and the distribution of digital products.

State of Avalanche Q3 2024

- Avalanche9000, the most significant network upgrade since mainnet launch, reduces the cost and complexity of launching Layer 1s (L1s) and facilitates seamless liquidity flow across L1s.

- Retro9000, announced in Q3 and starting in Q4, is a $40 million gamified testnet experience, to encourage developers to explore Avalanche9000 features and enhance network scalability.

- Off the Grid, a AAA battle royale game on Avalanche, conducted a successful closed playtest in August, generating over 400,000 transactions from 30,000 players in its first weekend.

- Avalanche saw significant enterprise and RWA growth, with the California DMV digitizing 42 million vehicle titles, Franklin Templeton launching the Benji U.S. Government Money Fund on the Avalanche blockchain, Grayscale launching the AVAX Trust, and Tixbase securing an exclusive partnership with Passo - a large Turkish ticketing platform.

Avalanche (AVAX) is a Proof-of-Stake (PoS) smart contract platform for decentralized applications. Avalanche differentiates itself by creating and implementing a consensus family known as "Avalanche consensus."

Following years of research, the Avalanche mainnet was launched in September 2020 and featured the release of a multichain framework utilizing three chains: the P, X, and C chains. Each chain plays a critical and unique role within the Avalanche ecosystem while providing the same capabilities of a single network, often called the Primary Network. Avalanche consensus and the Primary Network are designed to support sovereign, interconnected blockchains known as Avalanche L1s.

L1s are subclasses of Primary Network validators that run the same Virtual Machines (VMs) with their own rules. L1s enable different properties of reliability, efficiency, and data sovereignty. They allow the creation of custom blockchains for different use cases while isolating high-traffic applications from congested activity on the Primary Network.

Website / X (Twitter) / Discord

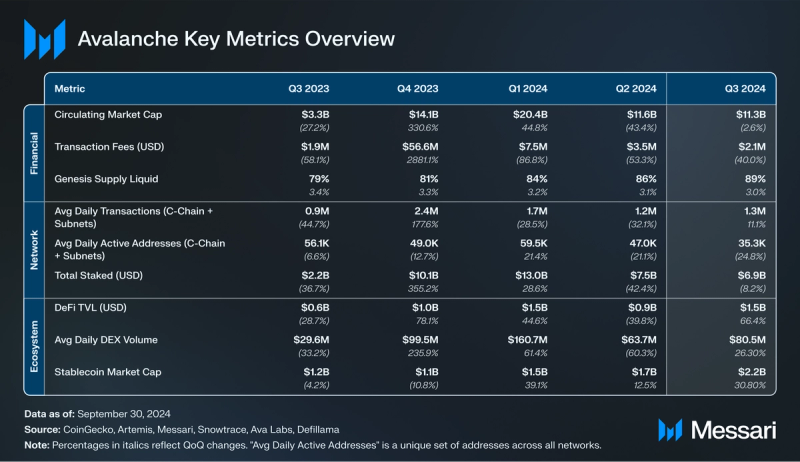

Key Metrics Financial Analysis

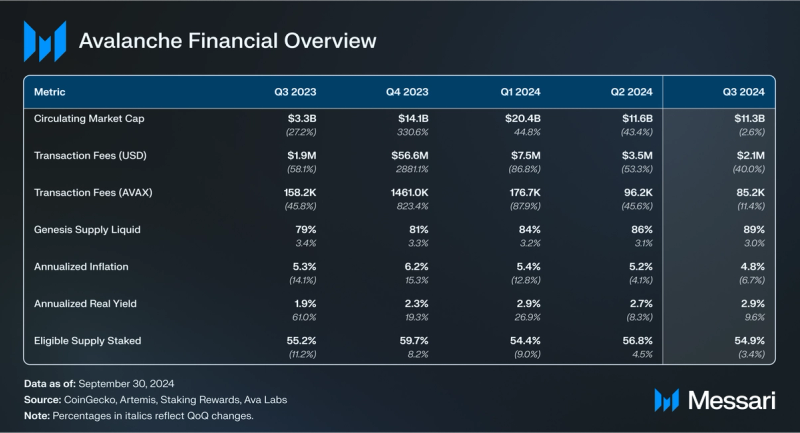

Financial Analysis Market Cap and Revenue

Market Cap and Revenue

After rallying for two straight quarters at the beginning of the year, AVAX’s growth has slowed, following the industry’s trend. By the end of the quarter, its market cap was $11.3 billion, down 3% QoQ. Despite this, AVAX’s circulating market cap is 244% higher YoY ($3.3 billion at the end of Q3’23). By the end of Q3’24, its market cap amongst all tokens dropped by one spot from 11 to 12.

Revenue, which measures all gas fees collected by the network, fell in Q3. Revenue in AVAX decreased by 11% QoQ from 96,200 to 85,200, while revenue in USD decreased by 40% QoQ from $3.5 million to $2.1 million. Revenue in AVAX has been in a gradual downtrend since Q4’23. However, revenue in AVAX was notably heightened in Q4’23 due to inscription-related activity. Revenue on Avalanche should begin to pick back up once onchain activity rebounds across all smart contract platforms, especially with the rebound of the overall market at the beginning of Q4.

Supply DynamicsAll revenue on Avalanche is burned. Instead, validators and stakes are rewarded with newly minted tokens. AVAX currently has a fixed supply of 720 million tokens.

Half of these tokens are distributed as staking rewards, with a dynamic schedule depending on the amount staked and time staked. As more users stake AVAX for more extended periods, more AVAX is issued as staking rewards. The annualized inflation rate for Q3 was 4.8%, down 7% QoQ from 5.2%. Additionally, eligible supply staked was down 3% QoQ from 56.8% to 54.9%.

