and the distribution of digital products.

State of Core Q4 2024

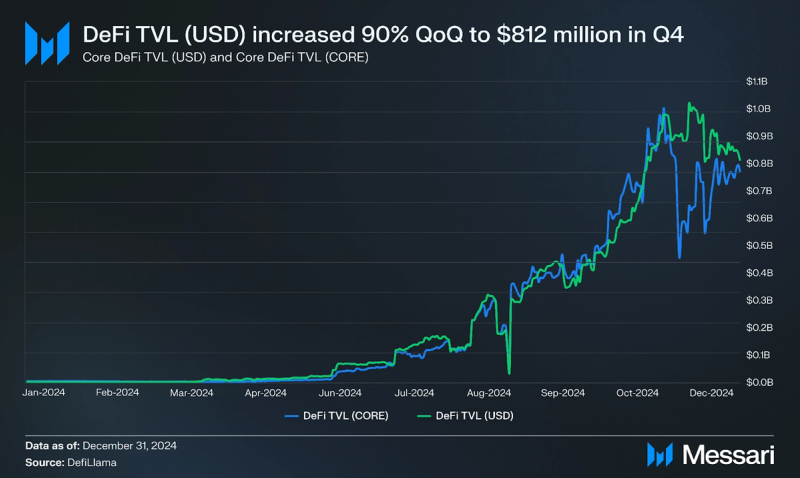

- Core’s DeFi TVL (USD) increased by 90% QoQ to $811.8 million. Avalon Labs topped the leaderboard for DeFi TVL, followed by Colend and Pell Network, which launched BTC restaking on Core in August.

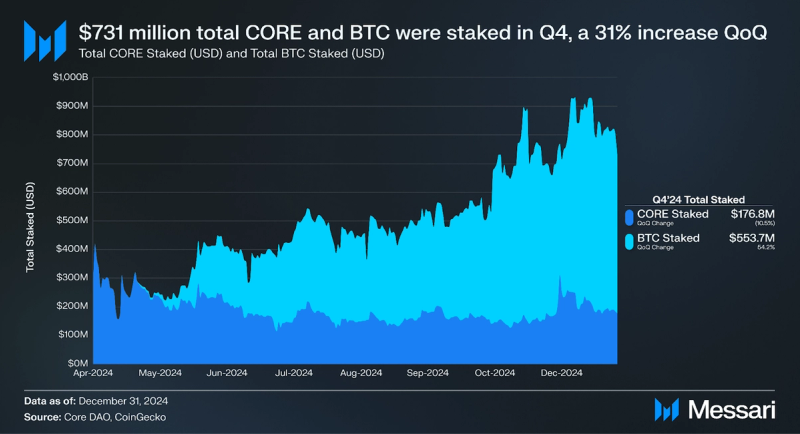

- CORE and BTC Staked (USD) increased by 31% QoQ to $730.5 million. The increase was primarily due to 500 BTC staked through Core’s non-custodial BTC staking product, launched in April.

- Average daily active addresses increased 160% QoQ to 249,700. At the end of Q4, Core finished with a cumulative total of 34.8 million unique wallets.

- Core released the Fusion Upgrade in Q4, launching Dual Staking and introducing LstBTC. In Q4, 1,298 BTC and 16.5 million CORE were dual-staked, representing 22% of all BTC and 19% of all CORE staked on the Core network.

The Core blockchain (CORE) is a Proof-of-Stake (PoS) Layer-1 for Bitcoin, differentiated by its Non-Custodial BTC Staking product, EVM execution environment, and Bitcoin DeFi ecosystem. Launched in early 2023, the Core community is building an ecosystem of Bitcoin-focused applications, leveraging Bitcoin security via its Satoshi Plus consensus mechanism, which leverages Bitcoin miners, BTC stakers, and CORE stakers.

Satoshi Plus consensus involves staking and hash rate delegation from Bitcoin miners. Staking includes both the native CORE token and BTC. This combination of security resources results in a hybrid model that leverages Bitcoin mining, rewards miners, and separates block production to mitigate censorship and MEV risks. The network's EVM compatibility allows Core to run smart contracts and applications by leveraging existing Ethereum developer tools and the Ethereum ecosystem. In Q2 2024, Core introduced non-custodial BTC staking for users to earn yield and contribute to consensus on the Core Network. The Fusion Upgrade introduced higher rewards via Dual Staking of BTC and CORE and LstBTC, a BTC liquid staking token, enabling users to access yield-bearing BTC liquidity in Core's fully expressive execution environment. For a complete primer on Core, refer to our Initiation of Coverage report.

