and the distribution of digital products.

Understanding ZKsync: A Comprehensive Overview

- ZKsync Era is an EVM-compatible validity rollup that offers users low-cost and scalable transactions while inheriting security from the Ethereum main chain.

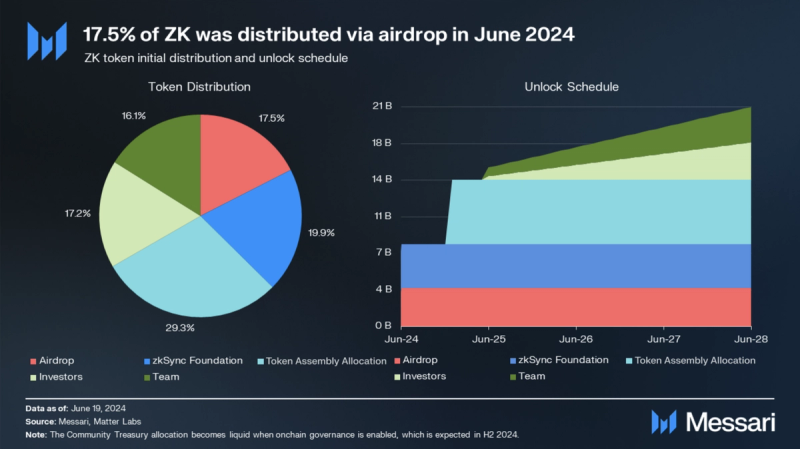

- The ZKsync Association launched the ZK token in June 2024 with 18% of its supply airdropped to users and a circulating market cap of $730 million.

- ZKsync has onchain governance and hybrid DA on its roadmap. The introduction of onchain governance will provide access to the ZKsync Token Assembly's ZK supply, which accounts for 29% of ZK’s total supply.

- Over 10 L2s, including Lens, are in development using the ZK Stack. The ZK Router coordinates these L2s to make up an interconnected group of “ZK Chains.”

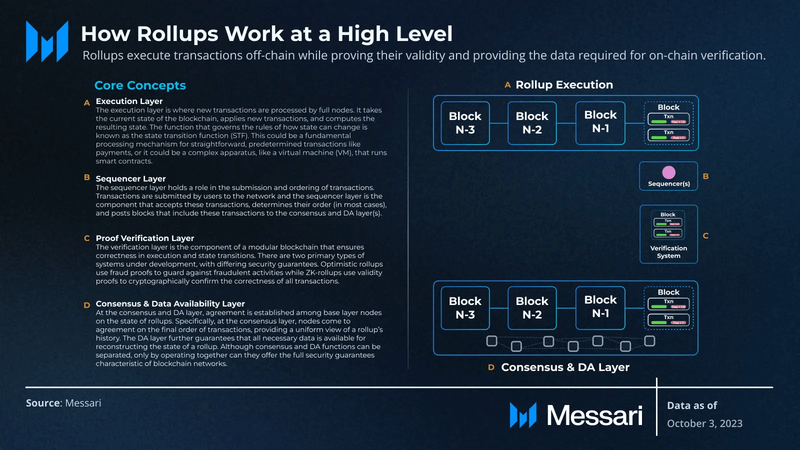

Layer-1 (L1) blockchains such as Ethereum and Bitcoin get congested when user activity exceeds capacity. This congestion often leads to slower transaction confirmations and higher gas fees, which represent the time value of the cost of performing a certain computation and including it on a particular blockchain. Rollups are scalability-focused Layer-2 solutions built to offload some of this computation, ultimately publishing the history back onto L1. ZKsync is a validity rollup (also called a zero-knowledge rollup) on Ethereum.

A zero-knowledge proof (ZKP) is a cryptographic method that allows one party to prove to another that a given statement is true, without revealing any specific information about the statement itself. Though ZKPs were invented in 1985, practical applications of the technology were not built till the mid-2010s when the crypto space found a use for them. The first major implementation of ZKPs came from Zcash, which launched in 2016 as a privacy protocol. It used a certain type of ZKPs called zk-SNARKs (Succinct Non-interactive ARgument of Knowledge) to enable the verification of transactions without revealing the sender, receiver, or transaction amount on the blockchain, thereby providing a high level of privacy and anonymity.