The other 360 million tokens were allocated to various buckets at launch. Genesis supply liquid measures the percentage of these tokens that have unlocked.

At the genesis block, 360 million AVAX was minted. This genesis supply was distributed to various allocations over differing vesting periods. Year to date, the liquid genesis supply increased by 10%, from 81% to 89%. The genesis supply is projected to be fully vested by 2030. In Q3, an additional 9.5 million AVAX was vested in the team’s and foundation’s allocation. The Q3 token unlock was the last major unlock. There will only be 1.4 million AVAX unlocked in Q4 to the foundation. A full breakdown of vesting schedules for AVAX can be found at Messari’s Token Unlock Screener.

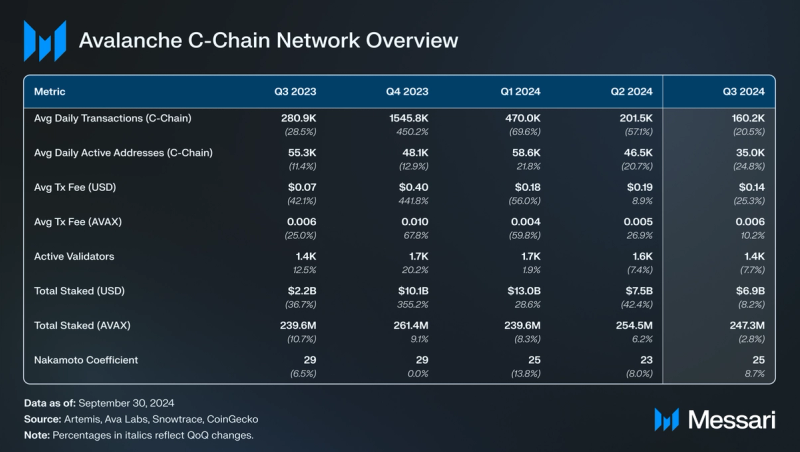

Network AnalysisC-Chain Usage

Usage

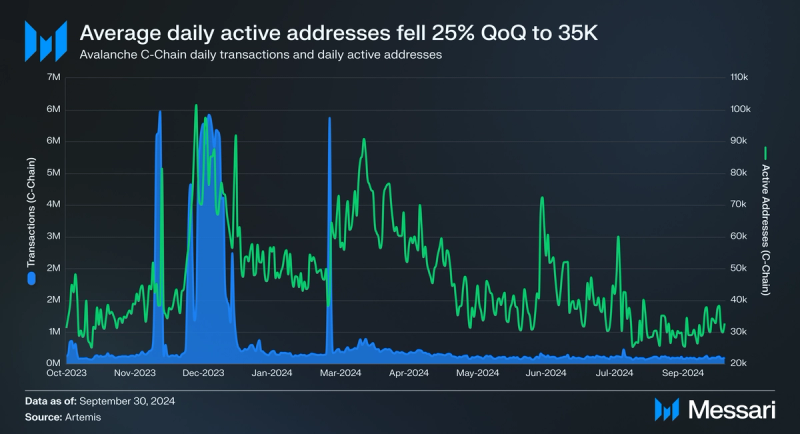

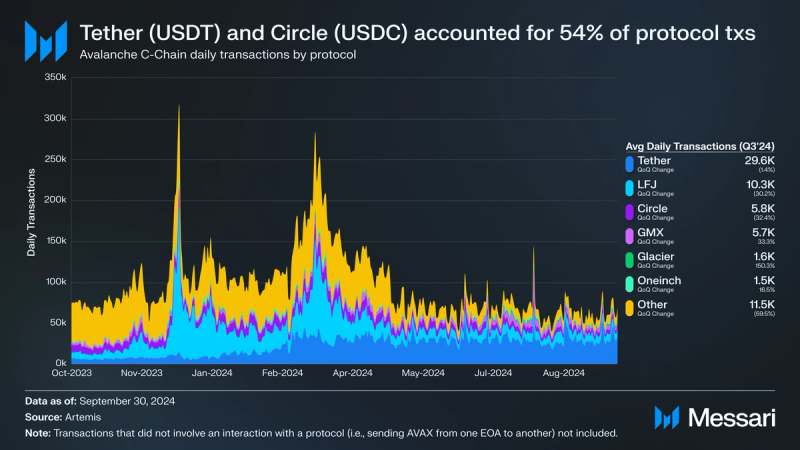

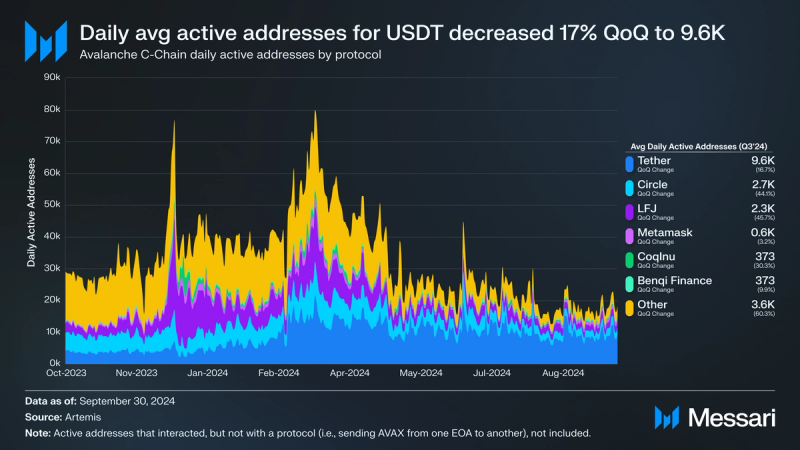

Average daily transactions fell by 21% QoQ from 201,500 to 160,200 in Q3. This downtrend was likely due to the broader crypto market slowing down after a highly active Q1 and Q2. Average daily active addresses also trended lower, finishing Q3 down 25% QoQ from 46,500 to 35,000.

