and the distribution of digital products.

State of OP Mainnet Q4 2024

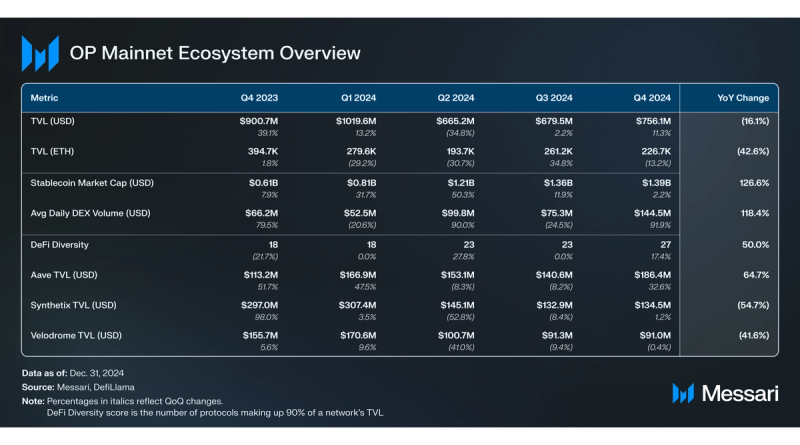

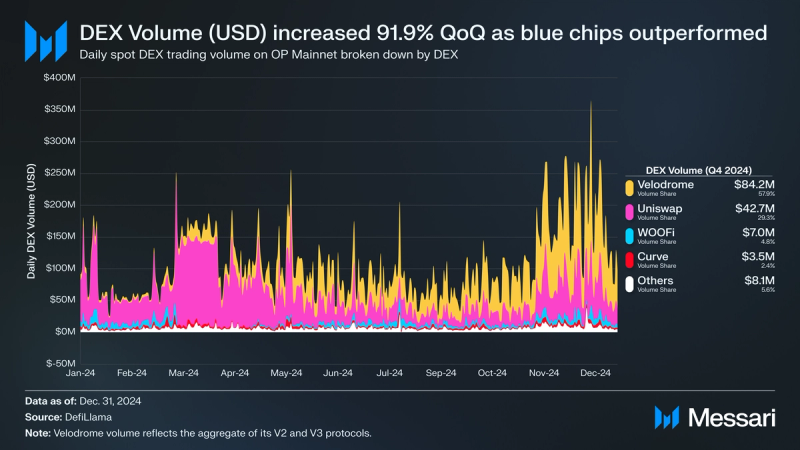

- Average daily DEX volume (USD) grew 91.9% QoQ to $144.5 million, up 118.4% YoY. This was led by Velodrome, which had a historic quarter making up 57.9% of DEX volume at an average of $84.2 million per day.

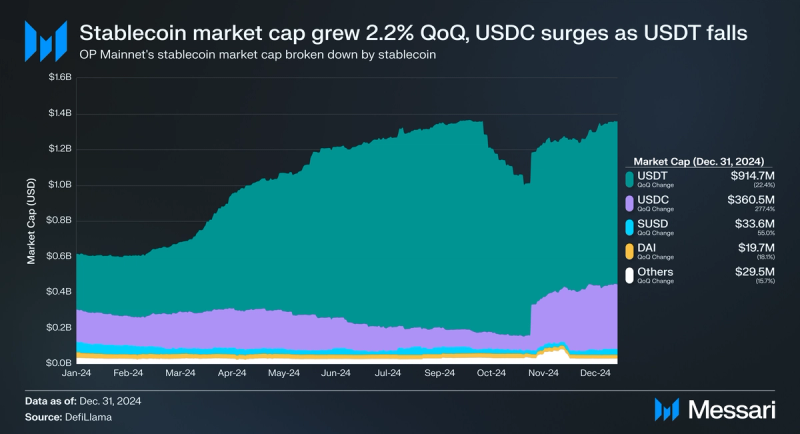

- TVL (USD) increased 11.3% QoQ to $756.1 million, though was down 16.1% YoY. USDC’s market cap surged 277.4% QoQ to $360.5 million, while USDT’s market cap fell 22.4% to $914.7 million.

