and the distribution of digital products.

State of Merlin Chain Q4 2024

- Merlin Chain partner BitcoinOS successfully executed the first ZK Bridge transaction on Bitcoin’s testnet. This development helps advance Merlin Chain’s transition to a decentralized Bitcoin L2.

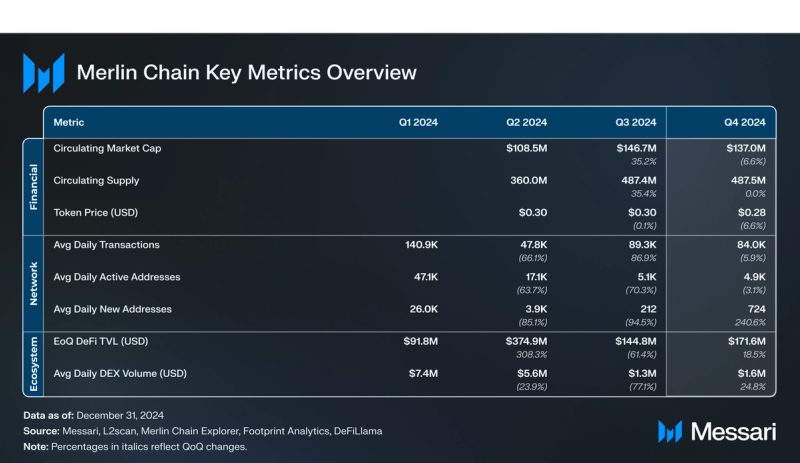

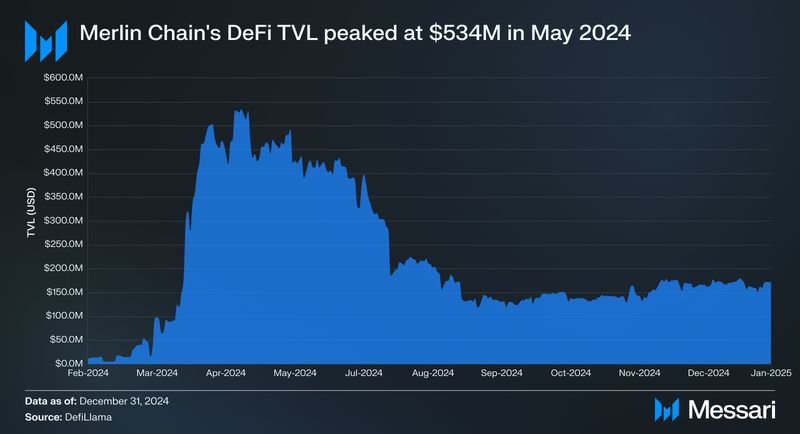

- Merlin Chain’s DeFi TVL grew 18.5% QoQ to $171.6 million. Increased activity on Avalon Finance and MerlinSwap drove Merlin Chain’s economic growth in Q4 2024.

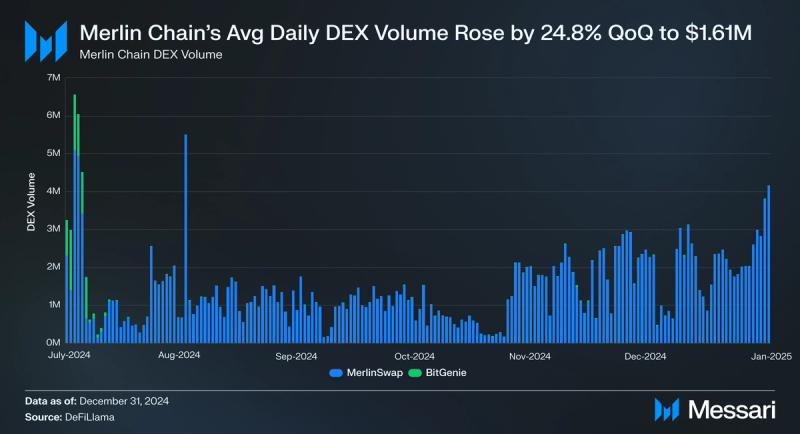

- Merlin Chain’s average daily DEX volume increased by 24.8% QoQ to $1.6 million. MerlinSwap accounted for 99.5% of all trading volume on Merlin Chain.

