and the distribution of digital products.

Understanding the Composable Foundation: A Comprehensive Overview

- Composable Finance is an infrastructure layer enabling DeFi applications to interact and conduct transactions across different blockchain layers.

- With the launch of Mantis in Q3 2024, Composable will leverage an Inter-Blockchain Communication (IBC) Protocol, Solana Virtual Machine rollup, and cross-domain auctions to bring decentralized and efficient transactions.

- Composable aims to become the central hub for DeFi, with over $30 million USD and 100,000 transactions transferred through Picasso’s IBC connection.

- Mantis will launch a deposit waitlist in early July and begin a pre-launch campaign later in the month. The campaign will allow users to earn multipliers based on their network participation before the token generation event (TGE).

The Composable Foundation launched in June 2021 to abstract the fragmented blockchain landscape. Composable began its work on Picasso within the Polkadot ecosystem, developing parachains on Kusama and Polkadot. In 2022, Composable expanded Picasso to the Cosmos ecosystem, spinning up the Picasso chain using the Cosmos SDK. Picasso sits at the heart of the Composable tech stack, as it leverages IBC, along with the other core technical components, to connect various individual blockchain ecosystems.

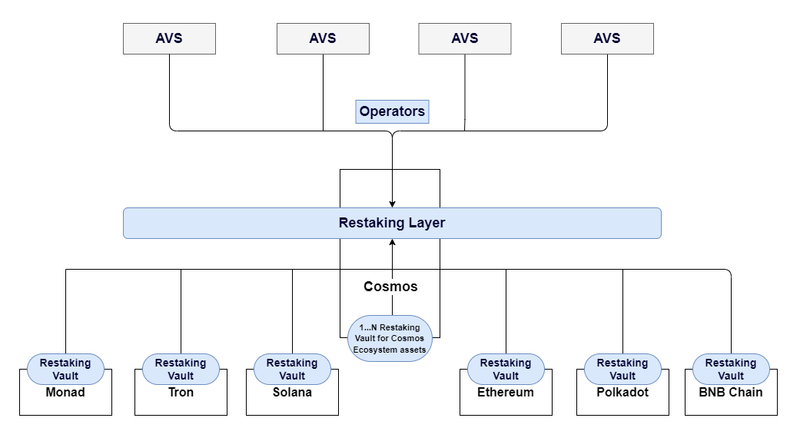

As of March 2023, Picasso is rolling out generalized restaking to enhance security across multiple PoS networks. Generalized restaking in Picasso will support a wide range of assets from various PoS networks, allowing for a larger pool of tokens to be restaked at a lower opportunity cost. The first implementation focuses on AVSs for Solana IBC.

Mantis is the culmination of all other elements of the Composable technical stack – it uses Composable’s IBC connections and the Composable Virtual Machine (CVM) to facilitate cross-chain execution of user intents. Mantis aims to provide a unified DeFi experience that abstracts away frontend complexity for users through IBC.At launch, its co-founders 0xbrainjar, Blas Rodriguez Irizar, and Miguel Santafé raised a $7 million seed announcement with backing from CMS, Blockchain Capital, and Anagram. Less than a year later in March 2022, Composable announced a $32 million Series A, which included Coinbase Ventures, LongHash Ventures, Jump Capital, and Spartan Group, among others.

In the last three years, Composable has developed a comprehensive technical stack that includes trust-minimized bridging infrastructure (the Picasso Network), a virtual machine, an intent settlement framework (Mantis), and XCM and Inter Blockchain Communication (IBC) protocol integration.

TechnologyThe Composable technical stack is designed to fulfill Composable’s primary mission: streamlining the cross-chain DeFi experience via chain abstraction. The comprehensive technical stack includes a number of core products: the Composable Virtual Machine, the Picasso Network (leveraging the Inter-Blockchain Communication Protocol), and the Mantis intent settlement framework. These different components collectively facilitate an ecosystem for cross-chain functionality.

