and the distribution of digital products.

Memecoin Market Analysis: 4 Strategies for Better Returns in 2024

\ Bitcoin's surge past $70,000 has reignited the memecoin market, with tokens like $GOAT delivering mind-bending returns of 10,000x in just five days. After analyzing trading data from the TOP 25 memecoins, we've uncovered four proven strategies that separate successful traders from the crowd. Here's your comprehensive playbook for navigating this high-reward market.

\

:::warning Editor’s note: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies are speculative, complex, and involve high risks. This can mean high prices volatility and potential loss of your initial investment. You should consider your financial situation, investment purposes, and consult with a financial advisor before making any investment decisions. The HackerNoon editorial team has only verified the story for grammatical accuracy and does not endorse or guarantee the accuracy, reliability, or completeness of the information stated in this article. #DYOR

:::

Strategy 1: Master the Holder Distribution GameUnderstanding holder distribution patterns has become a crucial edge in memecoin trading. My analysis reveals a three-tier system that smart money watches closely.

\

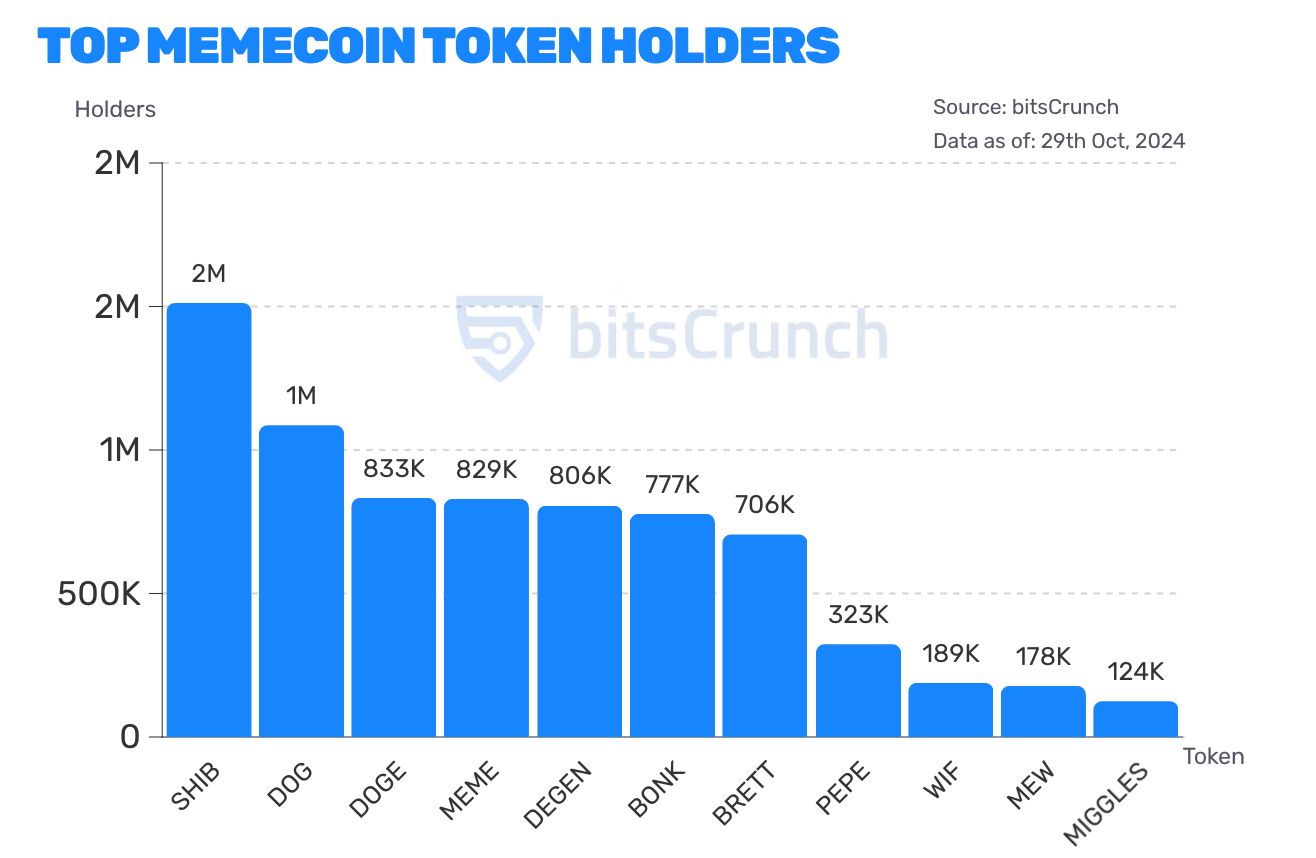

