and the distribution of digital products.

AscendEX Earn Guide: Earn UPTO 14% APR on StableCoins

Trading can be tedious at times; it can even take away your mental peace or disrupt your sleep schedule. But then how to gain returns without trading? Well, here comes AscendEX Earn, where you can earn up to 14% APR on stablecoins and over 700% APR on other cryptocurrencies.

Summary (TL;DR)- AsnedEX Earn offers the users a base for Staking, Yield Farming, ASD products and much more that allows its users to earn maximum yield from their Crypto assets.

- Its ASD Ecosystem is another excellent source of passive income if the user utilises the ASD Token and claims its benefits, including a VIP status account and lower trading fees.

- This platform also offers stake services to boost user returns. Furthermore, Compound Mode automatically delegates staking bonuses once they are handed out.

- AscendEX earn also offers the feature of Collateral for future trading as well as Collateral for margin trading, where the staked assets are transferred directly and be used to earn yield.

- Another way for the user to maximise their return on capital leveraging various decentralised finance (“DeFi”) protocols, including Lending protocols, Decentralised liquidity pools, Derivatives protocols.

- The users of this platform can support and vote on their preferred projects by bidding DOT Tokens and can get up to 40,000 USDT Worth of rewards.

- In addition, The user can act as a liquidity provider in the pools to become and earn transaction fees and flexible interest, which can be added and claimed without paying any handling fees.

- This fee structure is built upon the VIP structure. The users are also entitled to discounts based on the base trading fees, trailing 30-day trade volume (in USDT), and trailing 30-day average unlocked ASD holdings.

- The users can earn interest on a daily basis with its BitTreasure feature, where the user has to deposit an amount which they will receive after the maturity date along with interest.

AscendEX is a digital asset financial platform that provides the services of institutional clients in over 200 countries and regions around the world. Headquartered in Singapore, It was founded in 2018 and now provides high-quality digital assets. In addition, it allows multiple fiat payment opportunities and various services to ensure high trading liquidity. This particular platform offers more than 150 crypto assets and trading pairs.

Its various services and products include earning rewards in USDT, BTC and ETH, Cross-Asset Margin Mode with which the user can borrow and repay directly through trading, and last but not least, its Staking services.

VISIT ASCENDEX AscendEX exchange

AscendEX exchange

Also read, 5 Best Crypto Staking Platforms: Easy way to Earn Crypto!

What is AscendEX Earn?Ascendex Earn is a base for Staking, Yield Farming, and ASD products that allow users to earn maximum yield from their Crypto assets. It allows the users to become proficient in investment opportunities that are available to them on this particular platform and go through the current offers. Along with that, AscendEX Earn can acquire an understanding of where to deposit its digital assets according to its investment strategies and risk tolerance.

Also read, Where and How to Stake or Earn Shiba Inu (SHIB)?

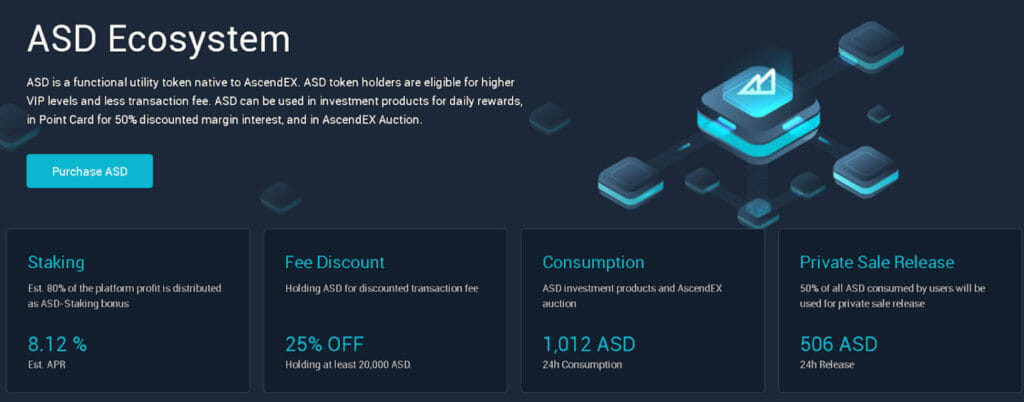

AscendEX Earn: Services ASD EcosystemAscendEX Earn provides The ASD ecosystem to its users that is a compilation of a variety of investment products and service offerings that involve using the utility token ASD. It provides users with ASD multiple ways to earn extra income, yield, and fee discounts. For example, if the user acquires and holds ASD in their account, they can have access to benefits like their account up-gradation to VIP status and lower trading fees.

