and the distribution of digital products.

DM Television

What is Stop Limit Order? Binance Spot Limit

- A stop-limit order is a combination of a stop order and a limit order.

- You can use a stop-limit order for buying/selling stocks and stop-loss.

- There are certain risks involved in stop-limit orders, such as no-guaranteed execution, partial fills, and paying a larger commission.

- You should analyze charts, consider stock volatility and liquidity before deciding your stop-limit order strategy.

- You can place a stop-limit order on Binance by following three simple steps.

- Summary (TL;DR)

- What is Stop-Limit Order?

- Why should you use Stop-Limit Orders?

- When to use stop-Limit Orders?

- Stop-Limit Order Risks

- Stop-limit order Strategies

- How to place a Stop-Limit order on Binance?

- Stop-limit Order: Pros and Cons

- Stop-Limit Order: Conclusion

- Frequently Asked Questions

A stop-limit order is a combination of two types of orders: stop order and limit order. It integrates the features of these two types of orders and is used to alleviate risk.

These orders are conditional trades over a set timeframe and help trading if you can’t watch your trades all day long. They will be executed at a specified price after the given stop price has been reached. When the stock reaches the stop price, the stop-limit order becomes a limit order, and you can buy/sell at the limit price or better.

A stop-limit order consists of two prices: the limit price and the stop price. The limit price is the price limitation required to perform the order once prompted (In other words, buy price). The stop price is the price that triggers the limit order and is based on the last trade price (In other words, sell price).

Stop-limit orders are executed only during standard market hours. These orders won’t get completed during the pre-market, after-hours sessions, market holidays, stock halts, or weekends.

Let’s take some examples to understand it better.

Stop Order – If you want to hold the stock if it breaks out above $10, you can set a stop order. If the price reaches $10 or above, we can buy/sell the shares.

Limit Order – If you set a limit to buy 2000 shares at a limit of $10.40, then 2000 shares will be bought at any price under $10.40.

Stop-Limit Order – A limit order is triggered by a stop-limit order when a stock price hits the stop level. For example, we can set a stop-limit order to buy 2000 shares of ABC, up to $10.40, when the price hits $10.

The stop-limit order is entered through a trading platform and is then placed on the order book at the exchange time. It remains there until you cancel it or it’s triggered or gets expired. You can decide how long your stop limit will be valid- only for the current session or for further sessions as well.

Stop Limit Order

Stop Limit Order

A good-til-canceled (GTC) order carries to future market sessions and stays in the order book until it expires, or it’s triggered. You can use a day order if you want the order to expire by the end market session if it is not triggered.

In the case of sell stop-limit orders, they are placed below the market price, while the buy stop-limit orders are placed above the market price at the time of the order.

Why should you use Stop-Limit Orders?Your trading strategy determines the use of specific order types in different situations. Choosing a stop-limit order in the following areas helps you build your strategy:

- Part-time trading: A stop-limit order is beneficial for traders who can’t sit and watch their trades and order books all day long.

- Illiquid stock trading: Because of less trading volume, selling a position on a thinly traded stock using a market order can get you about 20% or more away from the market price at that time. Using a stop-limit order and placing a limit on it would result in it getting filled gradually as the traders (buyers) would keep on popping up throughout the session to buy the stock.

You can use a stop-limit order in several ways:

- Buying a stock: You can use the order to purchase a stock if the price hits a specified point.

- Selling a stock: You can use the order to sell a stock if the price drops to a specified threshold.

- To stop-loss:

- Out of a short position: The order can be used to exit your short position if the price decreases.

- Out of a long position: The order can be used to exit your long position if the price declines.

A simple stop-sell or stop-buy can be used with any of these situations, but it could result in you selling for less or buying for way too much if the trading volume is thin. This is the reason traders use stop-limit orders since they can choose the stop price at which they want to sell/buy.

Stop-Limit Order RisksThe various risks involved with stop-limit orders are:

- No Guaranteed execution: Stop-limit orders let you acquire a specific price or better, but there is no guarantee if that price would ever meet or exceed your limit price in the specified timeframe. Even if the price reaches up to your limit price, that also does not guarantee the order’s execution because the various offers placed before you could end up using all the shares available at that price. Therefore, there is no guarantee that a stop-limit order, once triggered, will be executed. It can happen when the stock reaches your stop price, but the trade immediately crosses your limit price because the liquidity is thin. This would result in your order not getting filled. For example, if you own 100 shares of ABC and set up a stop-limit order to sell if the price reaches $8, setting the limit price to be at $7.75. Imagine that the stock trades below $8, triggering the stop price, but the stock has no buyers at that moment. The price could immediately cross to $7.50, and in such a case, while the stock is trading much below your limit price, you still end up holding a losing position.

- Partial fills: ‘Partial fill’ occurs due to lack of liquidity where some of the shares in an order are executed. This leaves the unexecuted shares as an open order. In continuation with the above example, imagine that your stop price is triggered and you want to sell 100 shares, but you can sell only a few shares due to the lack of liquidity. Consider that the price drops below $8, and you can sell ten shares, but the price immediately reaches $7.50, and you are still left with 90 shares; it will result in you facing a huge loss.

