and the distribution of digital products.

State of Sei Q4 2024

- Sei Labs announced Giga, an in-development upgrade that plans to include a new EVM client that offers a 50x improvement in throughput over other EVM-compatible networks.

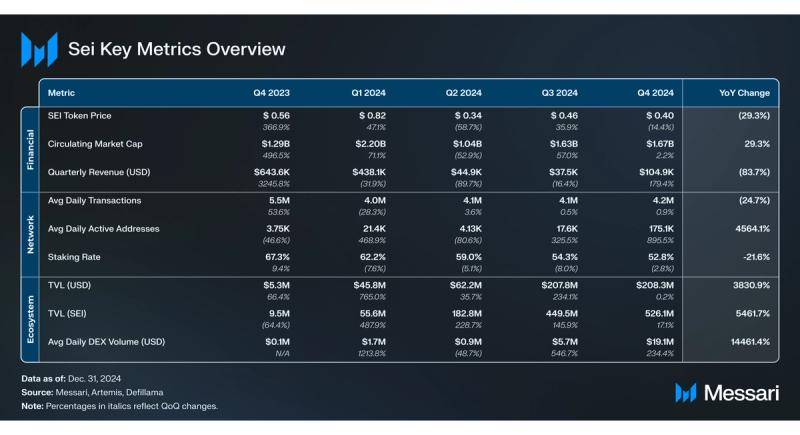

- Average daily DEX volume (USD) increased 234.4% QoQ to $19.1M. Daily volume on DragonSwap grew 815.9% QoQ to $10.1 million, while Jellyverse grew 554.9% QoQ to $2.2 million.

- TVL (USD) increased 3,830.9% YoY from $5.3 million to $208.3 million. TVL (SEI) rose 17.1% to 526.1 million in Q4’24, as the total amount of assets being utilized in DeFi grew for a fourth straight quarter.

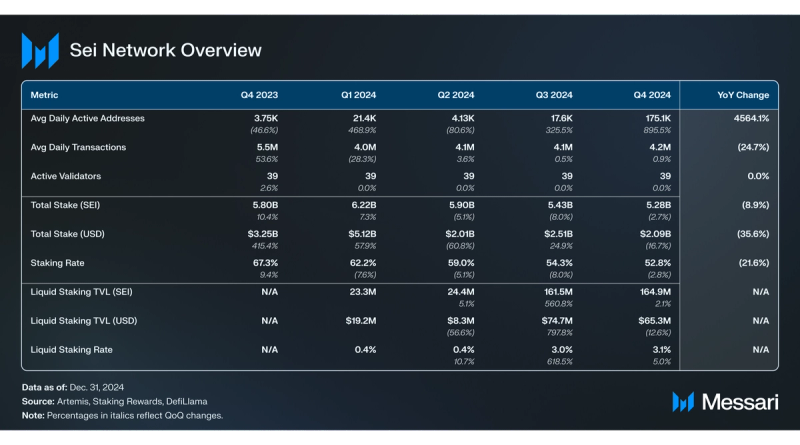

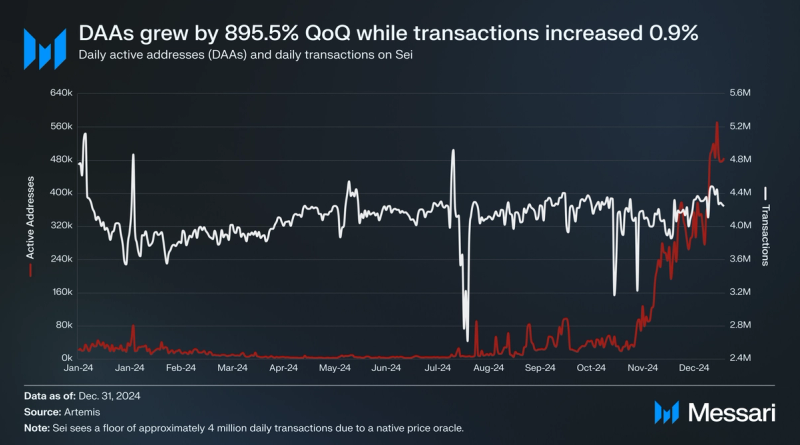

- Average monthly transactions in the gaming sector increased 1,677.3% QoQ to 2.9 million, outpacing all other categories. Average daily active addresses (DAAs) increased 895.5% QoQ to 175,100 due to a major uptrend that began in mid-November.

