and the distribution of digital products.

DM Television

Who creates all the money in the world?

If we don’t have money then how much Beer ???? cost?

In the 2nd quarter of 2020, the Federal Reserve Bank injected more than $3 Trillion in the economy.

So from where this money comes from, and who created it? In this article, explain how money is created, who creates it, and its effects.

We will only focus on the U.S. Dollar because it’s the world reserve currency and affects everyone regardless of nationality.

How money is created?Money is created primarily in 3 ways.

- Physical Money (Note and Coins)

- Private Bank Money (Debt)

- Central Bank Money (Quantitative easing)

According to different estimates, 3–8% of physical money exists in the world. In the United States, approximately $1.5 trillion in physical currency currently in circulation.

Yes, more than 90% of the money in the world exists in the digital form.

Note — People who think Bitcoin exists only on the internet, nothing is behind it, should consider that more than 90% of money already exists only in digital form.

Who prints Physical money?The government prints physical money (Coins or paper currency) at the request of the Federal Reserve. The Fed anticipates demand and orders new physical money every year.

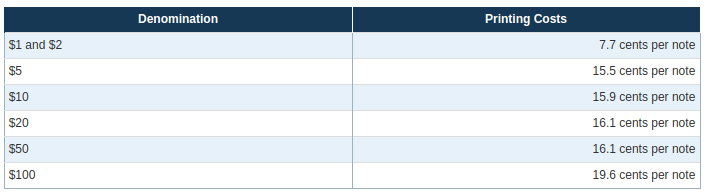

Printing money usually costs less than its face value. For example, it only cost 19.6 cents to print a $100 bill in 2020. The difference in money printing cost and its face value is called Seigniorage.

Seigniorage is government revenue.

Source

So why can’t the Government always print more money?

Source

So why can’t the Government always print more money?

It is a massive conflict of interest if politicians were allowed to print money. They will make unimaginable campaign promises and inflate the money supply to fulfill it.

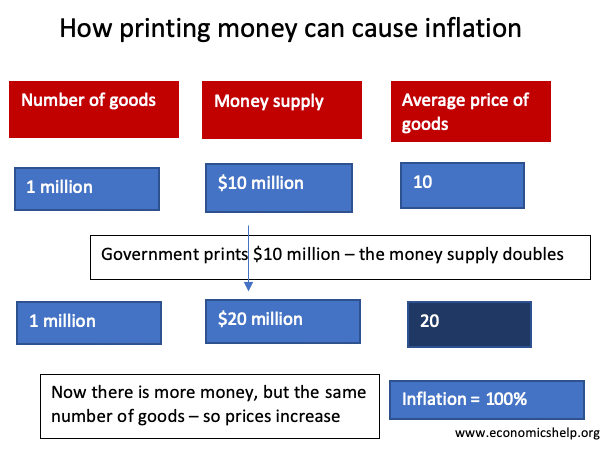

Inflating money supply will also cause hyperinflation and currency debasement.

Inflation explained — source

Inflation explained — source

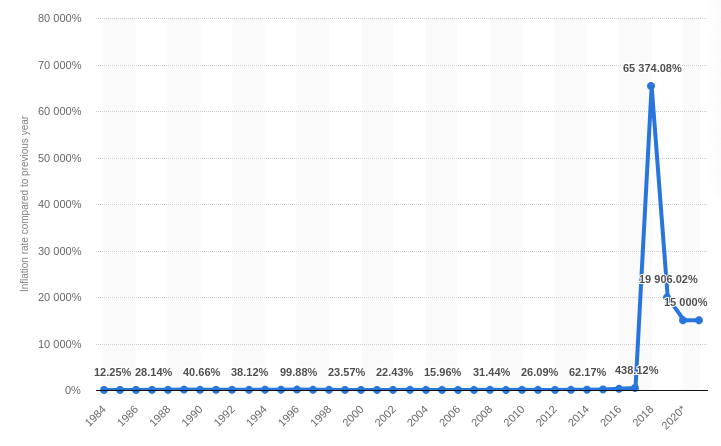

For example, in 2017, Venezuela’s national currency Bolivar lost 90% of its value in just five months, with 14,200% yearly inflation.

