and the distribution of digital products.

Jupiter: The DeFi Superapp

- Jupiter dominates Solana DeFi, processing over 90.0% of aggregator volume on Solana, with a growing suite of products (i.e., Portfolio Tracker, Pro Dashboard, Jupiter Mobile, a Perps DEX, and more)

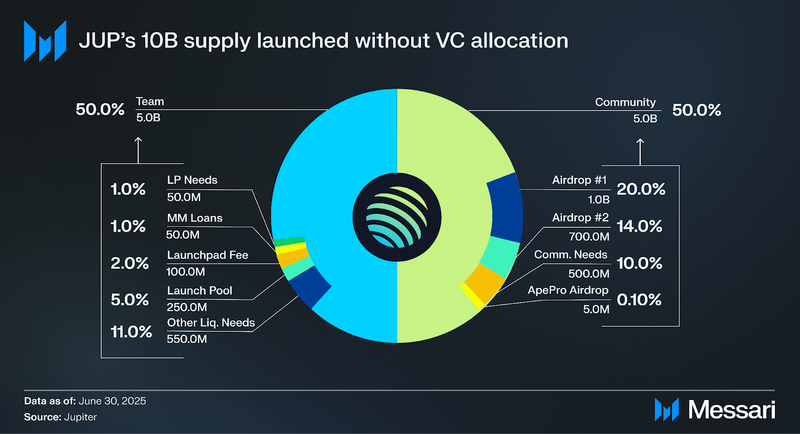

- JUP’s tokenomics prioritize community ownership and autonomy, with public token audits, no VC allocations at launch, a 3.0 billion token burn (30.0% of total supply, split evenly between team and community allocations), and a commitment to allocate 50.0% of protocol fees toward accumulating JUP in the “Litterbox,” a dedicated wallet that holds repurchased tokens on behalf of the community.

- The upcoming Jupiter Lend product expands the team’s vertical reach by introducing borrowing and lending ability through a backend integration with Fluid, targeting Solana’s second-largest TVL sector.

- Beyond DeFi, the announcement of JupNet will abstract away fragmentation across blockchains, wallets, and identities through a unified account-based system.

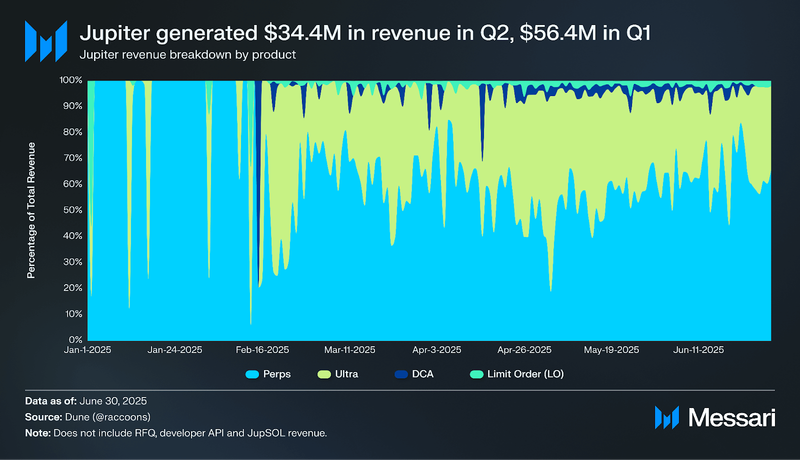

- In Q2, Jupiter generated $38.4 million in revenue across its product suite, with trading activity, perpetuals (54.5%), Ultra Mode (30.8%), and DCA/recurring orders (2.6%) comprising the majority, alongside contributions from RFQ (8.7%), limit orders (1.6%), developer APIs (1.0%), and jupSOL (0.9%).

Jupiter (JUP) launched in October 2021 as a Solana swap aggregator, designed to surface the best prices by consolidating liquidity across fragmented AMMs and order books by routing trades along the most efficient paths. As Solana’s DeFi activity expanded, Jupiter became the network’s most actively used trading interface, supporting hundreds of millions of swaps per quarter and integrating with 100+ partners across the ecosystem.

