and the distribution of digital products.

DM Television

How to Earn Crypto on OKX (Previously OKEx)?

OKX (Previously OKEx) is a cryptocurrency exchange and a platform for trading cryptocurrencies. Thus, it provides a safe and stable environment for crypto trading. This article will guide you on how to earn a yield on OKX.

Summary (TL;DR)- OKX (Previously OKEx) is a cryptocurrency exchange offering multiple trading options.

- Yield is a trading technique to generate earnings by investing.

- To start earning, you need to download the OKX application available online.

- OKX (Previously OKEx) provides multiple trading techniques. Select a trading technique at your convenience.

- Traders can purchase multiple cryptocurrencies on the same platform.

- It provides easy transactions and withdrawal methods.

OKX is an innovative cryptocurrency exchange with financial services. This platform is the top cryptocurrency exchange for traders around the globe, beginning to professional. Specifically, it is operational in over 200 countries, offering 400+ trading pairs and multiple currencies.

The payment options include VISA, MasterCard, and many others. Furthermore, OKX allows multiple trading options including, BTC, ETH, USD, XRP, and many other digital assets. A one-stop solution for all trading purposes.

For more in-depth information, check out the OKX (Previously OKEx) review.

OKX (Previously OKEx)

What is Yield?

OKX (Previously OKEx)

What is Yield?

Yield is a trading technique to generate earnings released on an investment over a while. It is a percentage-based record of the value of the original market or its current value. It also provides invested value, current market value, and the face value of the security.

Overall market and interest rates are two factors that affect the yield. In addition, the financial situation of the company also plays a vital role.

For more in-depth information about yield farming, check out the DeFi yield farming article.

How to earn yield on OKX (Previously OKEx)?There are multiple ways to earn interest in your crypto holdings. Meanwhile, OKX provides DeFi and staking to maximize your yield. Furthermore, you can earn free coins daily by learning about the cryptocurrency industry and how it works.

Download the OKX applicationFirstly, download the OKX application on your mobile or PC. You can find the application on PlayStore for android users and App Store for iOS users. On the other hand, you could also download it from the official website of the application.

OKX Mobile App

OKX Mobile App

Secondly, once the application has been installed, sign up using your email. Contrarily, if you have an existing account, log in to proceed further.

Select Trading MethodOKX (Previously OKEx) has various trading methods to earn yield. Therefore, we have explained the procedures and process in detail.

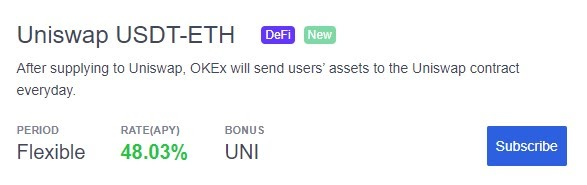

Defi TokensOkX has a feature that splits the fee among trading by depositing funds for Uniswap’s smart contract.

Earn Yield on OKX with UniswapUniswap is a protocol for trading ERC-20 tokens on Ethereum. Most importantly, it helps eliminate intermediaries and unnecessary forms of rent extraction. In addition, it makes trading efficient, safe, and censorship-resistant.

OkX (Previously OKEx) has a feature that splits the fee among trading by depositing funds for Uniswap’s smart contract.

UNI tokens can be earned by the digital asset trading pairs listed below:

- DAI-ETH

- WBTS-ETH

- USDT-ETH

- WBTC-ETH

The process of earning using Uniswap is listed below:

Subscribing to earn UNI with UnsiwapFirstly, select USDT as the crypto in the “Earn” tab to bring up the deposit period, APY rate, and estimated daily return for earning UNI with UNIswap. Then, click Subscribe to move ahead.

Subscribing to earn UNI

Go through the terms for the UNI subscription.

Subscribing to earn UNI

Go through the terms for the UNI subscription.

Before you start trading, it is necessary to read the terms and conditions. Once you click on “I understand,” you will be able to proceed.

Supply your USDT and ETH to the Uniswap protocolFirstly enter the amount of USDT and ETH. Then, to subscribe with the available balances, click on “Max.” In the meantime, you can refer to the Q&A box at the top of the page to clear your doubts. Then, click “Continue” to proceed.

Verify Transaction DetailsVerify the transaction details. Ensure to check the estimated return and service fee. Click on “subscribe” to proceed.

