and the distribution of digital products.

State of Marinade Q1 2025

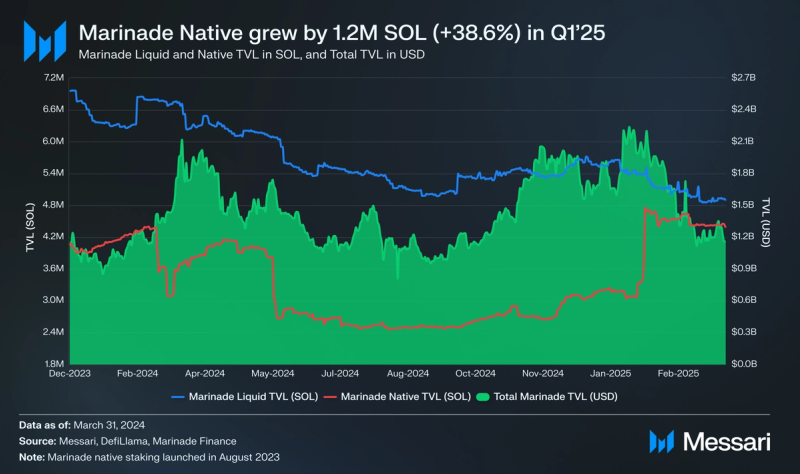

- Marinade Native’s TVL (SOL) increased 38.6% QoQ. Marinade Native added ~1.2 million SOL in TVL in Q1’25.

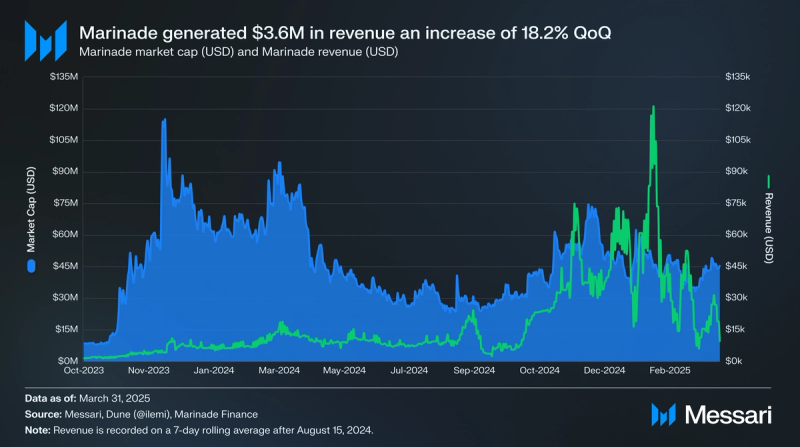

- Marinade generated $3.6 million in protocol revenue in Q1’25, an increase of 18.2% QoQ and 328.4% YoY. The Stake Auction Marketplace (SAM) was the primary driver of revenue.

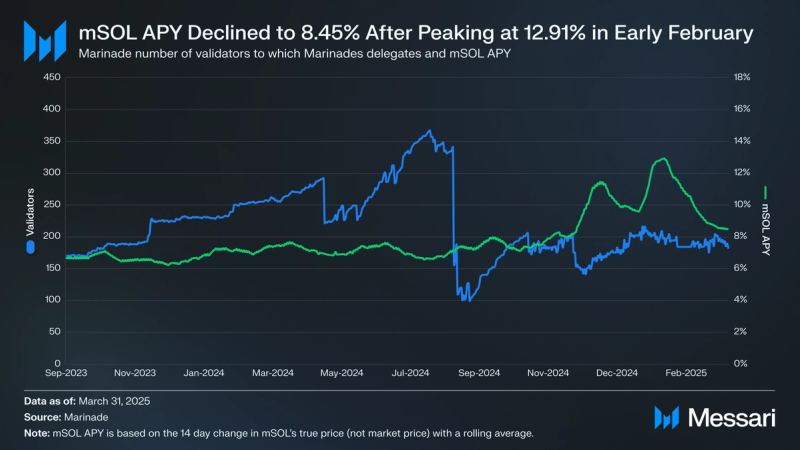

- mSOL APY ended the quarter at 8.45% but peaked at 12.91% on Feb. 6, 2025. Although down from Q4’24’s 9.95% APY, mSOL’s APY in Q1’25 remained competitive.

