and the distribution of digital products.

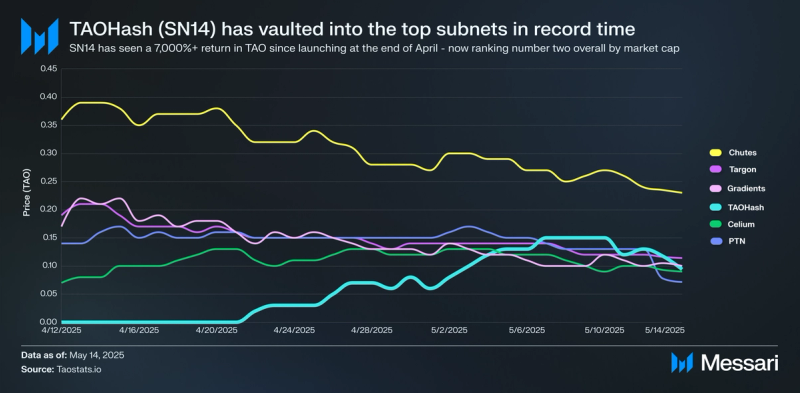

Subnet 14: TAO Hash

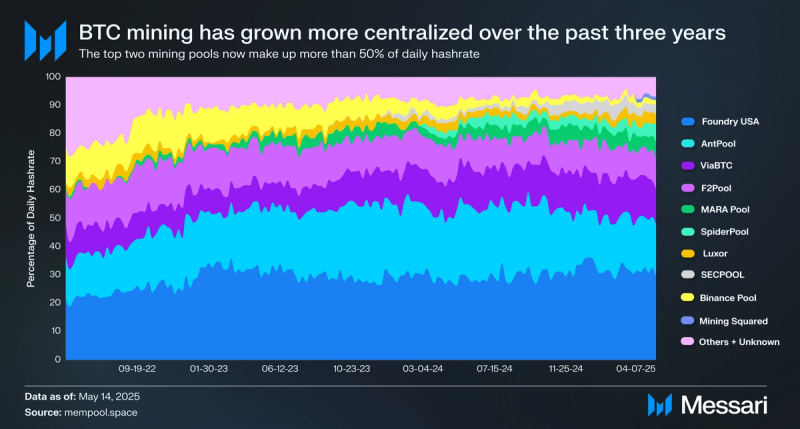

- Foundry USA and AntPool now supply over half of Bitcoin’s hashrate, concentrating power and raising risks around network attack vectors.

- TAO Hash, subnet 14, converts hashrate into a tradeable alpha token, amassing ~6 EH/s (≈0.7 % of global hash) in weeks with zero capex.

- Miners swap immediate BTC payouts for alpha, betting its price and fast, low‑fee payouts will outpace today’s BTC discount.

- Next steps for the subnet involve owning a solo‑pool, multi‑coin hash routing, and block‑space “priority fees”— it aims to cut costs and generate unique revenue streams for miners that feed back into alpha buy‑pressure.

