and the distribution of digital products.

State of Akash Network Q3 2024

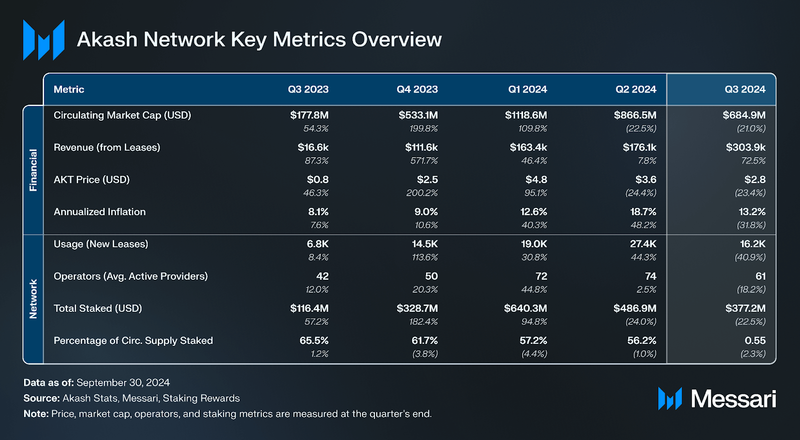

- Revenue reached a record of $304,000 (+73% QoQ) due to a rise in GPU demand and higher costs spurred by deployments of resource-intensive AI models like Meta’s Llama 3.1. Revenue surged 1,731% YoY, rising from $17,000 to $304,000.

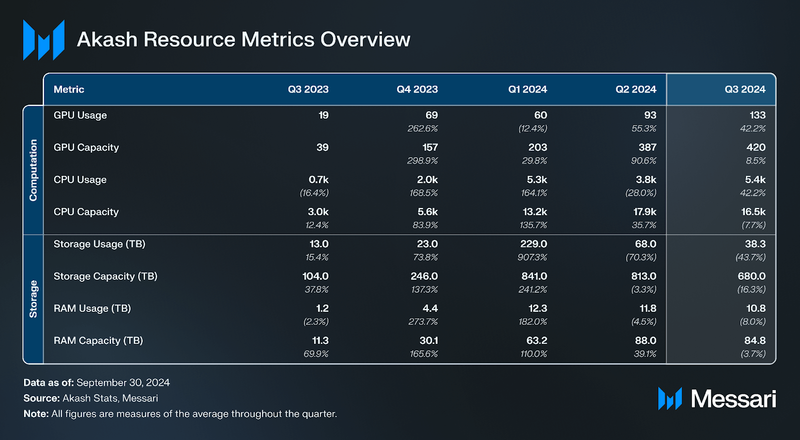

- Akash’s GPU capacity grew by 8.5% QoQ, reaching a daily average of 420 GPUs, while GPU utilization increased by 42%, aligning with the strong demand for AI compute resources despite a reduction in overall network lease volume.

- Active providers declined by 18% QoQ, falling from 74 to 61, possibly due to rising provider’s costs. However, Akash maintained a global provider presence, with continued participation from regions such as Brazil and Mexico

- Strategic partnerships included integrations with NVIDIA, following the acquisition of Brev.dev, as well as Prime Intellect and Venice.ai, supporting Akash’s positioning in decentralized AI compute with enhanced access to high-density GPU resources.

Akash (AKT) is a decentralized cloud computing marketplace that facilitates the buying and selling of compute resources. It is an open-source, permissionless protocol that provides an alternative to today’s centralized cloud services (i.e., AWS, Azure, and Google Cloud). Akash aims to leverage the global amount of underutilized server capacity, which can range from 5% to over 30%. The Akash marketplace functions via a reverse auction, giving users the ability to name a price and describe the resources they want for deployments. Akash’s decentralized network of compute providers runs its open-source software and competes to provide resources, often at a fraction of the cost of big cloud providers. Specifically, Akash hosts containers where users can run any cloud-native application (e.g., gaming servers, blockchain nodes, and websites). Akash offers extensive cloud management services like Kubernetes, which can be used for hosting and managing containers.