- Merlin Chain’s average daily new addresses increased by 240.6% QoQ. The Bitmap and Party token launches correlate with the creation of new addresses in Q4’24.

- Merlin Chain partnered with the memecoin launcher BTC.Fun to drive community-centric growth. BTC.Fun’s top memecoin, Party, achieved a peak market capitalization of over $43.6 million.

Merlin Chain is an EVM-compatible Bitcoin Layer-2 (L2) built to enhance the scalability and usability of Bitcoin-native assets, such as Ordinals, BRC-20 tokens, and Runes. The network addresses Bitcoin’s challenges, including high transaction costs and limited functionality, by offering a seamless and cost-efficient execution environment. Merlin Chain’s current technical implementation is more accurately described as a Bitcoin sidechain but aims to develop into a Bitcoin Layer-2 solution, leveraging innovative technologies like zero-knowledge proofs (ZKPs), decentralized oracle networks, and fraud-proof mechanisms.

Launched in January 2024 by Bitmap Tech, the team behind the BRC-420 protocol and the “Blue Box” Ordinal collection, Merlin Chain has rapidly developed its ecosystem. In collaboration with partners like Lumoz Network, Nubit, BitcoinOS, and Particle, the chain integrates modular scaling solutions and advanced data availability tools to achieve high performance and security. Merlin Chain currently utilizes the Polygon CDK to enable an execution environment tailored to Bitcoin native assets and is working with BitcoinOS and Nubit to support the evolution of its architecture into a Bitcoin rollup.

In Q4 2024, Merlin Chain continued to expand its ecosystem, with significant progress in native and cross-chain integrations. Key developments include partnerships with BTC.Fun and TimonFun and the extension of M-BTC’s reach to networks such as Taiko, ZKSync, DuckChain, and BNB Chain, enhancing its utility and accessibility across multiple ecosystems. With over $3.5 billion in TVL at its peak, the chain has attracted attention as a hub for Bitcoin-based DeFi, gaming, and memecoins. For a complete introduction to Merlin Chain, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Financial Analysis

Financial Analysis Market Capitalization

Market Capitalization

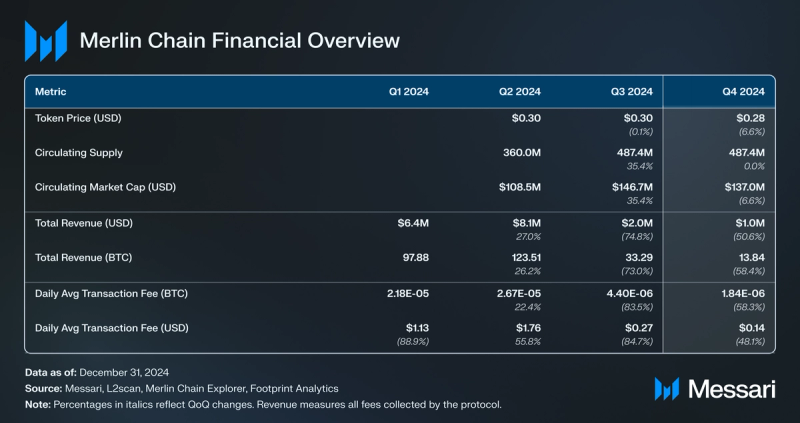

According to CoinGecko, MERL’s market cap decreased by 6.6% from $146.7 million to $137.0 million in Q4’24, driven by a 6.6% decline in token price to $0.28. According to Merlin Chain’s vesting schedule, the liquid supply of MERL also increased. In Q4’24, the liquid supply of MERL rose to 30.7% of the maximum supply, a QoQ increase of 14.2%. As of Dec. 31, 2024, Merlin Chain’s market cap ranks 546th among all cryptocurrencies.

