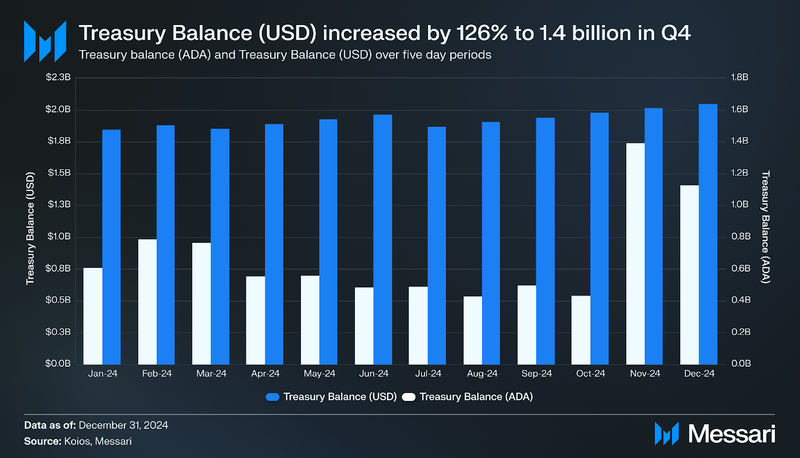

The treasury aims to provide funds to develop Cardano activities through voting. Currently, 20% of Cardano’s transaction fees go to the treasury. Cardano’s treasury balance (ADA) rose 6% QoQ to 1.6 billion ADA, while the treasury’s dollar value increased 126% to $1.4 billion.

Network Analysis

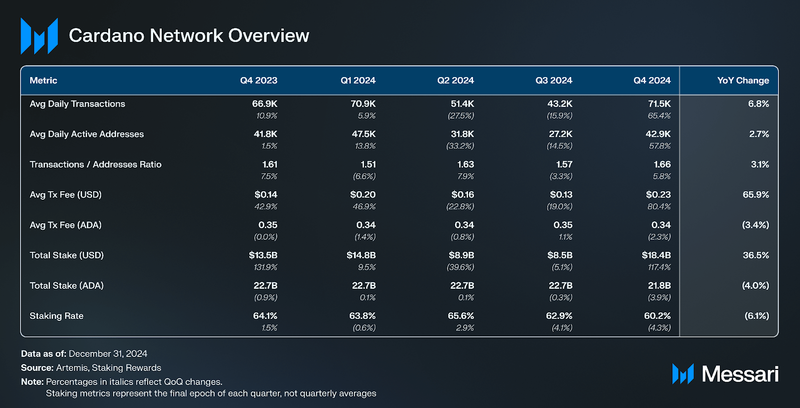

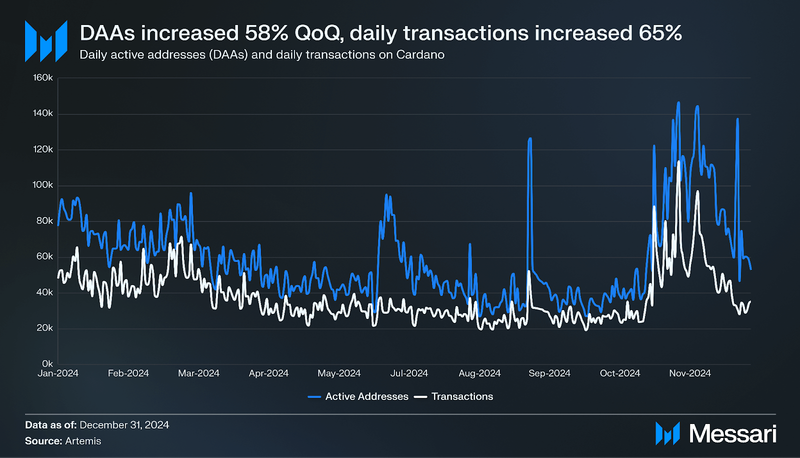

Cardano’s average daily transactions increased by 65% QoQ to 71,500, coinciding with a 58% rise QoQ in average daily active addresses to 42,900. Cardano’s average transaction fee (USD) rose 80% to $0.23. However, the average transaction fee (ADA) dipped 2% QoQ to 0.34, meaning the network handled a large increase in transaction activity with limited movement in native costs.

The ratio of transactions to active addresses increased by 6% QoQ to 1.7; an increasing ratio suggests activity is distributed more evenly across users.