\ The first tier, comprising addresses exceeding 800,000 holders, is led by SHIB with 1.51M addresses, followed by DOG, DOGE, MEME, and DEGEN. These tokens consistently demonstrate higher trading volumes and market stability.

\ The second tier, ranging from 300,000 to 800,000 holders, includes BONK and BRETT, each maintaining approximately 700,000 addresses. Notably within this tier, PEPE and WIF have shown growth trajectories, with 30-day increases of 3.02% and 4.86% respectively, outpacing other larger counterparts.

\ The third tier encompasses tokens with 50,000 to 300,000 holders. MEW and MIGGLES stand out with over 100,000 addresses each, while HIGHER, FLOKI, POPCAT, MOCHI, PONKE, MOODENG, and MYRO occupy the 50,000 to 100,000 range. This tier exhibits the highest volatility but also presents significant growth potential.

Strategy 2: Decode Liquidity Patterns for Optimal EntryMemecoin trading demands sophisticated liquidity analysis. According to bitsCrunch data, SHIB and WIF currently lead with seven-day volumes reaching $70.2B and $67.3B respectively, but raw volume only tells part of the story.

\ The real profit opportunity lies in understanding the evolving nature of memecoin liquidity. Large-cap memecoins are increasingly becoming pseudo-stable assets, attracting strategic "buy the dip" behavior. Meanwhile, small-cap tokens maintain their role as speculation vehicles, offering higher risk-reward ratios.