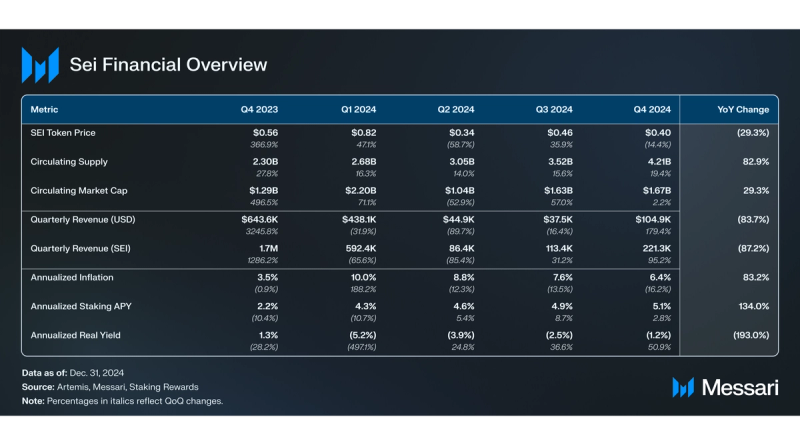

- SEI’s price decreased 14.4% QoQ to $0.40, with its market cap rank falling from 53rd to 66th. However, quarterly revenue (USD) increased 179.4% QoQ to $104,900.

Sei (SEI) is an integrated, general-purpose Layer-1 network that aims to be the fastest network for exchanging digital assets. It is compatible with Cosmos’ Inter-Blockchain Communication (IBC) protocol and Sei V1 was based on the Cosmos SDK and Tendermint Core protocol.

Sei launched in August 2023 alongside SEI, its native token that was airdropped to early users. The SEI token serves functions related to (i) transaction fees, (ii) staking, (iii) rewards, and (iv) governance.

The network's built-in features, such as Twin-Turbo Consensus and transaction parallelization, reduce latency and increase transaction throughput. The Sei V2 upgrade introduced three major upgrades to the network in May 2024; (i) compatibility with Ethereum Virtual Machine (EVM) smart contracts written in Solidity, (ii) optimistic parallelization, and (iii) a re-architecture of the network’s storage interface with SeiDB . In the future, Sei plans to launch Giga, an upgrade that aims to include a new EVM client that offers a 50x improvement in throughput. For a full primer on Sei, refer to our Initiation of Coverage report.

Website / X / Discord / Telegram

Key Metrics Ecosystem Analysis

Ecosystem Analysis

Since the launch of Sei V2 and its introduction of EVM compatibility on May 27, 2024, the categories with the highest transaction levels have shifted. The shift has been from the NFT category, which led activity in H1’24, to DeFi activity in Q3’24, and most recently, to gaming activity in Q4’24. Average monthly transactions in the gaming sector were up 1,677.3% QoQ to 2.9 million, surpassing all other categories. Notably, in December 2024, Galxe launched the Arcade, a two-month campaign focused on onchain gaming tasks. Gaming ecosystem highlights included projects like Cat VS Monsters, Archer Hunter, and Dragon Slither, which helped drive average daily active addresses (DAAs) up 895.5% QoQ to 175,100.

Copilot Insights: What does gaming activity look like within the Sei ecosystem?DeFi