Composable began its work on Picasso within the Polkadot ecosystem, developing parachains on Kusama and Polkadot. In 2022, Composable expanded Picasso to the Cosmos ecosystem, spinning up the Picasso chain using the Cosmos SDK. Picasso sits at the heart of the Composable tech stack, as it leverages IBC, along with the other core technical components, to connect various individual blockchain ecosystems.

As of March 2023, Picasso is rolling out generalized restaking to enhance security across multiple PoS networks. Generalized restaking in Picasso will support a wide range of assets from various PoS networks, allowing for a larger pool of tokens to be restaked at a lower opportunity cost. The first implementation focuses on AVSes for Solana IBC.

Mantis is the culmination of all other elements of the Composable technical stack – it uses Composable’s IBC connections and the Composable Virtual Machine (CVM) to facilitate cross-chain execution of user intents. Mantis aims to provide a unified DeFi experience that abstracts away frontend complexity for users through IBC.

Core ComponentsPicassoPicasso is a Layer-1 protocol dedicated to delivering trust-minimized interoperability through cross-ecosystem IBC. Complementary to the interoperability work, Picasso is building the first Generalized Restaking Layer, starting with deployment on Solana, while also expanding support for all IBC-connected ecosystems.

Picasso uses the Cosmos SDK framework and acts as an IBC Protocol hub between IBC-enabled chains. Picasso’s Generalized Restaking Layer, paired with IBC, will be able to utilize any economically valuable assets to secure any use cases that require temporary or permanent security. Through this infrastructure, Picasso will deliver native protocol-level security and permissionless interoperability for all DeFi users.

Key features of the Picasso ecosystem are as follows:

- Cross-Ecosystem IBC: The IBC Protocol is used for trust-minimized communication between different blockchain networks/ecosystems. It relies on security at the consensus level of the two transacting chains. As such, IBC was selected as a cornerstone of Picasso's efforts to connect ecosystems and its performance and standardization. Originally, IBC was tailored for native connections between Cosmos SDK chains. Without Picasso, significant development effort would have been required to extend IBC to more networks. IBC on Solana, Ethereum, Polkadot, and Kusama all require respective customization from implementing a light client to achieving state proof (finality). This customization is necessary to not rely on any centralized intermediary and uphold the IBC standards and values of censorship resistance. Now, thanks to Picasso, the IBC can connect all these ecosystems, with more connections planned for the future, while maintaining the IBC standards.

- Generalized Restaking Layer: Restaking enables users to provide blockchain security by collateralizing the economic value of their liquid-staked tokens and yield-bearing assets. These restaked tokens validate PoS protocols and services, also called Actively Validated Services (AVSs) that seek security. Picasso expands upon the concept of restaking popularized by Eigenlayer to deliver Generalized Restaking: restaking of assets on multiple PoS networks to establish cross-ecosystem pooled security. This type of restaking was made possible by Picasso’s IBC connections and the flexible architecture of the Generalized Restaking Layer on Picasso.

The Composable Virtual Machine (CVM) is a runtime environment and orchestration language designed to execute and settle cross-chain programs over the IBC protocol. With the CVM, developers are not restricted to one blockchain but can execute cross-chain operations in one transaction. For example, the CVM enables users to move DOT to Osmosis, swap DOT to ETH, move ETH to Ethereum, swap ETH to USDC, and move USDC to Cosmos in one transaction.

Multichain Agnostic Normalized Trust-minimized Intent Settlement (Mantis)Multichain Agnostic Normalized Trust-minimized Intent Settlement (Mantis) is an ecosystem-agnostic intent settlement framework. After several years of development, the platform is set to launch in Q3 2024.

To navigate multichain environments in DeFi, Mantis was built on several foundations:

- The Inter-Blockchain Communication Protocol (accessed through the Picasso Network), enabling decentralized and interoperable data sharing between different blockchains.

- A bridge contract facilitating the flow of Solana (SOL) tokens and liquid staked tokens (LSTs) into the Mantis rollup.

