and the distribution of digital products.

Understanding Rumpel

- Rumpel transforms off-chain loyalty points into tradable on-chain assets through its innovative point tokenization framework. This approach addresses inefficiencies in traditional point programs, offering liquidity to users, exposure to investors, and greater control for protocols.

- Rumpel, launched in September 2024, has amassed $52 million in TVL. Its support for diverse point strategies, including those from Ethena, Symbiotic, and Zircuit, highlights strong adoption among high net-worth users and active participants.

- Rumpel’s customized Safe wallets incorporate the Rumpel Guard and Module to enhance user and protocol security. These features prevent misuse of point tokens and ensure proper redemption, reinforced by five completed audits and an active bug bounty program.

- The Straw rewards program incentivizes user participation with boosts for early adoption, liquidity provision, and referrals.

- With the introduction of new point token markets like Etherfi and Mellow Protocol, as well as advanced Fluid looping strategies, Rumpel offers users opportunities to maximize point earnings with assets like weETH, wstETH, and stablecoins such as sUSDe and GHO.

Points are the lifeblood of crypto incentive systems. They drive user engagement, foster loyalty, and accelerate protocol adoption. Yet, as point programs have grown, inefficiencies have emerged. Farmers face shrinking returns due to opaque airdrop criteria and stagnant rewards. Investors often find themselves excluded, unable to gain meaningful exposure while whales dominate allocations. Protocols struggle to maintain influence over user behavior, limiting the growth and effectiveness of their programs. These challenges highlight a growing need for a better solution to unlock the full potential of point systems.

Efforts to address these issues have largely fallen short. Existing secondary marketplaces introduce barriers like collateral requirements, discouraging casual participation. Platforms such as Pendle and Spectra restrict flexibility by locking in liquidity or limiting tradability. These gaps leave farmers unable to de-risk, investors blocked from scaling their exposure, and issuers unable to showcase the value of their rewards. Without a cohesive system, stakeholders are left frustrated, and the ecosystem suffers from inefficiency and fragmentation.

Rumpel offers a solution by transforming points into onchain tokens via the Rumpel Wallet. This innovation provides farmers with the ability to sell points, gives investors access to targeted exposure, and equips protocols with tools to demonstrate their program’s tangible value. By addressing liquidity, usability, and transparency, Rumpel creates a unified marketplace for all stakeholders. Backed by industry leaders like Dragonfly and Variant and developed by a team with extensive DeFi expertise, Rumpel sets a new standard for point-based systems and is poised to reshape crypto incentive structures.

Source: Rumpel Docs

BackgroundRumpel officially launched on Ethereum mainnet on September 13, 2024, but its origins trace back to a prior project, Sense Finance. In August 2021, Sense Finance secured its seed funding in a round led by Dragonfly with participation from Bain Capital Ventures, Nascent, Variant, and UDHC. The funding also garnered support from industry leaders and advisors, including Ryan S. Adams, Freddie Farmer, and DeFi Dad. Sense Finance originally focused on DeFi primitives aimed at fixed-rate lending and yield trading, a vision that shifted into the more broader Rumpel Labs. The pivot preserved the core mission of building advanced financial tools and broadened its scope to include features like dynamic reward mechanisms and enhanced liquidity incentives.

Founded by Kenton Prescott and Josh Levine, Rumpel is built on a foundation of deep DeFi expertise. Before Rumpel, the duo co-founded Sense Protocol, a fixed-income DeFi platform that operated from 2021 to 2023. Their collaboration began at MakerDAO (now Sky), where they worked as software developers. Kenton and Josh draw on their extensive experience in developing financial protocols and designing incentivization mechanisms.

TechnologyRumpel is a point tokenization protocol that converts offchain loyalty points into tradable tokens, enabling a liquid secondary market for these point tokens on Uniswap v3. By facilitating price discovery and liquidity, Rumpel opens new opportunities for point holders, traders, airdrop hunters, and point issuers. Its design is built around four core components:

- The Point Token (pToken)

