and the distribution of digital products.

THORChain Q4 2024 Brief

- The launch of THORChain V3 on Dec. 21, 2024, represents a major milestone in the platform's development. It introduced a RUNE token burn mechanism and upgraded to Cosmos SDK v50 and CometBFT consensus.

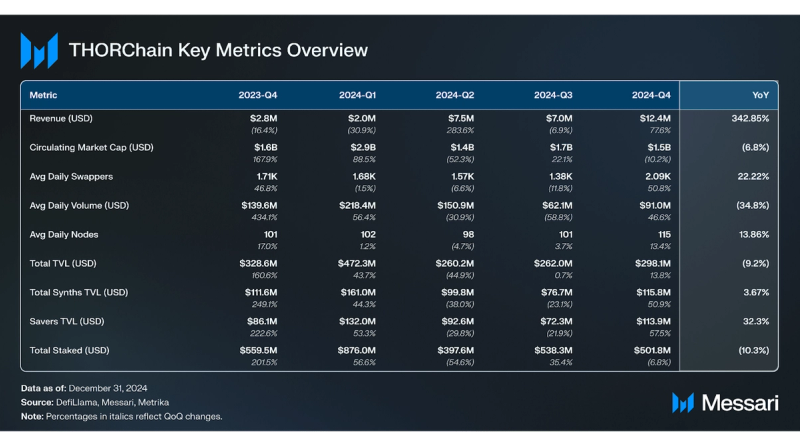

- THORChain average daily volume rose significantly in Q4 from $62.1 million to $91.0 million, a 46.6% rise QoQ.

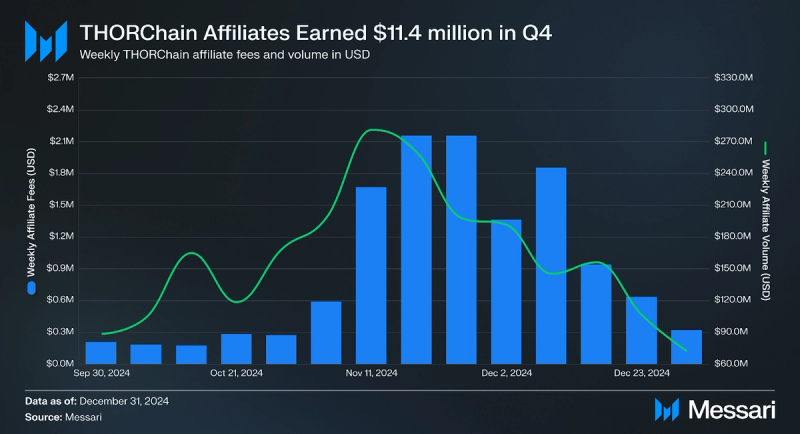

- THORChain affiliate revenue also rose from $3.2 million in Q3 to $11.4 million in Q4, a sizable 256.3% increase.

- After a strong Q3 THORChain’s RUNE token cooled off slightly in Q4 finishing the quarter at a market cap of $1.5 billion, a 10.2% decrease QoQ.