- Paying a larger commission: The condition of partial fill can cost you a lot more commission than usual. Various firms still charge commission for the trades that have been executed. Typically, a single order, despite having multiple fills, on a single day results in one commission. But in case a single order is executed in parts and is stretched across multiple days, it would require a separate commission for every day on which an execution occurs. Therefore, if an execution occurs for five days, you will have to pay five different commissions. However, you can lower the partial fill risk by specifying some specific conditions in the stop-limit order. You can set your particular requirements that suit your trade, for example, ‘minimum quantity, ‘fill or kill,’ ‘all or none, ‘immediate or cancel,’ etc. Additionally, special conditions can end up reducing the chance of your order execution.

- Liquidity and Volume: While determining if you should use a stop-limit order, it is essential to analyze the trading volume. Where the limit has to be placed should also be decided upfront only. It could be better to use a stop-order without a limit if the stock is associated with a high amount of liquidity. In case a stock is illiquid, you should lower the position size allowing an efficient risk management process.

- Considering Stock Volatility: It is essential to consider the volatility of the stock. A more volatile stock demands a broader limit. If the set limit is too loose, the trader could end up paying a bad price for it. While if the limit is too tight, the probability of getting the stock filled is significantly less. Either way, these situations can make you suffer huge losses or gain minimal profits.

- The Use of Charts: Analyzing stock charts can prove an excellent strategy for determining key levels in a stop-limit order. Such key levels include previous highs and lows or support and resistance levels. Once these levels are identified, it becomes easier to place the orders around them. You can expect an increase in liquidity as the price approaches these key levels. For example, you can use a horizontal line chart to determine the areas where the market turns around.

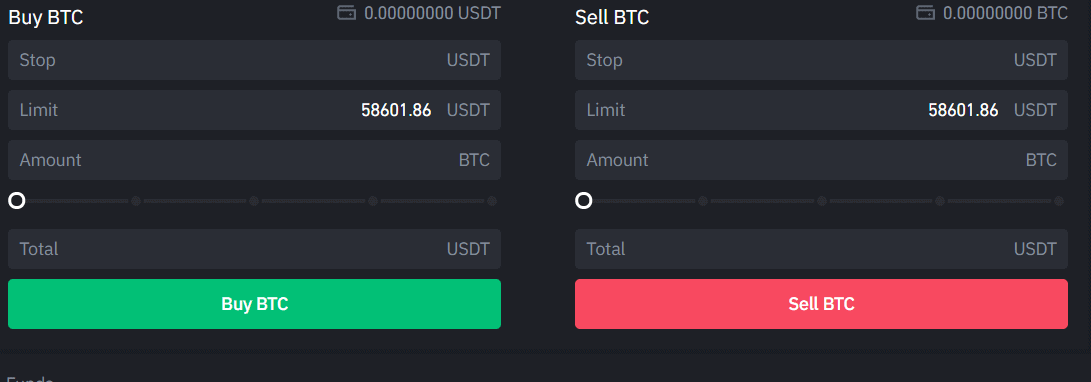

You have to follow three steps to set up a Stop-Limit Order on Binance:

1. You will find an option for the Stop Limit order on the Binance Trading Terminal. It will direct you to the screen as illustrated in the image given below:

Binance Stop-Limit Order

Binance Stop-Limit Order

You have to enter three parameters:

- Stop price: The price at which you want your Limit order to appear in the order book.

- Limit price: The price at which you want to sell your cryptocurrency

- Amount: Enter the number of cryptocurrencies you want to sell.

2. After entering the parameters, click Buy/Long or Sell/short; a confirmation window will appear. Verify everything and press Place Order to confirm the order.

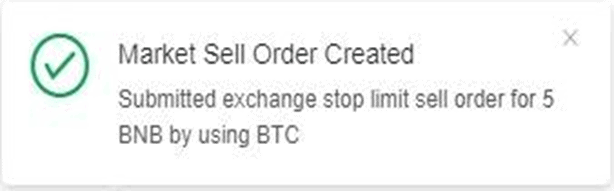

3. A confirmation message appears after placing the order, which means that the transaction is complete.

Binance Stop-Limit Order Confirmation Message

Stop-limit Order: Pros and Cons

Pros

Binance Stop-Limit Order Confirmation Message

Stop-limit Order: Pros and Cons

Pros

- Stop-limit orders allow you to have precise control over when to execute an order.

- If the stock does not reach the stop price during the specified timeframe, the trade won’t be executed. Therefore, there is no guarantee that a stop-limit order, once triggered, will be completed.

- The order could result in a partial fill condition, either putting the trader in a loss position or resulting in the trader paying a lot more commission than usual.

A stop-limit order is a combination of a stop order and a limit order. These orders are conditional trades over a set timeframe. There are certain risks involved in stop-limit orders, such as no-guaranteed execution, partial fills, and paying a larger commission. Therefore you should consider stock volatility, liquidity, and other factors before using it.

Frequently Asked Questions What is a Stop-Limit Order?A stop-limit order is a combination of two types of orders: stop order and limit order. These orders are executed at a specified price after the given stop price has been reached. When the stock reaches the stop price, the stop-limit order becomes a limit order, and the trader can buy/sell at the limit price or better.

What are the risks in Stop-Limit Order?There are certain risks involved in stop-limit orders, such as no-guaranteed execution and partial fills, leading to paying a larger commission.

What is the difference between a stop order and a limit order?A stop order buys or sells a stock only once a specific price has reached. A limit order buys or sells a stock with a maximum price limitation to be paid and minimum price to be received.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.