and the distribution of digital products.

Seven Stages of Empire

Our school systems do not have money in our curriculum, yet our lives depend on it. \n We spend most of our lives worrying about it, working for it, saving it, spending it, and even fighting, dying, or killing for it. It defines our social status and even compromises our morals.

\ Those most concerned with trade and budget deficits are typically advocates of hard money, such as the gold community. These individuals often study monetary history, which has a recurring pattern that echoes back to the dawn of civilization.

\

The Dawn of Sound MoneyGold and silver have been predominant currencies for about 5000 years, but it wasn’t until around 650 BC that they became money. That’s when they were minted in coins of equal weight somewhere in LYDIA, where each coin was the same size and weight; this made them interchangeable, calling them fungible. At that point, they became useful as a unit of account and a measurement. You can price goods and services in those gold or silver coins, and a certain number of them. This made the trade easier.

\ In Athens, these coins exploded in use. Money found its natural home, i.e. the free market. Athens was the first society to have a working tax system and free markets. This enabled them to rise to the pinnacle of civilization. They created great works of art and achieved a level of architecture and engineering that the world had not yet seen.

\

But then something went wrong, and so did such a great and powerful civilization fall. But why?

\ The answer is in the same pattern we see throughout history.

\

:::warning Too much greed and too much war.

:::

\ It was when Athenians got involved in the Peloponnesian wars, a war with Sparta, that their monetary problems began.

\ First, they lost access to their gold and silver mines. They were funding distant armies operating miles away from Athens, which led to a deflationary market as all their coinage was being sent out of the city.

\ Then they started debasing their coinage to fund their wars. If you take in 1000 coins in taxes and you melt down those gold coins and mix 50% copper in that, now you can mint 2000 coins. What is it called?

\

Deficit spending or fraud?

\ They also continued to fund their expensive public works, like the Temple of Athena Nike and didn’t allow their market economy to heal from the expenses of war.

\ So the large factor in Athens's downfall was the expense of war, the expense of expansion of the Empire, the debasement of their currency, and the eventual inflation that was caused. They debased those gold coins so many times that they minted nothing but flecks of copper. This was the world’s first Hyperinflation.

\

\

Empire After EmpireToday we are doing the same thing that Athenians did that caused the loss of their great culture. We are doing the same currency debasement; we’re doing the same deficit spending and it’s for the same reason: for war and great public works.

\ What you’ve just seen is the first recorded example of one of the most predictable secrets of money. The Seven Stages of Empire; it’s a long-term cycle that echoes throughout history to this day and is a societal pendulum that swings from quality money to quantity currency and back again to quality money.

\

It always plays out in seven stages.

It always ends with gold delivering a knockout blow to the debased currencies.

\ It goes like this:

Stage 1: Sound MoneyA country starts with good money, which is either gold or silver or backed by either of them.

Stage 2: Layers of Public WorkAs a country develops economically and socially, it begins to take on more economic burdens, adding layers of public works.

Stage 3: Massive MilitaryAs economic affluence grows, so does its political influence, and it increases expenditures to fund a massive military.

Stage 4: WAREventually, it puts its military to use and expenses explode.

Stage 5: Currency DebasementTo fund the war, it steals the wealth of its people by debasing their coinage with base metals or by replacing their money with a currency that can be created in unlimited quantities.

Stage 6: Loss of FaithThe loss in purchasing power of the expanded currency supply is sensed by the population and the financial markets, triggering a loss of faith in the currency.

Stage 7: Currency CrisisA mass movement out of currency into precious metals and other tangible assets takes place. The currency collapses and gold and silver rise in price as they account for the huge quantity of currency that was created.

\ This process transfers wealth to those who had the foresight to position themselves beforehand in real money: Gold and Silver.