- A Solana Virtual Machine (SVM) rollup (called the Mantis rollup) with an integrated submission layer, enabling intent submission and discovery by counterparties called solvers that compete to provide users with best execution.

- A cross-domain auction system that promotes efficient blockspace allocation and supports atomic transactions.

- A commitments mechanism that enables the execution of conditions across different chains within the architecture.

Inter-Blockchain Communication Protocol is a standard for allowing different blockchains to communicate and share data interoperably. Each participating blockchain operates a light client of the compatible chains. This establishes secure communications by validating each other's blocks and states based on the underlying consensus algorithm. Mantis value add is creating chain abstraction with IBC-based intents. IBC helps enable trust verification so anyone can deploy confidentially and without trust assumptions typically of intent-based bridging. This includes oracle providers, DEXs, and protocols seeking cross-chain capabilities, such as AI agents and Telegram bots.

For blockchains using a Proof of Stake (PoS) model, a light client will check new blocks by confirming that a sufficient number of trusted validators have signed off on them. Following a block's acceptance, the light client updates its state, which may include refreshing its set of trusted validators. IBC protects network transactions while avoiding the centralization and vulnerabilities of third-party bridges. This trust-minimized bridge allows participants to interact directly across different chains with verifiable and binding commitments.

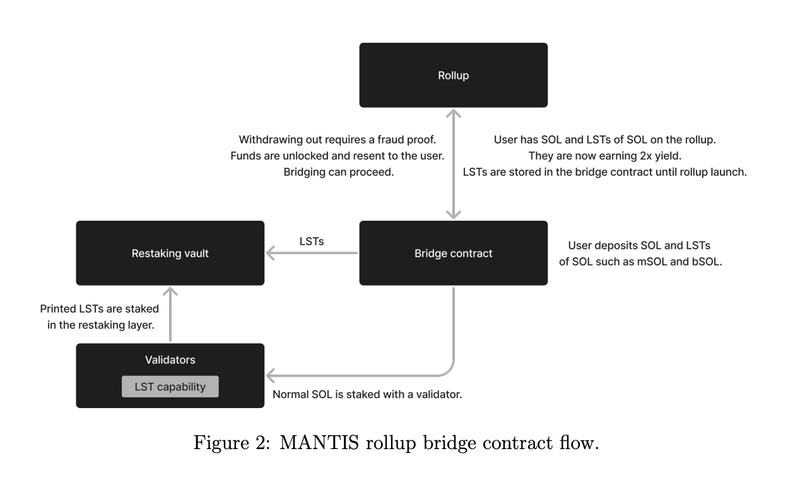

Bridge ContractAn enshrined bridge leverages Picasso’s IBC connections to facilitate tokens through the Mantis network. At the time of writing, users can deposit SOL and various Solana-based liquid staked tokens (LSTs) into this contract. The deposited tokens are then staked with Solana validators for Proof-of-Stake (PoS) participation. Composable has plans to add additional token compatibility in the future.

After a user stakes SOL, they receive an LST representing their staked position. This LST can be restaked through Picasso's Restaking Layer to simplify restaking process and potentially increase yield. This process is called native restaking.

LSTs deposited into the bridge contract are moved to the restaking vault. Solana-native stablecoins deposited into the bridge are channeled into Solana-based lending protocols (e.g., Kamino Finance and MarginFi). Users can restake these stablecoins within the Solana restaking layer for increased yield.

This restaking feature can be beneficial for uses such as Telegram bots. In this example, the initial capital deployed but not utilized would typically remain idle without earning yield. However, if Telegram bots deployed to the Mantis rollup, they could earn yield on those funds. Additionally, these Telegram Bots can offer cross-chain intents to their users.

When a user withdraws their restaked tokens, a zero-knowledge (ZK) proof unlocks the funds in the bridge contract. The funds are returned to the user in the same form they were originally deposited. The user can transfer these tokens to other locations or use them for other functions over IBC.

