and the distribution of digital products.

State of Covalent Q4 2024

- Covalent unveiled its AI agent SDK, allowing AI agents to both read and write to supported blockchains.

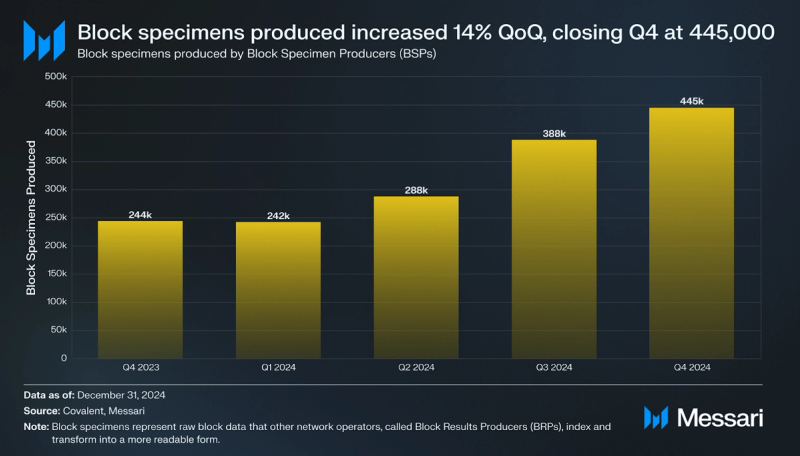

- Covalent added four new networks (Ink, World Chain, Apechain, and Unichain’s Testnet) and one new operator for block specimen production in Q4. These additions increased block specimen production by 14.5% QoQ.

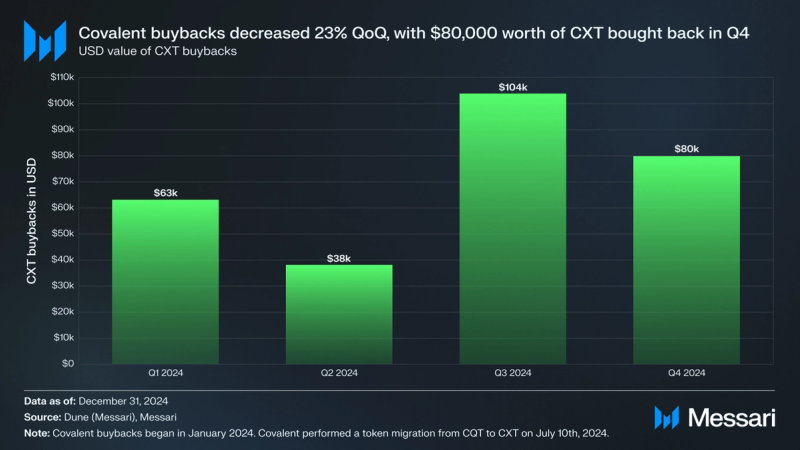

- Covalent bought back $79,800 in CXT in Q4, a 23.1% QoQ decrease. The cumulative value of CXT bought back totaled $285,000 at Q4 close.

- Covalent governance deployed Ethereum Wayback Machine (EWM) infrastructure to Base, allowing for expanded user participation.

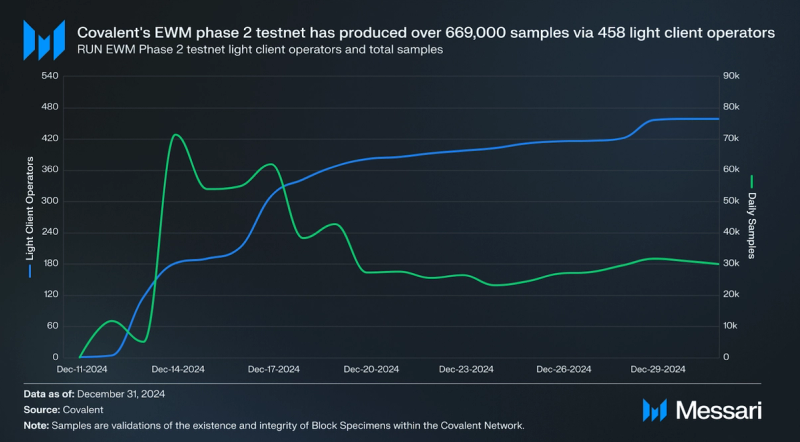

- Covalent’s EWM Light Client testnet has validated over 669,000 samples by 458 operators. The success of the testnet paves the path to mainnet deployment, with Covalent positioned as a solution to Ethereum’s long-term data availability issue.

