and the distribution of digital products.

THORChain Q2'24 Brief

- THORChain’s Ecosystem expanded with eight new frontend interface integrations (wallets, exchanges, and various services). Li.Fi, Cake Wallet, and Zengo Wallet were among some of the interfaces that added support for THORChain swaps.

- THORChain’s TVL declined by 44.9% QoQ from $472 million to $260 million. This decline was primarily due to a market-wide downturn, which led to a 49.5% decrease in RUNE’s price, which makes up approximately 50% of their TVL.

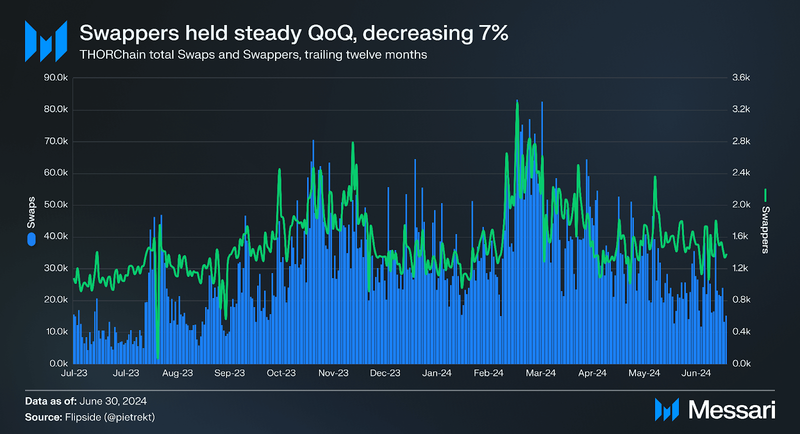

- Swappers remained resilient, falling only 6.7% QoQ despite a 30.9% fall in average daily volume. Swappers decreased from an average of 1,700 swappers per day in Q1 to 1,600 in Q2, but the average daily volume decreased from $218 million to $151 million.

- Six Architecture Decision Records (ADRs) were passed and implemented. These ADRs helped to reduce risk and liabilities to RUNE tokenholders and the network as well as strengthen long-term growth through project team funding.

THORChain (RUNE) is a Layer-1 network designed to facilitate cross-chain DEX swaps without the need for wrapped assets (i.e. Swap native BTC for native ETH). The blockchain is developed on the Cosmos SDK and utilizes BFT Tendermint consensus engine. Native assets are managed directly in onchain vaults and funds are secured by nodes bonding or staking RUNE, the native token of THORChain.

The network employs a Threshold Signature Schemes (TSS) requiring a two-thirds majority of nodes for the movement of funds to and from vaults. Each vault must have a RUNE bond worth more than 1.5 times the value of the vault's funds to ensure they do not collude to steal funds.

THORChain uses continuous liquidity pools (CLP) where all pools are paired with RUNE and provide consistent liquidity to all assets in the network. Furthermore, fees are adjusted according to the liquidity depth of the pool. Additionally, THORChain provides a Savings Product for yield on synthetic assets (synths) and a Lending Product for overcollateralized, 0% interest loans with no liquidations or expiration.

