and the distribution of digital products.

State of Polygon Q4 2024

- Polygon launched the Agglayer v0.2 testnet in December 2024, setting the stage for a mainnet release in February 2025 and integrations with Okto and Agora.

- Polymarket facilitated nearly $3 billion in U.S. election bets and ended Q4 2024 with 347,000 monthly active users, reinforcing its status as a leading decentralized predictions platform.

- Polygon PoS DeFi TVL ended Q4 at $871.5 million, with Aave as the largest protocol, increasing its TVL by 18.9% QoQ.

- The migration from MATIC to POL progressed significantly, with 88.1% of the supply transitioned, resulting in a 31% QoQ increase in POL’s market capitalization to $3.8 billion.

- Polygon maintained robust developer growth, ranking eighth in the crypto ecosystem with 1,240 developers, and expanded its institutional partnerships with major players like HSBC and BlackRock.

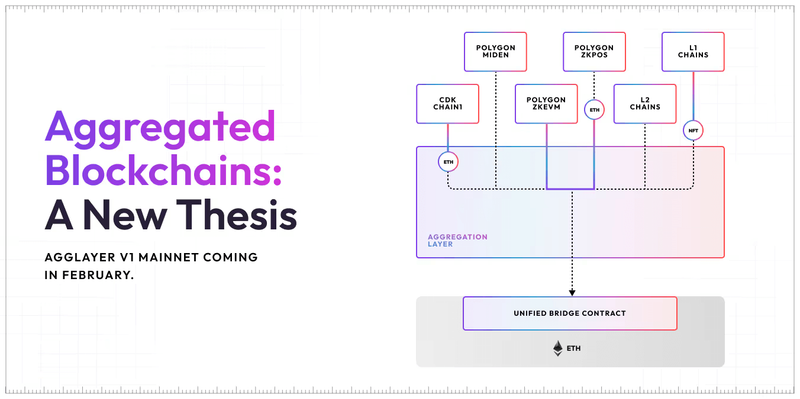

Polygon Labs is a zero-knowledge (ZK) focused software company building a network of aggregated blockchains via the Agglayer. As a public infrastructure, the Agglayer aims to unify user bases and liquidity across connected chains while leveraging Ethereum as a settlement layer. Polygon Labs has contributed to the core development of several scaling protocols and tools for launching blockchains, including the Polygon Proof-of-Stake (PoS) network, Polygon zkEVM, and Polygon Miden. Additionally, the Polygon Chain Development Kit (CDK) provides open-source tools for developers to create and deploy ZK-powered Layer-2 blockchains on Ethereum, connecting to the Agglayer.

The vision of the Agglayer is to enable a horizontally scalable network with a shared state and unified liquidity, creating a web of chains that functions like the internet. As part of this roadmap, a proposal is underway to connect the Polygon PoS network to the Agglayer, marking the first step in upgrading Polygon PoS to a zkEVM Validium network. Discussions about updates to protocol architecture, tokenomics, and governance are ongoing within the community and among core developers.

Website / X (Twitter) / Discord

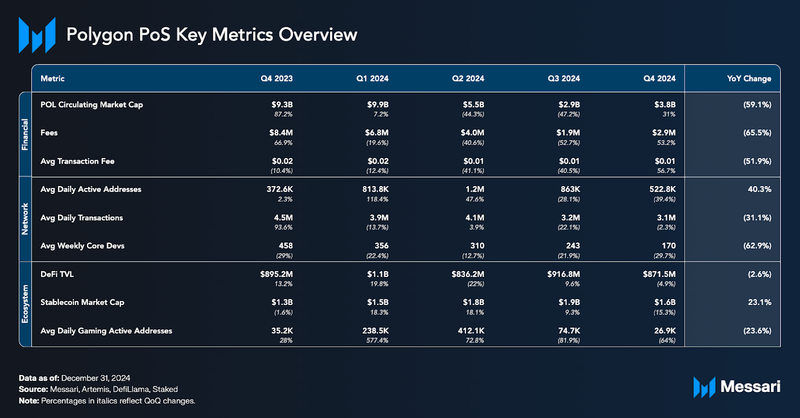

Key Metrics Polygon Technical DevelopmentsIntroduction

Polygon Technical DevelopmentsIntroductionThroughout 2024, Polygon accomplished significant technical innovation by addressing critical scaling challenges in the blockchain ecosystem. These efforts focus on synthesizing the two primary approaches to blockchain design: modular and integrated architectures. While modularity allows for the creation of sovereign chains tailored to specific needs, it often leads to fragmented liquidity and suboptimal user experiences. Conversely, integrated chains offer cohesive ecosystems but face inherent scaling limitations. Core developers contend that a single blockchain cannot support the scale of a future Web3 ecosystem the size of the current internet, and believe only an aggregated network can provide the necessary scalability. So, in January 2024, Polygon Labs proposed a solution: the Agglayer.