Furthermore, users holding ASD can produce USDT based returns daily if they invest in financial products of ASD with consistent APRs. In addition, the users are entitled to a discount of fifty percent on margin trading interest if the users buy point cards, use the ASD in the auction event, and much more by engaging with the ASD Ecosystem.

Ascendex Earn : Ecosystem

AscendEX Earn: Staking

Ascendex Earn : Ecosystem

AscendEX Earn: Staking

To attract more users, Staking services are also offered by AscendEX Earn. By locking up tokens in an AscendEX staking project, users help in maintaining blockchain network operation. Compared with the act of depositing in a bank, staking boasts higher returns. The longer the staking period is, the higher are the returns. Therefore, with AscendEX earn, you can earn over 14% APR on stablecoin. Moreover, another innovative feature that is introduced by this platform is the Compound Mode that automatically re delegates staking bonuses once they are handed out.

AscendEX Earn: Staking

AscendEX Earn: Staking

Also read, Coinbase Staking – Earn staking rewards on your Crypto

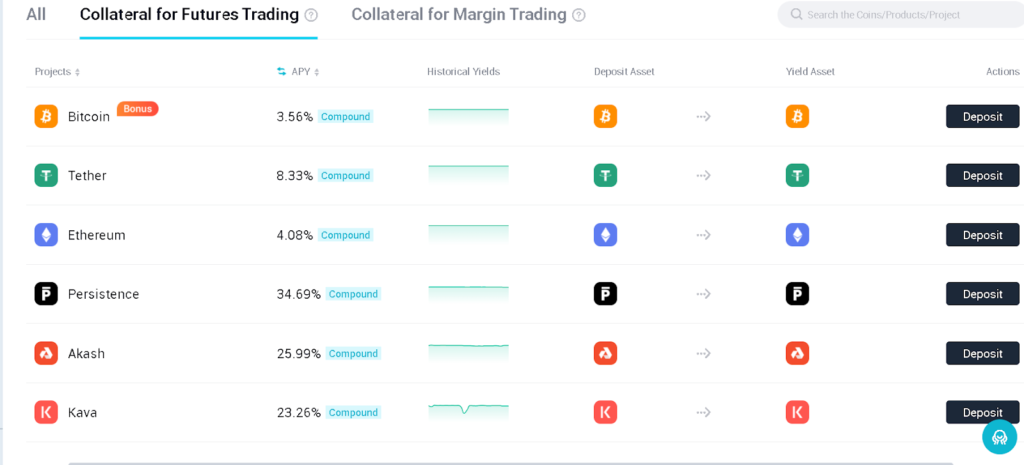

AscendEX Earn: Collateral for Future TradingYou can also use crypto for collateral while you’re trading futures. For this, you can simply transfer your funds to the futures account. At the same time, you are entitled to receive regular staking returns. In addition, you can also claim a benefit of 220 USDT worth of future bonus credits when you complete the platform’s future trading tasks.

The amount of staked assets that can be used as collateral for future trading depends upon the discount factor of the futures to be traded with the staked asset. This function is applicable on 16 staked assets, and more are being added to the pipeline. Currently, these 16 staked assets include USDT, BTC, ETH, USDC, ATOM, DOT, XTZ, KAVA, BAND, SRM, ONE, CSPR, XPRT, PORT, AKT, and WOO.