Website / X (Twitter) / Telegram

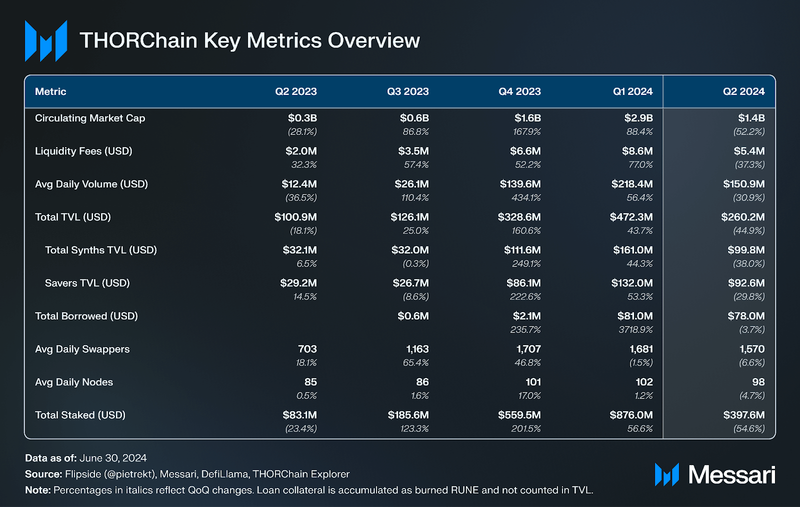

Key Metrics Performance AnalysisMarket Cap and Fees

Performance AnalysisMarket Cap and Fees

Over the quarter, 2.9 million RUNE (0.7% of total supply) were net burned, a 54% QoQ decrease. RUNE is primarily burned by the lending product where collateral supplied to the lending product is converted to RUNE and burned. Overall, over 86.4 million RUNE has been net burned, reducing RUNE’s current token supply from 485 million tokens to 414 million.

Token emissions to node operators and liquidity providers (LPs) come from the protocol-owned Reserve Module which controls ~76.4 million RUNE (18% of the current supply). Another 31% of RUNE’s total supply is held in the Staking Bond Module and the liquidity pool module.

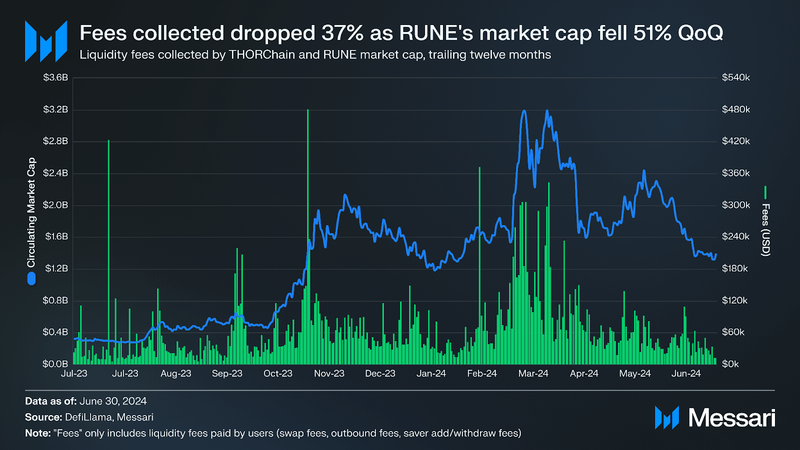

Total liquidity fees (swap fees, outbound fees, and saver fees) decreased by 37.3% QoQ from $8.6 million in Q1 to $5.4 million in Q2 primarily due to a drop in volume, which was reflective of the broader market downturn. Liquidity fees include:

- Swap Fees - Depend on liquidity pool depth, with greater liquidity resulting in lower fees, and trade size, with larger trades incurring higher fees.

- Outbound Fees - Cover the cost of gas to withdraw liquidity from pools. These fees are calculated as the external blockchain's "fast fee" multiplied by 1.5 to 3. This multiplier was recently adjusted to be specific to each blockchain.

Of note, Network Fees (0.02 RUNE per transaction) for settling on the THORChain Network are not included in the chart above. In addition to emissions, these fees are distributed between node operators and LPs based on the total bonded (e.g., staked) and TVL using the Incentive Pendulum logic.

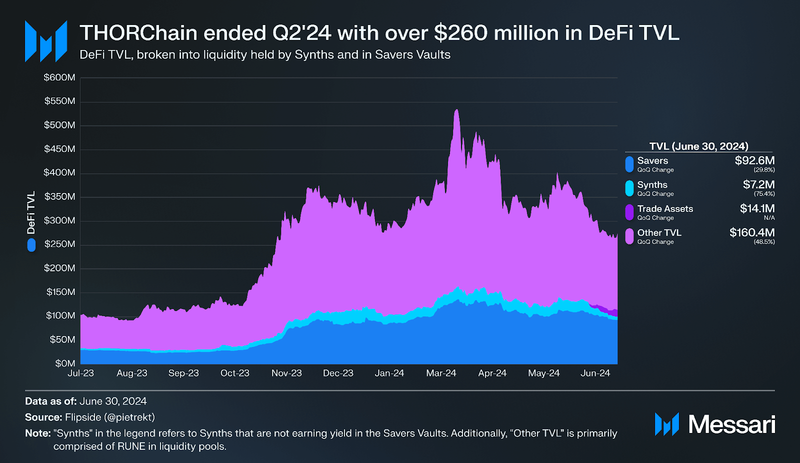

Synthetic Assets and TVL Breakdown

After increasing 43.7% last quarter, TVL in THORChain pools decreased 44.9% from $472.3 million to $260.2 million in Q2, joining the downtrend experienced by several protocols during this time.

