and the distribution of digital products.

State of Filecoin Q2 2024

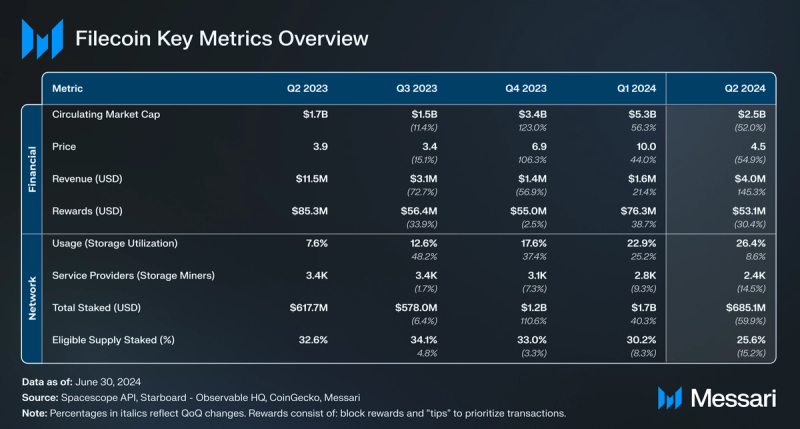

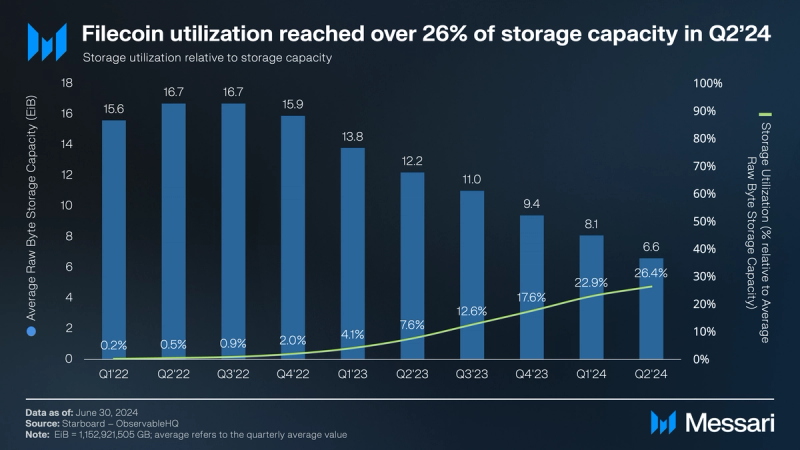

- In Q2’24, Filecoin’s active storage deals decreased 6% QoQ. Storage utilization grew from 23% in Q1’24 to over 26% in Q2’24, while storage capacity fell 19% QoQ.

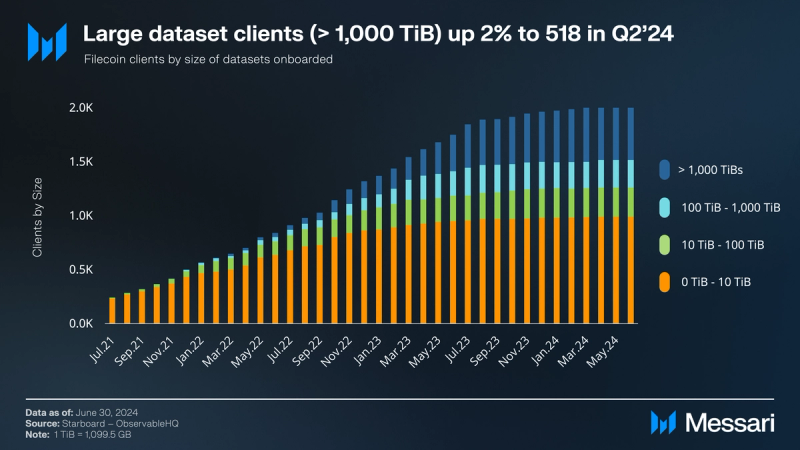

- Simultaneously, 2,034 clients have onboarded data on Filecoin by the end of Q2’24, of which 518 onboarded large datasets over 1,000 TiB, up 2% QoQ from 508 in Q1’24.

- As of June 30, 2024, over 3,700 unique contracts were deployed on the Filecoin Virtual Machine (FVM); driven by token staking and leasing activity, TVL on FVM reached an all-time high of 63 million FIL ($273 million) in Q2’24.

- Filecoin continues to develop as a decentralized physical infrastructure network (DePIN), creating a decentralized storage marketplace for enterprise adoption, as well as enabling decentralized compute and AI.