Despite the daily average of total transactions falling in Q3, some protocols experienced QoQ increases for daily transactions. GMX continued another quarter of growth from 4,200 to 5,700 (up 33% QoQ).

Tether continued to maintain dominance with 45% of protocol transactions. The protocol ended with 29,600 transactions, a 1% decrease QoQ. On September 23, Trader Joe rebranded to LFJ . LFJ generated the second-highest transaction activity in Q3, finishing the quarter with a daily average of 10,300 transactions (down 30% QoQ). After LFJ, the protocol with the third-highest transaction activity was Circle (USDC), ending Q3 with a daily average of 5,800 transactions (down 32% QoQ). Tether, LFJ, and Circle collectively accounted for 69% of all transactions that interacted with a protocol, up 14% QoQ from 61% last quarter.

Similarly to transactions, daily active addresses interacting with protocols decreased in Q3. Tether remained the top protocol by average daily active addresses this quarter, decreasing by 17% QoQ from 11,600 to 9,600. 49% of active addresses that interacted with a protocol in Q3 interacted with Tether—as for Q1’s top protocol, LFJ, average daily active addresses decreased by 46% QoQ, falling from 4,300 to 2,300. Overall, daily active addresses interacting with protocols have declined since Q3’23. However, part of this decline is due to active address metrics being inflated last year due to LayerZero airdrop farming, which airdropped its ZRO token in June.

Security and DecentralizationAvalanche uses a Proof-of-Stake consensus mechanism known as “Avalanche Consensus.” Avalanche’s P-Chain is responsible for validator coordination and staking operations. Both C-Chain and X-Chain utilize the entire P-Chain validator set for consensus. To determine if a transaction is valid, validators on Avalanche use repeated sub-sampling voting of a minor, random subset of all validators. Consensus occurs once a sufficient majority of validators agree over consecutive rounds. Both the necessary majority and consecutive rounds are configurable. Additionally, the more tokens staked/delegated to a validator, the more influential that validator is in the consensus process.

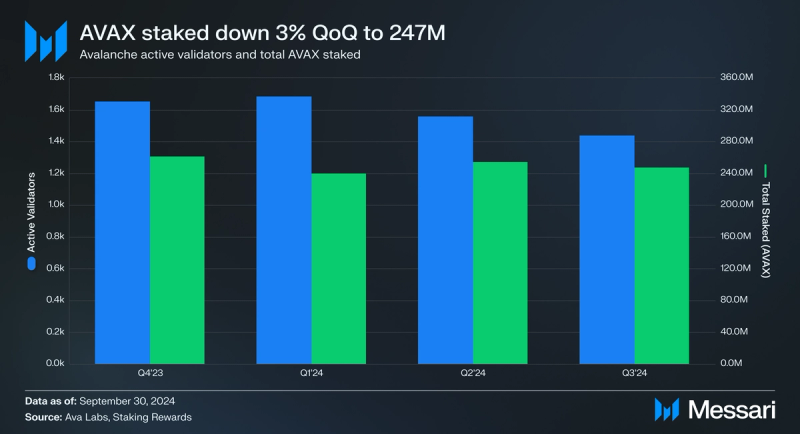

The active validator count continued to decrease, falling by 8% QoQ from 1,558 to 1,438. However, active validators on Avalanche are up YoY (5% from 1,374), a healthy sign for the network's decentralization.

AVAX staked decreased in Q3, down 3% QoQ from 254.5 million to 247.3 million. The Avalanche Foundation sought to improve AVAX staking metrics in Q2 by launching its Icebreaker Program, an initiative aimed at strengthening Avalanche’s onchain ecosystem. As a part of the first phase of this program, 500,000 AVAX was contributed from the program to several liquid staking solutions on Avalanche. AVAX staked was also partially bolstered by Coinbase, which launched native support for AVAX staking in May. As for AVAX staked in USD, it fell by 8% QoQ to $6.9 billion due to the price of AVAX falling in Q3.

The Nakamoto coefficient is the number of node operators collectively controlling over 33% of the network. The higher the coefficient, the more resilient a network is to attacks and bugs. Avalanche’s Nakamoto coefficient increased by 9% QoQ to 25. Despite this decrease, Avalanche remains above the median of other PoS networks.

Technical DevelopmentsAvalanche9000

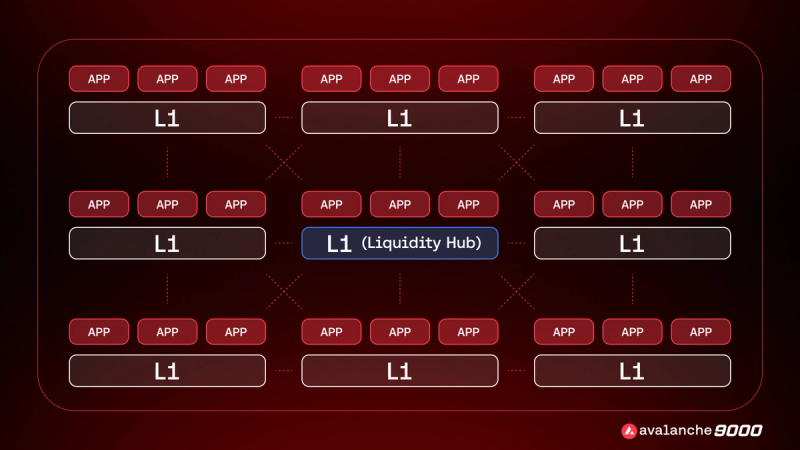

In early September, the Avalanche team introduced Avalanche9000. This network upgrade has been labeled “the largest network upgrade since mainnet launch”. The upgrade will make launching an L1 easier. The majority of the upgrade is the implementation of ACP-77. This ACP replaces ACP-13 and aims to rework how validation for Avalanche L1s works. Each L1 validator must first become a P-Chain validator, which requires staking 2,000 AVAX ($56K at Q3 end). Since the average L1 utilized eight validators in Q3, the approximate cost for initiating a validator set for an L1 in Q3 was 16,000 AVAX ($450K at Q3 end). This proposal will remove the P-Chain validator requirement, thereby separating L1 validators from P-Chain validators. Instead, L1s will pay a dynamic fee to P-Chain validators. This new upgrade will combine the C-chain, the network of L1s, and Avalanche Interchain Messaging.