Collateral for Future Trading

AscendEX Earn: Collateral for Margin Trading

Collateral for Future Trading

AscendEX Earn: Collateral for Margin Trading

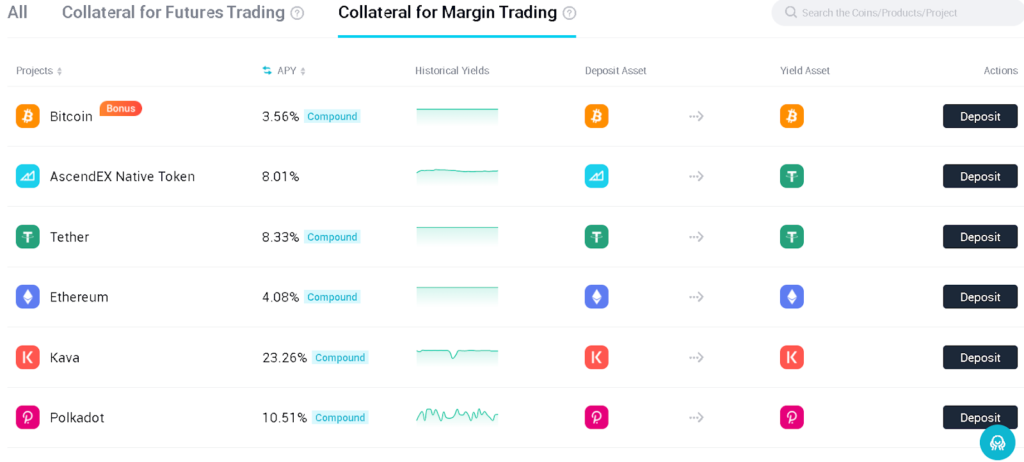

In addition, the collateral share of the staked funds is not confined to only futures trading, but also for margin trading. A percentage of staked assets can be transferred directly into the margin account as Collateral to add extra earnings as well as simultaneously claim the regular staking returns. This particular platform provides support for 14 assets currently, and some are yet to be included.

Collateral for Margin Trading

DeFi yield farming

Collateral for Margin Trading

DeFi yield farming

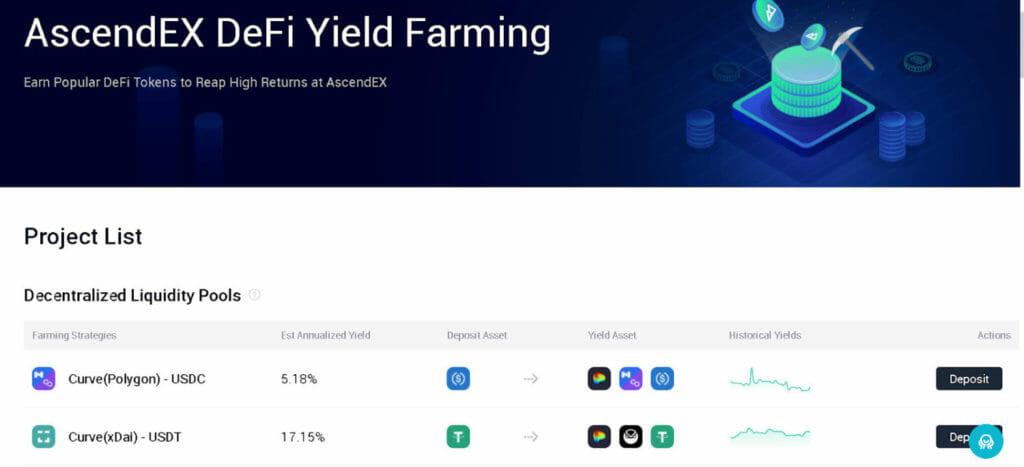

Further, you can maximize your return on capital by leveraging various decentralised finance (“DeFi”) protocols, including Lending protocols, Decentralised liquidity pools, and derivatives protocols. A “Yield Farmer” who allocates capital to any of these protocols is rewarded for their “liquidity contribution.” Rewards are granted to Yield Farmers in a variety of tokens from relevant DeFi protocols issued as fees, interests, or incentives and distributed to liquidity contributors. By farming with AscendEX Earn, you can enjoy several benefits which include:

- You can enjoy the benefit of paying no gas fees, thus maximising your yield.

- AscendEX offers pure “yield driven” strategies for subscription especially for the users who are seeking to maximise their yield on principal capital, rather than accumulating DeFi governance tokens. Users can further enhance yield by engaging in leveraged strategies to increase farming exposure.