- Average transaction fees fell 90.8% YoY to $0.03 due to EIP-4844 blobs. This led to a 173.8% YoY increase in average daily transactions, up to 928,200 in Q4’24.

- OP’s price stayed flat QoQ at $1.75 but its market cap rank fell from 43rd to 50th, underperforming the broader market and its Layer-2 peers.

- Airdrop 5 distributed 10.37 million OP tokens worth $15.9 million to 54,723 addresses that transacted on various OP Chains between March and September 2024.

Optimism (OP) is a Layer-2 network that aims to increase Ethereum’s transaction throughput while decreasing the cost of transacting. This is achieved through an optimistic rollup design. Transactions are executed on OP Mainnet, Optimism’s original network, while relying on Ethereum for settlement, consensus, and data availability.

After years of research on Ethereum scalability by founders Benjamin Jones, Karl Floersch, Jing Wang, Mark Tyneway, and Kevin Ho, Optimism launched on public mainnet in December 2021. The years that followed saw Optimism Foundation and OP Labs constantly experiment, develop, and iterate a long-term vision. This included introducing the Optimism Collective, launching the OP token via an airdrop, introducing the OP Stack, launching the Bedrock upgrade, and more.

Optimism’s long-term strategy stems from its vision for a “Superchain.” The OP Stack, Optimism's modular, open-source, forkable technology stack, allows for the creation of Layer-2 and Layer-3 networks (”OP Chains”). The Superchain is a network of over 30 OP Chains built with the OP Stack that power over 65% of all Layer-2 rollup transactions. The ultimate goal of the Superchain is to bring seamless interoperability between OP Chains that share security, bridging, governance, upgrades, and a communication layer.

Website / X (Twitter) / Discord

Key Metrics Ecosystem Analysis

Ecosystem Analysis Onchain Activity

Onchain Activity

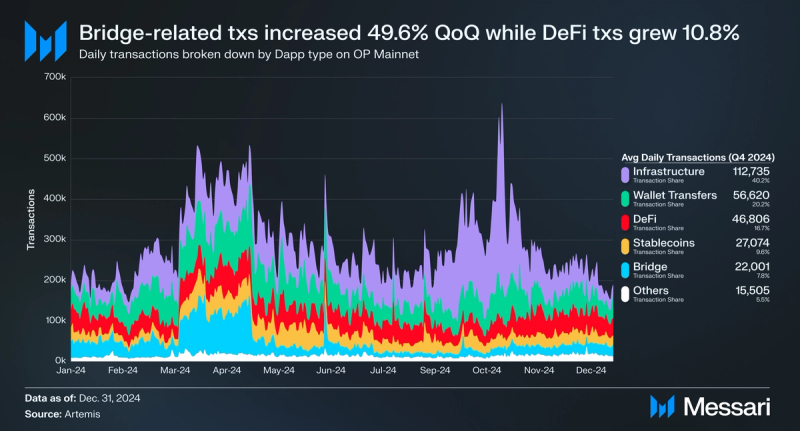

Infrastructure was the leading category among transactional activity across active addresses on OP Mainnet once again in Q4 2024. Transactions in this category were up 4.2% QoQ, making up 37.8% of transactional activity on OP Mainnet through applications such as World, Chainlink, and Optimism Governance. Transactional activity across DeFi grew 10.8% QoQ, making up 15.7% of transactional activity on OP Mainnet through applications like LI.FI, Uniswap, and Synthetix.

