and the distribution of digital products.

State of Hashflow Q3 2024

- Daily average volume on Ethereum increased 34% QoQ, while overall daily average volume grew 3% to 16.2 million.

- While the end-of-quarter staked HFT decreased 7% from its Q2 peak, the daily average HFT staked rose 38% QoQ to 11.4 million.

- Daily unique sources increased 68% QoQ to 198, mainly due to a surge in activity on Arbitrum.

- HFT holders rose for the fourth straight quarter to 13,900.

- Hashflow governance approved a proposal to develop a ZK-based settlement layer (xOS), which enables any exchange to become provable, enhancing security and performance.

Hashflow (HFT) is a decentralized exchange (DEX) that uses a request-for-quote model with pricing provided by professional market makers. Hashflow's signature-based pricing offers traders a guaranteed execution price, MEV resistance, and no slippage. The offchain order routing enables significantly reduced costs and allows market makers to compete on price with CEXs. After launching in Private Alpha in April 2021, Hashflow fully launched in August 2021. Since initially launching on Ethereum, it has expanded to Arbitrum, Avalanche, BNB, Polygon, Optimism, Solana, and Base.

Hashflow also offers cross-chain trading, allowing traders to exchange assets on different chains without escrowing or bridging assets between chains. More recently, Hashflow announced its ZK-based settlement layer (xOS), which enables any exchange to become provable, enhancing both security and performance. HFT is the governance token for the Hashflow protocol. For a full primer on Hashflow, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

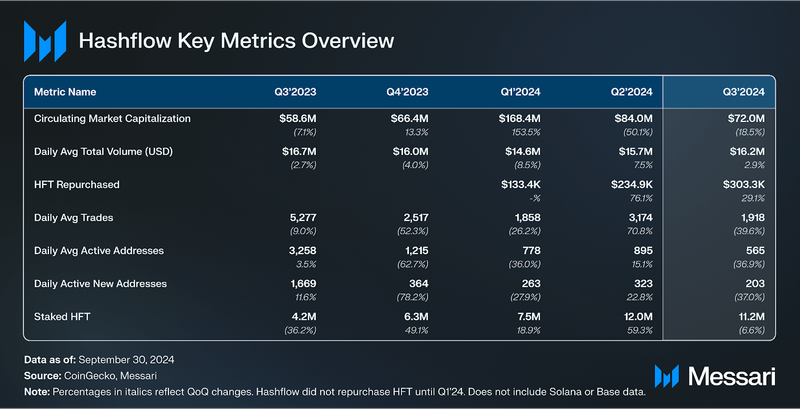

Key Metrics Performance AnalysisProduct Usage

Performance AnalysisProduct Usage

In Q4’23, Hashflow implemented a fee switch that would only take a fee when Hashflow’s price is significantly better than other options. The amount that is significant and how much of that amount that is taken is still being optimized and iterated on. Additionally, in November and December 2023, Hashflow transitioned to V3 contracts. These changes initially resulted in lower volumes for Hashflow in Q1, as market makers needed to adjust to the changes. The effects of the changes faded in Q2, with Hashflow experiencing an 8% QoQ increase in daily average volume.