\

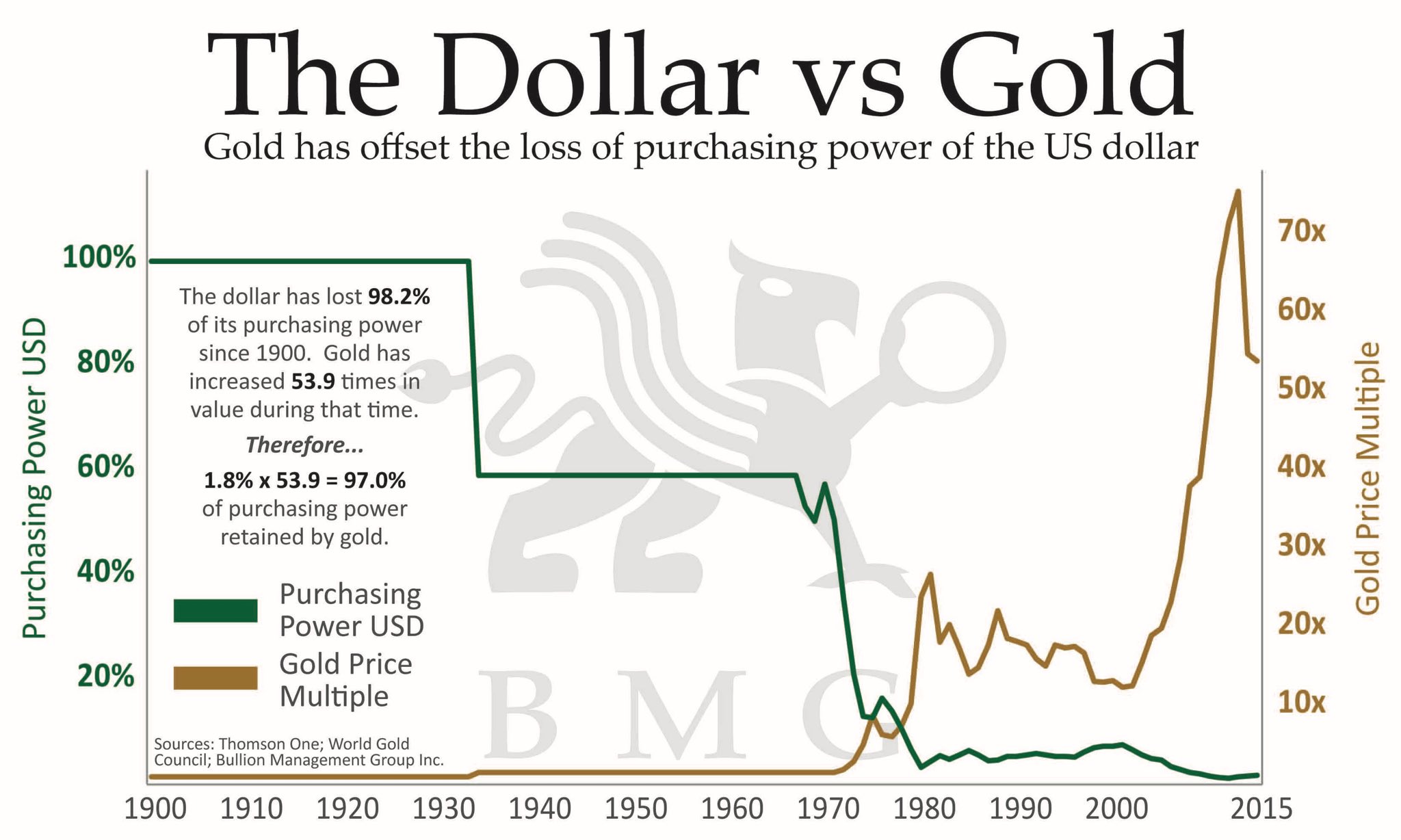

Last 140 Years of Monetary HistoryOur monetary systems steal from the poor and middle class and transfer the wealth to the banks. We see this throughout history and it keeps happening over and over again. The best option to get out of the system trap is to understand gold, and in turn, understand our monetary history.

\ Everybody thinks US Dollar is as good as gold, and it hasn’t been since 1971.

Looking at the world monetary system:1873, Germany went on the Classical Gold Standard, where each unit of currency was backed up by an equivalent amount of Gold in the Treasury. Any fiat currency would act like a receipt in this case, where holders can redeem them for the equivalent amount of gold from the bank. This gives Governments the ability to start the scam in the first place, where they print these receipts for gold, and they can print more than the gold they hold in their vaults.

\ And we got to World War I, 1914 - when all the combatants stopped redemption rights, you could no longer go to banks and trade your pounds, lira marks, or francs into gold. They lit up the printing presses and started printing like crazy.

\ Then after World War I, they went on to something called the Gold Exchange Standard, where currencies were partially backed by gold. In the United States, under the Federal Reserve Act of 1913, the FED was allowed to put $50 worth of claim checks on the gold currency in circulation, backed up by only $20 of Gold, i.e. 40% Reserve Ratio.

\ During both wars, Europe paid the United States with Gold. In WWI US mostly sold consumer goods as European Industry was busy supporting the War.

\

\ By the end of World War II, the United States had 2/3rd of all the world’s monetary gold, while 1/3rd Gold with the rest of the world, and Europe had almost none.