The Agglayer

The Agglayer is being built as an interoperability protocol to unify chains by aggregating proofs, verifying chain states, and settling to Ethereum. Leveraging ZK proofs, the Agglayer enables secure cross-chain communication, asset transfers, data sharing, and unified liquidity across diverse chains—similar to how TCP/IP revolutionized the internet. Key features include a unified bridge for seamless cross-chain asset connectivity and a pessimistic proof mechanism to ensure safety. These features enable low-latency coordination and safe interoperability, allowing developers to focus on project design without needing to bootstrap liquidity.

Copilot Insights: Can you compare Polygon Lab's Agglayer and the internet's TCP/IP?In early November, Magic Labs, a Web3 wallet infrastructure provider, introduced Newton, the first chain unification network for the Agglayer. Newton enables cross-chain wallet connections and a unified smart contract wallet experience, simplifying user interactions across diverse blockchain ecosystems.

On November 10-11, Polygon Labs hosted the first-ever AggSummit in Bangkok, Thailand, to discuss the future of aggregated blockchains with over 1,000 attendees. At the event, two notable announcements regarding the Agglayer were made:

- Okto, a chain abstraction technology provider, announced plans to integrate its Okto Wallet with the Agglayer. This integration aims to provide users with secure and unified access to assets and applications across multiple chains, enhancing cross-chain functionality within the Agglayer ecosystem.

- Agora, a leading stablecoin company, announced that its AUSD will serve as a native stablecoin for the Agglayer. AUSD, when on the Agglayer, will be interoperable across every chain integrated with the Agglayer.

On December 19, 2024, Agglayer v0.2 testnet went live, with the mainnet planned for February 2025.

Polygon CDKIn Q3 2023, Polygon Labs released the Polygon Chain Development Kit (CDK), an open-source development framework for launching ZK L2s and transitioning existing EVM L1s to L2s. Polygon CDK focuses on customizability and ZK technology, with future functionality planned to make connecting Polygon CDK chains to the Agglayer seamless.

Numerous teams have announced CDK chains in Q4, including Magic Labs, Okto, Agrotoken, and Moonveil. Lumia Chain’s testnet was the most active Polygon CDK to date, with over 20 million transactions and seven million unique wallets.

In October, Polygon Labs released Fork ID 12 for the Polygon CDK. Key enhancements include zk-based trustless finality with customizable proving systems, Erigon integration for faster data syncing and Ethereum compatibility, upgraded prover systems for increased capacity and speed, and improved developer tooling with a streamlined CLI and updated documentation.

Polygon MidenPolygon Miden is an upcoming ZK L2 utilizing the Rust-based Miden Virtual Machine instead of the Ethereum Virtual Machine. It aims for high-throughput applications using zero-knowledge proofs (ZKPs), emphasizing sovereignty and client-side proving for scalability.

In November, Polygon Miden launched the Alpha Testnet v5. This updated version introduces custom smart contracts, composable smart contracts, delegated proving, and expiring transactions. Polygon Labs plans to launch the Beta testnet soon, featuring a fully functional Rust compiler and support for network transactions.