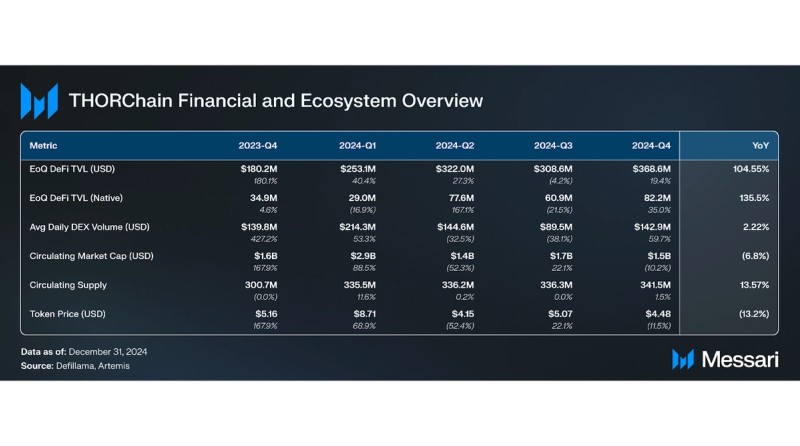

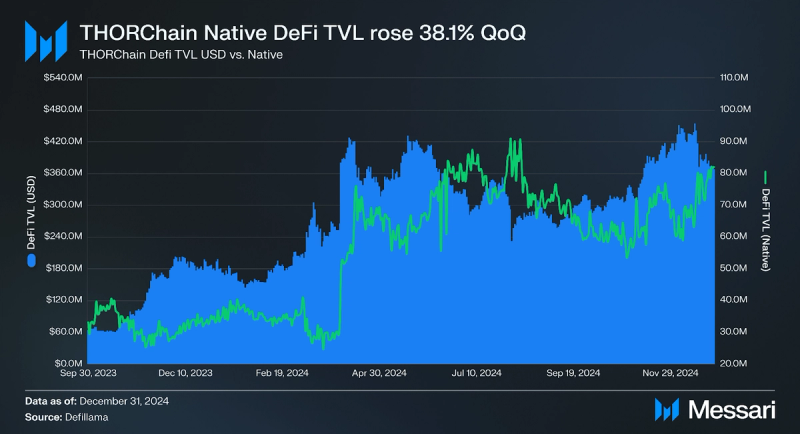

- Despite RUNE having a down quarter, THORChain DeFi TVL performed well, finishing the quarter up 19.4% from $308.6 million to $368.6 million QoQ after peaking at $455.8 million on Dec. 7, 2024.

THORChain (RUNE) is a Layer-1 network designed to facilitate cross-chain DEX swaps without the need for wrapped assets. The blockchain is developed on the Cosmos SDK and utilizes BFT Tendermint consensus engine. Native assets are managed directly in onchain vaults and funds are secured by node’s bonding or staking RUNE.

The network employs Threshold Signature Schemes (TSS) requiring a two-thirds majority of nodes for the movement of funds to and from vaults. Each vault must have a RUNE stake worth more than 1.5 times the value of the vault's funds to ensure they do not collude to steal funds.

THORChain uses continuous liquidity pools (CLP) where all pools are paired with RUNE and provide consistent liquidity to all assets in the network. Furthermore, fees are adjusted according to the liquidity depth of the pool. Additionally, THORChain provides a Savings Product for yield on synthetic assets (synths) and a Lending Product for overcollateralized, 0% interest loans with no liquidations or expiration.

Website / X (Twitter) / Telegram

Key Metrics Financial and Ecosystem Analysis

Financial and Ecosystem Analysis

After a strong Q3 THORChain’s RUNE token cooled off slightly in Q4 finishing the quarter at a price of $4.48, an 11.5% decrease QoQ. RUNE underperformed BTC and ETH, which finished Q4 up 38.6% and 24.9% respectively. RUNE’s market cap finished the quarter at $1.5 billion, a 10.2% decrease QoQ, and fell from 59th to 69th amongst all digital assets in total market capitalization. RUNE token emissions rose 1.5% QoQ, with circulating supply increasing from 336.3 million to 314.5 million.

Although RUNE finished the quarter down, there was significant price action in Q4. RUNE’s price and market capitalization peaked on Dec. 8, 2024, at $7.55 and $2.57 billion, a rise of roughly 50% from the beginning of the quarter.

DeFi

Despite RUNE having a down quarter, THORChain DeFi TVL performed well, finishing the quarter up 19.4% from $308.6 million to $368.6 million QoQ after peaking at $455.8 million on Dec. 7, 2024. Marketwide, DeFi TVL rose 35.1% on average over Q4 from $87.3 billion to $124.5 billion. In RUNE, THORChain TVL performed even better, increasing from 60.9 million RUNE to 82.2 million RUNE, a 35.0% rise QoQ. THORChain DeFi adoption rising significantly in a quarter where RUNE price action underperformed is an especially positive metric regarding THORChain DeFi adoption.