- Marinade liquid staking market share fell to 11.3% as demand shifted toward Marinade Native. Marinade Native is a non-custodial, smart contract-free, native staking solution that charges no fees and automatically delegates to top validators.

- Marinade governance advanced initiatives to improve MNDE utility, expand protocol growth, simplify validator delegation, and introduce token buybacks. As of May 5, 2025, eleven Marinade Improvement Proposals (MIPs) have been created to enhance the protocol.

Marinade (MNDE) is an automated staking protocol on Solana that offers two core products: liquid staking via mSOL and Marinade Native. Marinade Native allows users to delegate SOL directly to top-performing validators while retaining custody of their SOL, minimizing risks, and providing consistently higher staking yields compared to any 0% fee validator. Marinade Native does not use any smart contracts, charges no management fees, and does not issue a liquid staked token. Institutional-grade features such as SOC 2 compliance, integrations with custodians like BitGo, Zodia, and Copper, a staking rewards report tool for tax purposes, and the upcoming addition of instant liquidity via Native Instant Unstake have positioned Marinade Native as a leading choice for institutional stakers.

Marinade’s liquid staking product, Marinade SOL (mSOL), is a tokenized version of staked SOL that can be freely used across DeFi protocols. Users receive mSOL when staking through Marinade’s liquid staking interface, allowing them to earn staking rewards while maintaining the flexibility to trade, lend, or use their assets within Solana’s growing DeFi ecosystem.

Marinade was founded during the March 2021 Solana x Serum Hackathon and launched on mainnet on Aug. 2, 2021. Marinade’s governance token, MNDE, was released a few months later, with a retroactive airdrop for mSOL holders. Marinade has not raised venture capital funding or conducted public token sales. Instead, Marinade’s token, MNDE, has mainly been distributed via various campaigns to reward users and contributors. Beyond incentives, MNDE is used for governance on Realms. Previously, Marinade delegated staked SOL to validators based on its algorithmic delegation strategy. After Q2’24, the delegation strategy was updated with the launch of the Stake Action Marketplace (SAM), where validators bid on stakers' SOL deposits. As of the approval of Marinade Improvement Proposal (MIP) 3 in November 2024, the SAM is responsible for allocating 100% of Marinade’s TVL, creating a market-based mechanism for validator competition, and enabling stakers to earn optimized returns.

To participate in Marinade, validators need to meet specific criteria for eligibility, notably a maximum 7% commission. In April 2024, Marinade launched Protected Staking Rewards (PSR), which also requires validators to put up a SOL bond to be eligible for stake on Marinade. The PSR is a safeguard that guarantees 100% uptime insurance. It enforces an onchain service-level agreement protecting stakers from validator downtime and commission changes, protecting users' staking rewards.

Website / X (Twitter) / Discord

Key Metrics Financial Analysis

Financial Analysis Market Cap

Market Cap

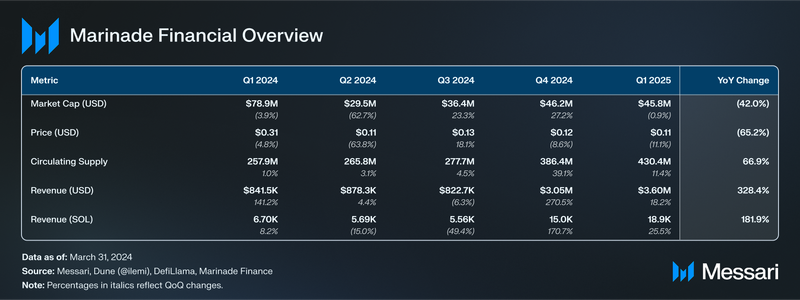

During Q1’25, Marinade Finance’s market capitalization decreased by 0.9% QoQ from $46.3 million to $45.8 million. This modest decline occurred as the circulating supply of MNDE increased 11.4% QoQ to 430.4 million tokens. MNDE’s price declined 11.1% over the quarter to $0.1065.