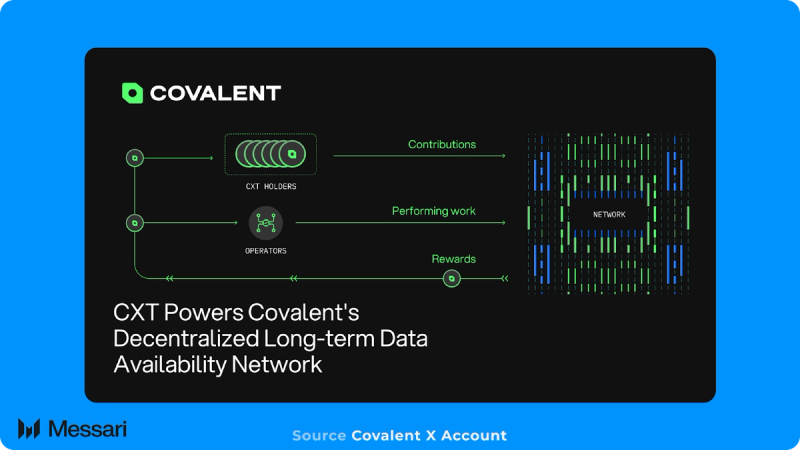

Covalent (CXT) is a long-term data availability protocol that structures data. It solves the problem of long-term data availability made prevalent after Ethereum’s Dencun upgrade, which deletes rollup history due to the state expiry feature. This particular solution is called the Ethereum Wayback Machine (EWM); it is used as a modular verifiable data infrastructure to solve AI challenges related to augmented decentralized training and inference.

Covalent supports over 200 networks across mainnets and testnets with GoldRush.dev, an API, SDK, and Frontend Kit. GoldRush (formerly Unified API) enables developers to query and use any blockchain’s data points in a standardized way. This feature is also available through the GoldRush SDK. The GoldRush Kit contains a set of React components that application developers can utilize to build their user interfaces.

Halfway through 2024, Covalent went through a rebrand and implemented a series of upgrades focused on accelerating its commitment to data availability and decentralized AI. It also raised $5 million in strategic funding to expand its operations in APAC. Following the rebrand, Covalent transitioned the previous CQT token to the new CXT token. For a full primer on Covalent, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

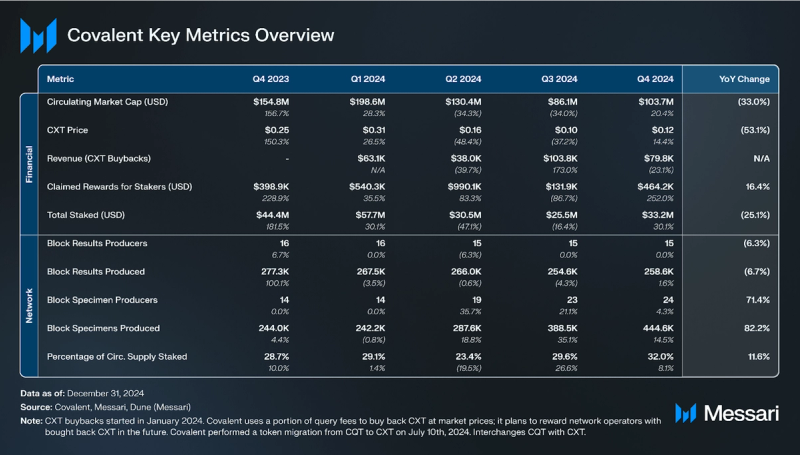

Key Metrics Performance AnalysisNetwork

Performance AnalysisNetworkCovalent has over 70 paid API customers using its structured data protocol. These data consumers range from traditional finance and consulting companies to DeFi applications and investment tools. A few notable users include Fidelity, EY, Consensys, Matcha, Rainbow Wallet, and CoinGecko. With its focus on AI and long-term data availability on Ethereum, Covalent also serves Laika AI, Entendre Finance, SmartWhales AI, and more. To properly structure the data these entities consume, the protocol must extract, transform, and enrich the raw blockchain data to make it accessible.