Affiliate Revenue

THORChain users typically interact with exchanges, wallets, or custodial services to broadcast transactions, rather than directly engaging with THORNodes. To incentivize these integrations, THORChain allows wallet developers to include an affiliate address and a custom fee rate. The protocol then collects these affiliate fees in a non-custodial and transparent manner for every transaction processed.

THORChain Average Daily Volume rose significantly in Q4 from $62.1 million to $91.0 million, a 46.6% rise QoQ. As a result, THORChain affiliate revenue also rose from a total of $3.2 million in Q3 to $11.4 million in Q4, a staggering 256.3% increase. On average, affiliates earned a combined $136,755 per day throughout Q4 with a peak of $555,766 on Dec. 5, 2024, a day of high market volatility.

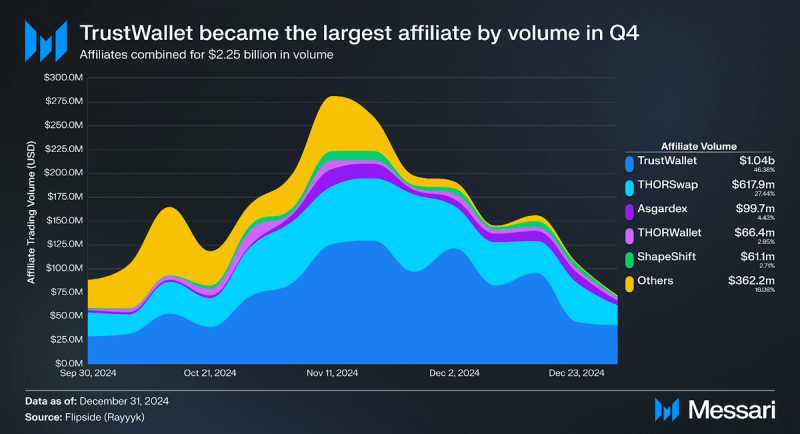

Affiliate volume rose 30.18% from a total of $1.66 billion in Q3 to a total of $2.25 billion in Q4 with TrustWallet leading all affiliates with $1.04 billion in volume.

This explosion in affiliate revenue and trading volume shows the continued adoption of THORChain and steady affiliate activity highlights the growing utility of THORChain’s ecosystem and the ongoing value being provided to third-party platforms.

Key DevelopmentsTHORChain V3The launch of THORChain V3 on Dec. 21, 2024, represents a major milestone in the platform's development, introducing foundational changes to enhance scalability, efficiency, and developer accessibility. The V3 upgrade addresses core architectural limitations, introduces new economic mechanisms, and expands developer tooling, positioning THORChain as a leader in cross-chain liquidity solutions. Key technical advancements include:

Economic Model TransformationOne of the standout features of the V3 upgrade is the introduction of a deflationary economic model for the RUNE token. The updated model incorporates a RUNE burn mechanism, which reduces token supply over time, thereby potentially increasing scarcity and supporting long-term price stability. 5.0% of the system income is burned in each block and is deducted from the total RUNE token supply. This shift represents a strategic pivot for THORChain, prioritizing sustainable tokenomics to incentivize liquidity providers and validators while benefiting token holders.

In addition, the Incentive Pendulum, a system that balances liquidity distribution between pools and network security, has been refined. The pendulum mechanism ensures that RUNE staked for security and liquidity is optimally balanced, reducing inefficiencies and incentivizing user participation in both roles. These changes are intended to strengthen the protocol’s economic sustainability and align participant incentives with network health.