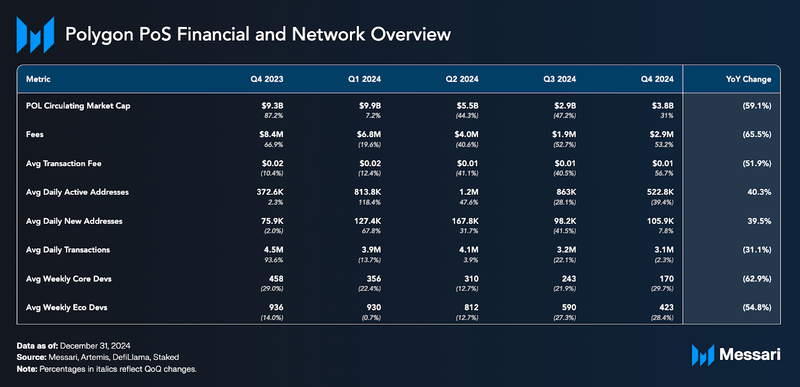

Financial and Network Overview Market Capitalization

Market Capitalization

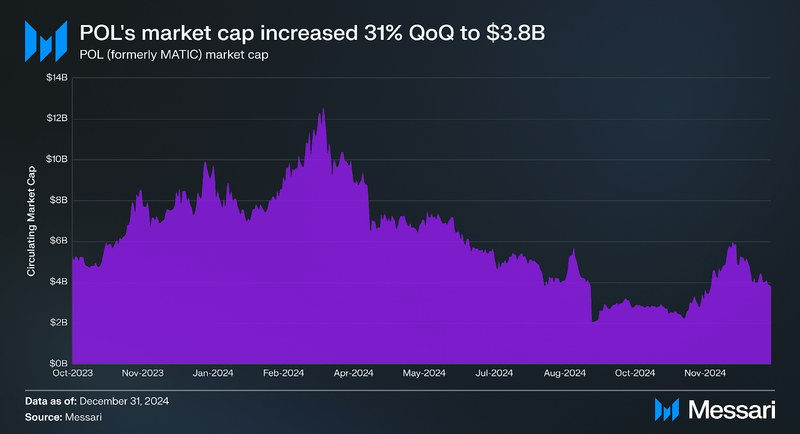

POL (formerly MATIC) reached an all-time high market capitalization of $12.9 billion in Q1 2024. However, the subsequent quarters saw significant declines, with POL retracing alongside the broader market. By the end of Q3 2024, its market cap had fallen to $2.9 billion, marking a 47.2% QoQ decline. This significant drop is partially attributable to the ongoing transition from MATIC to POL, which has temporarily split the market cap between the two tokens.

In Q4 2024, as market conditions improved and users migrated 1.38 billion MATIC tokens to POL, the token's market capitalization rose 31% QoQ to $3.8 billion. By the end of Q4, 88.1% of the supply has transitioned to POL, with the remaining 11.9% still in MATIC. POL continues to rank as the largest Ethereum Layer-2 token by market cap.

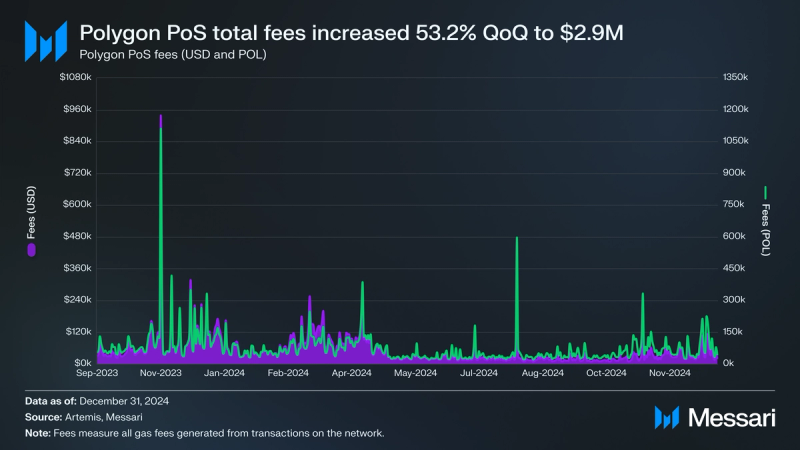

Transaction Fees

In Q1 2024, EIP-4844 was enacted on Polygon PoS mainnet, introducing blobs and significantly changing the Polygon cost structure. EIP-4844 and blobs result in cheaper posting costs to the L1, which lowers users' average transaction fees. Consequently, the average transaction fee has fallen significantly over the past year, down to $0.01 during Q4 2024.

In Q4 2024, total Polygon transactions fell by 2% QoQ, but the average transaction fee increased by 56.7%. As a result, total transaction fees increased by 53.2% QoQ to $2.9 million.

SupplyPOL officially went live on September 4, 2024, and is now the native gas and staking token for the Polygon PoS network. While POL replaces MATIC for these purposes, there is no set deadline for upgrading the remaining circulating MATIC tokens to POL. In the first phase of the transition, as per governance decisions, POL is being used as the gas and staking token in Polygon PoS. In subsequent phases, POL will play a pivotal role in the Agglayer. It will enable holders to contribute to network security across various chains via a native re-staking protocol, earning rewards for diverse services. These services range from basic transaction validations to more advanced tasks like generating ZK-validity proofs. Each protocol in the Polygon ecosystem can offer customized roles and rewards for validators.

POL adopts an inflationary model with a yearly emission rate of 2%, divided equally between validator rewards and the Community Treasury. This model aims to incentivize validator participation and fund a community-governed treasury for network growth and development.