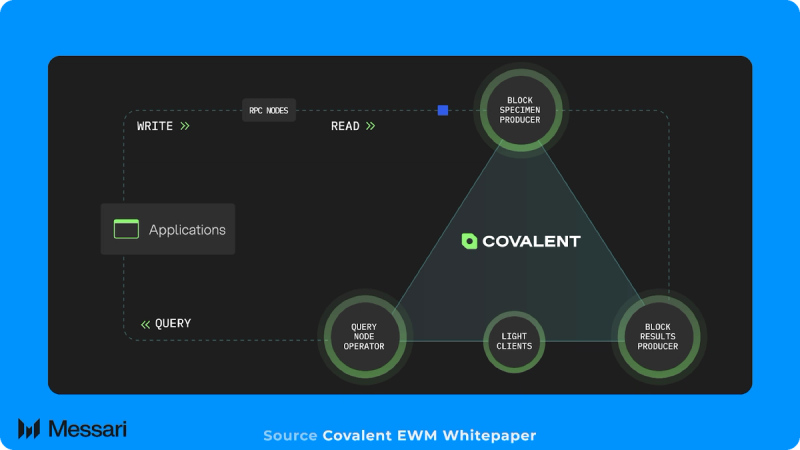

Network Operators

Covalent has four core network operators: Block Specimen Producers (BSPs), Ethereum Wayback Machine (EWM) light client operators, Block Result Producers (BRPs), and Query Node Operators (QNOs). BSPs extract data from various blockchains and upload it to storage instances as block specimens. EWM light client operators validate block specimens to ensure the integrity of each block specimen. At the moment, the EWM light client is in phase two of its three-part rollout to mainnet, with phase two having it operate on testnet. BRPs structure and transform block specimens into block results (queryable data) and upload them to storage instances. QNOs load block results into local data warehouses and serve API queries. Currently, the QNO role is operated by Covalent Labs, but it will be decentralized in the future. The QNOs may also have different implementations that allow for AI pipelines to leverage this modular data infrastructure.

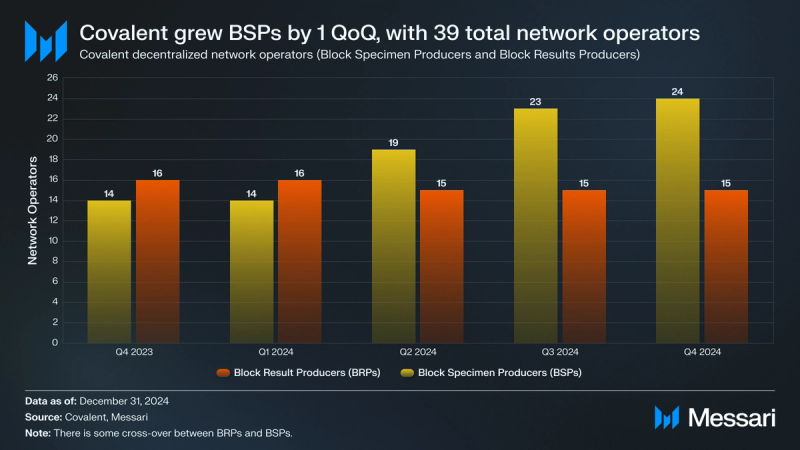

Over the course of the year, Covalent grew network operators by 30%, increasing from 30 to 39. The majority of this growth has come from block specimen producers, which grew 71.4% YoY, increasing from 14 to 24. The majority of these operators were added earlier this year, with Covalent announcing it had onboarded five new operators to run BSPs in Q3. Adding network operators increases the amount of stake the protocol can absorb and increases its workload capacity in block specimen and block result production. Covalent raised its CXT staking target in Q3, to approximately 35% of all circulating CXT. Staking acts as a supply sink, reducing the tradable supply and amplifying market forces. In Q4, Covalent added one new operator to run a BSP, bringing the total number of BSP’s to 24, while the number of BRP’s remained constant QoQ at 15.