Inflation % in Venezuela over the years – source

What is money?

Inflation % in Venezuela over the years – source

What is money?

Money is a measurement of “Value” or “Wealth”. It performs 3 primary tasks for us.

- Store of Value — Preserve value creation or wealth creation (Ex- Your salary)

- Medium of Exchange — Buy things

- Unit of Account — Measure worth of different goods using a single unit. (Ex- Everything on Amazon is in dollars)

Historically, humans used beads, shells, and many other things in the form of money.

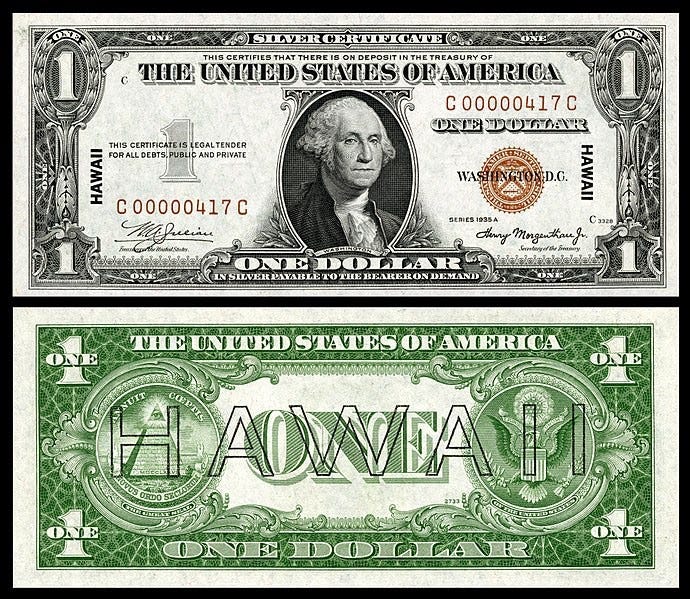

However, in recent history, gold and silver coins were used as commodity money. The image below shows one of the first issued Silver certificates in 1878. If you look closely, it says

“This Certifies that there is on deposit in the treasury of The United States of America”

“One Dollar in Silver payable to the bearer on demand”

1 Dollar Silver certificate

1 Dollar Silver certificate

The U.S. government was obliged to provide 1 Dollar worth of silver to the bearer of this note. The dollar note was entirely backed by silver or gold.

Similarly, for higher value, the U.S. Government also issued Gold certificates from 1863 to 1933.

Note: These certificates were just a representation of actual gold and silver reserve kept by the government.

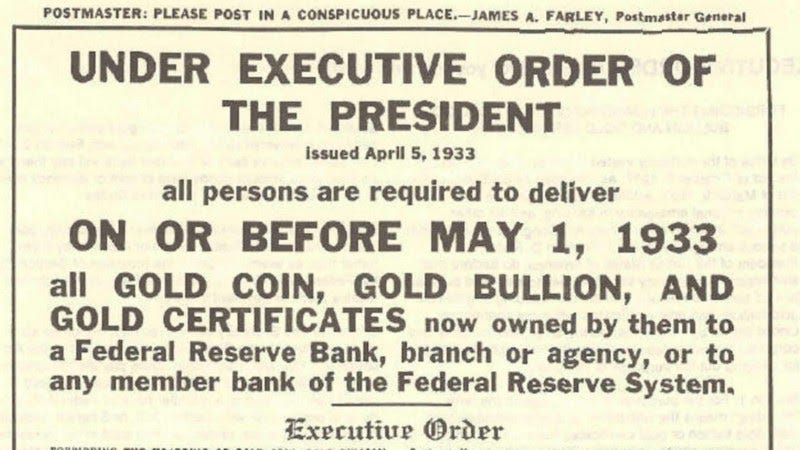

Gold StandardOn 5 June 1933, the United States went off the gold standard when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold.