Activity

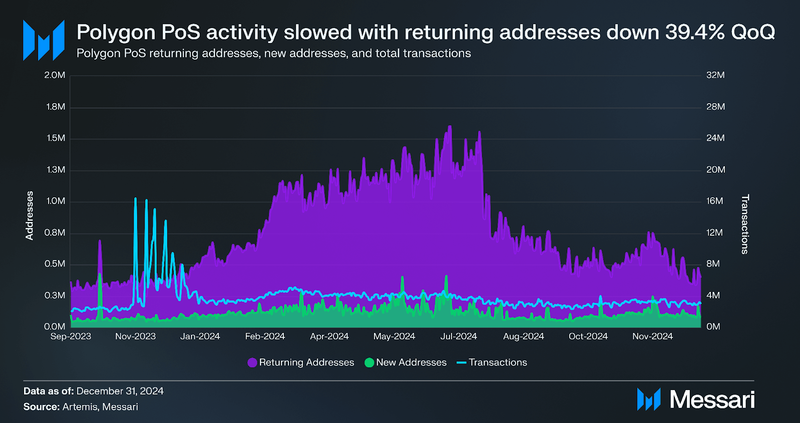

After a year of increasing active addresses, Polygon PoS saw a decline in active addresses during Q4 2024. The average daily active addresses fell to 523,000, a 39.4% decrease QoQ. Similarly, average daily transactions decreased to 3.1 million, a 2.3% decline QoQ. Most of this decrease can be attributed to a reduction in gaming activity, which had previously been a major driver of user engagement on the network. Despite the slowdown, the average daily number of new addresses rose to 106,000, a 7.8% increase QoQ, and active and new addresses were up 40.3% and 39.5%, respectively, YoY.

Sectors

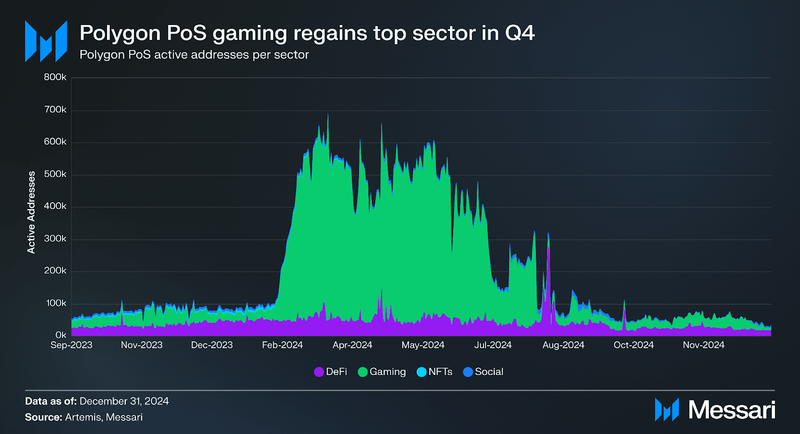

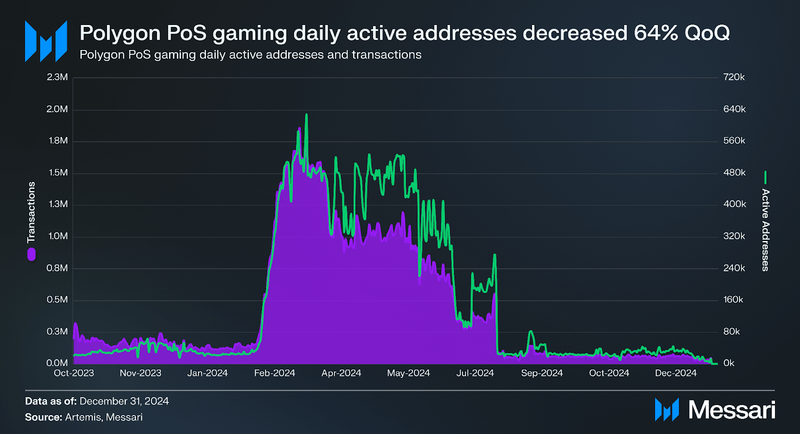

Gaming was the dominant sector on Polygon PoS for the first half of the year. Over 95% of this gaming activity came from MATR1X, a Web3 entertainment platform that integrates various gaming and NFT elements within a metaverse setting. However, in Q3 2024, MATR1X activity fell significantly and continued to fall in Q4 as the platform conducted smart contract migrations and ongoing development, reducing user engagement. Consequently, Polygon PoS's topline user metrics declined along with the decreased activity from MATR1X.

Most other sectors also saw decreased activity in Q4 2024. Average daily DeFi users decreased 47.3% QoQ to 24,000, average daily NFT users decreased 20.6% to 561, and average daily consumer users decreased 75.2% to 2,500.

Arguably, Polygon’s biggest winner in Q4 2024 was Polymarket. Polymarket is the Polygon-based predictions market that gained global recognition as the leading political betting market for the U.S. presidential elections. With nearly $3 billion bet on the U.S. presidential elections in November 2024, it reached a high of $376.8 million daily volume on November 5. Polymarket ended Q4 with 347,000 monthly active users, 9.22 million monthly matched trades, and 272,000 monthly new accounts.