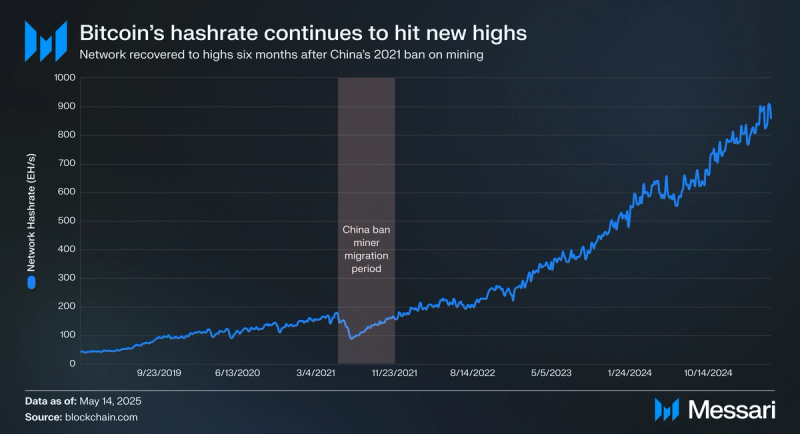

Bitcoin mining has evolved into an industry dominated by large-scale companies operating specialized data centers running tens of thousands of ASICs (application-specific integrated circuits). Post China’s 2021 ban of crypto trading and mining, much of the Bitcoin network’s hashrate relocated to North America. The US is now estimated to host the largest proportion of mining capacity globally. Within the US, states with abundant, cheap power and supportive grid programs have become mining hubs, namely Texas, Kentucky, Georgia and others. Large industrial miners cluster in areas with low-cost electricity and favorable policy, usually in regions with excess renewable energy or incentives for demand response programs.

The days of solo miners helping secure the network from their home computers are largely behind us. Today’s miners are often publicly listed companies or well-funded private firms with large facilities across energy-friendly states. Individual miners almost always join mining pools to smooth out their income. A mining pool coordinates the efforts of many miners worldwide, aggregating their hashpower so that blocks are found more frequently by the pool, and then shares the block rewards among participants. Over the past few years, the distribution of hashpower across pools has become more concentrated, with the top two pools - Foundry USA and AntPool - often providing more than 50% of the network’s hashrate.

The Herfindahl-Hirschman Index (HHI) is a commonly used metric to gauge market concentration. Based on hashrate data from mempool.space, the HHI for the mining industry has moved from around 1200 to 1700 in the past three years. This metric has hit as high as 2000, which indicates moderate to high concentration. The level of concentration has largely been driven by the rise of the Foundry USA pool. Digital Currency Group launched their mining subsidiary Foundry in 2019 to support North American dominance in crypto mining. Foundry capitalized on the previously mentioned vacuum in hashrate around the 2021 China ban by positioning itself as a well-capitalized institutional partner for migrating miners. Its access to capital, influence, financing, and network through DCG has led to the Foundry pool supplying around 30-34% of the network’s hashrate on any given day.

Miner Profitability & IncentivesBasic StatsBitcoin miners’ revenue consists of the block subsidy (the number of newly minted tokens given to the miner who successfully adds a new block) and transaction fees. Outside of a few periods (like Runes, Ordinals, and BRC-20s in 2023/2024) where the network was fairly congested with high transaction fees, 90%+ of miner revenue is usually coming from the block subsidy. After the halving event in April 2024, the current block subsidy sits at 3.125 BTC.