The bridge contract optimizes yield and secuirty for users by facilitating the deposit, staking, and restaking of SOL, LSTs, and stablecoins. At the same time, it enhances the security that benefits the Mantis rollup and Actively Validated Services (AVSs).

ZK-RollupMantis is positioned to be Solana’s first L2. It coordinates and settles cross-domain, intent-based mechanisms. With IBC and the Mantis SDK, Mantis provides a chain-abstraction action that streamlines the creation of cross-domain decentralized applications.

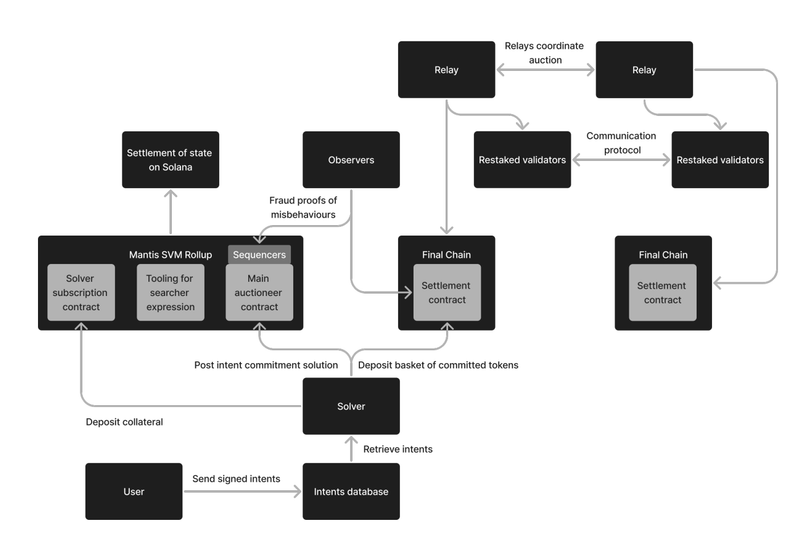

The Mantis rollup establishes a system for block proposals and commitments across different domains, ensuring accountability through the IBC security model. Decentralization is a key feature, with a rotating set of independent sequencers operating in a round-robin fashion to maintain a censorship-resistant environment. This ensures all intents and solutions are considered before the scoring period concludes, preserving the integrity of scores and enabling blockspace auctions.

The architecture of the Mantis rollup is depicted below:

The Mantis offers a decentralized block proposal and commitment framework, enabling secure multichain interactions and intent submissions from any location.

Intent MechanismTo initiate an intent being settled by Mantis, users first sign these intents (i.e., "I want to trade A for B"). Intents are then added to the private Mantis rollup mempool. Solvers, who are staked agents, observe these transactions and propose solutions scored by an auctioneer contract. To participate, solvers must stake collateral in the staking contract and incur fees based on their activity and usage to access the intent database. This payment grants them exclusive rights to retrieve intents, financially committing them to the auction process.

The auctioneer contract scores the solutions based on user utility maximization, the benefit derived from a user’s product or service. The winning solver settles the intent by sending the transaction via IBC to the relevant protocols and blockchains, completing the settlement on the destination chain.