The dominant trend in crypto during Q4 was the rise of AI agents. In December, Eternal AI, a decentralized operating system for AI agents, launched on Polygon, enabling users to create customized, decentralized AI agents in just five steps. Since its launch, over 100 AI agents have been built on Polygon using Eternal AI’s platform.

Building on the recent tokenization trend from the past few quarters, Assetera’s non-US regulated trading platform on Polygon has begun offering tokenized versions of NVIDIA, Coinbase, and S&P500 trackers through a partnership with BackedFi. These assets are fully collateralized, MiFID-compliant, and accessible 24/7. By utilizing Polygon’s scalable infrastructure and integrating with the Republic Wallet, Assetera enables non-US investors to easily trade tokenized stocks, ETFs, and T-Bill trackers.

DevelopmentPolygon has maintained a strong focus on supporting its developer ecosystem. According to Electric Capital, Polygon ranked as the eighth largest developer ecosystem in crypto as of November 2024, with 1,240 total developers, of which 330 were full-time. The network also ranked among the top three in Asia and South America by developer count and attracted over 1,000 new developers who contributed to Polygon for the first time in 2024.

In October, Polygon’s Plonky3, a toolkit for building ZK proving systems, was benchmarked as the fastest zero-knowledge proving system. Plonky3 can prove more than 2 million hashes per second, four times more than StarkWare’s Stwo proving system. In December, Scroll announced its plan to adopt Plonky3 to build a more performant ZK Virtual Machine (zkVM).

Also in December, Polygon began supporting ERC-7683, the standard for cross-chain intents on Ethereum, across Polygon PoS, Polygon zkEVM, and the Agglayer. This integration enables enhanced interoperability and UX to Ethereum L2s with faster transactions and deeper liquidity.

GovernancePolygon Governance 2.0 introduces three main governance pillars for Polygon. Each pillar of governance will have a unique framework, aiming to create scalable and efficient governance mechanisms.

- Protocol Governance: Facilitated by the Polygon Improvement Proposal (PIP) framework, it provides a platform for proposing upgrades to Polygon protocols.

- System Smart Contracts Governance: Addresses upgrades of protocol components implemented as smart contracts. The Protocol Council, governed by the community, will be responsible for these upgrades.

- Community Treasury Governance: Establishes a self-sustainable ecosystem fund, the Community Treasury, to support public goods and ecosystem projects. The governance process involves two phases, starting with an independent Community Treasury Board and evolving into community-driven decision-making.

In Q4 2022, PIP-29 proposed the introduction of the Polygon Protocol Council, which was adopted by the community. The council is responsible for conducting both regular and emergency upgrades to system smart contracts, specifically components of Polygon protocols implemented as smart contracts on Ethereum. The Protocol Council consists of 13 publicly named members.

In Q2 2024, the Governance Hub was announced, enabling community-driven protocol and smart contract upgrades. It is a full-stack governance solution and user interface for the community focusing on two of Polygon Governance’s three pillars: Protocol Governance and System Smart Contracts Governance.

In Q4 2024, Polygon introduced signal voting through the Governance Hub, enabling staked POL tokenholders to engage in community governance for Polygon protocols and shared Agglayer components (once live). This system allows participants to either delegate their votes to technical delegates or vote directly on upcoming proposals. Although there is no onchain mechanism to enforce a veto, the Protocol Council is anticipated to consider community feedback when making decisions.