Matter Labs saw the potential of building a zk-solution for rollups and launched ZKsync Lite (originally called ZKsync 1.0), a simple peer-to-peer payment protocol, in December 2020. Two years later, Matter Labs coined the term “zkEVM” in an announcement of plans to build a zk-powered smart contract platform. And in March 2023, it launched ZKsync Era (originally called ZKsync 2.0), the first mainnet zkEVM. ZKsync is now poised to accelerate the mass adoption of crypto by scaling Ethereum with interconnected zk-powered ZK Chains.

There are several techniques to achieve this scale, including horizontal scaling (e.g., parallelized execution) and increasing node requirements to handle a higher throughput. The former is a strategy being implemented by ZKsync, while the latter is often contradictory to the broader Ethereum ethos of decentralization (specifically, the ability for individuals to run their own nodes). ZKsync, as a rollup, inherits that particular flavor of decentralization from Ethereum even if all roles in the stack (provers, verifiers, and sequencers) are not as decentralized as Ethereum’s validators and nodes. This approach allows ZKsync to compete in horizontal scalability, not only on ZKsync Era but also in its broader Elastic Chain ecosystem (i.e., L2s and L3s built on ZKsync Era or with its ZK Stack).

To help realize this vision, Matter Labs raised $258 million from various investors, including a16z, Union Square Ventures, Blockchain Capital, Dragonfly Capital, and others.

Website / X (Twitter) / Discord

TechnologyLayer-2s

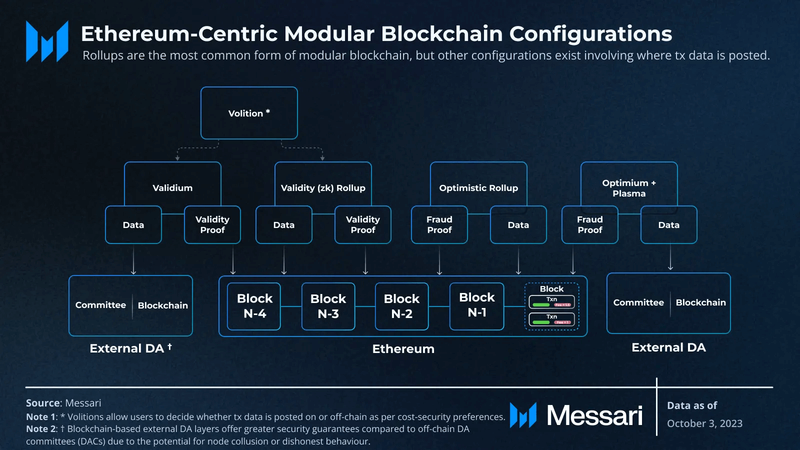

Layer-2s (L2s) are the primary method of scaling the Ethereum network today. While there are various types of L2s, the majority routinely offer 10x cheaper fees than Ethereum Mainnet when using Ethereum calldata for data availability. These cost-savings increased considerably with the introduction of EIP-4844, with users experiencing 100x cheaper fees compared to Ethereum Mainnet transactions when L2s use blobspace as opposed to calldata.

The lower transaction fees offered by L2s are possible due to the fact that they perform the computation and transaction execution that the Ethereum mainnet typically handles. Once transactions are processed, the associated transaction data is posted to the data availability (DA) layer. Rollups are L2s that use Ethereum as the DA layer, such as ZKsync. L2s “roll up” the executions of many transactions into compressed batches that are then settled on the DA layer. ZKsync uses validity proofs to enforce the integrity of its transactions, while some other L2s use fault proofs. In a validity proof model, the correct execution of transactions is cryptographically proven with each L2 block, with a proof posted onchain. In the fault-proof model, transaction executions are assumed to be correct, with a challenge period after each block where a user can later prove if any executions are not represented properly.

Storing data on Ethereum is expensive, even when the execution is offloaded to a rollup. While most rollups post all transaction calldata to Ethereum, ZKsync only posts state differentials to save on costs. Other L2s, such as validiums and optimiums, don’t use Ethereum for data availability (DA). Some of these L2s use external DA solutions, such as Celestia or EigenDA, while others use custom DA solutions (e.g., Immutable X). For the cost of lower security, these L2s offer considerably cheaper transaction fees. The hybrid-DA model (i.e., volition) of ZKsync would allow it to function as both a rollup (Ethereum is used for DA) as well as a validium.