The total stake (ADA) and ADA's staking rate (rewards earned from staking ADA) both declined by 4% QoQ. However, the total stake (USD) increased 117% QoQ to $18.4 billion, driven by ADA's price increase.

GovernanceOuroborosIn October 2024, Cardano revealed the Ouroboros Peras update. This extends Cardano’s Ouroboros Praos protocol by adding stake-based voting and a heaviest-chain selection rule to shorten transaction settlement times and reduce the chance of reversions. The update works with scaling solutions like Hydra and Mithril to improve the network’s scalability. Developed through IOHK’s open-source and research-based approach, Ouroboros Peras involves collaboration with the Cardano community to refine and implement the protocol changes.

Ouroboros Leios, introduced in October 2022, is designed to increase Cardano’s throughput while retaining all the security properties of previous Ouroboros variants. Existing Ouroboros variants have been limited in data and CPU processing throughput because of communication and data dependencies inherent to Proof-of-Stake. The Leios upgrade, which, as of Q3, has been prototyped, aims to pair with Peras in delivering a blockchain capable of handling more transactions per second (1500+) while ensuring rapid confirmation.

Chang Hard ForkIn April 2024, Cardano unveiled the Chang Hard Fork, a two-phase network upgrade that would enable onchain governance and fulfill the core purpose of Cardano’s final roadmap phase (Voltaire). Voltaire takes the final steps toward Cardano’s self-sustainability via onchain voting, offchain mechanisms, and institutions like the member-based organization Intersect.

- Phase one began on September 1, 2024, initiating a technical bootstrapping phase that sets the stage for decentralized voting and governance actions.

- The Interim Cardano Constitution bridges the gap until the actual constitution is iterated through Cardano Constitutional Workshops and ratified at the Cardano Constitutional Convention in Buenos Aires, Argentina, in December 2024.

- The Interim Constitutional Committee (ICC) is comprised of seven members, three of whom were voted in. It has veto powers over certain onchain governance actions throughout phase one.

- Phase two, also known as the Plomin Upgrade, will see Cardano’s onchain governance fully online as the Cardano Constitution is finalized and ratified. This phase will empower ADA tokenholders to direct technical changes and treasury withdrawals, partially by introducing a new user role, Delegate Representatives (DReps). ADA tokenholders can delegate governance power to DReps and SPOs, who can vote on governance proposals on their behalf.

- Registration to become a DRep is open and requires a one-time deposit of 500 ADA and obtaining an onchain DRep certificate.

After completion of phase two, DReps, SPOs, and the Constitutional Committee will govern all areas of the network via an onchain voting and treasury system based on CIP-1694. This would transfer responsibility from IOG, Cardano Foundation, and EMURGO, which have historically held all seven governance (genesis) keys. Governable actions will include those related to the Constitutional Committee, parameter changes, constitution updates, hard fork initiation, protocol parameter changes, and treasury withdrawals. The upgrade is set to be implemented on January 29, 2025.

Ecosystem Analysis

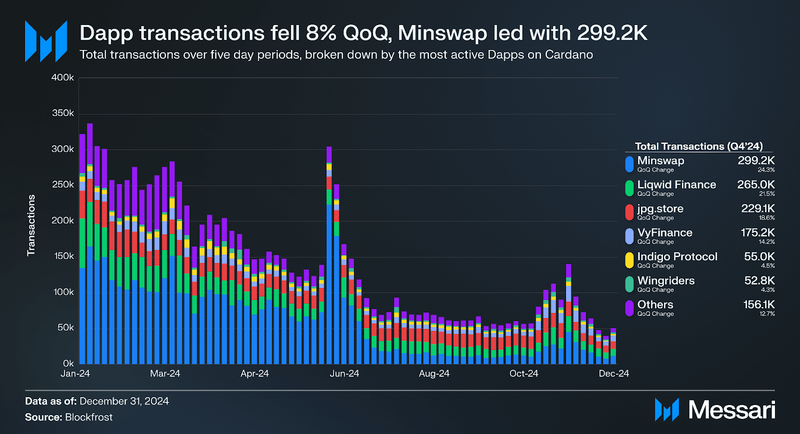

Average daily Dapp transactions decreased by 8% QoQ to 14,300 in Q4. The top Dapps by volume in Q4 were Minswap, Liqwid Finance, and jpg.store. Overall, Dapp activity is primarily affected by Minswap, which is consistently Cardano’s most active application.