Gold Standard is a monetary system in which currency is partially or fully backed by gold.

In Gold standard, the government was not able to increase the money supply without increasing its gold reserve. Theoretically, this keeps a check on government overspending and inflation because the gold supply only grows 1–2% every year.

The United States had been on a gold standard since 1879.

After that, the U.S. government increased the price of gold to $35/oz from $20.67/oz. The U.S. government held the $35/oz until 15 August 1971.

In 1971, President Richard Nixon changed everything by announcing that the United States would no longer convert dollars to gold at a fixed value, thus abandoning the Gold standard altogether, making the U.S. dollar a fiat currency.

Fiat is a Latin word that meant “let it be done.” In the 1630s, the English translator translated as an “authoritative decree.”

“Nothing backs the US dollar today.”

To Recap- Only 3–8% of the money in the world is physical.

- The government prints physical money at the request of the Fed.

- Governments benefits of the printing money called Seigniorage

- U.S. dollar was initially backed by gold, which is called the Gold Standard. It means that the paper money was a representation of Gold.

- But Nixon abandoned in 1971, making the U.S. dollar a fiat currency. Now USD is backed by nothing.

Private banks create around 97% of the money that exists today. Yes, not the central banks but the private banks. To understand how private banks create money, we need to understand Fractional reserve banking (FRB).

But let’s first understand the Bank Notes.

Bank Notes (Paper Money)The first bank to initiate the permanent issue of banknotes was the Bank of England.

In 1687, King William engaged in a nine-year war with France, which was also known as a King William’s War or Nine Years’ War. However, war is expensive. Therefore, In 1694, the English government borrowed 1.2 million pounds at a rate of eight percent to build its navy. King William paid the loan by raising taxes.

In return, the lenders were allowed to incorporate themselves as a new company, the Bank of England. The royal charter was granted on 27 July through the passage of the Tonnage Act 1694. The bank had the right to take in deposits of gold (bullion) from the public and print “Bank Notes” as receipts for the deposits.

These new deposits were then lent to the King. The banknotes, being guaranteed by the deposits and people considered them as good as gold, Therefore these notes rapidly became a generally accepted new currency.

In 1707, the newly created Bank of England was given the responsibility of managing this currency. However, the bank wanted to circulate its own banknotes because of more profits. These new Banknotes were in the form of fractional money, which provided for the collection of interest, not the payment of it. (A physical form of debt money, which we will talk about later in the article)

Consequently, the government bills gradually passed out of use and were replaced by banknotes, which, by the middle of the eighteenth century, became England’s only paper money.

Fractional Reserve BankingThe first banks in the United States were chartered by the states and were not required to keep reserves. By 1820 a few New York and New England banks entered into redemption arrangements provided that a sufficient deposit of gold was maintained in their respective vaults to guarantee their paper money. Most states still had no reserve requirement when the American Civil War began in 1861.

In 1863 the National Bank Act established reserve requirements to ensure liquidity, the ability to satisfy a customer’s cash demands, especially during times of financial panic. Several bank runs in the late 19th and early 20th centuries demonstrated that reserve requirements did very little to provide liquidity. Private banks persuaded the government to allow them to create the money legally, hence the government outsourcing the money creation.

To enable this, the Federal Reserve System created in 1913 became the lender of last resort, capable of meeting cash needs. The requirement of reserves meeting liquidity demands vanished. Instead, fractional reserve requirements evolved into a monetary policy tool of the Federal Reserve System.

In Fractional reserve banking, banks are allowed to take deposits from customers and make loans to borrowers, while holding only a fraction of the original deposit amount as reserves.

Every central bank in the world sets its own reserve requirement, determining the reserve requirements for commercial/Private banks.

Consumer money deposited in the bank is legally owned by the bank.

Debt as MoneySo how do Private banks create money? The answer is lending. Let’s understand this with an example.