Block SpecimensA block specimen is a cryptographically secure representation of a block. BSPs extract and export block specimens to a storage instance. These new data objects can be reconstructed to represent a blockchain's historical state. To ensure this offchain process is valid, BSPs then publish a proof to the ProofChain contract containing the block specimen hash and the IPFS access URL. The ProofChain contract will soon launch on a Byzantine fault-tolerant, high-throughput event streaming system built from the Cosmos SDK called EWM-ProofChain.

Block specimens produced in Q4 grew 14.5% QoQ, increasing from 388,500 to 444,600. Over the last year, block specimens produced have increased 82.2%, jumping from 244,000 to 444,600. Since block specimens represent data that could be reconstructed to form a blockchain’s history, the number of block specimens produced increases as more blockchains are covered. Additionally, as the number of BSPs increases, so does the number of block specimens produced. Covalent added support for Ink, World Chain, Apechain, and Unichain’s Testnet in Q4, contributing to the rise in block specimens produced.

Block specimens make blockchain data composable and reusable outside its respective execution environment. This property is vital in powering Covalent’s Ethereum-focused data availability solution, the Ethereum Wayback Machine (EWM). The EWM will address deleted rollup history due to the state expiry feature introduced in the Dencun upgrade. It will also be pivotal in serving as a modular data infrastructure layer in Covalent’s initiatives to provide AI models with verifiable data for training and inference.

Copilot Insights: What is state expiry?Ethereum Wayback Machine Light ClientsThe Ethereum Wayback Machine (EWM) Light Client is a key addition to the Covalent Network, designed to preserve Ethereum's historical blockchain data in a decentralized and scalable way. The EWM Light Client enables participants to validate blockchain data without operating full nodes, addressing the high resource demands of traditional validation.

The EWM Light Client works alongside BSPs as they produce Block Specimens by validating them against cryptographic proofs. Using methods like data availability sampling and KZG commitments, the Light Client allows for efficient validation without requiring extensive hardware or bandwidth. Doing so lowers the barrier to entry for network participation while supporting the decentralization of Ethereum’s data. Light Client operators must stake a minimum of 5,000 bCXT (CXT on Base) per client instance to perform the validation process. In exchange, operators receive bCXT rewards based on the accuracy and volume of their validation work, with an estimated APY of 14-25%.

The EWM Light Client launched its phase two testnet towards the end of Q3, with block specimens beginning to be validated in December 2024. Phase two of the rollout has seen over 669,000 block specimens validated by 458 light client operators. Covalent plans to launch phase three of the EWM light client rollout in early Q1 2025, which will be the mainnet deployment of the EWM.

Block ResultsAfter being saved to a storage instance, BRPs structure block specimens, perform data transformations, and output block results (queryable data by Query Node Operators) to a storage instance. As enriched transformations of raw block specimen data, block results can include offchain features related to the data, like NFT media. Data enrichment provides a more holistic context for the data, making it more useful to developers. BRPs also publish proofs to the ProofChain contract verifying their work, including an IPFS access URL.

Covalent Labs was the only BRP for the protocol until mid-Q3 2023, when it decentralized the role to shortlisted operators. In Q4, block results produced increased 1.6% QoQ despite no new BRPs coming online. The increase in BSPs could indicate a need for Covalent to scale the number of BRPs, given the growth that BSPs have experienced YoY.

Staked CXT

Covalent uses a Stake-for-Access model where network operators (BSPs and BRPs) stake CXT to perform work on the network. Covalent employs staking parameters, such as max/min values and a delegation ratio. These measures ensure that staked CXT remains distributed among the operator sets. BSPs must stake between 175,000 and 350,000 CXT. They also have a max delegation ratio of 40:1 (i.e., individual BSPs can only be allocated a maximum delegation of 14 million CXT). Alternatively, BRPs must stake a minimum of 35,000 CXT, while being restricted to a maximum of 70,000 CXT and receiving no delegation.

