and the distribution of digital products.

DM Television

I Built a €500K Neobank for Immigrants—It Didn't Go As Planned

\

Table of Contents- The Beginning

- The Problem Space

- Building Relocare

- The Reality Check

- Lessons Learned

- Moving Forward

Imagine moving to a new country with no local credit history, no proof of address, and no easy way to open a bank account. You have a job lined up, but no way to receive your salary. You need a permanent address to open a bank account, but you need a bank account to rent an apartment.That was my experience as an immigrant in Portugal. I thought, ‘This is a massive problem—I can fix it.’ Six months, €500K, and 5,000 users later, my neobank Relocare was dead.

Who am II’m Dmitry, a fintech entrepreneur with 13 years in the industry. My company, Finbox Solutions, helps startups scale financial platforms. With multiple fintech ventures under my belt, I thought I was ready to build a neobank. I was wrong.With multiple fintech ventures under my belt and deep technical expertise in banking infrastructure, I felt well-equipped to tackle the challenges of building a neobank.

Relocation and How It StartedI didn’t have the purpose to leave my country, it happened mostly accidentally. I visited Portugal for the Web Summit conference in 2018.

\ At the conference, I met prominent figures like Ray Dalio (Investor), Tim Berners-Lee (Inventor of the Web) and Evan Williams (Founder of Twitter & Medium).It was an amazing and exciting experience.

\ This vibe on the edge of technologies helped me decide to stay longer. When COVID-19 hit in 2020, what started as a temporary stay turned into a permanent move.

\ Portugal has one of the best fintech environments for startups, providing legal frameworks, startup ecosystem and has big expat community, around 1.1m people. Add to the fact, awesome weather, good location and its all I needed that time.

\

\ The first thing in settling in a foreign country is to get the required papers. For us, it meant opening a local bank account.

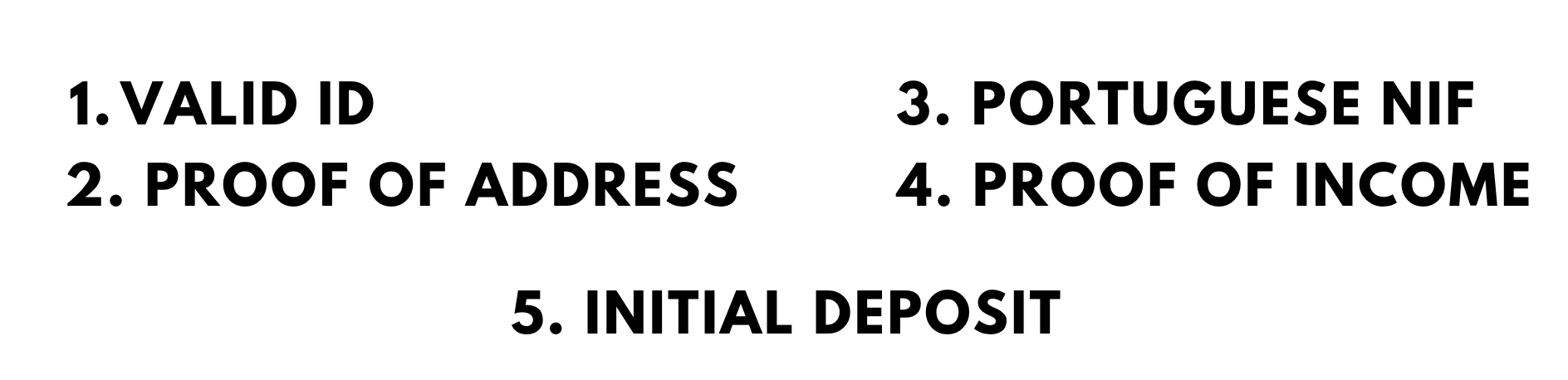

The Problem Space Problems with SettlingThe hardest thing for immigrants in any country is opening a local bank account. For citizens of Portugal, it takes up to 3 days, but for immigrants, the term exceeds 2-3 weeks. And it’s not a bank, but documents that it requires.

\ The brutal irony? You need a bank account to start your life, but you need to have started your life to get a bank account.

\ Every morning becomes a new bureaucratic adventure. You need a NIF (tax number) to open a bank account, but you need proof of address to get a NIF. You need a bank account to rent an apartment, but you need a permanent address for a bank account. Each document costs money - a NIF alone can set you back 100 euros. And that's just one piece of the puzzle.