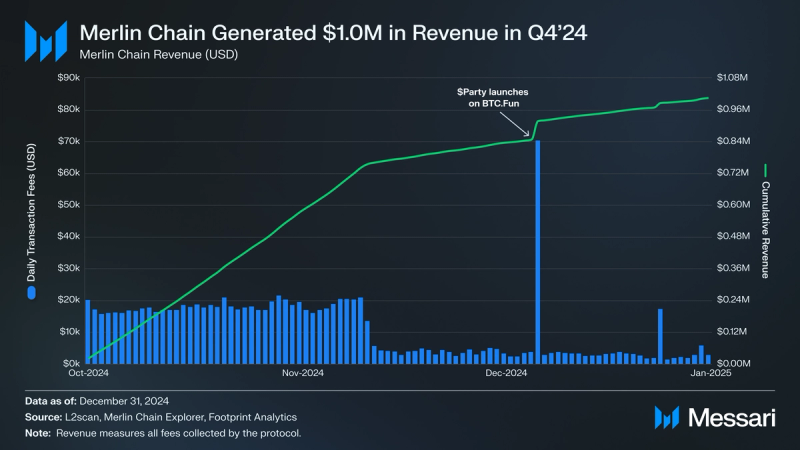

Revenue

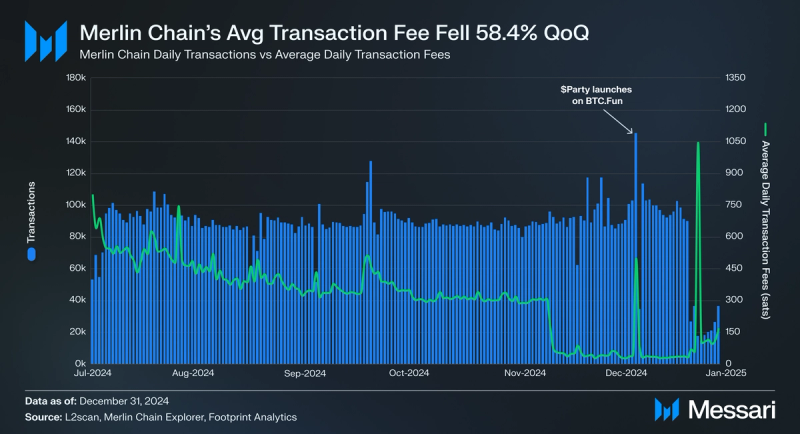

Merlin Chain’s total revenue, i.e., all fees collected by the protocol, reached $1.0 million in Q4’24. However, the quarter marked a significant shift in revenue dynamics. Between October 1 and November 11, daily revenue averaged $17,975, supported by consistent network activity and a relatively high average transaction fee. This period accounts for the majority of revenue generation in Q4.

From November 12 to December 31, daily revenue fell to an average of $4,992, reflecting a 72.2% decrease compared to the earlier part of the quarter. This decline in revenue was driven by a reduction in the average transaction fee, which fell from a daily average of $0.27 in Q3 to $0.14 in Q4. This fall in the average transaction fee coincided with Particle Wallet supporting the use of MERL as a gas for transaction fee payments on Merlin Chain. With this upgrade, gas fees have been reduced from 0.05 gwei to 0.006 gwei. The large spike in revenue on Dec. 6, 2024, corresponds with the launch of the $Party memecoin on the memecoin launchpad BTC.Fun. Despite stable transaction volumes during Q4, the reduced fees significantly impacted total revenue generation.

Liquid SupplyCopilot Insights: What is the liquid supply of MERL?

According to Merlin Chain’s vesting schedule, by the end of Q4’24, 30.7% of MERL's supply was liquid, marking a 14.2% QoQ increase. This liquid supply increase is due to the vesting of MERL initially allocated to Advisors, the Ecosystem, and the Community. Additionally, Private Sale A participants extended the cliff associated with their vesting schedule until April 9, 2025. Looking ahead to Q1’25, an additional 80.34 million MERL, or 3.8% of MERL’s total supply, will unlock.

The key components of the Q1’25 unlock include:

- Team/Advisors (7.6% of Q1 unlocks): Approximately 6.09 million MERL tokens will be unlocked for Merlin Chain advisors. The team has a 24-month cliff and will begin receiving tokens on April 19, 2026.

- Community (27.1% of Q1 unlocks): Approximately 21.75 million MERL will unlock in Q1 as part of the community allocation, which will be used to support future ecosystem initiatives.