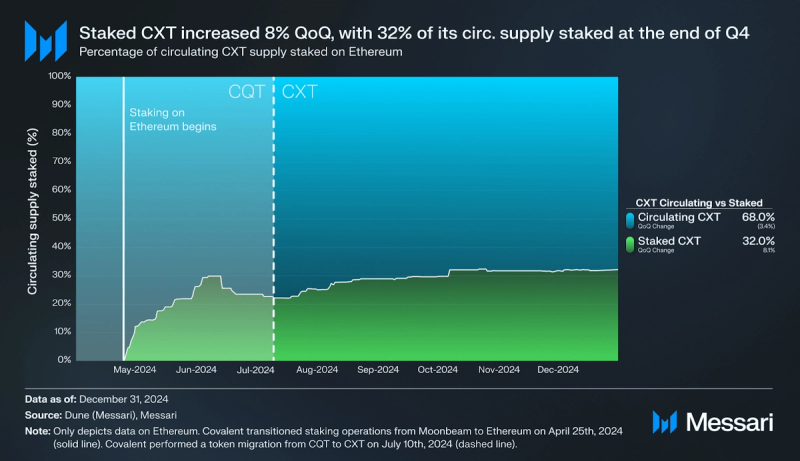

Since transitioning staking operations to Ethereum in Q2, Covalent has seen an 8.1% QoQ rise in the percentage of circulating CXT that is staked, moving from 29.6% to 32.0. By closing Q4 with 32.0% of the CXT circulating supply staked, Covalent continued to make solid progress toward its goal of having approximately 35% of the circulating CXT supply staked.

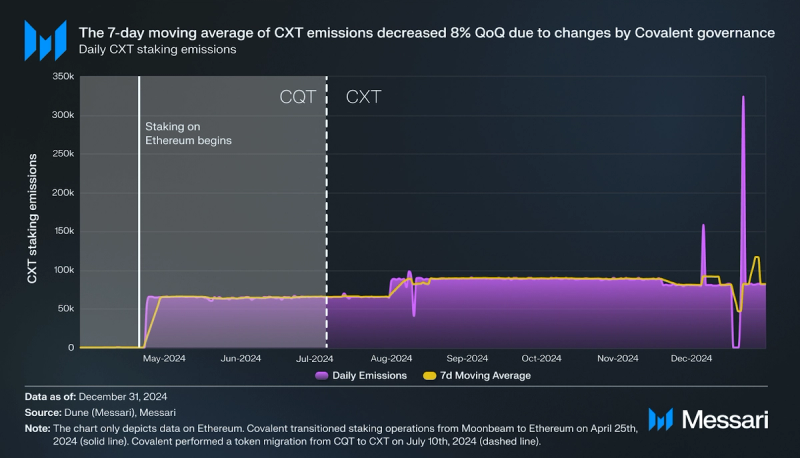

Covalent daily emissions decreased 8.1% QoQ from approximately 89,700 to 82,400 as governance approved a proposal to decrease the emissions per block specimen produced. In line with this change, the seven-day moving average of CXT emissions, decreased 8.1% QoQ, moving from 89,100 to 81,900. CXT emissions fluctuate based on the following:

- The amount of CXT staked.

- The number of block specimens produced.

- The number of block results produced.

- The number of EWM light clients staked and operating.

BSPs and BRPs are currently subsidized with a budget of 20 million CXT rewards per year. However, Covalent only used about 10 million CXT in each of the 2022 and 2023 years enabling the use of roughly 24 million CXT in 2024. Before subsidization ends by 2026, Covalent plans to implement a revenue share. In this model, query revenue would be paid in US-denominated dollar stablecoins, with a portion being used to buy back CXT to reward node operators.

Currently, 20% of all query revenue is used to execute automatic buys of CXT, which are stored in a multisig wallet for later distribution. In Q4, CXT buybacks decreased 23.1% QoQ, dipping from $103,800 to $79,800. Since a portion of query revenue is used to buy back CXT, it acts as a proxy for measuring the demand for Covalent’s GoldRush API. This decline in CXT buybacks suggests that the GoldRush API saw a decrease in demand in Q4.