- New data services on the Filecoin Network have emerged, including perpetual archiving, data privacy, and integration with Web2 and Web3 applications.

Filecoin is building a marketplace for hardware — with the first service being storage. Filecoin is built on top of IPFS (the InterPlanetary File System). FIlecoin uses deals that price the storage based on a market of providers, instead of a fixed pricing structure. A storage deal is like a contract with a service level agreement (SLA) — users pay fees to storage providers to store data for a specified duration.

To keep data safe, Filecoin uses a cryptoeconomic incentive model to regularly verify the storage with zero-knowledge proofs. To incentivize storage providers to participate in deals, Filecoin rewards them with FIL, the network's native token. Storage providers are slashed in the event they either fail to provide reliable uptime or act maliciously against the network.

To retrieve data, Filecoin users pay a retrieval provider to fetch the data. Unlike storage deals, which involve transactions onchain, retrieval deals use payment channels to settle payments offchain, to enable faster retrieval. Besides storage and retrieval, Filecoin aims to offer an open market where compute power can be contracted to run over data, providing more efficient alternatives to traditional centralized systems.

Key protocol upgrades to enable compute-over-data services include smart contracts (the Filecoin Virtual Machine - FVM) and scaling (Interplanetary Consensus - IPC). The launch of the FVM in March 2023 brought Ethereum-style smart contracts to enable new use cases on Filecoin, including token leasing, perpetual storage, and data-intensive compute. Besides growing its FVM ecosystem, Filecoin's focus is on increasing enterprise adoption and attracting new use cases to the Filecoin Network.

Website / X (Twitter) / Discord / Slack

Key Metrics Performance Analysis

Performance AnalysisThe Filecoin Network is used to store data decentrally by two parties:

- The demand side, i.e., storage users in need of data storage

- The supply side, i.e., storage providers with excess storage capacity.

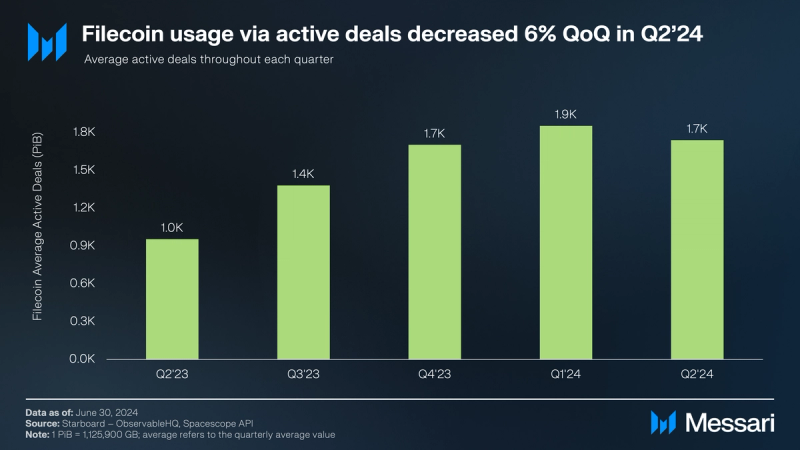

The amount of data stored in active deals between storage users and storage providers gauges the demand for Filecoin storage.

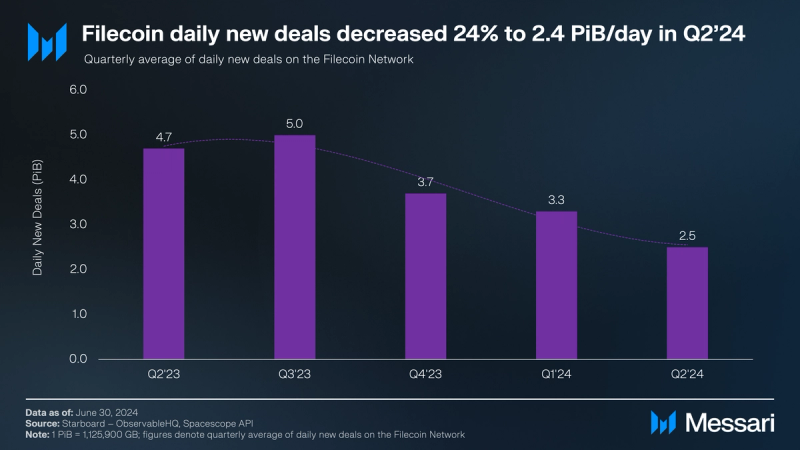

Deals

In Q2’24, over 1,700 PiB was stored on the Filecoin Network through active deals, down 6% QoQ from the all-time high of 1,900 PiB in Q1’24, but on par with the levels last seen in Q4’23. Filecoin's current focus is on increasing adoption from enterprises. In June, Filecoin announced a new grants program aimed at accelerating teams focused on paid data onboarding. The grant pool supports teams working on increasing onchain Filecoin deal and retrieval payments and settlements, as well as attracting use cases to the Filecoin Network. This grants program may potentially drive an increase in both active deals and new deals over the next quarters.