THORChain pools always pair an asset (e.g., BTC) against RUNE. The BTC-RUNE pool TVL can be broken down into synths TVL, savers TVL, and other TVL.

Synthetic assets (Synths), paired with RUNE in liquidity pools, are collateralized 50% by the underlying asset (e.g., BTC) and 50% by RUNE. Synths are designed to peg to the value of the underlying asset. When RUNE’s price fluctuates, internal accounting mechanisms repeg the synth by adjusting the asset ratio, putting non-synth liquidity providers (LPs) in a leveraged long position on RUNE if the price of RUNE rises.

In April 2024, ADR-014 reduced the percentage of a pool that can consist of synths (i.e., the maximum synth utilization) from 60% to 50%. This change aimed to reduce risk for LPs by preventing overleveraging.

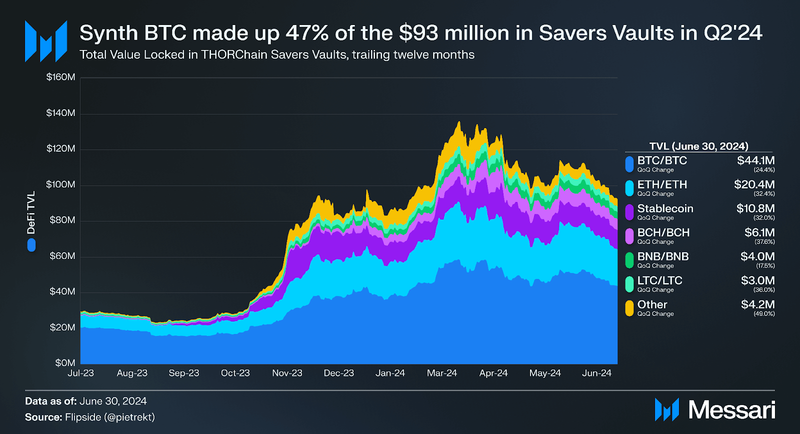

Q2 saw Synth TVL drop 75.4%, while saver vault TVL decreased 29.8%. The decline was driven by the introduction of "trade assets," a new asset class with lower fees, attracting synth traders and easing pressure on LPs.

By the end of Q2, $130 million of RUNE was paired with external assets in liquidity pools. The remaining TVL primarily represents the RUNE portion in dual liquidity pools, which fell 48.5% in line with RUNE’s price decrease.

Saver vaults held $92.6 million in TVL, down 29.8% from the previous quarter, while synthetic BTC's market share of TVL rose to 47% despite a 24.4% TVL decline. BTC Saver's APR also fell from 1.15% over the past 180 days to 0.65% over the past 90 days. Both ETH and BCH saw similar declines in TVL and APR, likely due to lower trading volumes and increased synth utilization. These declines in APR could be in-part due to declines in volume and increased synth utilization (from ADR-014 and RUNE’s decline as a portion of TVL).