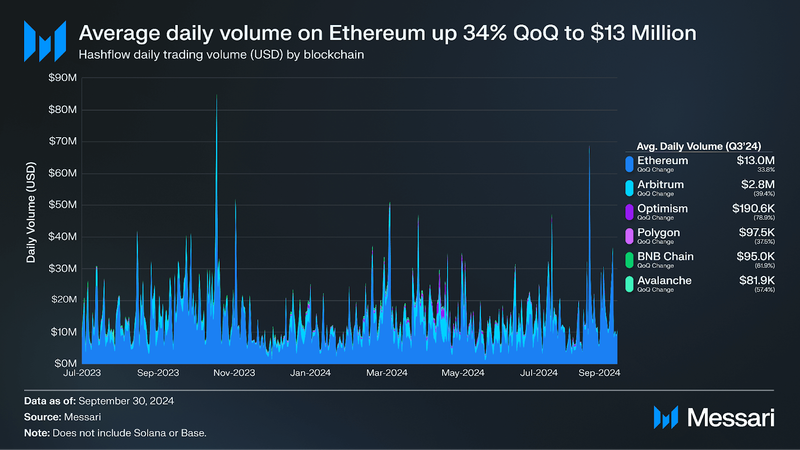

In Q3, the daily average volume on Hashflow continued to grow, increasing 3% QoQ from $15.7 million to $16.2 million. Growth was primarily driven by Ethereum, which experienced a 34% QoQ increase from $9.7 million to $13.0 million and accounted for 80% of the total trading volume. Arbitrum represented 17% of the total trading volume but saw its daily average volume drop from $4.5 million to $2.8 million (-39% QoQ). The remaining deployments accounted for $465,000 in daily average volume and 3% of the total trading volume in Q3. With Ethereum’s scaling roadmap primarily focused on L2 scaling, a gradual shift of trading volume from L1s to L2s is expected to increase over time.

According to Messari’s State of DeFi Q3 2024, overall DEX volumes declined 8% QoQ to $490.0 billion. As a DEX aggregator for the most popular EVM-based Layer-1 chains and Layer-2 rollups, Hashflow’s trading volumes are mainly influenced by wider market activity. However, Hashflow outperformed the market by achieving a 4% increase in total trading volume in Q3.

In July 2024, Hashflow deployed on Base. As a top chain in trading volume and TVL, Base provides Hashflow with access to deeper liquidity and the potential for increased trading volume. While data is still limited as of the time of writing, the integration presents Hashflow with a significant opportunity for growth in trading activity moving forward.

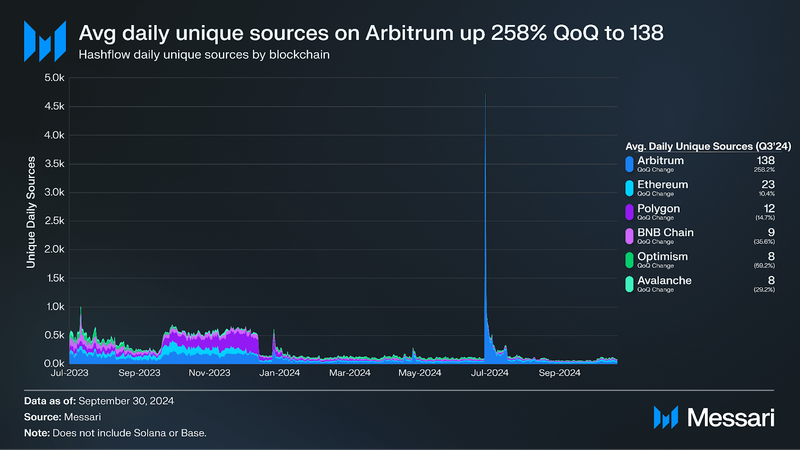

The number of daily active users (DAUs) measures how many externally owned accounts (EOAs) initiate transactions that get routed to Hashflow or use Hashflow directly. However, this report measures the number of direct contract interactions with Hashflow, not necessarily how many end users (i.e., EOAs) are driving those transactions. We count “Sources” to be native users and aggregation routers that use Hashflow, thus excluding EOAs that interact with an aggregator directly instead of Hashflow.

The average number of contracts transacting with Hashflow grew to 198 in Q3, a 68% increase from 118 in Q2. This was primarily driven by a 258% QoQ increase on Arbitrum from 39 to 138 daily average contracts. Most notable was the activity in July, when Arbitrum recorded a daily average of 357 unique sources.

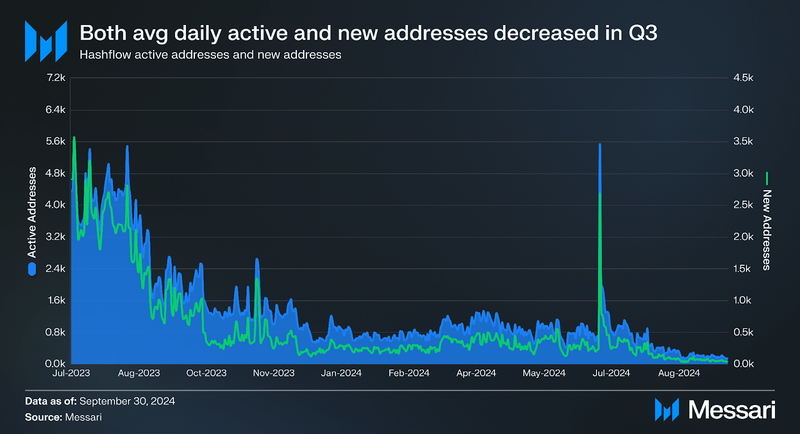

After a hot Q2 that saw growth in addresses for the first time since Q3’23, the raw number of traders interacting with Hashflow contracts (EOAs included) declined in Q3’24. Average daily active addresses decreased 37% QoQ from 895 to 565. Average daily new addresses fell by the same percentage, down to 203 from 323 in the prior quarter.