Staking

Marinade is a non-custodial staking protocol that offers two distinct SOL staking products: liquid staking via mSOL and native staking through Marinade Native. As of May 5, 2025, the combined TVL of both products accounts for approximately 2.5% of all staked SOL.

Marinade’s liquid staking product allows users to receive mSOL, a tokenized receipt of their staked SOL, which can be freely used across DeFi applications. In contrast, Marinade Native delegates SOL to validators without issuing a token, allowing users to retain custody, eliminate smart contract risk, and earn rewards directly to their stake accounts with no management fees.

In Q1’25, the TVL of mSOL declined 12.3% QoQ to 4.9 million SOL. Meanwhile, the TVL of Marinade Native increased 38.6% QoQ to 4.4 million SOL. Combined, Marinade’s TVL reached 9.3 million SOL, equivalent to $1.2 billion. This shift reflects growing demand for native staking, as institutional-grade features such as SOC2 compliance, native instant unstake, PSR, and partnerships with BitGo and Coinbase Prime, position Marinade Native as a preferred solution among staking products.

Revenue

During Q1’25, Marinade generated approximately 18,870 SOL ($3.60 million) in revenue, with the vast majority derived from performance fees collected via the Stake Auction Marketplace (SAM). In Q1’25, the SAM generated 18,864.7 SOL in revenue, accounting for all but 6.28 SOL in revenue generated through unstake fees. Under the SAM’s auction-based model, validators compete for delegation by bidding a portion of their earned yield, which is then captured by the protocol and redistributed or retained based on defined mechanisms.

The validator performance fee, set at a maximum of 9.5%, remains the primary revenue stream for Marinade. In Q1’25, the Marinade DAO approved MIP-5, which introduced a new reward path for token holders who direct stake to validators by allocating 0.95% of performance fees to MNDE-enhanced stakers. As of the end of Q1’25, this reward mechanism has not yet been implemented. The approval of this proposal marked the beginning of a broader effort to align protocol revenue with tokenholder participation.

While protocol revenue fluctuated with validator bid intensity and overall staking volume, revenue trends in Q1 were supported by:

- Increased participation in Native Staking.

- Validator fee competition within SAM.

- Continued mSOL issuance and activity across DeFi protocols.

Marinade’s revenue model is designed to be both performance-based and modular. By integrating validator bonding requirements (via PSR) and market-based delegation (via SAM), the protocol ties revenue generation to validator reliability and competition. Marinade uses the SAM to allocate stake dynamically based on validator bids and enforces quality through PSR, which requires validators to post a bond. This architecture supports long-term sustainability by incentivizing validator quality, aligning stakeholder incentives, and enhancing the economic utility of MNDE.

Token EmissionsMarinade has a maximum token supply of 1.0 billion MNDE, with 430.4 million MNDE in circulation at the end of Q1’25, rising from 386.4 million MNDE at the end of Q4’24, an increase of 11.4% QoQ. While no changes were made to the overall emission framework, the DAO approved two new token allocations that expanded the protocol’s short-term distribution profile. In January 2025, the community passed MIP-4, allocating 10.5 million MNDE to support protocol infrastructure development. The funds were earmarked for improvements to the unstake mechanism, liquidity monitoring tools, and stake management processes. In March, the DAO approved MIP-6, which committed 21.0 million MNDE to a 12-month initiative focused on user growth and ecosystem awareness. The program targets a 5 million SOL increase in Marinade’s TVL and aims to expand its staking market share on Solana.