\

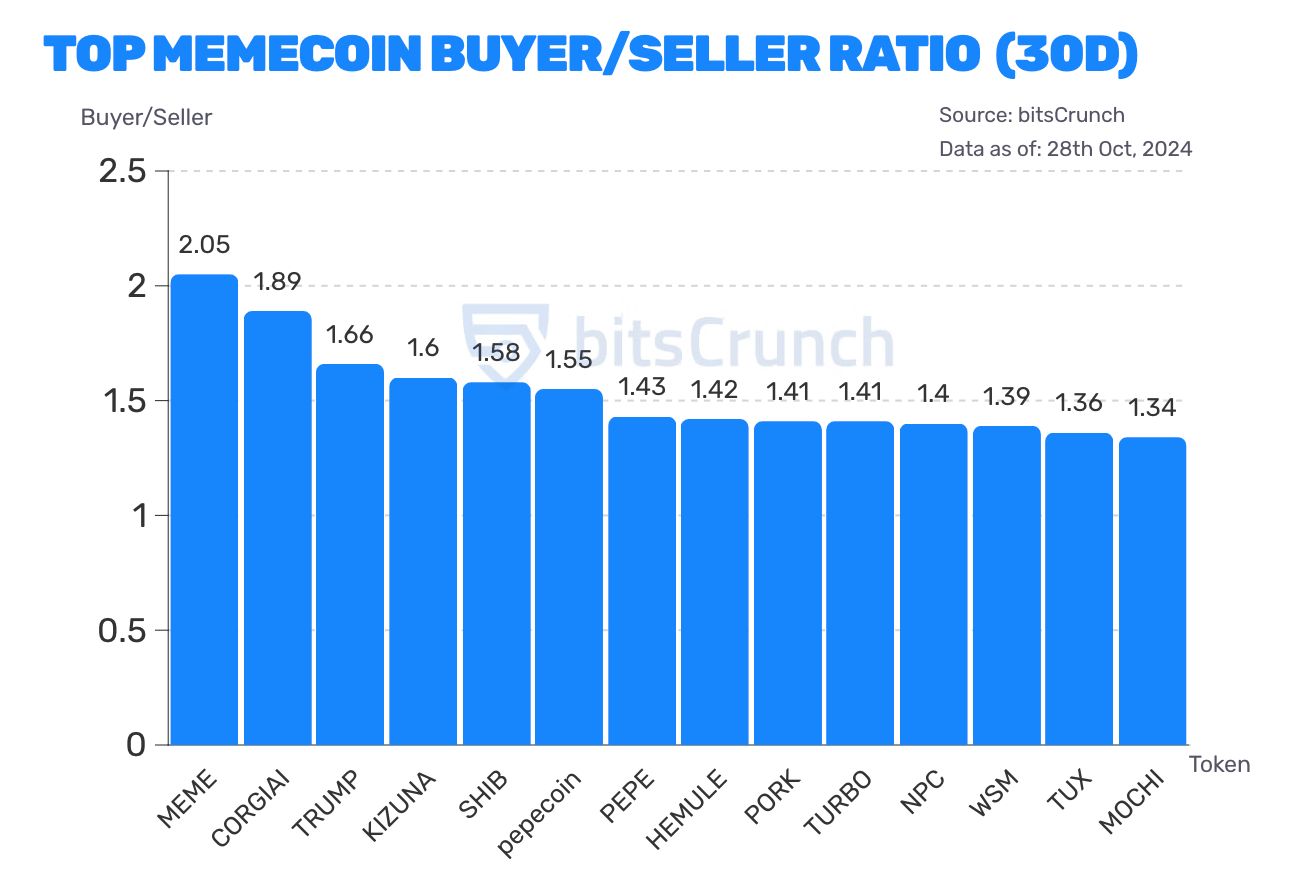

\ A prime example is TRUMP's recent performance, showing a buy/sell ratio of 1.66 and 15.9% price increase during the US election events. This demonstrates how traders leverage news catalysts for enhanced returns.

Strategy 3: Implement the Advanced Security MatrixSuccessful memecoin trading requires mastering three critical security dimensions. First, monitor authority concentration metrics to spot red flags early. Second, verify liquidity lock status to protect against rug pulls. Third, analyze address overlap patterns to identify potential market manipulation.

\ My research shows that projects with founder allocations below 5% demonstrate significantly higher success rates. This metric alone has proven invaluable for early identification of promising investments.

\ The emergence of sophisticated trading patterns requires constant vigilance. Watch for complex fund flows between large holders - these often precede significant price movements. Projects showing unusual 24-hour gains warrant particular scrutiny, especially when accompanied by suspicious wallet interactions.

Strategy 4: Leverage Social AnalyticsThe social landscape of memecoin trading has evolved dramatically. Traditional metrics focusing on KOL followers (previously requiring 3-5 influencers with 100K+ followers) have given way to more nuanced indicators.

\ Current market leaders often emerge from projects with moderate but highly engaged communities rather than those with massive but passive followings. The temporal distribution of social engagement has become a key success predictor - projects gaining steady support consistently outperform those relying on concentrated promotion campaigns.