- Ecosystem (65.3% of Q1 unlocks): Approximately 52.50 million MERL will unlock in Q1 as part of the ecosystem allocation. The ecosystem allocation is designed to be distributed through ecosystem grants and incentives.

Notably, no unlocks are scheduled for Private Sale A or Private Sale B investors in Q2’25. The first unlock for Private Sale A and B participants is scheduled for April 19, 2025. Additionally, Merlin’s Seal and public sale allocations completed their respective vesting schedules in Q3’24.

Network Analysis Usage

Usage

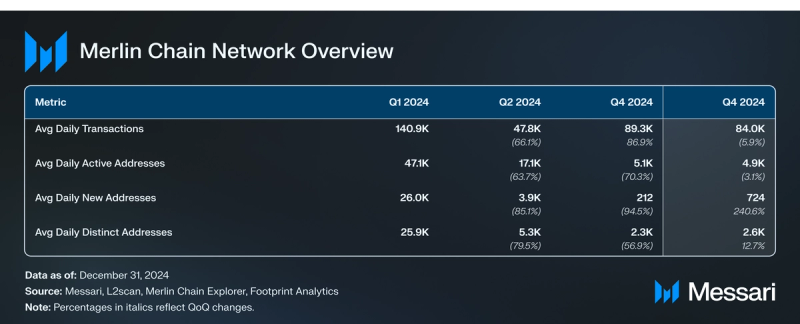

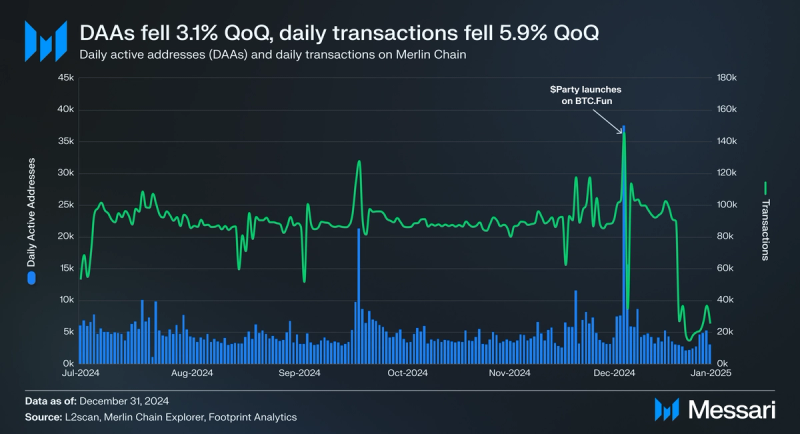

In Q4’24, Merlin Chain experienced mixed trends in network activity, reflecting both stability in core usage metrics and growth in new participants. Average daily transactions declined slightly by 5.9% QoQ, averaging 84,000 for the quarter. However, this drop follows a strong Q3, when average daily transactions reached 89,300 per day, an 86.9% increase compared to Q2’24. The Q4’24 metrics indicate a stabilization of transaction volume at a high baseline, suggesting consistent activity on Merlin Chain.

Daily active addresses (DAA) also saw a marginal decline of 3.1% QoQ, stabilizing at an average of 4,900. Despite this, the average daily distinct addresses, which tracks only addresses initiating transactions, grew by 12.7% QoQ to reach 2,600. This trend suggests a shift toward more engaged users actively interacting with the network.

One of Q4’s standout network usage metrics was the surge in average daily new addresses, which increased 240.6% QoQ, averaging 724 new addresses daily. This growth indicates a noticeable influx of new participants to the ecosystem, likely driven by onboarding initiatives and increased interest in Merlin Chain’s applications. The rise in new addresses demonstrates Merlin Chain’s ability to attract new participants.

Much of Merlin Chain’s growth in new addresses occurred between Nov. 19, 2024, and Dec. 9, 2024, during which time the new network added 54,064 new addresses, representing 62.8% of the quarter’s total. This period also saw a slight increase in transaction volume, suggesting partial conversion of new addresses into active network participants. During this period, two anticipated token launches occurred. The first was for the Bitmap token, which occurred on MerlinStarter, a Merlin Chain launchpad, on Nov. 22, 2024. The second was the launch of the Party memecoin on BTC.Fun. The decline in transaction activity toward the end of the quarter may reflect seasonality, with decreased activity potentially linked to the holiday season.