DeFi

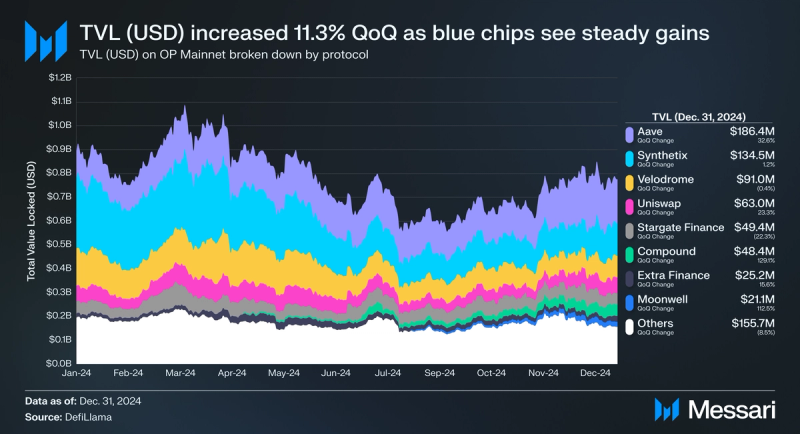

OP Mainnet’s TVL (USD) increased 11.3% QoQ to $756.1 million in Q4 2024. Due to ETH’s price increasing 28.9% QoQ, TVL (ETH) fell 13.2% QoQ to 226,700. OP Mainnet’s DeFi Diversity score (i.e., the number of protocols making up 90% of a network’s TVL) increased 17.4% to 27 in Q4’24.

Aave was the leading protocol by TVL once again, and experienced a 32.6% QoQ increase to $186.4 million. Synthetix ended the quarter with $134.5 million in TVL while Velodrome ended with $91 million. Both Synthetix and Velodrome stayed relatively flat, up 1.2% and down 0.4% QoQ, respectively. Compound and Moonwell were notable outperformers in Q4’24 as their TVL increased 129.1% QoQ to $48.4 million, and 112.5% to $21.2 million, respectively. The “Other” category, which aggregates protocols outside of the top eight, was down 8.5% QoQ to $155.7 million, indicating a consolidation of assets into blue chip protocols like Aave and Uniswap.

DEXs

OP Mainnet saw an average daily DEX volume of $144.5 million, a 91.9% QoQ increase. Velodrome and Uniswap maintained their historical dominance over OP Mainnet’s spot DEX trading volume in Q4 2024.

Velodrome surpassed $20 billion in lifetime trading volume while consistently generating weekly trading volumes and rewards for veVELO tokenholders that were at all-time high levels. The protocol’s share of DEX volume in Q4’24 landed at 57.9% at an average of $84.2 million per day. Throughout H2’24, Velodrome has taken the lion's share of spot DEX trading activity from Uniswap, which led for much of H1’24. Uniswap ended Q4’24 with a 29.3% share of DEX volume at an average of $42.7 million per day.

Stablecoins

OP Mainnet’s stablecoin market cap continued its uptrend for the fifth straight quarter in Q4 2024, ending up 2.2% QoQ and 126.6% YoY to $1.39 billion. After two quarters of performance dominated by USDT, USDC saw a major resurgence.

On Nov. 3, 2024, USDC saw its market cap explode by $175.3 million, or 211.4%. Overall, USDC’s market cap increased 277.4% QoQ to $360.5 million. USDC commanded a 26.5% stablecoin market share on OP Mainnet by the end of 2024, just shy of the 29.2% it began the year at. In contrast, USDT saw a string of large redemptions occurring on Oct. 2, 5, 12, 17, 22, 26, and Nov. 16, before stabilizing and restarting an uptrend. Overall, USDT’s market cap fell 22.4% to $914.7 million, ending the quarter with a 67.4% share of stablecoins on OP Mainnet.

Notably, Blackrock launched an OP Mainnet-native version of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on Nov. 13, 2024. BUIDL aims to maintain a stable value of $1 per token while distributing accrued dividends to tokenholders wallets every month. OP Mainnet-native BUIDL ended Q4’24 with a market cap of $26.1 million and just two tokenholders.

GovernanceOptimism is governed by the Optimism Collective, a bicameral system comprising the Token House and Citizens’ House, along with stewardship provided by Optimism Foundation.

Token HouseThe Token House consists of all OP tokenholders and governs network changes through onchain voting via Agora. OP grants the ability for a tokenholder to delegate OP to themselves or to another delegate. Delegates can vote on proposals related to Governance Fund budgets, network upgrades, inflation adjustments, treasury appropriations, grant clawbacks, council elections, council dissolutions, etc.

Token House proposals fall under Non-grant Proposals, or Governance Fund Grant Proposals that distribute OP tokens from the Governance Fund on a seasonal schedule. A new season occurs each quarter and consists of several voting cycles.

