and the distribution of digital products.

Why the Return of Optimism to Wall Street Could be Slower Than Expected

While the stock markets in America have been volatile, it is worth noting that Wall Street has bounced quite significantly from the worst of the selling pressure. This raises the question of what the expectations are regarding interest rates.

\ In recent sessions, the S&P 500 index has regained stability after dropping to 5186.33 on August 5th, closing at 5455.21 on August 14th. Much of the focus among traders has been on the potential for a Federal Reserve rate cut during the September meeting, scheduled for the 17th and 18th.

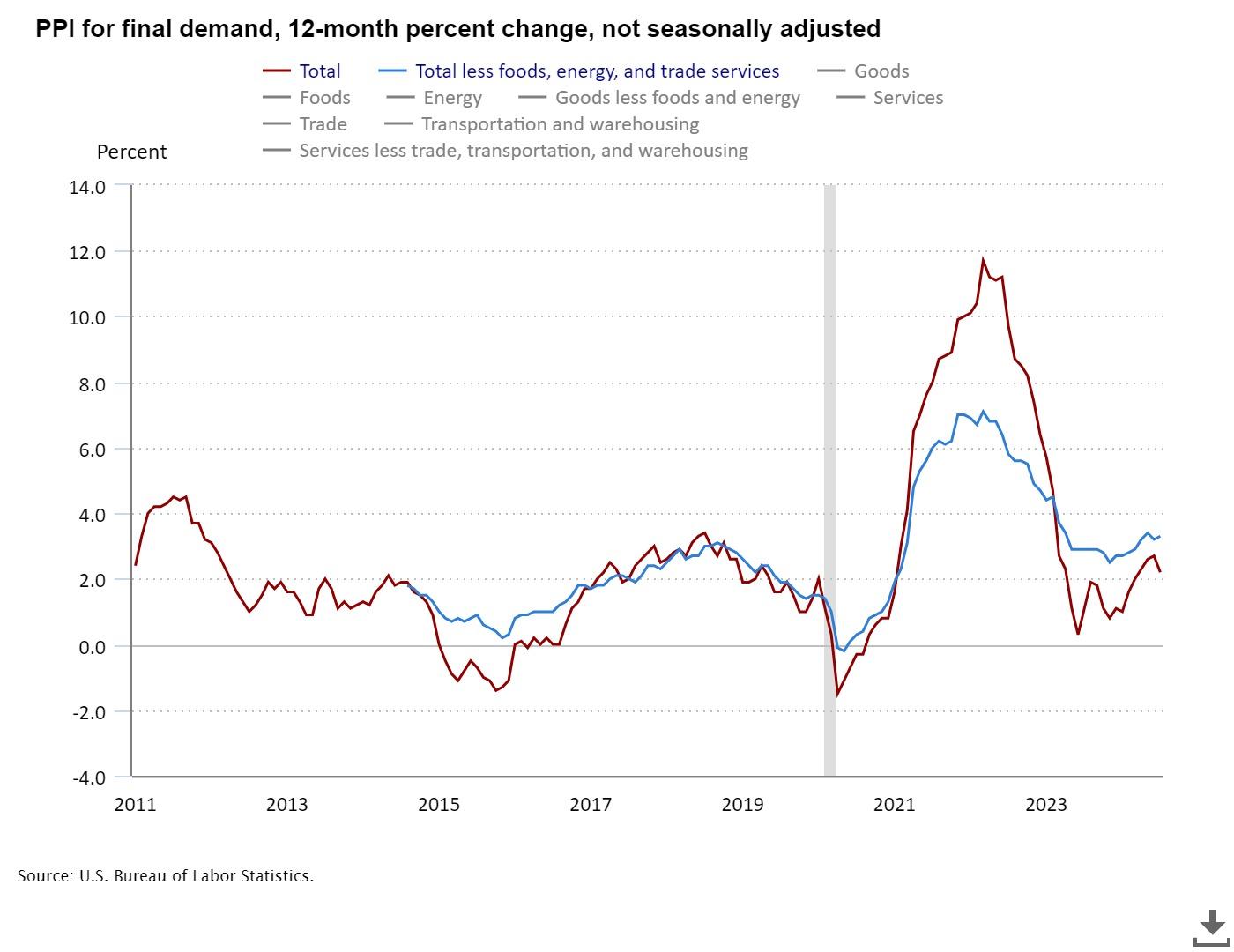

\ Many traders are looking at the recent lower Consumer Price Index (CPI) and Producer Price Index (PPI) figures as signs that the US economy might finally be cooling enough for the Fed to take action. Consumer Prices rose 2.9% year-over-year in July, down from 3% for the previous 12 months. The Producer’s Price Index came in at 2.2% for the 12 months prior in July, a drop from the 2.7% seen for that same time in June.