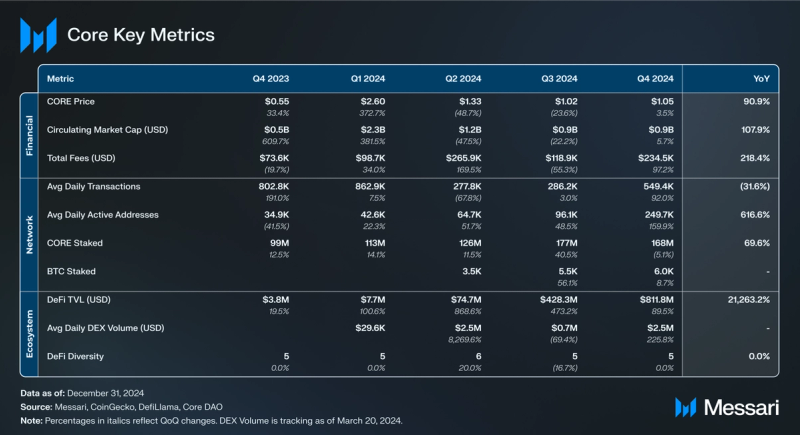

Key Metrics Financial Analysis

Financial Analysis

CORE is the native token of the Core blockchain and is used as the primary medium of exchange when transacting on the network. CORE has four primary use cases:

- Paying transaction fees.

- Staking to secure the network and earn rewards.

- Boost BTC-staking yield rates via Dual Staking.

- Participating in onchain governance.

The total supply of CORE is 2.1 billion tokens, with block rewards distributed over 81 years. CORE also has a minor deflationary burn mechanism aimed to counteract inflationary pressure. Additionally, block rewards decrease by 3.6% annually.

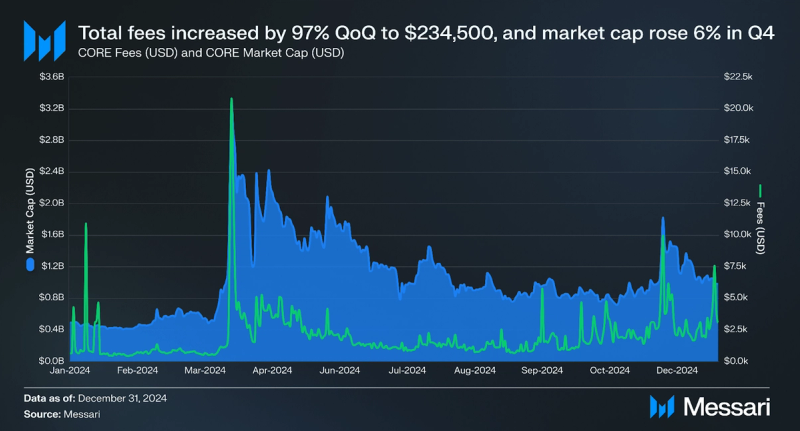

Market Cap & Fees

Core fees denominated in USD increased by 97% QoQ to $234,500. Core’s fees come from transactions on the networks. This quarter's notable increase in revenue was correlated with a 92% increase in transaction fees. Core fees denominated in USD increased by 218% YoY, while fees denominated in CORE increased by 52%. A 91% YoY increase in the price of CORE is responsible for the discrepancy.

Core’s market cap increased by 6% QoQ to $981.1 million, while its price increased by 4% QoQ to $1.05 in Q4. A 3% increase in the circulating supply of CORE is the reason for this discrepancy. Core’s price movement tracked the altcoin market, with a high correlation to popular Layer-1s and Bitcoin sidechains such as Stacks and Merlin Chain.