After beginning in June 2024, Season 6 concluded in December 2024. The voting cycles that occurred in Q4 include voting cycles #29 and #30, while #24, #25, #26, #27, and #28 occurred in Q3’24. Overall, Season 6 distributed 4.98 million OP (0.12% of the token supply) to 30 projects through grants.

The season’s Reflection Period is ongoing. Special Voting Cycle 31a concluded on Dec. 18, 2024, while Special Voting Cycle 31b concluded on Jan. 15, 2025. The following notable governance outcomes have been introduced for Season 7 as of the conclusion of Special Voting Cycle 31a:

- The Intent for Season 7 of Interoperability was ratified with an approved budget of 10 million OP (0.24% of the token supply). The main goal of this Intent is for the Superchain to become a “set of interoperable Stage 1 chains doing $250m per month in cross-chain asset transfers.”

- Notably, onchain decision markets were approved for Season 7. These markets will experiment with a futarchy model, whereby market predictions of a project’s ability to achieve key success metrics will determine allocations for select grants.

- Onchain Treasury Execution was approved and tested, allowing for future Optimism Collective treasury distributions to be enacted onchain via governance.

- The Standard Rollup Charter was approved and ratified. The Standard Rollup Charter is the first Blockspace Charter, aiming to categorize OP Chains into various types with specific implementation details across the Superchain’s blockspace.

- The Holocene Network Upgrade was approved and went live, introducing several changes related to block derivation, EIP-1559 configurability, and the MIPS contract.

- Several updates to Token House Councils were made:

- Operating budgets were approved for the Grants Council, Security Council, and Developer Advisory Board. Notably, the latter two had their budget distributions executed onchain after approval.

- The Anticapture Commission was approved for another two seasons. Notably, the Anticapture Commission does not operate with a budget.

- The Milestones and Metrics Council, a new experimental council, was established and had its budget approved.

- The Code of Conduct Council was dissolved.

Season 7 begins after the conclusion of Special Voting Cycle 31b’s veto period on Jan. 22, 2025, and will run until June 11, 2025. The season will operate under the theme of “Shared Success,” and pursue its singular intent surrounding Superchain interoperability.

Citizens’ HouseThe Citizens’ House consists of “Citizens,” core Optimism community members (not required to hold OP tokens) that are appointed largely to govern over RetroPGF distributions. These Citizens hold voting badges and operate under a one-person, one-vote system. RetroPGF occurs in rounds, and Citizens vote on which projects should receive funding. Before each round, a scope of funding is determined. The initial rounds of RetroPGF have scope and funding amounts determined by Optimism Foundation, though the foundation plans to hand off this aspect to the Citizen House in the future.

- RetroPGF 5: In July 2024, Optimism announced RetroPGF 5, where 8.00 million OP (~0.18% of the token supply) were to be distributed to “contributors to the OP Stack.” Final results were announced in October 2024, with 79 participants receiving OP.

- RetroPGF 6: In September 2024, Optimism announced RetroPGF 6, where between 1.10 million and 3.50 million OP were to be distributed to “contributors to Optimism Governance.” Final results were announced in December 2024, with 88 participants receiving OP.

In November 2024, Optimism published an update regarding RetroPGF. Going forward, RetroPGF will shift away from rounds to continuous rewards, aiming to provide greater consistency and predictability for builders. RetroPGF in H1’25 will focus on Developer Tooling (libraries, debuggers, etc.) and Onchain Builders (projects driving Superchain activity). RetroPGF in H2’25 will add a focus on OP Stack Contributions (Ethereum Core Development).