The virtual machine is another integral design choice for L2s. ZKsync uses a form of the EVM, offering familiarity to developers and a quick time to market for infrastructure. Ecosystem tools such as wallets, fungible and non-fungible token standards, DEXs, stablecoins, oracles, and more can generally be transferred over from other EVM ecosystems. This puts EVM ecosystems ahead of the competition in terms of mindshare and onboarding. Other VM choices for L2s include other L1 VMs (e.g., Eclipse’s Solana VM), general-purpose VMs (e.g., Cartesi’s Linux VM and WASM), or custom-built L2 VMs (e.g., CairoVM, FuelVM, and Aztec’s Noir) which can be either general-purpose or application specific.

ZKsync, as a rollup, uses an exogenous security resource: ETH. For this reason, ZKsync is not a circular economy, instead exporting capital to Ethereum (in the form of transaction fees for settlement and DA). This is one of the core financial aspects of ZKsync (and other rollups) that make it “Ethereum-aligned,” in contrast to other “scaling solutions” like sidechains. By leveraging Ethereum’s security, ZKsync is an extension of Ethereum in that it both supports and relies on the success of Ethereum.

ZKsync EraZKsync Era is an Ethereum L2 defined by several key design choices. The three design choices that best summarize its differences from other L2s are:

- Data availability: With DA (state differentials) posted to Ethereum, ZKsync is a rollup. ZKsync plans to transition to a Volition, a hybrid DA model.

- Execution environment: ZKsync’s execution environment simulates the EVM, meaning it is a general-purpose environment. Some other general-purpose L2s use novel execution environments.

- Proving: Validity proofs are used to enforce transaction validity, rather than fault proofs.

ZKsync Era is an EVM-compatible validity rollup (also called ZK-rollup). Computation on ZKsync Era is performed by the zero-knowledge EVM (zkEVM), a virtual machine that executes smart contracts in a way that is compatible with zero-knowledge proof (ZKP) generation and proving algorithms. With the capacity to theoretically process up to 2,000 transactions per second, ZKsync Era offers users low-cost and scalable transactions, while inheriting security from the Ethereum main chain. At the time of writing, ZKsync’s peak observed TPS averaged over a full day was 62 on December 16, 2023, exceeding the peak TPS of Ethereum itself and all other Ethereum L2s. Benchmarking on ZKsync Era showed that 181 TPS is possible for AMM transactions.

Transactions on ZKsync Era undergo the following process:

- Batch Creation and Commitment: Transactions are first bundled into a batch, which is then committed to the Ethereum blockchain. This commitment essentially acts as a placeholder or a record that these transactions have occurred and are queued for processing. This process takes only a few minutes.

- Proof Generation: After the batch is committed to Ethereum, a SNARK proof (comprising multiple STARK proofs) is generated for the entire batch. This proof is a cryptographic guarantee that the batch of transactions adheres to the rules of the blockchain and is valid. The proof generation process is computationally intensive and can take some time (roughly an hour), which is why it's done after the batch has been committed. If there is an invalid transaction, such as a double-spend, a proof cannot be generated.

- Proof Submission and Verification: Once the proof is generated, it is submitted to the Verifier smart contract for verification on Ethereum. The smart contract checks the proof to ensure that the batch of transactions is valid.

- Finalization: After the proof is verified and accepted, the batch is finalized on the Ethereum blockchain. This finalization updates the L2 state in accordance with the transactions in the batch. This process undergoes a roughly 21-hour delay as a security measure for ZKsync Era’s current alpha phase.

In ZKsync Era’s current form, the total process takes roughly 21 hours to finalize. While it’s fully permissionless to access as a user and developer, ZKsync is currently in an alpha phase where Matter Labs acts as a centralized operator running the above processes. Matter Labs is working to decentralize this role in the near future, thereby furthering the resilience and censorship resistance of the entire system. In doing so, the time to finality should drop to anywhere between 15 minutes and 2 hours without the security delay.

Regardless, this process does not affect user experience. Transactions on ZKsync Era can be considered instantly confirmed given that the transaction details are instantly displayed in wallet UIs and the API (though they are marked unconfirmed). Transacted assets can also be used immediately in other transactions.

zkEVMThe EVM was not designed with ZK circuits in mind and is not natively provable. For this reason, the EVM must be adapted to be ZK provable at some level. Not all zkEVMs are built the same, as their levels of compatibility scale from full Ethereum equivalence to high-level-language equivalence. In 2023, a bug was found in ZKsync Era’s zkEVM circuits, which has since been fixed. This displays how making the EVM ZK-provable (or any zkVM) is not a straightforward task.