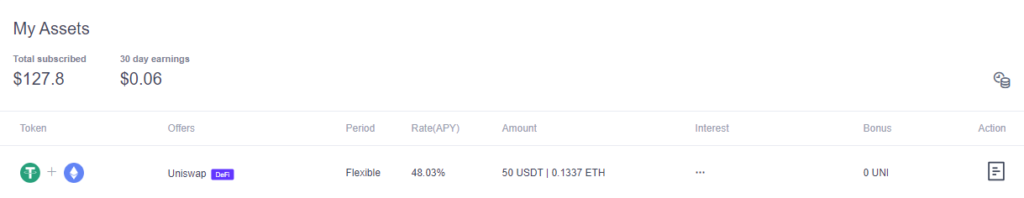

Review your TransactionYou can review your transaction under “My Assets” at the bottom of the OKX Earn section. Then, again, you can withdraw USDT and ETH by clicking on the document icon and cancel.

Example: Invest an equivalent amount of ETH and DGTX to Uniswap to produce liquidity for the trading pair on the platform. In exchange for providing liquidity, you’ll receive UNI-V2 tokens representing the tokens you have contributed to the pool. Next, deposit your UNI-V2 pool tokens to the platform to stake them and earn a passive income.

Uniswap: Review your Transaction

Earn Crypto with Compound

Uniswap: Review your Transaction

Earn Crypto with Compound

One of the most dominant lending protocols is Compound. It has obtained extensive popularity in the Defi community after the release of its governance token. It allows delegates to debate, propose and vote on changes to the protocol. Furthermore, this will help to expand the protocol.

You can deposit multiple tokens to earn crypto income that will support the compound ecosystem. These tokens include BAT, DAI, Ether, and Tether.

Example: Individuals can deposit USDT to earn COMP. The minimum subscription amount is 50 USDT. The invested USDT then provide the yield farmers with COMP.

Earn Crypto with YFIIYFII is a decentralized protocol that generates a yield. It uses a toke halving modal that ensures stability and equal distribution of tokens. In addition, OKX has a flexible deposit product to enhance user involvement. The product functions like Curve Deposit and supports USDT and DAI.

Example: Users can profit by subscribing to USDT and DAI on the YFII on-chain protocol. Additionally, they can go for USDC, USDT, DAI and TUSD on the Curve on-chain protocol.

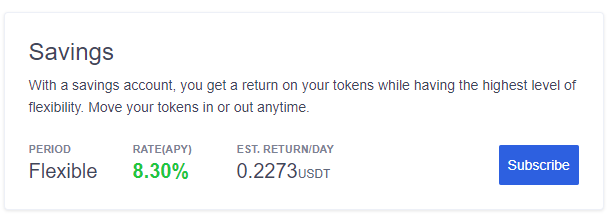

Savings Account at OKX (Previously OKEx)Savings allows OKX users to earn interest by depositing their digital assets on the platform. These assets are given as margin loans to users. OKX collects and distributes the interest equally to them.

You can subscribe to Savings following the steps listed below:

Visit OKX Savings

Savings

Also, read 6 Best Bitcoin Savings Account.

You can subscribe to Savings following the steps listed below:

Subscribe to SavingsYou can find the Savings option under the Earn tab in the OKX Earn Section. Select your asset and the amount you want to dedicate. Subscribe to proceed.

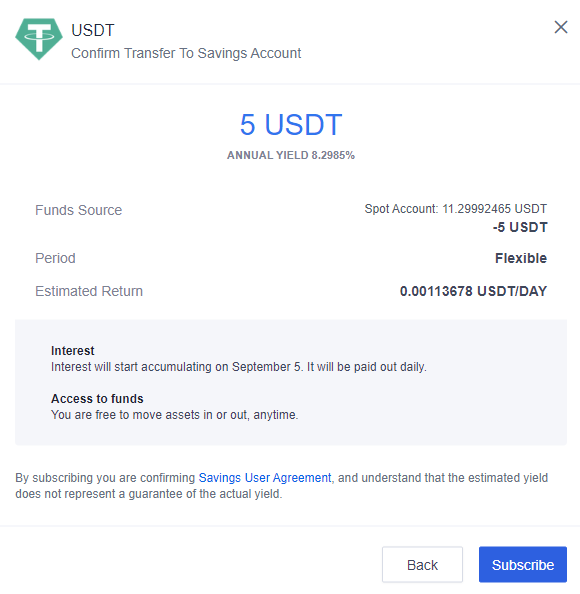

Enter and Verify transaction detailRecheck the amount dedicated and verify the subscription amount. You will come across a Savings User document. If you agree to the terms and conditions mentioned, proceed further. Click on Subscribe.

OKX Savings Verify transaction details

Review transaction

OKX Savings Verify transaction details

Review transaction

Review the transaction under “My Assets” at the bottom of the OKX Earn section. You can withdraw the asset whenever required.