- Minswap is the most popular DEX on Cardano, with over 200,000 traders and a cumulative volume of $3.1 billion by the end of Q4. Minswap also offers liquidity pools, staking, and a token launchpad.

- In September, Minswap launched its Launchbowl V2, which enables initial DEX offerings (IDOs). Rewards for staking MIN expanded to include Launchbowl tokens and yield from the protocol’s revenue. Four IDO projects launched in Q4: the top launch, Tokeo IDO, raised 1.9 million ADA.

- A proposal to address staking periods, rewards, and recognition of industry volatility was passed in October.

- Liqwid Finance is a lending, borrowing, and liquid staking protocol. In Q4, the most popular markets were ADA and POL. Liqwid Finance’s token, LQ, can be staked on the platform for yield and governance rights.

- In April, Liqwid Finance launched its V2 upgrade, revamping its UI/UX, creating a public API, adding supply and borrow cap parameters, and more—afterward, the protocol released a 12-month roadmap.

- Liqwid completed a rebrand in September and added support for growing assets like USDM.

- jpg.store is Cardano’s top NFT marketplace regarding transactions and volume (ADA). jpg.store was the third-most-used Dapp in Q4, accounting for 20% of Dapp transactions at 273,800.

- In July, jpg.store announced a new product, Rocket. Rocket was similar to pump.fun on Solana, allowing users to launch and trade tokens easily. Soon after the end of Q4, jpg.store decided to sunset Rocket for the foreseeable future, given a lack of product-market fit.

The average daily DEX volume on Cardano increased by 271% QoQ to $8.9 million in Q4. The top DEXs on Cardano were Minswap, WingRiders, and SundaeSwap. DEX volume increased by 40% year-over-year.

DeFi

DeFi TVL (USD) on Cardano increased 13% QoQ to $231.6 million in Q4, while the DeFi diversity score (i.e., the number of protocols making up 90% of a network’s TVL) increased 13% to 9.

Liqwd’s TVL grew by 141% QoQ to $113.6 million, surpassing Minswap as the leading protocol by DeFi TVL on Cardano. Minswap saw a 69% QoQ increase in TVL to $98.9 million. More minor protocols like Splash Protocol and Aada grew 253% and 105% QoQ, up to $59.6 million and $30.2 million, respectively.

- Indigo is a synthetic asset issuer that offers iUSD, iBTC, and iETH. In Q4, Indigo completed an upgrade to V2.1, introducing an algorithmic interest rate split interest to be shared between the treasury and INDY stakers, among other upgrades. Indigo also launched a new website for the Indigo Foundation dedicated to developing the Indigo Protocol. The Indigo Foundation introduced PoCoP (Proof-of-Commitment-Protocol), a points system allowing you to earn $INDY tokens by creating content for the Indigo DAO.

- Splash is a DEX launched in July after a token sale for SPLASH raised 17.2 million ADA in May. Splash also worked to develop snek.fun, another protocol similar to pump.fun on Solana that allows users to launch and trade tokens easily. The application launched in September and saw over 2,230 tokens created and 4.5 million in trading volume (ADA) in the first 24 hours. In Q4, Splash launched the Splash DAO for users to vote on parameter changes, manage SPLASH inflation, and earn DAO rewards. Additionally, Splash open-sourced all their contracts.

DeFi TVL declined by 16% YoY in 2024. Although DeFi TVL rebounded from mid-year lows, the data suggests that users favor staking ADA but increasingly prefer holding liquid ADA in the current market environment.

Stablecoins

Cardano’s first stablecoins (iUSD and DJED) were launched in November 2022. They are both fully overcollateralized stablecoins. In Q4, Cardano's stablecoin market cap grew 66% QoQ.

In Q4, the market caps of iUSD and DJED increased by 20% and 41% QoQ, respectively. MyUSD experienced slightly lesser growth of 17% QoQ, while USDM’s market cap fell 5%, falling further behind IUSD.

- Launched on March 16, 2024, Moneta’s USDM is not algorithmic or synthetic, unlike iUSD, DJED, and MyUSD. USDM is collateralized 1:1 with U.S. Dollars (USD). Indigo’s iUSD has had an inconsistent peg, which is less likely to happen with 1:1 USD backing as more accessible redemptions create arbitrage opportunities that close price gaps.

- MyUSD launched in December 2023 and is collateralized by USDC and USDT. In June 2024, Mynth introduced MyUSD staking to earn Mynth’s MNT tokens. This program has driven growth for MyUSD in H2’24.