The primary chain will be the economic and foundational hub that powers Avalanche9000. Liquidity will flow easily between other L1s and allow developers access to pre-built tools to use new L1s. The graphic above showcases how every L1 is connected through Avalanche Interchain Messaging (ICM). This architecture will unlock the following:

- Complete control to customize L1 staking economics, gas tokens, and more

- Open and permissionless validator sets to increase decentralization

- Regulatory compliance built-in with geo-restrictions and custom permissions

- Scale with any virtual machine to maximize performance

Avalanche9000 will include the following:

- The Etna Uprage

- ACP-77

- ACP-125: Reduce C-Chain minimum base fee - This ACP will reduce the minimum base fee from 25n AVAX to 1 nAVAX. Since implementing dynamic fees, the base fee for a transaction is pinned to the minimum, suggesting the minimum base fee is higher than the market demands.

- ACP-103: Add Dynamic Fees to the X-Chain and P-Chain - This procedure adds dynamic fees to the P and X-Chains in preparation for multidimensional dynamic fees.

- ACP-113: Provable Virtual Machine Randomness - This ACP proposes a mechanism to generate verifiable, non-cryptographic random number seeds. This will allow developers to build more versatile applications since the current state of development is limited by the platform’s deterministic block execution limits.

- ACP-20: Ed25519 p2p - Implements Ed25519 public keys and signatures into the network and ProposerVM.

- ACP-131: Activate Cancun EIPs on C-Chain and L1-EVM chains - Implements five EIPs included in Ethereum’s Cancun upgrade.

- ACP-118: Standardized P2P Warp Signature Request Interface - This ACP will change how AppRequest payloads are sent so they are received in a VM-agnostic manner.

- Nomenclature changes

- Developer incentives and tooling

- Multichain solutions powered by Core

- Partner launches

Avalanche9000 will be rolled out in phases. The kickoff event happened early in Q4 at the Avalanche Summit LATAM. The team will start with a $40 million incentivized testnet called Retro9000, which it plans to launch mid-Q4. Applications are currently open for early access.

Other Technical Developments:

In Q1, Avalanche successfully underwent the Durango upgrade, which enables any Avalanche network to natively communicate with one another by asynchronously calling smart contracts on EVM-enabled chains within Avalanche. Q1's report provides more details regarding the Durango update.

In Q3, several optional upgrades for validators were released, including:

- Durango 9 (July 3) - Improved the consensus engine, fixed incorrect warning logs, and fixed C-chain filename logging.

- Durango 10 (July 25) - Removes status from blocks (reduced number of DB reads by 10%), added AppError messages to the P2P SDK, and redesigns how fees are calculated on the P-Chain and X-Chain.

- Durango 11 (September 3) - Implements changes needed for ACP-77, ACP-103, and ACP-118. Also, the amount of time it takes to download the P-chain when bootstrapping a node has been decreased by half.

Other ACPs ready for implementation:

- ACP-151: Use current block P-Chain height as context for state verification - This ACP changes that the ProposerVM passes the current block height rather than the parent block height. This should remove unnecessary waiting periods while determining which validators should participate in consensus.

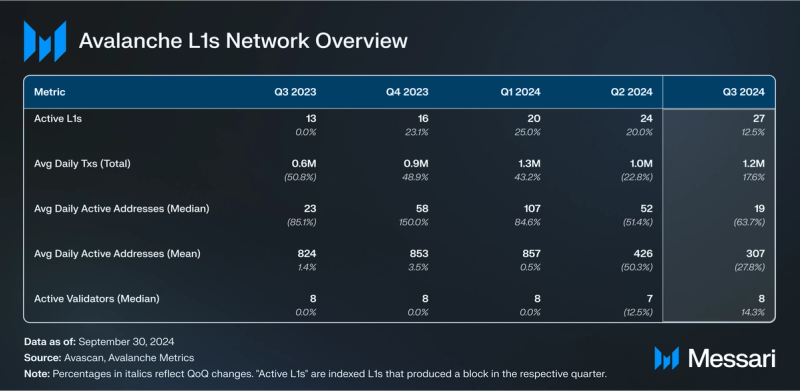

27 indexed Avalanche L1s produced a block in Q3:

- Beam

- Blitz

- Cloudverse (shut down in Q3)

- DFK

- Deboard (Q3 Launch)

- Dexalot

- DOS

- HighOctane

- Innovo

- Lamina1

- Masa Network (shut down in Q3)

- MELD

- NUMBERS

- OMOCHI

- ONIGIRI

- PLAYA3ULL Games

- PlayDapp

- PLYR PHI

- Shrapnel

- StraitsX (Q3 Launch)

- Space

- Step Network

- Tiltyard

- UPTN

- XANA

- Intersect (Q3 Launch)