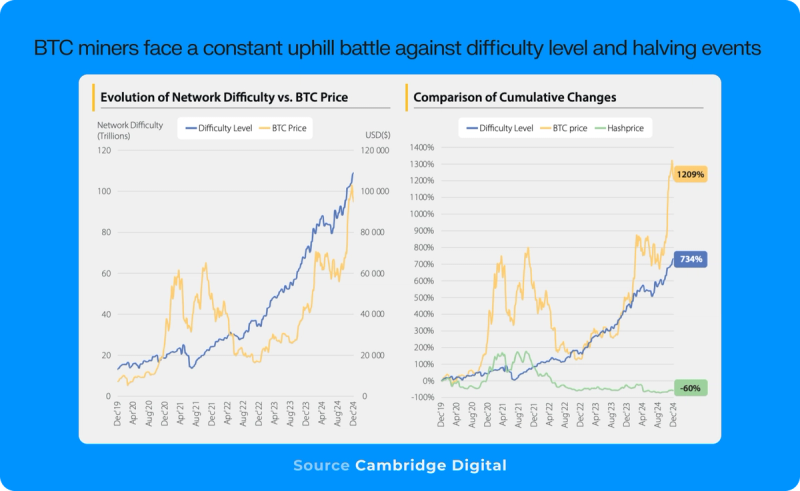

The above charts from Cambridge are perhaps the most illustrative examples of how miners need to fight tooth and nail for economies of scale. Hashprice (in dollar terms) is the amount a miner is paid per unit of computational power per day (so $ per petahash per day). As the network hashrate grows - because new miners join the network or old miners upgrade to more efficient ASICs - the difficulty level also increases. Difficulty isn’t raw “power”; it’s a target number set by the network that dictates how many SHA‑256 hash attempts miners will need, on average, to find a block, so a higher difficulty means more guesses before hitting the winning hash. Every halving event effectively cuts the hashprice in half. Therefore, miners need some combination of (i) increasing BTC price, or (ii) increasing transaction fees to maintain similar levels of revenue. Because industrial miners often maintain longer-term real estate and power contracts, network difficulty is not super responsive to BTC price declines. Thus miners often face challenging periods where the difficulty level is either steady or increasing while BTC is declining (like in 2022). These realities incentivize chasing economies of scale - larger miners can negotiate better energy, rack-space, and machine prices, as well as spread operational expenses over more hashpower.

That being said, Cambridge has noted in its recent report that miner margins have expanded into the end of 2024 with BTC’s move to all-time highs. Based on miner surveys, electricity costs typically make up around 80% of expenses, while hardware depreciation, maintenance, SG&A may make up the other 20%. It is tough to give an average margin metric because miners vary greatly in the efficiency of their average machine (in Joules per petahash) as well as the cost of the energy they source ($ per MWh). As of June 30, 2024, the median all-in cost among surveyed miners was around $48,333. This cost of production may be offset by various factors like curtailment credits.

In any case, miners have to relentlessly find ways to cut costs and increase the efficiency of their hardware in order to survive periods of BTC declines.

Why Pools ExistIn the days before industrial Bitcoin mining, solo mining was a more viable venture. Bitcoin’s mining lottery implies a small miner with sub 0.1% of network hashrate would statistically find only 1 in every 1000 blocks, or around one block every ~7 days. But due to luck variance, the miner may go weeks or even months without a block reward. This is impractical for paying energy costs and other expenses involved in mining. Mining pools solve this problem by grouping miners together so blocks are found more regularly, with the rewards distributed proportionally based on hashrate supplied to the pool. They reduce income variance which allows operators to scale.

There are a few common reward distribution methods today:

- Pay-Per-Share: Pools pay miners a fixed amount for each share of work they submit, regardless of whether the pool finds a block in that period. The pool takes on the variance in the lottery and pays out proportionally according to miner hashrate. In order to handle such variance, the pool has to maintain a decent buffer of BTC and typically charges a 2-4% fee.

- Pay-Per-Last-N-Shares: Pools only pay out when a block is found, and the reward is distributed to miners that contributed during the period right before block discovery (to mitigate miners exploiting hopping between pools). Miners effectively share the luck variance (instead of getting rid of it altogether), so these pools typically charge much lower fees (often sub 1%).

- Full-Pay-Per-Share: This is an improvement over the PPS model in which the pool also distributes expected transaction fees in addition to the block subsidy. Pools have to estimate fees and distribute proportionally. This has become the most popular reward scheme among some of the top pools like AntPool and Foundry USA. The top pools usually charge around 2.5% (with tiering) in this structure.

Pools ultimately clip fees in exchange for smoothing out miner income variability.

Concentration RisksPool ConcentrationWhile Foundry USA and AntPool at times control over 50% of the network hashrate, this obviously does not mean just a few entities control all of that hashpower. Each pool has many independent miners, so even the HHI mentioned before is not a perfect representation of concentration. However, there are still theoretical risks involved. If a single pool or colluding group exceeds 50%, they could technically execute a 51% attack - allowing them to double-spend or censor transactions through a controlling majority of blocks. Foundry being US-based and AntPool being China-based (while operating global servers with miners in different jurisdictions, including the US) means that both could theoretically be influenced by respective government regulations, pressures, and actions. These risks are of course mitigated by the fact that miners can and often do switch pools. But many Bitcoiners have complained that the censorship-resistant property of the network has already been compromised with such mining pool concentration.