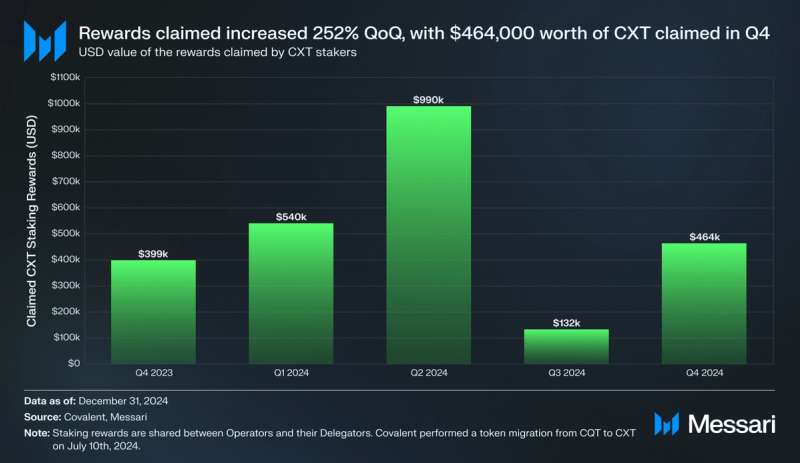

Network operators claimed 252.0% more USD rewards QoQ, increasing from $131,100 to $464,200. The price of CXT increased 14.4% in Q4, partially explaining the increase in USD rewards claimed.

Market Cap

The CXT market cap grew 20.4% QoQ, moving from $86.1 million to $103.7 million. Despite the decrease in CXT emissions for BSPs, the circulating supply rose 5.2% QoQ. This growth in market cap was largely due to CXT’s 14.4% QoQ price increase. Nevertheless, CXT’s market cap amongst all tokens fell 25 spots from 401 to 426, underperforming similarly priced cryptoassets. In the future, Covalent’s buyback program will link network demand directly to CXT's increased buying pressure. As API query demand rises, Covalent's revenue will increase, enabling further buybacks of CXT with the additional revenue. If there were to be a catalyst in decentralized AI protocols seeking structured historical onchain data, Covalent and CXT holders would be well-positioned to benefit from integrating AI with crypto.

Qualitative AnalysisAI Agent SDKMidway through December 2024, Covalent announced its AI Agent SDK, which offers a streamlined approach to building context-aware AI agents with integrated blockchain functionality. Unlike other AI agent tools like ai16z’s Eliza, which focuses primarily on enabling basic AI agent development, Covalent’s AI Agent SDK addresses the gap between onchain and offchain data access, providing direct integration for decentralized networks. This enables agents to perform tasks like executing transactions, verifying blockchain data, and interacting with decentralized applications autonomously.

Covalent’s AI Agent SDK incorporates features such as pre-built modules, customizable templates, and advanced memory management. It supports multi-blockchain interoperability, ensuring that agents can operate seamlessly across ecosystems, including Ethereum and Layer 2 rollups. Additionally, the SDK simplifies the creation of efficient, purpose-built agents tailored to specific use cases. Built on Covalent's infrastructure, the SDK is designed to address the growing demand for blockchain integrated AI agents. This release marks a step forward in intertwining AI development with blockchain technology, making it more accessible and practical for developers.

Copilot Insights: What are AI agents?GovernanceIn November 2024, Covalent passed a significant update to enhance the EWM infrastructure and align it with market demands. To achieve this, three main adjustments were made:

- The network set the BSP delegator APY to ~10% and capped the staking target at 300 million CXT during the remainder of the bootstrapping phase. Adjusting BSP emissions to 16.75 CXT per specimen, totaling daily emissions of 82,410 CXT for 24 BSPs across 4,920 block specimens produced daily.

- The EWM Light Client infrastructure will be launched on Base to enhance accessibility, enabling users to validate Ethereum’s historical data using commodity hardware.

- The deployment of a bCXT/ETH liquidity pool on Aerodrome Finance, supported by $150,000-$250,000 in initial liquidity. This will allow CXT holders on Ethereum to bridge their tokens to Base and participate in a less expensive network.

With Base’s streamlined onboarding and the potential for light client operators to earn an APY of 14%-25% in bCXT, these changes aim to expand user participation while maintaining a balanced emissions strategy.

Closing SummaryCovalent unveiled its AI agent SDK which will allow for AI agents to both read and write to blockchains. Covalent took steps to improve accessibility for the Ethereum Wayback Machine by moving critical infrastructure to Coinbase’s Base L2. Covalent also improved on key metrics throughout the quarter, adding four new networks, increasing block specimen production, and growing the number of EWM light client testnet operators to 458. Additionally, the percentage of the CXT circulating supply staked rose to 32% and Covalent performed $79,800 in CXT buybacks. Covalent solidified its position at the intersection of AI and crypto in Q4, while continuing to roll out the EWM, its solution to Ethereum’s long-term data availability problem.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.