\ I watched people burn through their savings on temporary accommodations while waiting for bank accounts. Highly skilled professionals reduced to carrying cash like students, unable to receive their salaries or pay bills properly.

\ That all made the process annoying and frustrating. But it’s not all….

\ Portugal has a closed banking system. It means, if you have an account in international bank, then there is no guarantee it’s legit in Portugal.

\ I personally had an account in Brazilian branch of Santander. When I came to the Portuguese branch, local clerks stared at me in utter confusion, like “what are you…”

\ Different branches don’t recognize each other. Credit history, proof of employment, any other documents mean nothing. Start from scratch, boy! I was devastated.

The banking challenges I experienced firsthand, combined with countless similar stories from other immigrants, highlighted a clear gap in the market. My fintech background provided unique insight into how these problems could be solved systematically.

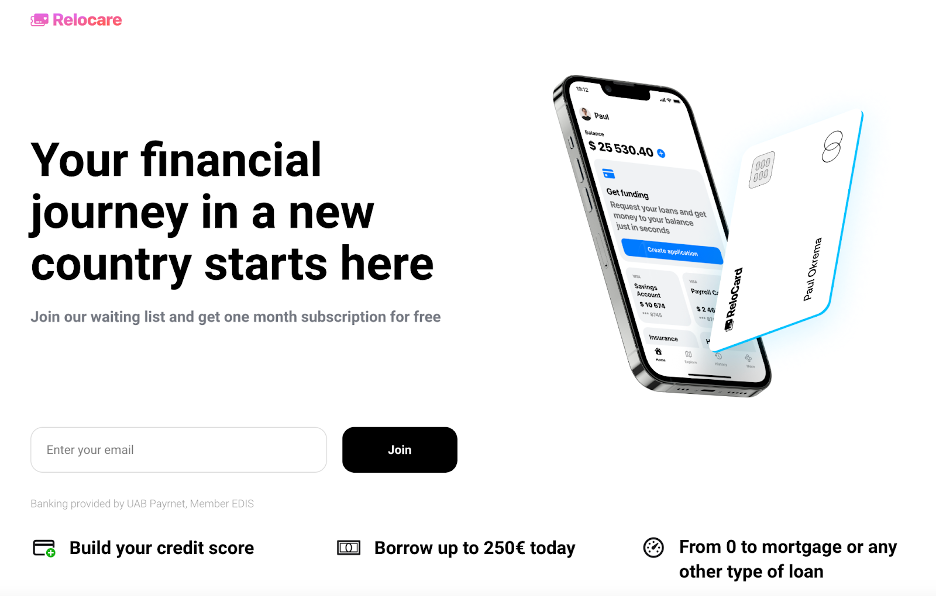

\ This led to the creation of Relocare, a neobank specifically designed to address the unique challenges immigrants face when establishing their financial presence in a new country. Plus, I saw the market as underserved and wanted to challenge myself: “Can I build it and scale?”That’s how It started.

How I Applied Product Mindset to RelocareWhen developing Relocare, we focused on deep validation:

\

- In mid-2020, conducted 50+ interviews with immigrants and identified their pain points (not possible to get a loan, hard to get a banking account)

- By Q3 2020, created landing page for signups and distributed across immigrant communities. We got 13,000 on the waitlist.

