and the distribution of digital products.

DM Television

Top 7 Cryptocurrency Savings Accounts | Earn Interest on Crypto

With minimal regulations and price fluctuations almost every single day, many people believe that cryptocurrency investments are a massive risk. However, if you play your cards wisely, you can earn a great deal of interest for the money you invest in the ever-expanding crypto market. One of the fastest-growing sectors in the crypto industry is crypto interest accounts via interest-bearing savings account.

There is no shortage of crypto savings accounts available these days, but it can also make things a bit confusing. This is particularly true for people who are relatively new to the crypto world.

Features of Cryptocurrency Savings AccountsTypically, the best cryptocurrency savings accounts out there are ones that feature the following:

- High-interest rates

- No deposit fees

- No locking of funds

- No need to invest in a platform token to unlock higher rates

- Compounding interest rates

- Good security

- A large list of currencies to earn interest on

Now that we know what to look for in a good savings account, let’s introduce you to the basics and then compare a few to help you make the best decision on where to put your funds.

What are cryptocurrency savings accounts?Crypto storage accounts provide users with complete access to the crypto market, allowing them to gain interest, similar to how a regular bank savings account works. If you plan to make long-term investments in the cryptocurrency world, an account like this can be ideal for accruing interest and safeguarding your coins at the same time.

As mentioned earlier, there are plenty of crypto investment options available these days. However, every crypto savings account is different and has its own sets of features, options, etc. If you are new to cryptocurrency savings accounts and wondering which one would suit you the most, continue reading this piece as it lists down some of the best.

This table briefly compares the most interesting options from the companies below. Read further for more detailed information about each company.

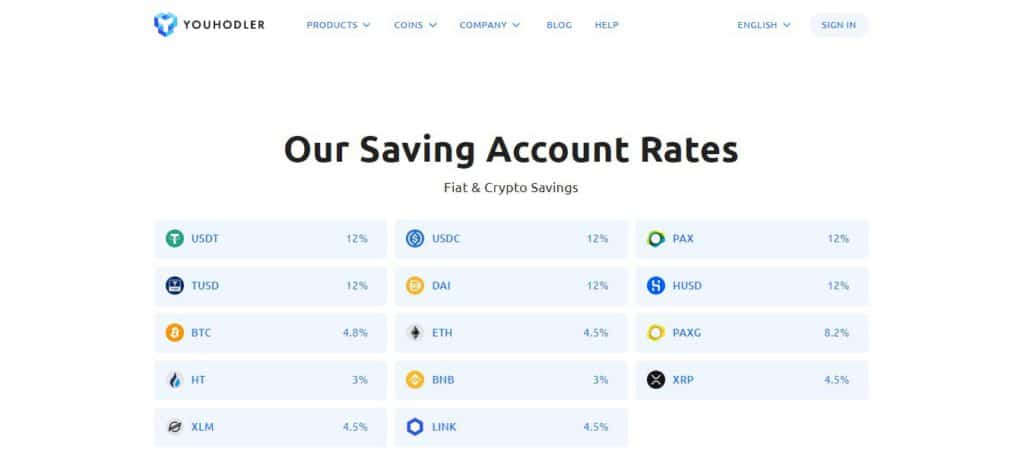

1. YouHodlerLet’s start this list with the best crypto savings accounts out there. This savings account for cryptocurrencies offers users unmatched variety. Whether you want to invest in bitcoin or any other type of cryptocurrency, you can breathe a sigh of relief knowing that you can use YouHodler for your crypto-saving needs.

YouHodler

YouHodler

What makes YouHodler stand out from a large number of crypto apps is that it enables you to earn around 12% APR along with compound interest on a variety of cryptocurrencies and stable coins. With this crypto savings account, users can easily gain interest by making investments in various cryptocurrencies like XRP, BCH, LTC, LINK, ETH, Bitcoin, etc.

The main stablecoins you will find on this platform are EURS, DAI, BUSD, HUSD, PAX, PAXG, TUSD, USDT, and USDC. Each crypto savings account must offer a high level of insurance and security and this one is arguably the finest. While a large number of Bitcoin savings accounts are very limited when it comes to cryptocurrencies (most of them only feature bitcoin), YouHodler takes the extra step and offers some other features too.

This platform has a handy conversion tool that allows clients to purchase Bitcoin and several other cryptocurrencies at excellent conversion rates. What’s most impressive about all of this is that YouHodler users don’t have to worry about any limitations. If you happen to be an experienced trader, this crypto saving app has advanced tools known as Multi HODL and Turbo Charge.

Using these tools, clients can take loans to short or long the cryptocurrency market. The method is tremendous for using small sums of capital to increase the chances of profits. There are no withdrawal or deposit fees associated with the crypto savings account at YouHodler. That said, you may need to pay a small sum of withdrawal fees for some cryptocurrencies and stable coins.