\

\

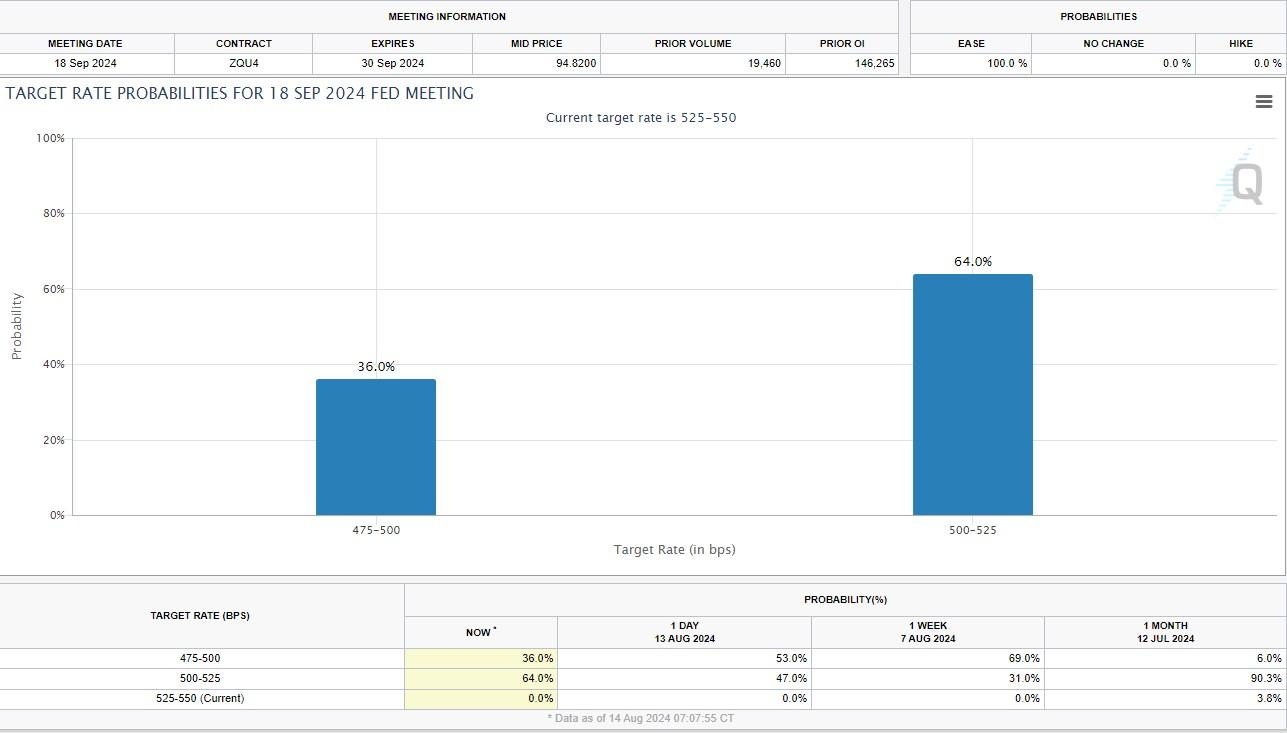

Traders Are Becoming Aggressive in the Futures MarketsThe Federal Fund Futures market for the September meeting is currently pricing in a 36% chance for the Fed to cut rates down from the current range of 525 to 550 basis points down to the 475 to 500 range. Meanwhile, 64% of traders are betting that the Fed will cut to a range between 500 and 525 basis points, while the same market has no traders predicting that the Fed will maintain current rates.

\ While 69% of traders in the market on August 7th bet on the most aggressive cuts, expectations for outsized rate moves are cooling a bit, silencing some of the euphoria that had previously been seen.

\

\

Experts Weigh InMaxim Manturov, head of investment research at Freedom24, says: “Historically, the S&P 500 Index tends to rise in the second half of an election year, especially if the incumbent party wins. Unique to this year is the decreased uncertainty from both major party candidates previously occupying the White House, potentially contributing to year-end gains. Moreover, expectations of Fed rate cuts have historically boosted the S&P 500 Index by nearly 6% over the previous six months before the 1st cut.

\ Although there are concerns about overvaluation, optimism, and overbought conditions, the market's gains since the beginning of the year have been concentrated in a few fast-growing tech stocks, making it vulnerable to significant drawdowns if the “bullish” outlook falters amid a weak news backdrop.”

Is Now the Time to Be Bullish?While this is a complex question, there are a few things to consider when asking it. At this point, the real worry is that the US economy could be heading toward a recession, and while that may not be technically true at the moment, things are indeed slowing down for many Americans. Recent headlines are full of prominent layoff notices, such as the ones at Intel, Tesla, Microsoft, and Amazon, and this will do nothing to quell worries.

\ A recession is a decline in economic activity that can last for a significant period. However, the statistics aren’t necessarily what drives recessions. People's perception of the economy can push it into a recession, whether warranted or not. The most common measure of a recession is two consecutive quarters of contracting output, typically measured in GDP.

\ In this environment, it is common for traders to seek refuge in less volatile stocks. Many of these include consumer staples and healthcare—things that people need to purchase regardless of economic conditions. As traders start to look at the possibility of a slowdown in America, it's possible that companies that performed well in 2008 and 2020 could be of interest. These include Walmart, Abbott Labs, T-Mobile US, and Netflix.

\n So, while some high-flyers in the tech sector may struggle, some more mainstream companies are likely to attract attention. When the Fed cuts rates, it will often be when the economy is sluggish. The aim is to encourage consumers and businesses to borrow and spend more. However, the Fed has a long history of being “behind the curve” in monetary policy, which could cause more turbulence. Ultimately, it is likely that traders would be wise to think of all of these factors before simply following the euphoria that has already subsided somewhat over the last several sessions.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.