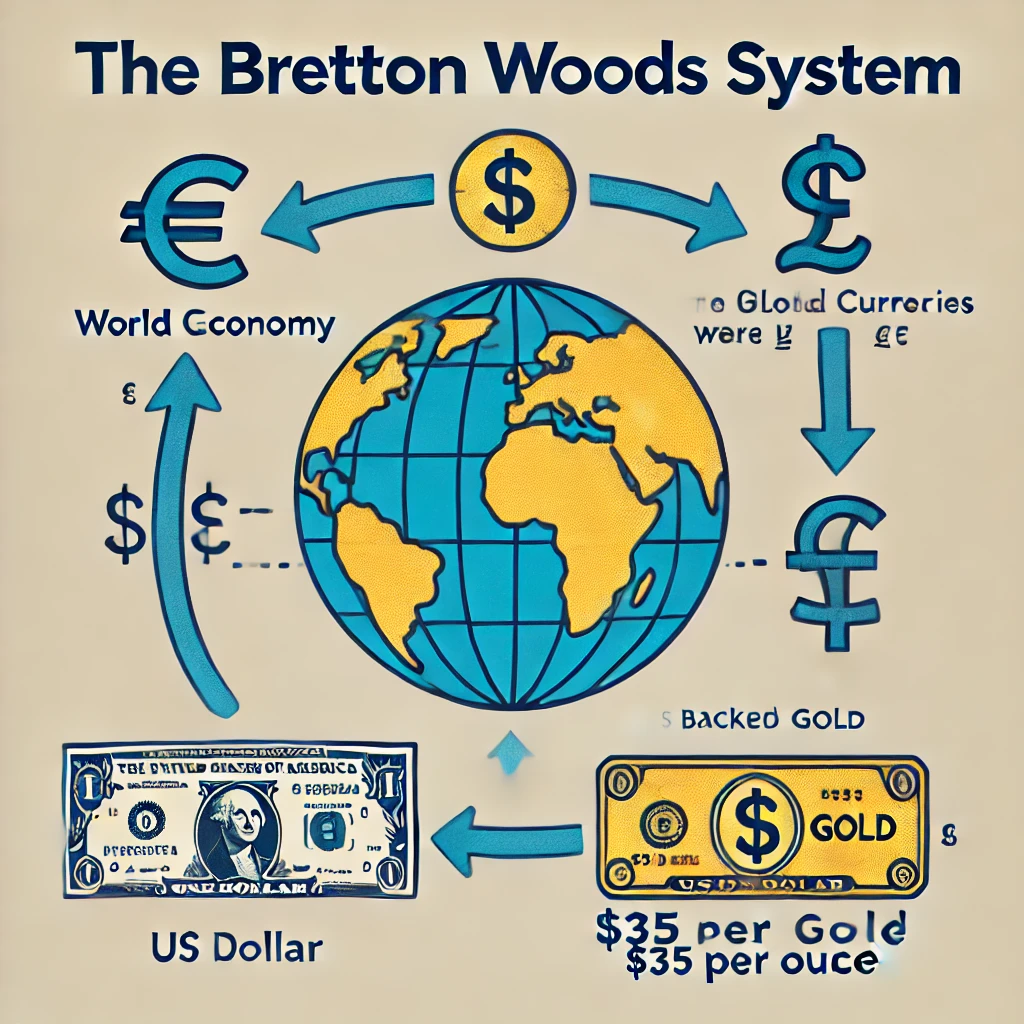

\ So the world monetary system was no longer going to work and it would collapse. But the United States made loans to Europe making its market flooded with dollars. So, representatives around the world met at Bretton Woods, New Hampshire in 1944. They came up with a new world monetary system called the Bretton Woods system, where every currency on the planet (with few exceptions), would be backed by US dollars, which in turn would be backed by Gold at $35 per ounce.

\ This gave world stability and it pegged all world currencies to each other and to Gold through US Dollar. So there was no such thing as forex, currencies didn’t float, and the exchange rates were fixed year after year, making the world trade boom.

\ Under the Bretton Wood system, there was no reserve ratio established, so kept on printing US Dollars and did a bunch of deficit spending for Korea, Vietnam, or Johnson’s Great Society. This expanded the currency supply, and the amount of paper dollars in circulation, and exported them all over the world.

\ In 1960, Charles DeGaulle, President of France, realised that the United States didn’t have enough gold to back the dollars, and asked to trade back Gold giving the US back their dollars. Other countries saw this and jumped on board, making the US lose 50% of its gold from 1959 to 1971.

\ In 1971, the US had printed 12x the dollar created than the amount of GOLD in reserves. This created a bank-run situation, with the US being the giant World Bank.

\

:::info Everyone sensed this and US President Richard Nixon was decided to take us off the Gold standard.

:::

\

:::tip On August 15, 1971, All the World’s currencies became fiat currencies.

:::

\ There have been thousands of fiat currencies throughout history and there isn’t one that survived. It is a 100% failure rate.

\ In the world of floating currencies and that’s what all national currencies are today, they bob up and down relative to each other but they’re all syncing relative to gold, which includes Dollar, Euro, British Pound, Rupee, and all the others. They’re gonna continue to lose value and continue to lose purchasing power.

\ There’s no way to fix it, but there’s a way to either let it wipe you out or benefit from it. Looking back at the 7 stages of Empire, we can say, we’re in the sixth stage, and at the beginning of 7th stage. Gold started accounting in the year 2001, it was $250 then.

\

\

LessonsMoney was born in roughly 630 BC when it became fungible.

It was free markets and sound money, that led to Athens's great prosperity.

The debasement of their money for deficit spending on war and public works played a large role in their demise.

Over the past 140 years, we have debased our currencies, to the point where 2 generations of scholars don’t even understand gold.

Gresham’s Law: Bad Money drives out Good.

In recent history, there has been a new monetary system roughly every 40 years.

\

\ Reference for this article: Hidden Secrets of Money Episode 2 - Mike Maloney

https://www.youtube.com/watch?v=EdSq5H7awi8&embedable=true

\ \

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.