ZKsync Era’s zkEVM enables existing Ethereum developers to redeploy code without extra audits or re-factoring. Currently, developers can write smart contracts in Solidity and Vyper, which are processed by ZKsync Era’s LLVM-based compilers. Using the LLVM framework, ZKsync Era plans to leverage the compiler’s extensibility to support new smart contract languages in the future, such as C++ and Rust.

Boojum: SNARKs to STARKsBefore ZKsync Era’s cryptographic upgrade called Boojum, in the proof generation phase of the transaction path, zk-SNARK proofs were used as the cryptographic proof guaranteeing the transaction batch’s validity. Today, a zk-SNARK is still used, but only as a wrapper around multiple zk-STARK proofs. SNARKs have smaller proof sizes, meaning a smaller onchain footprint and lower costs, as the values of the inputs (i.e., the STARK proofs) are generally irrelevant to the size of the output SNARK proof.

In cryptography terms, both zk-SNARKs and zk-STARKs are zero-knowledge non-interactive arguments of knowledge. As zero-knowledge proofs, SNARKs and STARKs maintain the core ZKP privacy principle: when a proving party (called the “prover”) tries to prove to another (the “verifier”) that a particular statement is true, they do not reveal any information about the statement itself. Being non-interactive simply means that there is only one round of communication between the prover and verifier. By extension, interactive proofs require multiple rounds. Being “arguments of knowledge” refers to the fact that these proofs are cryptographically sound and cannot be created without knowledge of the original statement. The core differences between zk-SNARKs and zk-STARKs are listed below.

- SNARK (Succinct Non-interactive ARgument of Knowledge)

- Proof generation and verification times increase linearly with statement size.

- Generates smaller proofs with smaller statements (where Succinct is derived from in SNARK) — compared to STARKs.

- Generates larger proofs with larger statements — compared to STARKs.

- Uses ECDSA (elliptic curve cryptography), posing a risk to quantum computing.

- Requires a trusted setup to create the shared key that provers and verifiers use in generating and verifying proofs.

- STARK (Scalable Transparent ARgument of Knowledge)

- Proof generation and verification times grow sub-linearly with statement size.

- Generates larger proofs with smaller statements — compared to SNARKs.

- Generates smaller proofs with larger statements (where Scalable is derived from in STARK) — compared to SNARKs.

- Uses collision-resistant hashes, ensuring post-quantum security.

- Uses publicly verifiable randomness to create the shared key that provers and verifiers use in generating and verifying proofs (where Transparent is derived from in STARK).

In using SNARKs, ZKsync Era arguably trades off trust (or safety) for efficiency. While true in theory, this argument often lacks the context of various solutions created to minimize trust in trusted setups of shared keys. A shared key is a set of public parameters (known as a Common Reference String — CRS) used by provers to generate a ZKP. Shared keys are also used by verifiers to verify the proof.

STARKs use publicly verifiable randomness to generate the public parameters in a transparent way that does not require a trusted setup. Shared key generation for SNARKs relies on a trusted setup ceremony where multiple parties must participate to generate the shared key, with at least one honest party deleting their contribution seed (also known as entropy — a term describing the "randomness" of the seed). Zcash’s original setup ceremony had only six participants due to the difficulty of reliably adding more entropy. Since then, academics have designed creative solutions that scale the participant pool and lead to a less trusted setup. One such solution is called the Powers of Tau ceremony.

Powers of Tau spearheaded a safer shared key setup process. To oversimplify, it uses a random beacon that produces public, random values at set intervals to enable a continuous ceremony without pre-selected contributors. This approach can scale to over 1,000 participants and enables anyone to publicly verify the coordinator of the ceremony. Again, at least one honest party must delete their contribution seed to ensure that no complete record of the setup process exists, making it infeasible to reconstruct the setup parameters and exploit the system. ZKsync leveraged Aztec’s existing MPC ceremony to set the foundation for its cryptographic operations.

The Boojum upgrade measurably improved data efficiency, as seen in the number of L1 bytes committed per L2 transaction. The upgrade decreased the Ethereum bytes needed per ZKsync Era transaction from 211 to 68.

Native Account AbstractionUnlike Ethereum and most other EVM-compatible rollups, ZKsync supports native account abstraction. Abstraction refers to the idea of simplifying user experience by removing clunky processes that add friction between a user and their desired actions. Typical examples of friction in Ethereum include not having enough ETH to pay for an action despite holding other assets, manually approving contract approvals and transactions for a single action, and manually sending assets for subscription renewals.