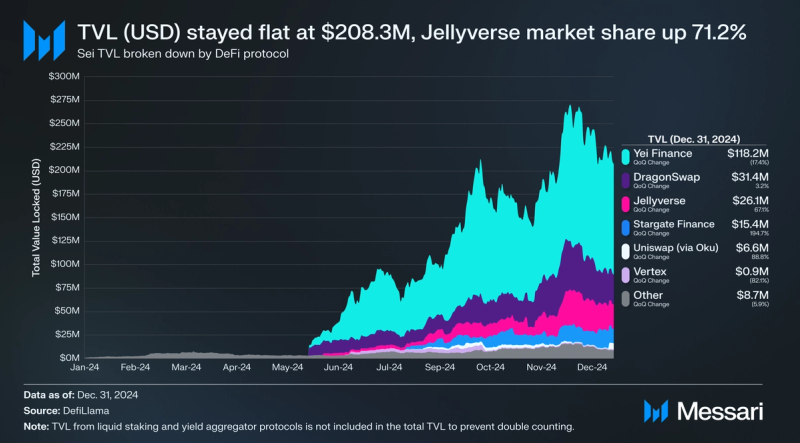

Sei’s TVL (USD) stayed flat in Q4 2024, increasing 0.2% QoQ to $208.3 million. However, despite SEI’s price falling 14.4% QoQ to $0.40, TVL (SEI) rose 17.1% to 526.1 million. This indicates the total amount of assets being utilized in DeFi continued to grow for the fourth straight quarter. DeFi activity on Sei has been steadily growing since the launch of Sei V2. TVL (USD) has increased 3,830.9% YoY, up from $5.3 million at the start of 2024.

Before the launch of Sei V2, Sei had a DeFi Diversity score of 1 (i.e., the number of protocols making up 90% of a network’s TVL). Sei’s DeFi Diversity score increased 33.3% in Q4’24 from 3 to 4, indicating continued diversification as the ecosystem matures. Notably, Pit Finance, a Sei-native yield aggregator, launched in September 2024. Pit Finance offers asset looping on Yei Finance and ended the quarter with a TVL of $12.3 million.

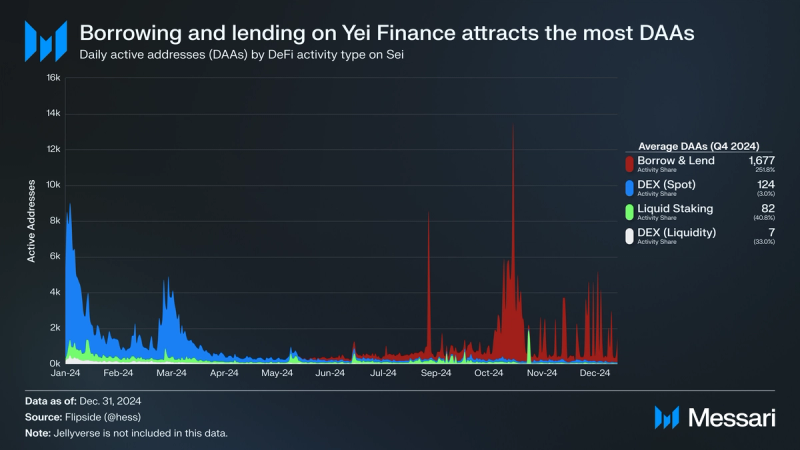

Borrowing & Lending

The launch of Sei V2 also led to a change in the makeup of DeFi activity. Borrow and lend activity on Yei Finance continued to grow in Q4’24, making up 88.7% of DeFi daily active addresses (DAAs) on Sei as the protocol continued its points program that began on June 17, 2024. On top of token incentives offered by Yei, OKX Wallet partnered with Sei Foundation to offer SEI token incentives for lenders from Sept. 4 until Dec. 31, 2024. These programs incentivized activity throughout Q4 as Yei ended the quarter with a TVL of $118.2 million, down 17.4% QoQ for a total share of 57% of Sei’s TVL.

Various stablecoins and liquid staked tokens (sETH, ssETH, STONE, frxETH, fastUSD, syUSD, redETH, etc.) launched on Sei in H2’24. Yei initially featured SEI, iSEI, USDT, and USDC for borrowing and lending, but has since expanded support for WETH, WBTC, frxETH, FRAX, sFRAX, sfrxFRAX, and fastUSD. Due to the aforementioned points program, incentives, and asset offerings, Yei continues to be one of the most used protocols on Sei. The project experienced the following developments in Q4’24:

- In December 2024, Yei raised $2 million in a seed round led by Manifold and communicated its vision to evolve the protocol into an omnichain money market.

- In December 2024, Yei experienced its first-ever vulnerability, leading to frozen withdrawals as the WBTC pool was exploited and $2.4 million in USDC was stolen, bridged to Arbitrum, and swapped to ETH. A post-mortem detailed the incident and stated that “losses will be entirely compensated from Yei Finance’s revenue reserves.”

- In October 2024, Yei introduced cross-chain bridging powered by Stargate and Circle CCTP. This product introduced another avenue for revenue generation as Yei charges a 0.05% fee on bridge transactions.