Let’s say you went to a Bank A and deposited $1000.

Assume the current reserve requirement is 10%, set by the Central bank. In this case, Bank A can lend 90% of your original deposit value, which is $900.

Now that borrower went to Bank B and deposited that $900, then Bank B also allowed to loan out 90% of $900, which is $810, and so on.

For consumers, Debt is a liability, for banks, it’s an asset.

Everyone in the system will see the full amount in their account. For example, you will see $1000 in your account and be allowed to withdraw them. This whole system works because banks know that not everyone is going to withdraw at the same time. However, if there is a Bank run, the Fed can always bail them out.

Remember that under a fractional reserve banking system only a small percentage of deposits is kept on hand for dispersal to depositors. The rest of the money is loaned out. Not only are many of the loans made by these banks going bad, but the reserve requirement in Euro-system countries is only one percent! If just one euro out of every hundred is withdrawn from banks, the bank reserves would be completely exhausted and the whole system would collapse. Is it any wonder, then, that the EU fears a major bank run and has shipped billions of euros to Cyprus? — Ron Paul

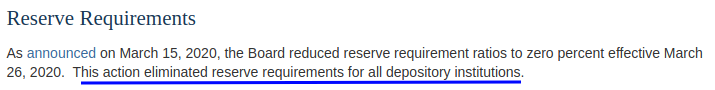

On 15 March 2020, the U.S. Fed eliminated the reserve requirements.

Source

Source

Debt money automatically gets destroyed, once borrowers pay back the original sum with interest. This interest is the bank’s profit and their business model.

But what if enough people default on Bank loans? That’s what happened in 2008.

when a bank creates a loan it’s not somebody else’s money, it’s created out of thin air, just by typing in a computer.

How debt helps economic growth?When banks extend credit (create Debt), there is more money in the economy which increases the money velocity and propels growth. Let’s understand with an example.

Let’s say I deposited $1 million in the bank and the bank lends it to a borrower to buy a new home. In this case.

- Banks (Creates debt money)

- Borrower ( Buy a new home with debt)

- Homeseller (can now buy other things in the economy)

- Hence economic growth

Bank’s business model is to get deposits at minimum interest rates and lend it to maximum interest rates and earn profit in the middle.

More Loans = More Profit

Real estate and property are conventional collaterals in money lending. Banks all over the world treat them as the safest way yet most profitable for creating debt, so they can take your house bank in case of default.

2008 Housing BubbleBut in the early 2000s, banks focused on this single market and provided riskier loans causing the Housing bubble. This bubble is financed by mortgage-backed securities and collateralized debt obligations (CDOs).

In simple terms, Banks were gambling with the people’s money to get higher returns.

Little technical? So let Margot Robbie and Selena Gomez explain it to you in a simpler form.

https://youtu.be/anSPG0TPf84 Margot Robbie explains finance Selena Gomez explains finance To Recap- Private banks create money(debt) out of thin air through fractional reserve banking

- They earn interest on these loans, that’s the Bank’s business model.

- More loans == More profits

- In 2008, they got greedy and gambled away people’s money.

When the market found out about it and started shorting these securities, banks faced a liquidity crunch, Therefore, to prevent the bank run, Fed stepped in and injected $700 billion dollars into the banking system.

Yes, the Fed just printed the $700 billion dollars on their computer and gave out to the private banks. This takes us to our next Chapter, Central Bank Money.

Chapter 3- Central Bank MoneyThe Central Bank in our case Fed was established in 1913 through the federal reserve act. It’s a sudo-independent institution.

The Fed can also increase the money supply through Quantitative easing. Let’s understand what Quantitative easing is and how Central banks increase the money supply.

Quantitative Easing (Q.E.)Japanese invented the Q.E. in the late 90s and the Fed used it to bail out the banks in 2008.

Q.E. is a monetary policy tool, in which central banks create money in order to loan out to private banks, large corporations, and even the public through the bond market.