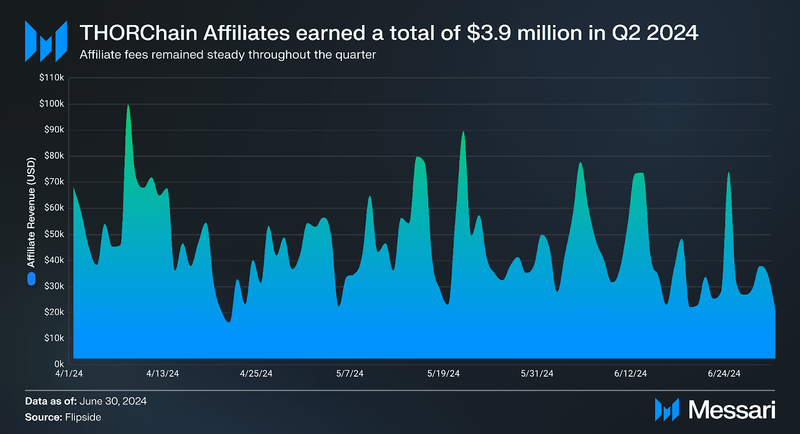

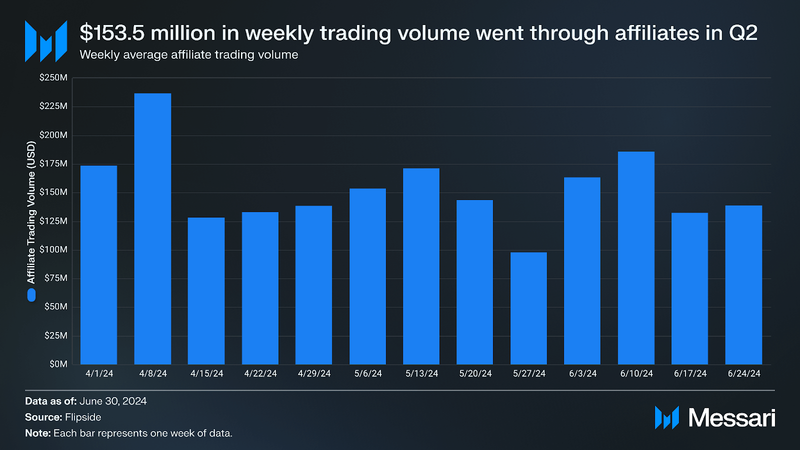

Affiliate RevenueTHORChain users typically interact with exchanges, wallets, or custodial services to broadcast transactions, rather than directly engaging with THORNodes. To incentivize these integrations, THORChain allows wallet developers to include an affiliate address and a custom fee rate. The protocol then collects these affiliate fees in a non-custodial and transparent manner for every transaction processed via a front end that includes an affiliate address.

Even amidst a broader market decline, THORChain’s affiliate fees have shown resilience. During Q2, the protocol generated an average of over $43,000 per day in affiliate revenue, reflecting the continued demand for seamless integrations and cross-chain services. This steady affiliate activity highlights the growing utility of THORChain’s ecosystem and the ongoing value it provides to third-party platforms.

In addition, a total of $1.9 billion of volume was swapped through affiliate platforms in Q2, with a weekly average of $153.5 million, further confirming the steady demand for THORChain swaps.

Volume

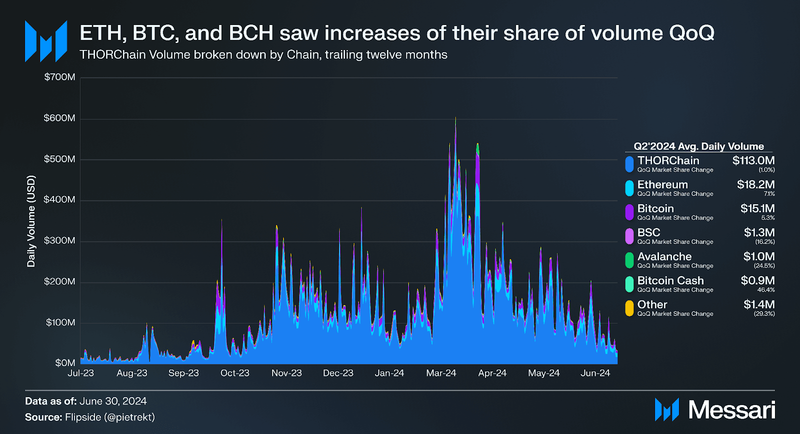

Avg daily trading volume fell 30.9% QoQ to $150.9 million. THOR continued to drive volume, with $113.0 million in Q2 average daily volume, down 1% QoQ. Among external assets, ETH and BTC constituted the majority of volume, with 22.1% of swapped volume appearing to concentrate primarily on Ethereum and Bitcoin. ETH and tokens on the Ethereum network remained the most swapped external assets averaging $18.2 million per day. Despite a decline of 26.1% in volume over the quarter, Ethereum’s market share of all swapped assets increased by 7.1%. Bitcoin also saw increases in market share of 5.3% despite declines in volume of 27.3%.