A total of 31.5 million MNDE was unlocked through two proposals in Q1. Under MIP-4, 10.5 million MNDE was allocated to DAO operations to support infrastructure upgrades. Separately, 21.0 million MNDE from MIP-6 was distributed to fund the marketing budget over the next 12 months. As outlined in the respective governance proposals, the allocations were directed toward infrastructure improvements and marketing initiatives. The full proposal context is provided in the Governance section.

Performance AnalysisStaking Incentive Design: SAM, PSR, and MNDE AlignmentAt the end of Q1’25, Marinade delegated SOL to 181 active validators across the Solana network. All validators receiving delegation must maintain a maximum 7% commission rate and participate in the PSR program, which requires posting a SOL-denominated bond as collateral. This bond may be slashed for extended downtime, misbehavior, or commission manipulation, serving as an economic safeguard to promote validator reliability.

Following the approval of MIP-3 in November 2024, Marinade transitioned all stake allocation to the Stake Auction Marketplace (SAM), replacing its previous hybrid delegation model. The SAM introduces a competitive auction where eligible validators bid for SOL delegation by offering yield terms. Marinade applies a performance fee of up to 9.5% on validator bids, which is captured as protocol revenue.

The SAM incentivizes validator competition and yield optimization, while PSR enforces minimum performance standards, forming a dual-incentive structure that balances decentralization with staking efficiency. In Q1’25, governance approved MIP-5 to introduce MNDE-enhanced staking, which will allow MNDE holders to delegate MNDE to specific validators and earn a share of SAM-derived performance fees when implemented. MNDE-enhanced staking will integrate the MNDE-directed stake mechanism with the SAM. MNDE-directed stake was previously removed through MIP-3. These mechanisms work in tandem to align the interests of validators, stakers, and governance participants.

Validators and APY

Marinade’s staking products, native staking, and liquid staking through mSOL, continued to offer competitive returns throughout Q1’25. Yields are influenced by Solana network activity, validator performance, and access to priority fees.

Native staking APRs generally ranged between 8.6% and 11.5% during the quarter, depending on validator competitiveness and the proportion of rewards passed through to stakers. While exact time-series data for native staking yields is not published, observed returns during periods of high network usage occasionally exceeded typical liquid staking rates. Native staking typically offers slightly higher yields than liquid staking with mSOL, as native stakers avoid liquidity-related fees but must lock SOL during the unstaking cooldown period.

The mSOL APY ended Q1’25 at 8.45%, compared to 9.95% at the end of Q4’24. mSOL yields are calculated based on the protocol’s true price metric, which measures the ratio of SOL backing each mSOL token. mSOL APY tracks staking performance across Marinade’s validator set and is influenced by validator uptime, network transaction volumes, and priority fee generation.

AdoptionMarinade’s adoption in Q1’25 was shaped by growing utility for mSOL within Solana DeFi, new liquidity initiatives, and early steps toward institutional readiness, including Marinade Native integrations with custodians such as BitGo, Zodia, and Copper. As staking yields improved and activity across the Solana ecosystem increased, Marinade worked to expand access to its products through integrations, incentives, and infrastructure improvements. Key developments included broader mSOL usage in lending and leverage protocols, new liquidity support through PumpSwap, and strategic upgrades to meet institutional requirements.

