and the distribution of digital products.

Australia Dominates Crypto ATM Market With 16x Growth

Australia is making headlines in the world of crypto, as it leads in the installation of Bitcoin ATMs. This achievement amounts to a sixteen-fold increase in the number of kiosks the country has produced over the last two years.

The unexpected rise has kept the eyebrows of many raised and even spurred debate on just what’s behind the demand in the evolving hot hub for digital currency transactions.

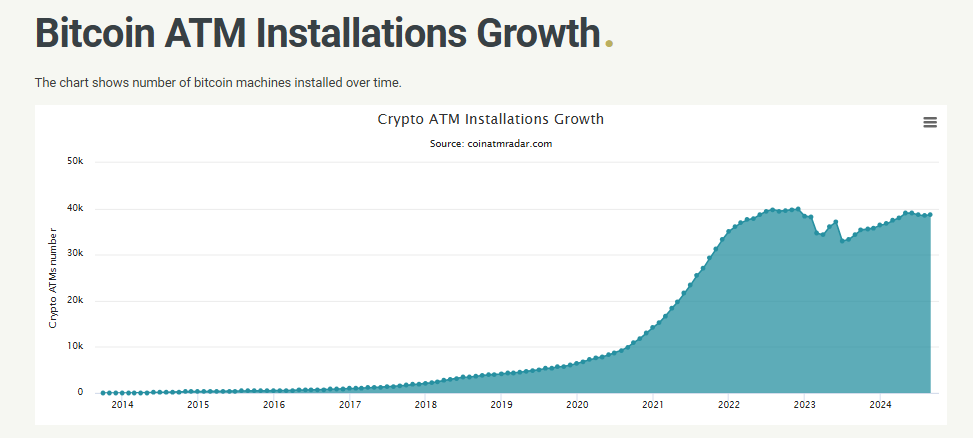

The Rise Of Crypto ATMsAccording to the latest statistics provided by Coin ATM Radar, Australia now ranks third in the global market for crypto-ATMs with 2,000 machines. Data shows that the US stands first with 32,000 machines, while Canada is at second with 3,000 machines.

Users may easily purchase Bitcoin and other cryptocurrencies using cash thanks to the increasing number of ATM installations enabling this type of transaction.

The typical Australian now finds digital currency more easily available. Particularly among the younger and more open-minded generations to new financial technology, the surge in these ATMs reflects increasing curiosity in cryptocurrencies.

The emergence of Bitcoin ATMs is more of a sign of shifting perceptions of digital currencies than of their count. The decent profits on cryptocurrencies have many Australians ready to make investments in them.

For individuals wishing to dip their toes into the crypto market, having the simplicity of turning cash at a local kiosk into digital assets has drawn massive interest from different walks of life.

The regulatory framework in Australia has helped to explain this boom in great part. Here, the government has been aggressive in building a structure that strikes a compromise between consumer protection and fostering bitcoin innovation.

This has generated exactly the right level of support for businesses to invest in other bitcoin infrastructure including ATMs. Clear, unambiguous guidelines help companies to be more sure they can launch operations knowing they are well inside compliance with local legislation.

Stories of early success and significant price swings have piqued public curiosity in cryptocurrencies, which are covered on many media sources.

Demand for ATMs will keep rising as more and more Australians see the potential advantages from using digital currency. Of course, such expansion draws more attention.

Arguably, the more of these automated teller machines (ATMs) are deployed in key areas, the more authorities might wish to ensure they are not being used for illegal activities including money laundering.

Future Challenges And OpportunitiesThe future of Bitcoin ATMs in Australia looks promising, but challenges still abound. The rapid expansion may attract increased regulatory scrutiny, especially if fraud or money laundering concerns arise.

With the increasing number of ATMs, regulators have to ensure that operators stick with existing laws and that adequate protection for consumers is provided.

Featured image from Entrepreneur, chart from TradingView

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.