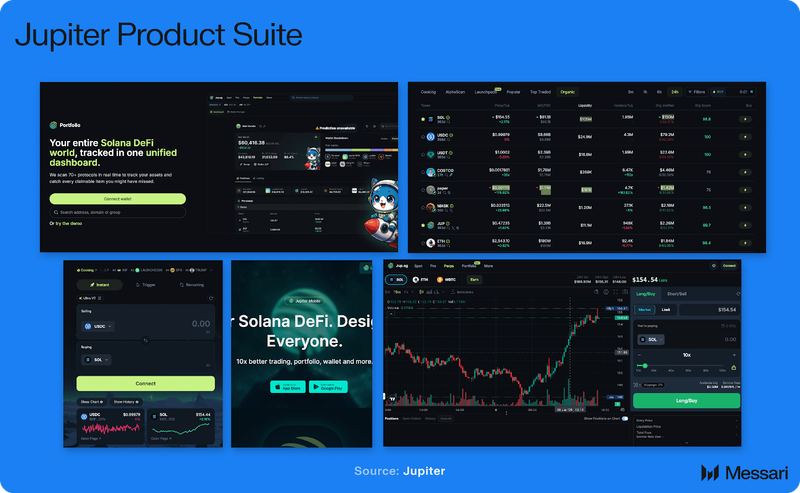

The protocol has continued to roll out a series of routing and transaction upgrades, including the Metis routing engine, transaction fee prioritization, and the recent introduction of “Ultra Mode,” which integrates real-time slippage estimation, dynamic priority fees, and optimized transaction landing to reduce execution costs behind the scenes. Alongside these optimizations, the team has broadened its suite to include features like dollar-cost averaging, perpetuals trading, a mobile app, and portfolio tracking, among others - positioning itself as a more comprehensive DeFi platform.

In January 2024, JUP, the project’s governance token, was launched via an open liquidity pool and an airdrop to over 600,000 wallets, avoiding traditional VC allocations and OTC deals. A year later, the protocol burned 3.0 billion JUP, representing 30.0% of the total supply, drawn equally from community and team allocations, and committed 50.0% of fee revenue to token buybacks, reinforcing its model of usage-driven value accrual. As of July 2025, there are approximately 920k onchain holders.

Website / X (Twitter) / Discord

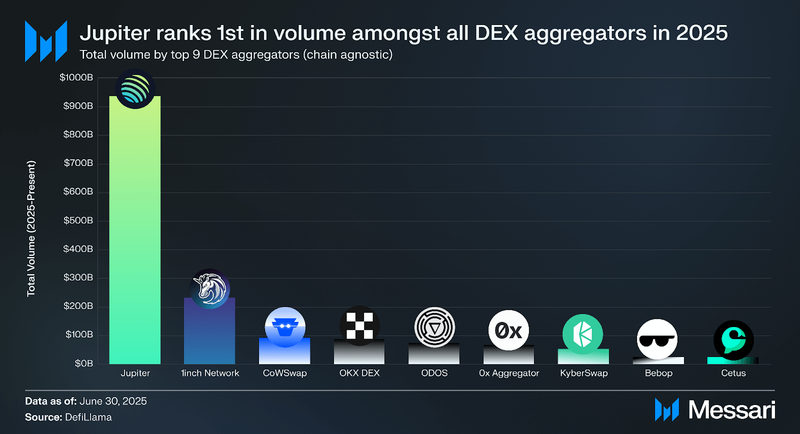

Jupiter was launched in 2021 by co-founders Meow (pseudonym) and Siong Ong to solve one of the largest issues in early Solana DeFi: fragmented liquidity across AMMs and order books. At the time, Solana's DEX landscape was a patchwork of isolated AMMs and order books, each operating in its silo. Early on, the team focused on aggregating DEXs like Serum, which offered deep liquidity, but lacked a user-friendly experience. Jupiter addressed this by building an aggregator that stitched these venues together, routing orders across them to surface optimal pricing. As Solana users scrambled for trust-minimized liquidity after the collapse of FTX, Jupiter quietly found product-market fit and became the network’s most-used swap aggregator. As of June 30, 2025, the project ranks first in volume (seven-day, one-month, and all-time timeframes) amongst all blockchain DEX aggregators.