Akash is a Tendermint-based blockchain built using the Cosmos SDK. Marketplace activity (requests, bids, lease details, etc.) is stored onchain and payments are settled with Akash’s native token (AKT). For a full primer on Akash, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Usage and Provider AnalysisLeases and Revenue

Usage and Provider AnalysisLeases and RevenueAkash’s marketplace uses a reverse auction, in which users propose a bid that describes the resources they’d like to use for a deployment. When accepted, a lease is opened onchain managing the activity of this relationship.

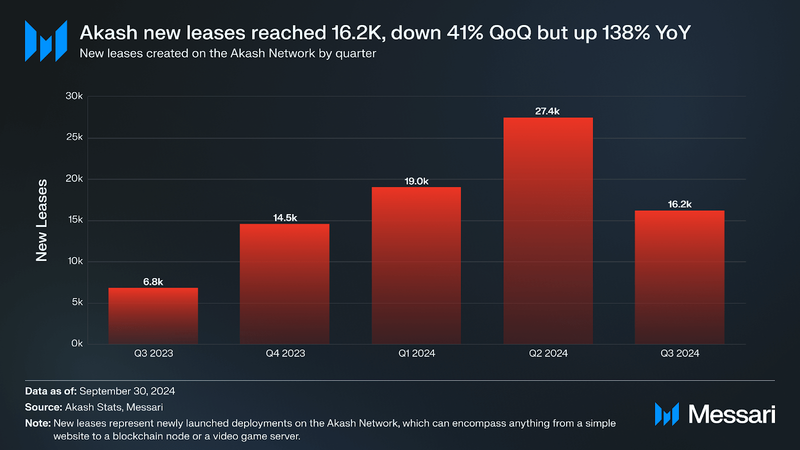

New leases on Akash show the number of new deals created between users and providers for renting resources on the network. In Q3’24, Akash Network experienced a 41% QoQ decline in new leases, falling from 27,000 in Q2 to 16,000 in Q3. This reduction can likely be attributed to multiple factors that impacted overall activity on the network. One significant element was a shift in focus towards deploying advanced AI models, such as Llama 3.1 and Nous Hermes 3. This emphasis on resource-intensive workloads may have diverted resources and attention from general lease activity, potentially slowing broader network usage.

Additionally, infrastructure costs rose due to the doubling of H100 GPU capacity, which may have led to higher lease prices, making the network less accessible to certain users. The number of active providers also fell from 74 to 61, an 18% decline that limited the network’s supply-side capacity and may have reduced overall deal volume.

The acquisition of Akash’s primary client, Brev.dev, by NVIDIA also introduced some uncertainty. Although this acquisition strengthened NVIDIA's connection to Akash and encouraged potential partnerships, it could have caused hesitation or reallocation among some users awaiting clarity on Brev’s strategic direction within Akash’s decentralized ecosystem.

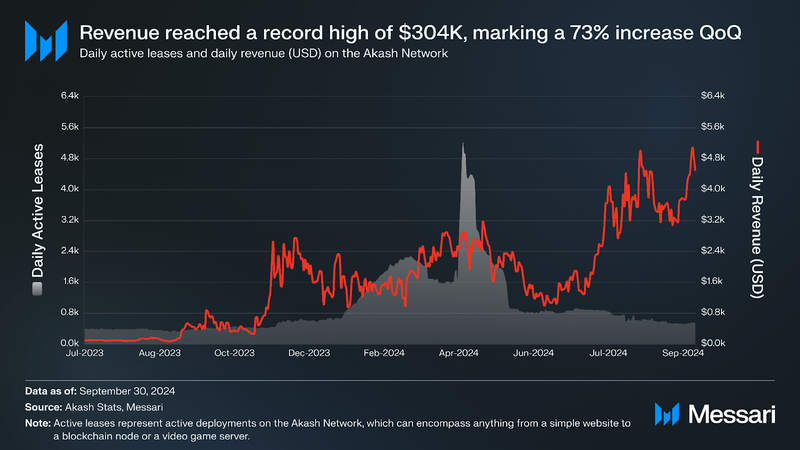

Active leases on Akash are leases that currently utilize and manage resources on the network. Leases that close are no longer considered active. Despite a decrease in the number of leases and active operators, Akash Network reached a record high in Q3'24 revenue, rising 73% QoQ from $176,000 to $304,000. This growth was primarily driven by increased GPU costs, which pushed the average lease fee from $6.42 to $18.75. While this raised costs and led to fewer new lease contracts, Akash’s strategic partnerships with industry leaders like NVIDIA and Prime Intellect, alongside the deployment of advanced AI models such as Llama 3.1 and Nous Hermes 3, spurred strong demand for high-performance computing. Akash also recorded a 1731% increase in revenue YoY, up from $17,000 to $304,000.