The money supply is the total amount of money in circulation within a country. The money supply includes cash and credit.

In simple words, the Fed just prints money out of thin air, which is paid by taxpayers and future generations.

Listen to Fed chairman Jerome Powell.

Bond and Bond MarketBonds are a fixed income financial instrument to acquire loans. Governments and big companies issue these bonds in order to raise money.

A Government bond is a promise that governments will eventually pay back the money with interest.

The bond market is bigger and more liquid than the stock market. The Fed injects the money into the system through the bond market.

Central banks that have no savings can create money to buy these bonds.

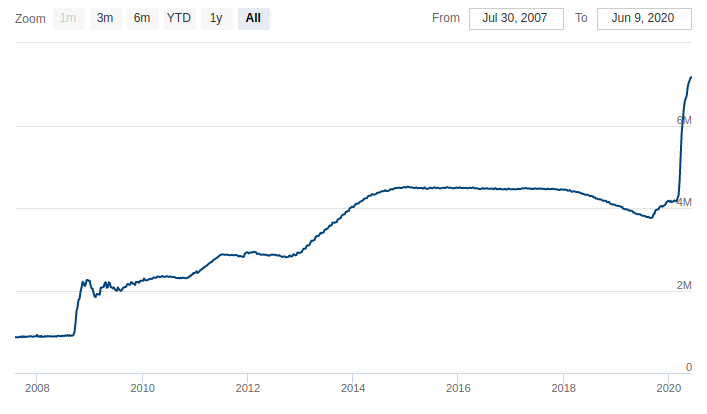

When the Fed prints money, it increases its balance sheet. The expansion of the Fed balance sheet can lead to inflation and systemic risks.

From the 2008 crisis, the Fed has printed more than $6 Trillion, in which it has printed $3 trillion dollars in 2020 alone (Within 3 months).

In addition, this time the Fed also created a program to buy corporate bonds, which is a direct violation of Federal reserve act 1913.

U.S. Fed balance sheet (in Trillions)

U.S. Fed balance sheet (in Trillions)

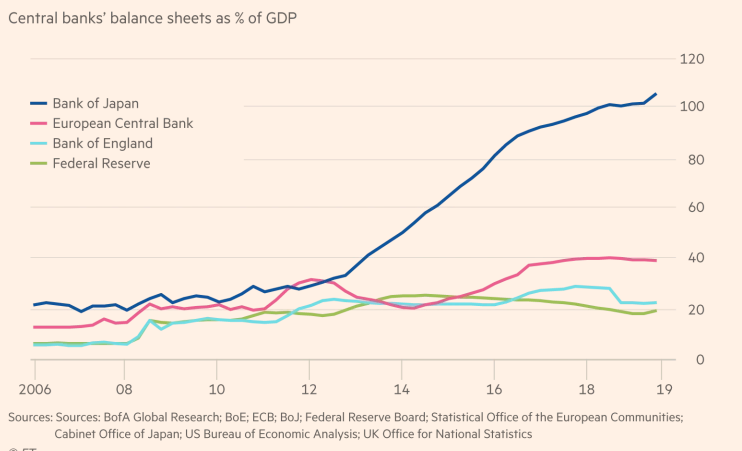

GDP to Central balance sheet ratios for 4 biggest central banks- Source

GDP to Central balance sheet ratios for 4 biggest central banks- Source

There are two main revenue sources for governments, Tax, and Trade. Using these revenue sources, the Government pays its debt to the Fed. Therefore,

It’s not the government that supports people, it’s the people who support the government.

So when governments bail out banks, it’s the government that needs to pay back this debt through the tax collected from the public. Now, you understand the cost of bailouts?

So can Central banks go bankrupt?Ideally, they can, it happened in developing countries but it is an unlikely scenario in bigger economies. A country like the USA cannot go bankrupt as the world reserve currency, but it is possible through hyperinflation to gradually make the dollar worthless.