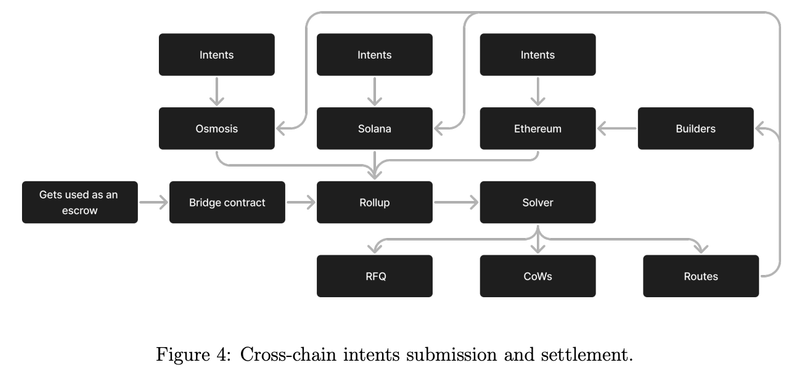

Intents can be submitted from IBC-connected chains like Ethereum and Solana or protocols like Osmosis, a Cosmos-based DEX. Regardless of the origin, all intents are sent through the Mantis rollup. Solvers then create solutions using Coincidence of Wants (CoWs) or requests for quotes (RFQs) to market makers for liquidity. These transactions are processed over IBC and settled on any IBC-enabled destination chain or protocol.

Source: Mantis Whitepaper

The ultimate goal of Mantis is to process intents to and from any IBC-connected chain using the Picasso Network. By accepting intents from various chains and protocols, Mantis aims to enhance atomicity and incentive alignment further, making cross-chain DeFi more accessible and user-friendly.

Cross-Domain ExpressivenessPricing cross-domain intent solutions poses financial challenges for solvers, including entry costs, congestion costs, and the risk of non-atomic execution. The current infrastructure cannot express these preferences atomically, leading to a high risk of execution failure.

Through the Picasso network, Mantis implements a combinatorial auction that allows builders and searchers to bundle transactions across domains, bringing atomic execution and increasing revenue for validators compared to selling blocks separately.

Validators have the flexibility to bundle and select specific blocks across blockchains, validating only if they can complete the entire bundle. This provides a coordinated cross-domain transaction process where validators can selectively bundle and complete blocks across multiple blockchains before validation. Additionally, restaking allows for combinatorial tickets where proposers can set conditions influenced by actions on other chains, further building a market for future blockspace across different domains.

Through a combinatorial auction, Mantis aims to provide validators with the flexibility to choose their rewards in terms of amount and timing. As a result, validators can maximize their extractable value (MEV) and are incentivized to improve to build the stability and security of the Mantis network.

Commitments MechanismThe current infrastructure supports a sequential auction, where builders submit bids for each block independently. This means that builders and searchers interacting with different blockchains cannot express preferences for future blocks or combinations of blocks, leading to an inefficient use of resources and block allocations.

Mantis solves this by utilizing a just-in-time auction, allowing builders to express their preferences and requirements for multiple blocks atomically. Upon meeting certain payment thresholds, block proposers can make credible promises to build blocks based on specific conditions from ticket holders.

As a minimum viable product, both block proposals and the relay set up a (3, 3) threshold decryption scheme. The relay allows validators to see block headers, all bids for independent blocks, and pre-commitments for counterparty block proposals. These pre-commitments include a signature, a share of the decryption scheme secret, and an encrypted signature of one of the blocks in the bundle.

When the pre-commitment phase ends, validators submit a pre-commitment for a bundled block. If the relay receives matching pre-commitments for the same combinatorial block before the deadline, it decrypts and releases the blocks; otherwise, it informs both parties that they can create separate blocks.

The potential risks involved in this process are double-signing and the high level of trust placed in the relay. While consensus protocols generally mitigate double-signing, the MEV opportunities in this market could increase misbehavior.

Mantis plans to increase the collateral staked by validators through restaking to enhance security. If an agent double-signs, a challenge period will start in the Mantis rollup, allowing observers to prove the double-signing. If the block proposer does not send the relay's signed authorization, the agent will be penalized; if they do, the relay will be penalized. Penalties will consider costs related to atomicity failure, missed slots, and other expenses. This ensures the security and efficiency of cross-domain transactions while addressing potential risks inherent in the system.

Use CasesUtilityMANTIS is the native utility token for the Mantis framework, enabling network functionalities such as transaction fees and order flow auctions. The network collects transaction fees to process transactions, while order flow auctions allow searchers to bid for their transaction bundles to be included in a block by builders.