Swappers and Swaps

Swaps fell 23.2% QoQ from an average of 40,000 swaps per day in Q1 to 31,000 in Q2. However, swappers remained resilient, falling only 6.7% QoQ from an average of 1,700 swappers per day in Q1 to 1,600 swappers in Q2, illustrating the demand for cross-chain swaps.

Key DevelopmentsArchitecture Decision Record (ADR) Updates- ADR-013 adopted; Merged April 11, 2024; Savers will be forcibly ejected and have their liquidity returned when synth utilization grows beyond a certain threshold (currently 50% of the pool depth). Savers are ejected on a last-in-first-out basis.

- ADR-014 adopted; Merged April 4, 2024; Savers will not receive yield on pools where synth utilization is over 50% (above which POL currently deposits).

- ADR-015 adopted; Merged July 9, 2024; Binance Beacon Chain was phased out and THORChain departed. With this departure, all synths were burned and effectively converted to RUNE which got transferred to the Reserve. This ADR would refund 24,192.83 RUNE to 46 addresses which held synths that were burned.

- ADR-016 adopted; Merged July 8, 2024; Swaps conducted through frontends that charge affiliate fees will incur an additional fee, set at 12% of the affiliate fee, payable to the protocol. For instance, if an affiliate charges 20 basis points (bps), the additional protocol fee would be approximately 2 bps (12% of 20 bps), which will be directed to the protocol.

- ADR-017 adopted; Merged June 19, 2024; Burn 1bps (1/10000) of the system’s income.

- ADR-018 adopted; Merged July 16, 2024; 5% of System Income (prior to being split to Nodes and LPs) should be paid into a certain address (nominated and upgradable by ADRs) for the purpose of funding the Core Protocol Team, currently Nine Realms.

- New Frontend Integrations; Eight new frontend interfaces (wallets, exchanges, and various services) added support for THORChain swaps, including Li.Fi, Cake Wallet, Zengo Wallet. Fireblocks also added multi-party computation (MPC) for RUNE wallets.

- Trade Account / Assets; Launched June 10, 2024, trade Assets are a new asset type issued on THORChain, backed 1:1 by native assets and custodied within THORChain’s vaults but not in liquidity pools. Traders only pay THORChain’s $0.2 fees when swapping, avoiding L1 fees, making them efficient for arbitrage. By the end of Q2, trade asset TVL reached $14.1 million. More information on Trade Assets can be found here.

- Router Contract Whitelist Removal; After a Code4rena audit, THORChain removed the whitelist requirement for inbound swaps on EVM chains. Now, smart contracts and Smart Contract Wallets can directly interact with the Router, enhancing integration and SwapIn aggregation.

- Lending Affiliates; Frontend Interfaces (wallets, exchanges, and various services) can now charge an affiliate fee when creating a THORChain loan.

- Simulation Tests; A new testing framework has been developed to simulate activity on external chains and the state of THORChain itself. Since THORChain’s state is influenced by actions on external chains, this new approach will replace smoke tests with a more maintainable and extensible testing suite.

- Manual Observation Tooling; new tools were introduced for node operators to manually monitor transactions on external chains. This enhancement will streamline the process for node operators to issue refunds for transactions that were not observed.

- Per-Asset Dynamic Outbound Fees; Outbound fees, which are charged to cover the gas costs for moving liquidity off the network, have been updated. The multiplier for these outbound fees is now determined on a per-asset basis. This means that different assets will have varying outbound fee multipliers, better reflecting the actual costs of sending each asset onchain.

In Q2 2024, THORChain's market cap decreased by 52.2% to $1.4 billion, and its TVL dropped by 44.9% primarily due to RUNE's price volatility. Despite a decline in TVL and volume, the number of active swappers remained relatively stable in Q2. Additionally, six Architecture Decision Records (ADRs) were passed and implemented. Notable ADRs include the implementation of a mechanism to limit utilization beyond 50% and the introduction of funding for the Core Protocol Team, helping to strengthen the long-term development of THORChain.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.