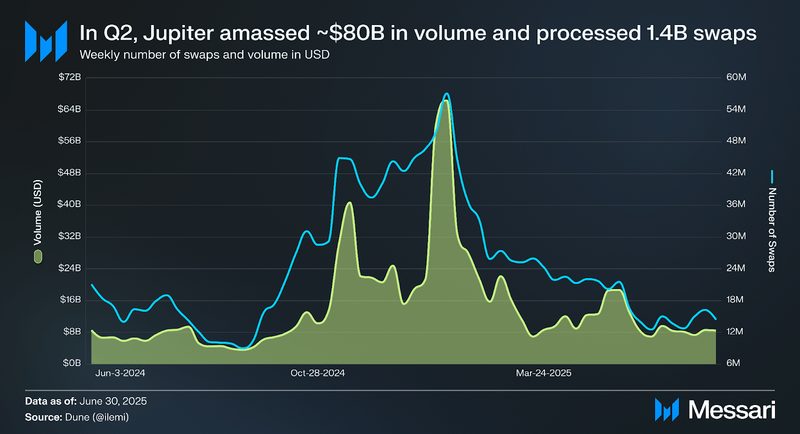

In Q2 alone, Jupiter facilitated over 1.4 billion swaps and amassed ~$80.0 billion in volume. To put that into perspective, that accounted for over 90.0% of all aggregator activity on Solana and 50.0% of total aggregator activity across all blockchains.

But aggregation alone was not the end goal. Jupiter has since grown into a full-stack DeFi platform, closer in resemblance to an operating system than a swap UI; combining new routing optimizations, an expanding in-house product suite, and selective acquisitions to extend its reach across Solana’s ecosystem. For example, to improve execution quality, the team rolled out Ultra Mode in January 2025, an optimization layer that automates slippage estimation, dynamic fees, and transaction landing, and makes this routing logic available to partners through an API.

Today, the team has various products, including (i) a Portfolio Tracker, (ii) a Pro Trading Terminal, (iii) the Jupiter Mobile application, (iv) a Perps DEX, and (v) Jupiter Studio, a token launchpad. On top of this, they have also expanded by acquiring complementary projects, such as (i) DRiP, an NFT platform; (ii) Moonshot, a memecoin trading platform; (iii) Coinhall, a Cosmos aggregator; (iv) SolanaFM, a block explorer; (v) Sonarwatch, a tracking dashboard; and (vi) Ultimate, a self-custody DeFi mobile app.

As the product ecosystem matured, so did its user base and with it, its token. Early users were substantially rewarded with Jupiter’s governance token, JUP, which was initially airdropped to over 600,000 wallets. The subsequent “wealth effect” for early adopters was to be expected, with JUP now acting as a proxy for exposure to the growth of the Solana ecosystem.

However, unlike most governance tokens, JUP launched without VC allocations and OTC deals. Additionally, Jupiter burned 3.0 billion JUP tokens (30.0% of the total token supply), split evenly between community and team allocations. It also committed to allocating 50.0% of platform fee revenue towards ongoing purchases of JUP from the open market, which accumulates in the “Litterbox,” a dedicated wallet for holding repurchased tokens that directly benefits JUP holders. Users can verify the burns, allocations, and buybacks in this community audit.

Recent usage and revenue data from Q2 help contextualize the scale of activity across Jupiter’s products. Specifically, the protocol generated $38.4 million in total revenue, with the majority coming from trading activity: perpetuals ($20.9 million, 54.5%), Ultra Mode ($11.8 million, 30.8%), DCA and recurring orders ($996.4k, 2.6%), and limit orders ($609.8k, 1.6%). Other revenue sources included RFQ ($3.4 million, 8.7%), developer-facing APIs ($393.6k, 1.0%), and jupSOL staking ($336.6k, 0.9%).

Other products and interfaces, such as Jupiter Pro, attracted 4.4 million unique users over the past 30 days, while the mobile app reached approximately 825,000 lifetime downloads. Portfolio tools also saw consistent engagement, with an average of 500,000 monthly users.

The question now is what the next phase of Jupiter’s growth will look like. So, where are they heading?