- DJED Stablecoin was developed by IOHK and is backed by ADA and SHEN. DJED is an overcollateralized stablecoin that uses SHEN as the reserve coin to reflect the overall sentiment of ADA. When the ADA token price increases, so does the reserve coin.

Notably, USDA is expected to disrupt the stablecoin market on Cardano. Encryptus launched USDA shortly after Q4, with technological support from EMURGO and stablecoin issuance performed by Anzens. Anzens has partnered with BitGo, a qualified custodian, to custody USDA reserve assets.

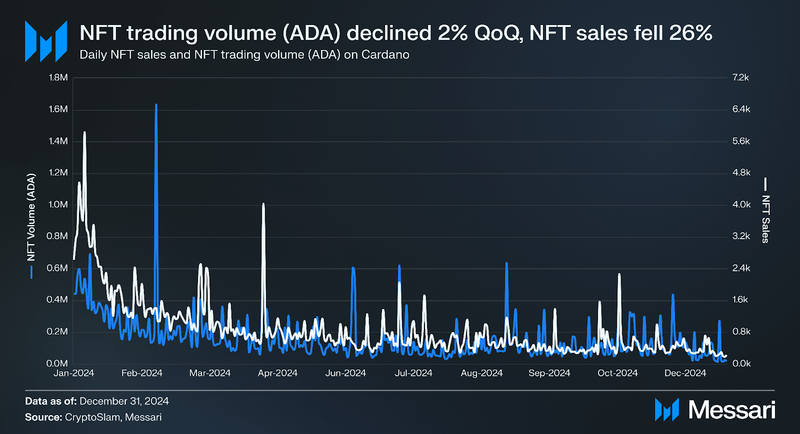

NFTs

Average daily NFT sales on Cardano were down 2% QoQ to 430 in Q4, while average daily NFT trading volume (ADA) decreased 2% to 114,800. Average Daily NFT Volume (USD) increased by 86% to $78,900 due to ADA price appreciation. jpg.store remained Cardano’s top NFT marketplace regarding transactions and volume (ADA) and was Cardano’s third-most-used Dapp in Q4.

In June, jpg.store launched NFT lending and borrowing, allowing NFT holders to borrow assets against their NFTs. The protocol continues to incentivize activity, having distributed $JPG tokens to users in July at the end of Season 3. Season 4 began on July 17, 2024, and ended shortly after Q4, with claimable $JPG rewards for users.

The average daily NFT volume (ADA) and sales decreased by 78% and 84% YoY, respectively, while DEX activity increased by 40% YoY. This indicates more user interest in trading liquid tokens than in NFTs.

Development, Growth, and CommunityCardano SummitThe Cardano Summit 2024 in Dubai convened over 1,000 industry leaders, developers, and blockchain enthusiasts from 87 countries to discuss advancements and future directions in blockchain technology.

Key highlights from the summit include:

- Blockchain's Potential in Space Missions: NASA Systems Engineer Matthew Vaerewyck highlighted blockchain's potential to enhance space mission design and efficiency by integrating decentralized tracking technology, aiming to reduce intermediaries and costs.

- Integrating Bitcoin Liquidity into Cardano: Emurgo announced a collaboration with BitcoinOS to extend Bitcoin's liquidity to Cardano DeFi users, providing secure, trustless access to the Bitcoin ecosystem.

- Art Beyond Borders Initiative: Goodwall, in partnership with the Cardano Foundation, launched a Global Impact Challenge to support young artists and displaced individuals through blockchain technology.

- Technical Roadmap Presentation: Cardano Foundation's CTO, Giorgio Zinetti, outlined the Foundation’s technical roadmap, emphasizing ongoing research in quantum resistance and post-quantum enhancements.

- Compliance and Regulatory Standards: Cardano Foundation CEO Frederik Gregaard and Binance CEO Richard Teng discussed strategies for creating resilient blockchain organizations, emphasizing the importance of compliance in fostering institutional adoption. This comes after the Cardano Foundation achieved MiCA-compliant sustainability in July.

Cardano’s development has historically followed a structured roadmap defined by distinct eras: Byron (Foundation), Shelley (Decentralization), Goguen (Smart Contracts), Basho (Scaling), and Voltaire (Decentralized Governance). After reaching the Voltaire phase, Cardano is set to enter a new era where its roadmap is driven by the community rather than a centralized team. In this model, development priorities and strategic decisions will be shaped collectively by community input. Intersect, a community-run organization tasked with ensuring Cardano’s continuity and development, will administer and review proposals, ensuring that the roadmap reflects the collective vision and needs of the Cardano ecosystem.