Builders may also participate in an additional auction, offering extra Mantis to validators within the network to prioritize their block for validation. When a different gas token is needed to complete a transaction(such as OSMO for a swap on the Osmosis DEX), Mantis can be exchanged for the required token to finalize the order.

Solver BondsTo become a solver, market participants must deposit Mantis. Once the deposit is made, the solver can operate within the protocol and join order flow auctions. This bond is a security measure for the protocol against malicious actions or the failure to repay a loan. If such events occur, the solver's bond will be reduced and replenished to maintain protocol participation.

Mantis StakingParticipants can stake their Mantis to create a pool available to solvers for flashloans covering fees and tips. Solvers and market makers can receive a share of the revenue from cross-sharing intents, solver bonds, and sending order flow, even as a B2B wallet submitting order flow.

In exchange for staking Mantis, users gain access to platform vaults. These vaults generate revenue through protocol fees, MEV share, and restaking fees. By delegating Mantis, you earn a percentage of the settled intents and other potential opportunities.

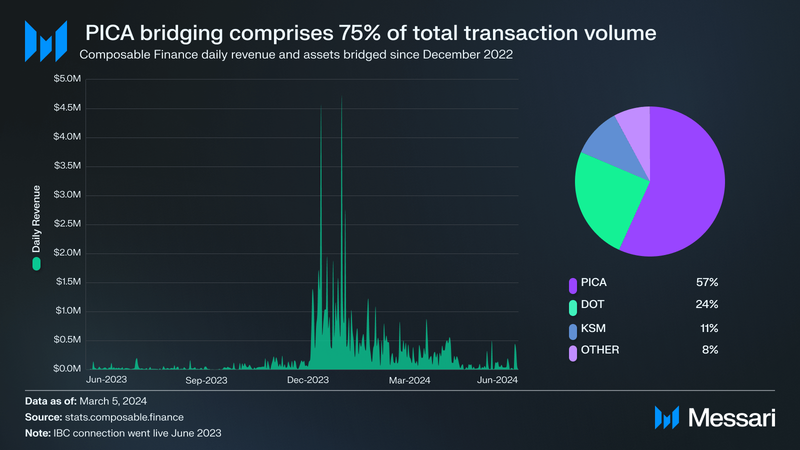

TokenomicsPICAPicasso (PICA) is the native token of Picasso, which powers the cross-ecosystem IBC and Restaking Hub. As a result, PICA is positioned to be the network and native token for cross-ecosystem-IBC transfer activity. The token is used for governance and validator staking to secure the Picasso Cosmos SDK chain. A portion of revenues from bridging fees and from AVS payments for restaking will flow to the PICA token. As the native token of Picasso, PICA is at the heart of Composable's strategy for a multichain, IBC-enabled future.

Distribution

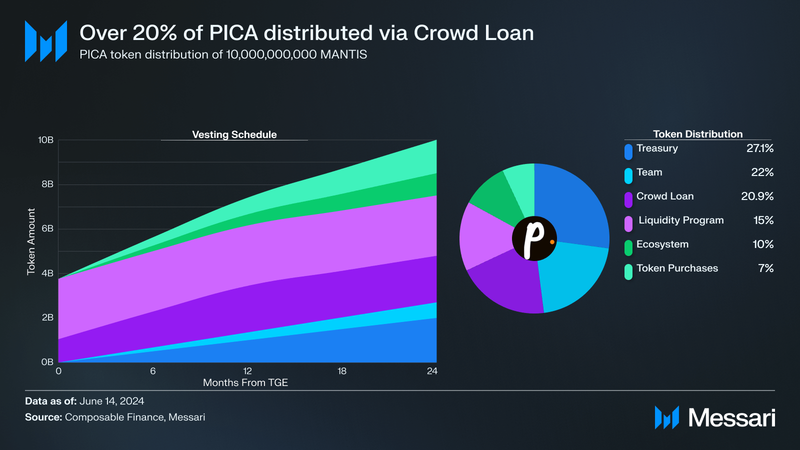

The total supply of PICA is 10 billion tokens. At Genesis, 4 billion PICA was distributed with the remaining subject to vesting schedules. Allocations are as follows:

- Founders, Contributors, Partners, and Advisors (20.0%): Distributed over two years with an initial six-month lock.