Mining Company ConsolidationWhile pools grow ever larger, individual mining companies are also expanding and absorbing competitors. The trend toward publicly traded mega-miners and mergers suggests a future where a handful of corporations might account for a substantial portion of mining. Marathon, Riot, and CleanSpark alone account for more than 10% of daily hashrate. With the recent halving in April 2024, these companies are incentivized to get the newest ASICs and as much cheap power as possible to lower breakeven costs; most of the time, buying existing capacity is faster and cheaper than building from scratch. This is evident from recent acquisition attempts (like Riot trying to buy out Bitfarms last year, and Hut 8’s all-stock merger with US Bitcoin Corp in 2023). Large miners usually cooperate on policy through industry groups like the Bitcoin Mining Council, which adds another vector in which the network might be swayed or influenced.

Hardware Manufacturing CentralizationPerhaps a more insidious angle of centralization is that the ASIC mining market is dominated by just a few companies. Bitmain’s Antminer ASICs, by some estimates, represent 70-80% of the ASIC market. The “Antbleed” controversy of 2017 involved a vulnerability in Bitmain ASIC firmware that could have potentially been used to remotely shut off the devices. This vulnerability was quickly patched, but the possibility of a malicious vulnerability being snuck into chip firmware (perhaps by government coercion) still exists. Security issues like these are unequivocally exacerbated with this level of centralization on the hardware side. But the level of competition in the industry demands using the most energy-efficient chips, and Bitmain has maintained an overwhelming edge.

Geographic ConcentrationLastly, mining within the US is regionally concentrated because of attractive energy costs in certain states like Texas. Certain local events (like extreme weather events in Texas causing miners to turn off) or even policy changes can have an outsized impact on the network. While Bitcoin ultimately proved quite resilient, the China ban in 2021 was a massive exogenous shock. It’s unlikely that we would see a policy shift of the same magnitude in the US or in individual states, but geographic concentration still represents (temporary) risks to the network’s security.

Enter TAO Hash - Subnet 14The unit economics of mining have continued to push hashrate into the top mining pools, worsening current concentration trends. How might the network buck this trend and keep itself more censorship-resistant long into the future? This is where subnet 14, TAO Hash comes in.