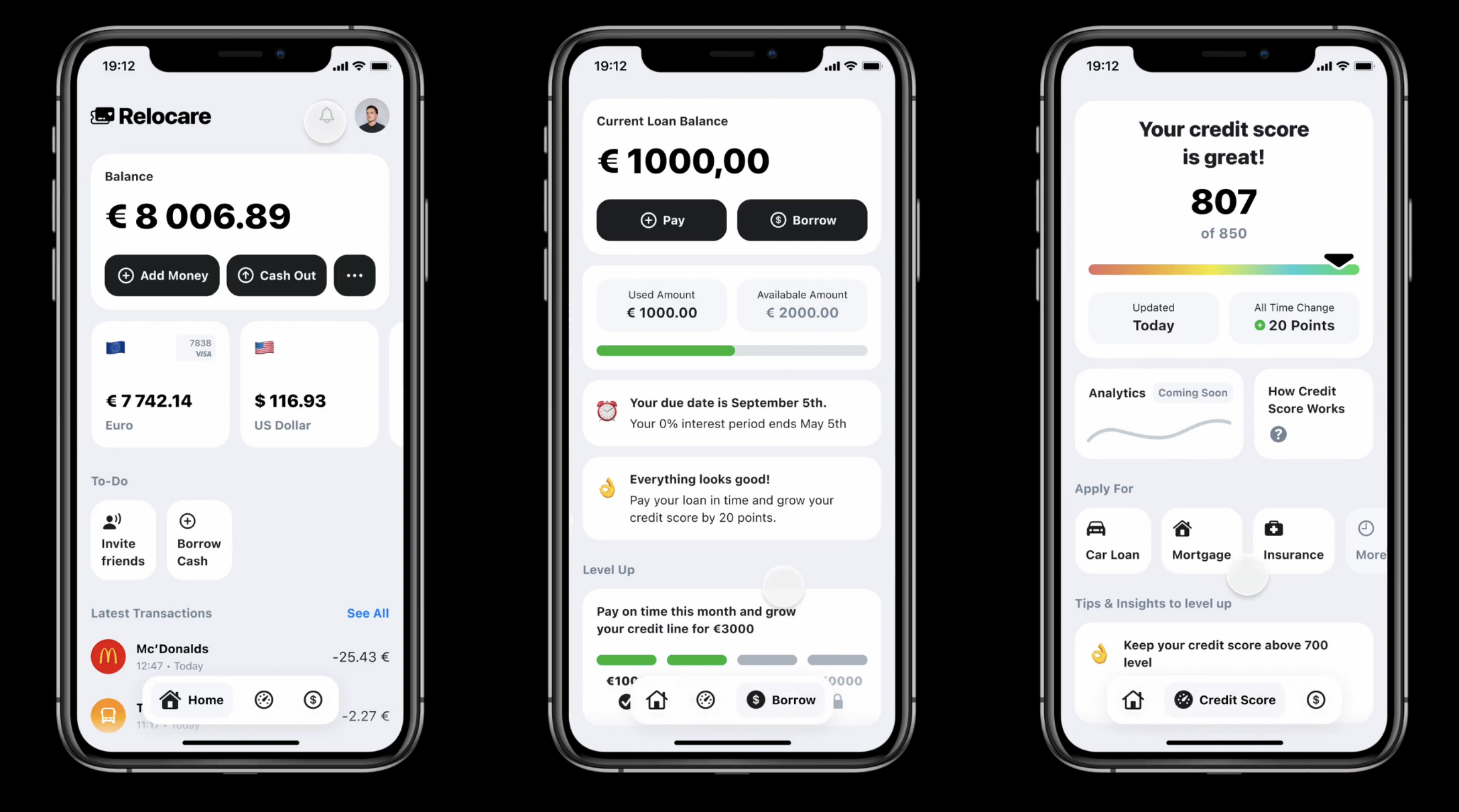

- Focused on 3 features during MVP stage:- Local IBAN- Credit card for immigrants- Local payment system integration (MBWay)

- Thanks to our B2B business, we already had robust technical infrastructure for:

Payment processing

KYC/AML checks

Core banking functions

Security protocols

\

However, operating as a bank requires a banking license, which takes years and millions in capital to obtain. By late 2020, we partnered with a BaaS (Banking-as-a-Service) provider who could give us regulatory coverage and access to the banking network. While we had the technical capability to build everything, we needed their license to operate legally. Unfortunately, their risk appetite was quite low, and they saw immigrants as high-risk clients. This conservative approach would later work against us.

\

We followed the proven revenue model that successful neobanks like Revolut had established. Our approach was straightforward:

\

- Monthly subscription — to access any service in our app, users needed to subscribe to a monthly plan. We wanted to charge 12,5 euro/month (It was naive). This supposed to be our primary revenue source (around 70% of total revenue).

- Transactional fees — Our BaaS (banking as a service) partner, who owned the infrastructure and carried the risk, set certain transaction fees. This generated approximately 25% of our projected income.

- Additional services — we put costs of processing into this stream, which might generate 5% of revenue: translation and document processing,

We had expectations on numbers:

- Forecasted CAC (Customer Acquisition Cost) — 50 euro.

- Expected customer lifetime (LTV) — 12 months

- Target LTV/CAC ratio — 3:1.

- Subscription cost — 12.5 euro/month

- Gross Margin — 66.7%

With Relocare's business and financial model in hand, we began seeking investors. Initially, we planned to bootstrap the project, but weren't certain about the actual costs involved. We had 10 candidates to co-invest in the project, but it didn't work out. We decided to build on our own, using our money from B2B SaaS. Using “assets” from previous projects, we crafted MVP in 2 months and launched it in our user community.