Cardano’s new technical roadmap is anchored in three core pillars, each addressing critical aspects of the platform’s evolution:

- Scalability: Cardano will enhance transaction efficiency by adopting optimistic and zero-knowledge Layer 2 rollups for offchain aggregation. At the same time, developments in consensus—featuring Ouroboros Leios and Peras—aim to reduce finality from 12 hours to just 2 minutes. Additionally, deploying Mithril Certificates speeds up node verification, while upgrades to core nodes with improved structures, revised incentives, and anti-grinding measures further boost performance.

- Usability and Utility: Cardano will add multi-language support with tools like Plinth, Plutus High Assurance, Aiken, and plu-ts. They are also integrating decentralized identity management through Hyperledger Identus, bolstering privacy with the Midnight partner chain using zero-knowledge proofs, and simplifying transactions with Babel fees that allow fees to be paid in any token.

- Interoperability and Extensibility: Cardano plans to adopt a microservices-based approach for scalable development, expanding partner chains with initiatives like Minotaur to enable trustless interoperability with networks like Ethereum. Additionally, Cardano announced they’re exploring a Bitcoin programmability layer to allow Bitcoin users to access decentralized applications and DeFi services using solutions like Midnight for private transactions.

Partner Chains is an all-encompassing term that can include technically sovereign sidechains or modular networks. These networks include Milkomeda C1, Wanchain, Midnight, and World Mobile. Launched in August, the Alpha V1 Toolkit allows developers to bootstrap the security of Partner Chains by leveraging Cardano’s network of SPOs. The toolkit introduces a committee selection algorithm that integrates Cardano data to form trusted committees capable of producing a predetermined percentage of blocks. By leveraging Cardano’s SPOs, Partner Chains can quickly grow their validator sets, enhancing security.

Midnight launched on Testnet on October 1, 2024. Midnight is developed by Input Output Global (IOG) and offers data protection and privacy capabilities using zero-knowledge proofs (ZK Proofs). The testnet allows developers to use Midnight’s capabilities in a stable sandbox environment. Midnight’s programming language, Compact, is based on Typescript, allowing Web2 developers to begin writing onchain smart contracts easily. Midnight continues to grow via partnerships and hackathons. Charles Hoskins also confirmed ADA holders would be eligible to receive a portion of the NIGHT token distribution.

Project CatalystProject Catalyst is a decentralized fund where ADA token holders decide which proposals receive funding from Cardano’s treasury. Through 12 funding rounds, Project Catalyst has funded 1,892 proposals worth $90.5 million in ADA.

Voting for Fund12 concluded in July with 258 funded proposals for 46.5 million ADA. Funding was distributed across six categories, with the highest funded proposals coming from the “Cardano Partners and Real World Integrations” category.

Proposal submission for Fund13 began at the tail end of Q3, and the round’s voting phase will conclude in December. Fund 13 aims to distribute 50 million ADA toward six categories. A significant change in this round is reducing the minimum amount of ADA needed to vote. In Fund13, only 25 ADA are required to vote, down from the 450 ADA that has been in place since Fund4—over 40.0 million ADA was requested through proposals, although no funds were distributed in Q4.

Closing SummaryCardano's performance in Q4 2024 reflected notable improvements in key financial and network metrics. The market cap of ADA increased 127% to $30.3 billion, driving the token price up 126% QoQ to $0.84. Quarterly revenue saw a significant 254% increase to $1.8 million, reflecting heightened transaction activity. Average daily transactions grew 65% QoQ to 71,500, while active addresses increased 58% to 42,900. However, total stake (ADA) declined by 4% to 21.8 billion, suggesting shifting investor allocation preferences within the ecosystem.

Ecosystem activity presented a mixed picture. DeFi total value locked (TVL) surged 94% QoQ to $448.9 million, reflecting renewed engagement in Cardano’s decentralized finance sector. However, average daily dApp transactions fell 8% QoQ to 14,300, and average daily NFT volume declined slightly by 2% to 114,800 ADA, indicating less interest in these segments. As Cardano moves forward, the upcoming Ouroboros Peras upgrade and the introduction of fully onchain governance with the Plomin Upgrade will be critical developments to watch, potentially influencing broader network adoption and long-term sustainability.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.