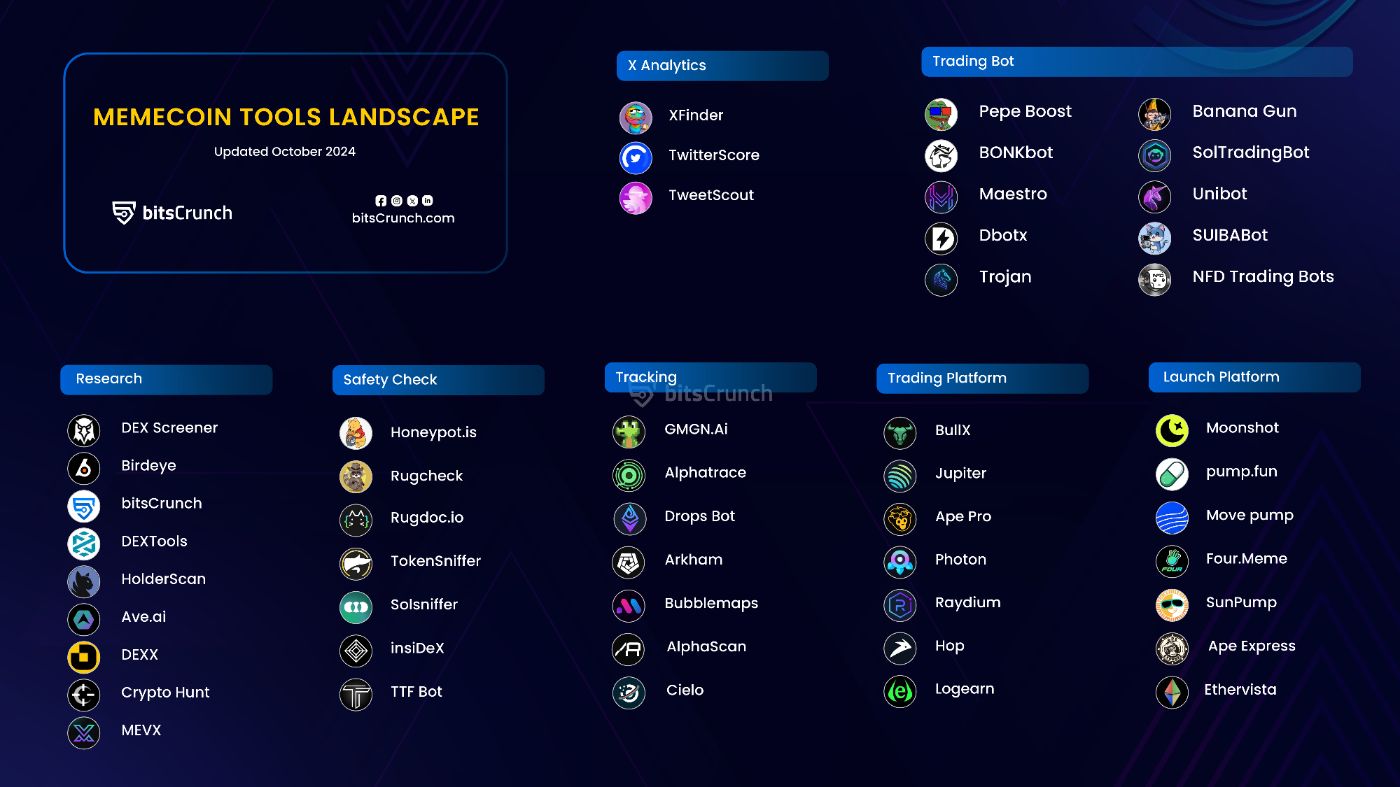

The New Playbook for SuccessThe Meme Tool Ecosystem Landscape presents five core segments of the overall industry: research tools, safety checks, tracking systems, trading platforms, and launch platforms.

\

\ Success in today's memecoin market demands a sophisticated approach combining these four strategies.

\ First, establish baseline metrics for project evaluation. Successful launches typically achieve $500-1000 hourly volumes within their first trading day. The crucial $100K market cap milestone serves as an early validation point - 87% of successful projects cross this threshold before significant growth phases.

\ Next, implement a comprehensive monitoring system tracking technical indicators, on-chain analytics, and social sentiment. Pay special attention to volume anomalies, position concentration shifts, and liquidity pool dynamics.

\ Finally, maintain strict risk management protocols. Use tiered stop-loss systems, monitor liquidity ratios continuously, and track social sentiment shifts across platforms. Remember, even the best strategies require proper position sizing and risk controls.

\ The memecoin market continues to offer exceptional return opportunities for traders who approach it systematically. By implementing these four strategies while maintaining rigorous risk management, you position yourself to capture the next wave of memecoin profits.

\ Disclaimer: This analysis is for informational purposes only and should not be construed as financial advice. Cryptocurrency investments carry significant risks, and thorough research is essential before making any investment decisions.

\

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.