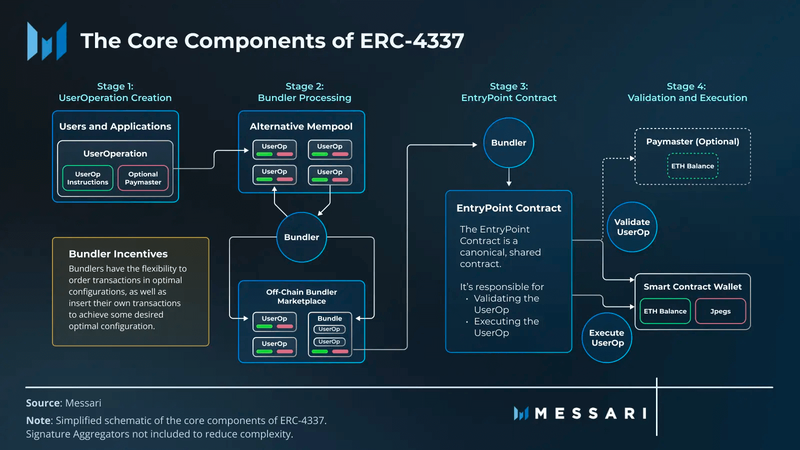

The Ethereum community has ideated on ways to improve UX, notably with the proposal of EIP-4337. This improvement proposal attempts to make changes at the application layer that would replace externally owned accounts (EOAs) with smart contract accounts. EOAs are the traditional form of user accounts controlled by private keys. Smart contract accounts enable developers to build features that could simplify a lot of the processes plaguing users of EOAs. EIP-4337 proposes a safe standard for smart contract accounts that also includes the following core components:

- Accounts: These are effectively the users' smart contract wallets.

- UserOperations: When users interact with applications and wallets enabled by ERC-4337, UserOperations, instead of the traditional transaction, are created and sent to an alternative mempool.

- Bundlers: They listen to the alternative mempool, package up UserOperations into bundles, and eventually put it onchain.

- EntryPoint Contract: This ensures that a wallet has funds to pay gas costs and then executes the UserOperation.

- Paymaster (optional): These entities can sponsor or subsidize gas costs for users.

- Signature Aggregators (optional): They can compress signature data to optimize transaction processing.

While ZKsync implements account abstraction at the protocol layer, it also uses many similar components highlighted by EIP-4337 and differs from Ethereum account abstraction in notable ways. EIP-4337 introduces dependencies on third-party intermediaries for certain actions, creates a separate transaction flow for smart contract account transactions, and does not resolve how existing EOAs would migrate to smart contract accounts.

ZKsync supports both EOAs and smart contract accounts. With account abstraction being native to ZKsync, both EOAs and smart contract accounts share the same transaction flow as opposed to creating a separate one like EIP-4337 on Ethereum. This benefits the protocol by maintaining a streamlined process for bundling transactions, optimizing scalability by managing only a single transaction flow, and enabling easier application integrations that only have to manage one transaction flow. Additionally, users who prefer to independently manage their private keys can start with EOA accounts while still benefiting from Paymasters. Or they can start with smart contract accounts to take advantage of a simplified user experience and the following features:

- Improved Accessibility: Replaces private keys and seed phrases with biometric verification and social recovery options.

- Gas Payment Flexibility: Enables gas payments in any asset on ZKsync (supported by Paymasters).

- Batched Operations: Simplifies transactions by allowing multiple actions to be batched and approved in one signature.

- Frictionless Interactions: Introduces session-based interactions with preset time and value limits, requiring just a single initial sign-in.

- Innovative Payment Solutions: Enables automatic and scheduled transfers.

As a rollup, ZKsync posts DA to Ethereum blobspace. However, unlike many other rollups, ZKsync does not post full transaction calldata. Instead, it posts state differentials to save on costs. However, hybrid DA is on ZKsync’s roadmap.

The hybrid DA model (i.e., volition) would have two (or more) parallel state trees representing all accounts on the network, one corresponding to each DA option. Users could use Ethereum DA for maximum security or save on costs by using custom (hosted by ZKsync) or alt (hosted by Celestia, EigenDA, etc.) DA layers. The model would allow ZKsync to function as both a rollup (Ethereum is used for DA) as well as a validium. High cost-per-bit transactions, such as swapping a large quantity of tokens in a single transaction, would be better suited for Ethereum DA, while low cost-per-bit transactions, such as high-frequency gaming transactions with no economic value attached, would be better suited for other DA.