In early August, Akash saw a peak in GPU rentals following Meta’s release of Llama 3.1, a powerful open-source language model requiring substantial GPU resources, including Nvidia A100s, due to its 1.46 million training hours and 405 billion parameters. Akash’s unique ability to deploy this model when others could not, drove GPU demand to record highs.

Average GPU and CPU usage grew by 42% QoQ, although daily active leases fell by 60%, from 1,754 in Q2 to 693. This suggests that existing users are intensifying their use of resources at higher costs, driving Akash’s revenue growth and underscoring the strong demand for AI-driven computing power that requires high-performance infrastructure. Meanwhile, as most of Akash’s partners focus on GPUs, Quasarch Cloud developers on the DeCloud platform, along with builders and validator nodes, are advancing on the CPU compute front. They are positioning themselves as a dedicated distributor of cloud services, powered entirely by Akash’s decentralized infrastructure.

In addition, Akash’s reverse auction pricing model has also enabled operators to prioritize profitable leases and effectively meet AI-centric workload demands, allowing for higher resource bids and supporting the network’s sustained revenue growth.

All Resource Compute

GPUs, CPUs, storage, and RAM are the primary resources available for lease on Akash Network. In Q3, GPU capacity increased by 8.5% QoQ, rising from 387 to 420 units. Despite this addition of only 36 GPUs, GPU usage surged by 42% QoQ, from 4,000 to 5,000 units, indicating heightened demand for GPU power. Conversely, CPU capacity decreased by 8%, from 18,000 to 17,000, yet CPU usage increased, aligning with the strong demand for compute resources overall.

On the other hand, Akash's other resource offerings, storage and RAM, both experienced declines in Q3. Storage usage dropped by 44% QoQ, while RAM usage fell by 8%. Additionally, storage capacity decreased by 16%, and RAM capacity declined by 4%. This drop in usage and capacity suggests that users are shifting their focus towards GPUs and CPUs, reducing demand for storage and RAM as they prioritize high-performance computing for intensive tasks.

GPU Compute

This sustained demand and effective capacity expansion were further supported by the passing of the Verifiable Compute proposal in Q3, which allocated funds to ensure secure and verified GPU allocation using Trusted Execution Environments (TEEs). This proposal is expected to build confidence among users requiring high-security compute environments, fueling GPU demand on Akash as a reliable resource for decentralized AI workloads. Additionally, key partnerships with industry leaders like NVIDIA and Prime Intellect bolster Akash’s positioning as a top provider of decentralized AI and compute resources, meeting the rising need for trusted, high-performance GPU capacity on the network.

Active Providers

In Q2, Akash reached a record daily average of 74 active providers. However, this number dropped to 61 in Q3, an 18% decrease QoQ but still a 45% increase YoY. This reduction in active providers may be due to the increasing costs associated with maintaining provider status on Akash. Rising GPU prices and other operational expenses likely led some providers to exit, while those who remained focused on profitability to meet the growing demand for high-performance compute resources.

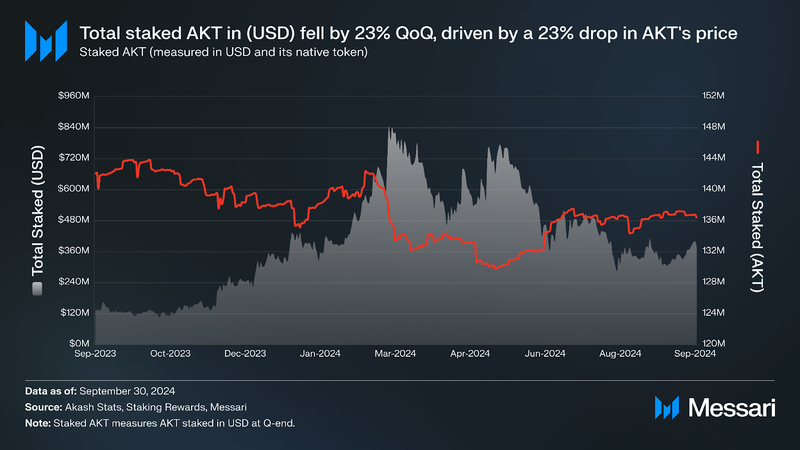

Token AnalysisMarket Cap Staking

Staking Qualitative AnalysisPartnerships and Developments

Qualitative AnalysisPartnerships and Developments Strategic Partnerships and Integrations