Example: Users can invest Ethereum in their cryptocurrency savings account. The account provider will loan out their Ethereum to borrowers, providing them with a percentage of interest in exchange as a reward

Also, read Cryptocurrency Savings Accounts | Earn Interest on Crypto.

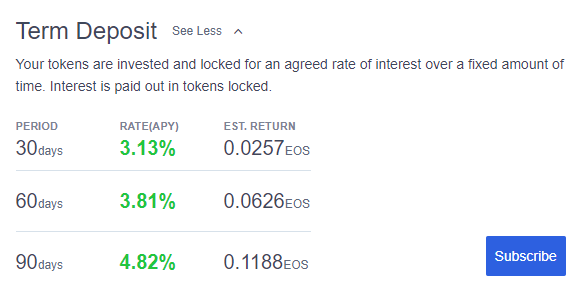

Term DepositYou can earn interest at an agreed rate of interest using a term deposit. A term deposit does not allow the withdrawal of money before the duration is complete. Instead, you can withdraw your money by paying a fee before the term is mentioned.

Visit OKX (Previously OKEx)Follow the steps mentioned below to subscribe to term deposit:

Subscribe to Term depositSelect EOS under cryptocurrency. Navigate to the Term Deposit Box and click on the drop-down menu. Here you will find the list to view all sessions available for term deposit and their respective rates of return. Click on “Subscribe” to proceed.

Term deposit

Verify and enter details of the term deposit

Term deposit

Verify and enter details of the term deposit

Select your term deposit plan and enter the amount you want to invest. The minimum subscription amount is visible for various assets. Click on Continue after you verify your details.

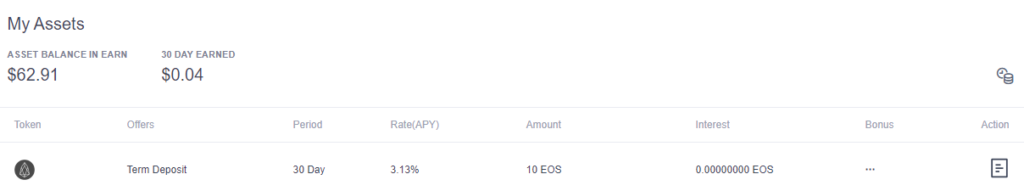

Review the TransactionYou can review your transaction under “My Assets” at the bottom of the OKX Earn Section. In addition, you can withdraw your assets by terminating the investment.

Term Deposit Order Confirmation

Staking at OKX

Term Deposit Order Confirmation

Staking at OKX

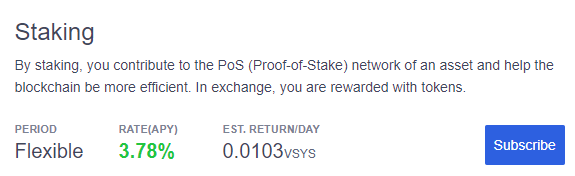

Staking helps actively participate in transaction validation on a proof-of-chain (PoS) blockchain. Anyone with a minimum-required balance of a specific cryptocurrency certifies transactions and earns rewards.

Try OKX (Previously OKEx) StakingYou can earn through staking by following the steps listed below:

Subscribe to stakingFirst, select VSYS as cryptocurrency in the “Earn” section and operate to staking to view the available options. Then, click on Subscribe to proceed.

Select VSYS as cryptocurrency in the “Earn” section and operate to staking to view the available options. Then, click on Subscribe to proceed.

OKX (Previously OKEx) Staking

Enter and Verify the detail

OKX (Previously OKEx) Staking

Enter and Verify the detail

Enter the amount of stake you desire. The minimum subscription is 100 VSYS. After you enter your amount, click on “continue.” Ensure to read all the terms and conditions provided.

Enter the amount of stake you desire. The minimum subscription is 100 VSYS. After you enter your amount, click on “continue.” Ensure to read all the terms and conditions provided.

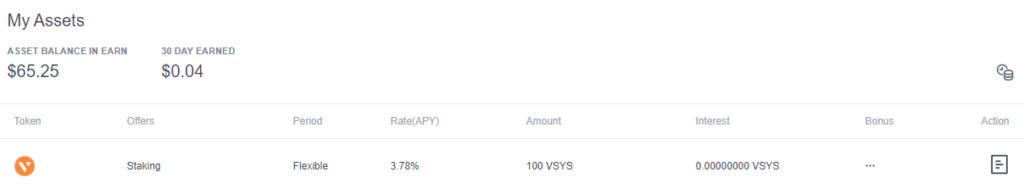

Verify the transactionsYou can verify the transaction under “My Assets” at the bottom of the OKX earn section. Then, you can withdraw the transaction by clicking on the document icon and Redeem.