- The AscendEX team handles all backend integration with DeFi protocols, thus allowing you to farm yield via a simple and easy-to-use “one-click” function.

- AscendEX allows you to deposit and withdraw assets anytime, with the ability to receive yield farming rewards in a timely manner.

Also read, Top 5 DeFi Tokens to Look Out for

DeFi yield farming

Dot Slot Auction

DeFi yield farming

Dot Slot Auction

Along with its blockchain, the user can take advantage of the Polkadot and Kusama (Relay Chain) to provide the developers ways to create new crypto assets and decentralized applications (Dapps). The users can support and vote on their preferred projects by bidding DOT Tokens which are locked during the Crowd Loan period. If the project of the bidder’s choice wins, AscendEX will thoroughly distribute the voting rewards to voters.

The DOT assigned to vote will be locked during the lease period. To ensure the provision of liquidity, AscendEX issues DOT-A to users, which is backed by DOT in a 1:1 ratio. Moreover, the users are entitled to earn a lot from voting:

- The user can proportionally share in a locked reward pool given by the project.

- Few project sponsors distribute extra rewards.

- If the user joins DOT Slot Auctions, they can get up to 40,000 USDT Worth of rewards.

While the lockup period is going on, the DOT is unavailable for staking, transferring, or trading. However, these tokens can be claimed after a 96-week lease period if the bidder wins the auction.

Also read, 5 Best Crypto Staking Platforms: Easy way to Earn Crypto!

AscendEX Earn: Liquidity MiningBased on the Automatic market Maker (AMM) principle, this AscendEX Earn also provides liquidity mining. Although Liquidity mining is not a guaranteed investment, it helps the user earn a passive income. It contains several liquidity pools, and every liquidity pool contains two cryptocurrencies. Further, The user can act as a liquidity provider to become and earn rewards without having to pay any handling fee.

AscendEX Earn: BitTreasureAlong with other investment products, BitTreasure is a fixed deposit investment product that allows the users to simply transfer USDT or other available coins/tokens to BitTreasure account and, on a daily basis, earn interest on it. Although if the user deposits their money in the BitTreasure, they cannot withdraw their money before the maturity date. This feature implements strict risk management to protect asset security and interests for users.

Also read, Where and How to Buy Tron Token?

AscendEX Earn: FeesAscendEX provides a tiered VIP structure to its users. Spot and Margin trading are subject to the same level of trading fees. The users are also entitled to discounts based on the base trading fees, trailing 30-day trade volume (in USDT), and trailing 30-day average unlocked ASD holdings.

AscendEX Earn: Sub Account VIP feeThe VIP level of every account depends upon the trailing 30-day trade volume, and the trailing 30-day average unlocked ASD holdings of the parent account and sub-accounts.

