and the distribution of digital products.

DM Television

What Do Global Users Really Think About Crypto and Web3 Banking? A Dive into CrossFi’s 2025 Survey

CrossFi has dropped a bombshell with its 2025 Crypto Market Research Survey—a sprawling study of over 5,000 crypto users from India, Finland, and Russia. This isn’t your typical tech-bro echo chamber. It’s a vivid snapshot of a shifting landscape: 80% women, aged 28 to 43, earning $1,000 to $3,000 monthly, and leaning hard into cryptocurrencies and Web3 banking. The data challenges stereotypes, exposes pain points, and hints at a future where digital finance could rival cash.

\ So, who’s driving this revolution? What’s holding it back? And what needs to happen by 2025 to make crypto as seamless as a dollar bill? Let’s unpack the numbers, decode the trends, and peer into the future of money.

The Survey at a Glance: Scope and CredibilityCrossFi surveyed 5,000 participants across three nations—India, Finland, and Russia—chosen, presumably, for their diverse economic and technological profiles. India’s a fintech hotspot with a booming middle class; Finland’s a Nordic tech leader with high digital literacy; Russia’s a wildcard with a complex financial history. Participants weren’t random; they were crypto users, likely sourced via CrossFi’s network or partnered platforms, giving the findings a focused lens on engaged adopters. This isn’t a general population poll; it’s a pulse-check on the crypto-curious and committed.

Who’s Using Crypto? A Demographic Shake-Up Gender Flip: Women Take the LeadThe standout stat? 80% of respondents are women, flipping the script on crypto’s male-heavy past. Compare this to Pew Research’s 2023 finding that just 16% of U.S. crypto users were women. What’s driving this? In India, women-led financial inclusion programs—like the government’s Jan Dhan Yojana—may be funneling more women into digital assets. Finland’s gender-equal tech culture could be a factor, while Russia’s economic volatility might push women toward alternative wealth-building tools. This isn’t a fluke, it’s a trend begging for deeper global research.

Age and Income: The Middle GroundMost respondents fall between 28 and 43 years old, a sweet spot for earning, saving, and investing. Their monthly incomes—$1,000 to $3,000—align with middle-income brackets in their regions, per World Bank data. In India, that’s above the national average ($180 monthly); in Finland, it’s modest but livable; in Russia, it’s solid for urban professionals. Crypto’s not just for billionaires or the unbanked—it’s resonating with the global middle class, a group hungry for financial control.

Why This MattersThis demographic mix hints at crypto’s broadening appeal. Women in these regions might see it as empowerment—a way to bypass traditional banking barriers. Middle-income earners, meanwhile, may view it as a hedge against inflation (India’s hit 5-6% annually) or currency instability (Russia’s ruble woes). It’s less about Lambos and more about stability.

Crypto as a Lifestyle: Usage and Income Patterns Holding Over HustlingHere’s the kicker: investing or holding cryptocurrencies is the dominant income source for respondents. Forget day trading or meme-coin flips—these users are playing the long game. This echoes Fidelity’s 2024 report, where 52% of institutional investors held crypto for growth. Respondents likely buy Bitcoin or Ethereum, stash it in wallets, and watch it (hopefully) climb. Some might stake assets on platforms like Lido or lend via Aave for passive income—low-effort strategies that fit their profile.

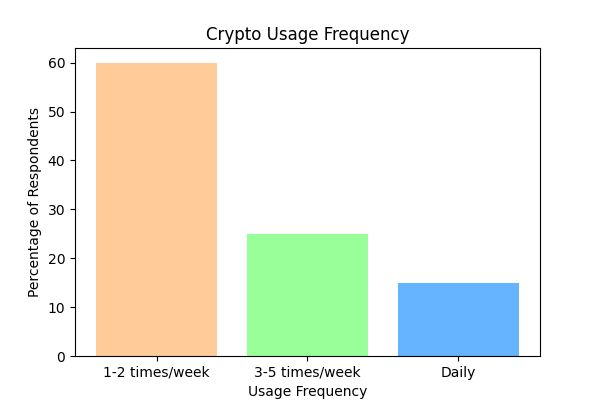

Most engage with crypto one to two times per week. What are they doing? Probably:

- Buying: Snagging dips on exchanges like Binance or Coinbase.

- Holding: Monitoring wallets via apps like Trust Wallet.

- Earning: Adjusting staking pools or claiming rewards.

This isn’t the frenetic pace of Wall Street traders. It’s deliberate—like tending a digital garden. For middle-income users, it’s a side hustle, not a full-time gig.

Insight UnlockedThis behavior signals crypto’s evolution from speculative toy to financial staple. It’s not about “to the moon” hype—it’s about building wealth incrementally, especially in regions where traditional investments (stocks, real estate) feel out of reach.