You can verify the transaction under “My Assets” at the bottom of the OKX ern section. Then, you can withdraw the transaction by clicking on the document icon and Redeem.

Example: In Staking coins, individuals buy Bitcoin and hold it in their wallets or on exchange. Here Bitcoin will work for individuals by contributing to the proof of stake. With Bitcoin, investors can diversify their staking portfolios and earn more.

OKX Staking Order Confirmation

OKX Staking Order Confirmation

Also, read Staking Crypto – An Ultimate Guide on Crypto Staking.

Earn with YFIYFII is a decentralized protocol that generates a yield. It uses a token halving modal that ensures stability and equal distribution of tokens. In addition, OKX has a flexible deposit product to enhance user involvement. Furthermore, the product functions like Curve Deposit and supports USDT and DAI.

The product function curve deposit with support of the following tokens

- USDT

- DAI

- DUDC

Ethereum 2.0 is the next upgrade of Ethereum that runs on the Beacon Chain, using Ethereum’s proof-of-stake (PoS) consensus model.

Try Ethereum staking at OKX SubscribingClick on ETH 2.0 staking from the ‘All Product’ dropdown menu. Then, click subscribe after viewing the estimated APY of ETH 2.0 Staking.

Read the risks involvedUnderstand and acknowledge the risks involved, then click on ‘I Understand’.

Enter the subscription amountEnter the amount you want to stake. Individuals can stake their entire balance by clicking on Max.

For more information, you can read Q&A, then click continue to proceed. Confirm the transaction details and carefully go over the information regarding interest calculation and fund redemption. Next, click on subscribe to proceed.

Review your transactionClick on My Assets from the Asset dropdown menu to review the completed transaction. Then click on the funding account tab to check recent transactions.

Example: The user locks up their Ether in a wallet to participate in the operation of a blockchain for rewards. A minimum of 32 Ether is required to participate in staking and be a validator. The rate of return for ETH staking is around 4% to 10%.

C2C Loan at OKXC2C Loan in simple terms is peer-to-peer loans. Here, users can borrow and lend crypto assets to each other within flexible terms. Thus, it is an open marketplace for borrowers and investors to give or take loans, granting users much flexibility in choosing investment amounts, loan duration, redemption dates, etc.

USDT is the only cryptocurrency available for a C2C loan.

OKX Subscribe to C2C loansSelect C2C Loan from the dropdown menu of ‘All Product’ and click ‘Select’ to view the estimated APY and term of the USDT C2C loan. Select subscribe to proceed.

Choose a loan offerAll the available loan offers with different rates of return, loan periods, minimum and maximum investments, etc., can be seen. Click Invest to proceed.

Enter the amount in multiples of 50 under the ‘Subscription Amount’ tab.

Read the risk control sectionIndividuals should read the details under the risk control tab before proceeding to initiate the C2C Loan. Then, after thoroughly going through the, click continue to proceed.

Review the loan balanceGo to ‘My Earnings’ in the earn section to see your loan balance.

Example: Borrowers are required to specify the loan amount, which can range from 200- 1,000,000 USDT. Individuals will set the loan duration after deciding on the amount (7, 15, 30 or 60 days).

Borrowers can customize the initial loan-to-value ratio (10%- 65%) and daily interest rate (0.01%- 0.1%). One can grant Bitcoin (BTC) as collateral and take USDT (Tether) after completing the process.

Pros and Cons of OKX (Previously OKEx) Earn Crypto on OKX (Previously OKEx): ConclusionOKX (Previously OKEx) is a great trading platform for traders as well as beginners. It offers multiple services and trading options, making it convenient for users. In addition to that, you can earn and enhance your yield by choosing from various trading alternatives. Trading is simple, inexpensive, and profitable. Furthermore, OKEx offers multiple currency options so that traders can trade on the same platform. Lastly, OKEx is a one-stop solution for trading cryptocurrencies.

Visit OKX (Previously OKEx) Frequently Asked Questions (FAQs) What is P2P trading?P2P or Peer-To-Peer platform, which allows trading of cryptocurrencies directly between users.

Are there any fees for the OKX (Previously OKEx) P2P platform?OKX (Previously OKEx) does not charge users to trade digital assets on the platform. However, the selling of digital assets might include charges. Therefore, read the terms and conditions carefully before investing.

What payment methods are available on OKX (Previously OKEx)?OKX (Previously OKEx) supports a wide range of payment methods that vary from one currency pair to another.

INR: Bank Transfer, IMPS, and UPI

VND: Bank Transfer

CNY: Bank Transfer, WeChat Pay, and AliPay

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.