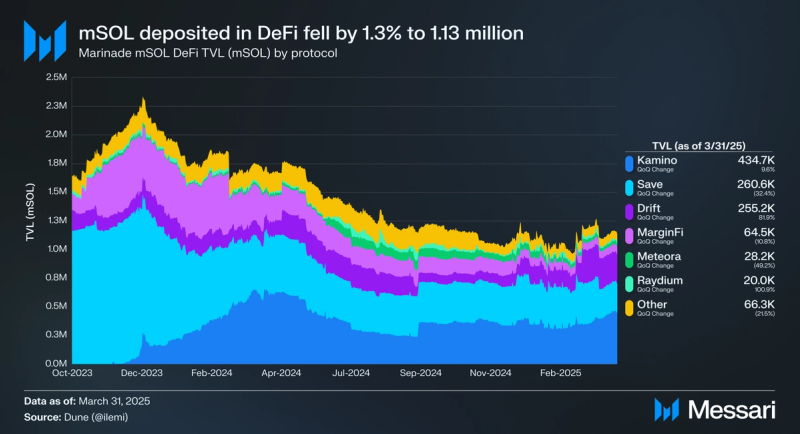

mSOL in DeFi

mSOL continued to serve as a core staking asset across Solana DeFi in Q1’25, with integrations spanning lending markets, structured products, and leverage protocols. However, the total amount of mSOL deposited in DeFi protocols ended the quarter at 1.1 million, representing a 9.3% decrease compared to Q4’24.

Kamino remained the largest protocol for mSOL usage, maintaining its lead for the fifth consecutive quarter. Kamino’s mSOL TVL increased by 9.6% QoQ to 434,697 mSOL, supported by strong borrowing demand. Save (formerly Solend) also remained a key protocol for mSOL usage in Q1’25, accounting for 260,567 mSOL in TVL. However, this decline of 124,879 mSOL represents a QoQ decline of 31.5% in Save's mSOL market share.

The largest gainer in mSOL in Q1’25 was Drift, which added 114,941 mSOL to its TVL and increased its mSOL market share by 84.4%. Drift ended the quarter with 255,241 mSOL.

Other protocols showed mixed performance. MarginFi saw a modest decline in usage, ending Q1’25 with 64,485 mSOL in TVL, a decrease of 10.8% QoQ, and a 9.6% drop in market share. Meteora experienced a sharper contraction, with mSOL TVL falling 49.2% to 28,228 mSOL, resulting in a 48.5% decline in market share. In contrast, Raydium posted a strong recovery, with mSOL deposits rising 100.9% QoQ to 20,038, more than doubling its mSOL market share with a 103.6% increase.

PumpSwap, a newly launched AMM built by pump.fun, also emerged as a relevant venue for mSOL activity. Marinade served as a launch partner for the platform, supplying liquidity to two key pools: SOL-mSOL and MNDE-mSOL. By the end of Q1’25, PumpSwap accounted for 595.3 mSOL in TVL. While the integration was still in its early stages, it marked a strategic effort by Marinade to expand mSOL’s liquidity footprint and improve trading access for users interacting with the broader pump.fun ecosystem.

Expanding mSOL utility across DeFi is a strategic priority for Marinade, positioning mSOL as a foundational yield-bearing asset for the Solana ecosystem, as evidenced by MIP-6. Broader usage enhances mSOL’s liquidity profile, supports capital efficiency for stakers, and aligns Marinade with the long-term growth trajectory of Solana’s DeFi landscape.

Competitive Landscape

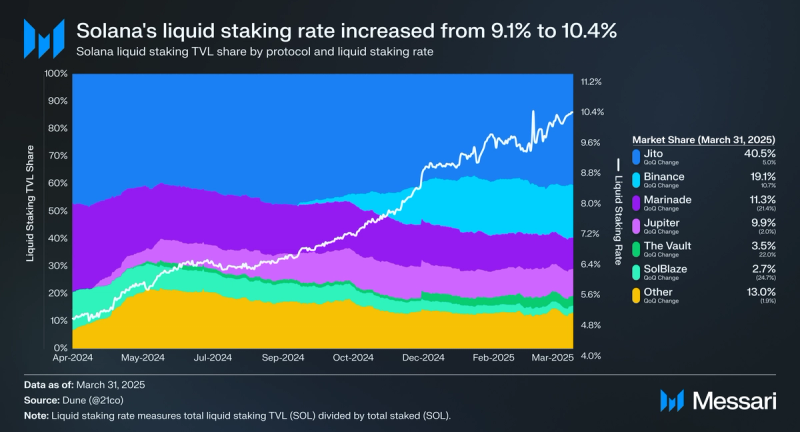

Solana’s liquid staking ecosystem grew meaningfully in Q1 as the network’s liquid staking rate increased from 9.1% to 10.4%. This expansion reflects growing demand for yield-bearing SOL assets in DeFi. As stakers opt for liquid over traditional staking, the competitive landscape among LST protocols has intensified.