Now, the most important question: Who benefits from the Central bank’s money-printing machine? Is it you, banks, institutions, or the stock market?

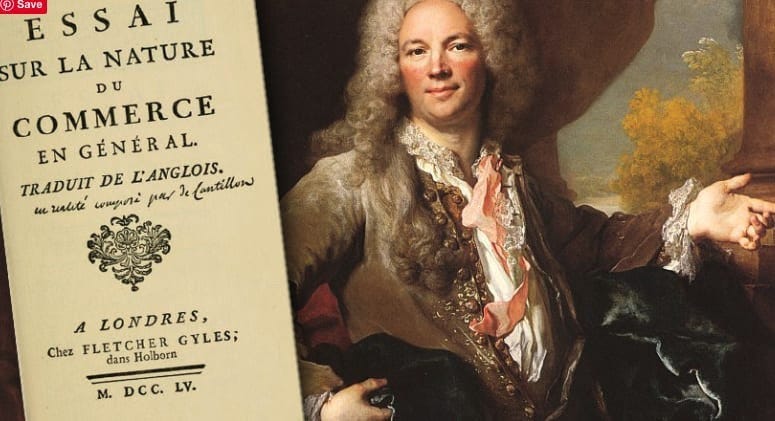

Cantillon effectAn 18th-century French banker named Richard Cantillon observed this phenomenon and mentioned it in his book ‘An Essay on Economic Theory.’ He wrote that the money is distributed through intuition set up by the state and hence it doesn’t create equal purchasing power for everyone.

doubling the quantity of money in a state, the prices of products and merchandise are not always doubled. The river, which runs and winds about in its bed, will not flow with double the speed when the amount of water is doubled. — Cantillon

Money is not neutral. Like a river, it has an original and it flows in a certain direction. Therefore, when the Fed prints new money, it first goes to banks and other financial institutions such as the stock market, hedge funds, private equities, etc.

Richard Cantillon- Source

To Recap

Richard Cantillon- Source

To Recap

- There are three ways to create money.

- Physical money, Private Bank money and Central bank money

- There is only 3–8% of physical money in the world.

- Profits of money printing is the government’s revenue, which is called Seigniorage.

- The government can only print physical money when the Fed asks them.

- More than 90% of the money is created by private banks/commercial banks.

- Private banks create money through Fractional reserve banking(FRB)

- In FRB, they create new money by creating debt.

- When debt is paid, this money gets destroyed, and interest from it is the bank’s profit.

- In 2008, banks became greedy and lent money for riskier assets.

- This caused the housing bubble in which the Fed had to bail them out by creating new money through Quantitative easing.

- Central Banks use Quantitative easing as a monetary policy tool to print new money.

- Central Banks don’t have any savings, like private banks; they create it out of thin air.

- This money is injected into the system through the bond market.

- Bond promises to repay the debt.

- Governments and big corporations issue these bonds to raise money.

- Big financial institutions and banks get the Fed’s money first and increase their purchasing power. Making rich richer and poor poorer.

The effect of money creation is so profound that every generation pays a high cost of overlooking it. The last four decades of money printing distorted the current economic system. That’s why, when more than 40 million people in the USA are unemployed, the stock market is soaring.

Henry Ford wrote in his 1922 book “My Life and Work”.

The people are naturally conservative. They are more conservative than the financiers. Those who believe that the people are so easily led that they would permit the printing presses to run off money like milk tickets do not understand them. It is the innate conservation of the people that has kept our money good in spite of the fantastic tricks which financiers play-and which they cover up with high technical terms. The people are on the side of sound money. They are so unalterably on the side of sound money that it is a serious question how they would regard the system under which they live, if they once knew what the initiate can do with it.

Instead of engaging in wealth creation activities such as research, education, etc; banks loaned out the American economy to Wallstreet for financial gambling.

“The American Republic will endure until the day Congress discovers that it can bribe the public with the public’s money.” — Alexis De Tocqueville (1835)

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.