and the distribution of digital products.

DM Television

Franklin Templeton launches Benji on Ethereum in ‘milestone’ move

This is a segment from the Empire newsletter. To read full editions, subscribe.

Franklin Templeton is launching its Benji tokenization platform on the Ethereum network, marking its fifth launch this year after Aptos, Avalanche, Arbitrum and Base. It was previously only available on Stellar and Polygon.

“The launch of our Benji platform on the Ethereum network represents an important milestone in our ongoing efforts to develop new and innovative blockchain solutions for our clients,” Franklin Templeton’s Sandy Kaul exclusively told us.

“We look forward to further exploring ways in which we can utilize the network’s Ethereum Virtual Machine and smart contract functionality to unlock new capabilities for our tokenized funds.”

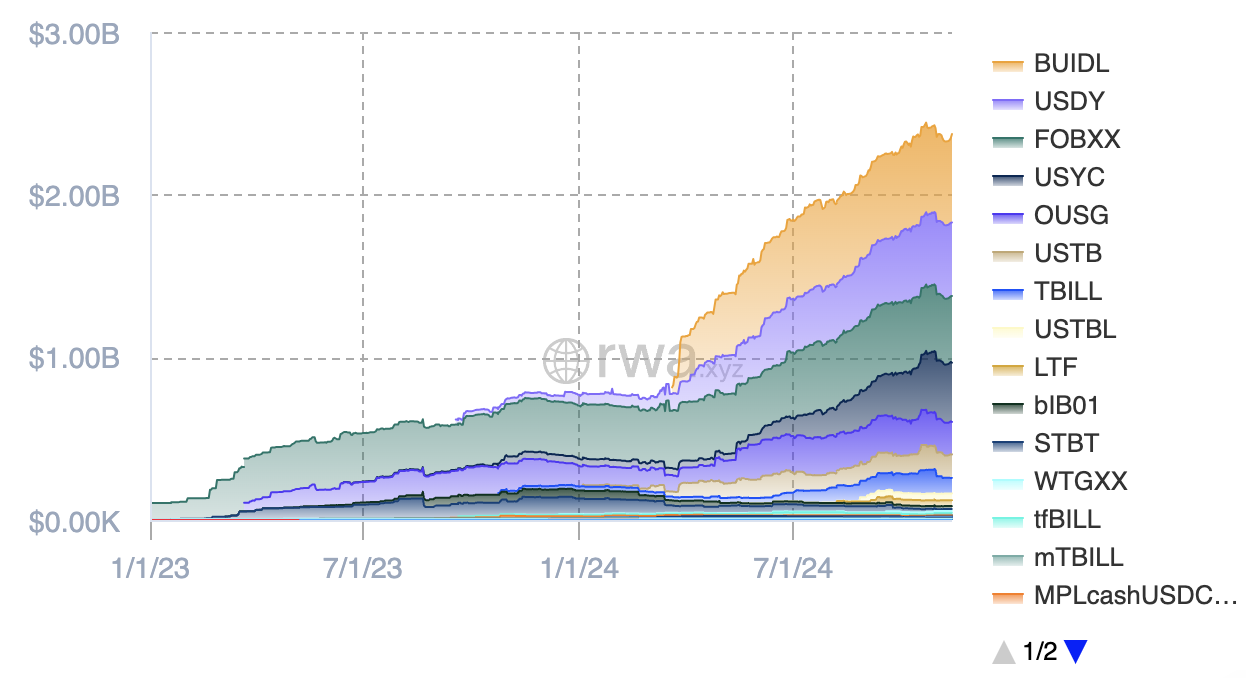

According to rwa.xyz data, tokenized treasuries have jumped nearly 2% in the last seven days, boosting their total market cap to over $2.37 billion. Franklin’s onchain market fund sits at $409 million.

Source: rwa.xyz

Source: rwa.xyz

Franklin’s is the third largest fund after BlackRock’s BUIDL and Ondo’s USDY.

And perhaps there’s something in the water, because BUIDL is also expanding to different chains, now available on Aptos, Optimism’s OP Mainnet, Polygon, Arbitrum and Avalanche.

I asked Securitize CEO Carlos Domingo if the expansion is a sign of maturity, given that BUIDL is one of the newest funds in the space. Franklin’s, for example, has been around since 2021 and was the first registered money market fund to use blockchain technology to record transactions.

BlackRock’s bullish stride into crypto otherwise really started this year, with the launch of the bitcoin ETFs in January and then BUIDL shortly after.

Domingo said that this is “just the beginning” for the fund and that it plans to roll out more features. He told me that this is also the first time that Securitize has issued the same asset on multiple chains versus picking one chain and issuing the asset there.

“So for us, there’s been a major change in the way we run our infrastructure on top of the different blockchains, so it’s encouraging,” he said.

No question about it, the tokenized fund space is heating up.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter.

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.