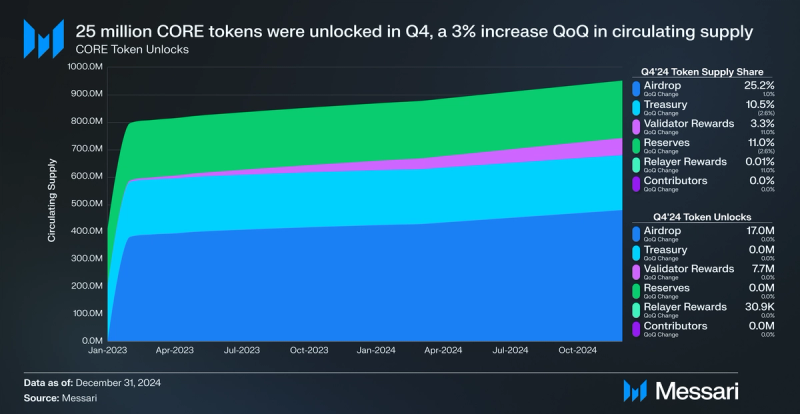

Token Supply

In Q4, 24.7 million CORE tokens were unlocked. Of the token unlocks, 17.0 million were for airdrop participants, 7.7 million were for validator rewards, and 30,900 were for relayers.

Airdrop participants will be vested with 484.9 million CORE by January 2025. Block rewards decrease by 4% annually, extending the emissions schedule and maintaining deflationary pressure. Rewards for relayers and validators will continue to be distributed over 81 years. In Q1 2025, contributor tokens will begin unlocking for the first time, with 6.6 million tokens scheduled to unlock in January.

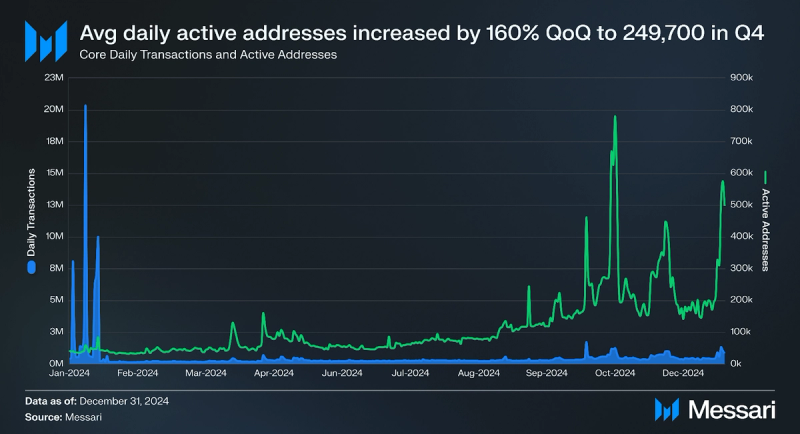

Network Analysis

In Q4, average daily active addresses increased 160% QoQ to 249,700, and average daily transactions increased 92% to 549,400. From Q4’23 to Q1’24, inscription activity spiked, causing increases in the number of average daily transactions and average active addresses. Inscription activity began to decline by late January.

The growth in daily active addresses is underscored by a 92% increase in transactions to 549,500 in Q4. Additionally, Core reached 34.8 million unique wallets in Q4, a 59% increase QoQ.

Average daily new active addresses increased 576% to 123,800. On an annual basis, average daily new addresses are up 4,861% YoY, a positive signal for network and downstream ecosystem growth.

In Q4, the average block time on Core was only 3 seconds, whereas the average block time on Bitcoin was 10 minutes. Core is not limited by Bitcoin’s block time and can execute at an independent pace in any instance since it executes on the Core network.

In Q2, Core announced the passing of CIP-2, which outlines the expansion of Core’s active validator set from 21 to 31 by Q2 2025. Currently, Core uses its Validator Election mechanism to rank the top 27 validators based on a weighted score of their hash and stake (CORE and BTC), creating the validator set for a consensus period of 200 slots, known as an epoch.

Staking

Core uses the novel Satoshi Plus consensus mechanism. Satoshi Plus is a hybrid model of Delegated Proof-of-Work (DPoW), Delegated Proof-of-Stake (DPoS), and Non-Custodial BTC Staking. Unlike merge-mined sidechains, Core validators, rather than Bitcoin miners, are responsible for mining new blocks.

Total CORE and BTC staked denominated in USD was $730.5 million in Q4, a 31% increase QoQ. CORE staked (USD) was down 11% QoQ to $176.8 million, equivalent to a decrease of 9.2 million CORE tokens in Q4. CORE staked peaked on December 1 at $309.8 million.

BTC staked (USD) increased by 57% QoQ to $359.1 million, equivalent to an additional 500 BTC tokens in Q4. BTC is staked on Core through Non-Custodial BTC Staking, which allows users to lock their BTC tokens on the BTC network and contribute to Core’s network security through consensus.

stCORE, Core’s native liquid staking product, launched in January 2024. stCORE enables CORE stakers to participate in DeFi and other yield opportunities while contributing to the Core blockchain. stCORE ended Q4 with $13.2 million TVL, a 13% decrease QoQ. This comprises roughly 12 million CORE tokens, approximately 7% of all staked CORE.