In Q2’24, daily new deals on the Filecoin Network continued to decrease by 24% QoQ to 2.5 PiB/day, after reaching an all-time high of 5 PiB/day in Q3’23. While new deals are net growing, they are contributing to an increase in the utilization of the Filecoin Network relative to its storage capacity.

Utilization vs. Capacity

Filecoin’s storage utilization relative to the total available storage capacity increased to over 26% in Q2'24, up from nearly 23% in Q1’24. While this increase is a positive sign in terms of Filecoin’s adoption through active storage deals, it requires the context of the network’s capacity.

In Q2’24, Filecoin experienced a 19% QoQ decline in average raw byte storage capacity to 6.6 EiB. The decline in storage capacity started approximately two years ago, after reaching its all-time high at nearly 17 EiB in Q2’22 and Q3’22. The gradual decrease in average raw byte storage capacity was further reflected by the drop in the number of storage providers, which declined to approximately 2,400 in Q2’24 after reaching an all-time high of over 4,100 in Q3’22.

Utilization of Filecoin needs to be regarded in terms of data-intensive activities beyond data storage. For instance, platforms like Basin and Akave are leveraging Filecoin’s infrastructure to provide data management and AI-related services, thus positioning Filecoin in the emerging AI data economy.

ClientsAs per Messari’s guide on decentralized storage networks, Filecoin is geared toward providing cold storage solutions (e.g., archival and recovery) for enterprises and developers. Low storage prices help attract traditional businesses seeking cost-effective alternatives for storing large amounts of archival data.

The DeStor data storage provider on Filecoin recently partnered with Qamcom DDS to provide enhanced security, robustness, and scaling for its storage services. The partnership includes data clients like YayPal, a Web3 gaming studio with over 500,000 users for its flagship game, and Fieldstream, an AI marketing analytics platform.

Examples of other client solutions include:

- GhostDrive: focused on prioritizing privacy and security through encryption, decentralization, and novel storage optimization techniques;

- Seal: focused on storage onramps for large clients such as UC Berkeley, Starling Labs, the Atlas Experiment, and the Casper Network;

- Steeldome: focused on data archival, backup, and recovery for enterprises.

Other efforts beyond cold storage are driven by solutions from Lighthouse, RIBS, Retriev, and Flamenco, among others.

As of the end of Q2'24, 2,034 clients have onboarded datasets on Filecoin. Of those clients, 518 onboarded large datasets (i.e., datasets that exceed 1,000 TiB in storage size), up 2% from 508 in Q1’24. To encourage usage via active deals, several storage services are being offered, including CID Gravity, Titan Storage and Decentrally.

According to Filecoin’s client explorer, major clients range from The Starling Lab, to the NFT platform OpenSea, to Layer-1 network Solana. Further notable efforts that leverage the Filecoin Network include:

- The Victor Chang Cardiac Research Institute safeguarding and sharing research data.

- Democracy’s Library storing datasets collected by the Internet Archive at the end of each American presidential administration.

- SETI Institute using Filecoin to store astronomical research data.

- UC Berkeley collaborating with Seal Storage for storing physics research.

- GenRAIT leveraging Estuary to store critical genomics data on Filecoin.

- Research center Starling Lab storing sensitive digital records of human history.

- Ewesion (China's fastest growing host of graphic files) using Filecoin for data preservation.

- DeSci Labs using decentralized data storage on Filecoin to enable research to be reproduced and independently verified by other researchers.

- Opscientia (OpSci) leveraging Filecoin to make it easier for scientists around the world to share data.

- Destor and Seal Storage collaborate on an AI data integrity improvement research project with Cyber SMART, an industry-university cooperative funded by the National Science Foundation and industry members.

An overview of featured clients leveraging the Filecoin Network can be accessed here.