SecurityIn Q4’24, Merlin Chain expanded its wallet integrations through partnerships with Tomo Wallet and UXUY. Both are Telegram-based wallets that enable users to store, send, and receive MERL and other Bitcoin-native assets directly within the Telegram app. These integrations also allow users to connect to Merlin Chain and interact with the ecosystem, improving accessibility and usability for Merlin Chain users.

DevelopmentIn Q3’24, Merlin Chain partnered with BitcoinOS to advance its transition from a sidechain to a fully decentralized Bitcoin Layer-2 (L2) network. BitcoinOS tackles Bitcoin’s scalability and computational efficiency limitations with its BitSNARK technology. This specialized zkSNARK verifier is tailored for Bitcoin, enabling trustless proof validation directly on the blockchain with minimal computational demands.

Through this collaboration, Merlin Chain plans to integrate BitcoinOS’s infrastructure to transition from a sidechain to a secure and decentralized L2 rollup. Central to this effort is the integration of BitcoinOS’s Grail Bridge, a trustless bridging mechanism driven by BitSNARK. The Grail Bridge enables cross-chain asset transfers between Bitcoin and L2s without requiring centralized custodians, aligning with Merlin Chain’s commitment to decentralization and security.

In Q4’24, BitcoinOS achieved a key milestone by executing the first zero-knowledge (ZK) bridge transaction on Bitcoin’s testnet to Merlin Chain. The process of completing this transaction utilized BitcoinOS’ BitSNARK technology and the Grail Bridge to enable the following:

- Bitcoin L1 Locking: funds on Bitcoin are sent to an address controlled by BitSNARK.

- Token Minting on Merlin Chain: Upon confirmation, a cryptographic proof triggers a smart contract on Merlin Chain to mint BTC-pegged tokens representing the locked coins.

- Trustless Security: This mechanism operates entirely through cryptographic proofs, eliminating the need for centralized custody or multi-signature wallets.

The successful execution of the first testnet Bitcoin to Merlin Chain represents the first phase of the development of the Grail Bridge. The next phase will enable users to burn BTC-pegged tokens on Merlin Chain and settle BTC-pegged assets back on Bitcoin L1. Once completed, this will establish Bitcoin’s first bi-directional ZK bridge, enabling Merlin Chain to transition from centralized bridging models to a trustless framework that enhances scalability, security, and decentralization.

Ecosystem Overview DeFiCopilot Insights: What are Merlin Chain's top DeFi protocols?

DeFiCopilot Insights: What are Merlin Chain's top DeFi protocols?