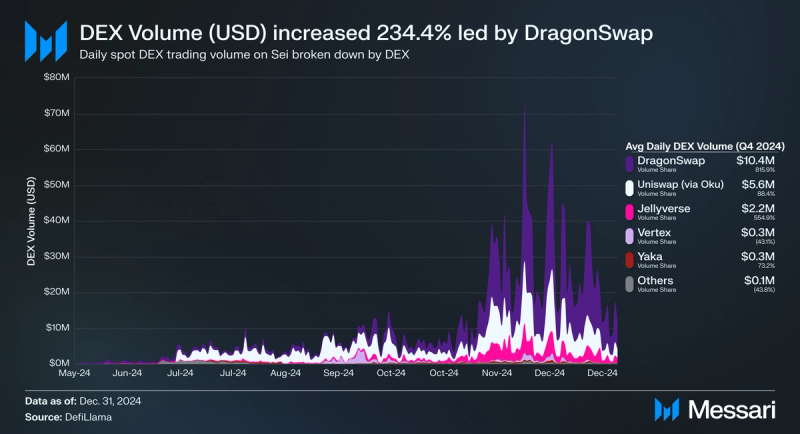

Average daily DEX volume (USD) has seen tremendous growth, up 234.4% QoQ to $19.1M. In Q4’24, DEX volumes were led by DragonSwap once again, though Jellyverse experienced outsized growth:

- DragonSwap, Sei’s most active spot DEX, continued its points program that began on June 25, 2024. DragonSwap reached $1 billion in all-time trading volume in December 2024, averaging $10.1 million daily in Q4’24, which was an increase of 815.9% QoQ. The protocol ended the year with a TVL of $31.4 million, up 3.2% QoQ for a total share of 15.1% of Sei’s TVL.

- In November 2024, DragonSwap introduced V2 incentives, aiming to incentivize concentrated liquidity on the protocol.

- In October 2024, DragonSwap introduced permissionless farms, allowing any project to launch and incentivize their own liquidity pools.

- Jellyverse, a DEX that serves as Balancer’s friendly fork on Sei, averaged $2.2 million in daily trading volume in Q4’24, up 554.9% QoQ. The protocol ended the year with a TVL of $26.1 million, up 67.1% QoQ for a total share of 12.6% of Sei’s TVL. Notably, Jellyverse’s total market share of TVL increased 71.2% QoQ.

The following ecosystem developments occurred in Q4 2024:

- In December 2024, Magic Eden announced support for NFT trading on Sei. This was followed by a trading competition that awarded 250,000 SEI to traders with the most volume.

- In December 2024, Sei announced that WBTC is live on Sei via LayerZero’s Omnichain Fungible Token (OFT) token standard.

- In November 2024, a governance proposal was executed to reduce Sei’s governance proposal voting period duration from five days to three.

- In November 2024, Sei announced the network was integrated with Dynamic, a software development kit that supports multichain wallet management.

- In October 2024, Rounds 3 and 4 of the $10 million Sei Creator Fund were held in partnership with Gitcoin. The program was first announced in April, aiming to empower creators and builders across NFTs and social (content creation, in-real-life (IRL) events, etc.) Each round pools donations from the community which are then matched by Sei Foundation.

- Round 3: Spanning Oct. 3 to Oct. 17, 2024, this round featured a $250,000 matching pool denominated in SEI. In total, the round saw 2,750 donors across 73 projects, raising $41,400 from the community.

- Round 4: Spanning Oct. 3 to Oct. 17, 2024, this round featured a $250,000 matching pool denominated in SEI. In total, the round saw 3,840 donors across 198 projects, raising $61,400 from the community.

- In October 2024, Moonpay introduced support for onchain payments on Sei.