RetrievalsTo meet the needs of hot storage use cases, a growing number of Layer-2s and protocols are being built atop of Filecoin and IPFS. Examples include:

- Basin: focused on decentralized AI/ML

- Akave: enabling on-chain data lakes for decentralized AI

- Storacha: previously web3 storage, now focusing on DePIN Gaming

Project Saturn, which completed its closed beta as a content delivery network (CDN) for Filecoin and IPFS, has announced the integration with Web3.Storage. The goal of this integration is to build a combined product and network for fast storage and retrieval.Simultaneously, tools such as the Station app bring decentralized retrievals to desktops, with the SPARK and Voyager modules allowing retrieval checks on the network. For context, Station uses idle compute resources and offers FIL rewards.

FVM TractionWhen the Filecoin Virtual Machine (FVM) launched in March 2023, it brought Ethereum-style smart contracts to Filecoin. As of June 30, 2024, over 3,700 unique contracts were deployed on the FVM, facilitating more than 2.5 million transactions. Simultaneously, TVL on Filecoin reached an all-time high of 63 million FIL ($273 million) at the end of Q2’24, driven by the GLIF protocol ($144 million), the Parasail protocol ($58 million), and the stFIL protocol ($22 million).

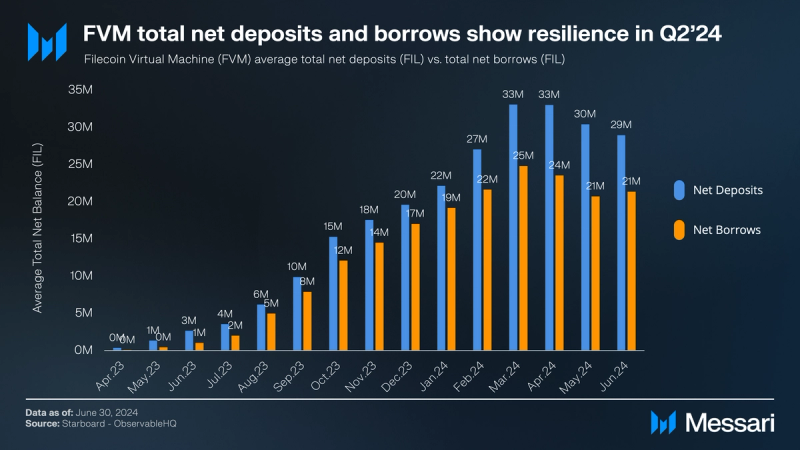

According to the FVM Explorer, average DeFi net deposits on the FVM accounted for 29 million FIL in June 2024 (approx. $131 million), primarily used in staking, liquid staking, and DEXs. The liquid staking protocol GLIF accounted for the majority of deposits (64% as of the end of Q2’24), followed by SFT Protocol (10%), FilFi (10%), and others (16%). For context:

- GLIF announced a rewards program to incentivize DeFi community participation.

- Parasail introduced a mechanism to earn rewards on FIL locked by storage providers

- FILLiquid proposed a FIL lending for storage providers.

- Thetanuts Finance introduced FIL-covered call vaults for earning yield.

Simultaneously, average DeFi net borrows accounted for 21 million FIL (approx. $95 million) in June 2024, according to the FVM DeFi leaderboard.

While both deposits and borrows showed an increase in Q1’24, April saw a cool-off. The cool-off was primarily driven by overall risk-off market environment, as well as as well as halting of the stFIL lending program and freezing of its 2.6 million FIL assets by local Chinese police pending a legal investigation. The assets remain under the control of the Chinese authorities, though lawyers representing stFIL customers continue to advocate for the release of the assets.

FinancialsFilecoin's revenue framework is similar to Ethereum's because its gas system is based on EIP-1559. This gas system consists of network fees that are burned to compensate for the resources used. Both storage users and storage providers generate revenue.

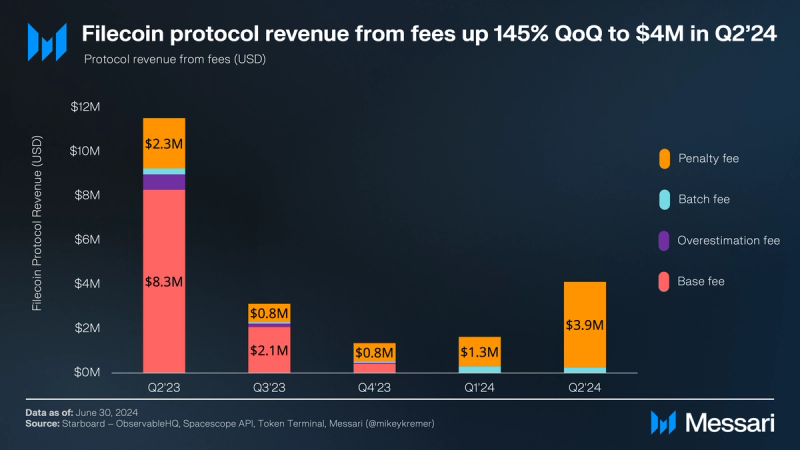

RevenueAs per Messari's revenue analysis, Filecoin's revenue represents the sum of:

- Base fees – Determined by blockspace congestion and required by any storage proof.