Financial Analysis OP Token

OP Token

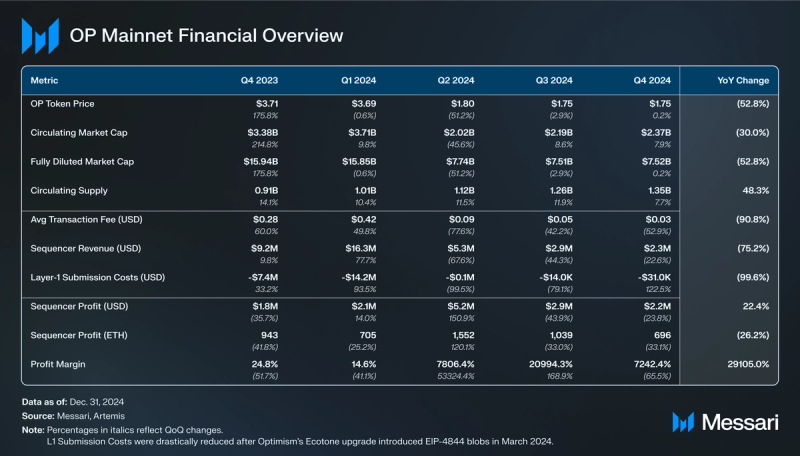

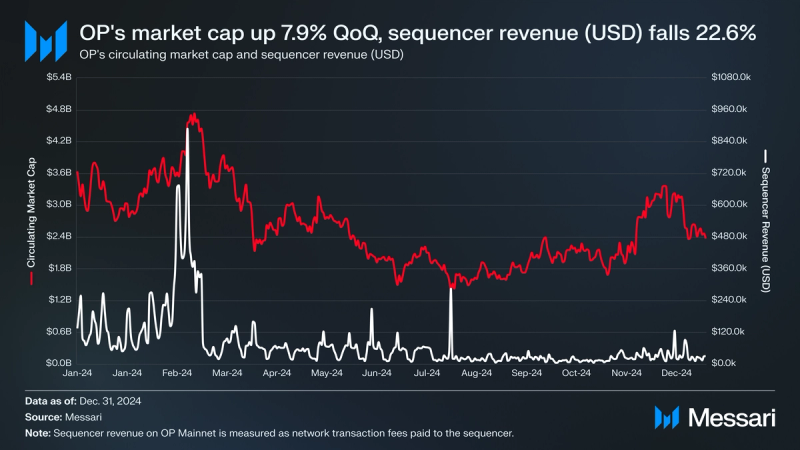

OP is an ERC-20 equivalent token on OP Mainnet that began circulating on May 31, 2022, with a token supply of 4.29 billion. OP’s circulating market cap increased 7.9% QoQ to $2.37 billion in Q4 2024. However, price stayed flat at $1.75, down 52.8% YoY. This was due to OP’s circulating supply increasing 7.7% QoQ to 1.35 billion, which is a 48.3% YoY change. Notably, Gemini and Bitstamp listed OP in Q4’24, while Grayscale launched the Grayscale® Optimism Trust.

The token underperformed the broader market and its Layer-2 peers as its circulating market cap rank fell from 43rd to 50th in Q4’24. This made it the fourth largest Layer-2 token by market cap, behind Mantle (MNT), Polygon (POL), Arbitrum (ARB), but ahead of Immutable X (IMX) and Movement (MOVE). After starting 2024 strong, OP experienced a large drawdown in price in Q2’24. The token ranged for much of H2’24, ending the year down 52.8% YoY.

In October 2024, Airdrop 5 went live and distributed ~10.37 million OP (~0.24% of the token supply) worth $15.9 million to 54,723 addresses that transacted on various OP Chains between March and September 2024.

Token UsesOP continues to serve functions related to governance and incentives:

- Governance: Optimism is governed by the Optimism Collective, a bicameral system comprising the Token House and Citizens’ House. The Token House consists of all OP tokenholders and governs network changes through onchain proposal voting via Agora. OP grants the ability for a tokenholder to delegate OP to themselves or to another delegate.

- Incentives: Optimism stakeholders are incentivized to grow the Optimism ecosystem through the following programs:

- Ecosystem Fund: 1.07 billion OP (25% of the total supply) were allocated to an Ecosystem Fund designed to stimulate the development of the Optimism ecosystem through four subcategories (Governance Fund, Partner Fund, Seed Fund, and Unallocated Reserves).

- Retroactive Public Goods Funding (RetroPGF): 859 million OP (20% of the total supply) was allocated to RetroPGF, where funds are distributed by the Citizens’ House to community members that have previously impacted Optimism, based on each round’s scope.

Airdrops: 816 million OP (19% of the total supply) were allocated for user airdrops. Eligibility criteria for each round of airdrops vary and are determined by Optimism Foundation. 549.43 million OP (~12.80% of the total supply) remain to be distributed as of the end of Q4’24.