Launch and first problemsWhen we launched Relocare in January 2021, 13,000 users from our waitlist turned into 5,000 MAU. Our technical infrastructure handled the scale perfectly, but the BaaS partnership created unexpected challenges:

\

Fraud Prevention

Immediately we’ve started to face fraud problems. It started as early as the 5th issued card. That moment we realized, what banks meant by high risk clients (meaning immigrants)

Regulatory Constraints

Users started complaining about our strict KYC/AML policies. We couldn’t process everything related to crypto, NFT. Users literally felt rejected.

User Experience

Despite positive feedback about core features like IBAN and MBWay, many users felt rejected by our strict verification process.

\ These early problems were just the beginning of our market fit issues.

While these initial operational challenges were concerning, the deeper problems with Relocare's business model began to surface around the six-month mark. Our data started revealing a troubling pattern: users were churning.

\ We started to investigate, by analyzing user feedback, conducting interviews again, and seeking patterns across accounts in our Amplitude panel. And here is what we found so far:

\

- Most immigrants struggle for the first six months, and it’s all good after they open a local bank account. It removes us from value chain. They don’t need us after the temporary challenge.

- They also used Wise and Revolut along the way. Those companies provide global banking services and they’re more friendly to immigrants than local banks.

What we initially saw as a significant market opportunity turned out to be a temporary pain point. This fundamental realization meant that a neobank exclusively for immigrants had a built-in churn problem—users would naturally leave once they established themselves in the country.

The Numbers That Killed UsOur illusions on unit economics also broke down. We expected to have:

\ LTV/CAC as 3:1,

but get 0.53:1.

\ Lifetime as 12 months but 6 months in reality.

\ Pricing, that changed from 12,5 to only 8 euro per month.

\ With mounting costs and deteriorating metrics, we needed a bigger investment to turn things around. After spending €500K of our own money, our calculations showed we needed around €10M to make the business viable. While we managed to attract about €1M in potential investor interest, it wasn't enough.

The Final DecisionStanding at this crossroads with Relocare, we explored every possible direction:

- Dive into new products around neobanks.

- Dive into crypto-powered cross-border payments (which was highly requested thing in a project)

- Credit solutions for expats, helping them get financing in a new country

\ All of that wasn’t a part of our expertise. Lending is too hard, you need to assess credit risk and onboard clients with strong policy. Crypto also wasn’t our main focus, we weren’t sure what to build.

\ Our final analysis put the final nail in the coffin. We realized:

- We couldn’t compete with Revolut and Wise, which had far more resources and funding.

- We needed €10M+ to build a sustainable lending model, and even with €1M in potential investor interest, the gap was too large to bridge.

\ With an already profitable B2B business, we decided not to lose focus here and closed it. We sort of saved money for our investors, spending only 500,000 euros. Now, it’s time to share what we’ve learned from experience.

Lessons LearnedLooking back, Relocare's journey taught me some painful but invaluable lessons that I hope will help other founders avoid similar pitfalls:

\ 1. Beware of Transition Period Business Models

The hard truth we discovered: building a business around a temporary problem is like trying to catch smoke. Our users needed us intensely for 4-6 months, then vanished. It's like building a business selling umbrellas only when it rains – the demand is real but fleeting.

\ 2. Market Size ≠ Market Opportunity

The 1.1M expat market in Portugal looked fantastic on paper. But here's the reality check: only 15% of these expats were actually in our target segment (tech-savvy, middle-income professionals), and only 10% of those converted to paying customers. Always dig deeper into your TAM calculations.

\ 3. The "Good Enough" Problem

We learned that existing solutions like Wise and Revolut were "good enough" for most users. They weren't perfect for immigrants, but they worked. The lesson? Your solution needs to be 10x better than existing alternatives, not just marginally better.

\ For founders eyeing the fintech space: the future isn't in building another bank – it's in solving the infrastructure problems that make banking difficult in the first place. And that's exactly what we discovered through this journey.