Jito solidified its dominance in the sector, increasing its market share from 38.5% to 40.5%. Binance’s bnSOL also grew significantly, climbing from 17.3% to 19.1% market share after launching just two quarters earlier. In contrast, Marinade’s mSOL saw its market share decline from 14.4% to 11.3%, a 21% drop QoQ. Despite this setback, Marinade continues to differentiate through protocol-native features like the SAM and PSR, which support high yields and validator diversity.

Qualitative AnalysisInstitutional ReadinessMarinade took early steps toward institutional adoption in Q1’25 through technical and compliance-focused upgrades designed to meet enterprise-grade expectations. The protocol announced SOC 2 compliance on April 25, 2025, a widely recognized security and operational standard adopted by custodians, asset managers, and institutional allocators. Marinade also disclosed Marinade Native integrations with custodians BitGo, Zodia, and Copper, enabling institutional clients to access Marinade Native through trusted custodial platforms. These partnerships advance Marinade’s long-term goal of serving both retail and institutional participants with robust, non-custodial staking solutions.

To further meet the operational requirements of institutional clients, Marinade is prioritizing the rollout of several infrastructure upgrades in Q2. These include native instant unstake, a feature enabling faster liquidity access for native stakers; a tax reporting tool for staking rewards to support compliance obligations; and Phase 3 of the SAM, which will accelerate re-delegation between validators. Together, these efforts are designed to enhance Marinade Native’s appeal to institutional stakers by improving liquidity, operational flexibility, and regulatory readiness.

GovernanceMarinade’s governance framework continued to serve as the foundation for protocol development in Q1’25. The DAO introduced and approved several MIPs focused on infrastructure, emissions, staking design, and validator protections. These proposals reflect the community’s ongoing effort to refine Marinade’s staking architecture, enhance the utility of MNDE, and strengthen the protocol’s position within the Solana ecosystem.

MIP 4: Infrastructure Development BudgetApproved in January, MIP-4 allocated 10.5 million MNDE to support core infrastructure upgrades. The funds were earmarked to improve Marinade’s unstake system, stake management, and liquidity monitoring tools. The allocation was transferred to the DAO operations multisig wallet without a formal vesting schedule.

MIP 5: Reward Share for MNDE StakersMIP-5 proposed a new incentive model to strengthen the utility of MNDE by rewarding participants in MNDE-Enhanced Staking. The system allocates a portion of validator performance fees, set at 9.5% of inflation, MEV, and Stake Auction Marketplace (SAM) bids, to MNDE holders who direct stake to validators in the winning SAM bid set with sufficient bonding. Of this performance fee, 95 basis points (0.95%) would be routed back to eligible MNDE-enhanced stakers. This mechanism aligns incentives between token holders and validators while reinforcing MNDE’s role in staking and governance.

Rather than a traditional up-or-down DAO vote, MIP-5 was evaluated and approved through a MetaDAO-run decision market. The community first passed a Realms vote authorizing futarchy to determine whether the proposal would positively impact Marinade. The MetaDAO market returned a favorable outcome, clearing the 3% threshold required for passage. With that result, the DAO formally adopted the proposal, enabling the development and implementation of the performance fee routing system for MNDE-Enhanced Staking.