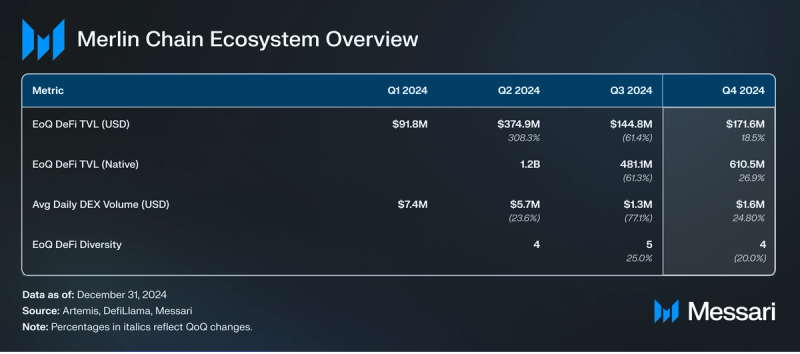

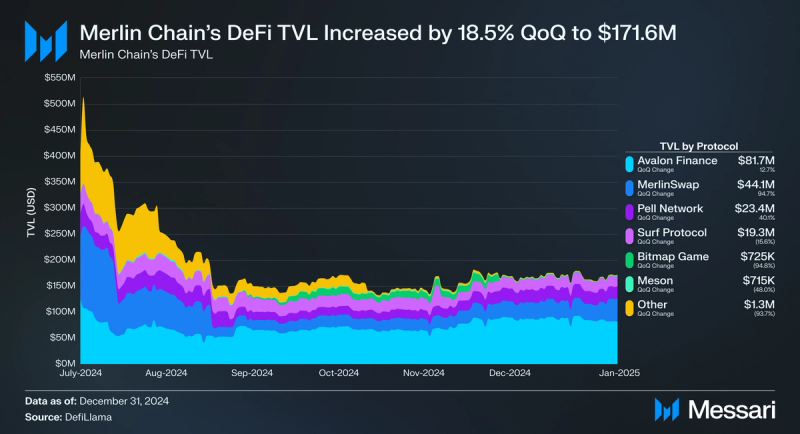

In Q4’24, Merlin Chain’s ecosystem regained $26.8 million of DeFi TVL, with End-of-Quarter (EoQ) TVL increasing by 18.5% QoQ to $171.6 million. This growth reflects sustained user engagement and asset inflows. Average daily DEX volume also grew by 24.8% QoQ to $1.6 million, signaling heightened trading activity and improved liquidity. However, DeFi diversity, which measures the number of dApps that make up 90% of the network’s total DeFi TVL, declined from 5 to 4. This reduction is primarily due to the consolidation of TVL within Merlin Chain’s top four applications: Avalon Finance, MerlinSwap, Pell Network, and Surf Protocol.

Avalon Finance, Merlin Chain’s leading lending protocol, remained the dominant protocol by TVL, contributing $81.7 million to Merlin Chain’s TVL, a 12.7% increase QoQ. Merlin Chain’s largest contributor to DeFi TVL growth in Q4’24 was MerlinSwap. MerlinSwap nearly doubled its TVL QoQ to reach $44.1 million by the end of the quarter, reflecting increased user activity and liquidity on Merlin Chain’s top DEX, which can partially be attributed to BTC.Fun, a memecoin launching platform that migrates liquidity to Merlin Swap when a token successfully mints.

Other key contributors included:

- Pell Network is a restaking platform. Pell’s $23.4 million in TVL represents a 40.1% increase QoQ.

- Surf Protocol is a perpetual futures exchange. Surf’s $19.3 million in TVL represents a decrease of 15.6% QoQ.

Additional top TVL contributors:

- Bitmap Game is a metaverse project centered around the Bitmap ecosystem. Its $725,000 in TVL represents a decrease of 94.8% QoQ. Bitmap Game’s decline in TVL in Q4 corresponds with the launch of the BITMAP token. BITMAP is a Runes token that allows users to freely convert between Bitmap NFTs and BITMAP tokens to access liquidity.

- Meson is a cross-chain bridging and swap protocol. Meson’s $715,000 in TVL represents a decrease of 48.0% QoQ.

Even with Merlin Chain’s QoQ DeFi TVL growth, DeFi TVL remains far below the highs of early 2024, which reached $534 million in DeFi TVL in Q2’24. This reflects ongoing challenges due to a narrative shift away from the BTCfi sector. However, unlocking the value trapped in Bitcoin with smart contract functionality remains a promising opportunity in 2025 and beyond.

Lending

On November 12, 2024, Avalon Finance announced plans to launch USDa, a Bitcoin-backed stablecoin, on Merlin Chain. USDa operates as a collateralized debt position (CDP), enabling users to mint stablecoins against Bitcoin collateral. As of December 31, 2024, USDa is unavailable on Merlin Chain.

Decentralized Exchanges

In Q4 2024, Merlin Chain’s average daily DEX volume increased 24.8% QoQ, rising from $1.3 million in Q3 to $1.6 million. MerlinSwap remained the dominant DEX on Merlin Chain, accounting for 99.5% of the total volume over Q4. Meanwhile, BitGenie, Merlin Chain’s second largest DEX by TVL, averaged $8,275 in daily volume in Q4’24, a decrease of 81.5% QoQ from $44,634 in Q3. The rise in DEX volume aligns with the broader increase in TVL across Merlin Chain’s ecosystem, indicating sustained user engagement.

Perpetual Futures

Surf Protocol, Merlin Chain’s leading perpetual futures platform, achieved $2 billion in cumulative trading volume. Additionally, Surf earned inclusion in Binance Labs’ Most Valuable Builder (MVB) program, highlighting its potential in the DeFi sector.