Protocol upgrade V24 laid the groundwork for custom ZKsync DA and the volition model. Aside from Matter Labs, other development teams such as LambdaClass have actively participated in development related to ZKsync DA models.

ZK Token

The ZKsync token, ZK, launched on June 17, 2024. The token is used for transaction fees and to power the protocol’s three-body governance system. It allows users to propose protocol upgrades, delegate voting power, and vote on proposals. In total, 14.0 billion ZK (66.7% of the total supply) was allocated to the community, while 7.0 billion ZK (33.3% of the total supply) was allocated to the team and investors.

At launch, 3.68 billion ZK (17.5% of the total supply) was allocated to the token airdrop, which was fully claimable with no vesting terms. Of this allocation, 89% was allocated to users who bridged funds to ZKsync Era and met the eligibility criteria, while the remaining 11% was allocated to contributors. Another 10.33 billion tokens are available to be distributed from the ZKsync Foundation and ZKsync Token Assembly. The ZKsync Foundation’s allocation was immediately liquid and available for distribution, while the ZKsync Token Assembly allocation will become liquid once onchain governance is enabled.

Investors and team were allocated 3.61 billion (17.2% of the total supply) and 3.38 billion (16.1% of the total supply), respectively. Both groups have a 4-year lockup with a 1-year cliff: 10% for investors and team executives, and 25% for non-executive team members.

GovernanceZKsync’s onchain governance structure is expected to be announced and launched in 2024. Leveraging the ZK token, delegates will be able to submit, vote on, and ultimately approve proposals. Voting and quorum thresholds are to be decided. A security council is expected to exist, as well as a body of Guardians selected by the Governance Lead of ZKsync Association with the ability to veto (but not vote on or introduce) proposals.

Elastic Chain ThesisEthereum's rollup-centric roadmap is tightly coupled with the appchain thesis: the idea that dozens, hundreds, or even thousands of chains will emerge for application-specific use cases. While ZKsync Era itself uses a general-purpose VM (the EVM), the project aims to support a multichain future of appchains. This vision is embodied in ZKsync’s Elastic Chain, a group of interoperable ZK Stack-built chains — known as ZK Chains — connected by ZK Router.

ZK Chains are either built atop ZKsync Era as L3s or with its ZK Stack SDK as L2s. Either way, they retain composability as they are interconnected by ZK Router. Builders will be able to customize various aspects of ZK Chains, such as the types of sequencers they will use, the data availability model, the data visibility (public or private), and the form of gas payments. Using the ZK Stack, anyone will be able to launch a ZK Chain that is interconnected with other ZK Chains.

ZK StackThe ZK Stack is an open-source framework that enables developers to build sovereign ZK-powered chains (ZK Chains) in the ZKsync ecosystem. Its modular design facilitates the creation of ZK Chains with customizable features, from the data availability mode to tokenomics. ZK Chains built with the ZK Stack benefit from native account abstraction and operate asynchronously. They are also interoperable with other ZK Chains in the ZKsync ecosystem, including ZKsync Era.

Using ZK Stack to launch different interconnected chains will be imperative for scaling the ecosystem. For general applications with frequent dependencies on other applications, ZKsync Era may be the ideal hosting option. However, ZK Chains may be more suitable for applications that require ultra-low latency and a more independent state, while maintaining interconnectedness to the rest of the ecosystem without needing a constant, live connection or immediate response. Additionally, the ZK Stack's compression capability makes certain transactions remarkably cheaper, while building with optional zkPorter chains extends ultra-low-cost features with different security assumptions.

ZK ChainsTo remain interoperable, all ZK Chains will utilize different instances of the same zkEVM engine offered by the ZK Stack. The Bridgehub is the registry and coordination point for ZKsync and all ZK-stack built rollups, validiums, and L3s. Regardless, the ZK Stack offers builders a high degree of chain customization. As sovereign blockchains, proof aggregation and ecosystem participation are optional. In other words, ZK Chains can settle proofs directly on Ethereum (more expensive) or in aggregate as a part of the ecosystem (less expensive). Additionally, ZK Chains can permissionlessly join and exit the ecosystem. The most significant architectural aspects in customizing one’s chain come from determining its sequencer type, data availability model, and privacy mode.