MIP 6: Growth and Marketing BudgetIn March 2025, the DAO approved MIP-6, allocating 21 million MNDE over 12 months to support protocol growth through strategic marketing and partnership initiatives. The campaign is designed to drive TVL growth, increase user adoption, and expand awareness of Marinade’s staking products, including mSOL, native staking, and the SAM.

Funds will be used to secure high-impact media partnerships, launch cross-channel promotional campaigns, and expand Marinade’s ambassador and advisory programs. Target outcomes include onboarding 100,000 new users, growing protocol TVL by 5 million SOL, and increasing Marinade’s LST market share from 14% to 18%. The proposal passed with 100% approval on Realms.

MIP 7: Marinade Earn Season 4In March 2025, Marinade governance approved MIP-7 with 99.9% support, allocating up to 12.5 million MNDE from the DAO treasury and reactivating 10.7 million MNDE in unused funds from the previous campaign. The proposal launched “Marinade Earn – Season 4,” a strategic liquidity and adoption program focused on solidifying mSOL’s competitiveness in Solana DeFi.

Season 4 expands on the success of its predecessor by extending emissions to sustain mSOL liquidity across decentralized exchanges, deepening lending market penetration, and supporting strategic DeFi integrations. The initiative aims to improve institutional-grade liquidity conditions and leverage opportunities, particularly through isolated lending pools and competitive yield-bearing positions. By enhancing mSOL’s accessibility and composability, the campaign supports Marinade’s goals of growing TVL, increasing adoption, and maintaining top-tier staking yields relative to other SOL liquid staking tokens.

MIP 8: Sunset of Delayed Unstake TicketsIn Q1’25, the Marinade DAO unanimously approved MIP-8 with 100% support (18.3M votes in favor), implementing critical upgrades to the protocol’s delayed unstake feature for mSOL. The proposal transitions the existing “claim ticket” model to a more resilient system that issues users a stake account holding SOL. This adjustment better aligns with native Solana staking mechanics and reduces protocol complexity.

The proposal introduced a 10 basis point (bps) fee on all delayed unstake transactions. While modest, the fee discourages potential exploits such as rapid minting and redemption cycles that could deplete onchain liquidity. The updated system also enforces a minimum threshold of 1 SOL for delayed unstakes; smaller amounts are redirected to instant unstake routes via Jupiter.

Although MIP-8 was approved with unanimous support, it did not proceed to implementation due to a low voter turnout in the Realms’ voting participation. To address this issue, the Marinade team reintroduced MIP-8.1 on April 24, 2025, restarting the process with clearer communication and a shorter voting cycle. The updated proposal preserves the same core changes, including removing the ticket-based delayed unstake mechanism in favor of stake accounts, introducing a 10 basis point fee, while aiming to close protocol-level risk gaps and align Marinade with broader industry practices.

MIP 9: Blocklisting Malicious ValidatorsIn Q1’25, the Marinade DAO unanimously approved MIP-9, a proposal to blocklist validators repeatedly identified as engaging in sandwich attacks and other harmful activities. The measure passed with 100% of votes in favor, excluding 73 validators from receiving stake through the SAM.

Initial analysis by the Marinade Labs team showed that blocklisted validators had, at times, received up to 20% of delegated stake and depressed SAM APY by as much as 4.5 percentage points. The policy is expected to improve staking yields and promote decentralization by removing validators whose actions undermine the protocol’s integrity. Validators may appeal for reinstatement following a one-month observation period, with repeat offenders facing permanent exclusion.

MIP 10: Simplification of Delegation ConstraintsIn Q1’25, the Marinade DAO approved MIP-10, a proposal to streamline the validator delegation framework by removing the minimum and maximum stake thresholds and increasing the per-validator TVL cap from 2% to 4%. The proposal was designed to simplify operational logic and respond to feedback from validators requesting fewer constraints and greater capacity for stake growth. MIP-10 passed with 77.8% of votes in favor and 22.2% against.