ConsensusCore has multiple validators (M Labs, InfStones, OKXEarn, etc.) participating in Satoshi Plus consensus. In Q4, two new validators joined Core:

- Foundry Services: Foundry is a digital assets infrastructure company that provides services such as mining operations, staking solutions, and strategic consulting.

- Figment: Figment is a blockchain infrastructure company that provides tools, APIs, and staking services to simplify onchain access to blockchain technology.

In Q4, Core had up to 75% of the delegated hash rate from BTC miners on multiple occasions. Core leverages the large pool of computing power to promote decentralization and enhance security on its network. Core has stated they will have 31 validators by Q2 2025; as of Q4, there are 27 validators on the network.

Fusion UpgradeOn November 19, Core released the Fusion Upgrade, which introduced Dual Staking to align BTC stakers with the CORE token. The upgrade also introduced liquid BTC staking, allowing BTC stakers to use a liquid, yield-bearing BTC-pegged token (LstBTC) within BTCfi.

Dual StakingDual Staking provides higher BTC staking rates to participants who stake both Bitcoin and CORE tokens (“dual stakers”), incentivizing BTC stakers to acquire and stake CORE to maximize their yield. Dual Staking further aligns the utility of BTC and CORE tokens by leveraging CORE to boost yield for BTC staking. This alignment aims to enhance Core’s security by raising economic incentives to stake BTC and CORE.

The staking process remains unchanged, but reward allocation now follows a tiered system. Previously, all BTC stakers received the same rewards rate, but under Dual Staking, rewards tiers are determined by the amount of CORE staked relative to BTC staked. The more CORE staked relative to BTC staked, the higher the rewards in that tier. While staking CORE introduces risks beyond holding BTC, the principle BTC holdings remain unaffected, ensuring that Dual Staking enhances yield without compromising Bitcoin’s fundamental security.

1,298 BTC and 16.5 million CORE have been dual-staked as of December 31. 22% of BTC stakers are also staking CORE, while 19% of CORE stakers also stake BTC. Most BTC and CORE Dual Stakers have staked at the highest possible tier (Satoshi) for maximum rewards.

Liquid Staking BTCLstBTC is an upcoming liquid staking token issued on the Core network representing staked BTC. Traditionally, BTC holders on Core had to choose between earning staking yield via non-custodial BTC staking or using their BTC within Core’s BTCfi ecosystem. LstBTC is Core’s native solution to offer users staking yield and liquidity on their BTC. LstBTC is pegged 1:1 to BTC, and yield is generated as CORE tokens. LstBTC also supports network consensus by further decentralizing staking.

Core DAO is sunsetting coreBTC, the first Core-native bridged BTC wrapper, in tandem with the launch of LstBTC. Existing coreBTC in circulation will remain fully redeemable, and collateral assets can be used to mint LstBTC or other bridged BTC assets on Core.

LstBTC's future success lies in delivering BTCfi yield opportunities while maintaining the liquid utility enjoyed by other pegged BTC assets in the Core and broader EVM landscape. Core announced plans for several opportunities for users to earn BTCfi yield on their LstBTC, including lending, borrowing, staking, perpetual futures, DEX trading, and NFT trading. LstBTC must capture market share from competition such as WBTC, cbBTC, and even native liquid BTC assets like Solv.CORE.

Ecosystem Analysis

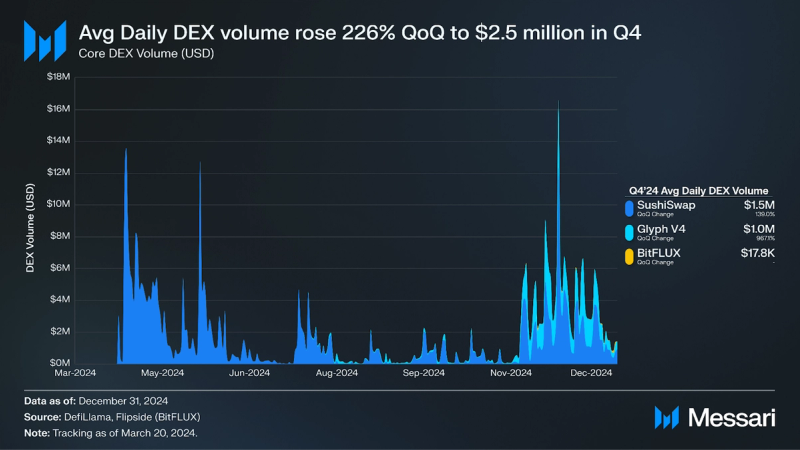

In Q4, Core added 20 new apps to its ecosystem. The most notable integration was BitFLUX, which offers low-slippage swaps between Bitcoin-pegged assets. As of Q4, Core has 94 dApps listed on its ecosystem page.