Integration of Cosmos SDK and CometBFTA cornerstone of the V3 release is THORChain's upgrade to Cosmos SDK v0.50 and its transition to the CometBFT consensus algorithm. The Cosmos SDK upgrade enhances interoperability, aligning THORChain with the broader Cosmos ecosystem and enabling seamless integration with other IBC-enabled blockchains. In addition, the integration of the CosmWasm module and the enabling of smart contract functionality enables further development. These steps not only broaden the scope of cross-chain communication but also position THORChain as a vital infrastructure layer in the Cosmos network.

The shift from Tendermint to CometBFT introduces significant improvements in performance, scalability, and security. CometBFT offers faster block finality, allowing THORChain to process transactions more efficiently. These upgrades ensure THORChain can handle increased transaction volumes and support more complex DeFi operations, paving the way for broader adoption.

App Layer and Rujira Developer EcosystemThe App Layer, introduced in V3, represents a significant addition to THORChain's architecture. This layer provides developers with the tools to build dApps directly on THORChain's liquidity network. By enabling native integration of dApps, the App Layer creates an environment where developers can leverage the protocol's liquidity pools to deploy advanced financial applications.

The collaborative nature of this development is notable, as it incorporates contributions from the Rujira Alliance, a collective of DeFi projects. The App Layer supports a variety of use cases, including order books, perpetual futures, NFTs, launchpads, and liquidation platforms. The potential for innovation is already evident in projects like RUJI Swap, a proof of concept that demonstrates how the App Layer enables user-friendly and complex DeFi interfaces.

Implications for Cross-Chain Liquidity and DeFiThe technological advancements introduced with THORChain V3 have far-reaching implications for the platform’s role in DeFi and cross-chain liquidity. The integration of Cosmos SDK and CometBFT has improved interoperability and performance, positioning THORChain to meet the demands of increasingly sophisticated financial operations. By addressing MEV and enhancing transaction efficiency, the protocol has created a more equitable system for liquidity providers and traders.

The App Layer is poised to attract a diverse range of developers, extending THORChain's utility beyond liquidity provision into a broader spectrum of DeFi use cases. Projects like RUJI Swap demonstrate the potential for creating seamless and user-friendly applications, highlighting the protocol’s ability to support complex interfaces and interactions.

The updated economic model, with its deflationary RUNE mechanism, strengthens the token’s value proposition and enhances long-term ecosystem sustainability. These features, combined with the platform’s continued focus on developer tooling and community governance, ensure that THORChain remains a key player in the decentralized financial landscape.

Other Notable Q4 UpdatesTHORSwap Referral ProgramTo accelerate growth and community engagement, THORSwap, a project in the THORChain ecosystem, launched an official Referral Program on Dec. 17, 2024. This program is designed to reward users, including influencers and community members, for helping to expand the protocol by sharing personalized referral links.

The Referral Program offers a tiered reward structure, with base referral rewards starting at 0.1% and scaling up to 0.2% based on vTHOR holdings. This approach aims to incentivize user acquisition and encourage deeper engagement with the THORChain ecosystem through vTHOR staking. The program’s feature allowing participants to offer rebate discounts to their audience demonstrates THORChain’s effort to create a mutually beneficial scenario for both referrers and new users.

Closing SummaryTHORChain’s Q4 2024 performance showcased a blend of challenges and significant achievements, underscoring the platform’s evolution as a key player in the decentralized finance ecosystem. While RUNE’s price declined 11.5% QoQ amidst broader market growth, the protocol demonstrated underlying strength through a 19.4% rise in DeFi TVL and an extraordinary 256.3% increase in affiliate revenue, reflecting steady adoption and user engagement.

The launch of THORChain V3 was a defining moment, introducing foundational upgrades that enhanced scalability, efficiency, and interoperability. With features like a RUNE burn mechanism, Cosmos SDK integration, CometBFT consensus, and the App Layer, the upgrade not only addressed technical limitations but also expanded the protocol’s potential for supporting additional DeFi use cases.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.