- Brev.dev (acq. by NVIDIA) Partnership: Brev, a platform for AI/ML development, enables users to build, train, and deploy machine learning models on cloud infrastructure. As one of Akash’s closest partners and primary client, Brev announced support for Akash GPUs in April 2024. In mid-July, Brev was acquired by NVIDIA, effectively positioning NVIDIA as a primary partner of Akash. Due to the AKT requirement for deploying workloads on Akash, Brev initially held AKT on its balance sheet; now, with the acquisition, NVIDIA also holds AKT, marking a substantial integration of Akash technology within NVIDIA’s operations.

- Prime Intellect Collaboration: Akash has partnered with Prime Intellect to launch a decentralized platform for AI model training, utilizing Akash's high-density GPUs from the Akash Supercloud, such as NVIDIA's H100 and A100. Through this collaboration, contributors can provide computational resources and, in return, earn fractional ownership of the AI models they help train.

- FluxEdge Integration: Once considered rivals, FluxEdge and Akash have expanded their collaboration to include Akash's high-density GPUs in FluxEdge’s marketplace. With fiat payment options available, this integration makes Akash’s infrastructure more accessible for AI and machine learning developers who seek powerful GPUs without cryptocurrency as a barrier, simplifying access to decentralized compute.

- Venice.ai Partnership: Venice.ai, a private, uncensored generative AI application, uses Akash Network’s GPU infrastructure to handle inference requests, ensuring privacy and delivering unfiltered results from open-source models. Leveraging Akash’s decentralized network, Venice deploys advanced models such as Llama 3.1 (405B parameters) and Nous Hermes 3 (8B parameters), enabling globally accessible, cryptocurrency-powered AI services. This partnership highlights Akash's role in supporting secure, censorship-free AI applications.

AI Model Deployment and Infrastructure Expansion

- Akash Permissionless AI Access: Akash Network has launched permissionless AI access, allowing developers and researchers to deploy and utilize AI models, including Meta’s Llama 3.1, Llama 3.2 (3B parameters), Llama 3, Mistral-7B, Nous Hermes 2 Mixtral, Mixtral, and Dolphin-Mixtral, without sign-ups or sign-ins. Through the Akash Chat API, users gain free access to AI inference capabilities, with initial support funded by Overclock Labs. As the first open-source cloud to support Llama 3.2, Akash leverages NVIDIA A100 GPUs, reducing entry barriers and fostering a more inclusive, accessible environment for seamless AI experimentation and development.

Innovations in Verifiable Hardware for Security and Trust

- Verifiable Hardware Initiative: Recent Sybil attacks on rival networks highlight the critical need for secure hardware verification. In response, Akash is piloting a non-KYC incentive program and strengthening security by implementing Trusted Execution Environments (TEEs) for hardware verification. Supported by academic expertise from the University of Texas, this TEE integration enhances security while maintaining Akash’s permissionless framework.

Some other notable Highlights:

- $AKT Trading on Uphold: Akash’s token, $AKT, became tradable on Uphold in Q3, increasing token accessibility and liquidity.

- Expansion in Latin America: Akash expanded its reach in Latin America by establishing new community nodes in Mexico and Brazil.

- Decentralized AI Leadership Recognition: Grayscale highlighted Akash in a report as a leader in decentralized AI, shared publicly at the end of August 2024.

- Cosmoverse AI Track Leadership: Akash was announced as the lead for the AI Track at Cosmoverse in Dubai, October 2024, underscoring its influence in AI and decentralized computing within the Cosmos ecosystem.

- Academic Research Collaboration: Akash’s A100 GPU cluster supported research on Unified Masked Diffusion, demonstrating its use in academic and research-driven AI projects.