SEI Token

SEI Token

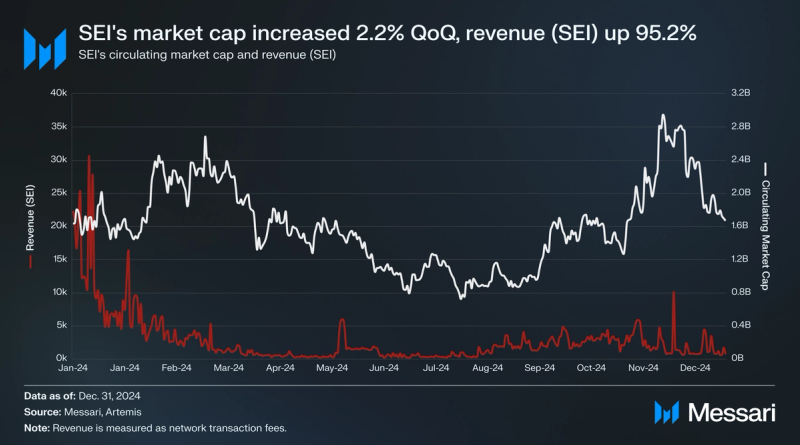

SEI’s price decreased 14.4% to $0.40 in Q4 2024. The token’s price surged in November 2024, up 73.2% MoM, reaching a high of $0.71 on Dec. 6, 2024, before ultimately retracing the quarter’s gains. Meanwhile, Sei’s quarterly revenue (USD) decreased 179.4% QoQ to $104,900, while quarterly revenue (SEI) decreased by 95.2% QoQ to 221,300.

Due to a circulating supply increase of 19.4% QoQ to 4.21 billion, SEI’s circulating market cap actually increased 2.2% QoQ to $1.7 billion, though its circulating market cap rank fell from 53rd to 66th, indicating underperformance of the broader market. Notably, Bitstamp listed SEI in December 2024.

Copilot Insights: How is the SEI token performing in 2025?Token Supply

Annualized inflation decreased 16.2% QoQ from 7.6% to 6.4%. Combined with a 2.7% QoQ decrease in the amount of staked SEI, annualized staking APY increased 2.8% from 4.9% to 5.1%, resulting in an annualized real yield of -2.8% at the end of Q4.

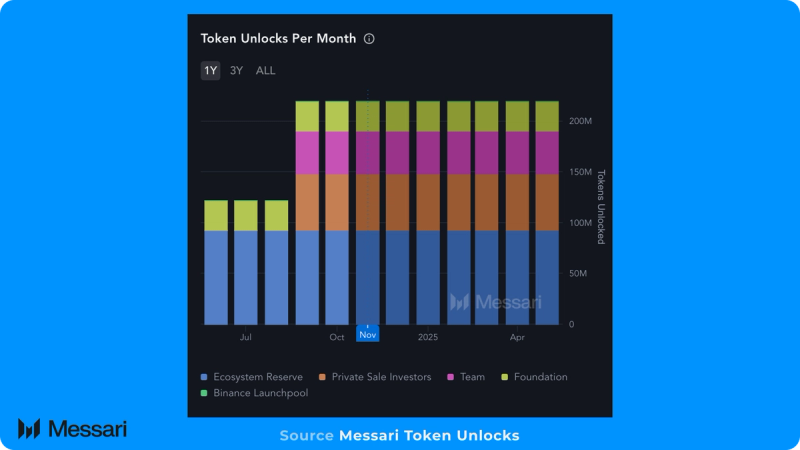

SEI’s circulating supply increased 19.4% QoQ to 4.21 billion due to a mix of token unlocks and staking rewards. In Q4’24, 659 million SEI vested, as investor and project team allocations are vesting at a rate of 97.8 million per month. Ultimately, SEI tokens will continue to vest until Aug. 14, 2033, with another 659 million scheduled to vest in Q1’25.

Network Analysis Usage

Usage

Average daily active addresses (DAAs) increased 895.5% QoQ to 175,100, while daily transactions increased 0.9% to 4.2 million in Q4 2024. A major uptrend in DAAs began in mid-November. Growth was sustained through the end of the quarter, as DAAs increased 201.2% in November and another 214% in December.

Notably, Sei sees a floor of approximately 4 million daily transactions due to a native price oracle. All validators are required to participate as oracles by sending vote transactions and providing updated price data in every other block.

StakingActive validators remained unchanged in Q4’24 at 39. The total stake (SEI) decreased by 2.7% QoQ to 5.28 billion. Combined with the aforementioned decrease in SEI’s price, the total stake (USD) decreased 16.7% QoQ to $2.09 billion. Notably, this metric includes unvested, locked SEI tokens that can be staked to earn liquid rewards.