- zeroone

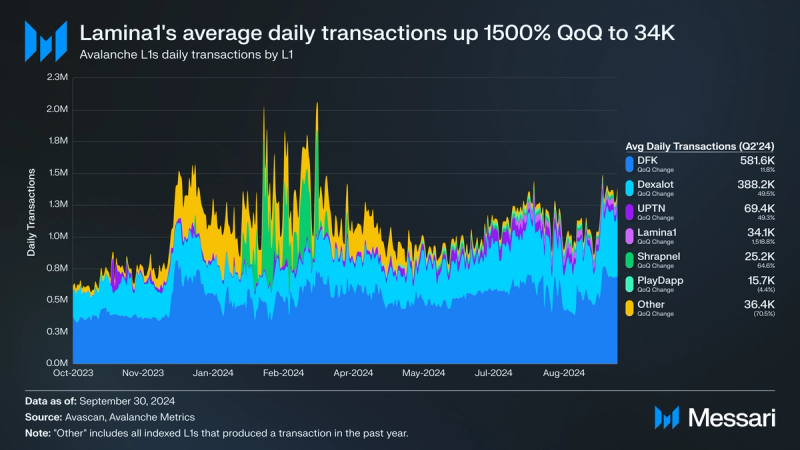

Unlike Avalanche’s C-Chain, transaction activity was up in Q3 for most L1s. Across all L1ss, Q3’s daily average transaction count was 1.2 million, up 18% QoQ from 1.0 million. Notable gainers included Dexalot (up 50% QoQ to 388,200), UPTN (up 49% QoQ to 69,400), and Lamina1 (up 1500% to 34,100). DFK was the main driver of transaction activity, accounting for 51% of all L1 transactions in Q3. Daily average transactions on DFK increased by 12% QoQ to 581,600. Finally, aggregated L1s outside the top six decreased daily average transactions by 71% QoQ, from 123,400 to 36,400.

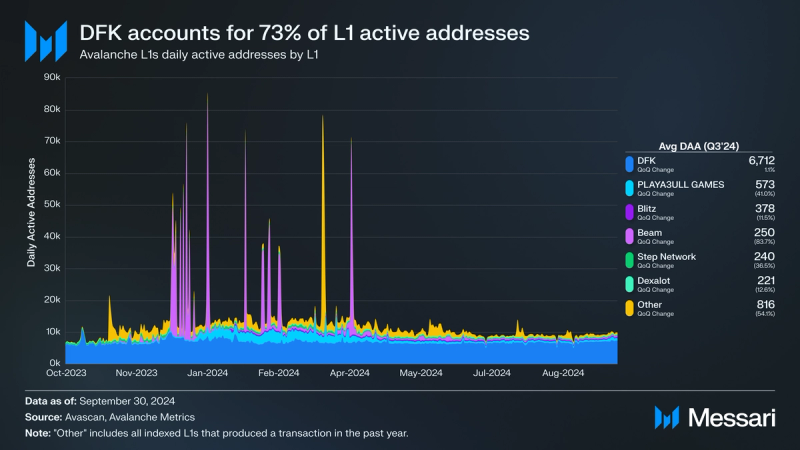

Active addresses on L1s were down in Q3, with the median (down 64% QoQ from 52 to 19 active addresses) and mean (down 28% QoQ from 426 to 307 active addresses) decreasing. Most of the drawdown can be attributed to new L1ss launching this quarter. The vast majority of active addresses continue to come from gaming L1s, with the top four L1s by active addresses being gaming-focused. DFK, Beam, Blitz, and PLAYA3ULL Games accounted for 86% of all active addresses in Q3. However, besides DFK, these L1s experienced QoQ declines in active addresses. DFK was the only L1 within the top six to go against the trend in Q3, which saw its daily average active addresses increase by 1% QoQ from 6,600 to 6,700.

Ecosystem Analysis

DeFi

DeFi

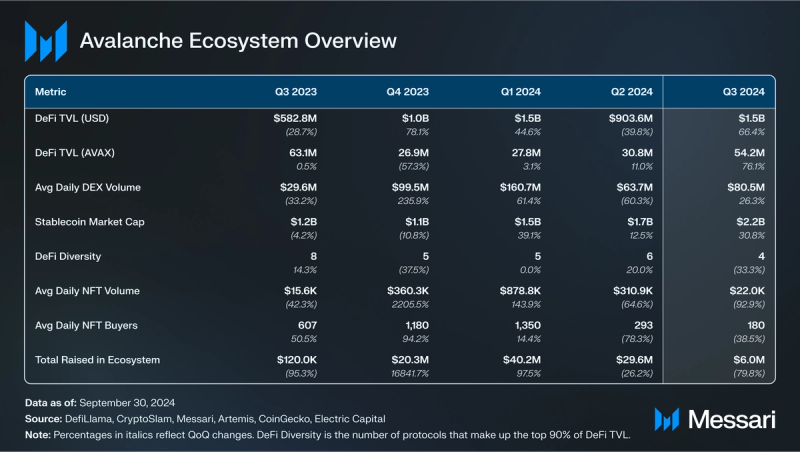

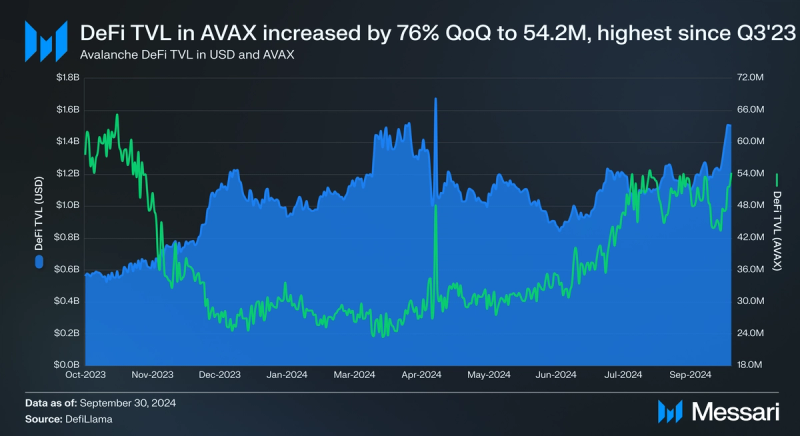

Avalanche DeFi TVL denominated in USD increased from $903.6 million to $1.5 billion in Q3, a 66% QoQ increase. This ranked Avalanche as the 7th highest chain by TVL denominated in USD by the end of the quarter, flat QoQ. TVL denominated in AVAX increased QoQ by 76% from 30.8 million AVAX to 54.2 million.