Core development on Akash is approved through token-weighted governance and goes through a structured proposal process. The community can also simply create tools that anyone can use to access Akash. Below are highlights from the Q3 2024 governance initiatives:

- 2024 Q3 Community Support: This proposal allocated $57,000 in AKT from Akash’s community pool to strengthen Q3 community programs, focusing on the Insiders & Vanguards Program and structured bounties. The Insiders & Vanguards Program incentivizes volunteer participation, helping onboard and retain active members, while monthly community bounties of $5,000 encourage contributions across projects, tracked on a public board. The total 2024 community support budget is $228,000, divided quarterly to sustain engagement and growth.

- 2024 Q3 Events Resourcing: The 2024 Q3 Events Resourcing Proposal requests $485,484.74 to support Akash’s participation in prominent industry events like EthCC, Korean Blockchain Week, and Token 2049, aimed at increasing visibility and networking. This includes $161,417.09 for Tier 1 sponsorships (with an expanded cap of $50,000 for high-profile engagements), $48,261.53 for Tier 2, and a $17,865.97 adjustment to cover budget shortfalls and ensure full funding for commitments.

- Verifiable Compute Development: To strengthen network security and resource verification, $243,701.70 was allocated to develop verifiable computing capabilities, starting with Trusted Execution Environments (TEEs) for hardware provisioning. Phase 1 focuses on secure GPU provisioning to ensure accurate computing power allocation. Milestones include a high-level design by Q3 2024 and a Devnet prototype by Q2 2025.

- Revive Akash<>Comdex IBC Client: To maintain interoperability, a proposal was approved to update the IBC client between Akash and Comdex, migrating from 07-tendermint-104 to 07-tendermint-190.

- Developer Onboarding Funding Proposal 2: This proposal approved $12,000 over four months to support Akash’s developer onboarding program through Zealy, aimed at growing the developer community. The funding structure allocates $2,000 per contributor and $3,000 for rewards to incentivize engagement and strengthen the developer ecosystem.

- August 2024 Inflation Adjustment: To improve inflation management, the community approved a proposal to reduce inflation rates from a minimum of 13% to 8% and a maximum of 20% to 13%, supporting ecosystem sustainability. This change separates inflation control from community pool tax adjustments, allowing for a more independent inflation framework.

- Reduced Deployment Take Rate for uAKT and axlUSDC: A reduction in the deployment take rate for uAKT to 1% and axlUSDC to 2% was approved to enhance affordability and attract new users to Akash. This adjustment aims to lower deployment costs and encourage wider adoption of Akash’s services.

- Upgrade to Cosmos SDK v0.47: A $377,196.13 funding request was approved to migrate Akash to Cosmos SDK v0.47, aligning it with the latest Cosmos ecosystem advancements. The funds cover development, testing, and support costs to maintain Akash's competitive edge within Cosmos.

- 2024 Q4 Community Support Proposal: For Q4 2024, the community approved 21,902.45 AKT to support ongoing initiatives, with an increased bounties budget of $10,000 per month to encourage community contributions. The total Q4 requirement is projected at $72,000 to meet the Akash community's growing needs.

Akash Network saw significant developments in Q3, reaching a record revenue of $304,000 (+73% QoQ) despite a 41% decline in new leases, which fell to 16,000. The rise in revenue was largely driven by increased demand for resource-intensive AI workloads, such as Meta’s Llama 3.1, which contributed to higher average lease fees. GPU supply also expanded, with a daily average of 420 units available (+8.5% QoQ), helping to meet the demand for high-performance computing even as infrastructure costs rose. The active provider count decreased by 18%, though Akash maintained its reach across regions like Brazil and Mexico.

Strategic partnerships with NVIDIA (following their acquisition of Akash's partner Brev.dev), Prime Intellect, and Venice.ai illustrate Akash’s role in decentralized AI and compute services. These collaborations enhanced access to GPU resources and facilitated privacy-focused AI applications on Akash’s infrastructure. Governance initiatives this quarter, including inflation adjustments, community support funding, and protocol upgrades, supported both network growth and security improvements.

Looking ahead, Akash’s focus on expanding its compute capacity for AI workloads, integrating hardware security features, and fostering partnerships positions it to meet the growing demand for decentralized AI infrastructure, with a continued role within the Cosmos ecosystem.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.