- The Rumpel Wallet

- The Rumpel Oracle

- The Vault

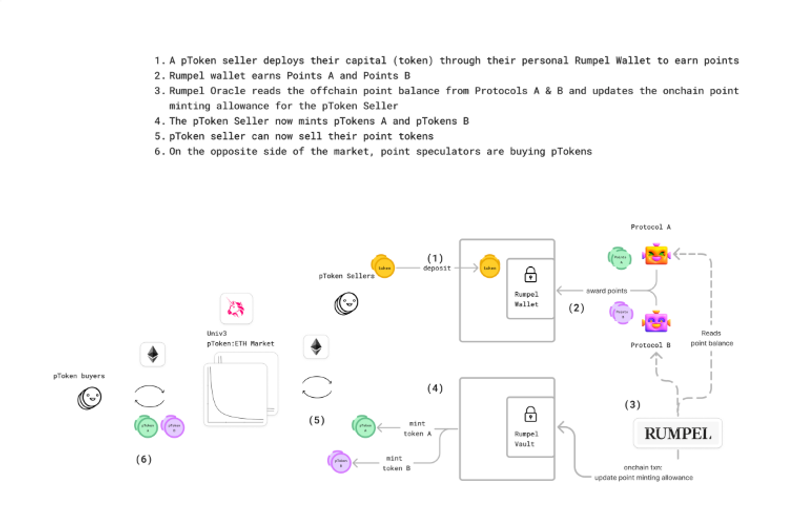

Users seeking to accumulate tokenized points (pTokens) begin by setting up a Rumpel Wallet. Through actions like staking, trading, and lending, they accrue points in their wallet. These points are verified by the Rumpel Oracle, allowing users to mint pTokens proportional to their earned points. These pTokens, which are ERC20 tokens representing off-chain points, can be traded, sold, or held. Once an airdrop launches, users can redeem their pTokens for airdropped tokens through the Rumpel Vault.

For example, Alice wants to earn Ethena points by staking USDe while maintaining the flexibility to trade her points. She creates a Rumpel Wallet and stakes 1,000 USDe through Ethena.fi. Over five days, Alice earns 100 Ethena points. The Rumpel Oracle verifies her accumulated points, enabling her to mint 100 Ethena pTokens. Alice can then trade, sell, or hold the tokens as she chooses. When Ethena launches its token airdrop, Rumpel claims the airdropped tokens on behalf of users and deposits them into a vault. Alice can then redeem her pTokens for the airdropped tokens.

Source: Rumpel Docs

Rumpel Wallets are specialized Safe wallets designed with enhanced security features. The Rumpel Guard prevents users from claiming and selling airdropped tokens that have already been sold as pTokens, ensuring fairness and preventing abuse. The Rumpel Module automates the process of claiming airdropped tokens and transferring them to the vault for user redemption. Together, these features enhance security for both users and protocols.

The Rumpel Oracle plays a critical role in tracking off-chain points and determining users' pToken minting or redemption allowances. Oracle clients push updates every three to five days using a Merkle root, with a three-day delay to reduce the risk of faulty data. Rumpel operates multiple Oracle clients to diversify implementation risks and plans to progressively decentralize this system.

The Rumpel Vault handles the minting and redemption of pTokens. As users accumulate points, the Oracle keeps track of their balances, allowing them to mint pTokens through the vault. When an airdrop is launched, Rumpel claims all airdropped tokens on behalf of users and deposits them into the vault. Users can then redeem these tokens by burning their corresponding pTokens, ensuring a seamless process from minting to redemption.

To accommodate a variety of point programs, Rumpel supports complex vesting schedules through its Redemption Rights feature. Vesting schedules govern how and when users can redeem their points, preventing immediate and unrestricted redemptions. While simple programs may not require Redemption Rights, more advanced setups — such as those with staggered or conditional vesting — rely on this feature to ensure fair distribution. By using Merkle roots and proofs, Rumpel enforces vesting rules while still allowing pToken trading. For example, Vanilla Vesting applies a uniform schedule, such as allowing users to redeem 50% of their points on day one and the remainder in increments over time. Whale Vesting, meanwhile, ensures large holders adhere to the same vesting schedule as other users. In Minimum Balance Vesting, users must maintain a specific token balance to qualify for rewards. These mechanisms prevent gaming, protect liquidity, and ensure equitable reward distribution.

Rumpel’s design addresses the complexities of point tokenization and reward distribution while prioritizing user and protocol security. Through features like the Oracle, Vault, and Redemption Rights, Rumpel creates a robust framework for managing tokenized points and airdrop incentives effectively.

SecurityBecause users deposit their principal assets into Rumpel wallets, security is paramount. While much of Rumpel’s security is inherited from Safe, customizations to the Rumpel Module and Rumpel Guard provide additional protection. The Rumpel Guard restricts user actions to specific calls on an allowlist, while the Rumpel Module enables admins to make calls on behalf of users, except for those on a blocklist.

Admin privileges are critical for preventing users from claiming airdrop tokens they’ve already minted and sold as point tokens, ensuring that point tokens remain fully backed. Admins also automatically claim reward tokens and transfer them to the Vault, where point tokens are redeemed.

The module blocklist and guard allowlist together control user and admin permissions. A "call" refers to invoking a smart contract function, such as transferring USDC or depositing DAI. By default, the guard allowlist blocks all calls, meaning users can only initiate actions explicitly added to the allowlist. Conversely, the module blocklist prevents admins from making certain calls, such as transferring user-held assets, ensuring these actions remain under user control.