Ecosystem Overview DeFi

DeFi

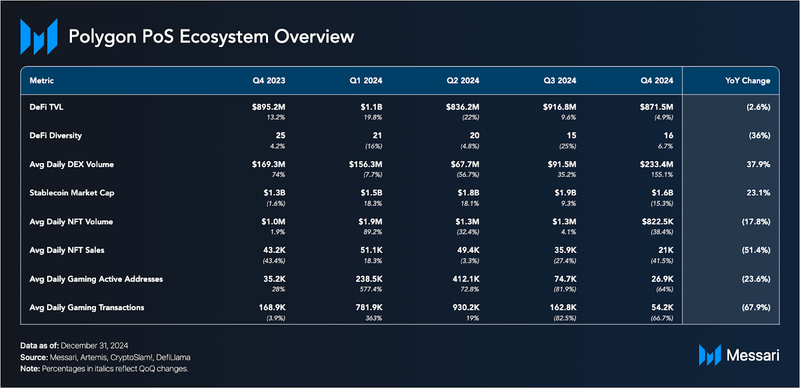

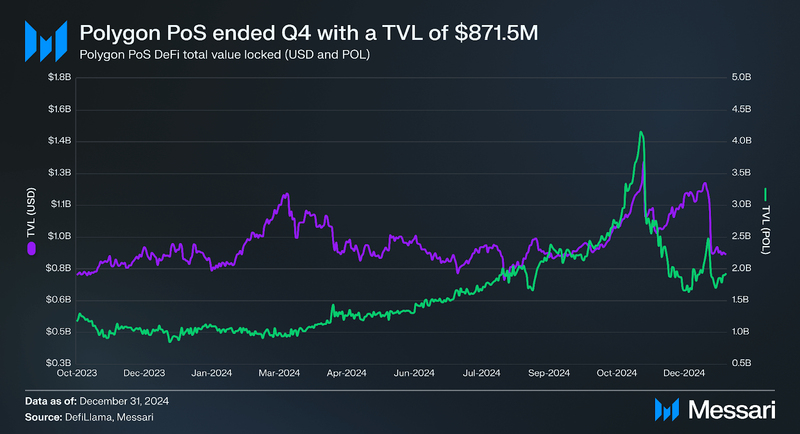

Polygon PoS DeFi total value locked (TVL) ended Q4 2024 at $871.5 million, a 4.9% QoQ decrease and a 2.6% YoY decrease. Polygon fell from being the tenth largest network by TVL to the twelfth.

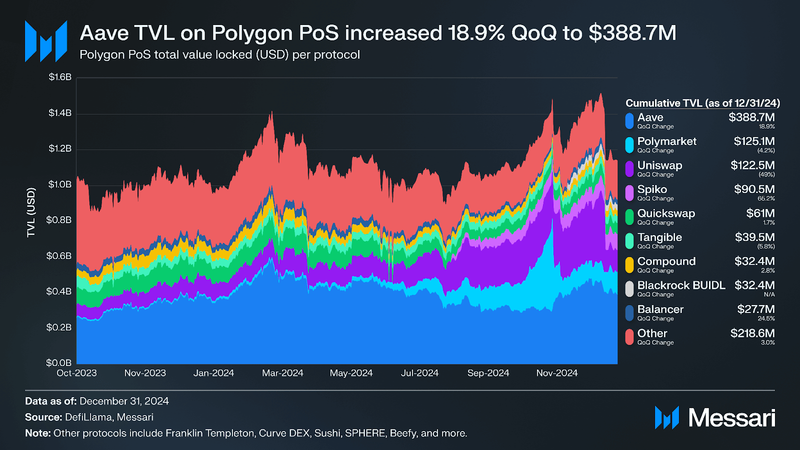

Aave continued to be the leading protocol by TVL on Polygon PoS with $388.7 million in TVL (+18.9% QoQ). Polymarket overtook Uniswap in Q4 as the second largest Polygon protocol by TVL with $125.1 million in TVL (-4.2% QoQ) as Uniswap’s TVL decreased by 49% QoQ to $122.5 million. The next largest protocols by TVL were Spiko with $90.5 million (+65.2% QoQ), Quickswap with $61 million (+1.7% QoQ), Tangible with $39.5 million (-5.8% QoQ), Compound with $32.4 million (+2.8% QoQ), Blackrock BUIDL with $32.4 million (new in Q4), and Balancer with $27.7 million (+24.5% QoQ). The total TVL of protocols outside of the top nine was $218.6 million, which increased 3.0% QoQ.

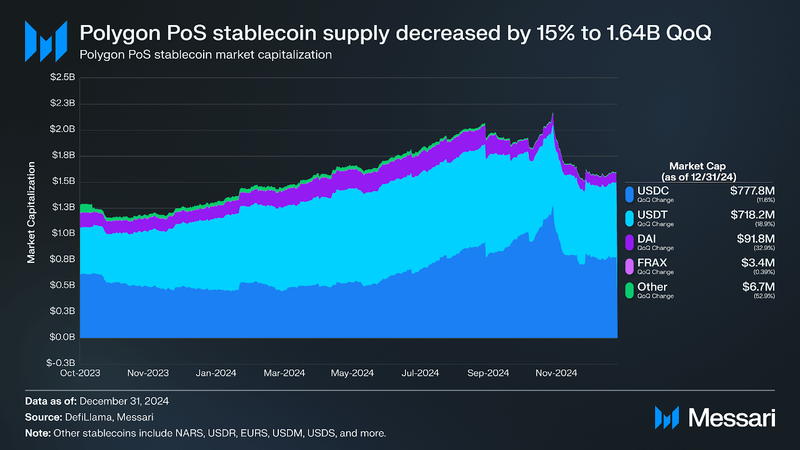

Polygon PoS’s stablecoin supply ended Q4 2024 with a total market capitalization of $1.64 billion, reflecting a 15% decrease QoQ but a 29.7% YoY increase.