To learn more, read our comprehensive YouHodler review.

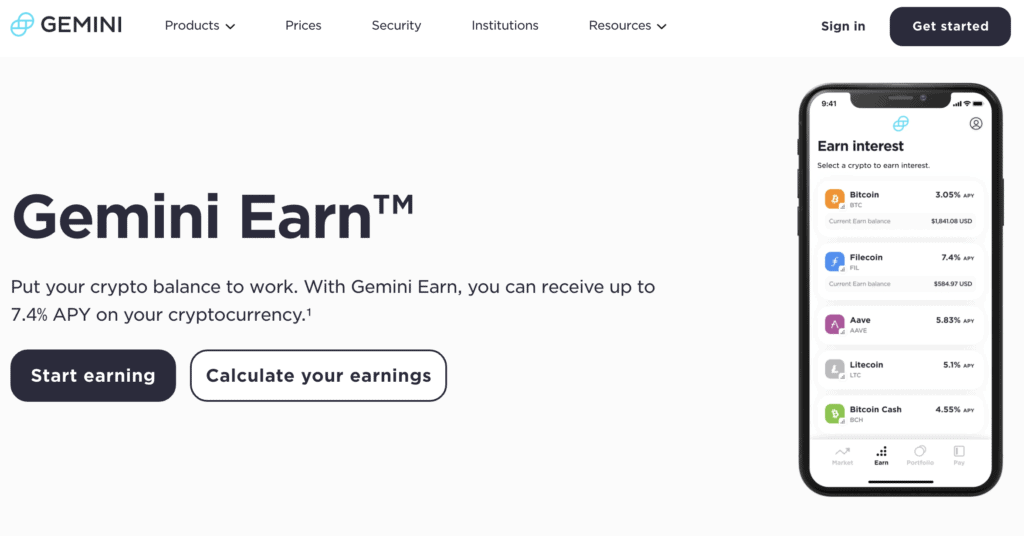

2. GeminiGemini is one of the most secure cryptocurrency savings and exchange accounts you will find. Based in the United States, Gemini has FDIC protection and has been free from hacks so far. The platform is relatively straightforward and its user-friendliness makes it an excellent option for anyone looking to invest in crypto.

Cryptocurrency Savings Accounts: Gemini Earn

Cryptocurrency Savings Accounts: Gemini Earn

You will need to fund your Gemini account using a bank account. The max funding limit (per day) on Gemini is 500 and 1500 USD per month, with a daily withdrawal limit being USD 100,000. This crypto savings account also lets you earn excellent interest on your savings with its Gemini Earn feature.

How to choose a Crypto Savings Account?When choosing a crypto savings account, there’s a couple of things to consider. First is the security of your funds. To determine whether your assets will be safe when depositing is to look into the company. Who is running the company? This is important because at its core, crypto savings accounts are considered as centralized finance (CeFi) institutions. Which means you’re entrusting your assets to the individuals or companies behind the platform.

Credentials and licenses can come in handy when it comes to choosing the right platform to invest. While cryptocurrency is not a legal tender and not backed by any government, having some recognition from regulated entities could give you peace of mind as you entrust your assets with the said platform.

The technology stack on the savings account also plays an important role. How do they store their funds? Is it in a hot wallet or cold wallet? Do they have a multi-signature authentication feature? In case of defaults, how are they going to return the funds to you? These are some important questions and features that you need to pay attention to when choosing the right savings account.

Benefits of Crypto Savings AccountDepositing your assets into a crypto savings account comes with a few benefits. The main one being growing the productivity of your idle assets.

These crypto savings accounts offer high-interest rates on your Bitcoin, Ethereum, and other crypto-assets compared to the rates that banks are offering for their savings account.

The process is much simpler compared to let’s say opening a bank account, all you need to do is to create an account that takes a few clicks. The next step is to go through their KYC process which often includes submitting identification documents such as a passport or driving license.

Once approved, you can begin depositing your digital assets to earn interest immediately. Another benefit is that the terms are flexible with crypto savings accounts.

Usually, there are no lock-in periods, no minimum deposits, and you can withdraw your assets at any time. With such flexibility, users can focus on growing their assets to get maximum yield with less risk.

Cryptocurrency Savings Accounts: ConclusionIn recent years, cryptocurrency savings accounts are taking off rapidly as cryptocurrency gains more momentum in the financial market. As with any financial decision, it’s very important to pay attention to the details and read the fine prints of the company where you’re intending to store your assets.

Some platforms offer better rates for popular crypto such as BTC and ETH but not so much on stablecoins, some have licenses while others are pending but with significant recognitions and reviews from happy users.

Ultimately, it’s not so much about the best crypto savings account to choose from, but rather, which one gives you what you’re looking for.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.