These changes are expected to improve delegation efficiency and simplify the staking experience without compromising decentralization. Based on prior auction participation, Marinade anticipates the updated structure will continue to support a validator set of at least 70 participants.

MIP-11: MNDE Buyback AllocationMIP-11, introduced on April 18, 2025, proposes allocating 40% of the performance fees generated by the SAM to buy back MNDE tokens on the open market. This initiative aims to enhance MNDE’s value proposition by introducing sustained protocol-driven buy pressure, complementing the MNDE-Enhanced Staking rewards established under MIP-5. If approved, the protocol would allocate 50% of SAM performance fees to the DAO treasury, 10% to MNDE stakers, and 40% to MNDE buybacks, helping reduce the circulating supply and incentivize long-term holding.

The buyback mechanism is designed to strengthen the MNDE token’s economic model by aligning protocol success with tokenholder rewards, following a model similar to that of other Solana-native protocols like JUP, RAY, and MPLX. This initiative is expected to increase demand for MNDE and reinforce Marinade’s positioning within the Solana staking ecosystem. As of May 5, 2025, MIP-11 has not yet proceeded to a vote on Realms. If the DAO approves the proposal, it will be evaluated through a futarchy-based decision market hosted by MetaDAO.

Roadmap and Looking AheadMarinade made steady progress on its roadmap in Q1’25. It launched staking referrals to support partner attribution and a staking rewards report tool for tax purposes. Marinade also introduced MIP-8.1 to reinitiate updates to the delayed unstake mechanism. The proposal aims to sunset the existing claimable SOL ticket system in favor of direct stake accounts and to implement a 10 bps fee on delayed unstake transactions. Additionally, MIP-11 was introduced to redirect 40% of Stake Auction Marketplace (SAM) performance fees toward MNDE token buybacks, adding new value flows for token holders. Two major upgrades are slated for Q2: native instant unstake, which will enable instant exits from native staking, and SAM Phase 3, designed to accelerate re-delegation between validators.

Marinade has also prioritized institutional readiness in Q2 as it expands access for enterprise and TradFi participants. The protocol announced SOC2 compliance and a strategic partnership with BitGo to make Marinade Native staking available to institutional clients. Alongside upgrades like native instant unstake, these developments demonstrate Marinade’s commitment to meet the infrastructure and compliance standards expected by institutional stakeholders.

Closing SummaryMarinade concluded Q1 2025 with mixed performance across its staking products amid intensifying competition in Solana’s liquid staking sector. Total SOL staked through Marinade increased to 9.3 million, up 5.2% QoQ but down 5.8% YoY. This was driven by a 38.6% QoQ and 13.4% YoY increase in Native Staking, which reached 4.4 million SOL. In contrast, mSOL TVL declined 12.3% QoQ and 22.5% YoY to 4.9 million SOL, while its share of Solana’s liquid staking market fell to 11.3%. Despite these headwinds, protocol revenue climbed 18.2% QoQ and 328.4% YoY to $3.60 million, supported by higher validator fee capture through the Stake Auction Marketplace (SAM).

Governance remained active in Q1, advancing initiatives to strengthen Marinade’s infrastructure, optimize delegation, and align tokenholder incentives. Proposals passed during the quarter allocated 31.5 million MNDE to growth and infrastructure (MIP-4, MIP-6), introduced a new MNDE staking mechanism (MIP-5), and implemented validator quality controls (MIP-9). Additional proposals streamlined delegation rules (MIP-10), introduced MNDE buybacks (MIP-11), and reinitiated the upgrade to delayed unstake operations (MIP-8.1). Marinade also progressed toward institutional onboarding with SOC 2 compliance and a BitGo partnership, laying the foundation for a secure and compliant institutional staking offering. Together with the upcoming release of native instant unstake and SAM Phase 3, these efforts aim to improve staking accessibility, increase token utility, and reinforce Marinade’s long-term positioning in the Solana ecosystem.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.