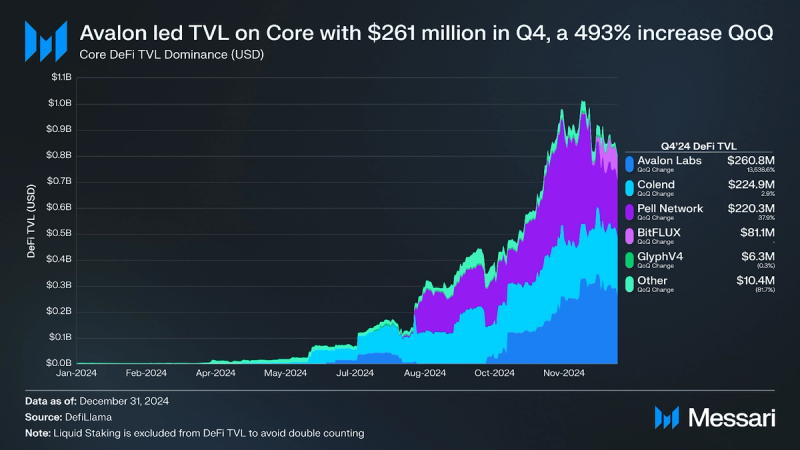

DeFi diversity represents the number of protocols that make up >90% of DeFi TVL. Core’s DeFi diversity was 5 in Q4; TVL was concentrated in Avalon Finance, Pell Network, and Colend.

DeFi

Avalon Labs (previously Avalon Finance), a decentralized lending protocol, flipped Colend for the top DeFi TVL spot on Core in Q4. Avalon ended Q4 with $260.8 million TVL, a 13,539% increase QoQ. Avalon’s TVL on Core mostly comes from SolvBTC.b, a Free Tech bridged BTC wrapper.

Colend, a lending and borrowing platform native to Core, had $224.9 million TVL in Q4, a 3% increase QoQ. Most of Colend’s TVL increase came from users supplying SolvBTC.m, a bridged version of BTC from Merlin Chain, and CORE. Colend launched a points program with an airdrop that went live in November.

Pell Network, a Bitcoin restaking layer, followed Colend as the third largest dApp with $220.3 million TVL in Q4, a 38% increase QoQ. Pell Network launched on Core in August, offering users higher yields for restaking coreBTC or SolvBTC, among other BTC derivatives. Obelisk’s oBTC is the largest restaked asset for Pell on Core, with a TVL of $130.1 million.

DEX Volume

Core had an average daily DEX volume of $2.5 million in Q4, a 266% increase QoQ. DEX Volume maxed out at $5.1 million on November 30. DEX volume increases on Core coincided with market-wide DEX volume increases across DeFi in Q4. The most popular DEX on Core was SushiSwap, followed by GlyphV4.

Ecosystem and GrowthTwo mutually reinforcing offerings define the Core ecosystem:

- Bitcoin Yield Product

- EVM-Compatible BTCfi Platform

Non-custodial BTC staking secures the Core network and delivers yield to Bitcoin holders. The yield is sourced from Core’s BTCfi platform, providing an endogenous source of Bitcoin value creation.

The Core network uses the EVM, which means it can leverage Ethereum’s infrastructure and ecosystem for expansion. Core integrates with wallets like MetaMask, developer tooling like Hardhat, and DEXs like SushiSwap. This familiarity reduces the development overhead and has other benefits, such as reducing the risk of exploits. Core’s ecosystem developers can leverage the learnings of EVM development on Ethereum, Arbitrum, Avalanche, and other EVM chains.