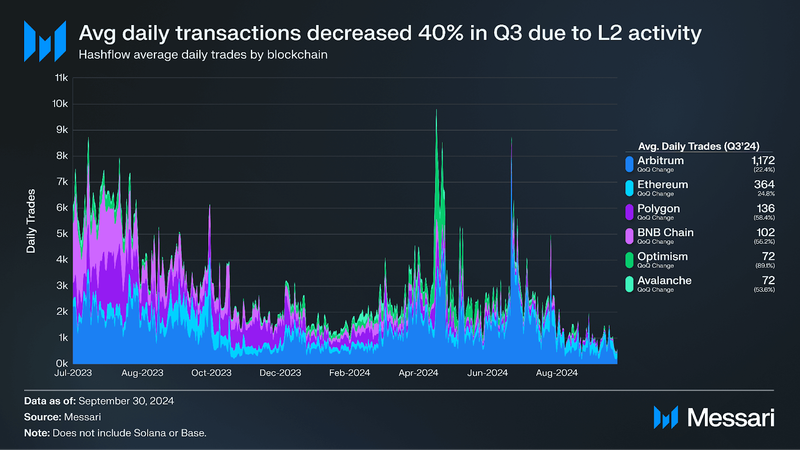

The average number of transactions per day decreased by 40% QoQ from 3,200 to 1,900, driven by decreased activity on rollups and alt-L1s. The average daily trades on Arbitrum decreased 22% QoQ from 1,511 to 1,172. Similarly, Optimism, BNB Chain, Polygon, and Avalanche recorded drops during the quarter, while the daily transactions on Ethereum increased from 292 to 364 (+25% QoQ). Collectively, Arbitrum and Ethereum accounted for 80% of trades on Hashflow during the quarter.

Q3 marked Hashflow’s first quarter without trading rewards, which may have negatively impacted the number of trades. Previously, up to 350,000 HFT was distributed to Hashflow traders each month to incentivize activity and bootstrap early growth. A governance proposal to terminate the rewards was approved in June 2024, freeing up the allocation to be used for other growth initiatives and aiming to enhance the distribution of HFT among tokenholders.

HFT Distribution and Staking

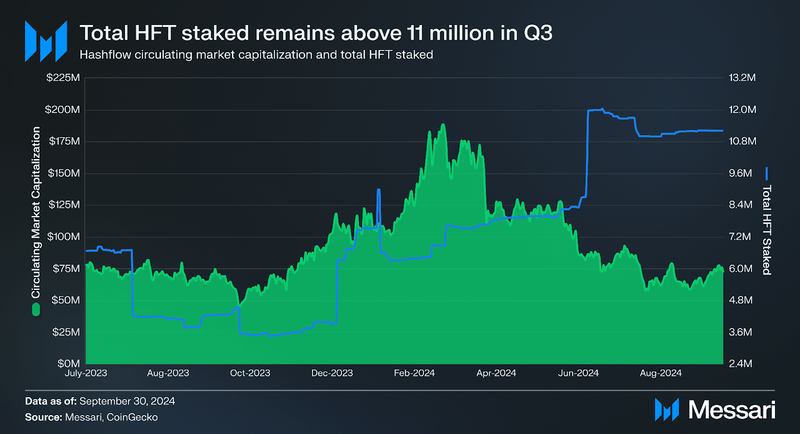

The cryptocurrency market continued to pull back in Q3, resulting in the circulating market capitalization of HFT declining 18.5% QoQ from $84 million to $72 million. Despite this downturn, the number of HFT holders experienced steady growth, increasing 4% to 13,900 from 13,300 in Q2. This continued a year-long trend of consistent QoQ growth in holder numbers.