Admins manage the allowlist by adding or removing permitted calls. Calls marked as ON can be removed by an admin, while those set as PERMANENTLY_ON remain unalterable, guaranteeing user access. For example, adding WBTC.transfer to the allowlist as ON allows future removal, while marking ETH.transfer as PERMANENTLY_ON ensures it is always accessible to users.

A recent transaction illustrates these rules. First, WBTC.transfer was added to the allowlist as ON, granting users access with the possibility of future admin removal. Second, RE7LRT.transfer was added as PERMANENTLY_ON, ensuring permanent user access without admin interference. Finally, RE7LRT.approve was added to the module blocklist, permanently preventing admins from granting approvals to other addresses. These changes demonstrate how Rumpel balances user access with limited admin control.

To ensure the security of its wallets and vaults, Rumpel has completed five audits verifying the functionality and integrity of its blocklist and allowlist systems. Additionally, an ongoing bug bounty program with a maximum payout of $50,000 underscores Rumpel’s commitment to reliability and security.

Rumpel StrawsThe Rumpel Straw program is a rewards initiative designed to incentivize user participation and growth across the Rumpel ecosystem. Operating in distinct "Chapters," the program allows users to earn Straw, a metric that tracks contributions to Rumpel's development. Chapter 1, which launched alongside the protocol in September 2024 and ended on December 1, 2024, rewarded early users through a mix of continuous emissions and discrete allocations. Participants earned Straw by engaging with strategies such as depositing funds to earn points, providing liquidity on Uniswap v3, and leveraging referral boosts.

Straw rewards operate through continuous emissions and are structured around metrics such as deposit value, liquidity provision, and strategy type. Central to this system is the Protocol Size Boost, a mechanism designed to incentivize early adoption by tying user rewards to the protocol’s growth. This boost evaluates growth through indicators like TVL, eligible Uniswap v3 liquidity, and the market cap of the in-wallet point token. Multipliers range from 1x to 3x and amplify rewards as the protocol scales. For instance, if Rumpel’s TVL triples after a user’s deposit, their daily rewards increase from 24 to 72 points per dollar invested.

Additional mechanisms further support participation and drive expansion. The New Market Boost doubles rewards for liquidity providers during the launch of new point token markets. This approach targets the early phase when engagement is essential. The Referral Boost offers a 10% reward increase based on the accrued earnings of referred participants. These features attract early adopters, encourage ongoing involvement, and build a scalable system that benefits the entire ecosystem.

With Chapter 2 now live (December 1, 2024, through March 1, 2025), Rumpel has refined and expanded the Straw program to sustain momentum and encourage new participation. Like its predecessor, Chapter 2 features continuous emissions and boosts but shifts its focus to address liquidity needs while maintaining fairness for early users. Discrete rewards, such as the Veteran Reward, continue to honor experienced contributors, ensuring they remain integral to Rumpel's ecosystem. As Rumpel evolves, the Straw program remains a critical tool for driving adoption, rewarding loyalty, and sustaining the protocol’s long-term progress. Interested users are encouraged to join the story by engaging with Rumpel’s community and contributing to its journey.