Looking ahead, the announcement of Surf V2 in early January 2025 signals further improvements aimed at enhancing the user experience and positioning Surf as a top-tier perpetual futures platform. These developments reinforce Surf’s critical role in driving DeFi activity on Merlin Chain.

M-BTC

M-BTC, the leading M-Token on Merlin Chain, continued to play a significant role in the ecosystem in Q4’24. M-Tokens, introduced during the Merlin’s Seal event in early 2024, represent staked assets on Merlin Chain and are redeemable 1:1 for their underlying assets. As of Dec. 31, 2024, M-BTC has maintained deep onchain liquidity, with the largest M-BTC/BTC liquidity pool on MerlinSwap reaching over $11.6 million of liquidity.

In Q4, Merlin Chain expanded M-BTC’s reach and utility through strategic partnerships. At the network level, collaborations with Persistence One, Taiko, ZKSync, DuckChain, and BNB Chain enabled M-BTC to be bridged to and supported across these ecosystems. At the application level, integrations with ZeroLend, TakoTako, and Unagi Swap allow M-BTC to be used as collateral in money markets and supported on DEXs outside of the Merlin Chain ecosystem, enhancing its utility and accessibility for users.

Additionally, Bedrock announced its new product, brBTC, will accept M-BTC as collateral. brBTC is a Bitcoin LRT designed to reduce market fragmentation by accepting various BTC derivative assets as collateral, including M-BTC, FBTC, cbBTC, WBTC, and uniBTC. These integrations highlight M-BTC’s expanding role in cross-chain liquidity and its growing utility throughout DeFi.

Restaking

Pell Network, an omnichain restaking protocol, continued to play a key role in Merlin Chain’s ecosystem in Q4 2024. Following its strong performance in Q3, Pell Network’s TVL increased by 40.1% QoQ to $23.4 million. Pell Network enables BTC holders to restake their Liquid Staking Derivatives (LSDs) to secure Decentralized Validated Services (DVSs) across multiple networks, including Merlin Chain. By offering a universal trust layer backed by BTC, Pell reduces the need for new protocols to establish costly validator sets, providing scalable and cost-effective cryptoeconomic security. This model also creates additional passive income opportunities for holders of M-BTC, uniBTC, SolvBTC, and other supported assets.

Throughout Q4’24, Pell Network continued to run a points campaign. Pell points represent and track how much users contribute to Pell Network throughout the campaign. On Merlin Chain, Pell points can be earned by restaking supported Bitcoin LSTs.

GamingDragonverse Neo

In Q4 2024, Dragonverse Neo, developed by MOBOX, remained the primary gaming application on Merlin Chain. The game is a 3D open-world fantasy anime experience inspired by Genshin Impact and Pokémon. It offers customizable game environments or REALMs, crafting through the Dratopia platform and DragonPals with unique skills that enhance gameplay.

In Q4, Dragonverse Neo launched Season 7, which introduced Dragon Defense, a new tower defense game that added a strategic gameplay element. The game also completed Season 8 in Q4’24 and launched Season 9 on Jan. 10, 2025. With continued updates and new content, Dragonverse Neo is well-positioned to drive engagement and growth within Merlin Chain’s gaming sector, reinforcing its status as a cornerstone of the ecosystem.

TimonFun

On Dec. 9, 2024, Merlin Chain announced a strategic partnership with TimonFun, a gamified rewards platform on Telegram. TimonFun leverages Telegram’s user base of over 950 million active users to drive adoption through its quest-based mini-app. The platform rewards users for completing tasks such as engaging on social media, inviting friends, exploring Telegram apps, and more.

TimonFun incentivizes user participation by offering tickets and diamonds that can be redeemed for prizes, ranging from cryptocurrency rewards like TimonFun Points, USDT, and MERL to physical items such as MacBooks, iPhones, and Teslas. By integrating features like zero-fee farming and gas fee loans, TimonFun lowers the barriers to entry for new users.

MemecoinsCopilot Insights: What are Merlin Chain's top memecoins?BTC.Fun

On Nov. 18, 2024, BTC.Fun announced a strategic partnership with Merlin Chain. BTC.Fun is a pump.fun-like memecoin launchpad that enables users to launch and trade Runes/BRC20 tokens on Bitcoin. All tokens created on BTC.Fun are inscribed or etched on the Bitcoin L1 and bridged to Merlin Chain, where they can be traded in a user-friendly environment.