The total HFT staked has been in a general upswing since Q4’23. This is mainly due to the community vote to turn on fees, which rewards stakers with 50% of protocol revenues. After reaching the highest end-of-quarter staked amount in Q2, the total HFT staked was down 7% in Q3 from 12.0 million to 11.2 million. Despite this, the daily average HFT staked increased from 8.3 million to 11.4 million (+38% QoQ).

At the end of Q2’24, a community vote approved multi-staking vaults, allowing users to stake variable amounts of HFT for different durations from the same wallet. Once implemented, the added flexibility is expected to enhance the user staking experience and increase staking activity.

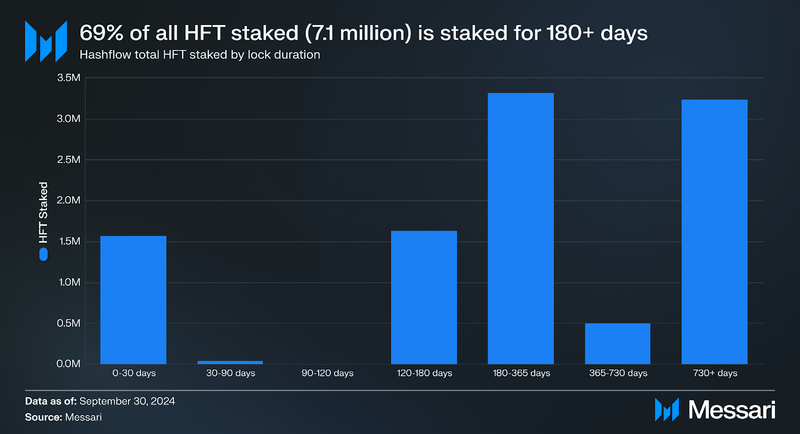

Despite a slight drop in the amount of HFT staked in the quarter, the allocation of that stake showed impressive distribution. By the end of Q3, 7.1 million HFT was staked for over six months (180+ days), representing 69% of all HFT staked. HFT stakers have the option of locking up their stake for varying lengths of time. Longer locking times are beneficial for Hashflow, as it showcases user confidence in the underlying protocol.

Qualitative AnalysisDeployment to BaseHashflow and Aggregator+ deployed to Base in July 2024. Base has established itself as a leading L2 network, with over $7 billion in onchain assets and $2.3 billion in DeFi TVL, ranking it among the top three L2s by both metrics. Deploying to Base gave Hashflow another avenue for both volume and revenue growth while also providing users and traders with enhanced liquidity and swap pricing.

The governance proposal to deploy Hashflow on Base received overwhelming approval from the Hashflow community. Voting ended on July 1, and 119 addresses controlling 239,000 veHFT participated, without any address voting ‘No’ on the proposal.

Exchange OS (xOS)On July 2, the Hashflow community unanimously approved a governance proposal to develop a zero-knowledge (ZK) proof-based settlement layer in addition to Hashflow’s existing RFQ DEX and Aggregator+ products. After Q3 ended, the settlement layer was introduced as Exchange OS (xOS).

xOS enables any exchange to become provable, simultaneously enhancing security and performance. xOS operates alongside existing infrastructure, allowing exchanges to execute transactions offchain and prove them onchain. Key benefits include increased scalability, lower transaction costs, and the potential for more advanced DeFi applications. xOS will also be integrated with the HFT token, potentially boosting token utility and value over time. xOS currently leverages Celestia as the data availability (DA) layer and RISC Zero as the zero-knowledge virtual machine (zkVM).

Closing SummaryHashflow saw steady growth in Q3, with a 3% increase in daily average volume, driven primarily by growth on Ethereum. While the HFT staked at the quarter’s end decreased by 7%, the daily average HFT staked increased 38% to 11.4 million in Q3. HFT holders also increased, continuing a year-long trend of QoQ growth in holder numbers. Most notable was the 68% increase in the average contracts transacting with Hashflow, driven by a 258% increase in QoQ growth on Arbitrum.

In Q3, the deployment of Hashflow and Aggregator+ to Base in July marked a significant milestone, opening new opportunities for volume and revenue growth. As the team continues to develop Exchange OS (xOS), the HFT token stands to gain additional utility, perfectly timed for a potential breakout in the broader market during Q4’24.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.