The Fee Problem: Crypto’s Biggest Roadblock The Pain of High CostsHigh transaction fees top the list of challenges—and it’s a universal gripe. Ethereum’s gas fees once soared to $200 per transaction (Etherscan, 2021), and while they’ve eased, a $10-$20 hit still stings for someone earning $1,000 monthly. Bitcoin’s no picnic either—fees peaked at $60 in 2021 (BitInfoCharts). For context, sending $50 via PayPal costs pennies. Crypto’s not competitive yet.

\

- Network Congestion: Ethereum’s clogged during NFT booms; Bitcoin’s slow by design.

- Mining Costs: Proof-of-work chains like Bitcoin burn energy, driving fees up.

- No Middleman Savings: Decentralization’s freedom comes at a price.

- Layer 2 Scaling: Polygon and Arbitrum slash Ethereum fees to cents.

- Faster Chains: Solana and Avalanche process thousands of transactions per second, cheaply.

- Fee Optimization: Tools like GasNow help users time transactions for lower costs.

For crypto to hit mass adoption, fees must drop. A $20 fee for a $5 coffee is a nonstarter. Respondents’ frustration underscores a broader truth: cost is king in financial inclusion.

Web3 Banking: Promise Meets Pain What Users WantWeb3 banking—blockchain-powered, decentralized finance—dazzles with potential: no banks, no borders, just you and your money. Respondents prioritize safety and reliability, and it’s easy to see why. Traditional banks fail (think Lehman Brothers) or freeze funds (Russia’s 2022 sanctions). Web3’s promise? Your assets, your rules—secured by code, not CEOs.

The Reality CheckYet satisfaction is lukewarm—most are only “somewhat satisfied”. Why?

- Frozen Accounts: DeFi platforms can lock funds due to bugs (e.g., Wormhole’s $320M hack, 2023) or liquidity dries up.

- KYC Clashes: Regulations demand “Know Your Customer” checks, but decentralized systems balk at central ID hubs. Uploading a passport to a blockchain? Awkward.

Web3’s ethos is trustless freedom, but reality bites. KYC is a legal must—exchanges like Binance enforce it, yet DeFi resists. Solutions like decentralized identity (Civic, SelfKey) aim to bridge this, letting users prove identity without compromising privacy. Meanwhile, frozen accounts reflect Web3’s immaturity—smart contracts need audits, and users need insurance (think Nexus Mutual).

2025 Vision: Crypto as Everyday Cash The Big DreamRespondents predict that by 2025, crypto will flow like fiat. Imagine swiping Bitcoin for groceries or tipping in Dogecoin—no delays, no fuss. It’s bold, but tech’s catching up:

\

- Lightning Network: Speeds Bitcoin to seconds, costs to pennies.

- Stablecoins: USDC and Tether nix volatility, mimicking dollars.

- Payment Rails: Solana Pay and Binance Pay streamline merchant use.

- Volatility: Even with stablecoins, Bitcoin’s wild swings scare vendors.

- Adoption: Only 1% of U.S. merchants take crypto (PYMNTS, 2024).

- Rules: Taxes and regs vary—crypto’s an asset in the U.S., currency in El Salvador.

- UX Overhaul: Apps as slick as Venmo, not clunky wallets.

- Merchant Incentives: Cashback in crypto? Lower fees than Visa?

- Global Regs: The EU’s MiCA is a model—others must follow.

Safety and cybersecurity dominate concerns—and for good reason. Hacks siphoned $1.7 billion in 2024 (Chainalysis). Phishing snares private keys; rug pulls tank projects; exchanges like FTX collapse. For every win, there’s a scam.

User Armor- Hardware Wallets: Ledger and Trezor keep keys offline—only 10% use them (2023 survey).

- Multi-Sig: Requires multiple approvals, thwarting thieves.

- Education: Spotting phishing or fake ICOs saves millions.

- Better UX: Biometric logins or social recovery (Argent wallet).

- Insurance: DeFi cover from Unslashed or InsurAce.

- Audits: Certik and Trail of Bits catch contract flaws.

CrossFi isn’t just reporting—they’re building. Their CrossFi Chain fuses fiat and crypto with non-custodial tech—users hold the keys, but transactions feel seamless. Targeting women in India or middle earners in Russia, they’re chasing inclusivity. It’s a blueprint for 2025: crypto that’s practical, safe, and open to all.

The Big Picture: What’s Next?CrossFi’s survey isn’t static—it’s a roadmap. Crypto and Web3 banking are rewriting finance, but they’re not ready for primetime. Here’s the playbook:

\

- Slash Fees: Layer 2 and new chains must scale fast.

- Simplify UX: Hide the blockchain, show the benefits.

- Boost Security: User-friendly tools beat hacks.

- Harmonize Rules: Global clarity unlocks adoption.

\ Crypto’s shedding its niche skin, reaching everyday people with big dreams. By 2025, it might just deliver. Dive into CrossFi’s full report and see for yourself—the future’s digital, decentralized, and knocking.

\ Don’t forget to like and share the story!

:::tip Vested Interest Disclosure: This author is an independent contributor publishing via our business blogging program. HackerNoon has reviewed the report for quality, but the claims herein belong to the author. #DYOR

:::

\ \

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.