When a token is launched, and the mint process has been completed, tokens and mint fees are added to a liquidity pool on MerlinSwap. All tokens are paired with MERL as the base asset. As of Dec. 31, 2024, the most successful memecoin launch on BTC.Fun is the Party BRC-20 token, which reached a peak market capitalization of over $43.6 million on Dec. 27, 2024. Party is the third BRC-20 ticker with 5-byte and was launched as a test token for BTC.Fun.

Ecosystem GrowthThroughout Q4’24, the Merlin Chain ecosystem expanded its reach with additional partnerships, community events, and token listings.

Additional Q4’24 partnerships include the following:

- exSat Network Partnership: On Oct. 23, 2024, Merlin Chain partnered with exSat Network as a validator node.

- Akka Finance Partnership: On Dec. 3, 2024, Merlin Chain partnered with Akka Finance, a cross-chain liquidity aggregator.

- Beyond Tech Partnership: On Dec. 12, 2024, Merlin Chain announced a partnership with Beyond Tech, a Bitcoin to Bridge.

Merlin Chain remained active in the community and participated in many community events. Merlin Chain community events held in Q4’24 include the following:

- Bitcoin Malaysia 2024: Merlin Chain founder Jeff Yin spoke at the Bitcoin Malaysia 2024 conference.

- Dubai Influencer Party: Merlin Chain sponsored and attended the Dubai influencer party.

- DevCon 2024: Merlin Chain attended DevCon 2024 in Bangkok, Thailand.

- FireNow - Asian Web3.0 Institutional Summit: Merlin Chain partnered with and attended the FireNow summit.

- Bangkok Blockchain Night 2024: Merlin Chain participated as a gold sponsor in the Bangkok Blockchain Night 2024.

- Bitcoin Runes Incubator Day: Merlin Chain sponsored the Bitcoin Runes Incubator.

- End-of-Year Party in Seoul: Merlin Chain sponsored an end-of-year party in Seoul.

Merlin Chain’s MERL token also received several exchange listings in Q4’24. Q4’24 MERL token listings include the following:

- On Oct. 9, 2024, Kraken Pro announced the listing of MERL perpetual futures.

- On Nov. 22, 2024, Merlin Chain announced the listing of MERL perpetual futures on Binance.

- On Dec. 4, 2024, Merlin Chain announced the listing of MERL on Bitvavo.

- On Dec. 8, 2024, Merlin Chain announced the listing of MERL perpetual futures on Ox Fun.

In Q4’24, Merlin Chain demonstrated resilience and growth across several key metrics. The network’s TVL increased by 18.5% QoQ to $171.6 million, supported by heightened DEX activity driven by the rise of BTC.Fun. Average daily DEX volume rose 24.8% QoQ to $1.6 million, reflecting increased trading activity and liquidity migration from successful token launches. Despite a 6.6% decline in market cap and a sharp drop in protocol revenue due to reduced transaction fees, network activity remained robust, with a 240.6% increase in average daily new addresses signaling strong user onboarding.

Strategic collaborations further strengthened Merlin Chain’s ecosystem and technical foundation. Merlin Chain’s partnership with BitcoinOS advanced the network’s transition to a decentralized Bitcoin L2, highlighted by the successful testnet execution of the Grail Bridge’s first phase. This milestone showcased the potential for trustless, bi-directional Bitcoin asset transfers. Additionally, wallet integrations with Tomo Wallet and UXUY improved accessibility by enabling users to store, send, and interact with MERL and other Bitcoin-native assets within Telegram. Additionally, TimonFun, a gamified rewards platform on Telegram, leveraged its large user base to onboard new participants through interactive tasks and incentives, helping to drive adoption and engagement on Merlin Chain.

While challenges remain, such as the contraction in DeFi diversity and a narrative shift away from BTCFi in Q4’24, Merlin Chain’s efforts to build foundational infrastructure and onboard new users position it well for future growth. As the network advances its L2 ambitions and expands its offerings, Merlin Chain is poised to further solidify its place in the Bitcoin ecosystem in 2025.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.