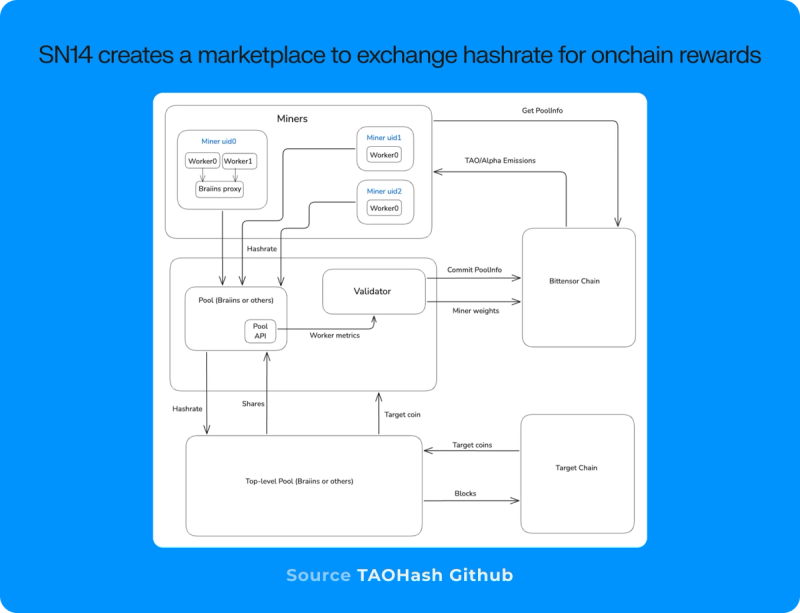

We’ve covered in previous pieces how Bittensor subnets, like Chutes (64) and Gradients (56), incentivize miners to perform different computational tasks like training, fine-tuning, and inference. Now that each subnet has their own alpha token, the market essentially decides where daily TAO emissions flow based on the performance of those tokens. The higher the alpha token price relative to other subnet alpha tokens, the more TAO emissions are directed to the miners, stakers, and owners of that subnet. Miners perform some computational tasks, validators verify miner output for quality, and owners maintain the criteria by which each is evaluated (scoring mechanisms). Miners get paid 41% of the TAO emissions directed to the subnet (in the form of alpha tokens), as do validators and their stakers. The remaining 18% of emissions are paid out to owners.

The premise of TAO Hash in this framework is fairly simple. Miners direct their hashrate to validators proportionally based on validators’ staked alpha tokens (SN14); the more SN14 a validator stakes, the more hashrate they receive from miners. Validators can choose to either use this hashrate to solo-mine, mine in a pool (like the ones we mentioned above), or sell the hashrate to a marketplace like NiceHash. Typically, validators direct the hashrate to the Braiins mining pool as it has low fees and an easy-to-use setup. The Braiins mining pool is a smaller pool that provides less than 1% of the network’s hashrate; the subnet is currently working to remove this minor dependency on Braiins going forward.

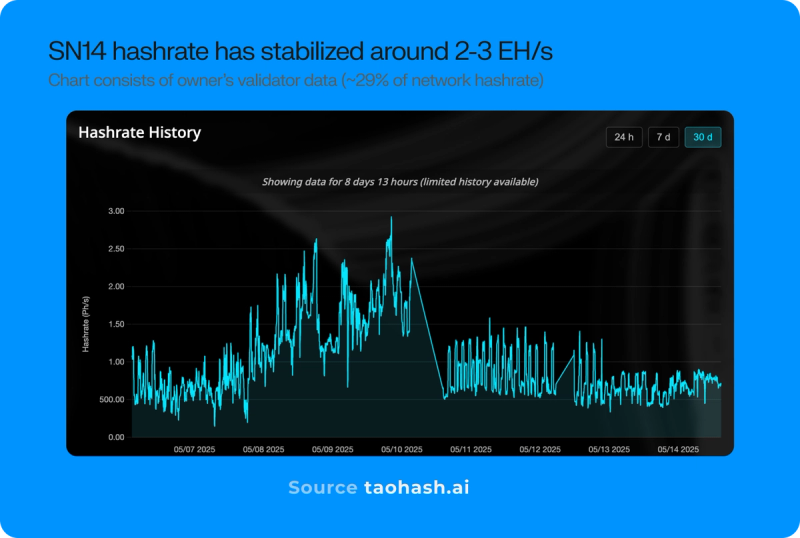

Validators are thus usually paid in BTC. However, because miners must allocate their hashrate to validators based on validators’ stake-weight in SN14, validators have a strong incentive to use their BTC earnings to buy back SN14, in order to get the same proportion of hashrate going forward. This incentive feedback loop has led to the subnet supplying more than 6-7 EH/s (at peak) to the network within a mere two weeks.