Where is Jupiter Heading Next?Jupiter Lend, the Onchain Money Market

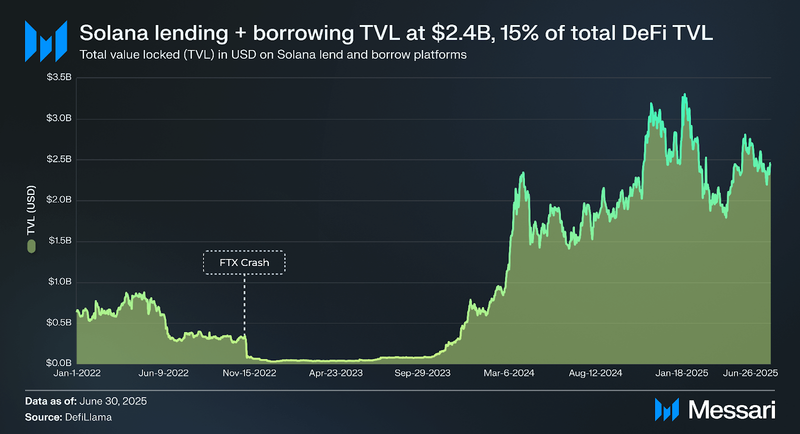

Jupiter built its brand by attracting crypto's most active users through a leading aggregated interface for Solana token swaps. Yet lending and borrowing, activities that account for 15.0% of Solana’s total TVL (as of Q2 2025 end), led by Kamino and MarginFi, remained untapped. Bringing lending and borrowing into Jupiter's interface could unlock meaningful annual revenue, with a portion extended to JUP tokenholders.

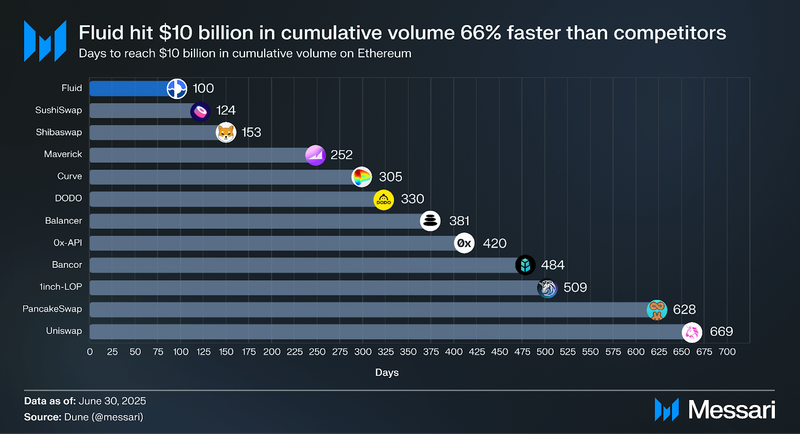

As such, on June 6, 2024, Jupiter announced Jupiter Lend, an onchain money market in collaboration with Fluid, one of the fastest-growing Ethereum DeFi protocols. Specifically, Jupiter will route lend and borrow transactions through Fluid’s backend liquidity layer. For a more comprehensive overview of Fluid and its unique technology (i.e., liquidation engine, smart debt, and more), please read our comprehensive overview here.

Jupiter Lend is set to launch in mid-August 2025 with over $1.0 million in incentives; waitlist here.

Beyond DeFi, JupNet, the Aggregator of Everything

Jupiter is not stopping at DeFi; the team also recently announced JupNet, the infrastructure layer unifying liquidity and identity layers within a single environment.

In simpler terms, Jupiter assumes the industry is moving toward a world of millions of chains, billions of people, and trillions of tokens. JupNet will aggregate this sprawl so users no longer need to figure out how to bridge assets, manage gas fees, or juggle dozens of wallets. Instead, JupNet will operate through an account-based system, similar to the familiar brokerage account experience, ultimately changing the current landscape of crypto UI and UX.

To do so, JupNet technology will consist of three pillars:

- Decentralized Oracles that Validate and Execute (DOVE) Network: A peer-to-peer layer for data and liquidity interoperability.

- Omnichain Ledger Network: Designed to provide a unified ledger view across chains.

- Aggregated Decentralized Identity (ADI): A self-sovereign identity layer that ties together (i) wallet addresses, (ii) reputations, and (iii) cross-app user history, similar to conventional Multi-Factor Authentication (MFA).

JupNet is currently in internal testnet, with the public testnet expected in early Q4.

Closing SummaryJupiter started with a narrow problem: efficiently routing token swaps across fragmented Solana liquidity. The solution: an aggregation engine wrapped in a seamless interface that quickly found product-market fit and now routes the majority of swap activity on Solana. It accounts for over 90% of aggregator traffic on Solana and 50% across all blockchains, making it the leading DEX aggregator by volume.

But that was phase one. Since then, Jupiter has continued to expand its scope, first horizontally, with new features like perps, launchpads, and mobile tooling, then vertically, with Jupiter Lend. Now, with the upcoming launch of JupNet, the project is shifting its focus inward, reframing the challenge to be not just one of user experience but of core infrastructure. In a future that is multichain and trends toward fragmentation, JupNet will aggregate execution, ledger states, and user identities into one system that is designed to hide complexity from the user without discarding it.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.