At the start of the year, USDT was the dominant stablecoin on Polygon. However, following the migration to native USDC in March 2024, USDC surpassed USDT as the leading stablecoin on the network. All major stablecoins on Polygon saw declines in Q4, with USDC supply decreasing by 11.6% QoQ, USDT by 18.9%, DAI by 32.9%, FRAX by 0.39%, and other stablecoins by 52.9%. Despite these declines, Polygon remained in its position as the eighth-largest blockchain by stablecoin supply at the end of Q4 2024.

Notably, during Q3 2024, Polygon integrated the Bridged USDC Standard with its Chain Development Kit (CDK). This integration allows chains built with the Polygon CDK to support an upgradeable version of bridged USDC, streamlining future transitions to native USDC without requiring additional code changes.

NFTs

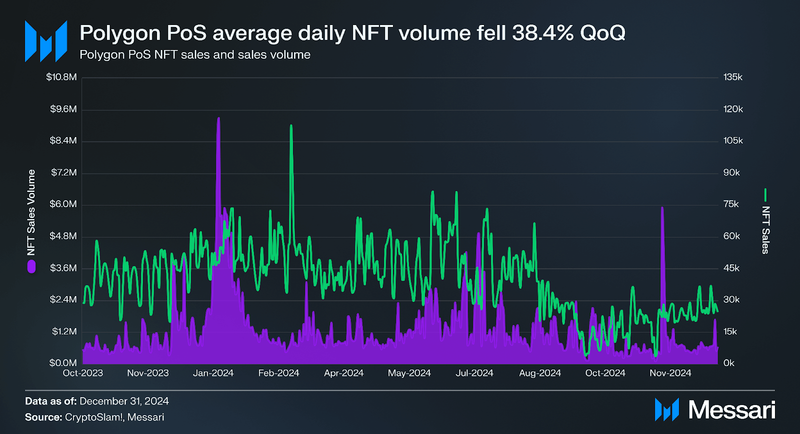

Polygon PoS experienced a decline in NFT activity during Q4 2024. Average daily NFT trading volume fell to $822,500, representing a 38.4% QoQ decrease and an 18% YoY decline. Similarly, average daily NFT sales dropped to 21,000, marking a 41.5% QoQ decrease and a 51.5% YoY decline.

NFT activity during the quarter was primarily driven by four collections: Courtyard, which recorded $23.3 million in sales; Planet IX Mining Pass, with $3.9 million; LEDNFT, with $3.1 million; and MATR1X, which achieved $2.9 million in sales. Notably, on November 21, 2024, Polygon experienced a quarterly peak in daily sales volume, reaching $5.9 million, partly attributed to Courtyard’s Charizard auction campaign.

Gaming

Gaming has been the largest and fastest-growing sector on Polygon through 2024. However, in Q3 and Q4 2024, gaming activity on Polygon PoS experienced a decline, primarily driven by MATR1X FIRE slowing down. Average daily gaming active addresses decreased to 54,000, representing a 66.7% decrease QoQ and a 67.9% decline YoY. Average daily gaming transactions fell to 27,000, marking a 64% decrease QoQ and a 23.6% decline YoY.

Despite the decrease on Polygon PoS, the overall gaming ecosystem on Polygon remains strong and continues to expand. During Q4 2024, Polygon funded 13 gaming projects through its Grants program, which included Empire of Sight, Intraverse, Space Mavericks, and Sunflower Land. GAM3S.GG gave out $500,000 in POL grants to GAM3 Awards finalists building on Polygon’s Agglayer.

InstitutionalOver the last quarter, Polygon has had several institutional collaborations, including:

- HSBC participated in Hong Kong's e-HKD pilot program, developing tokenized Hong Kong Dollar (HKD) cash deposits fully backed by the Hong Kong Monetary Authority (HKMA) and leveraging Polygon PoS. The bank also introduced a decentralized identity solution, HSBC Pass, which won a 2024 Red Dot Award.

- Stripe's integration with Polygon PoS enables millions of businesses across 150+ countries to accept USDC.

- Polygon Labs partnered with Abu Dhabi Global Market (ADGM) to establish global token disclosure standards to improve transparency, trust, and security in Web3. This effort builds on ADGM's DLT Foundations Regulations, the world’s first framework for blockchain foundations and DAOs.

- 21X, a blockchain-based exchange for tokenized assets on Polygon, secured approval from German regulator BaFin under the EU’s DLT Pilot Regime and plans to launch in Q1 2025. Headquartered in Frankfurt, 21X will facilitate the trading of tokenized equity, debt securities, funds, and real-world assets such as real estate and art.