Sequencer

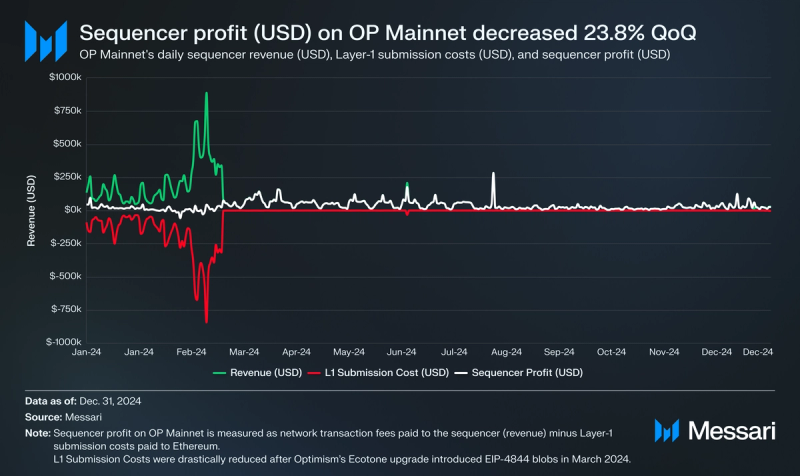

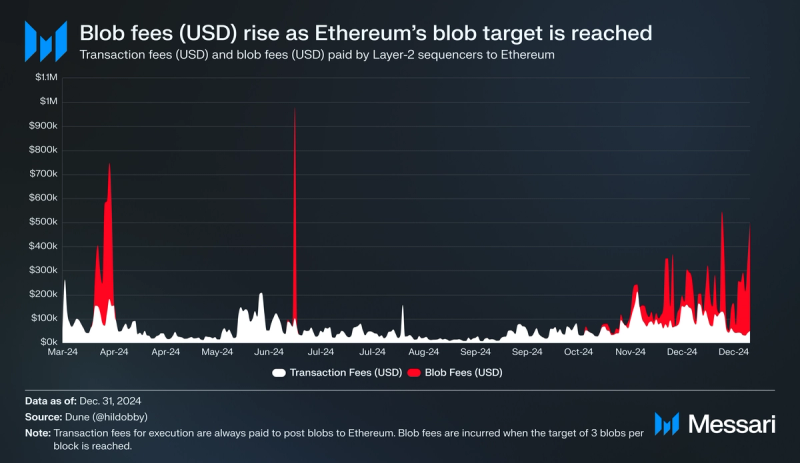

Optimism Foundation controls the lone sequencer that executes pending transactions stored in OP Mainnet’s private mempool. Blocks of executed transactions on OP Mainnet are created every two seconds and periodically batch-submitted as EIP-4844 blobs to Ethereum by the sequencer.

The highlight of the year occurred on March 13, 2024, when Optimism’s Ecotone upgrade was approved and went live, introducing EIP-4844 blobs for data availability after Ethereum’s Dencun upgrade. This was the cause for the 90.8% YoY reduction in average transaction fees to $0.03 on OP Mainnet as Layer-1 submission cost savings continue to be passed down to users.

In Q4 2024, sequencer revenue (USD) from network transaction fees fell 22.6% to $2.3 million. With a cumulative Layer-1 submission cost (USD) of just $31,000, Optimism Foundation’s sequencer profit (USD) was $2.2 million in Q4’24, down a similar 23.8% QoQ. Notably, sequencer profits are not retained by Optimism Foundation. Rather, they are distributed to the Optimism Collective’s treasury to fund RetroPGF.