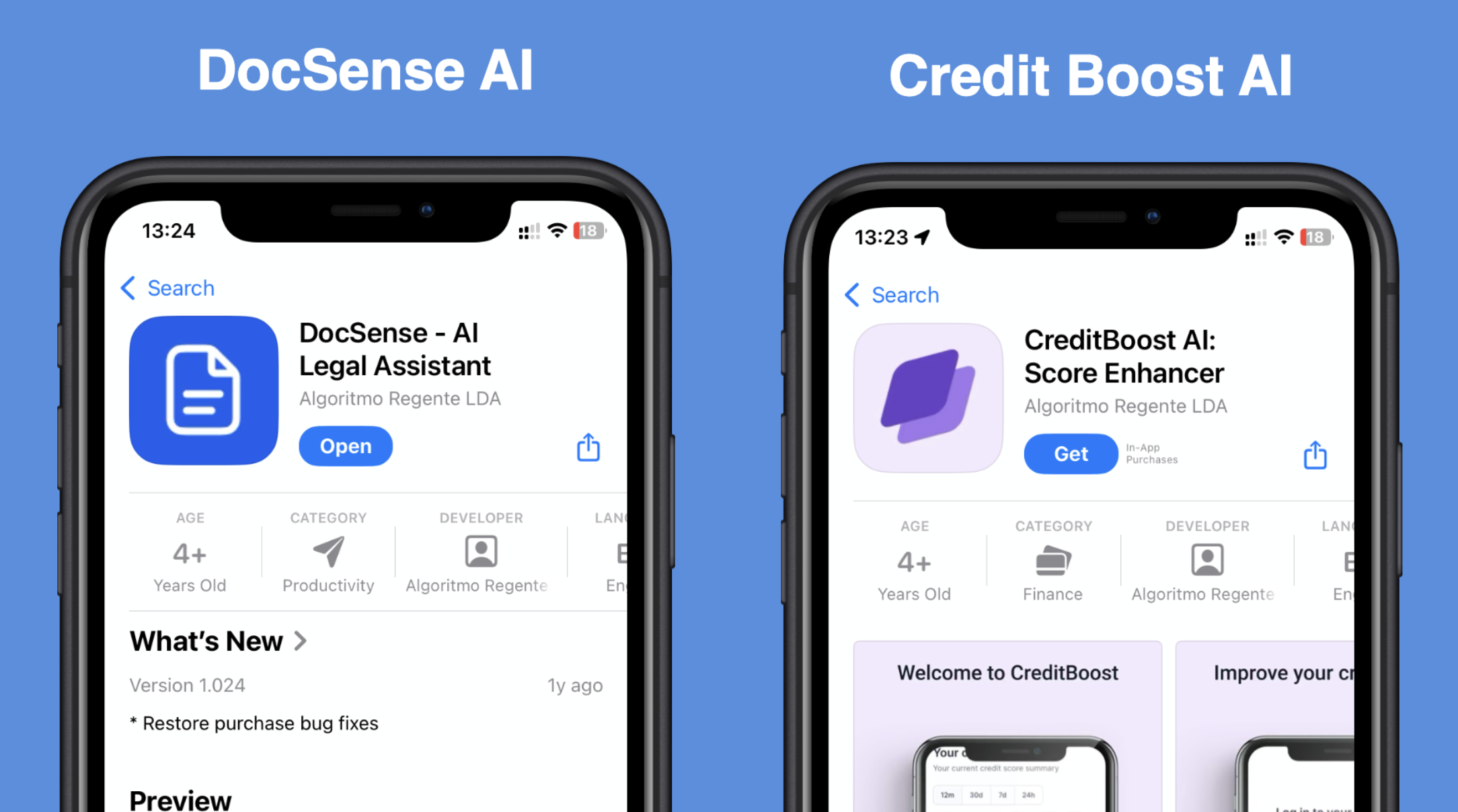

Silver LiningsDespite Relocare's shutdown in mid-2021, we didn't walk away empty-handed. We built several valuable assets that we're now repurposing:

\

DocSense: Relocare's AI tool for PDF analysis has found unexpected demand in the B2B sector.

PayMaster: The tax calculator developed for Relocare has become a standalone product with growing adoption.

Mobile App Architecture: We're licensing parts of the secure banking infrastructure we built for Relocare to other fintech startups.

After shutting down Relocare in mid-2021, I returned to B2B fintech, focusing on these opportunities:

- Cross-Border Credit Infrastructure: The big unsolved problem isn't payments – it's credit history portability across borders

- B2B Banking Services: Helping businesses navigate international banking has more staying power than consumer solutions

- Regulatory Tech: Tools that help fintech companies navigate complex compliance requirements

- Brokerage SaaS Solutions: Enabling fintech startups to launch investment & trading services

- Neobank Infrastructure: Providing white-label fintech solutions

- Payroll Fintech: Simplifying global salary paymentsIf you have any questions about this story, then find me on social media.

Looking back at this 2021 venture, I hope this post-mortem of Relocare has provided valuable insights.

\ Have questions? Find me on LinkedIn: Dmitry Prostov

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.