- Schuman Financial, the first European firm licensed as a stablecoin issuer in France under the EU’s MiCA regulation, launched EURØP, a euro-backed stablecoin pegged 1:1 to the euro. Initially available on Polygon and Ethereum, EURØP is designed for digital payments, onchain foreign exchange, and tokenized real-world assets, with plans for broader blockchain integrations and DeFi partnerships.

- BlackRock announced that its USD Institutional Digital Liquidity Fund (BUIDL), tokenized by Securitize and launched on Ethereum in March 2024, expanded to Polygon, among other chains.

Additional developments related to the broader Polygon ecosystem in Q4 2024 include:

- In Latin America, organizations adopted Polygon's PoS technology to address economic issues such as inflation and currency devaluation.

- Bitso, a crypto exchange in Mexico founded in 2014, integrated Polygon PoS to offer users protection against these financial challenges. This partnership enables low-cost transactions for its eight million users across Latin America and supports decentralized cross-border payments and remittances.

- Lemon leverages Polygon PoS to provide its 2.8 million users with fast, low-cost crypto transactions, offering a reliable way to mitigate the effects of currency instability. Its Visa Lemon Card, with over 1 million issued in Argentina, supports global payments in fiat or cryptocurrency and rewards users with Bitcoin cashback. Through the Lemon Nation project, users have minted 945,000 NFT-based digital IDs, promoting blockchain education and fostering a connected community.

- MuralPay utilizes Polygon PoS to facilitate fast, low-cost cross-border payments and invoicing across Latin America, moving millions of U.S. dollars into local currencies monthly. This integration provides businesses and freelancers with instant settlements, enhancing liquidity and financial accessibility in the region.

- Belo leverages Polygon PoS to offer a fast, low-cost, and scalable digital wallet solution for Latin America. It enables users to send and receive payments in local currencies or cryptocurrencies, convert funds into stablecoins like USDC, and earn up to 4.25% APY. With support for direct ACH transfers in U.S. dollars across 17 countries, Belo simplifies cross-border payments for freelancers, remote workers, and MSMEs, offering a practical hedge against inflation and currency volatility.

- In October 2024, Polygon hosted the POL Rush pitch competition at the AggSummit, encouraging ambitious grant proposals with no funding cap. The competition followed a structured process—submission ("Prospecting"), review ("Digging"), and presentation ("Polishing")—culminating in the top 10 teams presenting to the Community Treasury Board at DevCon in November.

- Alongside POL Rush, the Polygon Community Grants Program (CGP) concluded its first season on November 1, 2024, distributing 17.5 million POL tokens to 120 projects from over 1,200 applications. Nearly half of the grants supported early MVP-stage projects, highlighting Polygon’s focus on fostering developer growth.

- The Community Treasury Board awarded the 10 POL Rush finalists 1 million POL on November 10.

Polygon concluded Q4 2024 with significant advancements across its ecosystem, highlighted by progress on the Agglayer—a novel interoperability protocol for unifying blockchains. Agglayer v0.2 entered testnet in December 2024, laying the groundwork for a mainnet launch in February 2025. Alongside this, the first-ever AggSummit convened over 1,000 attendees in Bangkok, featuring announcements from Magic Labs and Okto onchain unification wallets, as well as Agora’s plans for AUSD as the native stablecoin of the Agglayer. Meanwhile, adoption of POL accelerated, with 88.1% of MATIC holders migrating to the new token, underscoring the growing role of POL in securing multiple Polygon chains via re-staking.

From a network perspective, total transaction fees on Polygon PoS rose 53.2% QoQ, supported by a 31% increase in POL’s market capitalization to $3.8 billion. Although gaming activity declined due to MATR1X migrations, other sectors like Polymarket and newly launched AI agent platforms gained momentum. Polymarket alone facilitated nearly $3 billion in bets on the 2024 U.S. elections, solidifying its status as a top decentralized predictions market. Beyond core DeFi and NFT segments, institutional partnerships with HSBC, Stripe, Abu Dhabi Global Market, and BlackRock showcased Polygon’s broader appeal as a scalable framework for tokenized assets, payments, and identity solutions.

Looking ahead, Polygon remains focused on scaling solutions and interoperability. With Agglayer’s mainnet on the horizon, the upcoming Polygon Miden Beta testnet, and the ongoing expansion of Polygon CDK chains, the ecosystem is well-positioned for continued developer growth and real-world adoption in 2025. By integrating advanced ZK technology, nurturing cross-chain liquidity, and fostering community-driven governance through the Protocol Council and Governance Hub, Polygon aims to solidify its role as a key infrastructure provider for an internet-scale Web3 future.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.