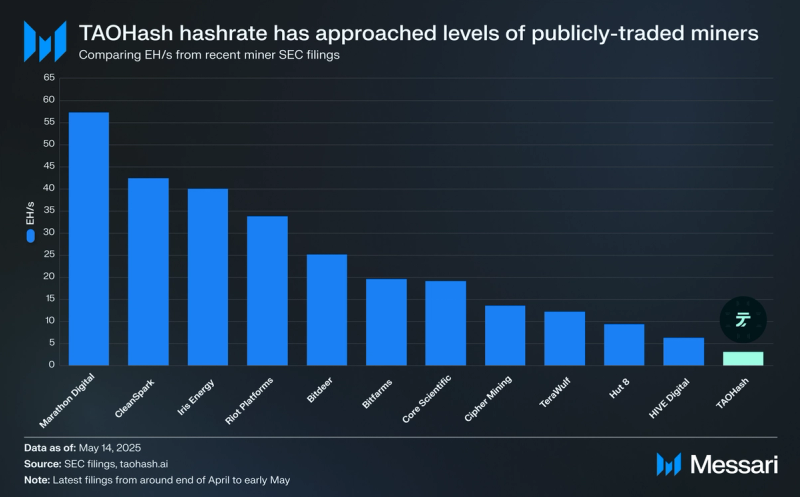

To put this in perspective, some of the large, publicly traded Bitcoin miners supply anywhere from five to fifty EH/s in hashrate to the network. With current network-wide hashrate around 900EH/s, TAO Hash’s contributions (around 2.5 EH/s) are now around 0.28% of the entire network. Most of these companies have taken years to acquire the equipment, hardware, human capital, land, and operational setups to accumulate this much hashpower. The fact that TAO Hash could achieve an almost equivalent feat in such a short time is a testament to market-driven incentives on Bittensor. Incentives can rapidly bootstrap and coordinate computational resources to direct them to wherever the market deems worthy.

TAO Hash is effectively acting as an alternative marketplace for hashrate. Miners have another venue and medium for pricing hashrate through SN14. Think of SN14 as a perpetual futures contract on hashrate: miners “sell” their compute power today and receive SN14, while validators must keep buying that same alpha with the BTC they earn later to maintain stake-weight. The token’s price therefore reflects the market’s forward view of how much BTC will be recycled into SN14 (or price increases from market demand). Instead of settling on a fixed date like a traditional futures contract, the position is rolled forward indefinitely because validators’ continuous SN14 buy‑backs act like the “funding payments” that keep the contract open. This mechanism effectively turns physical hashrate and future BTC earnings into a tradable, real‑time financial asset.

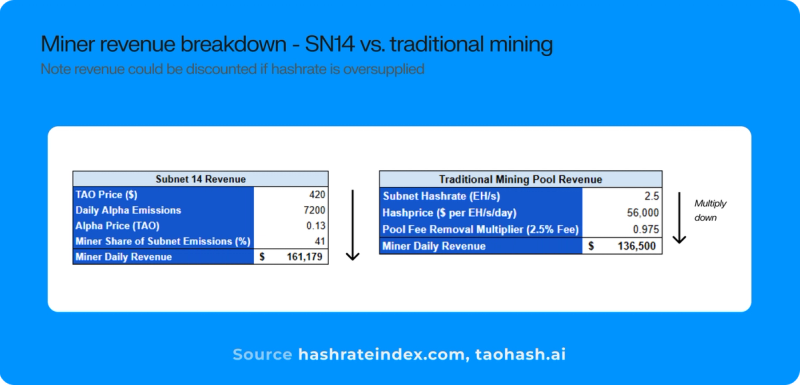

Let’s illustrate with some numbers. 7,200 alpha tokens are emitted to subnet participants each day. Miners on the subnet are paid for their ~2.5 EH/s with 41% of the emissions directed to the subnet. At current TAO and SN14 prices (~$420, ~$.13), this is around $161,000 per day. If instead the miner went directly to a mining pool, they would make around 2.5 * ~56,000 (hashrate * current hashprice) - 2.5% pool fees or around $136,000. So miners supplying hashrate on the subnet right now are receiving a slight premium to traditional mining. When hashrate on the subnet reached 6+ EH/s at similar SN14 prices, miners were receiving a fairly hefty discount to traditional mining. With the perpetual analogy, the “funding rate” (≈ $161 k α value vs. $136 k pool payout) is +18 % to hashprice, so miners are net paid to hold the perp. When subnet hash‑rate doubled to 6 EH/s, "funding" flipped negative and miners who stayed were effectively paying to keep the position open, hoping future α appreciation would compensate, exactly how traders decide whether to stay long a perp with a rich positive funding cost.