Protocol Usage

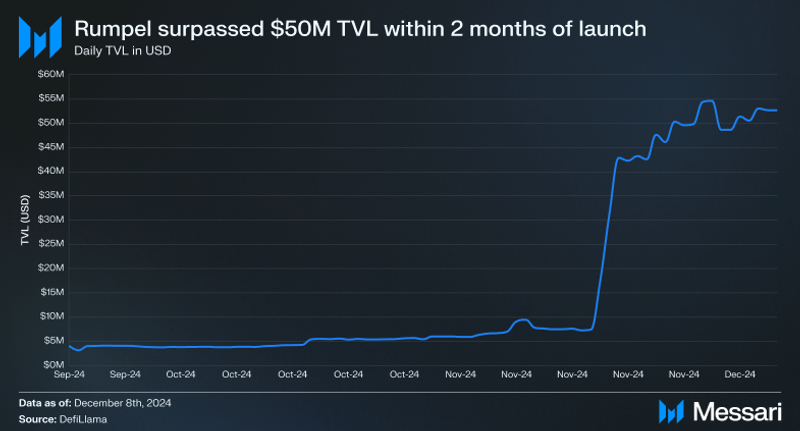

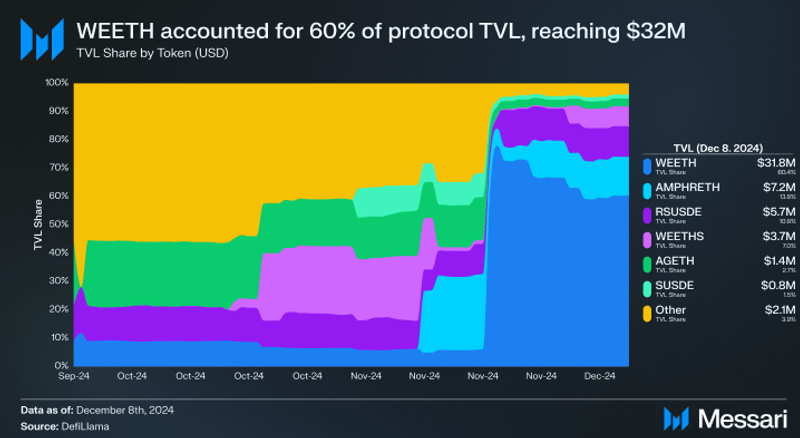

Rumpel has seen rapid growth since its launch in September 2024. The application debuted with liquid point strategies from Ethena, Symbiotic, Zircuit, and Karak. These strategies included locking USDe on Ethena, depositing Etherfi Wrapped eETH on Karak, and staking wstETH via Symbiotic. Between September and mid-November, Rumpel’s TVL grew to $7.5 million, eventually surpassing $50 million following the introduction of new Fluid looping strategies.

Etherfi’s wrapped eETH emerged as the most popular token used in Rumpel’s points strategies, accounting for $31.8 million in TVL. The second most utilized token is LRT Amphor ETH (amphrETH), which holds $7.2 million in TVL.

Since launching, Rumpel has introduced two additional point token markets: Etherfi and Mellow Protocol. Strategies include staking Etherfi’s weETHs via Zircuit and depositing ETH or wBTC into Re7 Capital Mellow Vaults. Users can also stake amphrETH to earn Zircuit points or restake LBTC to earn Symbiotic points.

Rumpel has expanded its offerings to include Pendle yield tokens, allowing users to earn liquid points simply by holding these tokens in their Rumpel wallets. Additionally, Rumpel introduced three Fluid looping strategies, which enables users to maximize point earnings with assets like weETH, wstETH, weETHs, and a stablecoin strategy using sUSDe and GHO.

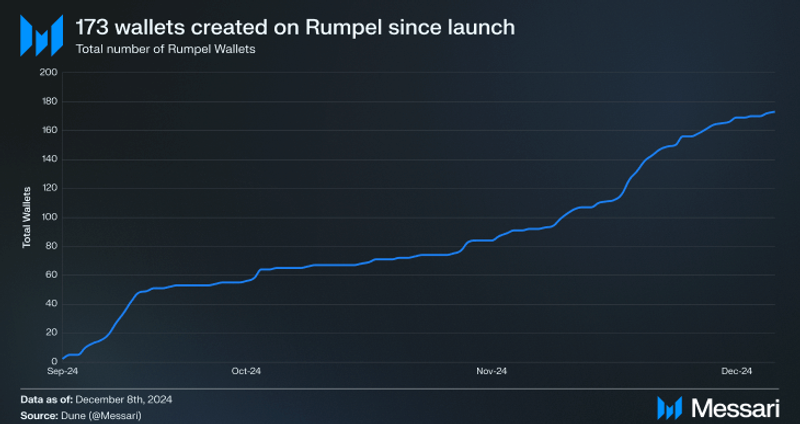

Since its launch, the number of Rumpel wallets has grown to 173. With $52 million in TVL distributed across these wallets, the protocol appears to attract high net-worth users. Notably, one user deposited $2 million into Fluid’s weETH and wstETH looping strategy, followed by another user contributing $8 million to a Fluid looping strategy just seven days later.

RoadmapRumpel is positioned to redefine loyalty and incentivization programs by bridging the gap between traditional points systems and the evolving needs of crypto users. With over 40 years of loyalty point program history serving as a foundation, Rumpel brings a modern, blockchain-enabled solution to the table. By enabling users to tokenize and trade points, the platform addresses long-standing challenges such as overfarming and illiquidity.

Building on its initial success with strategies from Ethena, Symbiotic, and EtherFi, Rumpel plans to expand its ecosystem with more diverse points strategies and deeper liquidity. This evolution aims to enhance user flexibility while maintaining robust opportunities for farmers, investors, and protocols alike. By meeting users halfway — offering the option to sell points without devaluing their worth — Rumpel sets the stage for a more balanced and dynamic points and airdrop ecosystem. Future developments will further solidify Rumpel’s role as a critical player in the next wave of crypto incentives.

Closing SummaryRumpel is transforming crypto incentives by converting off-chain loyalty points into tradable on-chain assets. This innovation empowers farmers with liquidity, investors with targeted exposure, and protocols with tools to demonstrate reward value. Its seamless ecosystem — centered around the Rumpel Wallet, Oracle, and Vault — ensures security, transparency, and usability.

Since launching in September 2024, Rumpel has grown rapidly, reaching $52 million in TVL across 173 wallets and supporting diverse strategies. With initiatives like the Straw rewards program and advanced looping strategies, Rumpel is reshaping point systems and driving engagement in crypto. First-time visitors can explore Rumpel using the referral code EQ8W5W.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.