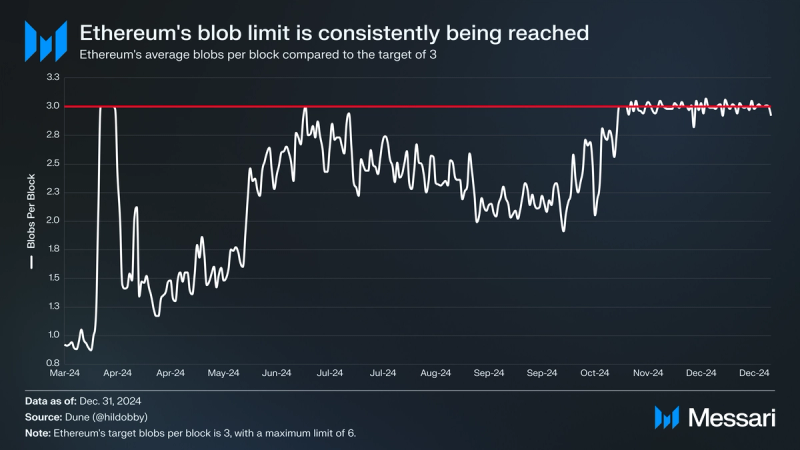

Blob Saturation

OP Mainnet’s sequencer had a profit margin of 7,232.4% in Q4’24. This was a 66.5% QoQ decrease due to the cumulative Layer-1 submission cost (USD) increasing 122.5%. As Ethereum’s target of three blobs per block was more regularly exceeded, blobspace fees began to be incurred on top of transaction fees for execution. In total, there were 26 days in Q4’24 where the average blobs per block exceeded 3 in a day. Additionally, Ethereum saw activity rise in Q4’24, leading to increased network transaction fees when posting blobs to Ethereum.

This combination of factors led to Layer-1 submission costs rising across Layer-2 networks in Q4’24. Still, the amount is negligible when considering OP Mainnet’s Layer-1 submission costs are down 99.6% YoY, and its profit margin is up 29,105%. Ethereum’s Pectra hard fork will include EIP-7691, which aims to increase the target blobs per block from 3 to 6, which could reduce Layer-1 submission costs for a period of time.