This is an illustrative example where we treated all of the miners on the network as one collective unit. In practice, the hashrate supplied is not constant, and a miner’s goal is to tactically supply hashrate when competition is low or perhaps when they think the alpha token is about to appreciate more. There are thus speculative and game theoretic components that would drive an individual miner to supply hashrate at a technically below-market price on the subnet.

After hitting a peak of 6 EH/s a few days ago (which could be considered an over-contribution of hashrate at current prices), hashrate has stabilized closer to an equilibrium hashrate around 2-3 EH/s.

Vision and Future GoalsThe overarching goal as an alternative venue is to counterbalance the rising concentration of mining pools. Because the subnet has spent effectively nothing on capex to “acquire” this hashpower (nor significant ongoing operational expenses), it can afford to eventually undercut mining pool fees and thus be a more profitable venue for individual miners. While most validators are currently using the Braiins mining pool, the subnet owner will eventually set up its own pool that will offer cheaper FPPS fees, faster payouts, and non-KYC. Core developer, Cameron Fairchild, notes that this solo pool will also target some interesting monetization strategies like transaction acceleration.

Transaction acceleration is the pay‑for‑priority lane pioneered by pools like ViaBTC: a user submits a stuck or zero‑fee TX plus an out‑of‑band tip, and the pool bumps its apparent fee so that transaction jumps to the very top of the next block template. Confirmation is “guaranteed” if the pool wins the block. For subnet 14 this is low‑hanging fruit. Once the subnet runs a solo‑pool, they can bolt on an API that sells a few high‑priority slots per block, collect the tips in BTC, and recycle that extra income straight into alpha buy‑backs. BTC earned through acceleration thus increases validator margins without raising explicit pool fees and creates constant buy‑pressure on the alpha token.

The team also aims to plug in other Proof of Work tokens (like KAS, LTC, and XMR) into this framework. Fairchild has noted how this could enhance and diversify revenue streams as TAO Hash grows:

“I see us mining a solo block within the month. Getting the TAO Hash name as a block producer on the Bitcoin chain. I think expanding to other PoW chains is especially important, given the revenue streams they'll bring (multipools, as mentioned). Also the possibility of appreciation that protocols like Kaspa are expected to see. I see the Alpha becoming a medium of exchange for all these assets, and a better alternative to FPPS, that's much more decentralized than the incumbent centralized mining pools.”An example multipool is MoneroOcean, which allows miners to point their rigs for other altcoins (like LTC) and still get paid out in XMR. This may be attractive for miners who value privacy and effectively untraceable holdings. Allowing PoW altcoins into the subnet framework would allow for instantly swapping unwanted altcoins for SN14 in a similar fashion. The subnet could also potentially take a small fee of all the volume within the newly created liquidity pools.

Role in the Bittensor Ecosystem

Some users in the community have complained about TAO Hash’s rapid ascent as it has perhaps vacuumed emissions away from other subnets. Isn’t Bittensor supposed to be about creating decentralized machine intelligence? If that is the case, what is the ecosystem doing mining Bitcoin?

But the better framing is that Bittensor is a flexible incentivization network. Its mechanisms can be used for file storage, Bitcoin mining, AI, and whatever other computational task the market says is valuable. If speculative forces push an oversupply of work towards one task, corrective forces will unavoidably nudge it back in the other direction as the market better understands the mispricing. There will likely be many more projects that launch a subnet that current subnet holders will say is unworthy of the network’s emissions going forward. The market will ultimately separate the wheat from the chaff. The great part about this permissionless system is that users, miners, and validators can all have a say in that price discovery process.

Looking AheadTAO Hash is one of many experiments making waves in the ecosystem. Chutes continues to attract thousands of users with its free endpoints for inference. Subnet 5 (formerly OpenKaito) recently climbed the ranks as it transferred ownership to Latent Holdings. Bittensor is even branching into more DeFi applications with Sturdy’s Subnet 10, which functions as an AI-powered yield aggregator. We’ll continue tracking standout subnets in future coverage.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.