Sequencer TypeThe sequencer role is responsible for bundling transactions, generating the proof, and submitting the proof to the verifier contract on Ethereum. Having a centralized sequencer requires trusting that the operator will maintain liveness, not censor transactions, and not prioritize MEV. Currently, ZKsync Era uses Matter Labs as a centralized sequencer, though it plans to transition to a decentralized model in the future. ZK Chains that launch a decentralized sequencer set will be able to choose which consensus algorithm will be used to coordinate transaction processing.

ZK Chains can also use priority queues (no sequencer) as a backup sequencing system or as the primary. This system allows transactions to be processed in a sequence determined by set criteria rather than by a centralized sequencer or decentralized set of sequencers. In this system, the bundling of transactions would fall on the application layer, where smart contracts would be responsible for fulfilling this role.

Data Availability ModelThe primary purpose of a data availability (DA) layer is to guarantee that all necessary data to validate and execute transactions is published and available to network nodes. Rollups process a large volume of transaction data off the main chain (like Ethereum) to improve scalability. However, they still need to ensure that this data is available for validation and dispute resolution. Using Ethereum as the data availability layer is the most secure option. With data availability secured on the Ethereum blockchain, the rollup inherits Ethereum’s security guarantees. ZKsync Era uses Ethereum as a DA layer.

Because Ethereum transactions tend to be expensive, using it as a DA layer can be costly. ZK Stack gives builders a more economical option: data availability secured by a central party or by the supermajority of validators’ stake. The former case would make the L2 a validium, which could be an ideal option for enterprises. The latter case describes a scaling solution developed by Matter Labs called zkPorter.

zkPorter chains will have a validator set that will manage transaction processing and maintain the data availability of zkPorter accounts in a Proof-of-Stake system. Failure to maintain DA would result in validator stake being slashed. Additionally, zkPorter validators only have the power to freeze the zkPorter state; hence, they cannot steal funds and would also freeze their own stake if they acted maliciously.

Builders can also choose other data availability models as well, such as self-hosting rollup data or processing inputs only. Currently, ZKsync ZK Chains are default set to publish state updates, not all inputs. This reduces costs given the lower amount of data being published. However, builders are free to pursue publishing inputs only, which would make state reconstruction and DA costs akin to optimistic rollups. In rollups that are self-hosted, data availability takes on a uniquely decentralized form. Because users would be responsible for the history of their account activity, reconstructing the complete state of the rollup would require aggregating the data from all individual users. In practice, this is rather complex and will likely be unavailable as a solution in the short term.

Privacy ModeBuilders will be able to choose whether their chain’s data remains public or private. However, builders can also be creative with how they implement privacy. Validiums work well as enterprise chains that use a trusted operator to maintain data privacy. Meanwhile, self-hosted rollups could offer the most data privacy depending on the implementation. Given that self-hosted rollups enable users to manage the data for the accounts they own, users could encrypt their data and store it locally on any device, or they could use a decentralized storage solution like Arweave or Filecoin. This approach, however, is quite complex and would require the rollup creator to develop a UI that abstracts most of the technical elements of the process if it were to reach a wider user base.

ZK RouterZK Router acts as the interoperability layer connecting ZK Chains and unifying liquidity across the ZKsync ecosystem. ZKsync’s bridge architecture consists of native bridges between ZK Chains and a shared bridge contract on Ethereum. In practice, the ZK Router is a system of smart contracts that verify Merkle proofs of the transactions occurring on different ZK Chains. Because ZK Routers are implemented at the protocol layer, interacting with them in the ZKsync ecosystem is invisible for users; relayers manage the bridging, burning, and minting of assets. The use of relayers results in relatively low bridge fees, though the time to settlement will range from 1 to 15 minutes depending on the destination chain.

ZK Routers are asynchronous and not atomic; however, atomicity between ZK Chains is expected to become available in the future. To clarify, atomicity ensures that if any part of a transaction fails, the entire transaction is reversed to its original state before it began, effectively making it as though it never occurred. Given that asynchronous transactions introduce a time lag and uncertainty between the execution of a transaction on the origin chain and its outcome on the destination chain, smart contracts must be designed with fail-safe procedures for failed transactions.

In contrast, synchronous transactions ensure immediate and consistent outcomes across chains, allowing for more straightforward smart contract designs. However, ZK Chains cannot ensure synchronicity without sacrificing decentralization. zkPorter chains will be able to support logical state partitions, ensuring that separate chain instances can interact synchronously and with atomicity.