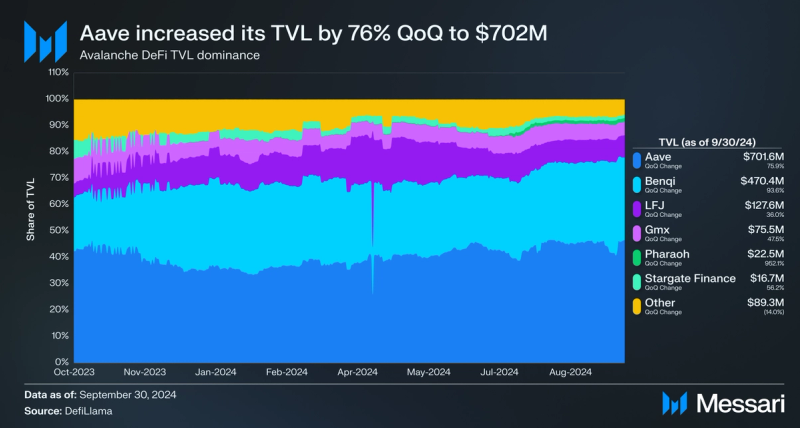

The top three protocols by TVL continued to represent the bulk of TVL on Avalanche in Q3. AAVE, the largest protocol by TVL on Avalanche, increased 76% QoQ from $398.9 million to $701.6 million. By the end of Q3, AAVE’s TVL dominance was 47% (up 6% QoQ from 44%).

Benqi, the second largest protocol by TVL, also saw an increase in TVL. Its TVL grew by 94% QoQ from $243.0 million to $470.4 million. As for its TVL dominance, it increased by 16% QoQ from 27% to 31%.

The third largest protocol by TVL, LFJ, grew by 36% QoQ from $93.8 million to $127.6 million. By Q3 end, LFJ represented 8% of TVL on Avalanche. When LFJ announced their rebranding, they also announced a roadmap. The roadmap highlighted Joe v3 and Joe v4. Joe v3 is a bonding curve AMM similar to Pump.fun, which launched in early Q4. Joe v4 will be a central limit order book, however, there is no announced details on when this will release.

AAVE, Benqi, and LFJ accounted for 86% of DeFi TVL on Avalanche, a QoQ increase of 6%. Outside of the top three, Pharaoh Exchange, had a strong Q3 growing by 952% to $22.5 million in TVL.

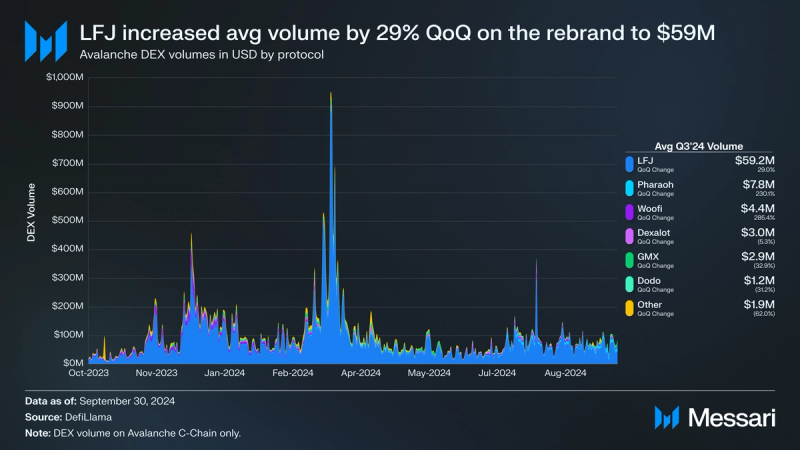

Average daily DEX volumes on Avalanche C-Chain increased in Q3, growing by 26% QoQ from $63.7 million to $80.5 million.

By the end of Q3, there were 38 different DEXs on Avalanche, adding 7 over the quarter. Despite the increased competition, leading DEX LFJ remained the dominant DEX on Avalanche. The average daily DEX volume on LFJ increased 29% QoQ from $45.9 million to $59.2 million.

For Q3, the top five DEXs by average daily trading volume were:

- LFJ - $59.2 million (74% of Avalanche DEX volume)

- Pharaoh Exchange - $7.8 million (10% of Avalanche DEX volume)

- Woofi - $4.4 million (5% of Avalanche DEX volume)

- Dexalot - $3.0 million (4% of Avalanche DEX volume)

- GMX - $2.9 million (4% of Avalanche DEX volume)