Valour, the asset management arm of DeFi Technologies, leveraged the Core blockchain to introduce the first yield-bearing BTC exchange-traded product in June. It’s available to German investors on the Börse Frankfurt, the largest German stock exchange. Valour generates yield by delegating BTC to their validator node on Core through the non-custodial BTC staking feature. The yield is attributed daily to the Net Asset Value, providing investors yield without selling or trading their BTC holdings. In Q4, DeFi Technologies announced the upcoming launch of CoreFi Strategy, a company applying MicroStrategy’s investment methodology to the Core network. This company will deploy capital to acquire BTC and CORE tokens, stake and borrow against those assets, and continue to grow its exposure to Core’s BTCfi ecosystem. The goal is to provide investors with a regulated pathway to BTCfi exposure.

Core Commit ProgramThe Core Commit Program is a three-month program designed to encourage developers to build on Core. Developers can receive support from the Core ecosystem, 1:1 mentorship, and funding from Core Ventures. This initiative marks Core Ventures’ first effort to incubate a cohort of developers aimed at onboarding additional native dApps to the ecosystem. The program kicked off on December 9, and Core Ventures selected 10 teams to participate and receive support:

- 0xBridge

- Focus: BTCfi, DeFi

- B14g

- Focus: BTCfi, BTC Staking

- Bitcoin Derby

- Focus: Game, BTCfi

- BQLabs

- Focus: Insurance, DeFi

- Celeriz

- Focus: BTCfi, Stablecoins, Infrastructure

- Coffer Network

- Focus: Infrastructure, BTCfi

- Degen Markets

- Focus: SocialFi

- Ordinistan

- Focus: Ordinals, NFTs, BTCfi, DeFi

- Sats Terminal

- Focus: BTCfi, Ordinals/Runes, DeFi, Infrastructure

- VaultLayer

- Focus: BTCfi, LSTs

In May 2024, Core DAO updated the Core Ignition Incentive Program to introduce Sparks, the network’s way of measuring user activity and engagement. Sparks are synonymous with the points several popular pre-airdrop protocols began offering the past year.

Users receive a daily allocation of Sparks, determined by their level of engagement and participation in the Core ecosystem. The more active and involved a user is, the greater their daily allocation of Sparks will be. Additionally, Core offers a multiplier on specific assets that adjusts your conversion rate (i.e., if you hold an asset with a 1.5x multiplier and earn 100 base Sparks a day, you'll receive an additional 50 Sparks through the asset multiplier, totaling 150 Sparks for the day).

In September, Core launched Season 2 of the Ignition Program. Sparks reset to 0 for all participants. Season 2 introduced new campaigns and ways to earn Sparks through Core network dApps, bridging, and trading. To track Spark Points, Core recently launched an Ignition Leaderboard.

Other Key DevelopmentsSeveral other key developments and initiatives took place in Q4:

- SolvBTC.CORE launched (October 1): Solv Protocol launched SolvBTC.CORE is a yield-bearing liquid staking token for Bitcoin holders on the Core network. 500 SolvBTC.CORE was minted in under 2 hours after launching.

- Hashnote Integration (December 2): The Hashnote integration with Core enables institutions to earn yield through non-custodial BTC staking and Dual Staking with CORE. Hashnote is a regulated asset manager built for traditional finance managers.

- BitGo enables BTC yield with Core (December 8): BitGo announced a partnership with Core to offer secure institutional yield services for Bitcoin liquidity. The collaboration aims to provide institutional-grade custody and enhanced yield through Dual Staking of BTC and CORE.

- Cactus Custody integration (December 13): The Cactus Custody integration, an institutional-grade platform offered by MatrixPort, enables institutions to earn yield through non-custodial BTC staking and Dual Staking with CORE. MatrixPort is a digital assets platform with Bitcoin mining relationships.

- Coretoshis NFT Launch (December 14): Coretoshis is a 3,333 PFP NFT project launched by Core DAO. The collection sold out in under 60 seconds during its public sale on OKX Marketplace.

Core recorded a 90% QoQ increase in DeFi TVL to $811.8 million in Q4 2024 and implemented the Fusion Upgrade, launching Dual Staking and introducing LstBTC to enhance BTC staking yields and liquidity. Ecosystem activity increased, with average daily active addresses rising 160% QoQ to 249,700 and the number of unique wallets growing to 34.8 million, a 59% QoQ increase. Staking activity also grew, with BTC staked increasing 57% QoQ to $359.1 million.

In the coming quarters, Core’s trajectory will be influenced by new features like LstBTC and Dual Staking and its ability to attract developers and dApps through initiatives such as the Core Commit Program. Institutional collaborations, including those with BitGo and Cactus Custody, may further integrate Core and BTCfi into institutional finance.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.