Network Analysis Usage

Usage

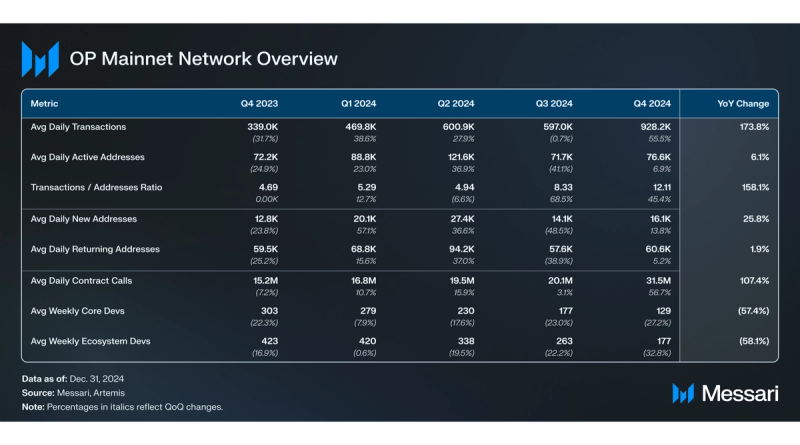

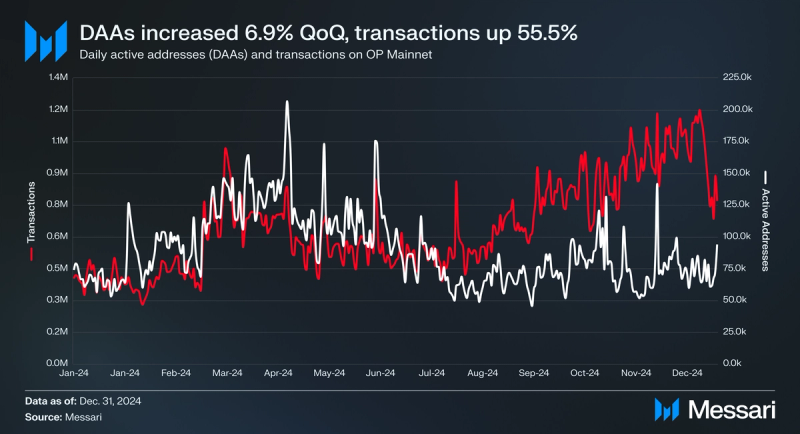

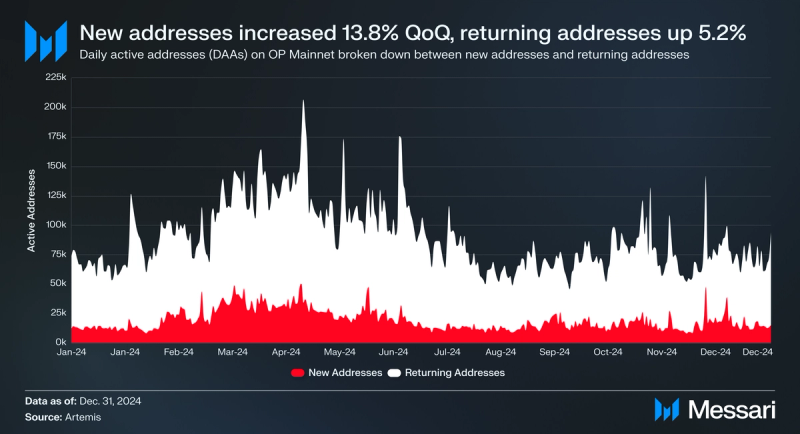

Average daily active addresses (DAAs) on OP Mainnet increased 6.9% QoQ to 76,600, while daily transactions increased 55.5% to 928,200. The ratio of transactions to active addresses (txs/DAAs) increased 45.4% QoQ to 12.11, suggesting an increase in “power users” of OP Mainnet; conversely, a decreasing ratio suggests activity is being distributed more evenly across users.

Average daily new addresses increased 13.8% QoQ to 16,100, while average daily returning addresses rose by a lesser 5.2% to 60,600. The positive changes in average daily transactions and DAAs indicate that OP Mainnet returned to a state of growth in Q4’24 after a sluggish Q3’24 that saw active addresses drop 41.1%. Overall, average daily transactions ended the year up 173.8% YoY, while average DAAs ended up 6.1%.

Technical DevelopmentsOptimism averaged 129 weekly active core developers and 177 weekly active ecosystem developers in Q4 2024, which were down 27.2% and 32.8% QoQ, respectively. While Optimism did not undergo any significant network upgrades in Q4 2024, it did share updates regarding native interoperability across the Superchain, which is the Optimism Collective’s central focus in 2025. Specifically, Optimism introduced the following:

- Superchain ERC-20: An implementation of ERC-7802, a cross-chain token standard proposed by OP Labs, DeFi Wonderland, and Uniswap on Nov. 7, 2024. The Superchain ERC-20 token standard allows tokens to move across the Superchain with limited trust assumptions via native minting and burning on OP Chains.

- Message Passing Protocol: This protocol enables cross-chain messages on the Superchain using a pull-based event system.

- A local development environment called “Supersim” allowed developers to experiment with Superchain Interop and native message passing.

- Interoperable Fault Proofs: This fault proof standard provides security across OP Chains.

Notably, while the Holocene Network Upgrade was approved in Q4’24 it only went live on Jan. 9, 2025. Holocene is meant to introduce changes related to block derivation, EIP-1559 configurability, and the MIPS contract.

Closing SummaryOP Mainnet experienced varied results across key metrics in Q4 2024. Within the ecosystem, TVL (USD) increased 11.3% QoQ to $756.1 million but was down 16.1% YoY. USDC’s market cap surged 277.4% QoQ to $360.5 million, while USDT’s market cap fell 22.4% to $914.7 million. Average daily DEX volume (USD) grew 91.9% QoQ to $144.5 million, which is up 118.4% YoY, led by Velodrome and Uniswap.

Financially, the price of OP stayed flat QoQ at $1.75, though its market cap rank fell from 43rd to 50th, underperforming the broader market and its Layer-2 peers. Sequencer profit (USD) fell 23.8% QoQ to $2.2 million. However, users enjoyed average transaction fees of $0.03 in Q4’24, which is down 90.8% YoY due to EIP-4844 blobs. This has resulted in average daily transactions of 928,200, up 173.8% YoY and 55.5% QoQ.

At the community level, Airdrop 5 distributed 10.37 million OP tokens worth $15.9 million to 54,723 addresses. Season 6 of governance concluded in December 2024 having distributed 4.98 million OP to 30 projects through grants. Season 7 is slated to begin on Jan. 22, 2025, and will operate under the theme of “Shared Success” while pursuing its singular intent surrounding Superchain interoperability.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.