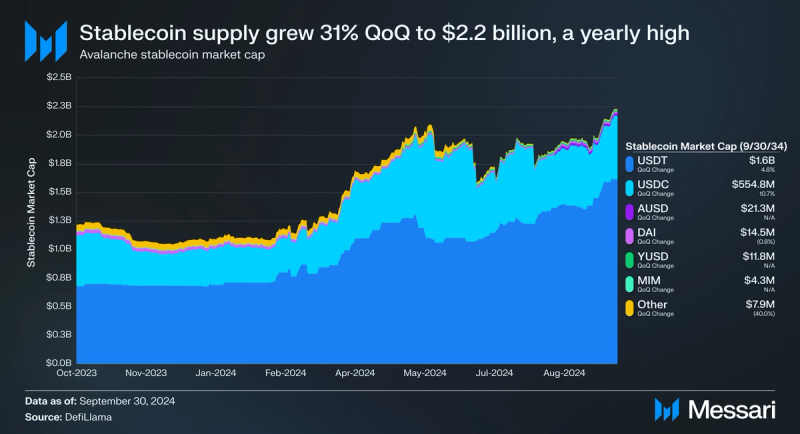

In Q3, stablecoins on Avalanche continued to rise. By the Q3 end, the stablecoin market cap reached $2.2 billion, up 31% QoQ from $1.7 billion. Compared to other chains, Avalanche had the 7th largest stablecoin market cap. Fiat-backed stablecoins like USDT and USDT represent 97% (5% growth QoQ) of the stablecoin supply on Avalanche. USDT increased by 5% QoQ from $1.1 billion to $1.6 billion (72% of Avalanche stablecoin supply), while USDC increased by 11% QoQ from $475.5 million to $554.8 million (25% of Avalanche stablecoin supply).

One interesting stablecoin product on Avalanche is Stable Jack’s aUSD. Stable Jack is a marketplace platform for volatility and yield related to cryptoassets and real-world assets such as stocks and bonds. As a part of Stable Jack’s product offering is aUSD, a yield-bearing stablecoin backed by various AVAX LSTs. Launched on June 20, $2.1 million aUSD had been minted by quarter’s end.

Agora’s AUSD

Another significant development was the announcement of AUSD, a new stablecoin developed by Agora. AUSD is a fully collateralized US digital dollar. Launching on Avalanche in Q3, AUSD garnered support from key players in the ecosystem, including Trader Joe, BENQI, Trensi, and Dragonfly. This new stablecoin is expected to play a crucial role in enhancing liquidity and stability within the Avalanche DeFi ecosystem. AUSD finished the quarter with $21.3 million in market cap on Avalanche. Within its first 60 days, the stablecoin did over $300 million in volume and over 12,500 transfers.

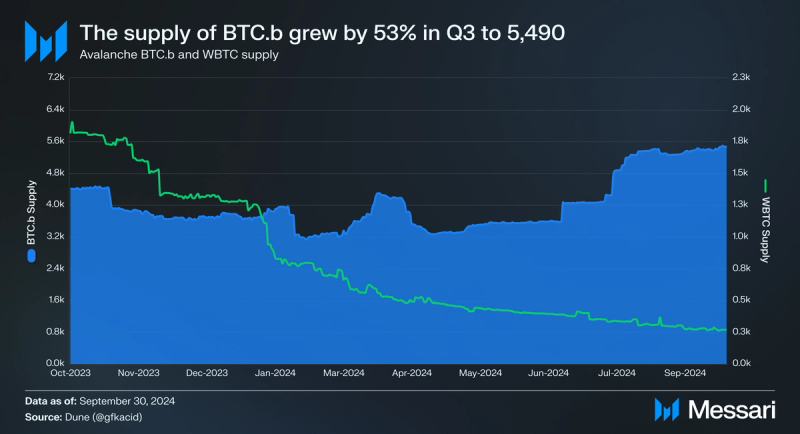

BTC.b is one of the largest assets on Avalanche besides AVAX and stablecoins. BTC.b is a token representing Bitcoin on Avalanche and can be automatically bridged in Core. Compared to other natively bridged Bitcoin assets, BTC.b allows users to freely transfer native Bitcoin without relying on custodians. The supply of BTC.b finished up 53% QoQ, from 3,580 to 5490 BTC.b. As for WBTC on Avalanche, its supply decreased by 31% QoQ from 390 to 267 WBTC.

Enterprise and RWAs

One of Avalanche’s primary initiatives for 2024 is to onboard institutions and enterprises onto the network. Last year, in Q2’23, Evergreen L1s launched, allowing anyone to create an L1 with customizable KYC/AML requirements and unique privacy capabilities. Since the launch of Evergreen L1s, Avalanche has onboarded several enterprises through partnerships, including J.P. Morgan, Citi, and Republic.

In Q3, Avalanche announced the following updates related to Evergreen and other enterprise and RWA adoption initiatives:

- Grayscale Avax Trust (August 22) - Grayscale launched the Grayscale Avalanche Trust, offering accredited investors a regulated avenue to gain exposure to AVAX, Avalanche's native token. This move was significant given Grayscale's reputation and influence in bridging the gap between traditional finance and the crypto world. The trust operates similarly to Grayscale's other single-asset crypto funds, subject to a one-year holding period. This structure may lead to significant premiums or discounts due to the absence of redemption mechanisms, yet it increases institutional accessibility to Avalanche.

- Franklin Templeton’s Benji (August 22) - Franklin Templeton launched its Franklin onchain U.S. Government Money Fund (FOBXX) on the Avalanche network. This move was noteworthy as FOBXX, launched initially on Stellar in April 2021, became the first U.S.-registered mutual fund to utilize a public blockchain for transactions and share ownership. The FOBXX fund, which currently manages $420 million in assets, invests in low-risk U.S. government securities and allows for 24/7 peer-to-peer trading. Each share, represented by a BENJI token, maintains a stable price of $1 and is accessible via the Benji Investments app.

- California DMV (July 31) - The California DMV digitized 42 million vehicle titles on the Avalanche blockchain. This initiative, developed in collaboration with Oxhead Alpha and Ava Labs over the past three years, aimed to streamline the title management process for California's 39 million residents.