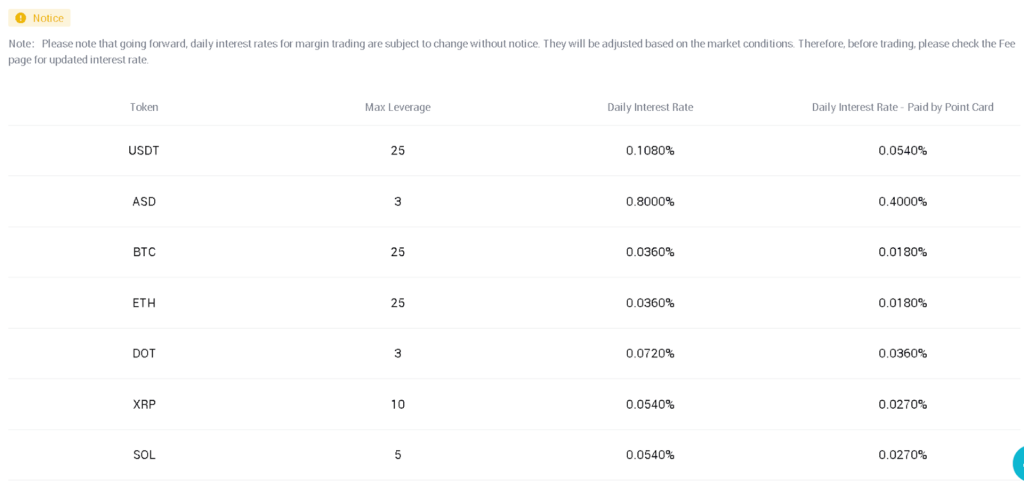

AscendEX Earn: Interest RatesThe maximum compounding interest rate available is around 796%. Moreover, apart from this, you can earn upto 14% interest on USDT stablecoin. Moreover, you can also deposit tokens with the AscendEX launch pool and get an opportunity to earn some interest on the newly listed cryptos.

Interest Rates

AscendEX Earn: Withdrawal fees

Interest Rates

AscendEX Earn: Withdrawal fees

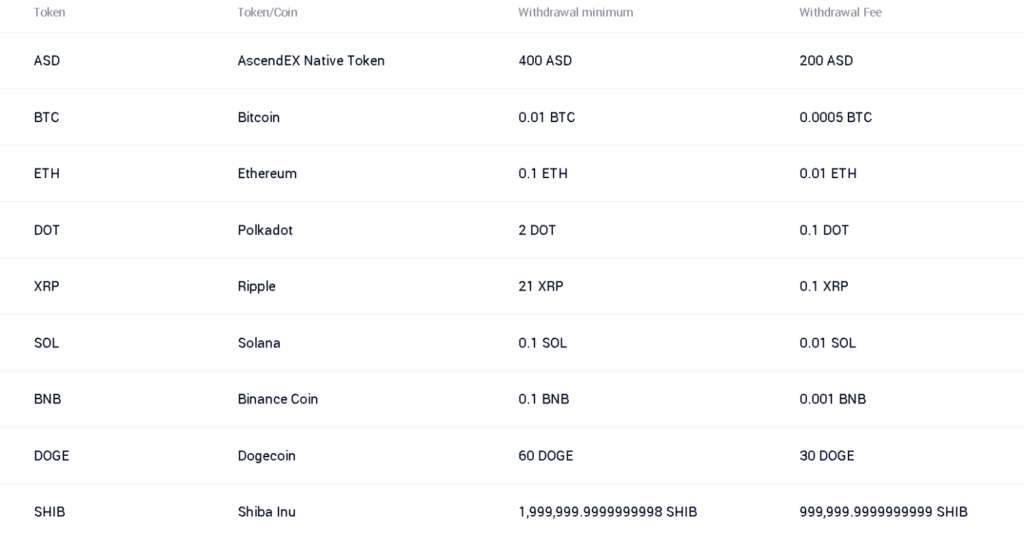

The user’s account is also imposed with a withdrawal fee which is subject to change depending upon the blockchain network conditions.

Withdrawal fees

Withdrawal fees

Also Read: Coinbase Staking – Earn staking rewards on your Crypto

ConclusionFormerly known as Bitmax, AscendEX is a very user-friendly platform that provides users with a wide range of crypto assets and tokens. Furthermore, its multiple features provide users with an opportunity to earn passive income and have also made it a popular as well as a preferred platform.

Also, AscendEX provides a secure environment to its users as well as the customer care team is active on all of its social media pages. Moreover, AscendEX is available in ten different languages for users all over the world. Therefore, this platform can prove to be a really good suit for beginners who wish to learn about the world of cryptocurrency.

VISIT ASCENDEX Frequently Asked Questions Q1. What are the limitations of this platform?A1. Although this platform is an excellent choice for beginners, it would not excite an experienced trader due to the following reasons. The residents of the United States cannot access this platform, no transaction deposit or withdrawal can take place using fiat, and the trading fee that is stated for altcoins is higher than the market average.

Q2. What happened to the Bitmax platform?A2. The Bitmax.io platform, which was launched in 2018, was earlier available to only Chinese users so as to make it accessible for users globally. Later 2021, this platform rebranded itself as AscendEX by including different languages.

Q3. Is there a mobile application for AscendEX?A3. AscendEX platform has a mobile application that is available for both iOS and Android, which provides the user with a regular trading view and its various services to keep the utility intact.

Also read,

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.