Liquid Staking

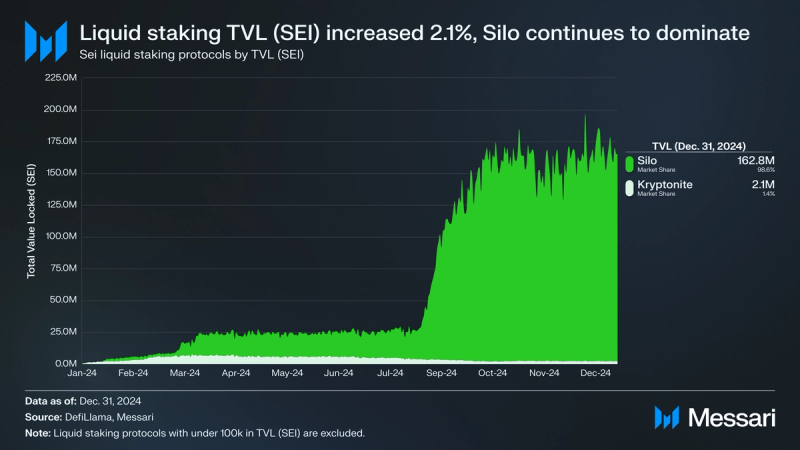

Liquid staking protocols Silo and Kryptonite launched in January 2024. These protocols allow users to stake SEI in return for their liquid staking tokens (Silo’s iSEI and Kryptonite’s stSEI). Both tokens can be redeemed to receive the underlying SEI after a 21-day unbonding period.

By the end of Q4’24, 164.9 million SEI had been liquid staked, a 2.1% QoQ increase from the 161.5 million SEI that had been liquid staked by the end of Q3’24. Compared to the total stake (SEI), Sei’s liquid staking rate increased for the fourth straight quarter, up from 2.98% to 3.12%. Liquid staking TVL (SEI) on Silo increased by 2.3% QoQ to 162.8 million, while Kryptonite decreased 7.1% to 2.1 million. Silo continues to dominate Sei’s liquid staking sector and has established a clear monopoly.

Notably, in November 2024, Silo introduced the SiloSearcher Library, an open-source tool for building MEV strategy bots. While MEV was possible prior to this, in the month after launch, approximately $125,000 was generated by MEV searchers. Silo’s roadmap includes an expansion of support for MEV opportunities, including cross-chain MEV swaps.

Technical DevelopmentsIn December 2024, Sei Labs announced Giga, an in-development upgrade that plans to include a new EVM client that offers a 50x improvement in throughput over other EVM-compatible networks. Specifically, Giga aims to reach a maximum capacity of five gigagas per second, which is a measure of a blockchain’s computational capacity rather than the commonly used measure of transactions per second (TPS). However, the anticipated maximum TPS post-Giga is approximately 250,000.

In November 2024, the v6.0.0 upgrade was implemented, introducing a dynamic base fee akin to Ethereum’s EIP-1559 which adjusts gas paid by users based on the amount of gas used in each block. This upgrade drastically reduced transaction fees paid by users on Sei.

Additionally, in November 2024, Sei Labs and Sei Foundation announced the Sei Research Initiative. The initiative aims to “reimagine the EVM across all layers—storage, consensus, and execution” through open-source research contributions from Sei Labs, Sei Foundation, and the broader industry. Several research reports were published in Q4 2024:

- In December 2024, a report on the amount of Ethereum Virtual Machine (EVM) transactions that can be parallelized was published.

- In November 2024, a report on the EVM’s storage layer was published.

In Q4 2024, average monthly transactions in the gaming sector were up 1,677.3% QoQ to 2.9 million, outpacing all other categories. Within DeFi, average daily DEX volume (USD) increased 234.4% QoQ to $19.1M. Daily volumes on DragonSwap grew 815.9% QoQ to $10.1 million, while Jellyverse grew 554.9% QoQ to $2.2 million.

TVL (USD) remained flat at $208.3 million but ended 2024 with 3,830.9% YoY growth. Yei Finance and DragonSwap continued to dominate, commanding 66.3% and 14.1% of Sei’s TVL, respectively. Financially, Sei’s quarterly revenue (USD) rebounded 179.4% QoQ to $104,900 as average daily active addresses (DAAs) rose 895.5% to 175,100. However, the price of SEI decreased 14.4% QoQ to $0.40, with its market cap rank falling from 53rd to 66th.

Looking forward, users can anticipate Giga, an in-development upgrade that plans to include a new EVM client that offers a 50x improvement in throughput. This and other technical developments in 2025 will be led by the Sei Research Initiative, which aims to “reimagine the EVM across all layers—storage, consensus, and execution” through open-source research contributions from Sei Labs, Sei Foundation, and the broader industry.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.