Ecosystem AnalysisZKsync Era has a robust ecosystem. It is partially a result of the broad mindshare of the EVM but also of the community of builders and users unique to ZKsync. In December 2023, ZKsync Era became the first rollup to execute more transactions than Ethereum Mainnet on a monthly scale. ZKsync’s ecosystem is home to entire chains, classic crypto sectors (DeFi, NFTs, etc.), newer sectors that incorporate legacy finance (RWAs), and even projects with governments, such as QuarkID – the decentralized identity initiative in Argentina.

ZK ChainsSeveral Rollup-as-a-Service (Raas) providers are already supporting the ZK Stack, with the first cohort going live in December 2023. These six RaaS providers — Ankr, Luganodes, Zeeve, Caldera, AltLayer, and Magic — aim to provide critical infrastructure to accelerate support for projects, developers, and enterprises that are launching, deploying, and testing L2 ZK Chains powered by ZKsync.

GRVT, a hybrid exchange, was the first to start building a ZK Chain. Its unique partially-custodial design benefits from the flexibility of ZK Stack, as the exchange can support liquidity from market makers like a CEX does; this is the value of allowing teams to build appchains custom-tailored to their use case.

Cronos Chain, supported by Crypto.com, is also integrating ZK Stack and joining the Elastic Chain. Leveraging ZK Stack, Cronos Chain retains code rights and customization autonomy, such as modifying the native gas token to the CRO token. Cronos zkEVM is in testnet.

Other upcoming networks built with ZK Stack include Sophon, Play Chain, zkCandy, and more.

DeFiDeFi is currently the primary use case (by user activity) for ZKsync, as is the case with most crypto networks. ZKsync Era’s DeFi TVL is led by SyncSwap, ZeroLend, Koi, and zkSwap, which all have more than $10 million TVL as of the time of writing. Notably, none of these projects are forks from Ethereum Mainnet, which is the case for most TVL leaders on EVM networks. Instead, new builders are coming in to build either exclusively on ZKsync Era or in addition to one or two other Ethereum L2s. However, ZKsync also hosts much of the favored DeFi infrastructure from Ethereum mainnet, such as Circle’s USDC stablecoin and Chainlink price oracles.

TradFi and RWAsTraditional financial players have become increasingly interested in crypto. Real-world assets (RWAs) are the obvious first choice of sectors, as those TradFi institutions are already familiar with, and often the issuers of, the assets in question.

Recently, reserves from Fidelity were tokenized on ZKsync. This process involved Fidelity, Sygnum, Chainlink, ZKsync, and Matter Labs. Sygnum tokenized $50 million from Fidelity’s money market fund (MMF) which belonged to Matter Labs’ treasury, with the onchain representation living on ZKsync and using Chainlink as an oracle. Fidelity’s total MMF is $6.9 billion, representing a massive TAM for other Fidelity customers who wish to tokenize funds.

Deutsche Bank is developing an interoperable asset tokenization and fund management platform for MAS Project Guardian on a ZK Chain, in collaboration with Memento Blockchain.

Tradeable has utilized ZK Stack’s flexibility to bring over $500 million of the private credit market, onchain, backed by Victory Park Capital. Real-world assets (RWAs) and institutional finance use cases can similarly benefit from this protocol-level flexibility, as seen with GRVT’s hybrid exchange.

Gaming, NFTs, and MoreThe ZKsync ecosystem is innovating with both onchain gaming, NFTs, and traditionally Web2 internet services. Notable projects include Pudgy Penguins and HYPERCOMIC.

The Pudgy Penguins NFT project migrated to ZKsync Era and is launching its Pudgy World game in Alpha in Q1 2024. Pudgy World is an immersive, multiplayer, digital game accessible to Pudgy Penguins NFT holders and Pudgy Toy owners. Pudgy Toys are sold through traditional retail giants such as Walmart and pass on royalties to tokenholders. This is an innovative approach, as it truly integrates Web2.

InteroperabilityShared sequencers with other rollups may bring cross-L2 transaction atomicity in the future, but generalized solutions such as Espresso and Astria are not yet in production. Until then, ZKsync retains composability within its own ecosystem through its ZK Router.

Closing SummaryZKsync Era is an Ethereum L2, defined by its usage of validity proofs, the EVM, hybrid DA, and ZK Stack development kit for interconnected L2s and L3s. ZKsync Era launched in H1 2023 and has since developed a vibrant ecosystem, even surpassing Ethereum’s transaction activity over certain periods of time. The ZKsync Era ecosystem features DeFi, NFTs, and other major sectors as it uses the EVM and has a general purpose scope, albeit with a deeper focus on gaming and appchains.

——

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.