- Batch fees – Used for bundling storage proofs.

- Overestimation fees – Required to optimize gas usage.

- Penalty fees – Collected for storage provider failures.

While revenue from fees increased 145% in Q2'24 to $4 million, the 19% QoQ decline in average raw byte storage capacity is reflected by the rising penalty fees and batch fees. In this sense, penalty fees grew in Q2’24 to $3.9 million from $1.3 million in Q1’24.

Simultaneously, base fees from storage deals accounted for $9,000 in Q2’24, which is in line with the overall decline in demand-side fees charged to the users across the decentralized cloud storage space. Groups including the Decentralized Storage Alliance (DSA) are actively working on reducing costs for onboarding data on the Filecoin Network.

RewardsFilecoin's rewards to storage providers consist of:

- Block rewards disbursed by the network.

- “Tips” to prioritize transactions for block inclusion.

Block rewards accounted for more than 99.9% of all rewards in Q2'24, while “tips” accounted for only a small portion. The minting mechanism of new FIL tokens relies on both:

- An exponential decay model (30% of tokens): Block rewards are highest initially to stimulate participation and then decrease exponentially over time.

- A baseline model (70% of tokens): Block rewards are allocated as storage capacity grows.

By combining these models, Filecoin can maintain participation after block reward distribution in the early stages of the network (see exponential decay model). It also helps continuously reward additional value created for the network through increased storage capacity (see baseline model).

Rewards decreased 30% from $76 million in Q1’24 to $53 million in Q2'24, driven by the FIL/USD price decrease. In FIL terms, rewards were down 15% from 10.6 million FIL in Q1’24 to 9.0 million FIL in Q2’24. The decrease in FIL reward issuance is likely to continue in the coming quarters. For an in-depth discussion and various simulations of future FIL issuance, please refer to Messari’s investigation on the FIL circulating supply.

Ecosystem OverviewThe Filecoin ecosystem features a diverse realm of applications that stretch from DeFi and AI, to enterprise storage and DePIN. Teams across the Filecoin ecosystem have been actively developing a funnel of builders. A number of hackathons and accelerators dedicated to building on Filecoin have helped early-stage projects and teams receive funding from external parties and affiliated entities, including hackathons ETH Global and communities like FilOz.

As of June 2024, over 160 known projects are included in the Filecoin Ecosystem Explorer, a non-exhaustive community-powered database of projects in the network. Most projects that leverage Filecoin offer data services:

- Lighthouse: Perpetual data storage service with a one-time payment pricing model.

- Seal Storage: Immutable data storage solutions.

- Steeldome: Data protection and data storage solutions.

- Fluence: Empowers developers to scale their Web3 projects.

- Storacha: Decentralized hot storage network, with a focus on DePIN Gaming.

- Ramo Network: Monetization of idle compute capacity.

- Bagel: GPU Restaking and Artificial Intelligence Infrastructure

- IoTeX, an open modular infrastructure for DePINs.

Media and entertainment-focused protocols include:

- Huddle01: Decentralized video conferencing.

- OP Games: NFT minting for games.

- FileMarket: Web3 shop builder and marketplace

Several use cases aim to leverage Filecoin’s infrastructure to power highly specific data needs:

- Cryptosat: Uses mini-satellites to prevent side-channel attacks and allow for secure verifiability.

- ZKsig NFTs: Access control to the marketplace.

- DataMarket: Data purchase and checkout functionalities.

- Bacalhau: Compute over data platform for running distributed compute jobs.

AI focused projects include:

- Basin: Data management and collaboration, used by Tableland, the WeatherXM network, and the Bacalhau computer network.

- EQTY Lab: Uses cryptographic methods to validate snapshots of an AI model's lineage, leveraging decentralized technologies, like IPFS and Filecoin, to anchor model data.

- SingularityNET, a leading AI platform developer.

- Bagel: GPU Restaking and Artificial Intelligence Infrastructure.

- Akave: Storage L2 creating on-chain data lakes.

