and the distribution of digital products.

DM Television

QED vs Chainlink: Is it the best Blockchain Oracle yet?

Since the blockchain revolution in the mid-2010s, there has been immense development in blockchain technology. We all have witnessed the industry growing from just transferring coins to sophisticated Metaverses. One of the biggest milestones is the BLOCKCHAIN ORACLES. We shall explore and introduce you to BLOCKCHAIN ORACLES. We will also compare a giant in the field with a relatively new but potential rival.

What is a Blockchain Oracle?A fundamental smart contract cannot interact with the outer world independently.

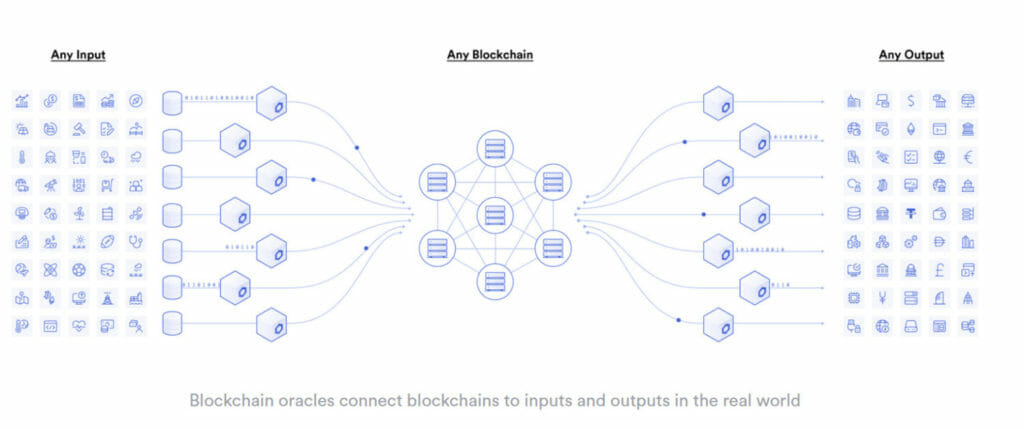

To put it simply, a blockchain oracle connects the WEB3 ecosystem to the external world environments like existing data sources, systems built in the past, and advanced computational resources. These Oracle networks enable the creation of hybrid on-chain and off-chain smart contracts. You can combine both the on-chain and off-chain infrastructure and use them together. The created system (dApps) can efficiently respond to real-time events and can work together with traditional systems.

Blockchain Oracle

Blockchain Oracle

Consider this situation from Chainlink:

“For example, let’s assume Alice and Bob want to bet on the outcome of a sports match. Alice bets $20 on team A and Bob bets $20 on team B, with the $40 total held in escrow by a smart contract. When the game ends, how does the smart contract know whether to release the funds to Alice or Bob? The answer is it requires an oracle mechanism to fetch accurate match outcomes off-chain and deliver it to the blockchain in a secure and reliable manner.” (Chainlink Website)

What is Chainlink?Chainlink was created in 2017 by Sergey Nazarov and Steve Ellis, who also co-authored its whitepaper.

Chainlink is a Blockchain Oracle Network built on Ethereum. The network can get off-chain event data like weather, match results, elections, etc., to on-chain smart contracts. Chainlink claims that smart contracts can get data from external events securely and reliably with the Chainlink ecosystem to ensure unbiased and error-free contract execution.

Like every technology, Chainlink also encounters a few problems, like a lower refresh rate (120 seconds). This refresh rate is much higher than other industry peers like Supra Oracles(3 to 5 seconds) and QED (half-a Second). Chainlink also suffers from true decentralization, as it needs third parties for technology implementation.

Let’s explore another revolutionary entrant in the field; QED, a blockchain oracle network designed for super high refresh rates.

QED vs Chainlink: DecentralizationChainlink is not a truly decentralized ecosystem. They have third-party partners for implementing technology. But their fees are less, which means currently they can carry on with their activities but eventually will have to get a truly decentralized system.

QED, on the other hand, has a truly decentralized system.

QED vs Chainlink: RewardsChainlink enables LINK Token holders to stake tokens to a node of their choice and awards them in LINK Tokens. The tokens are not staked evenly rather into some specific nodes. If an error is found in any node’s data, a portion of its stake is cut down.

QED demands collateral from nodes and implements a second layer system to verify data from nodes using the same oracle method. If any error is found from any node’s data, the collateral is released to the customer as compensation.

QED vs Chainlink: Collateral and PricingChainlink’s method of staking at specific nodes makes the rewards and pricing vary and arbitrary. Collateral is decided arbitrarily based on staking incentives.

QED allows the customer to negotiate the price and collateral directly with the node. So, both of them agree before any deal is made.

QED vs Chainlink: True On-Chain SystemChainlink uses an off-chain reporting system that is not up to the true spirit where on-chain data is the main aspect of the industry.

QED, on the other hand, has on-chain reporting.

QED vs Chainlink: SecurityEven the safest oracles such as Solana-based Pyth Network were compromised, leading to a subsequent crash in Bitcoin. Chainlink uses Ethereum.

Delphi Oracle, QED’s base software, have never been compromised, which further adds to the trust level.

QED vs. Chainlink: Chain AgnosticBoth QED and Chainlink are chain agnostic, which means they work well on multiple chains. Chainlink, however, has the edge over QED and has better integrated cross-chain capabilities.

QED vs Chainlink: ComputationThe QED Token runs as an ERC-20 standard token and runs on UX Network for computational purposes. This standard helps QED get fully on-chain computational proof without the need for any sacrifices from Layer-2. A benefit of the UX Network is that it helps QED clock over 20,000 transactions per second. There are no parallel chains or sidechains in this network.

Chainlink, on the other hand, has off-chain statistics and computation. This off-chain system hinders the true spirit of decentralization since the statistics are mutable and can be morphed. Also, these are open to cyber-attacks from various rogue parties.

QED vs Chainlink: Market SizeChainlink has more than 10 Billion US Dollars worth of market. Being a bigger institution, it has more room and money to innovate.

QED is a relatively new solution and needs additional time to prove its worth. However, seeing its 0.5 Sec Refresh Rate, a lot is expected from it.

Conclusion:Blockchain systems are developing every day. With each update, things are getting better due to intense competition. Chainlink is a popular platform for blockchain oracles, but it has its shortcomings. In conclusion, there are technologies such as QED that offer far better performance in terms of true decentralization, speed, on-chain computations, and security. With further adoptions, QED is far more potent and capable of handling future challenges.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.