and the distribution of digital products.

DM Television

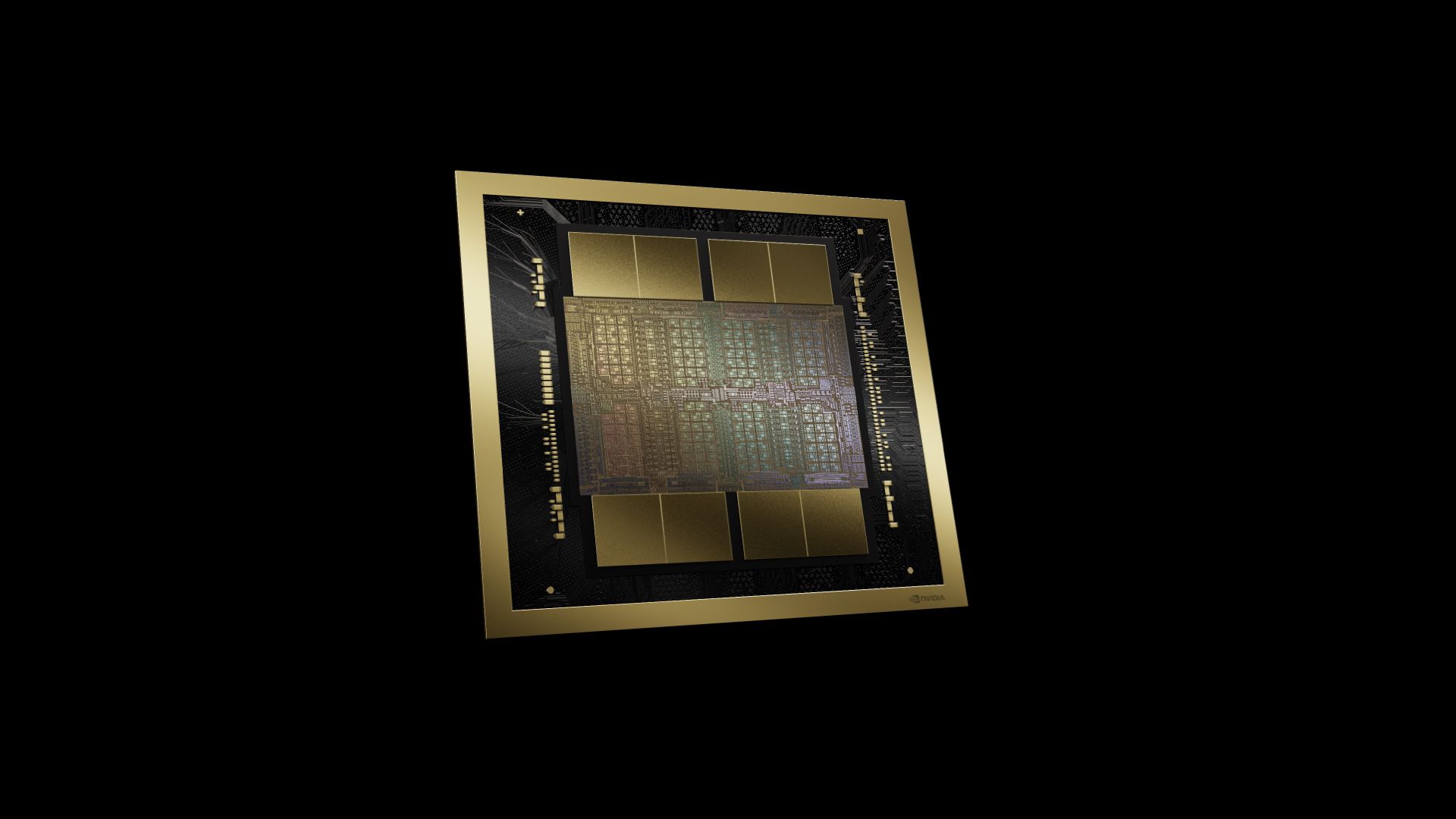

Cooling issues won’t halt Blackwell AI chip sales, Nvidia claims

Nvidia anticipates higher sales of its Blackwell AI chips than previously expected, driven by demand from major clients like Microsoft and OpenAI. The company confirmed its production capabilities during a recent earnings call, maintaining an ongoing expansion in AI chip manufacturing.

Nvidia expects stronger sales of Blackwell AI chipsNvidia’s new flagship Blackwell AI servers might be facing cooling issues, but the company sidestepped the topic during today’s call. Instead, Nvidia reassured investors that Blackwell is in “full production” and moving “full steam ahead,” promising to ramp up chip deliveries each quarter moving forward.

During the third quarter earnings call, Huang stated, “Blackwell production is in full steam,” noting that they will deliver more Blackwells this quarter than earlier projected. Despite some shipment delays due to engineering adjustments, Nvidia has already shipped 13,000 Blackwell chips, allowing key partners such as Microsoft, Oracle, and OpenAI to begin utilizing the technology.

The recent quarter witnessed Nvidia’s sales nearly doubling, resulting in an annual revenue run rate of $140 billion. Nvidia’s core focus is now on its AI-driven data centers, which generated $30.7 billion in revenue in the past quarter. This shift illustrates a significant pivot from gaming hardware, which now constitutes a smaller revenue segment for the company, only bringing in $2-3 billion per quarter.

In July, Nvidia anticipated a revenue of “several billion dollars” from Blackwell in the current quarter, and the recent disclosures indicated that sales might exceed this initial forecast as production ramps up. Huang emphasized that demand is outstripping supply, a trend expected to continue as customers seek high-performance GPUs for generative AI applications. He characterized this surge in demand as part of the “generative AI revolution,” underscoring the significance of Blackwell in meeting these needs.

While Nvidia is experiencing strong demand, the firm’s reported gross margins for Blackwell may be lower initially than the 73.5% reported in the previous quarter. However, Huang predicts that margins will improve as the product matures. The supply chain is a critical factor in production as well; partnerships with companies like TSMC, Amphenol, Vertiv, SK Hynix, and Micron play a vital role in Nvidia’s ability to meet customer demands. Huang noted, “Almost every company in the world seems to be involved in our supply chain.”

Nvidia stock might explode after Nov. 20: Here’s why

Nvidia’s competitive landscape has shifted markedly as it leverages its AI chips to dominate the market. While companies like AMD are starting to see growth in AI, Nvidia remains significantly ahead, having surpassed both Microsoft and Apple in market value due to its AI chip revenue. The company’s success with previous AI models, such as the H100, took longer to realize compared to Blackwell, which has already shown potential for billions in revenue shortly after launch.

Industry analysts and investors are watching Nvidia’s trajectory closely. Although the company missed some elevated expectations from optimistic investors, its position remains robust. Analysts express concern over potential delivery issues but have observed the company’s cautious optimism regarding its production capabilities.

Huang noted that the development timelines for new chips are accelerating, with Nvidia now aiming to release updates annually rather than biannually.

Featured image credit: Nvidia

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.