- Treasury (27.1%): The Treasury supports the Picasso network. Of the total network fees, 75% flow into the Treasury, with the remaining 25% are distributed to Collators. One billion PICA from the Treasury is bonded on Comosable Cosmos for network security.

- Future Personnel Incentives (2.0%): To be used for future personnel incentives and subject to a four year vesting schedule from network launch or a one year cliff with monthly vesting from a grant date.

- Crowdloan (20.9%): This loan is allocated to parachain slot auction crowd loan stakers, with 50% released at TGE and 50% released linearly over 48 weeks.

- Ecosystem Incentives (10.0%): Rewards for a number of actions.

- Series A Token Purchasers (7.0%): Three-month lockup with a two years vesting.

- Liquidity Programs (15.0%): Rewards for liquidity program participants.

Previously known as LAYR, the Mantis token is the native utility token for the Mantis framework, supporting various network functionalities. Mantis will be deployed as an SPL-20 token on the Mantis rollup. More information about the distribution and tokenomics of the Mantis token will become available upon the TGE.

Restaking

Picasso is rolling out generalized restaking to enhance security across multiple PoS networks by establishing cross-ecosystem pooled security for Actively Validated Services (AVSs). Given Picasso's role as a Layer-1 Cosmos chain and its function as an IBC hub, this restaking layer is positioned to operate cross-chain. Generalized restaking in Picasso will support a wide range of assets from various PoS networks, allowing for a larger pool of tokens to be restaked at a lower opportunity cost.

The first implementation focuses on Solana IBC, serving as a bridge that enables IBC communication between Solana and other IBC chains. Restaking Vaults on Solana provide a secure method for users to stake Solana tokens, securing AVSes on Solan. Initially, users can stake SOL, jitoSOL, mSOL, and bSOL. The second phase will expand eligibility to Orca LP tokens and other assets. Composable runs the Mantis Games to bootstrap liquidity and gamify participation on the restaking layer.

Network Activity

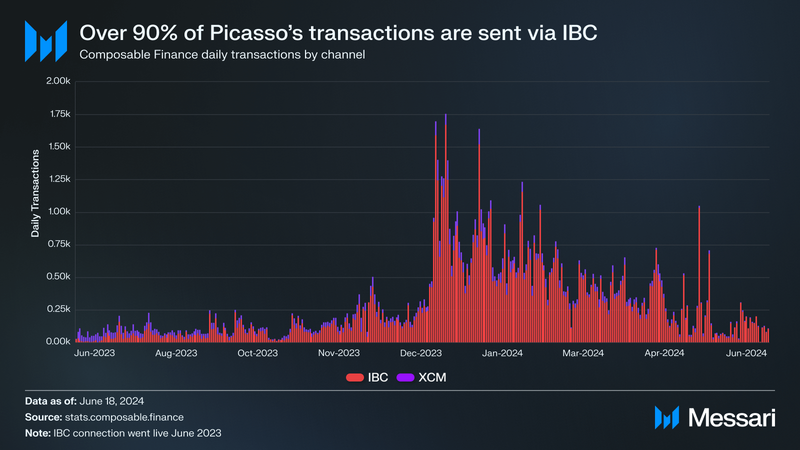

Composable’s daily transactions have decreased to approximately 500 from a peak of 1,700 in December 2023. Over 90% of these transactions leverage the IBC protocol, with a growing, but still small, fraction utilizing Polkadot's cross-consensus messaging (XCM). In recent months, there's been a marked increase in demand for IBC functionality beyond the Cosmos ecosystem. This growth has been highlighted by projects like Polymer, as they try to capture this trend. With last month's IBC volume reaching $2.4 billion, the potential expansion of projects such as Celestia, Osmosis, and Atom across various chains integrates them further into the broader crypto landscape. It provides access to their liquidity, security, and user communities.