- Theoriq: Modular and composable AI Agent Base Layer.

- Nuklai: Collaborative data ecosystem and infrastructure provider for private data networks.

The V22 “Dragon” upgrade was successfully implemented on Filecoin mainnet on Apr. 24, 2024. The scope of the network upgrade has been finalized to include the following FIPs:

- FIP-0063: Switching to New Drand Mainnet Network

- FIP-0074: Remove Cron-based Automatic Deal Settlement

- FIP-0076: Direct Data Onboarding

- FIP-0083: Add Built-in Actor Events in the Verified Registry, Miner and Market Actors

The Filecoin Network V23 "Waffle" upgrade is estimated to arrive on Aug. 6, 2024, introducing the following Filecoin Improvement Proposals:

- FIP-0065: Ignore built-in market locked balance in circulating supply calculation

- FIP-0079: Add BLS aggregate signatures to the Filecoin Virtual Machine (FVM)

- FIP-0084: Remove the Storage Miner Actor Method ProveCommitSectors.

- FIP-0085: Convert the f090 Mining Reserve actor to a keyless account actor.

- FIP-0090: Non-Interactive Proof of Replication (PoRep).

- FIP-0091: Add support for Homestead and EIP-155 Ethereum transactions, referred to as "legacy" Ethereum transactions.

Filecoin developers have announced that the protocol specifications for the Fast Finality in Filecoin (F3 or FIP-0086) initiative have been finalized in June. Proposed in December 2023, FIP-0086 aims to reduce finalization time in Filecoin. The specification introduces an F3 component that works alongside the current consensus mechanism, Expected Consensus (EC), within Filecoin client nodes (participants). Because of changes to the EC fork choice rule, FIP-0086 would require a network upgrade.

PartnershipsThe AI platform developer SingularityNET and the Filecoin Foundation are collaborating to store SingularityNET metadata on the Filecoin Network. This collaboration will also integrate the Filecoin tech stack to support archival data needs, enhancing the robustness and security of decentralized data storage.

Theoriq, an AI base layer platform, and Filecoin Foundation are developing a series of AI agents trained on data from the Filecoin network, making open data more accessible and usable. Currently, a Filecoin AI agent trained on the Filecoin docs and GitHub repositories is available for testing. This agent allows users to get answers through natural language queries on how to build on Filecoin, troubleshoot common issues, getting started as a storage provider, and more. Additionally, the Filecoin Foundation and Theoriq are exploring an AI agent leveraging 25 years of declassified CIA datasets from MuckRock that are stored on Filecoin, enabling efficient and verifiable research of one million documents.

Simultaneously, the IoTeX DePIN Layer-1 announced Filecoin as the preferred storage primitive of IoTeX 2.0's modular DePIN infrastructure.

Key GovernanceOnboarding Innovation Grants ProgramIn June, Filecoin announced a new grants program (entitled Onboarding Innovation Grants Program) aimed at driving innovation and accelerating growth in Filecoin data onboarding. Funded by the Filecoin Foundation and Protocol Labs, the grant pool supports teams working on increasing onchain Filecoin deal and retrieval payments and settlements, as well as attracting use cases to the Filecoin Network.

Closing SummaryIn Q2’24, Filecoin’s active storage deals decreased 6% QoQ. Storage utilization grew from 23% in Q1’24 to over 26% in Q2’24, while storage capacity fell 19% QoQ. Simultaneously, 2,034 clients have onboarded data on Filecoin by the end of Q2’24, of which 518 onboarded large datasets over 1,000 TiB, up 2% QoQ from 508 in Q1’24. Rewards decreased 30% from $76 million in Q1’24 to $53 million in Q2'24, driven by the FIL/USD price decrease and by a 15% reduction in FIL reward issuance.

More than a year after the Filecoin Virtual Machine (FVM) was introduced. As of June 30, 2024, over 3,700 unique contracts were deployed on the FVM; driven by token staking and leasing activity, TVL on FVM reached an all-time high of 63 million FIL ($273 million) in Q2’24. As FVM continues to gain traction, it serves as a base for developing monetizable FVM-enabled use cases around data and compute.

Besides growing its FVM ecosystem, the Filecoin community's focus is on increasing its enterprise adoption with a new grants program. The new grants program aims to increase onchain deal and retrieval payments and settlements, and attract new use cases to the Filecoin Network. Aside from enterprise adoption, there exists a growing pool of AI-oriented projects on Filecoin, which is expected to grow alongside the trend of decentralized compute.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.