- Tixbase and Passo Partnership (August 29) - Tixbase is creating Tixchain, an Avalanche L1 that is customized for ticketing systems. By bringing ticketing onchain, the user gains enhanced security, transparency of sales, built-in loyalty programs, reduced counterfeit tickets, secondary market revenue for sports teams and music IPs, and digital assets packages with the ticket. In late August, Tixbase partnered with Passo, a large Turkish ticketing platform, to bring their events to Tixchain under an exclusive 5-year partnership. Passo is the official ticketing company for the Turkish National Team, UEFA Champions League, Europa League, and many other events. They currently handle over 25 million tickets per year, with 11 million unique users and 6.5 million monthly active users.

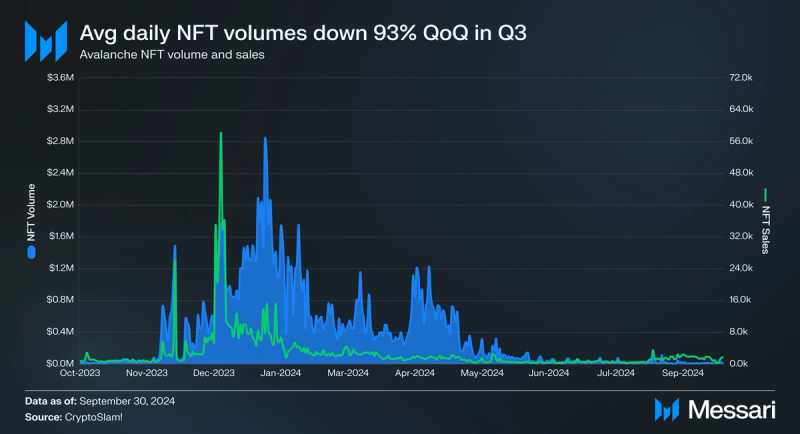

Avalanche’s NFT market continued to decrease in Q3, with average daily NFT volume decreasing by 93% from $310,900 to $22,000. Average daily sales also dipped by 39% from 300 to 180. NFT activity decreased in Q2 and Q3 due to the end of Hyperspace’s AVAX incentive program, which ran from October 11, 2023, to June 26, 2024. In Q2, rewards were distributed for Seasons 5-7, totaling 105,500 AVAX in incentives. With the Hyperspace incentive program winding down, the Avalanche Foundation launched a new $1 million incentive program with Salvor in May. Salvor is a peer-to-peer NFT lending platform on Avalanche C-Chain that allows users to use NFTs as collateral for loans in AVAX.

Q3 was a busy quarter for gaming on Avalanche, with the following notable events:

- Fableborn (July 1) - Fableborn launched their mobile action RPG to over 70,000 players. Their season 1 play to airdrop event had over 5,000 hours played in game.

- Chronos (July 19) - In July, Chronosworlds announced they are going to deploy their RPG on Avalanche.

- MapleStory (July 24) - MapleStory Universe launched their Pioneer Playtest, a limited event for early testers and fans. Shortly after launch, the L1 was generating 30,000 transactions per day.

- Off the Grid (August 12) - In August, the Off the Grid team launched their closed playtest, which resulted in over 400,000 transactions from 30,000 players in its first weekend on their testnet. Gunzilla’s Off the Grid is a AAA battle royale-style shooter built on a customized Avalanche L1 that immerses players in a 60-hour narrative campaign. It boasts a mind-blowing number of high-fidelity, fully customizable weapons and sports an unrivaled level of detail, thanks to 3D scanning technology. The game officially launched in early Q4.

Codebase

One of Avalanche’s major ecosystem growth strategies for 2024 is Avalanche Codebase. Codebase is a 12-week accelerator program to support early-stage Web3 projects building on Avalanche. On March 30, Avalanche announced the initial cohort of projects selected. A list of the initial cohort of projects can be found in Q1’s report. On August 8, the team launched Codebase Season 2, with registration ending on September 1. The onboarding process started at the Avalanche Summit in Buenos Aires in early Q4. The teams will pitch to investors and the ecosystem on December 18.

infraBUIDL Program

In September, the Avalanche team launched the infraBUIDL Program. The program is an initiative to support infrastructure developers within the Avalanche ecosystem through milestone-based retroactive grants. The program focuses on funding projects that demonstrate innovation or strategic importance in areas such as validator marketplaces, virtual machines, wallets, oracles, interoperability tools, and data storage. The goal is to improve developer and user experiences, encourage contributions to the Avalanche Network, and advance the capabilities of Avalanche L1s and distributed computing. Applications are still open.

Other notable ecosystem developments:

- On August 27, over 150 students in India learned how to launch their own L1 on Avalanche, cohosted by Chainlink.

- 17 of the 24 teams at the Ethereum Bolivia Buildathon decided to also launch their contracts on Avalanche.

- On September 24, the Avalanche Ambassador DAO held a developer workshop at the University of Nigeria where students learned how to launch an L1 on Avalanche.

Avalanche's Q3 2024 showcased substantial advancements across both technical and ecosystem fronts, emphasizing its adaptability and growth as a versatile blockchain platform. The rollout of Avalanche9000 marks a major step in enabling more scalable and affordable L1 deployment, reducing the barriers to creating custom L1 solutions while also facilitating seamless interaction between L1s. This technical milestone, paired with enhanced enterprise adoption and increased transaction activity within gaming L1s, demonstrates Avalanche's unique value proposition as a scalable platform for both Web3 developers and institutional users.

Despite a slowdown in the broader crypto market, Avalanche continued to push forward with innovations that enhance network utility and resilience. The successful playtest of Off the Grid and the launch of new enterprise partnerships, such as with the California DMV and Franklin Templeton, highlight the growing diversity in use cases across the Avalanche ecosystem—from AAA gaming experiences to institutional finance. Looking ahead, the network's emphasis on scalability, enterprise adoption, and developer incentives positions it well for continued ecosystem growth and user engagement.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.