However, Composable’s vision of using Mantis as a DeFi hub sets the ecosystem apart from its competitors. After announcing its Solana restaking, PICA’s price notably grew from $0.001 in December to nearly $0.03 at its January peak, a circulating market cap of $110 million. Daily transactions mirrored this growth as users flocked to Picasso and Pablo, Picasso’s now sunsetted native DEX (swaps now directly occur on picasso.network) to interact with the ecosystem.

Positive DeFi momentum is accelerating on Mantis, likely due to mantis.app being the only exchange for Solana restaking tokens. The massive adoption of Eigenlayer has opened the door for cross-chain staking, as proven via Picasso’s Solana restaking vault. Picasso reached 86% of its total cap in only two weeks, resulting in $16 million in total deposits and an APY of 26%. They partnered with Solend and MarginFi to integrate as many LSTs as possible and currently support cSOL, cbSOL, cjitoSOL, and cmSOL. Composable’s ecosystem continues to look to grow, while focusing on securing IBC connections with Ethereum and Solana.

EcosystemTheir strategy includes implementing features like restaking, interoperability, and intents across major ecosystems. Currently, Composable has live IBC connections with Ethereum, Solana, Cosmos, Polkadot, Kusama, Osmosis, Celestia, and many other Cosmos app chains. Picasso is thus positioned as a hub for IBC-based transfers, while Mantis is the nucleus for cross-chain intents-based activity.

Mantis aims to adopt an intent-centric framework to facilitate settlement. Mantis is designed to enhance the cross-chain transaction process by simplifying the complexity of cross-domain transactions using intents. It enhances the user experience by facilitating seamless asset transfers across any chain, enabling native swaps and instant yield earning. Intents empower users to optimize their transactions for the best possible outcome, utilizing solvers for superior price execution within dark pools (i.e., private liquidity pools). Furthermore, by integrating IBC, Mantis ensures a secure channel for executing concurrent, cross-chain trades.

The Composable Virtual Machine (CVM) orchestrates cross-chain bridge execution and the settlement of intents, centralizing these functions within picasso.network. This platform lets users swap and stake directly, offering a 7.48% APY on PICA. These actions, known as trustless swaps, allow the movement of assets across various blockchains without needing a trusted middleman. They manage to do this by using transport layers like IBC and XCM. Composable aims to extend these trustless capabilities to more blockchains in the future, with Bitcoin being its next target chain.

RoadmapMantis plans to launch a deposit waitlist in early July as part of a pre-launch campaign. Later in the month, Mantis will begin the pre-launch campaign, allowing users to qualify for multipliers based on their time on the network before the initial TGE, slated for Q3 2024. Mantis will be an SPL-native token on Solana, and the first rollup on the platform will be designed to extend Solana's speed and community to other ecosystems. The initial target audience will interact with Pump.Fun and AI agents that can deploy contracts on the rollup.

This launch is a key milestone within the broader Mantis and Picasso ecosystems, especially with the comprehensive rollout of Mantis. By utilizing restaking as the foundational layer of security, in combination with the trust-minimized interoperability of the IBC, Composable is dedicated to bolstering cross-chain functionalities across the crypto landscape.

Closing SummaryThe Mantis framework aims to be the canonical dApp for the future of cross-domain DeFi, introducing an architecture that enables cross-chain, trust-minimized, and efficient intent execution. The platform enables smoother transactions across various domains using the IBC protocol and supports the bridging of other assets into its ecosystem, all while maintaining a Solana-native user experience

Through MANTIS and PICA tokens, Composable Finance aims to streamline multichain DeFi operations and provide optimized execution for users. As a result, cross-chain DeFi can potentially become more accessible and user-friendly, accelerating the industry's path toward mass adoption.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.